Overview

This article identifies the seven regional banks with the largest exposure to commercial real estate (CRE), examining the associated risks and strategies they employ. Notably, banks such as Valley National Bank, Bank of America, and Wells Fargo are navigating significant challenges, including rising interest rates and increasing delinquency rates. These factors necessitate meticulous risk management and strategic adjustments in their lending practices to uphold financial stability. As these banks adapt, understanding their approaches can provide valuable insights for investors looking to navigate the complexities of the current market.

Introduction

The commercial real estate (CRE) landscape is evolving rapidly, presenting both opportunities and challenges for regional banks heavily invested in this sector. As interest rates rise and economic uncertainties loom, understanding the exposure levels of these banks becomes crucial for investors seeking to navigate a potentially volatile market.

What strategies are these institutions employing to manage their substantial CRE portfolios? How might their approaches impact investment decisions?

This article delves into the seven regional banks with the largest commercial real estate exposure, exploring their risk management practices and the implications for investors in this dynamic environment.

Zero Flux: Daily Insights on Regional Banks' CRE Exposure

Zero Flux provides daily insights into the real estate exposure of regional banks with the largest commercial real estate exposure by synthesizing data from over 100 sources. This comprehensive approach enables subscribers to remain informed about the latest trends and risks associated with the portfolios of regional banks with the largest commercial real estate exposure. Such insights are crucial for making informed investment decisions in a volatile market. By leveraging these insights, investors can navigate the complexities of the market with confidence, ensuring they are well-equipped to seize opportunities and mitigate risks effectively.

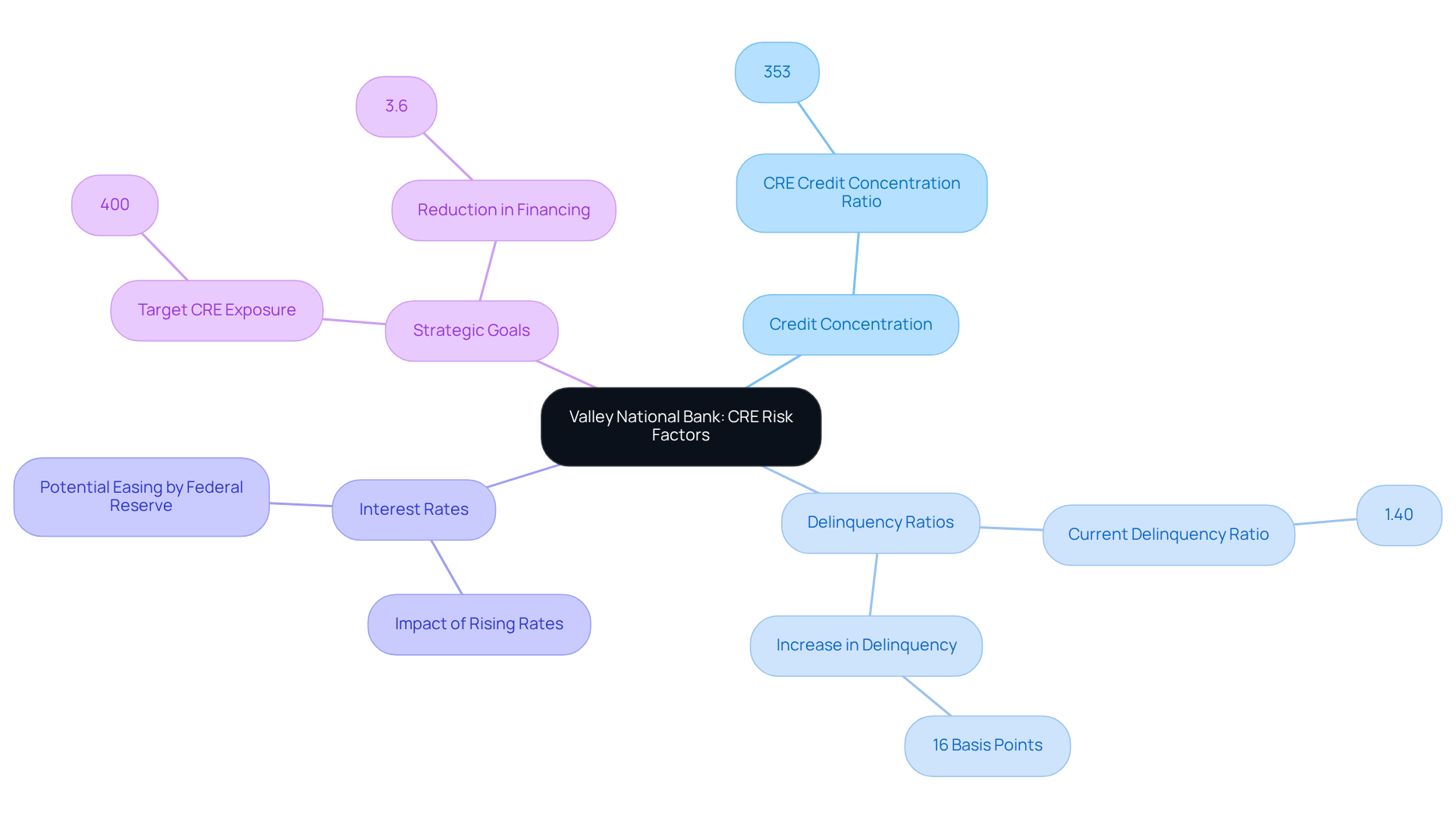

Valley National Bank: Notable CRE Risk Factors

Valley National Bank currently exhibits a notable concentration in commercial real estate (CRE) credits, making it one of the regional banks with the largest commercial real estate exposure, as evidenced by a reported CRE credit concentration ratio of 353%. This elevated exposure raises significant concerns, particularly for regional banks with the largest commercial real estate exposure, especially in light of rising interest rates that are exerting pressure on borrowers as debts mature.

