Overview

The article examines how predictive analytics revolutionizes investments in commercial real estate by enhancing decision-making, trend forecasting, and risk assessment. By leveraging advanced data analysis and machine learning, investors can significantly improve property valuations, identify lucrative opportunities, and optimize their portfolios. This strategic approach ultimately leads to greater financial success in a competitive market.

Investors are increasingly recognizing the value of predictive analytics. With the ability to analyze vast amounts of data, they can make informed decisions that mitigate risks and capitalize on emerging trends. For instance, by accurately forecasting market movements, investors can position themselves advantageously, ensuring they are not left behind in a rapidly evolving landscape.

In conclusion, embracing predictive analytics is not just beneficial; it is essential for those looking to thrive in the commercial real estate sector. By integrating these advanced tools into their investment strategies, investors can unlock new levels of financial success and maintain a competitive edge.

Introduction

In an industry where data reigns supreme, the integration of predictive analytics is fundamentally reshaping the landscape of commercial real estate investment. By harnessing advanced data analysis techniques, investors unlock invaluable insights into market trends, property valuations, and risk assessments, significantly enhancing their decision-making processes.

However, as the market continues to evolve, how can investors effectively leverage these tools to navigate potential pitfalls and seize lucrative opportunities?

This article delves into seven transformative ways predictive analytics is revolutionizing investment strategies, equipping stakeholders with the essential knowledge to thrive in a competitive environment.

Zero Flux: Daily Insights on Predictive Analytics in Real Estate Investment

Zero Flux delivers daily insights focused on predictive analytics in commercial real estate. By aggregating information from over 100 sources, it empowers investors to understand economic dynamics and identify trends that may influence their financial strategies. This resource proves invaluable for professionals eager to harness predictive analytics in commercial real estate, thereby enhancing their decision-making processes in an ever-evolving landscape.

Consider the implications: how can understanding these trends reshape your investment approach? By leveraging the insights provided by Zero Flux, you can navigate the complexities of the market with confidence and precision. In a world where data reigns supreme, the ability to interpret and act upon these insights is not just beneficial—it is essential for sustained success.

Altus Group: Enhancing Investment Analysis with Machine Learning

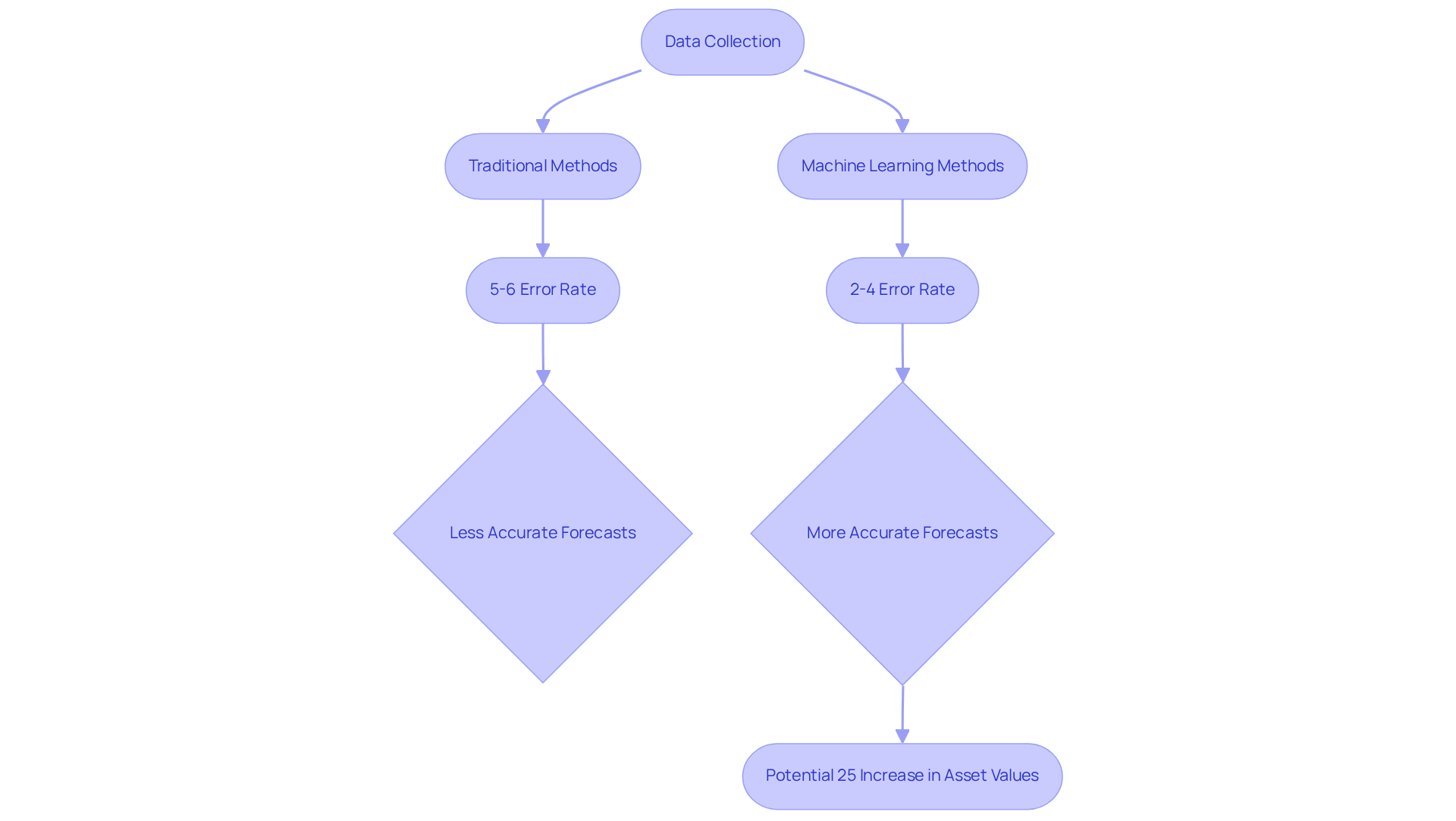

Altus Group harnesses the power of machine learning algorithms to significantly enhance predictive analytics in commercial real estate. By meticulously analyzing historical data alongside current market trends, predictive analytics in commercial real estate can accurately forecast future property values and assess financial risks. This cutting-edge approach not only automates data processing but also empowers investors with precise forecasts, enabling well-informed decision-making.

