Overview

The article highlights seven key trends that are shaping life science commercial real estate, underscoring the sector's rapid growth fueled by increased investment, specialized facility needs, and technological advancements. Notably, there has been a surge in lab leasing activity, emphasizing the necessity for adaptable spaces that can meet evolving scientific demands. Additionally, a strong focus on sustainability and regulatory compliance further indicates a promising future for investment in this sector. This combination of factors positions life science commercial real estate as an attractive opportunity for savvy investors.

Introduction

The life sciences sector is experiencing a transformative period, fueled by unprecedented investment and evolving operational needs. As companies endeavor to innovate and adapt to a rapidly changing landscape, it becomes essential for investors and developers to understand the key trends shaping life science commercial real estate.

What challenges and opportunities lie ahead for this dynamic market? How can stakeholders position themselves to thrive in a sector poised for sustained growth? These questions are critical as we navigate the complexities of this evolving industry.

Zero Flux: Essential Insights on Life Science Real Estate Trends

Zero Flux is at the forefront of delivering essential insights into the biological real estate sector. By meticulously curating data from over 100 sources, including those behind paywalls, it offers a comprehensive overview of market dynamics. This capability is particularly crucial in the biological field, where rapid changes demand timely and accurate information for decision-making. Subscribers gain access to a concise format that transforms complex data into actionable insights, establishing Zero Flux as an indispensable resource for real estate professionals and investors alike.