The delinquency ratio for CRE credits has recently escalated to 1.40%, reflecting the strain within the office sector, particularly for regional banks with the largest commercial real estate exposure, where vacancy rates have surged and property values have diminished. As noted by Xylex Mangulabnan, 'The delinquency ratio for commercial real estate (CRE) credits across US financial institutions increased 16 basis points in the second quarter to 1.40%.' Investors must remain vigilant regarding these dynamics, as they possess the potential to adversely influence the financial stability of regional banks with the largest commercial real estate exposure. Furthermore, market volatility introduces an additional risk, potentially complicating the bank's ability to manage its credit portfolio effectively.

Valley National Bank aims for a CRE credit exposure of 400% over the intermediate term, which emphasizes its strategic positioning and risk management approach among regional banks with the largest commercial real estate exposure. With the Federal Reserve signaling a possible easing of monetary policy, the trajectory of interest rates will be crucial in evaluating the future performance of regional banks with the largest commercial real estate exposure, including Valley National Bank's commercial real estate financing and overall financial health. Notably, the financial institution recently reported a 3.6% reduction in commercial real estate financing, which may suggest adjustments in response to these pressures. Additionally, a decline in medium-term interest rates could offer some relief to CRE borrowers, adding complexity to the current landscape.

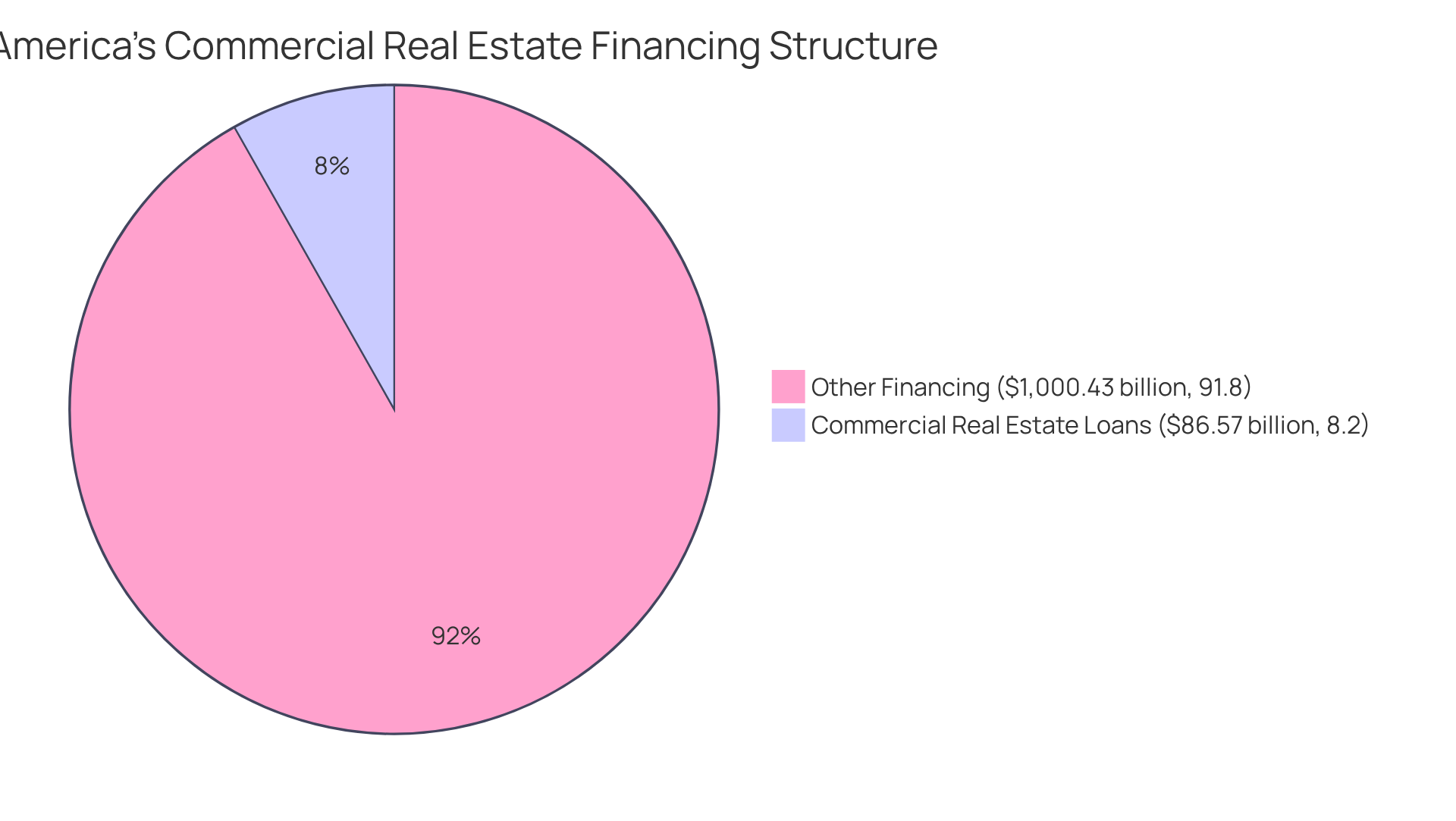

Bank of America: Analyzing CRE Exposure Trends

Bank of America currently holds approximately $86.57 billion in commercial real estate (CRE) credit, which constitutes 8.2% of its total financing. This financial institution employs a robust diversification strategy to manage its significant exposure, effectively reducing potential losses. By distributing its investments across various property types and geographic regions, Bank of America bolsters its resilience against market fluctuations.