Notably, machine learning models, particularly Automated Valuation Models (AVMs), exhibit a median error rate of merely 2-4% in property valuations, surpassing traditional methods that typically yield error rates of 5-6%. Projections suggest that firms embracing these technologies could experience a remarkable 25% increase in asset values over the next decade, as highlighted by industry experts.

As advanced analytics continue to rise, Altus Group exemplifies the transformative potential of machine learning in financial analysis, showcasing the importance of predictive analytics in commercial real estate to maintain a competitive advantage in the ever-evolving landscape.

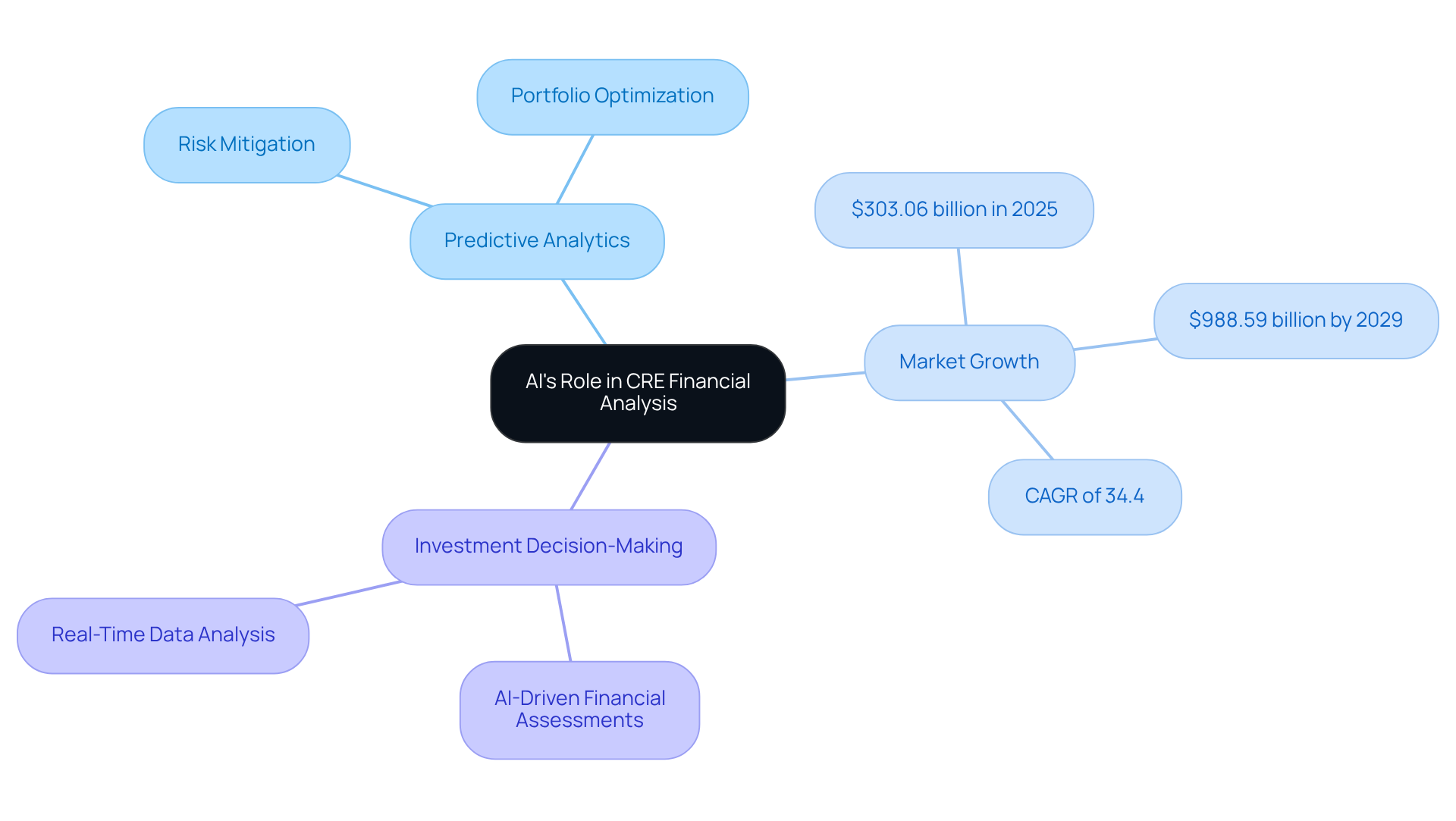

Gallagher Mohan: AI's Role in Transforming CRE Financial Analysis

Gallagher Mohan highlights the transformative impact of predictive analytics in commercial real estate on financial analysis. By leveraging AI-driven tools, firms can efficiently analyze extensive datasets, uncovering trends and anomalies that lead to more precise financial assessments. This evolution empowers investors to mitigate risks and optimize their portfolios effectively. Consider how AI technologies improve the precision of risk evaluations and property valuations, enabling companies to assess thousands of assets simultaneously and make informed decisions based on real-time information.

As the AI in real estate market is projected to grow significantly—reaching $303.06 billion in 2025 and expected to soar to $988.59 billion by 2029, with a CAGR of 34.4%—Gallagher Mohan's innovative approach positions them at the forefront of this evolution. This demonstrates how predictive analytics in commercial real estate can streamline financial analysis and drive investment success, urging investors to embrace these advancements for enhanced decision-making.