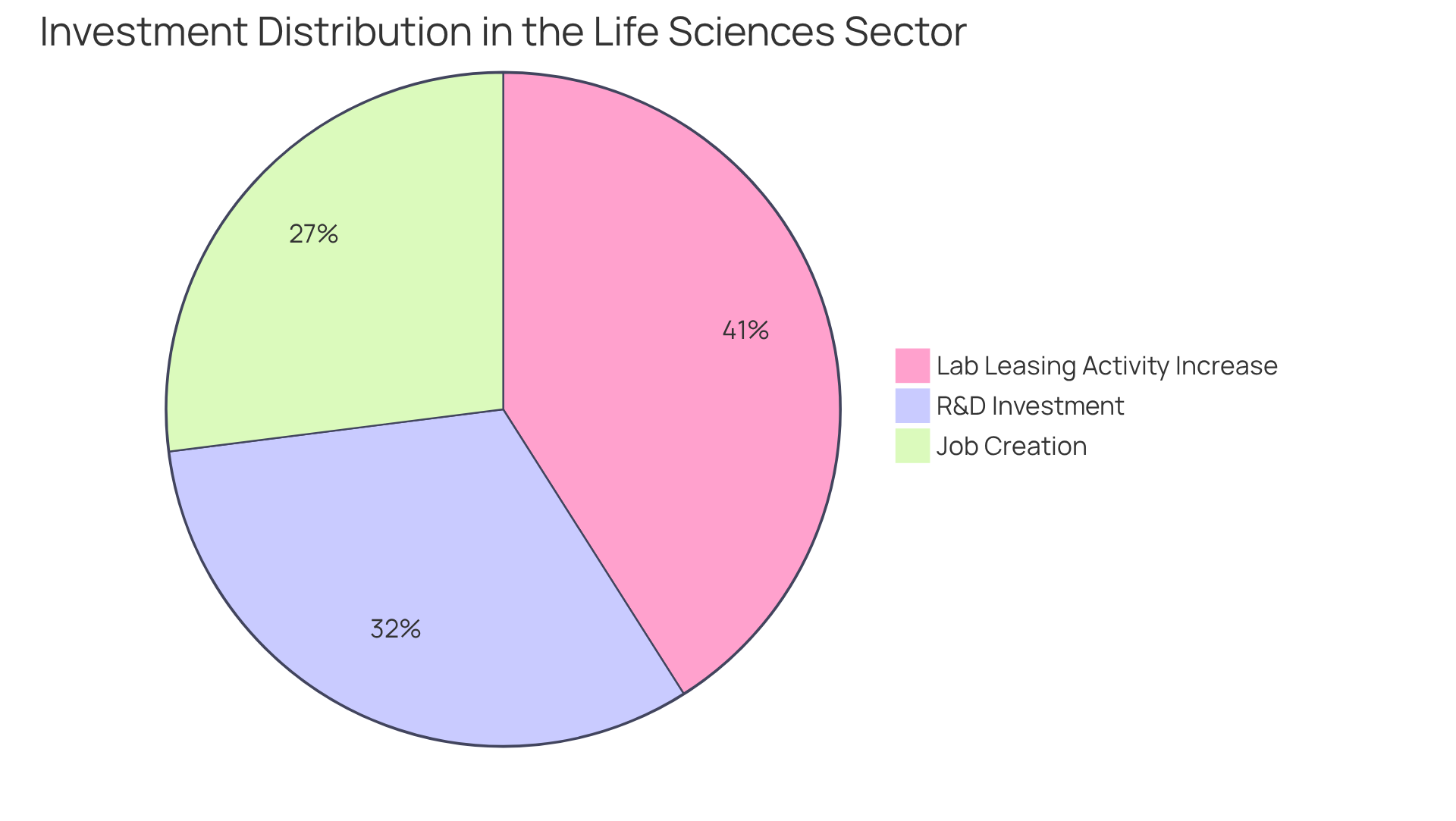

Increased Investment: Pandemic-Driven Growth in Life Sciences

The COVID-19 pandemic has ignited unprecedented growth in the biological fields, leading to a surge in investments. Recent reports reveal that lab and R&D leasing activity experienced an impressive 41% year-over-year increase in Q3 2024, coupled with a 14% quarter-over-quarter rise to nearly 3.1 million sq. ft. This trend indicates sustained demand extending into 2025. The influx of capital is primarily fueled by the pressing need for research and development facilities, as companies strive to innovate and address health crises. Investors are increasingly recognizing the biological sector as a stable and lucrative opportunity, further propelling growth in commercial real estate focused on this domain.

The pharmaceutical industry alone has poured approximately $3.2 billion annually into research and development, supporting over 110,000 full-time jobs in Canada and making a significant contribution to the economy. Additionally, the lab/R&D vacancy rate has risen by 1.7 percentage points to 18.4%, reflecting the market's dynamic nature. As the demand for specialized lab spaces continues to escalate, with an average triple-net asking rent climbing by 1.3% quarter-over-quarter to $72.80 per sq. ft., the life sciences sector is poised for further expansion, positioning it as an attractive focus for real estate investment.

Canada is also home to over 3,200 ongoing clinical trials, underscoring the industry's vibrancy and potential for growth. With these compelling insights, investors are encouraged to consider the biological fields as a prime opportunity for their portfolios.