Additionally, the institution has implemented strict risk management strategies, including increasing credit loss reserves in anticipation of rising defaults, particularly in areas with elevated vacancy rates. Notably, Bank of America experienced an 11.4% year-over-year growth in its CRE loan portfolio, underscoring its strategic focus on property lending despite market challenges. The institution's leverage ratio stands at 7.63%, emphasizing the importance of prudent risk management given the sector's hurdles.

As the real estate market contends with pressures from high interest rates and declining property values, investors should closely observe these trends, as they are likely to impact Bank of America's performance and stability within the evolving CRE landscape.

As Marie Judith Fleming, CEO at Gold Bridge Capital Solutions, aptly stated, "This situation not only influences financial institutions, where such credits make up over a fifth of portfolios but also impacts investors in mortgage-backed securities (CMBS) who encounter declining returns.

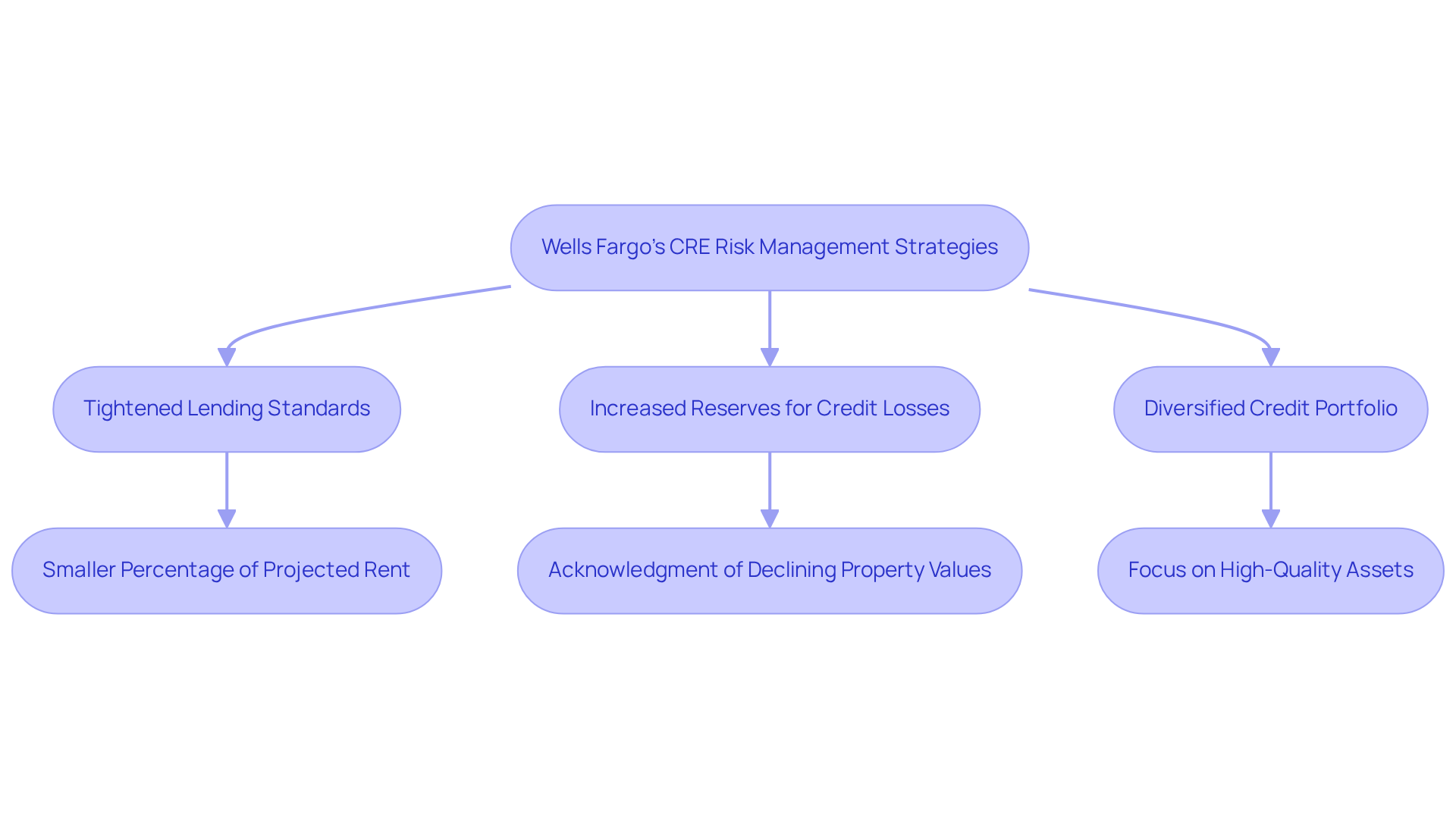

Wells Fargo: Strategies for Managing CRE Risks

Wells Fargo has implemented a series of strategic measures to mitigate its exposure to commercial real estate (CRE) risks, particularly in response to the evolving market landscape. As of June 2025, the bank has tightened its lending standards, now mandating that payments on refinanced credit represent a smaller percentage of projected rent. This adjustment reflects a deliberate strategy for managing risk, especially in light of the increasing defaults in the office space sector, where analysts anticipate that 21% of office credits may fail. Such failures could lead to significant losses for creditors, with forecasts indicating that lenders might lose an average of 41% of the principal amount on these failed credits.

