Overview

The article titled "7 Key Insights on Real Estate Latest News for Investors" delivers essential updates and trends in the real estate market that are pivotal for investors. It underscores significant insights, including:

- The ramifications of demographic shifts

- Mortgage rate trends

- The effects of remote work

- The increasing importance of sustainability

These factors are crucial for investors aiming to adapt their strategies in a rapidly evolving market landscape.

Introduction

The real estate landscape is experiencing a profound transformation, driven by a convergence of emerging trends and shifting consumer preferences. Investors are presented with a myriad of opportunities, ranging from the migration of Americans to low-tax states to the increasing significance of sustainability in property selections. Yet, in this dynamic environment, critical questions emerge: How can investors adeptly navigate the complexities of market volatility and technological advancements? This article explores seven essential insights designed to empower real estate investors with the knowledge necessary to excel in 2025 and beyond.

Zero Flux: Your Daily Source for Real Estate Market Insights

Zero Flux stands out as a specialized daily newsletter that curates essential real estate latest news and insights from over 100 diverse sources. By prioritizing factual information over opinions, it has established itself as an indispensable resource for industry professionals and enthusiasts alike. Subscribers benefit from concise summaries of the latest developments, encompassing housing trends, investment opportunities, and demographic shifts. This data-driven approach empowers investors to make informed decisions, reflecting the growing reliance on newsletters for precise insights.

With a subscriber base exceeding 30,000, Zero Flux exemplifies the increasing significance of data-driven insights in property investing. It assists individuals in navigating the complexities of the market efficiently. As the real estate landscape evolves, having access to the real estate latest news becomes paramount. Therefore, subscribing to Zero Flux not only keeps you informed but also enhances your investment strategies in a competitive environment.

