Overview

The article examines the pivotal trends shaping commercial real estate lending in 2025. Key factors include:

- Increased bank participation

- The emergence of alternative financing sources

- The incorporation of technology alongside ESG considerations

These elements collectively influence lending practices, resulting in substantial growth in lending activity. Financial institutions must adapt to the evolving market conditions and the diverse needs of borrowers. This adaptation is not merely a response but a necessity in a rapidly changing landscape.

Introduction

The landscape of commercial real estate lending is undergoing a seismic shift as it approaches 2025, shaped by a confluence of innovative trends and emerging challenges. With a remarkable 90% increase in lending activity year-over-year, the sector is witnessing a resurgence.

However, it grapples with significant distress, particularly in the office space market. This article delves into eight pivotal trends that are redefining commercial real estate financing, offering insights into how stakeholders can navigate the complexities of this evolving environment.

As lenders adapt to fluctuating economic conditions and regulatory pressures, the question remains:

- How will these trends influence the future of commercial real estate lending?

- What strategies will be essential for success?

Zero Flux: Essential Insights on Commercial Real Estate Lending Trends

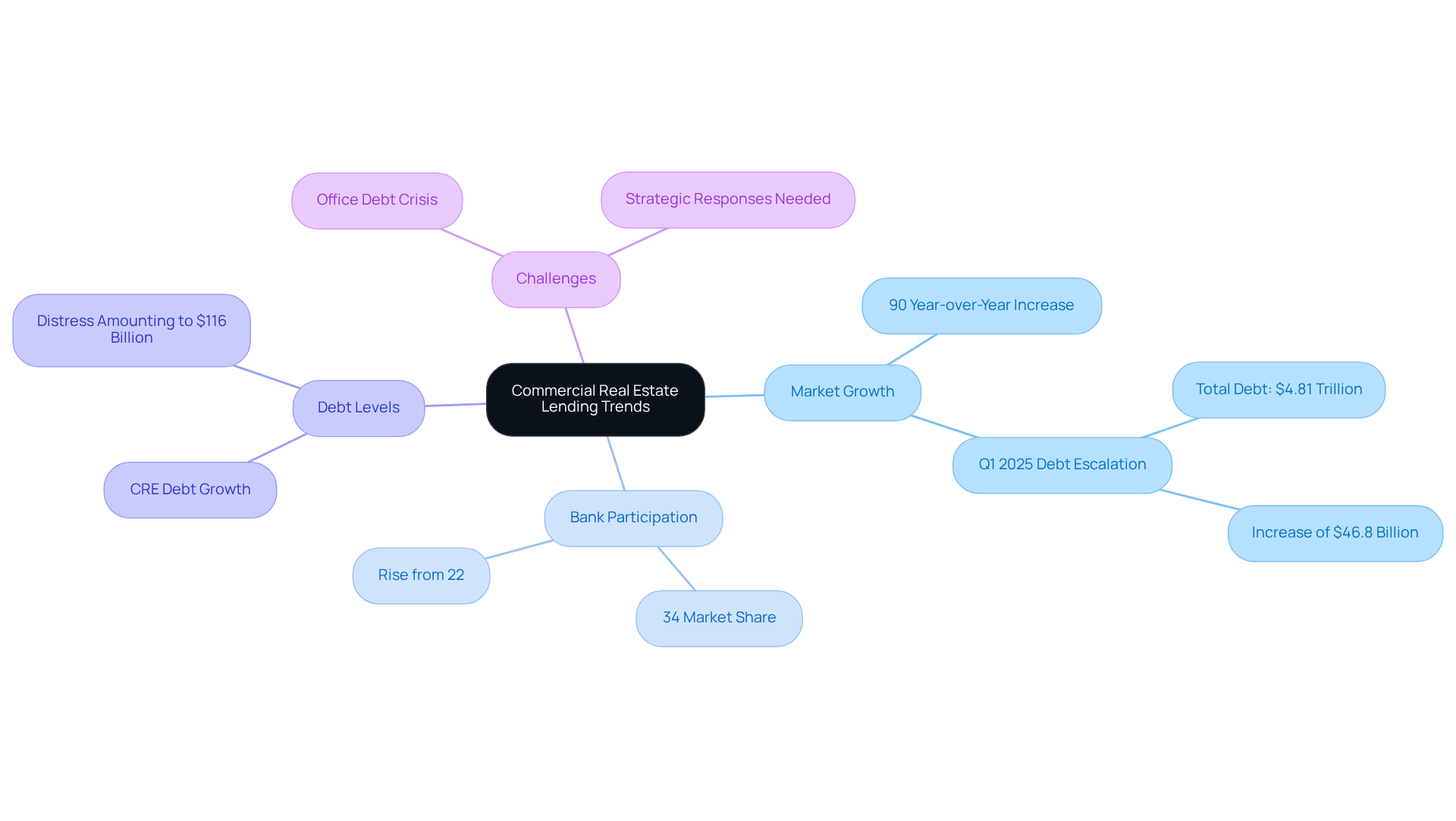

Zero Flux serves as an indispensable resource for property specialists, delivering meticulously curated insights into commercial real estate lending trends. By synthesizing information from over 100 diverse sources, including those behind paywalls, Zero Flux offers a comprehensive overview of the latest developments in the borrowing landscape. In 2025, the business property sector is witnessing notable transformations, as evidenced by the CBRE Lending Momentum Index, which reveals an impressive 90% year-over-year increase, indicating a robust recovery in lending activity despite persistent economic uncertainties. This surge is primarily attributed to banks capturing a 34% share of non-agency loan closings, a significant rise from 22% in the previous quarter, underscoring their crucial role in the current market.