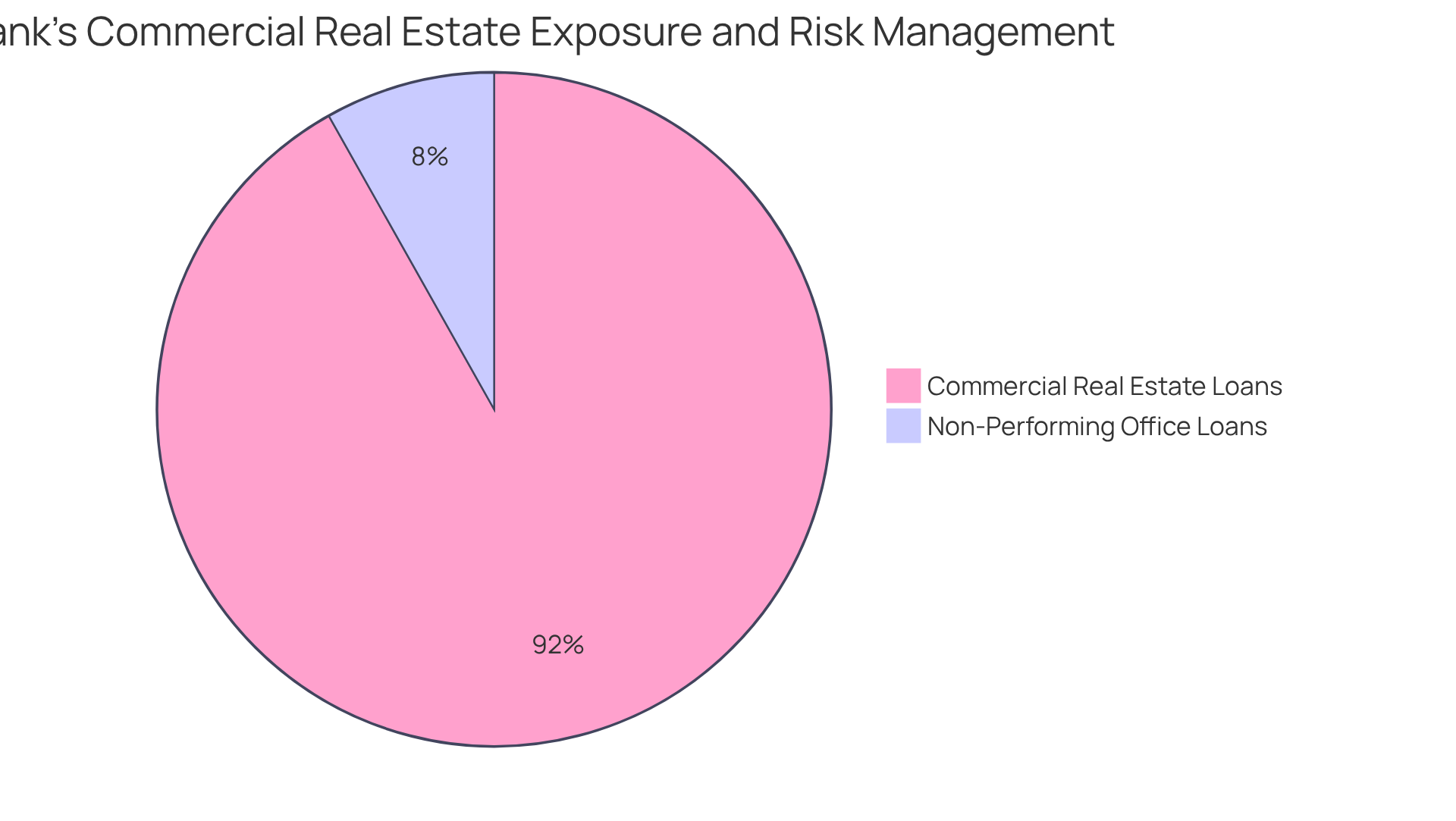

In conjunction with tightening lending standards, Wells Fargo has increased its reserves for potential credit losses, acknowledging the challenges posed by declining property values and high vacancy rates in major cities like New York and Chicago. The financial institution's business real estate exposure, amounting to approximately $137 billion in CRE loans, comprises 15.5% of its overall loans and 8% of its total assets, which positions it among the regional banks with largest commercial real estate exposure. This statistic underscores the necessity of robust risk assessment processes to sustain stability in a volatile market.

Wells Fargo's CEO, Tim Sloan, has expressed concerns regarding the real estate sector, characterizing it as 'frothy' during recent discussions. This perspective emphasizes the bank's dedication to enhancing its risk management strategies, which are vital for navigating the complexities of the current CRE landscape. By focusing on diversifying its credit portfolio and enforcing stringent lending criteria, Wells Fargo aims to safeguard its financial stability and mitigate the potential repercussions of a broader financial crisis stemming from the real estate sector.

PNC Bank: Navigating the Commercial Real Estate Landscape

PNC Bank is strategically navigating the business real estate landscape by prioritizing targeted investments and leveraging technology enhancements. Recent reports reveal a cautious lending approach, focusing on maintaining a balanced portfolio amidst evolving market dynamics. Notably, PNC's exposure to business real estate constitutes approximately 18% of its loan portfolio, with a non-performing rate for office loans at 1.6%, indicating effective risk management.

The bank's net income for the first quarter of 2025 was reported at $1.5 billion, reflecting its financial health in relation to its commercial real estate (CRE) strategy. Furthermore, PNC's net interest income (NII) has demonstrated sequential growth of 3.3%, with management projecting an increase of 6%-7% in NII for 2025 compared to 2024 levels. As PNC continues to adapt to market conditions, its strategic initiatives, including the launch of Mobile Accept® aimed at micro and small businesses, underscore a commitment to innovation in CRE lending. This technology enhances PNC's service offerings, facilitating more efficient transactions in the real estate sector.