Migration Trends: Americans Moving to Low-Tax States

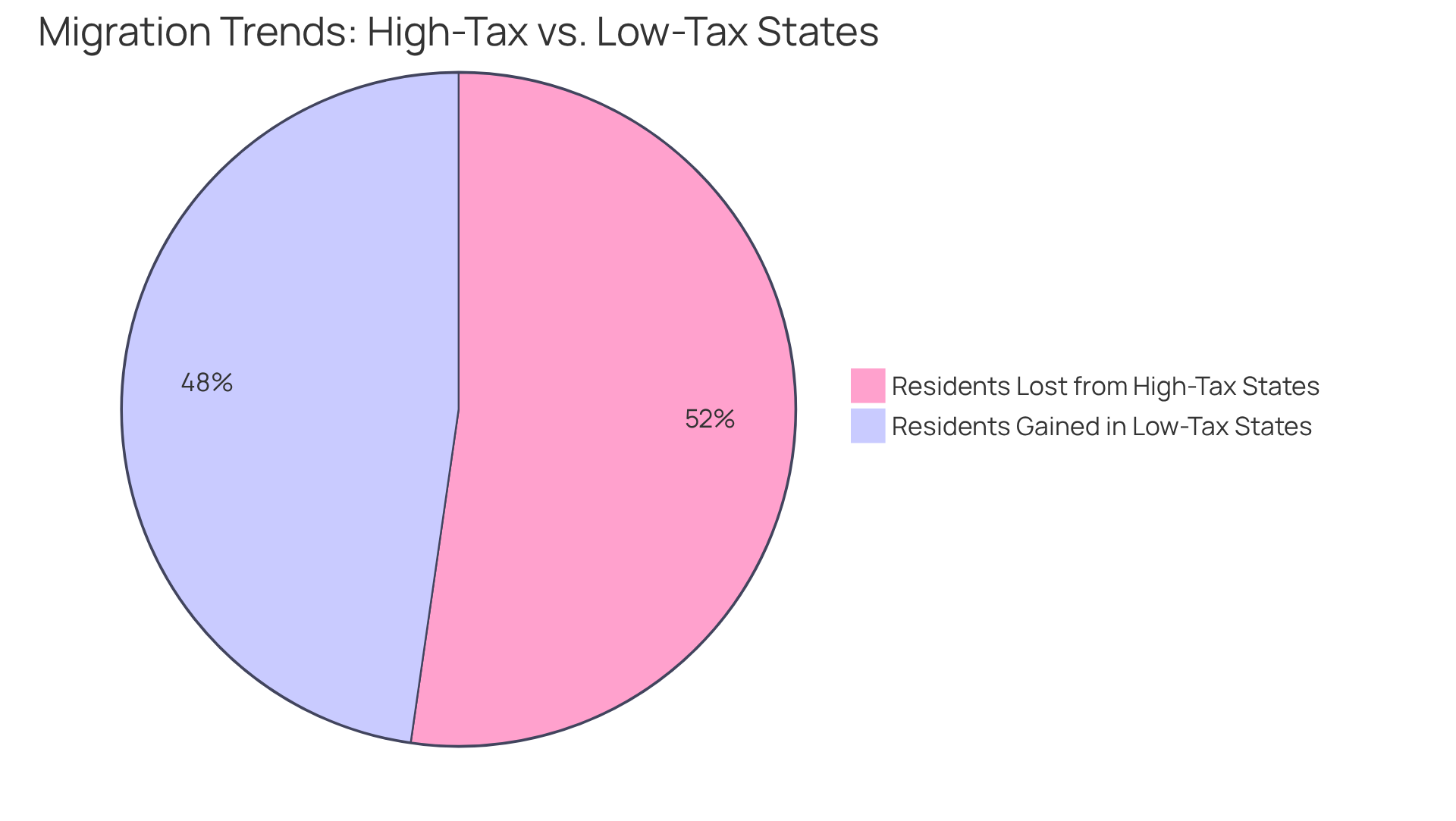

Recent trends reveal a significant movement of Americans towards low-tax states like Florida and Texas, driven by the pursuit of lower living costs and more favorable tax conditions. In 2023, states with the highest taxes lost approximately 2.3 million residents, while those with the lowest taxes gained around 2.1 million. This shift is especially significant for property investors, as the influx of new residents is anticipated to boost housing demand, which is often covered in real estate latest news, resulting in potential price appreciation and heightened rental growth.

According to real estate latest news, experts assert that the allure of low-tax environments not only attracts individuals but also enhances the overall investment climate, positioning these states as prime targets for property opportunities in 2025. Success stories abound in the real estate latest news, with investors capitalizing on the increasing demand in these sectors, further solidifying Florida and Texas as key players in the real estate arena.