Furthermore, commercial real estate debt has escalated by $46.8 billion in Q1 2025, totaling $4.81 trillion, according to the Mortgage Bankers Association. This growth highlights the rising demand for financing in the context of commercial real estate lending trends across various asset classes, especially in the multifamily and industrial sectors. However, the market faces challenges; the industry is grappling with $116 billion in distress, predominantly stemming from an office debt crisis that necessitates strategic responses from both investors and financial institutions. The implications of this distress are profound, compelling lenders to reevaluate their strategies and risk management approaches to effectively navigate the shifting market conditions.

The significance of data-driven insights is paramount in this dynamic environment. Zero Flux's unwavering commitment to data integrity guarantees that subscribers receive factual and relevant information, facilitating informed decision-making. As the market adapts to fluctuating interest rates and regulatory changes, tailored insights from Zero Flux empower property professionals to adeptly manage complexities, ensuring they remain competitive in a rapidly evolving landscape. With over 30,000 subscribers relying on its data-driven approach, Zero Flux continues to be an essential resource for understanding the intricacies of business property financing in 2025.

Data Analytics and AI: Transforming Commercial Real Estate Lending

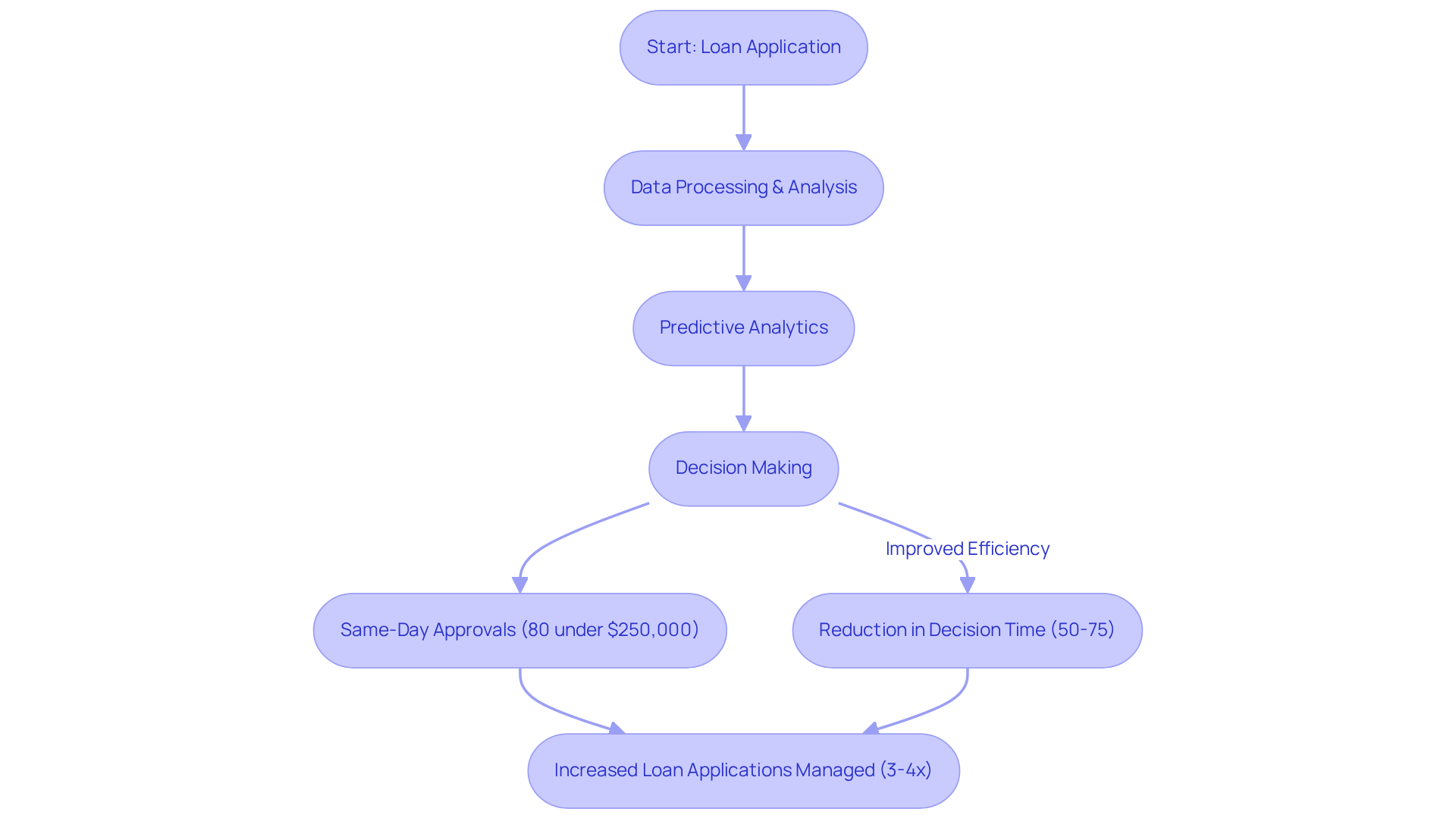

Data analytics and artificial intelligence are fundamentally transforming business real estate financing, empowering financial institutions to make informed and strategic decisions. AI algorithms adeptly process extensive datasets to uncover trends, evaluate borrower risk, and streamline the underwriting process. For instance, predictive analytics allows lenders to anticipate market shifts, facilitating proactive strategy adjustments. This technological evolution not only enhances operational efficiency but also significantly mitigates default risks, establishing it as a pivotal trend for 2025.