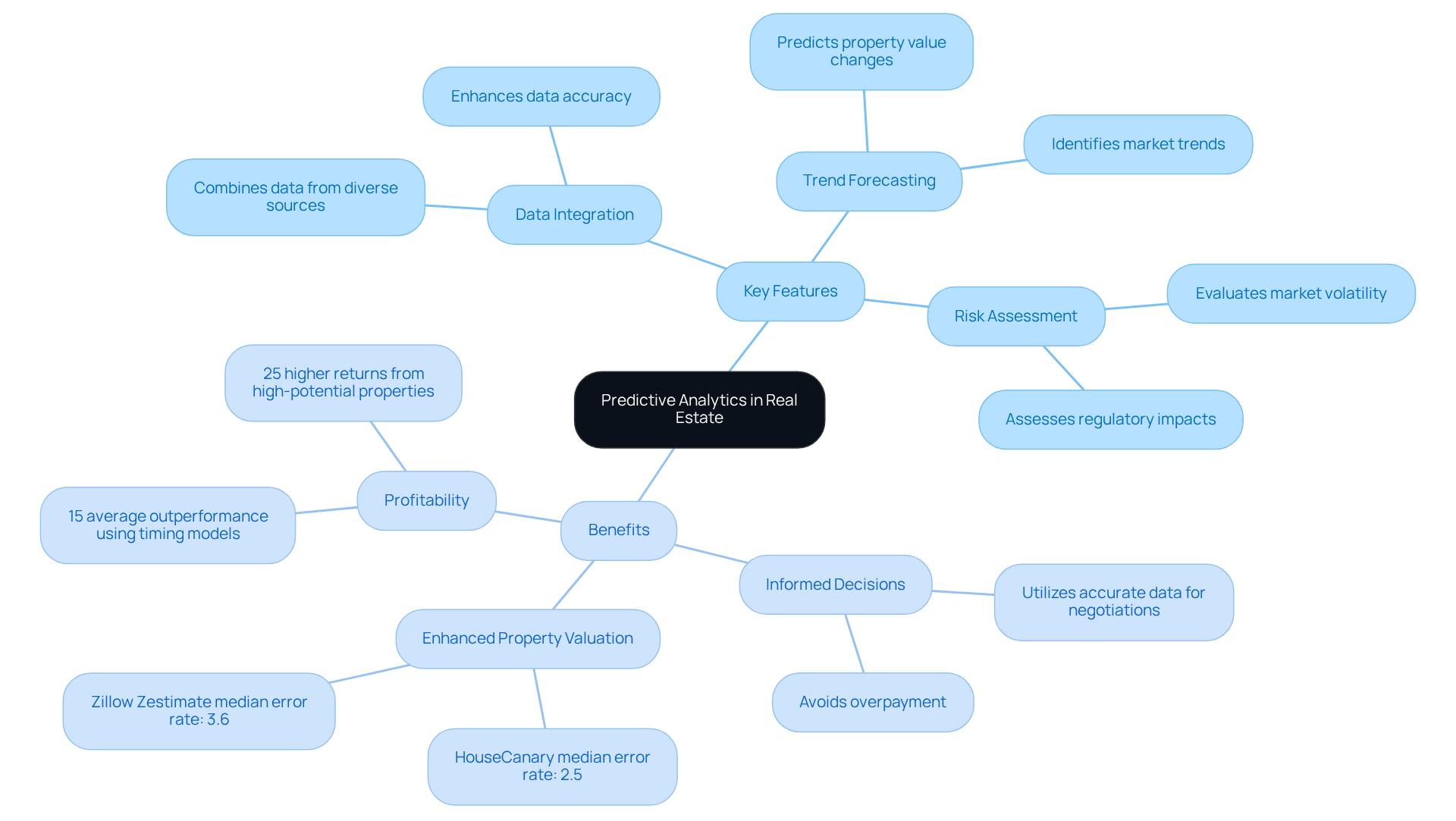

Matellio: Key Features and Benefits of Predictive Analytics in Real Estate

Predictive analytics in commercial real estate encompasses several crucial features, including data integration, trend forecasting, and risk assessment, collectively empowering investors to make informed, data-driven decisions. By synthesizing extensive datasets, forecasting techniques enhance property valuation precision, enabling investors to negotiate equitable prices and avoid overpayment. For example, companies like HouseCanary achieve a median error rate of just 2.5% in property valuation, significantly bolstering the reliability of investment assessments. Additionally, Zillow's Zestimate median error rate has improved from over 14% in 2006 to approximately 3.6% for on-market properties today, illustrating advancements in valuation precision through forecasting methods.

Moreover, forecasting tools provide investors with insights to anticipate changes in trends, allowing them to identify profitable opportunities and mitigate risks. This capability is particularly vital in a rapidly evolving environment, where understanding demographic trends and economic signals can lead to strategic financial decisions. For instance, property investors utilizing forecasting timing models have outperformed the sector by an average of 15% over five years, while properties identified as 'high potential' through forecasting algorithms yielded an average of 25% greater returns compared to conventionally selected assets (MIT Real Estate Innovation Lab, 2022).

As the landscape of predictive analytics in commercial real estate continues to evolve, its integration into investment strategies is becoming increasingly essential. The ability to use predictive analytics in commercial real estate to forecast demand and pricing changes based on historical data and current economic conditions enables investors to optimize their portfolios effectively. This data-driven approach not only enhances profitability but also equips investors to navigate the complexities of the real estate sector with greater confidence. Furthermore, the broader predictive analytics in commercial real estate sector is projected to expand from an estimated $17.87 billion in 2024 to $249.97 billion by 2037, underscoring the growing significance and relevance of predictive analytics in commercial real estate.