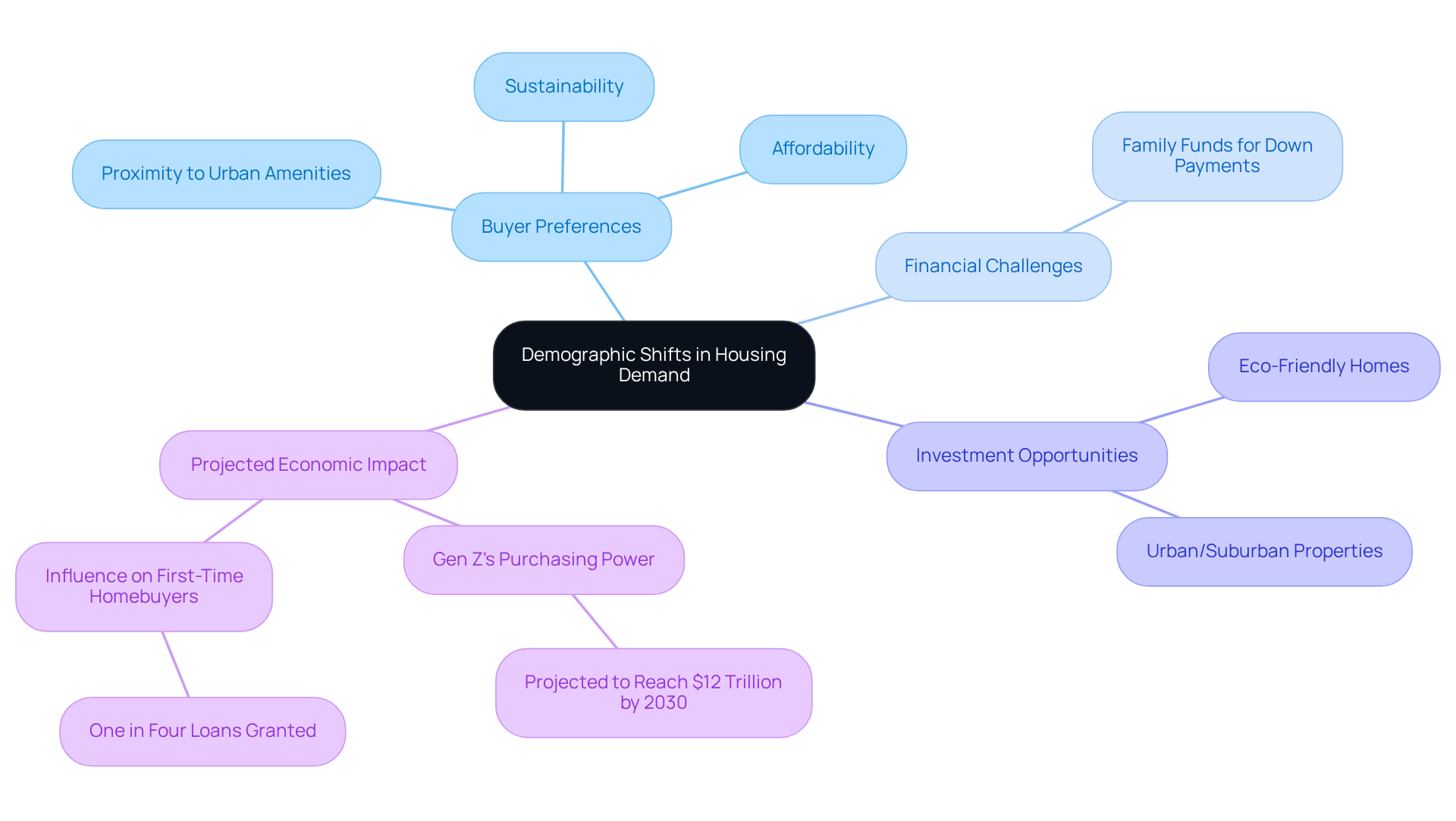

Demographic Shifts: Millennials and Gen Z Impacting Housing Demand

Millennials and Gen Z are reshaping housing demand as they increasingly engage with the sector. These generations place a premium on affordability, sustainability, and proximity to urban amenities, leading to a notable shift in buyer preferences. Notably, 23.8 percent of recent homebuyers from these demographics utilized family funds for down payments, underscoring the financial challenges they face in today's landscape.

Investors should strategically target properties that align with these values, such as:

- Smaller, eco-friendly homes situated in urban or suburban areas.

This focus not only addresses the demand for sustainable living but also positions investors to capitalize on the anticipated growth in this demographic's purchasing power, projected to reach $12 trillion by 2030. Furthermore, Gen Z accounts for one in four loans granted to first-time homebuyers, highlighting their increasing influence.

As the industry evolves, the real estate latest news indicates that understanding and adapting to the preferences of Millennials and Gen Z will be essential for successful real estate investment strategies in 2025.

Mortgage Rates: Current Trends and Future Predictions

As of July 2025, mortgage rates are averaging 6.67%, with forecasts indicating a stabilization in this range rather than a significant decline. Analysts predict that while rates may ease slightly to an average of 6.7% by year-end, they are unlikely to return to the lower levels seen in previous years. This situation presents difficulties for first-time home purchasers, who may find affordability challenging. Moreover, it can lower profit margins on rental units, influencing investment choices. Monitoring these rate fluctuations is crucial for strategic investment planning, as even minor changes can affect overall investment returns.

Experts suggest that potential homebuyers should actively compare offers from multiple lenders to secure the best possible rates. This approach can lead to substantial savings of $600 to $1,200 annually over the life of a mortgage. Additionally, understanding the broader economic factors influencing these rates, such as inflation and Federal Reserve policies, will be essential for making informed decisions in this evolving market.