Investors should closely monitor PNC's approach as it seeks to optimize its CRE exposure, particularly among regional banks with largest commercial real estate exposure, while navigating the complexities of the current economic environment. How will these strategic moves influence the bank's position in the market? The implications for investment strategies are significant, warranting careful consideration.

US Bank: Evaluating CRE Investment Strategies

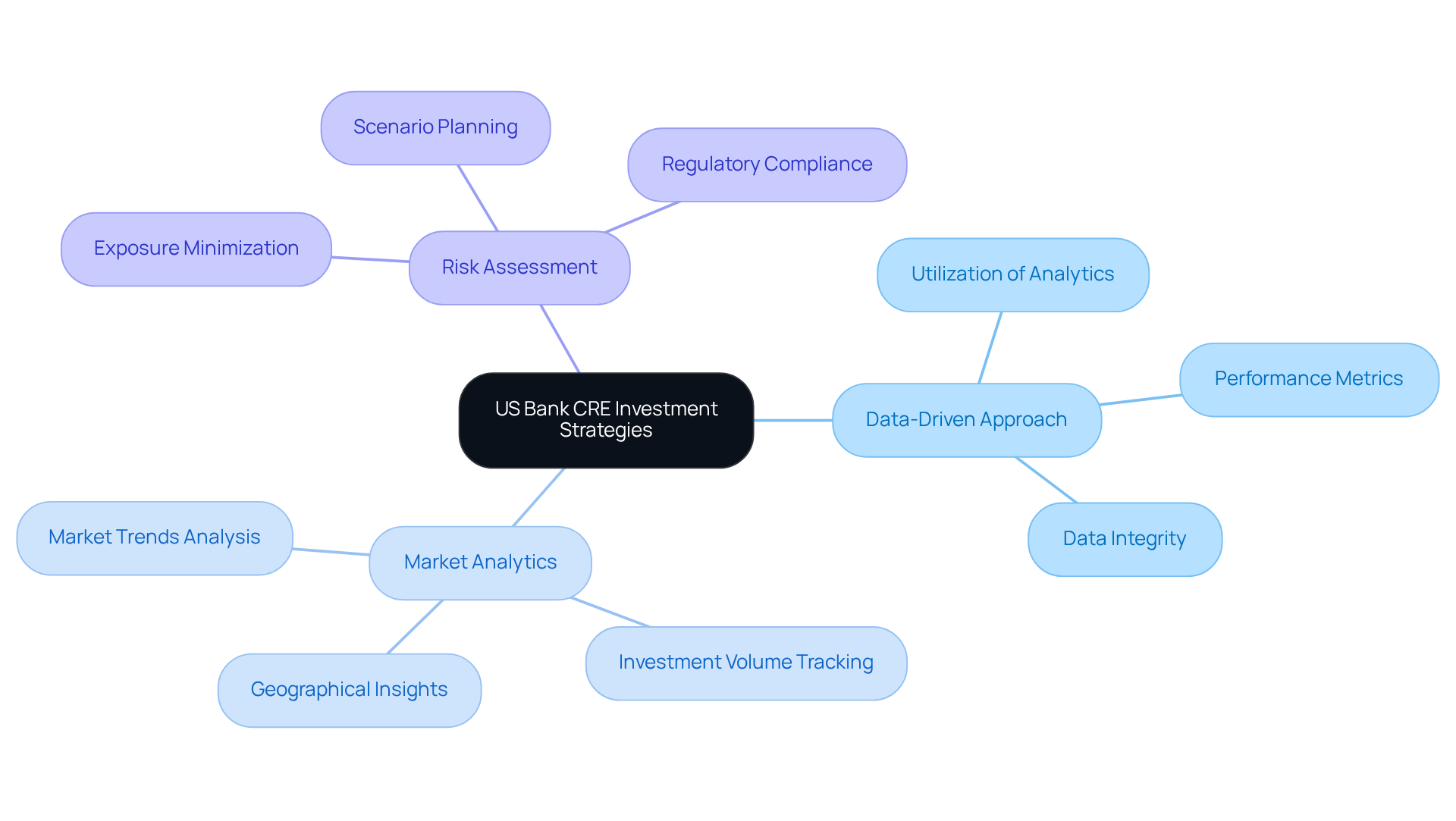

US Bank has embraced a data-driven approach to evaluate its business real estate investment strategies. By concentrating on market analytics and risk assessment, this financial institution seeks to optimize its CRE portfolio while effectively minimizing exposure to potential downturns. Investors should consider how US Bank's strategic initiatives may significantly influence its performance in the ever-evolving market landscape.