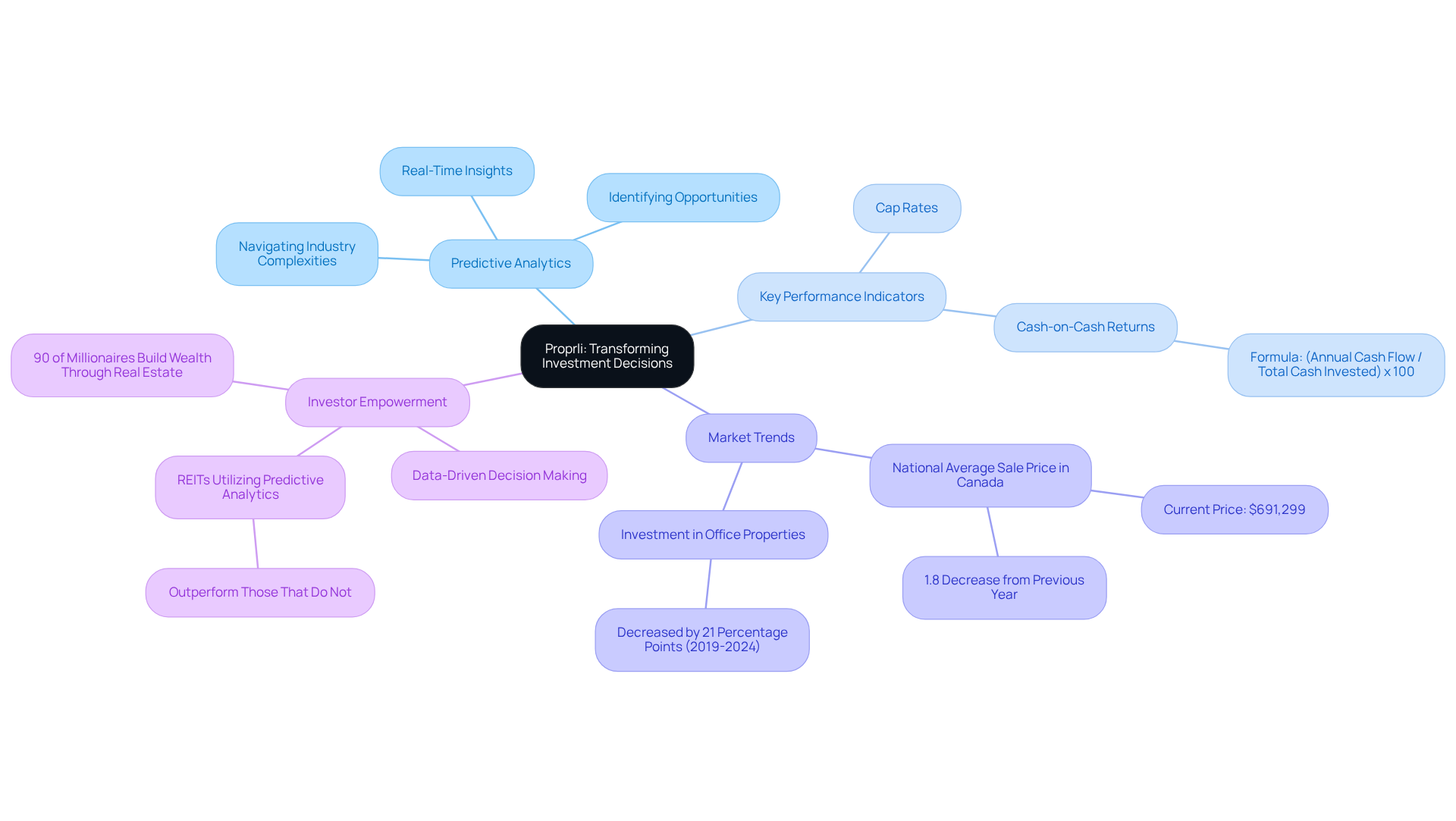

Proprli: Transforming Investment Decisions with Data Analysis

Proprli harnesses the power of data analysis to revolutionize financial choices in real estate. By delivering real-time insights and utilizing predictive analytics in commercial real estate, Proprli empowers investors to evaluate property performance and industry dynamics effectively. This data-driven approach utilizes predictive analytics in commercial real estate to not only identify lucrative opportunities but also facilitate informed decision-making that aligns with specific financial goals. As we approach 2025, the emphasis on predictive analytics in commercial real estate has become increasingly vital, enabling investors to navigate the complexities of the industry while remaining competitive and responsive to emerging trends.

The ability to access current information allows stakeholders to assess key performance indicators, including:

- Cap rates

- Cash-on-cash returns, calculated as (Annual Cash Flow / Total Cash Invested) x 100

This ultimately enhances their strategies and outcomes. Notably, 90% of millionaires accumulate their wealth through real estate, highlighting the critical role of predictive analytics in commercial real estate for data-driven decision-making in this sector. Furthermore, the national average sale price in Canada is currently $691,299, reflecting a 1.8% decrease from the previous year, which provides essential context for present market conditions.

Moreover, research indicates that REITs utilizing predictive analytics in commercial real estate outperform those that do not, underscoring the effectiveness of data-driven approaches in the real estate domain.