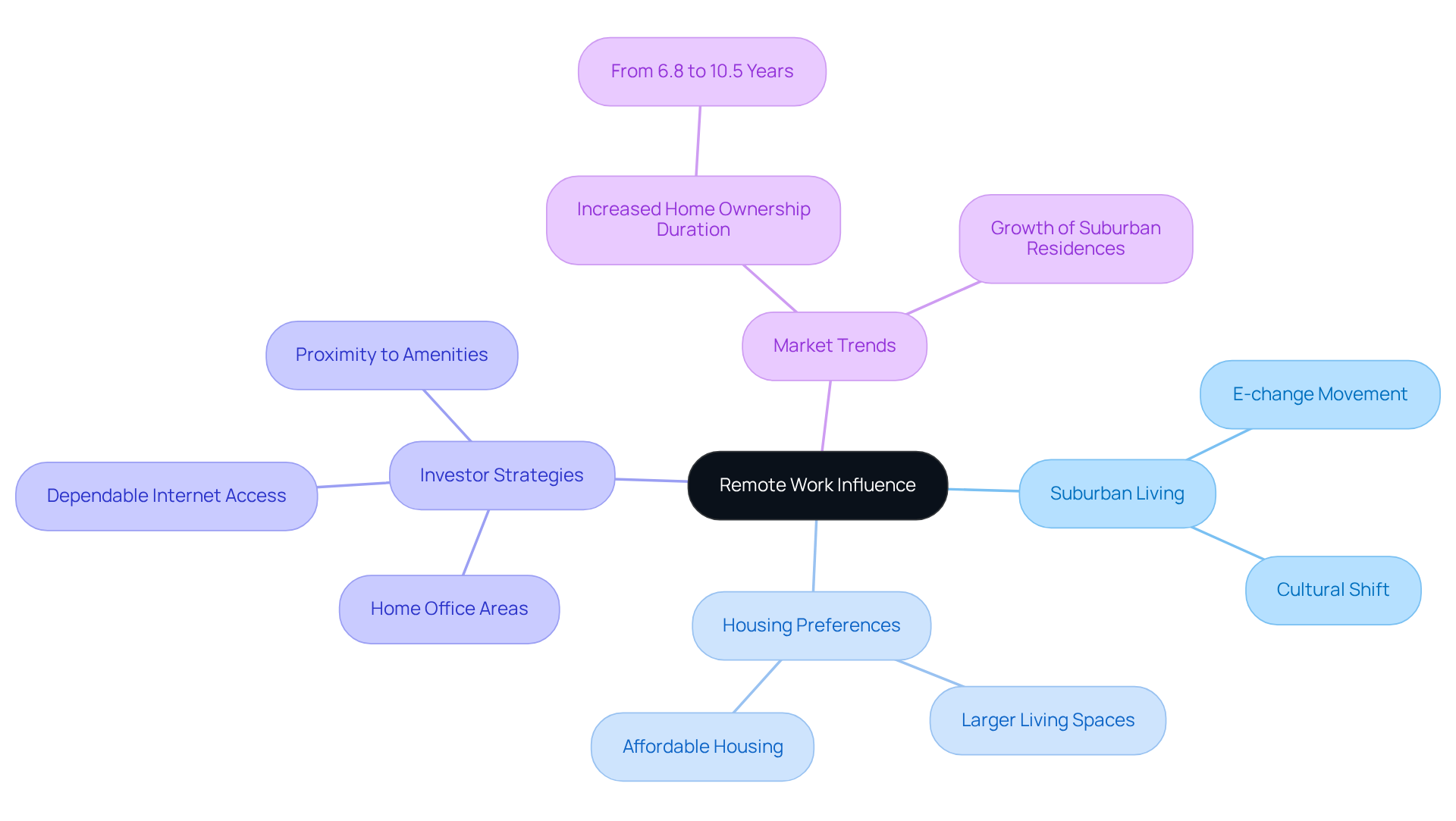

Remote Work Influence: Shifting Preferences in Property Locations

The rise of remote work has significantly reshaped housing preferences, driving many individuals to seek homes in suburban and rural areas. This shift is largely motivated by the desire for larger living spaces and more affordable housing options. Investors should concentrate on real estate that not only offers dedicated home office areas but also features dependable internet access and proximity to necessary amenities.

According to CoreLogic, the average length of home ownership in Australia has risen from 6.8 years to 10.5 years, indicating a rising demand for suburban residences. Market analysts, including demographer Bernard Salt, highlight that we are witnessing a cultural shift or 'e-change movement,' where the appeal of suburban living is further enhanced by the flexibility remote work offers. This flexibility allows individuals to prioritize lifestyle over proximity to urban centers.

This trend, as highlighted in the real estate latest news, indicates a potential long-term shift in the real estate landscape, making it crucial for investors to adapt their strategies accordingly. How will you position your investments to capitalize on this evolving market? The time to act is now.