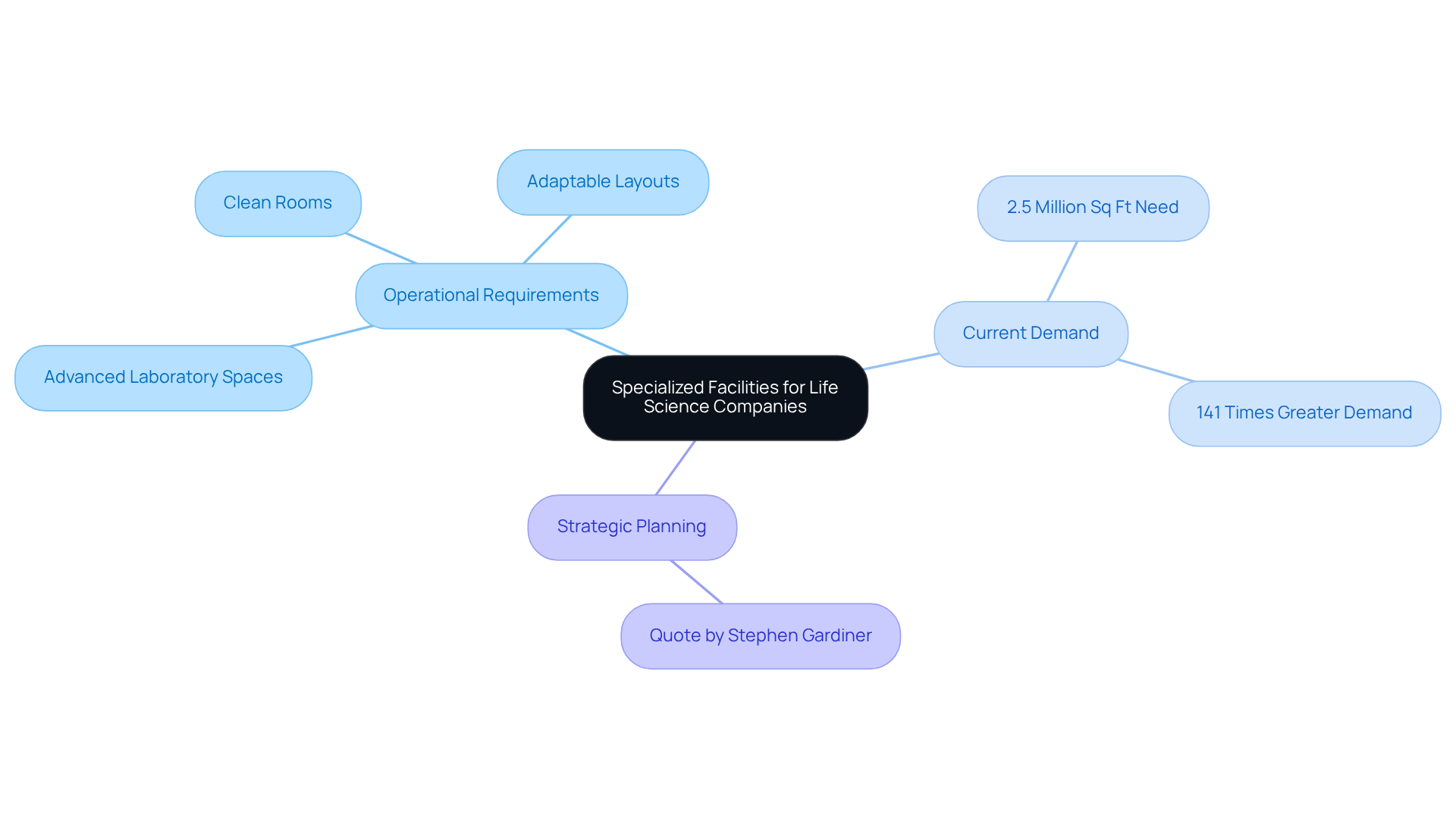

Specialized Facilities: Meeting the Needs of Life Science Companies

Life biology companies necessitate specialized facilities within the realm of life science commercial real estate, tailored to their operational requirements, which include advanced laboratory spaces, clean rooms, and adaptable layouts. These environments must not only accommodate high energy demands but also integrate cutting-edge technology to bolster research and development activities. As the demand for life science commercial real estate continues to expand, the need for such specialized spaces is anticipated to surge. Current estimates indicate a need for over 2.5 million square feet of wet lab space in the Greater Toronto Area, highlighting the critical demand for life science commercial real estate, where availability is nearly nonexistent and demand is an astonishing 141 times greater than the currently available lab space. This trend compels developers in life science commercial real estate to prioritize the creation of environments that can adapt and evolve alongside scientific advancements.

Strategic planning in life science commercial real estate development is therefore crucial. It ensures that facilities not only address current requirements but also anticipate future advancements. As Stephen Gardiner aptly noted, "Excellent structures originate from admirable individuals, and all issues are resolved through effective design." This observation underscores the importance of thoughtful design in addressing the pressing challenges faced by organizations in the biology sector.

Evolving Workforce: Attracting Talent to Life Sciences

As the biological fields continue to expand, the competition for exceptional talent intensifies. Companies are increasingly prioritizing the creation of appealing work environments that foster collaboration and innovation. This trend encompasses:

- Flexible work arrangements

- Modern office designs

- Amenities that significantly enhance employee satisfaction

Real estate developers are responding by crafting life science commercial real estate spaces that not only meet functional needs but also foster a positive workplace culture. By focusing on employee experience, organizations in life science commercial real estate can more effectively attract and retain the talented workforce essential for their continued success.

In fact, a recent report from the 2025 Life Sciences Workforce Trends Report highlights that 88% of industry leaders believe a strong workplace culture is vital for employee satisfaction and retention. This underscores the critical link between environment and talent acquisition. Moreover, Massachusetts is projected to experience a robust 32% job expansion in its biological sector by 2033, signaling a significant demand for qualified experts. However, challenges persist, as 83% of industry leaders report difficulties in finding the right skills. This issue is compounded by layoffs in larger pharmaceutical companies, which have introduced experienced talent into the job market, thereby increasing competition for available positions.