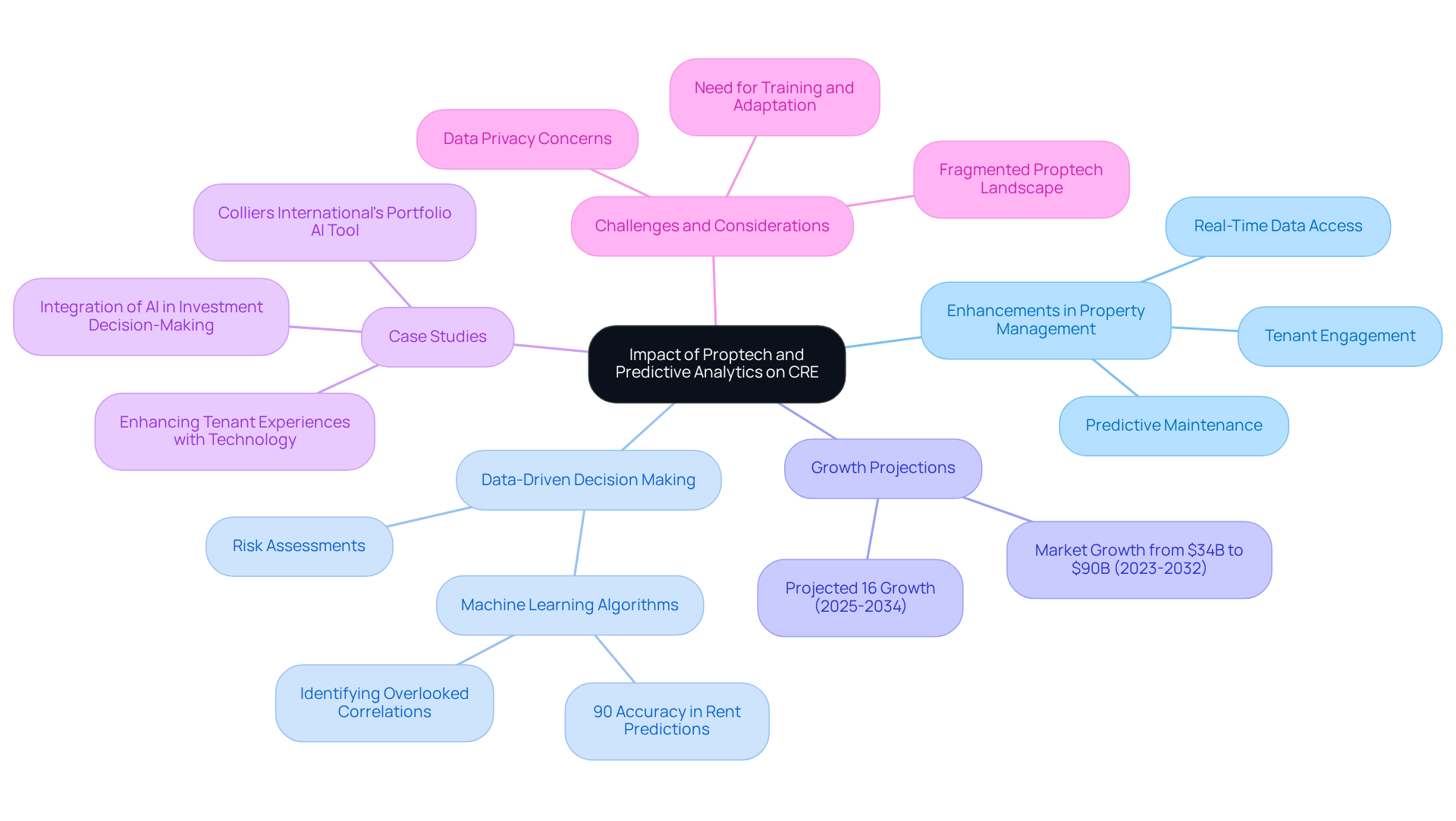

BPM: The Impact of Proptech and Predictive Analytics on CRE

The combination of proptech and predictive analytics in commercial real estate is revolutionizing the industry, significantly enhancing property management and funding strategies. By leveraging advanced technologies, investors gain access to real-time data and predictive models that refine decision-making processes. This synergy not only streamlines property management but also fosters improved tenant engagement and enhances overall investment outcomes.

Predictive analysis plays a vital role in identifying trends and forecasting future market conditions. For instance, machine learning algorithms can predict rent rate changes with up to 90% accuracy, enabling property managers to make informed pricing decisions. These algorithms also help uncover overlooked correlations for precise predictions, further enhancing decision-making capabilities. Additionally, predictive analysis aids in anticipating maintenance requirements, facilitating proactive management that reduces downtime and elevates tenant satisfaction.

Recent statistics underscore the escalating significance of predictive analytics in commercial real estate. The proptech sector is projected to expand from $34 billion in 2023 to $90 billion by 2032, reflecting a compound annual growth rate of nearly 17%. Furthermore, the proptech market is expected to register a growth rate of 16% between 2025 and 2034, propelled by the increasing adoption of technologies that enable data-driven decision-making.

Case studies further illustrate the effectiveness of predictive analytics in commercial real estate. For example, Colliers International's Portfolio AI tool utilizes forecasting techniques to assess real estate commitments and enhance facility portfolios, demonstrating how data can inform strategic planning. Additionally, the Colliers360 tool assists portfolio managers in recommending expansion strategies, showcasing practical applications of these technologies. Similarly, the integration of AI in investment decision-making processes has proven to enhance analysis, forecasting, and risk evaluation, resulting in superior investment performance.

As the landscape of commercial real estate continues to evolve, the latest trends in proptech and forecasting for 2025 indicate a shift towards more advanced data capabilities. However, challenges such as the fragmented nature of proptech, security concerns, and the complexities of intelligent building sectors must be addressed to fully realize the benefits of predictive analysis across the industry. By embracing these advancements, CRE professionals can position themselves for success in an increasingly competitive market.