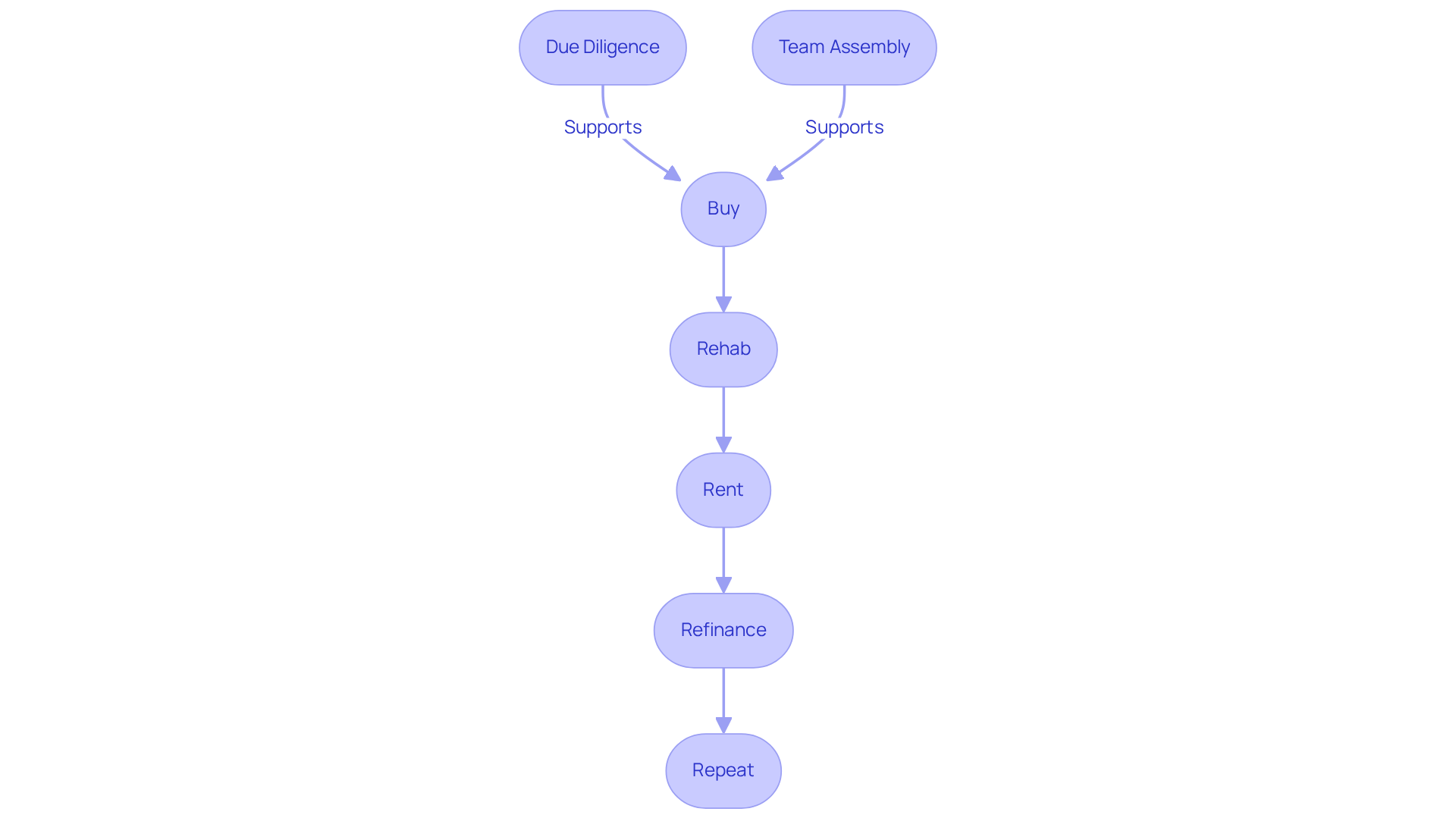

Investment Strategies: Capitalizing on Distressed Properties

To effectively capitalize on troubled real estate, investors should prioritize identifying undervalued assets that are ready for renovation or repositioning. The BRRRR method—Buy, Rehab, Rent, Refinance, Repeat—serves as a powerful strategy to maximize returns. This systematic approach allows investors to recover capital and enhance financial stability by adding value before financing. As David Greene notes, investors can add value by paying less than what a property is worth and improving its condition, significantly increasing equity.

Performing comprehensive due diligence and grasping local economic conditions are essential for success in this niche. With a 10% market decline occurring approximately once a year, awareness of market fluctuations can prevent panic selling and encourage strategic buying during downturns. By utilizing the BRRRR strategy and assembling a strong team of agents, lenders, contractors, and managers, investors can maneuver through the intricacies of the housing market and attain significant returns on their investments.