Regional Concentration: Key Locations for Life Science Growth

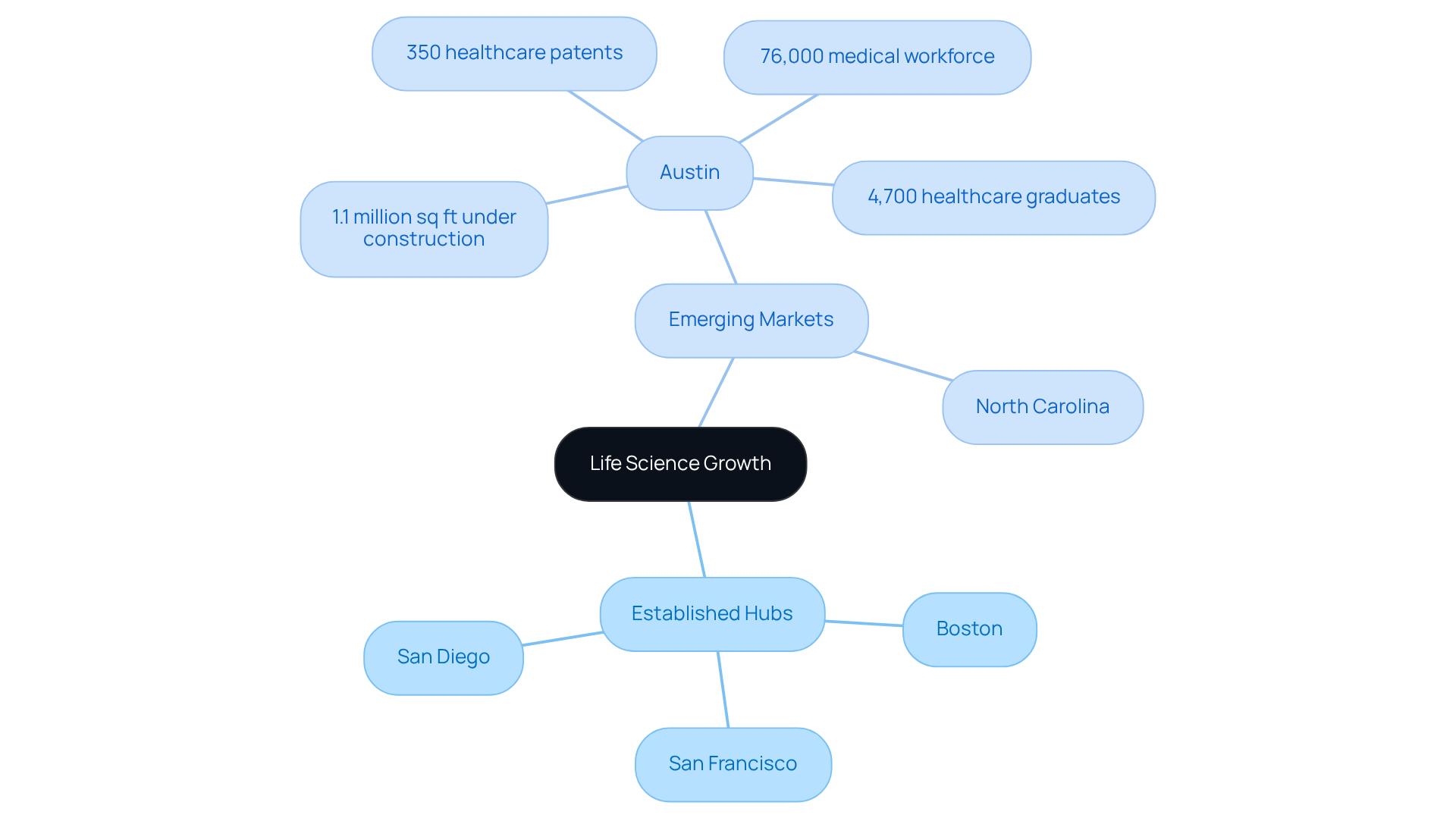

Areas are increasingly recognized as pivotal centers for life science commercial real estate, driven by factors such as access to skilled personnel, proximity to research facilities, and favorable regulatory environments. Established hubs like Boston, San Francisco, and San Diego lead the way in life science commercial real estate, thriving within their robust ecosystems. Meanwhile, emerging markets like Austin and North Carolina are swiftly rising in prominence in the life science commercial real estate sector, presenting competitive advantages such as lower operational costs and supportive local policies.

For instance, Austin is experiencing significant growth in life science commercial real estate, with:

- 1.1 million square feet of biological space currently under construction

- 350 healthcare patents filed over the past five years

- A medical workforce of 76,000 experts

- 4,700 healthcare graduates annually

Investors and developers should closely monitor these evolving landscapes, particularly as Texas provides property tax exemptions for tangible personal property utilized by medical and biomedical manufacturers in the life science commercial real estate market. This incentive, along with Austin's recognition as one of the top three emerging health markets in the nation, exemplifies a broader trend of diversification in life science commercial real estate investments. It is imperative for stakeholders to adapt to these changes.