Regions Bank: Understanding CRE Exposure Dynamics

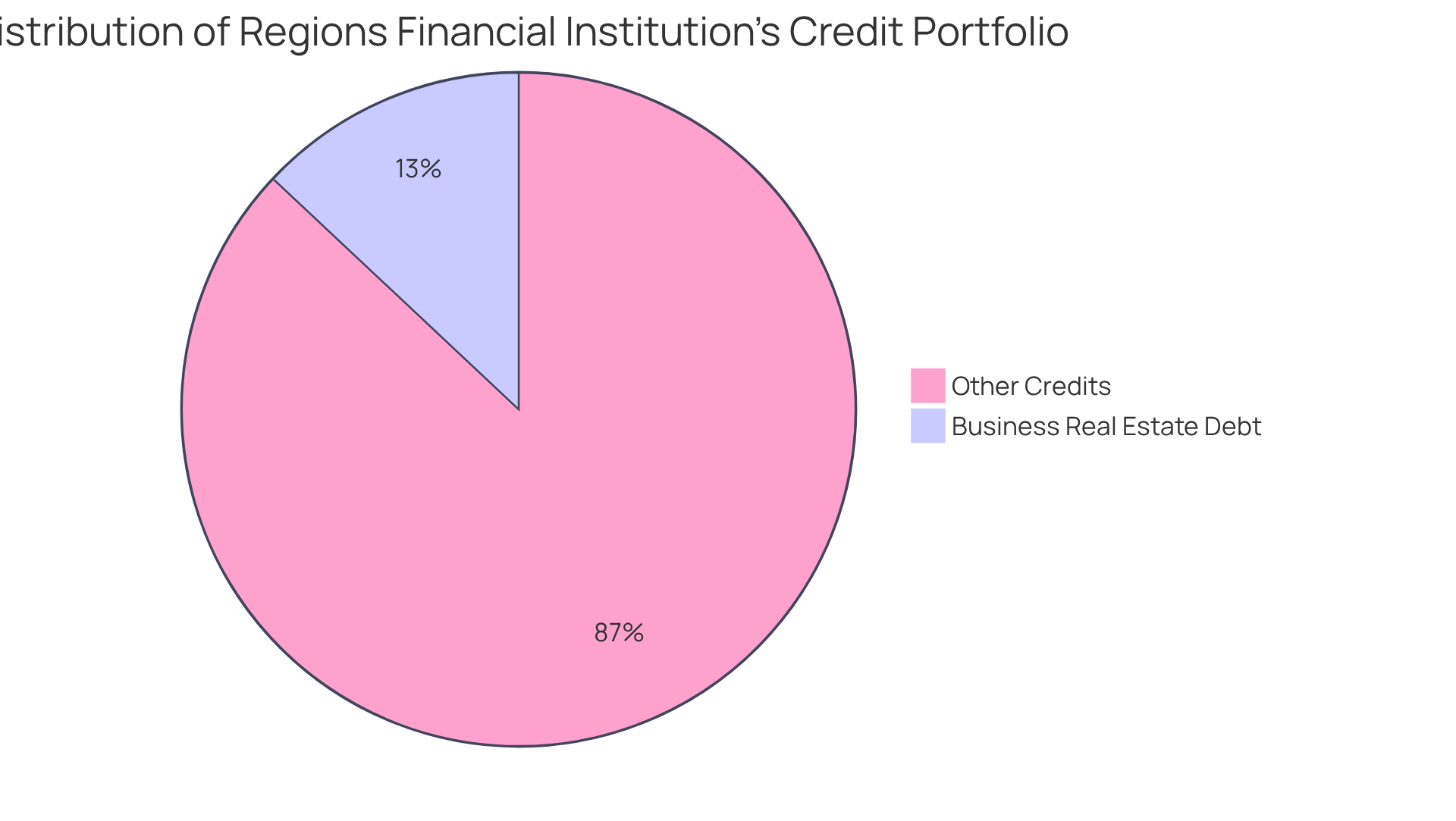

Regions Financial Institution demonstrates a strong emphasis on its credit portfolio within business real estate, which is significant among regional banks with largest commercial real estate exposure, where business real estate debt constitutes 13% of total credits at large financial institutions. This reality necessitates vigilant oversight of exposure levels.

The institution employs a proactive strategy that includes regular assessments of market conditions and borrower performance, both essential for effective risk mitigation. As of June 2025, nearly half of U.S. financial institutions, including regional banks with largest commercial real estate exposure, face similar challenges, as real estate debt represents the largest credit category for almost half of them.

Investors should closely monitor Regions Bank's strategies, particularly in light of the $1.2 trillion in real estate mortgage debt due by the end of 2025 and the concerning surge in overdue property debts, which reached $9.3 billion in 2023, especially as it relates to regional banks with largest commercial real estate exposure.

These dynamics, coupled with the tripling of distressed debt restructuring for real estate—from $6 billion in Q2 2023 to $18 billion in Q4 2024—could significantly impact the bank's financial stability and overall market health.

As Rebel A. Cole notes, "Banks opt to provide these credits, hoping interest rates might decline," highlighting the unstable nature of the current lending environment.