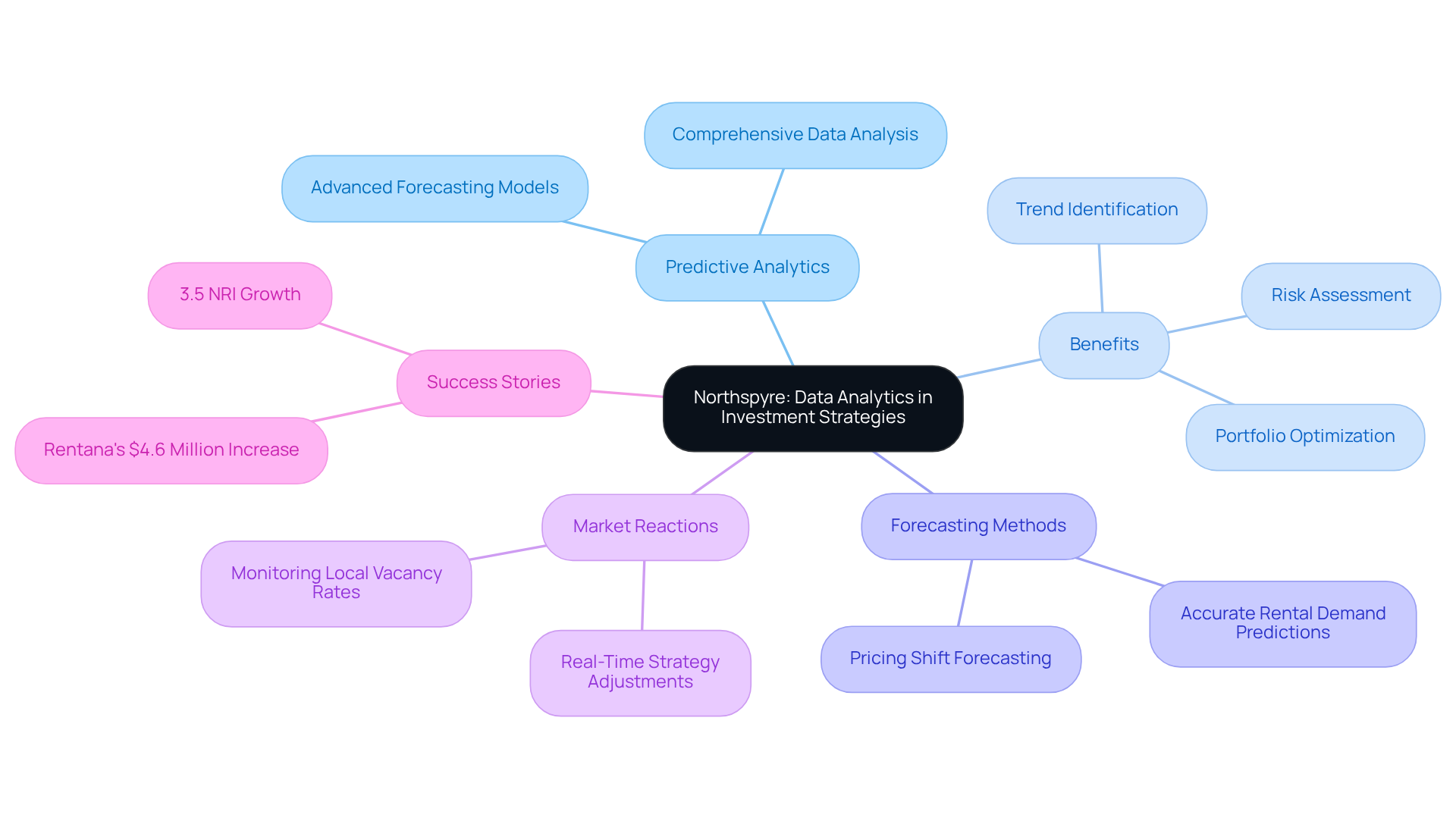

Northspyre: Leveraging Data Analytics for Enhanced Investment Strategies

Northspyre harnesses the power of predictive analytics in commercial real estate to elevate investment strategies within the sector. By employing predictive analytics in commercial real estate through advanced forecasting models and comprehensive data analysis, Northspyre empowers investors to identify emerging trends, assess potential risks, and optimize their portfolios. This proactive methodology not only refines decision-making processes but also equips investors to react promptly to market fluctuations, ensuring their competitive edge in an ever-evolving landscape.

Consider the precision of forecasting methods that utilize predictive analytics in commercial real estate to accurately predict rental demand and pricing shifts; this capability enables investors to pinpoint high-potential acquisitions and adjust strategies in real-time. Furthermore, the insights derived from forecasting data provide actionable recommendations regarding lease renewals, significantly enhancing leaseholder retention.

The importance of these forecasting tools is underscored by Rentana's notable success, which recorded a $4.6 million increase in property value through the strategic application of such instruments. Clearly, the integration of predictive analytics in commercial real estate is essential for maximizing returns and mitigating risks in real estate investments.

GetREBA: Improving Investment Strategies with Predictive Analytics

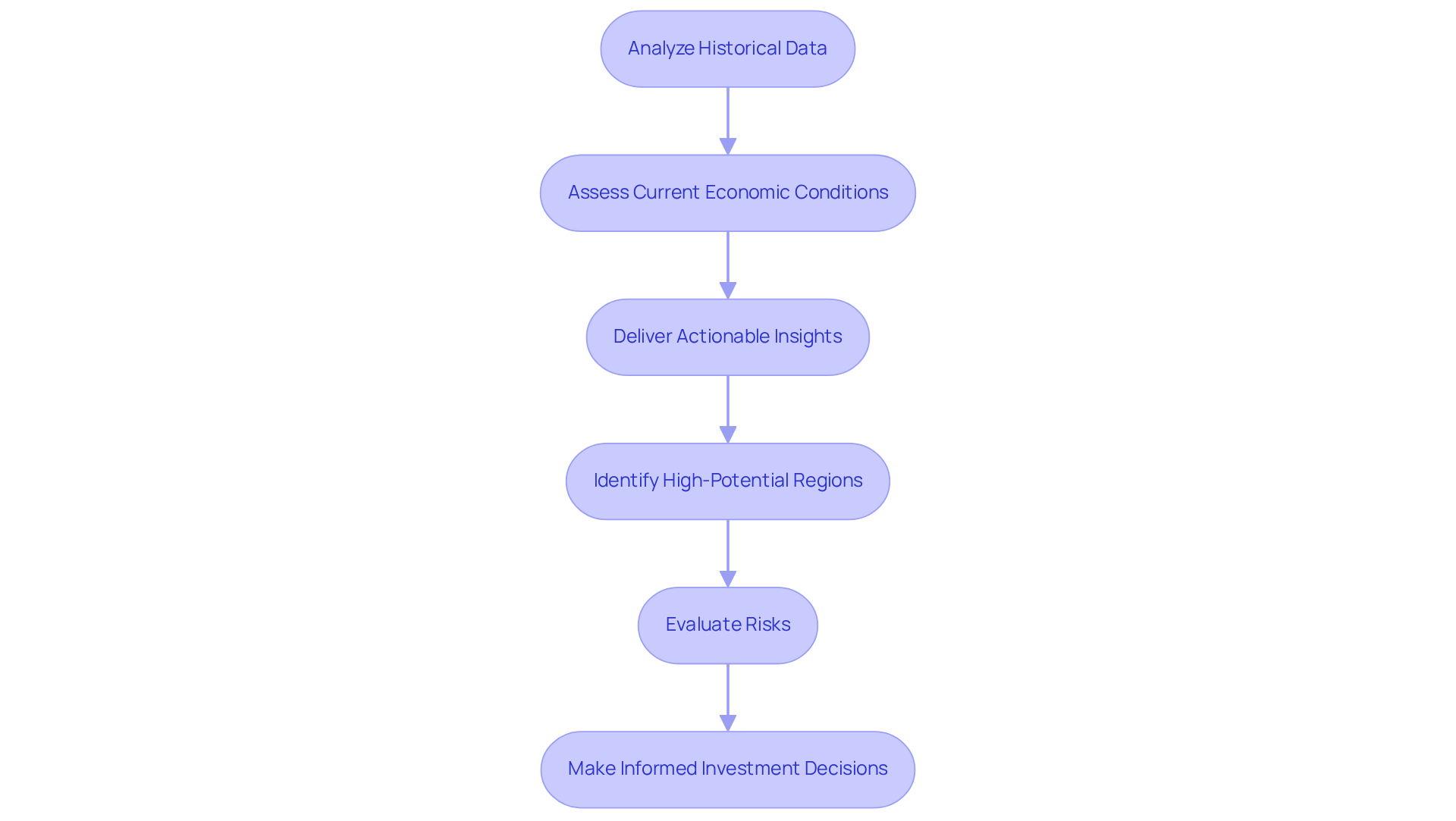

GetREBA leverages predictive analytics to elevate financial strategies by delivering actionable insights into market trends and property performance. By meticulously analyzing historical data alongside current economic conditions, GetREBA empowers investors to make informed decisions that align with their financial goals. This data-centric approach not only enhances the effectiveness of financial strategies but also yields superior outcomes by utilizing predictive analytics in commercial real estate. For instance, predictive analytics in commercial real estate have revolutionized how investors identify high-potential regions and assess risks, enabling them to navigate the complexities of the real estate sector with increased confidence.