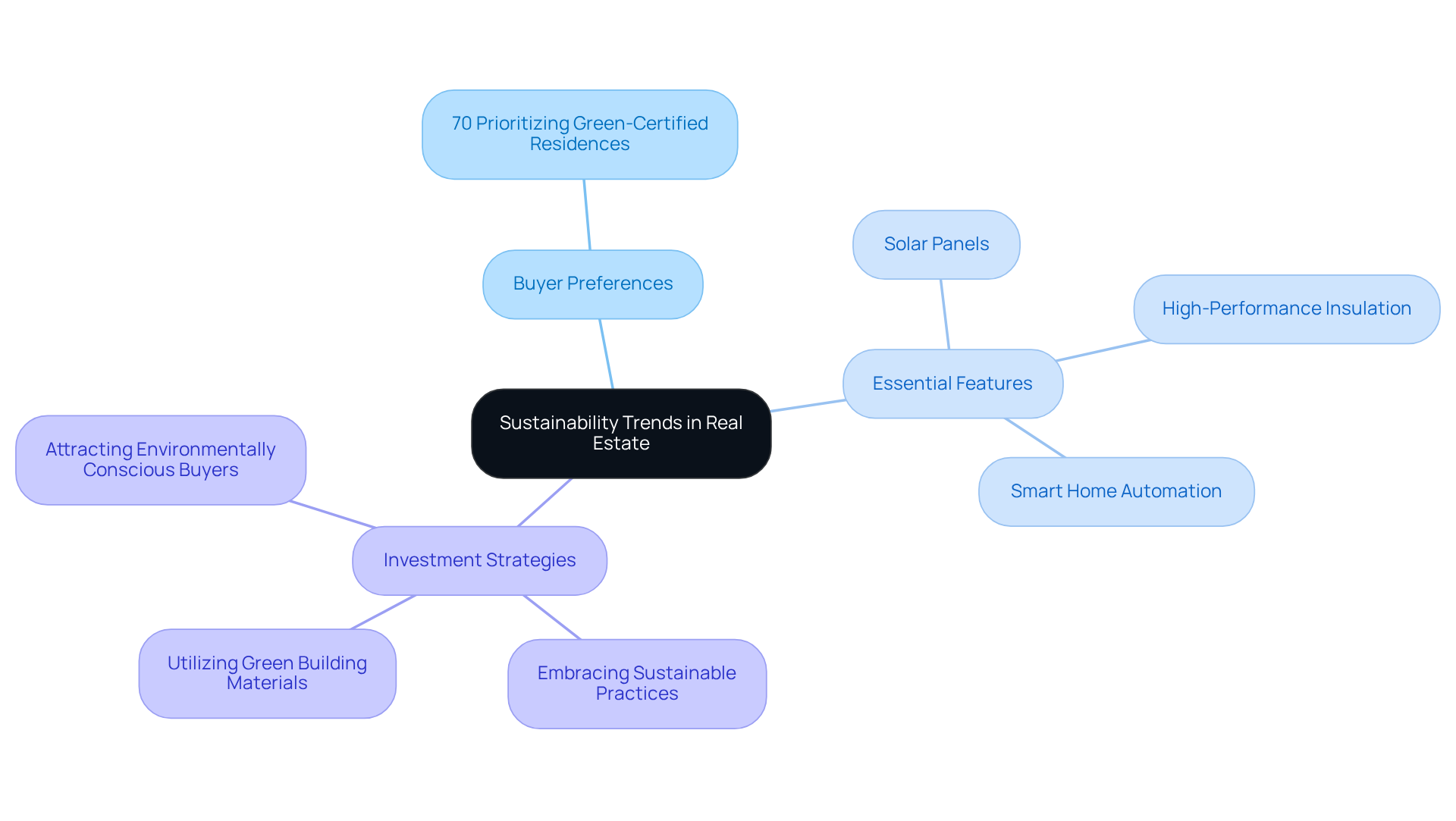

Sustainability Trends: The Growing Importance in Real Estate

Sustainability is reshaping realty choices, with a pronounced shift towards energy-efficient and eco-friendly buildings. By 2025, over 70% of purchasers are expected to prioritize green-certified residences, which typically command a 15% premium compared to non-certified options. This trend highlights the escalating demand for energy-efficient features—such as:

- solar panels

- high-performance insulation

- smart home automation

These features are becoming essential for many buyers. Investors are urged to embrace sustainable practices in their projects, utilizing green building materials and energy-efficient technologies to attract environmentally conscious buyers and tenants. Real property analysts assert that assets equipped with these sustainable attributes not only meet demand but also enhance long-term investment value. As the market evolves, integrating sustainability into property strategies is not merely advantageous; it is increasingly vital for achieving success.