Statistics reveal that AI underwriting can shorten decision times for transactions below $250,000 to same-day approval in 80% of instances. Furthermore, banks employing AI underwriting report a 50-75% reduction in time-to-decision for business loans, underscoring the efficiency and effectiveness of these innovations. Organizations that implement AI technologies are projected to manage 3-4 times more loan applications without increasing personnel. One team has noted a decrease in average approval cycles for business loans from 12-15 days to just 6-8 days.

As the property market evolves, leveraging data analytics and AI will be essential for lenders to understand commercial real estate lending trends and maintain a competitive edge. However, challenges such as data quality and integration issues must be addressed to fully harness the benefits of these technologies. The future of real estate financing hinges on the ability to adapt and innovate in this rapidly changing landscape.

Alternative Lending and Private Debt: New Financing Opportunities

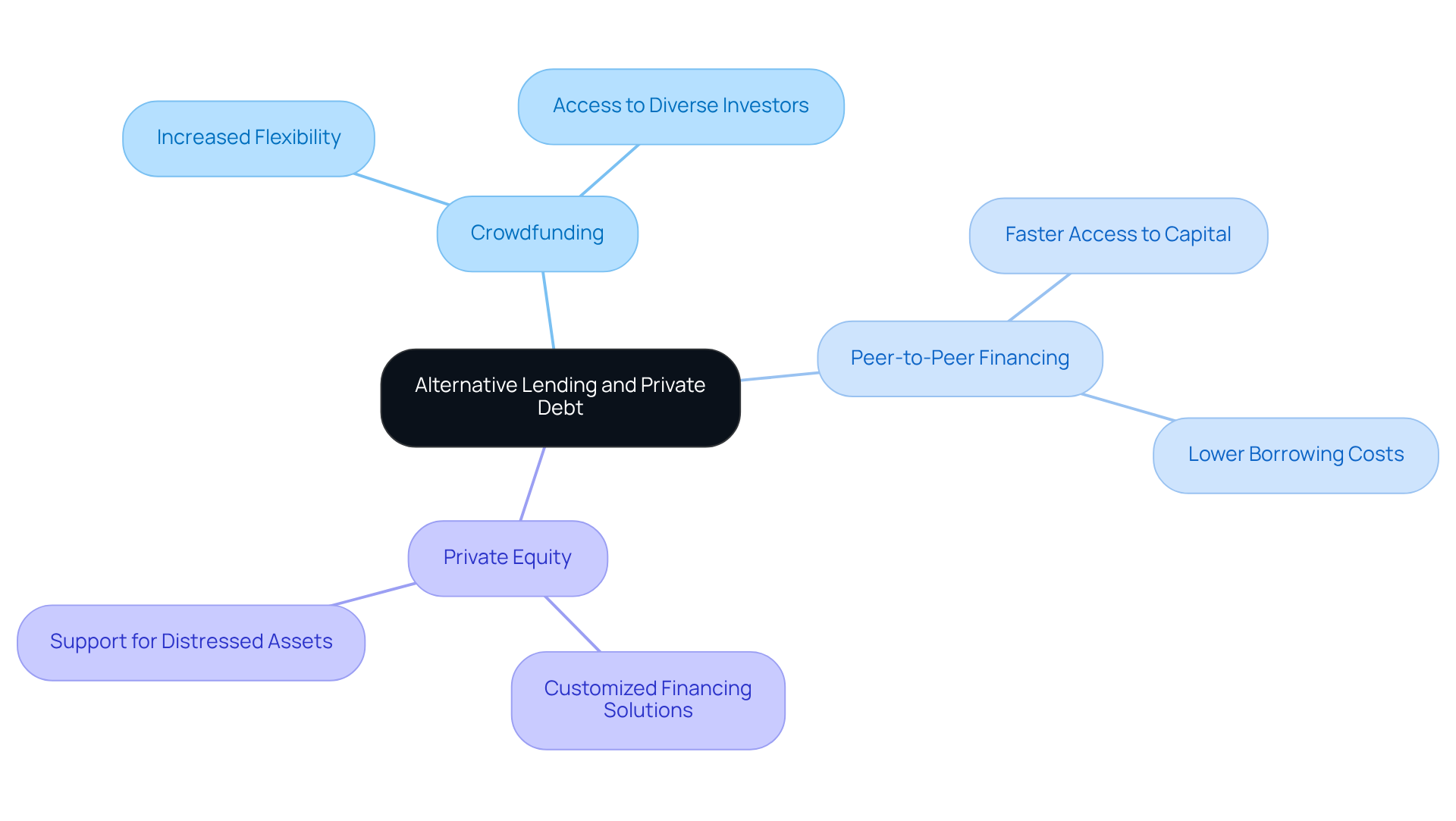

As traditional banks tighten their borrowing standards, the commercial real estate lending trends indicate that alternative financing sources and private debt are becoming essential elements of the funding landscape. Options such as:

- Crowdfunding

- Peer-to-peer financing

- Private equity

are gaining traction as part of the commercial real estate lending trends, providing borrowers with increased flexibility and faster access to capital. This shift empowers investors to seize opportunities that may not fit within traditional financing models, making these funding avenues crucial for navigating the market in 2025.