KeyBank: Assessing CRE Risk Management Approaches

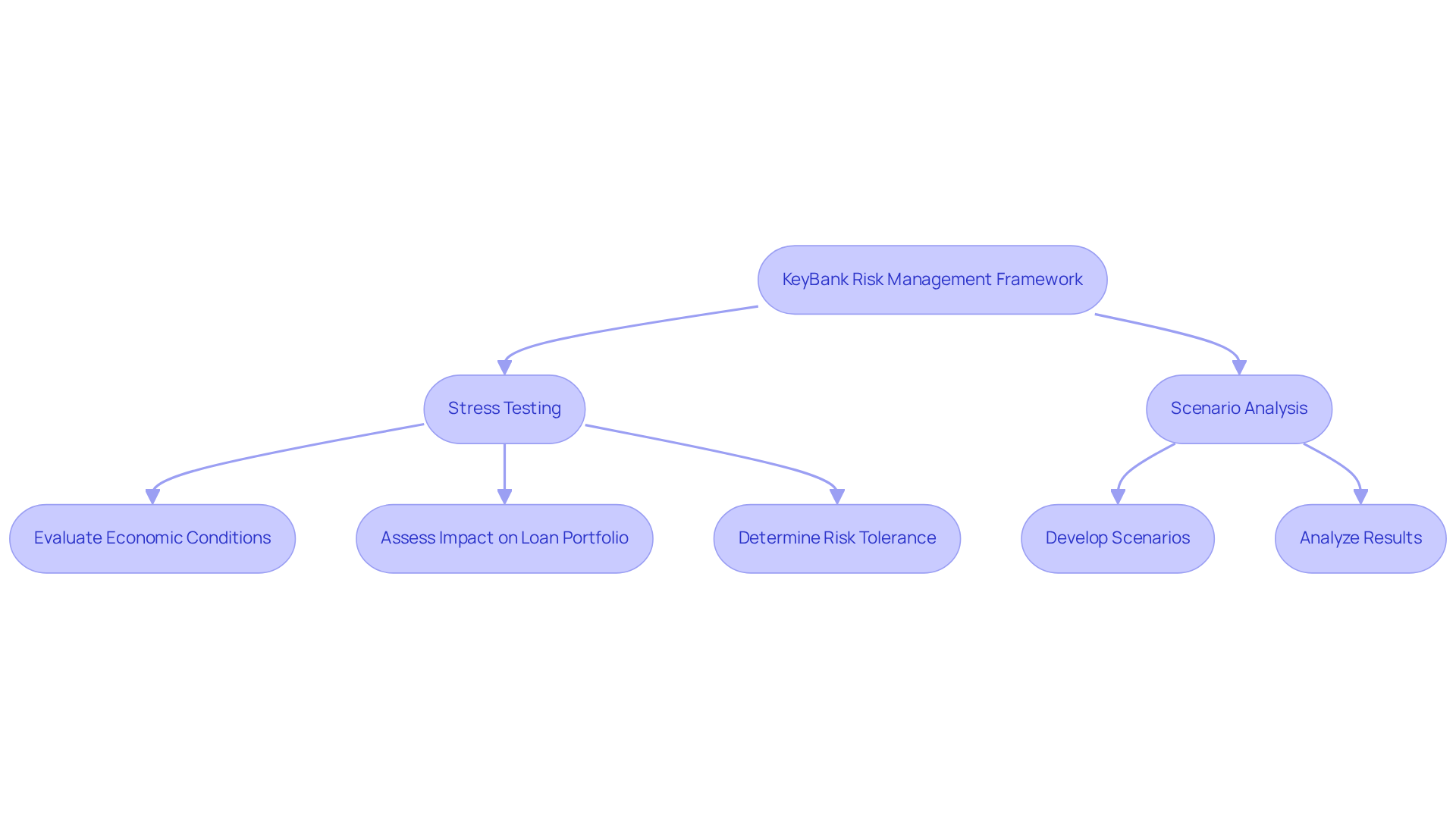

KeyBank has established a robust risk management framework designed to adeptly address its commercial real estate (CRE) exposure. This framework encompasses regular stress testing and scenario analysis, which are vital for assessing potential impacts on its loan portfolio. As of June 2025, KeyBank's stress testing scenarios have been meticulously crafted to evaluate diverse economic conditions, ensuring the institution remains resilient amidst market fluctuations. Notably, the institution's CRE portfolio has undergone thorough stress testing, yielding insights into its risk tolerance and financial stability.

For example, recent stress tests revealed that KeyBank's CRE portfolio could endure a hypothetical economic downturn with a projected loss rate of 5%, underscoring its preparedness. These proactive measures not only align with industry best practices—such as maintaining adequate capital reserves and diversifying loan types—but also serve as a benchmark for regional banks with largest commercial real estate exposure and other financial institutions facing similar challenges.

Floyd Merritt, Senior Vice President at KeyBank, stated, "Our commitment to rigorous stress testing allows us to better understand our risk exposure and make informed decisions."

Investors should take note of KeyBank's dedication to transparency and readiness; these factors are crucial for sustaining confidence in its ability to manage its CRE exposure effectively.

Implications of CRE Exposure for Investors in Regional Banks

Investors in local financial institutions must recognize the implications of high commercial real estate (CRE) exposure, especially for regional banks with the largest commercial real estate exposure, which includes potential volatility and credit risk. As these institutions navigate the complexities of the CRE market, it is crucial for investors to evaluate their risk tolerance, particularly when considering regional banks with the largest commercial real estate exposure, and to diversify their portfolios to mitigate potential losses. Staying informed about market trends and the strategies employed by financial institutions is essential for making sound investment decisions. By understanding these dynamics, investors can better position themselves in a fluctuating market.