According to industry forecasts, the AI-driven real estate market is projected to reach $226.71 billion by 2024, underscoring the growing importance of data-driven methodologies in investment strategies. As the landscape evolves, the integration of forecasting models continues to provide vital insights, ensuring that investors stay ahead of market trends and optimize their portfolios effectively. Furthermore, forecasting data plays a crucial role in risk management by identifying potential financial threats and facilitating proactive decision-making.

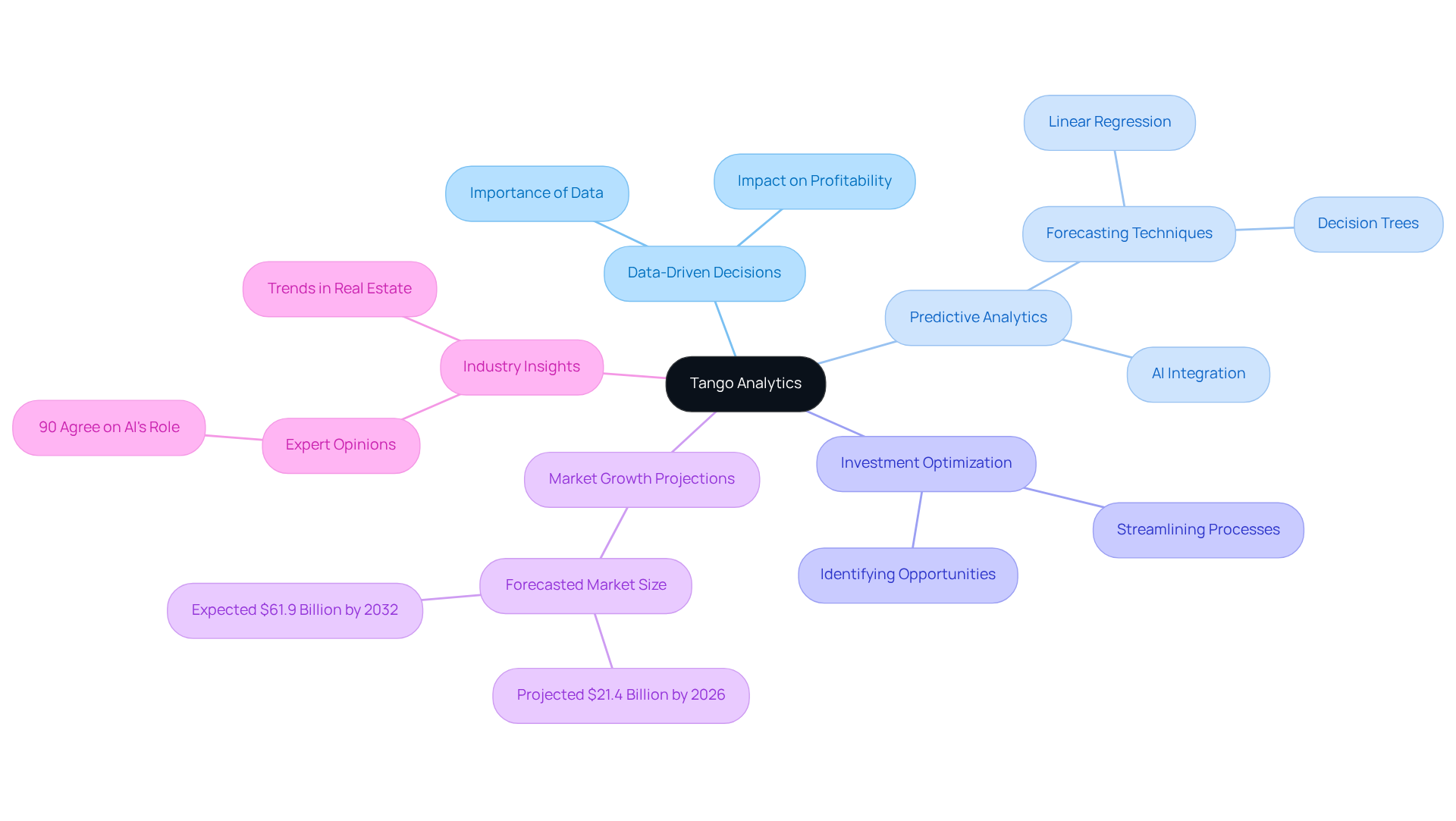

Tango Analytics: Optimizing Investments with Data-Driven Decisions

Tango Analytics stands at the forefront of resource optimization, leveraging data-driven decision-making to empower investors. By employing sophisticated analysis and forecasting techniques, the company utilizes predictive analytics in commercial real estate to allow for precise evaluation of market situations and identification of profitable opportunities. This approach not only streamlines the investment process but also significantly enhances strategic decision-making, ultimately driving growth and profitability.

As the real estate environment evolves, the integration of predictive analytics in commercial real estate becomes essential for investors seeking to navigate complexities and maximize returns. Industry insights reveal that the forecasting data sector is projected to reach $21.4 billion by 2026, underscoring the increasing importance of these technologies. Furthermore, 90% of real estate experts agree that predictive analytics in commercial real estate and AI will play a pivotal role in the future of the industry.

Investors are encouraged to explore forecasting tools to refine their decision-making processes and maintain a competitive edge. By embracing these advancements, they can position themselves effectively in a rapidly changing market landscape.