With approximately 20% of the $4.8 trillion in outstanding mortgages maturing in 2025—totaling about $957 billion—there exists a significant gap for potential investors. Notably, 'the private credit boom is expected to continue amid economic uncertainty and sustained high interest rates,' which underscores the necessity of these alternative sources in light of commercial real estate lending trends. The emergence of alternative funding sources is reshaping the financing landscape and impacting commercial real estate lending trends, allowing borrowers to explore customized solutions that traditional banks may not offer. This adaptability enhances their ability to respond to evolving market conditions.

ESG Considerations: Shaping Sustainable Financing in Real Estate

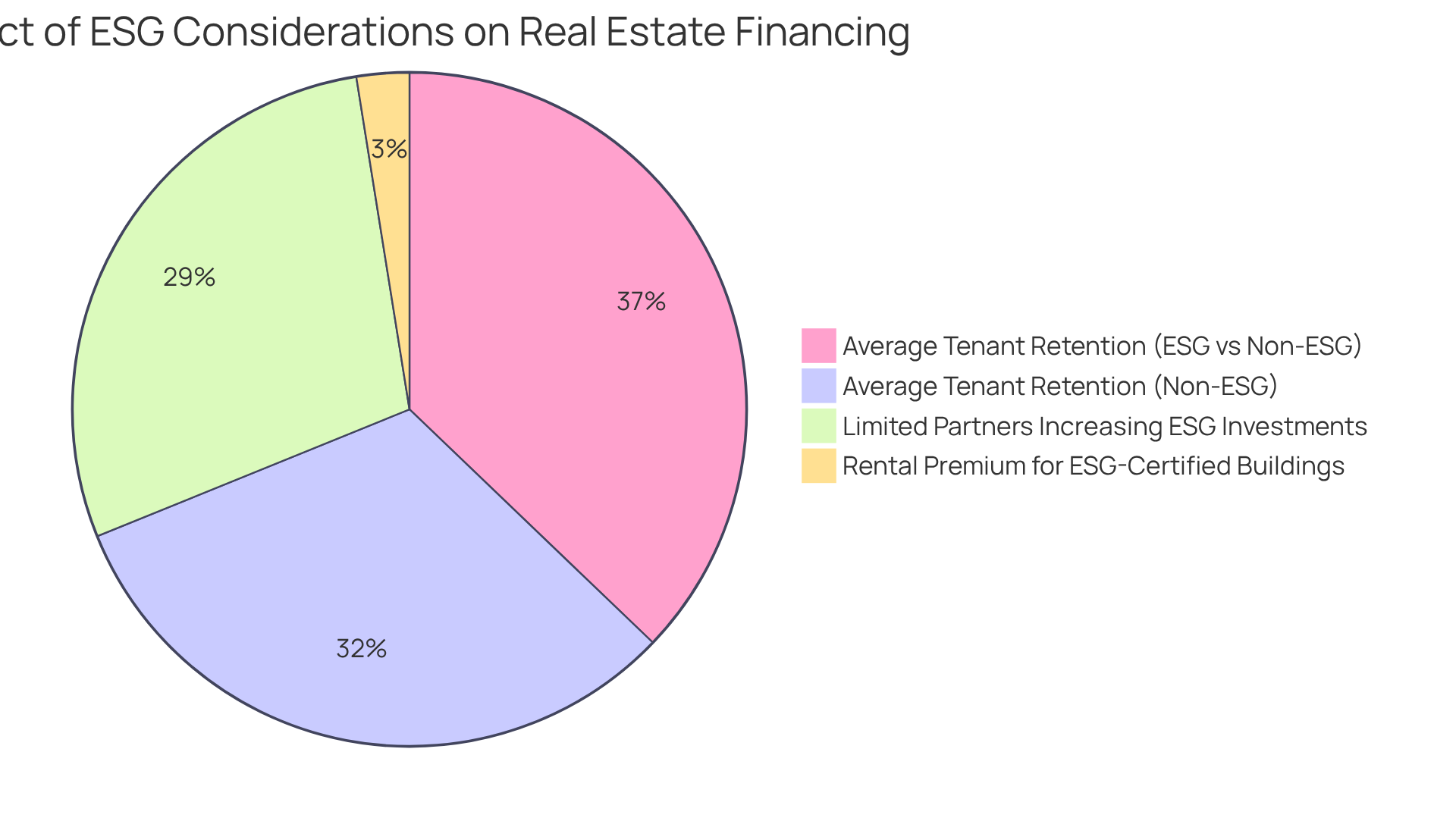

Environmental, Social, and Governance (ESG) considerations are increasingly influencing commercial real estate lending trends. Lenders are now assessing properties based on their sustainability practices and social impact, which directly influences loan terms and availability. Notably, properties with robust ESG credentials can secure lower interest rates and more favorable financing conditions, reflecting a significant shift in investor priorities towards sustainability.