Redefined Spaces: Adapting Life Science Offices for Remote Work

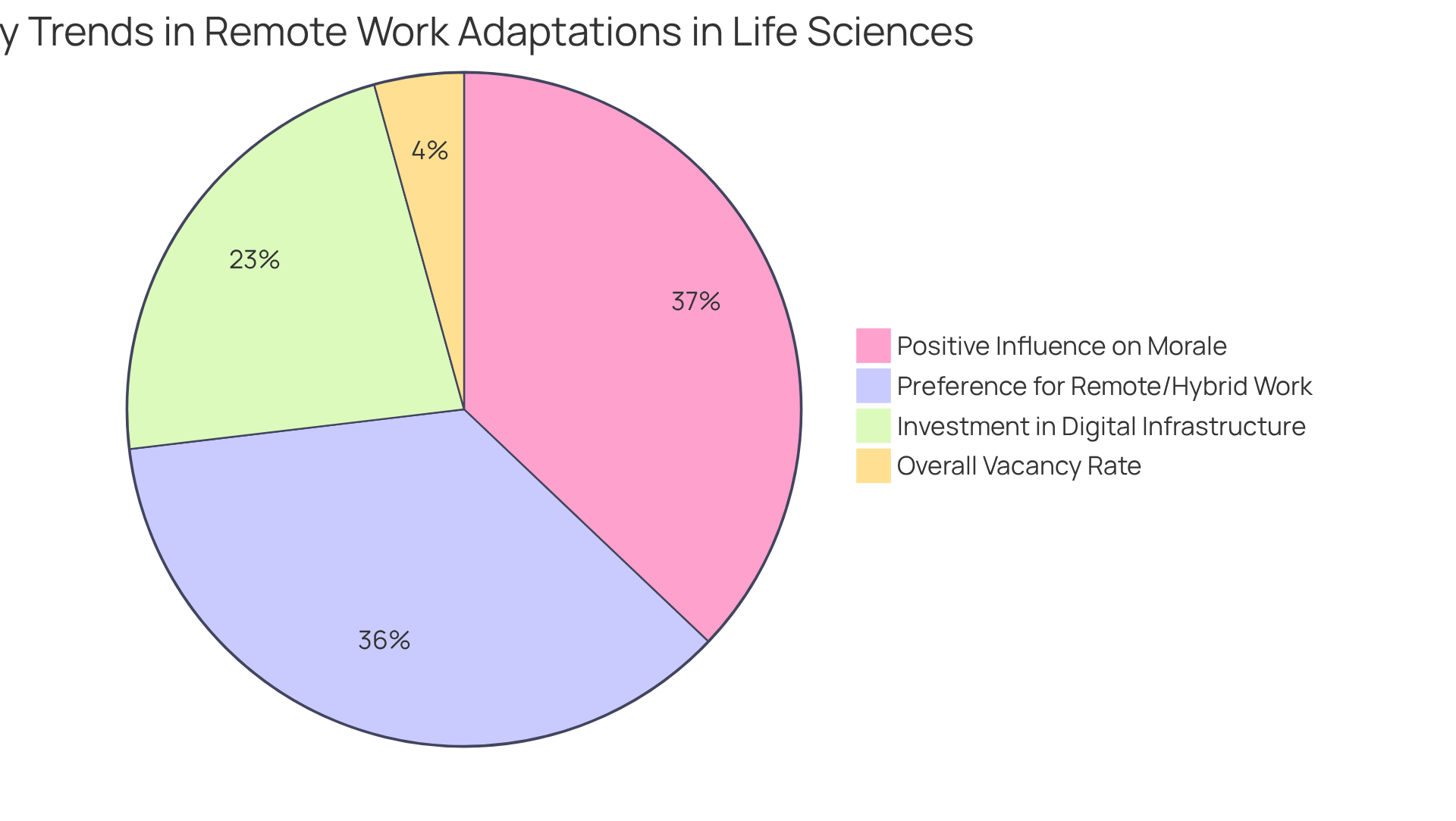

The shift to remote work has compelled organizations in the biological field to reassess their office layouts and purposes within the context of life science commercial real estate. A notable trend is the prioritization of flexible workspaces that accommodate both in-office and remote employees. This transformation encompasses the creation of collaborative areas that foster teamwork alongside quiet zones designated for focused tasks. As organizations embrace hybrid work models, the layout of offices in life science commercial real estate must adapt to support diverse working styles and enhance overall productivity.

Significantly, 42% of biological companies plan to increase their investments in digital infrastructure to bolster remote work, underscoring the necessity of flexible environments. Furthermore, with 67% of clinical research professionals favoring remote or hybrid trial management, the demand for adaptable office layouts is anticipated to rise. This trend highlights the critical need for real estate developers to address these evolving requirements in life science commercial real estate projects.

Additionally, 69% of respondents indicated that remote or hybrid work positively influences morale and job satisfaction, emphasizing the importance of cultivating environments that promote employee well-being. The overall vacancy rate for leading bioscience clusters, hovering just above 8 percent, further illustrates the competitive landscape, necessitating innovative office designs that attract and retain talent. Proximity to universities and public transit remains essential for successful research clusters, reinforcing the significance of strategic planning in office designs.