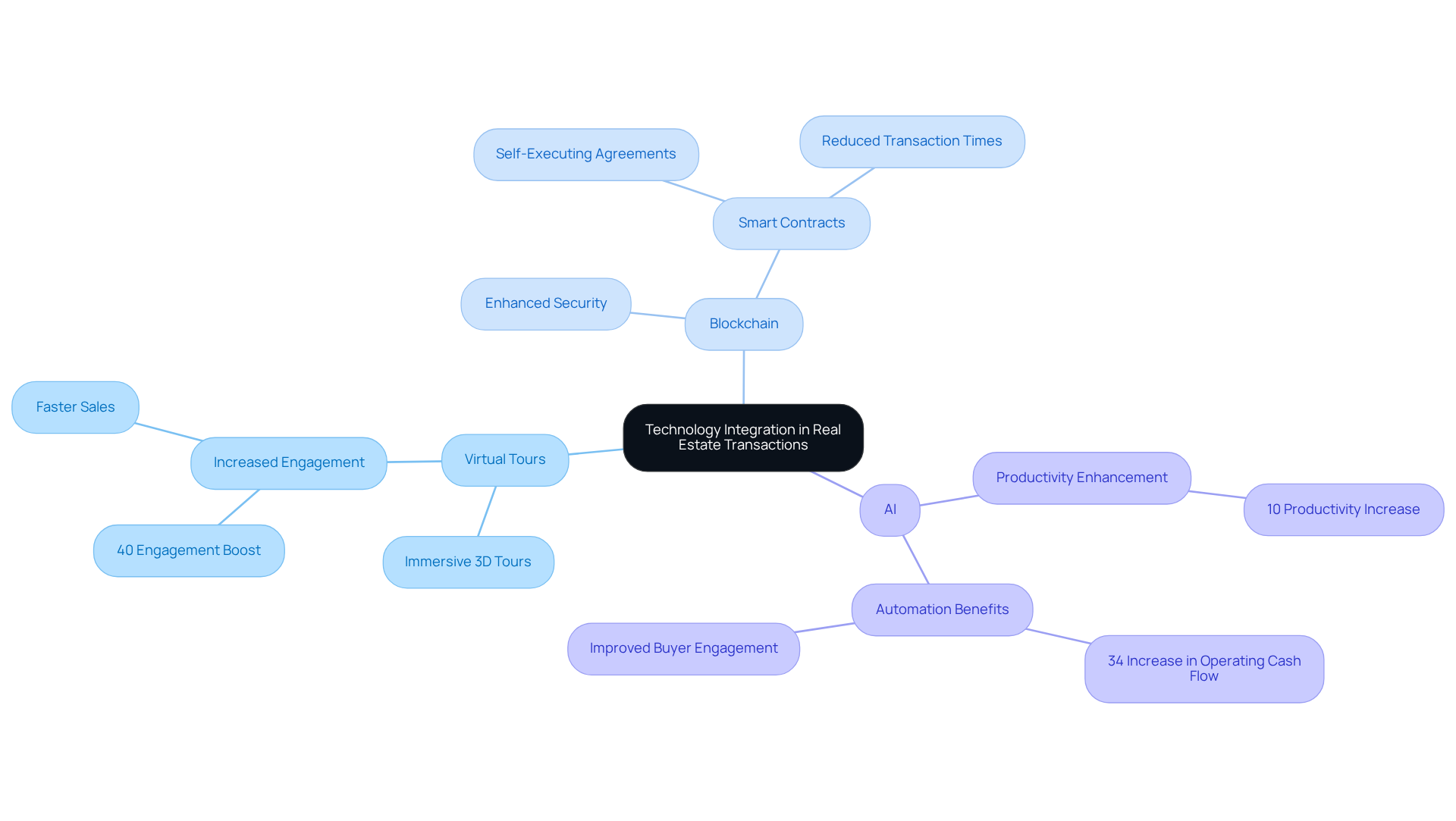

Technology Integration: Innovations Shaping Real Estate Transactions

The incorporation of technology in property is transforming transactions, with virtual tours and blockchain technology at the forefront. By 2025, immersive 3D tours are expected to allow potential buyers to explore properties through VR headsets and mobile apps, significantly enhancing the property viewing experience. Statistics indicate that listings featuring virtual tours can see a 40% increase in engagement, leading to faster sales and higher closing rates. Furthermore, a report by McKinsey estimates that incorporating AI can enhance productivity in property management by as much as 10%, underscoring the benefits of these technological advancements.

Industry leaders emphasize the importance of these innovations. Neema Bardi, founder of Atllas, observes that technology is making the property market more transparent and efficient. She asserts that "embracing these advancements will not only redefine the sales process but also elevate the overall standard of service in the sector." Alyssa Soto Brody and Erica Sachse from Powered by DMT highlight how automation tools are enhancing buyer engagement and streamlining sales processes, further validating the shift towards technology in real estate.

Successful implementations of virtual tours have already demonstrated their effectiveness in property sales. For instance, luxury developments like Brooklyn Point have utilized AI to stage units virtually, resulting in increased buyer interest and quicker transactions. Additionally, Powered by DMT employs technology to improve home展示 and sales procedures, showcasing the vast possibilities of tech integration in property.

As technology progresses, investors must leverage these advancements to optimize processes, elevate customer experiences, and boost operational efficiency, ensuring they retain a competitive advantage. Significantly, brokers and services could experience a 34% rise in operating cash flow due to automation benefits, emphasizing the broader impact of technology on operational efficiency in the property sector.

Market Volatility: Strategies for Real Estate Investors

In 2025, real estate investors will encounter increased volatility in the sector, driven by economic uncertainties and fluctuating interest rates. To navigate these challenges effectively, strategies such as:

- Diversifying portfolios

- Focusing on cash flow properties

- Maintaining liquidity

are essential for mitigating risks. Furthermore, investors must remain vigilant regarding the real estate latest news, which enables them to make prompt decisions that capitalize on emerging opportunities. By adopting these approaches, investors can position themselves advantageously in a shifting market landscape.