In 2025, approximately 68% of limited partners intend to boost their ESG investments, underscoring a significant market trend that financiers must take into account. Furthermore, research indicates that ESG-certified buildings can command rental premiums of around 6% and experience reduced vacancy rates, enhancing their attractiveness to lenders. Significantly, ESG-certified structures retain tenants for an average of 88.3 months, compared to 75.3 months for non-certified structures, highlighting the financial advantages of sustainability in property financing.

As demand for sustainable investments continues to rise, understanding commercial real estate lending trends will be crucial for effectively navigating the financing landscape. Embracing ESG considerations not only aligns with evolving investor expectations but also positions lenders to capitalize on emerging opportunities in the market.

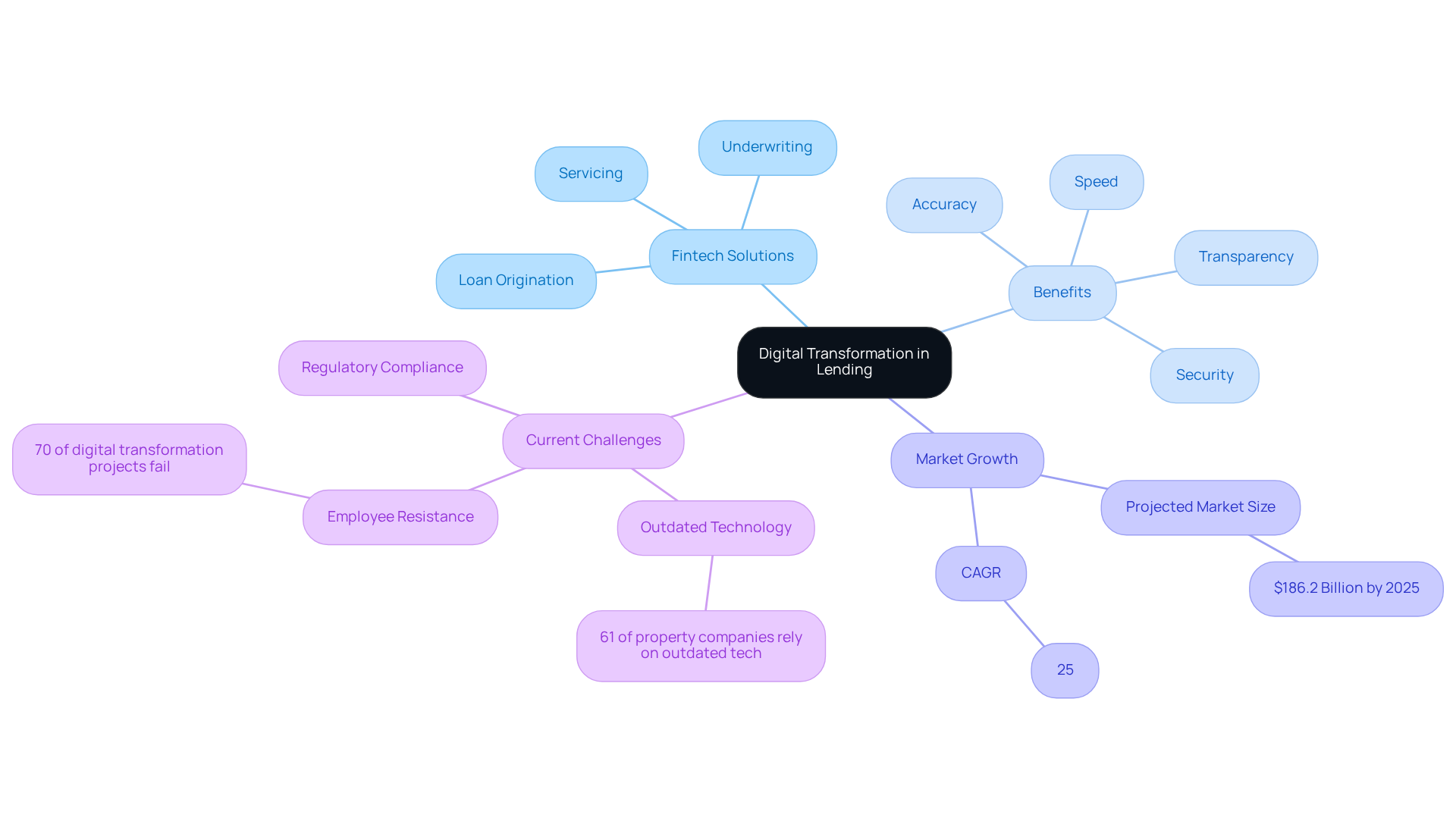

Digital Transformation and Fintech: Revolutionizing Lending Processes

Digital transformation is fundamentally reshaping commercial real estate lending trends, streamlining processes and enhancing customer experiences. Fintech solutions are automating essential functions such as loan origination, underwriting, and servicing. This automation allows financial institutions to process applications with greater speed and accuracy. For instance, platforms utilizing blockchain technology not only enhance transparency but also bolster security in transactions, significantly reducing the risk of fraud.

As of 2025, the fintech financing market is projected to reach approximately $186.2 billion, reflecting a compound annual growth rate (CAGR) of 25%. This growth is driven by the increasing demand for efficient and accessible credit solutions, particularly among underserved populations. Moreover, case studies demonstrate that digital borrowing platforms can process loans up to 20% faster than traditional lenders, without increasing default rates.