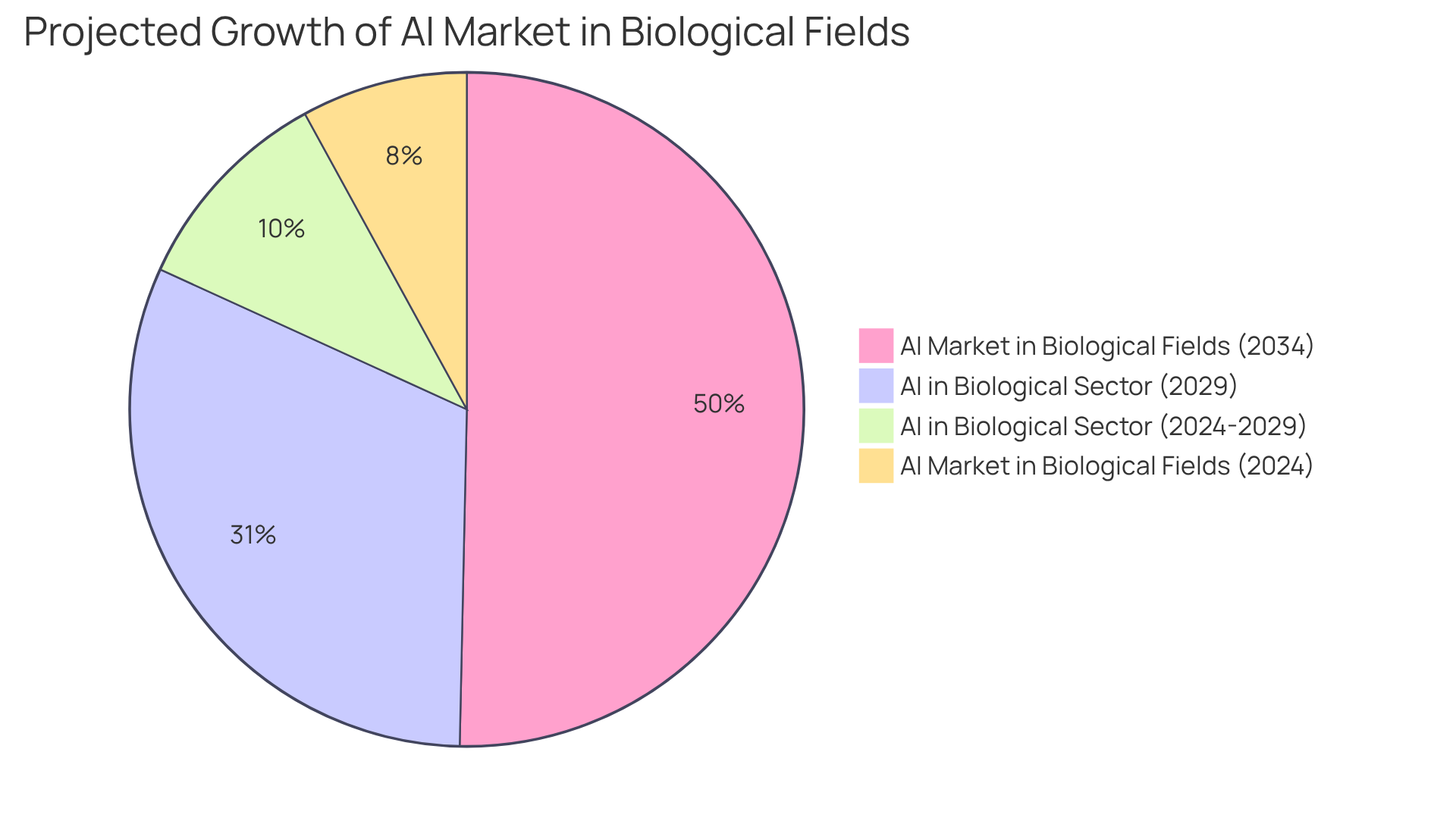

Technological Innovation: Infrastructure Needs in Life Sciences

Technological advancement is fundamentally transforming the infrastructure landscape of the biological sector. As organizations increasingly adopt advanced technologies such as AI and big data analytics, the demand for high-performance computing facilities and data centers is surging. Notably, the worldwide AI in biological fields market is projected to expand from USD 2.25 billion in 2024 to USD 14.20 billion by 2034, reflecting a compound annual growth rate (CAGR) of 20.21%. Furthermore, the AI in the biological sector is anticipated to grow from $2.88 billion in 2024 to $8.88 billion by 2029, with a CAGR of 25.23%. This rapid expansion underscores the necessity for real estate developers to create environments in the life science commercial real estate sector that can accommodate the technological demands of contemporary biological operations.

Moreover, the integration of AI tools and algorithms facilitates the processing of vast amounts of complex data, enabling the identification of patterns that are often elusive to human analysts. Consequently, the infrastructure must not only support current technological demands but also be adaptable to future advancements. Significantly, 52% of participants cited access to data as a barrier to AI adoption in healthcare, highlighting the challenges organizations face in embracing these technologies. This emphasis on robust infrastructure is crucial for fostering innovation and ensuring that biotechnology firms remain competitive in an increasingly data-driven landscape. The effective incorporation of these technologies ultimately hinges on the capacity of real estate developers in life science commercial real estate to respond to the evolving demands of the industry. As Dr. Peter Dayan, Director of the Max Planck Institute for Biological Cybernetics, aptly noted, "Machine learning is set to transform vast swathes of research," underscoring the critical role of infrastructure in supporting these advancements.