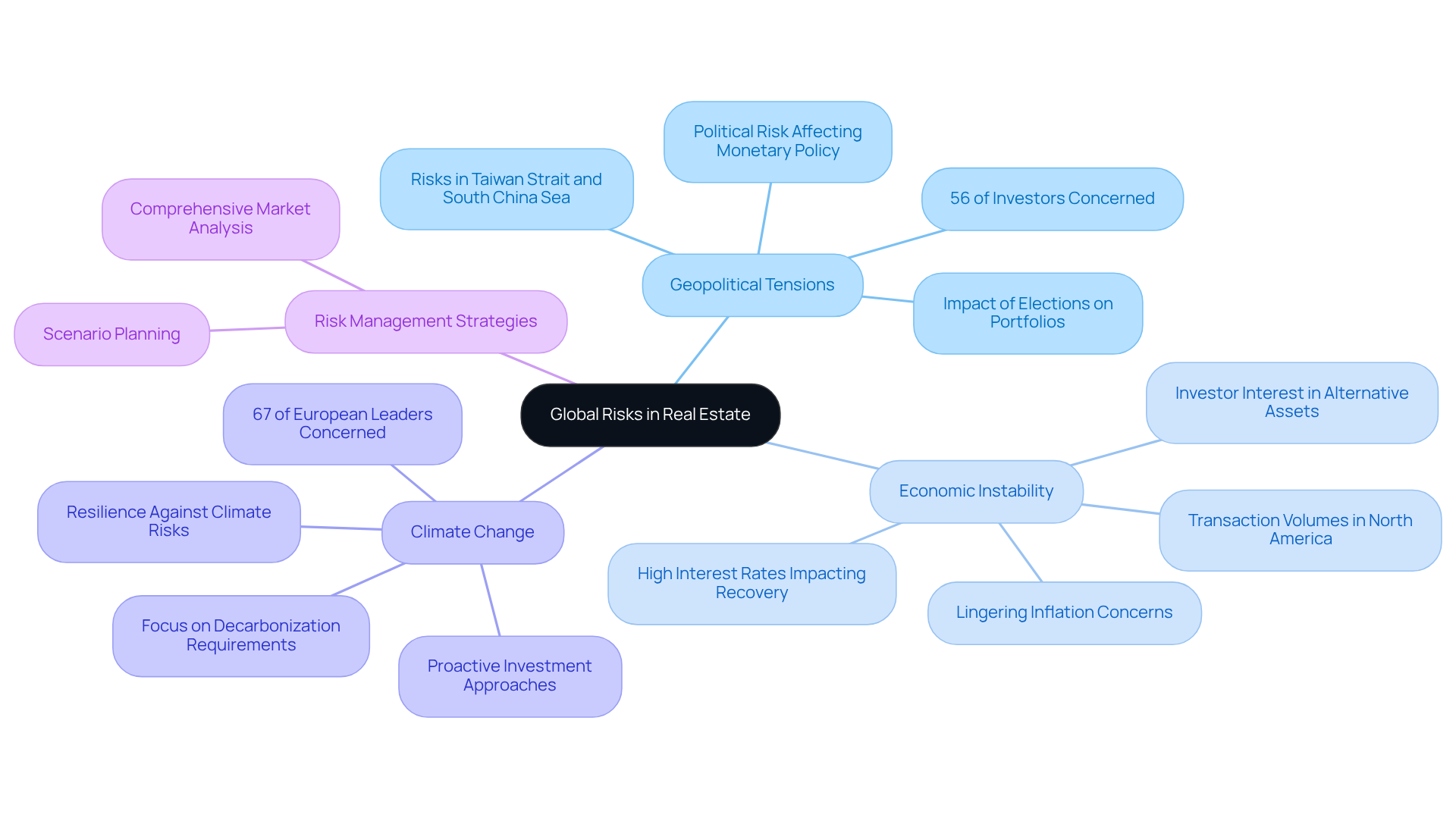

Global Risks: Navigating Challenges in the Real Estate Landscape

Investors must remain vigilant regarding global risks, particularly geopolitical tensions, economic instability, and climate change, as these factors significantly influence real estate. The ongoing geopolitical instability, especially in regions such as the Middle East and the South China Sea, has intensified concerns among investors, with 56% identifying geopolitical risk as their foremost worry. This uncertainty can trigger fluctuations in confidence and investment activity, with 56% of global investors indicating that the outcomes of this year's elections affect their portfolio decisions.

To effectively navigate these challenges, it is essential to develop a robust risk management strategy. This strategy should include:

- Scenario planning

- Comprehensive market analysis to anticipate potential impacts on real estate values and investment returns

For instance, the recent PGIM Global Risk Report highlights that while inflation fears have subsided, geopolitical risks continue to be a primary focus for investors, indicating a pressing need for adaptive strategies.

Furthermore, climate change is transforming investment strategies, with 67% of European real estate leaders underscoring the significance of environmental and decarbonization requirements. These mandates are driving investors to focus on assets that not only adhere to current regulatory standards but also exhibit resilience against climate-related risks. This transition necessitates a proactive investment approach, where grasping the implications of climate change on property performance is paramount.

By staying informed about the real estate latest news and their potential ramifications, investors can make proactive decisions that protect their portfolios. Emphasizing operational expertise and fostering innovative partnerships will further enhance the capability to generate value in a rapidly evolving market landscape.

Conclusion

The evolving landscape of real estate in 2025 presents a myriad of opportunities and challenges for investors. Understanding the latest news and trends—such as the migration towards low-tax states, the shifting preferences of Millennials and Gen Z, and the impact of remote work—is essential for making informed investment decisions. Furthermore, integrating sustainability and technology into investment strategies is increasingly vital for remaining competitive and meeting market demands.

Key insights from the article highlight the importance of being proactive in adapting to market conditions. The rise in mortgage rates, the volatility of the market, and the influence of global risks necessitate a strategic approach that includes diversification and thorough market analysis. By leveraging resources like Zero Flux for daily insights and staying attuned to demographic shifts and sustainability trends, investors can better navigate the complexities of the real estate market.

Ultimately, the future of real estate investment hinges on the ability to embrace change and innovate. As the market continues to evolve, investors are encouraged to adopt forward-thinking strategies that not only respond to current trends but also anticipate future demands. Engaging with the latest news and insights will empower investors to make decisions that safeguard their portfolios and capitalize on emerging opportunities in the dynamic real estate landscape.