Furthermore, with 61% of property companies depending on outdated technology, the necessity for embracing fintech solutions is evident. As these technologies continue to advance, they will play a crucial role in shaping the future of commercial real estate lending trends. The shift towards fintech not only makes the borrowing process more efficient but also ensures it is more customer-focused, ultimately benefiting all stakeholders involved.

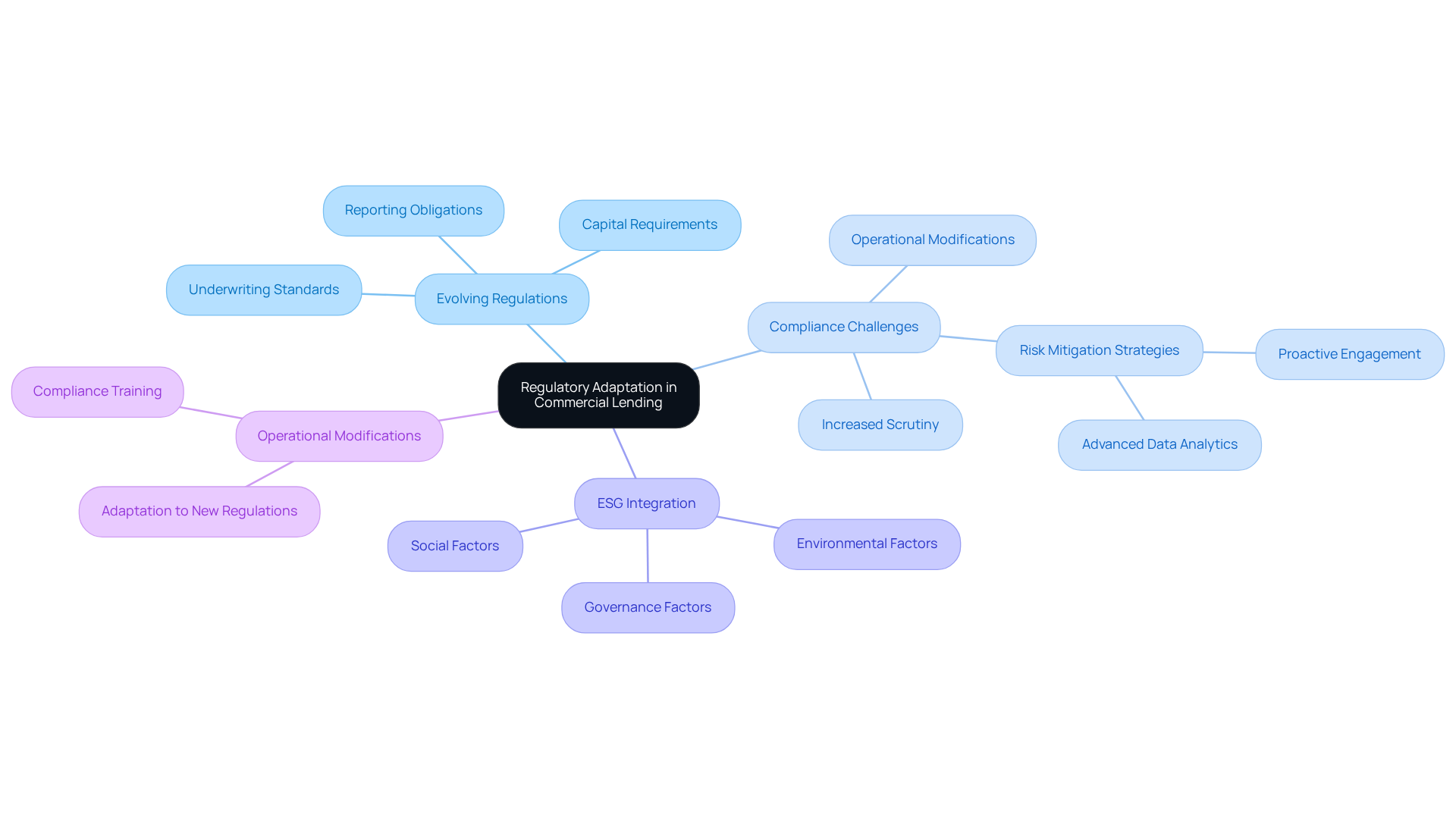

Regulatory Adaptation: Navigating Compliance in Commercial Lending

The evolving regulations significantly shape the commercial real estate lending trends, compelling financial institutions to continuously adapt their practices. Anticipated for 2025, new regulations are set to influence underwriting standards, capital requirements, and reporting obligations. Lenders will likely encounter increased scrutiny concerning Environmental, Social, and Governance (ESG) factors, which are progressively integrated into lending decisions due to regulatory pressures. This transformation requires financial institutions to remain vigilant and well-informed about compliance requirements to effectively navigate potential penalties.

Statistics indicate that compliance challenges are on the rise, with approximately 60% of financial institutions forecasting that adapting to these changes will demand substantial modifications to their operational frameworks. Moreover, case studies illustrate that firms proactively engaging with compliance measures are better positioned to mitigate risks and enhance their competitive advantage. For example, a recent analysis highlighted how a leading financial institution improved its underwriting processes by leveraging advanced data analytics, allowing for more accurate assessments of borrower creditworthiness and property performance, ultimately leading to enhanced compliance outcomes.