The Close: Best Predictive Analytics Companies for Real Estate Investment

The Close highlights the leading predictive analytics in commercial real estate companies, showcasing firms that excel in delivering data-driven insights and tools. These firms offer innovative solutions that empower investors to make informed decisions based on comprehensive industry analysis. By leveraging the expertise of these firms, investors can refine their strategies and achieve superior investment outcomes.

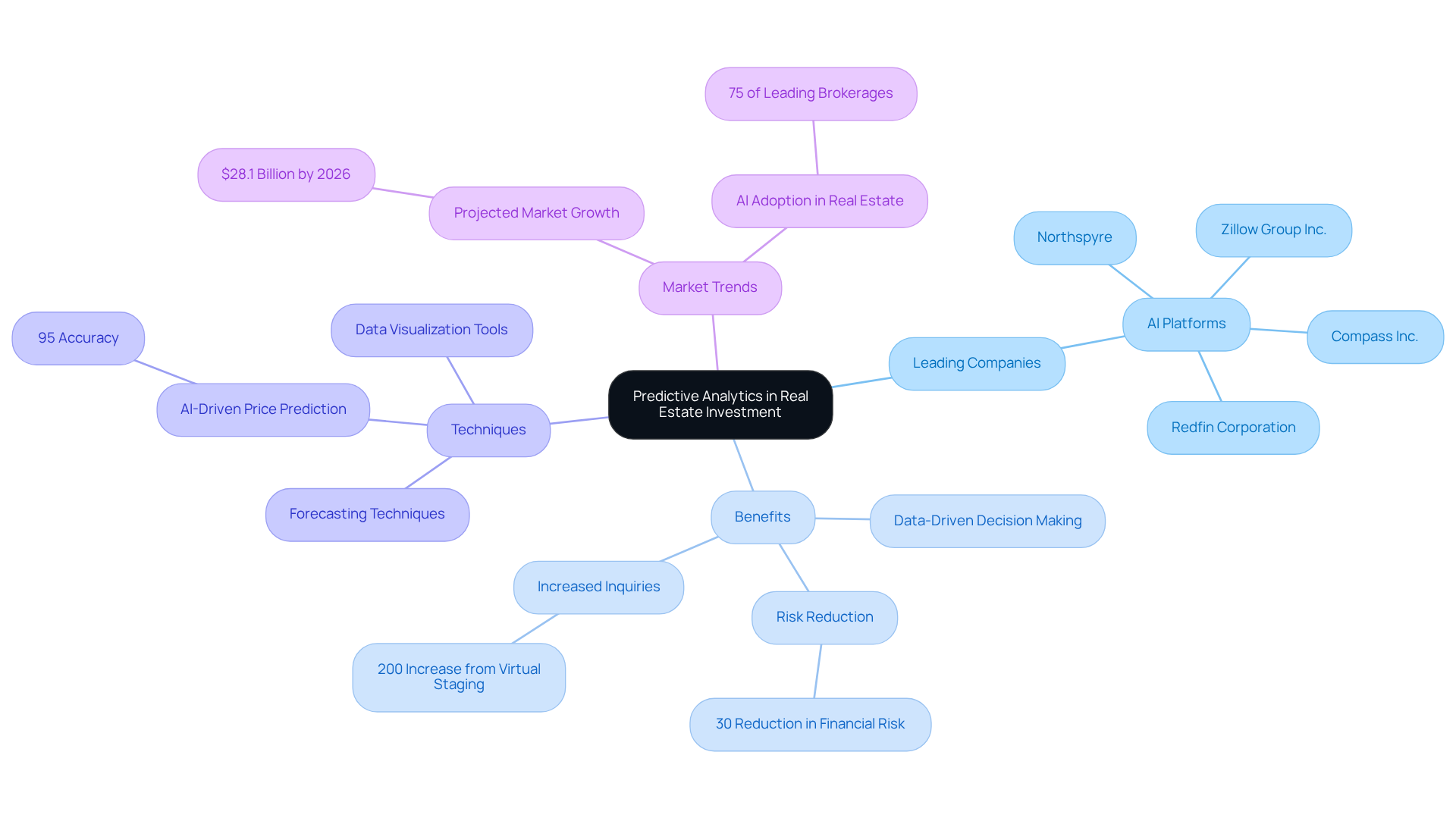

For example, AI-driven platforms can predict property price trends with remarkable accuracy—up to 95%. This capability allows investors to anticipate market trends and optimize their portfolios effectively. Furthermore, firms employing forecasting techniques have reported a reduction in financial risk by as much as 30%, according to Deloitte, underscoring the critical role of data-informed decision-making in real estate.

Case studies illustrate the success of these tools: one notable instance is the implementation of AI-enhanced virtual staging, which has been shown to boost property inquiries by up to 200%, revolutionizing marketing strategies and attracting a greater pool of potential buyers.

As we approach 2025, the forecasting data sector is projected to reach $28.1 billion, driven by the growing reliance on data-driven solutions within real estate. This trend emphasizes the importance of integrating sophisticated data analysis into financial strategies, enabling investors to navigate the complexities of the market with increased confidence and precision.

Investors are encouraged to explore how predictive analytics in commercial real estate can be integrated into their investment strategies for enhanced outcomes.

Conclusion

The integration of predictive analytics in commercial real estate signifies a transformative shift in how investors approach their strategies and decision-making processes. By leveraging advanced data analysis and machine learning, investors can gain unprecedented insights into market trends, property valuations, and risk assessments, ultimately enhancing their investment outcomes and competitiveness in a rapidly evolving landscape.

Throughout this article, various companies exemplify the power of predictive analytics in reshaping investment strategies:

- Zero Flux’s daily insights

- Altus Group's machine learning capabilities

Each firm showcases how data-driven approaches can lead to more accurate forecasts, reduced financial risks, and improved decision-making. The significant growth projections for the predictive analytics sector further emphasize its importance, highlighting the necessity for investors to adopt these innovative tools to stay ahead of market dynamics.

As the commercial real estate industry continues to evolve, embracing predictive analytics is not merely advantageous but essential. Investors are encouraged to explore and implement these sophisticated tools to refine their strategies, optimize portfolios, and navigate the complexities of the market with confidence. By doing so, they position themselves to harness the full potential of data-driven decision-making, ensuring sustained success in an increasingly competitive environment.