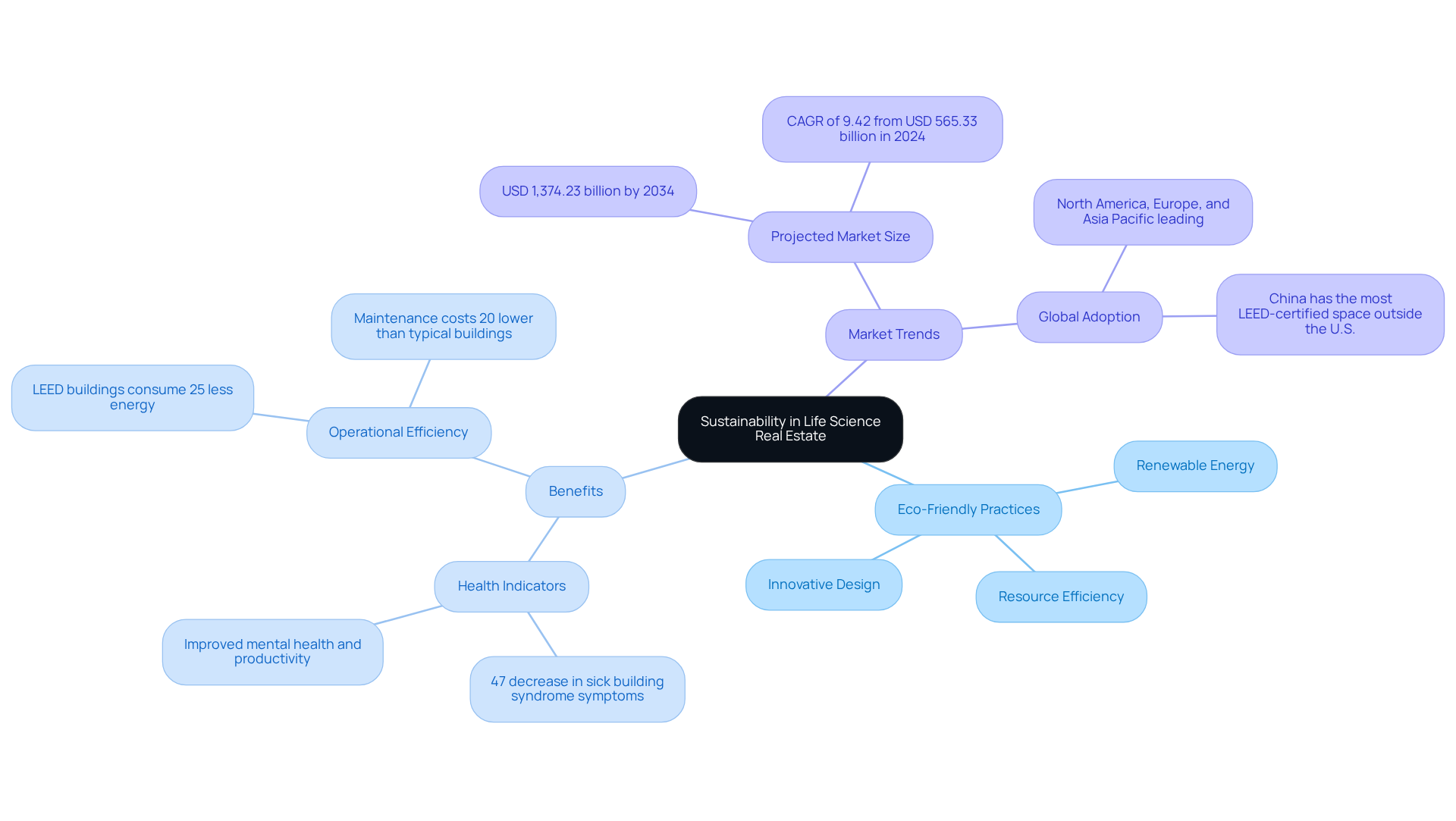

Sustainability Focus: Green Practices in Life Science Real Estate

Sustainability is emerging as a cornerstone in biomedicine real estate, as firms strive to minimize their ecological impact through eco-friendly construction methods. These initiatives encompass the use of renewable energy sources, enhanced resource efficiency, and innovative design strategies that align with regulatory pressures and public expectations. For instance, LEED-certified buildings have been shown to consume 25% less energy and use 11% less water than traditional structures. This makes them an attractive option for both developers and tenants. Moreover, research indicates that residents in LEED-certified structures report enhanced health indicators, including a 47% decrease in sick building syndrome symptoms, which is particularly pertinent in health-oriented biological fields.

Developers who prioritize sustainability not only comply with evolving regulations but also appeal to tenants who value environmental responsibility. The global green building market is projected to reach USD 1,374.23 billion by 2034, reflecting a significant shift towards eco-friendly construction practices, with a compound annual growth rate (CAGR) of 9.42% from USD 565.33 billion in 2024. Successful initiatives in the biological field illustrate the feasibility of these methods, highlighting how eco-friendly structures can improve operational efficiency while supporting occupant health. As Joseph Allen notes, "green buildings maximize natural efficiencies and integrate renewable technologies," creating healthier environments that benefit both occupants and the planet. With the rising demand for sustainable environments, the biological sector is poised to spearhead the adoption of eco-friendly building practices that promote innovation and accountability.

Regulatory Landscape: Navigating Compliance in Life Sciences

Navigating the regulatory environment poses a significant challenge for biopharmaceutical firms, where strict adherence to numerous laws and standards is vital for operational success. This includes compliance with safety regulations, environmental standards, and industry-specific guidelines. Real estate developers in life science commercial real estate must remain vigilant regarding these regulatory requirements when designing and constructing facilities to ensure compliance.

For instance, the FDA's stringent guidelines necessitate that firms stay informed to avoid delays and penalties; even minor deviations can result in substantial setbacks. Experts emphasize that embedding compliance into business operations is essential for seamless market entry and sustained growth. Dr. Sarah Thompson, a senior consultant, asserts, "You can’t afford to take shortcuts when it comes to regulatory compliance. Even minor deviations can lead to significant setbacks."

By proactively addressing regulatory challenges, businesses can mitigate risks and enhance operational efficiency. Statistics reveal that the implementation of digital tools can reduce compliance costs by an average of 30%, underscoring the importance of integrating technology in navigating these complexities. Furthermore, 89% of biotechnology firms are investing in digital transformation to enhance operational efficiency and patient outcomes, reinforcing the necessity for technological integration in compliance strategies.

As the biological fields advance, effective approaches will increasingly depend on a thorough understanding of regulatory structures and ongoing adaptation to shifting guidelines, ensuring that firms not only comply but thrive in a competitive environment.