As the business financing landscape becomes increasingly complex, understanding commercial real estate lending trends and managing compliance efficiently is essential for financiers who want to maintain their market standing. This adaptability not only safeguards against regulatory penalties but also fosters trust and reliability among clients, thereby influencing the commercial real estate lending trends. Furthermore, with approximately $1.5 trillion in business property debt maturing in 2025, the imperative for compliance adjustment among financiers is clearer than ever.

Market Volatility: Impacting Lending Strategies and Decisions

Market volatility presents significant challenges for business real estate financiers, profoundly impacting their strategies and decision-making processes in relation to commercial real estate lending trends. As we approach 2025, fluctuating interest rates and economic uncertainty compel financial institutions to adapt to commercial real estate lending trends and adopt more conservative practices. For instance, commercial mortgage loan spreads have tightened to an average of 183 basis points in Q1 2025, reflecting a decrease of 29 basis points year-over-year and highlighting a cautious lending environment. This tightening has led financial institutions to focus on sectors less susceptible to market fluctuations, such as multifamily and senior housing, reflecting current commercial real estate lending trends where demand continues to outstrip supply.

The influence of economic uncertainty is evident as financial institutions reassess their risk profiles in light of commercial real estate lending trends. Notably, the CBRE Lending Momentum Index has surged by 90% year-over-year, signaling a recovery in financing activity despite ongoing challenges. However, the distress within the office sector, with reported debts reaching $116 billion, underscores the necessity for financial institutions to remain vigilant and adaptable to the commercial real estate lending trends, as this scenario could prompt increased caution in lending practices.

To navigate these complexities, financial institutions are increasingly adopting strategies that encompass tighter credit standards and enhanced due diligence, reflecting the commercial real estate lending trends. For example, the integration of sustainability evaluations into underwriting procedures is gaining traction, as financial institutions strive to align with evolving market needs and regulatory requirements. Furthermore, alternative financing sources are capturing a 19% share of non-agency loan closings, offering more flexible terms in response to the constraints faced by traditional banks. This shift indicates that conventional financial institutions may need to adjust their strategies in light of commercial real estate lending trends to maintain competitiveness in a changing environment.

Understanding these dynamics is crucial for successfully navigating the commercial real estate lending trends in the lending landscape of 2025. As financial institutions brace for potential economic shifts, those who proactively adapt their strategies are poised for success in this unpredictable environment.

Flexible Financing Solutions: Meeting Borrower Needs

In the evolving landscape of commercial real estate, understanding commercial real estate lending trends is essential for meeting the diverse needs of borrowers through flexible financing solutions.

- Adjustable-rate mortgages, bridge loans, and customized loan structures empower borrowers to effectively navigate their unique financial circumstances.

- As highlighted by Penn State, properties that fail to meet evolving sustainability standards may face challenges in securing financing, underscoring the necessity of adaptable financing options.

- Lenders offering these flexible solutions position themselves to attract and retain clients in 2025, ensuring competitiveness in response to the commercial real estate lending trends in a rapidly changing market.

- Furthermore, the integration of technology and data analysis, exemplified by Blooma's advanced software, enhances efficiency and competitiveness among financial institutions, facilitating the customization of financing solutions.

- By 2025, prioritizing flexibility in financing will not only elevate borrower satisfaction but also drive lender success in a dynamic marketplace.

Borrower Education and Transparency: Building Trust in Lending

Informing borrowers about the borrowing process and ensuring clarity regarding loan conditions are vital for building trust in business property financing. Lenders who prioritize borrower education empower clients to make informed decisions, thereby strengthening relationships and enhancing loyalty. As we look toward 2025, transparency in communication about fees, terms, and potential risks will be crucial; it significantly contributes to building trust.

Statistics indicate that total business and multifamily mortgage borrowing is anticipated to reach $583 billion in 2025, marking a 16 percent rise from 2024's projected total of $503 billion. This underscores the increasing significance of transparent practices in our industry.

Case studies, such as 'Applying Transparent Credit Risk Explanations in the Real-World,' demonstrate that institutions implementing comprehensive borrower education programs have seen a marked improvement in client engagement and trust levels. With regulatory scrutiny on the rise, prioritizing transparency will not only meet compliance expectations but also cultivate long-lasting relationships in this competitive market.