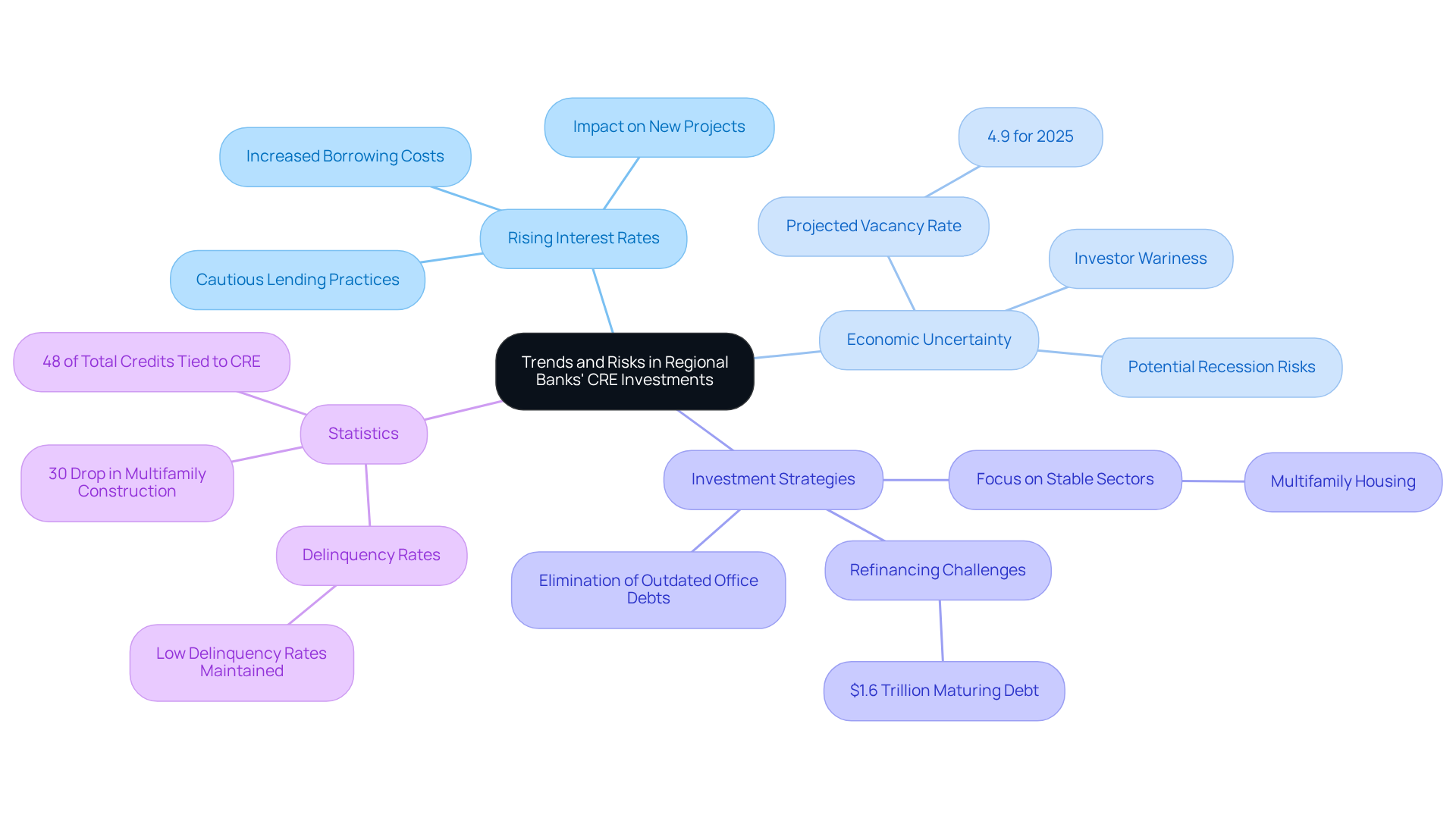

Trends and Risks in Regional Banks' Commercial Real Estate Investments

The commercial real estate (CRE) market is undergoing significant transformation, driven by rising interest rates and economic uncertainty. These factors are reshaping the investment strategies of regional financial institutions. As interest rates climb, many local financial institutions are adopting more cautious lending practices, reflecting an increased awareness of risk. Notably, approximately 48% of total credits at regional banks with the largest commercial real estate exposure are tied to CRE, which underscores their sensitivity to market fluctuations. This has led to a thorough examination of credit portfolios, with institutions actively eliminating outdated office debts while maintaining low delinquency rates, thus reinforcing their systematic approach to managing sector stress.

The landscape is further complicated by economic uncertainty, as concerns about potential recessionary impacts loom large. The anticipated national vacancy rate for 2025 is projected at 4.9%. However, many investors remain wary, particularly in high-risk regions like San Francisco, which faces the greatest risk of default on office loans. In response, regional banks with the largest commercial real estate exposure are adjusting their CRE strategies to focus on sectors with more stable demand, such as multifamily housing, where construction has experienced a significant decrease of 30% in May 2025.

Moreover, the amount of maturing CRE debt presents substantial refinancing challenges, with over $1.6 trillion due in 2025 and 2026, a significant portion of which is held by regional banks with the largest commercial real estate exposure. This scenario necessitates a disciplined approach to underwriting and restructuring, as financial institutions navigate a high-rate environment without succumbing to widespread distress. Investors must remain vigilant and consider adjusting their strategies to align with these evolving market conditions, as the interplay of rising interest rates and economic uncertainty continues to shape the future of regional banks with the largest commercial real estate exposure.

Conclusion

The landscape of commercial real estate (CRE) exposure among regional banks is intricate and evolving, marked by significant risks and opportunities. As highlighted in this analysis, regional banks are facing mounting challenges due to rising interest rates, economic uncertainty, and increasing delinquency rates in CRE loans. Understanding these dynamics is essential for investors looking to navigate this volatile market effectively.

Key insights reveal that institutions such as:

- Valley National Bank

- Bank of America

- Wells Fargo

- PNC Bank

- US Bank

- Regions Bank

- KeyBank

are adopting varied strategies to manage their CRE exposure. From tightening lending standards to implementing robust risk management frameworks, these banks are actively working to mitigate potential losses while positioning themselves for future growth. The emphasis on diversification, cautious lending practices, and proactive risk assessments underscores the necessity of a disciplined approach in a market characterized by uncertainty and fluctuating demand.

Investors must remain vigilant and informed about the ongoing trends and risks associated with regional banks' CRE investments. By closely monitoring these institutions' strategies and adapting their investment approaches accordingly, stakeholders can better navigate the complexities of the CRE landscape. Engaging with reliable insights and data will be crucial in making informed decisions that align with the shifting dynamics of the market.