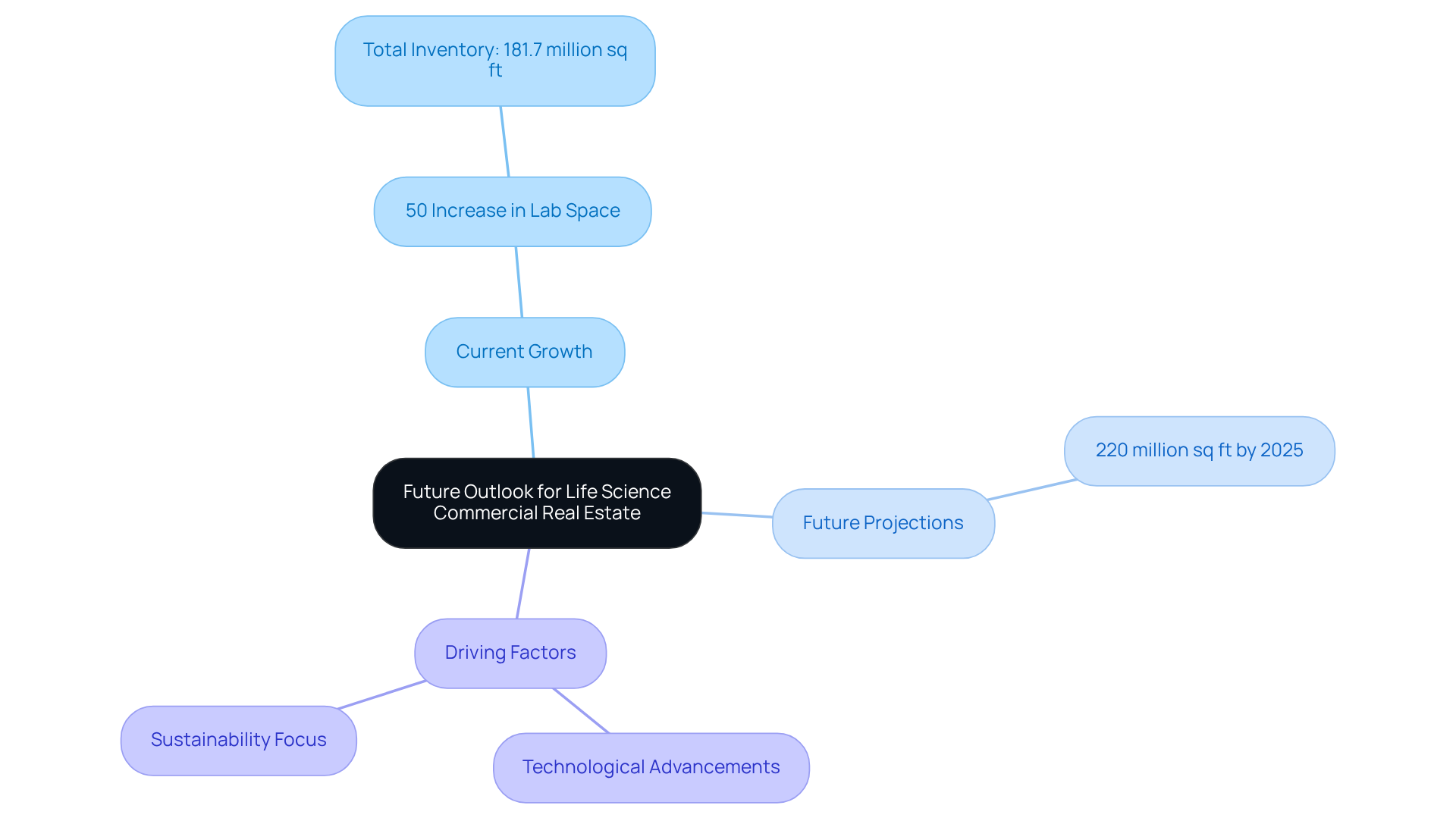

Future Outlook: Sustained Growth in Life Science Commercial Real Estate

The outlook for life science commercial real estate is exceptionally promising, with sustained growth anticipated as the sector adapts to evolving demands. Investment in biological fields has surged, evidenced by a nearly 50% increase in the inventory of laboratories and R&D locations across the U.S., reaching 181.7 million square feet by late 2022. This upward trend is expected to continue, with projections indicating that biological properties will require 220 million square feet by 2025. This growth is driven by ongoing technological advancements and a heightened focus on sustainability.

As companies navigate changing workforce dynamics and regulatory environments, the necessity for flexible and innovative spaces will be paramount. Investors and developers who remain vigilant to these trends will find themselves well-positioned to capitalize on the myriad opportunities emerging within the expanding biological market.

With life science commercial real estate employment at an all-time high and a strong pipeline of clinical trials, this sector stands ready for substantial growth, making it an appealing target for strategic investment.

Conclusion

The landscape of life science commercial real estate is evolving rapidly, driven by a confluence of trends that are reshaping the sector. The surge in investment, the demand for specialized facilities, and the emphasis on sustainability are just a few of the key factors influencing this dynamic market. Notably, the COVID-19 pandemic has acted as a catalyst, propelling growth and underscoring the importance of innovation and adaptability within the industry.

Several pivotal trends have emerged, including:

- The rising need for specialized lab spaces to support burgeoning research activities.

- Attracting top talent through appealing work environments has become critical.

- The necessity for infrastructure that can accommodate technological advancements.

- The regulatory landscape remains a significant challenge that firms must navigate to ensure compliance and operational success.

Looking ahead, the future of life science commercial real estate appears bright, with sustained growth anticipated as the sector adapts to ongoing changes. Investors and developers who remain attuned to these trends will be well-positioned to leverage the opportunities that arise within this expanding market. As the demand for innovative, flexible, and sustainable spaces continues to rise, embracing these shifts will be crucial for success in the life sciences sector. The call to action is clear: stakeholders must prioritize strategic investments and thoughtful development to thrive in this promising landscape.