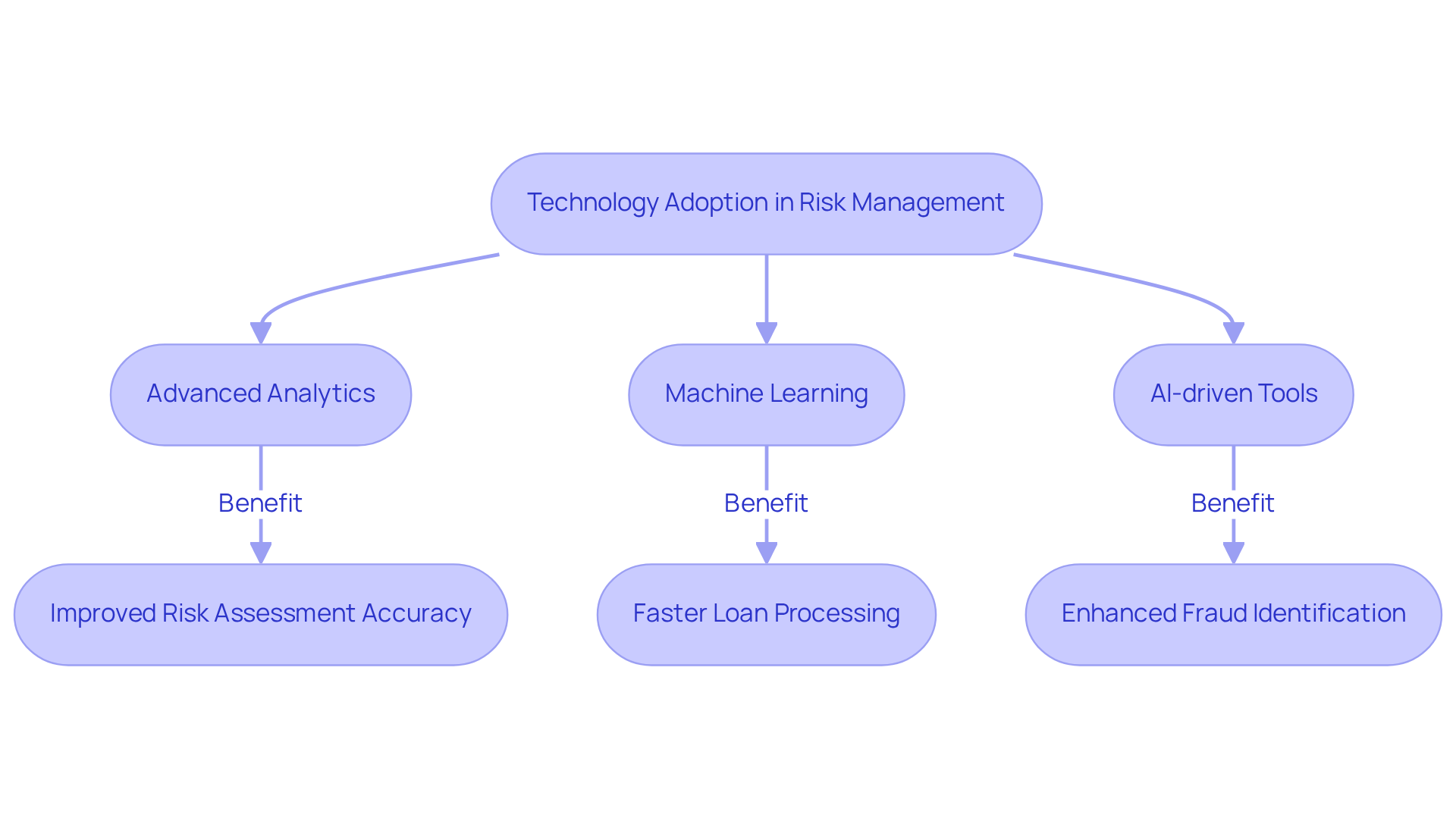

Technology in Risk Management: Enhancing Decision-Making in Lending

Technology plays a pivotal role in transforming risk management practices within commercial real estate lending trends. Advanced analytics, machine learning, and AI-driven tools empower lenders to evaluate borrower risk with unprecedented accuracy, enabling the early identification of potential issues. For instance, AI systems analyze vast datasets to forecast borrower behavior and financial performance, leading to a more nuanced understanding of risk factors. Statistics reveal that AI can enhance fraud identification and credit risk assessment accuracy by over 80%, significantly reducing the likelihood of defaults and underscoring its effectiveness in risk management.

Moreover, AI can process loans up to 25 times quicker than conventional methods, further demonstrating the efficiency improvements technology brings to finance. As the borrowing environment continues to evolve, understanding commercial real estate lending trends and incorporating technology into risk management strategies will be essential for success in 2025. Case studies illustrate how firms leveraging AI-driven solutions have achieved a threefold reduction in loan processing times and improved approval rates by 18-32%. By optimizing loan portfolios through real-time data analysis, lenders can make informed decisions that enhance operational efficiency and bolster resilience against market fluctuations.

Additionally, understanding the costs associated with developing custom AI solutions, which can range from $100,000 to $650,000, is crucial for organizations considering these investments. In this dynamic environment, embracing technological advancements—including the importance of explainable AI to ensure transparency and mitigate bias—will be vital for navigating the complexities of commercial real estate lending trends.

Conclusion

The landscape of commercial real estate lending is experiencing a significant transformation as it approaches 2025, driven by various trends that are reshaping how financial institutions operate. Lenders must adapt to these changes, particularly in light of regulatory shifts, market volatility, and the rising demand for sustainable financing options.

Key insights reveal that data analytics and artificial intelligence are revolutionizing the lending process. These technologies enable quicker decision-making and enhanced risk management, positioning lenders to respond effectively to market demands. Additionally, alternative lending sources are emerging as vital players in the market, providing borrowers with flexible financing solutions tailored to their unique needs. The growing focus on Environmental, Social, and Governance (ESG) considerations is also reshaping investment priorities, underscoring the significance of sustainability in securing favorable loan terms.

As the commercial real estate lending environment evolves, stakeholders are encouraged to stay informed and agile. By leveraging technology, embracing alternative financing options, and prioritizing transparency and borrower education, lenders can build trust and foster long-lasting relationships. Ultimately, success in this dynamic marketplace will depend on the ability to navigate complexities while remaining responsive to the shifting demands of borrowers and investors.