Overview

This article examines the pivotal trends shaping small bay industrial real estate, underscoring the increasing demand for these properties. This demand is propelled by:

- Urbanization

- The rise of e-commerce

- Favorable zoning regulations

Supporting data on leasing volumes and vacancy rates illustrates the strategic advantages of small bay spaces, reinforcing their significance as crucial assets in the dynamic logistics and commercial landscape. As investors consider their strategies, understanding these trends is essential for making informed decisions in this evolving market.

Introduction

The landscape of small bay industrial real estate is undergoing a remarkable transformation, driven by shifting market dynamics and evolving consumer demands. As urbanization accelerates and e-commerce continues to thrive, the need for strategically located, smaller industrial spaces becomes increasingly evident.

This article delves into eight key insights that illuminate the trends shaping this niche market, offering investors and industry professionals a roadmap to navigate the complexities and capitalize on emerging opportunities.

What factors are propelling this demand? How can stakeholders leverage these insights for success in a rapidly changing environment?

Zero Flux: Daily Insights on Small Bay Industrial Real Estate Trends

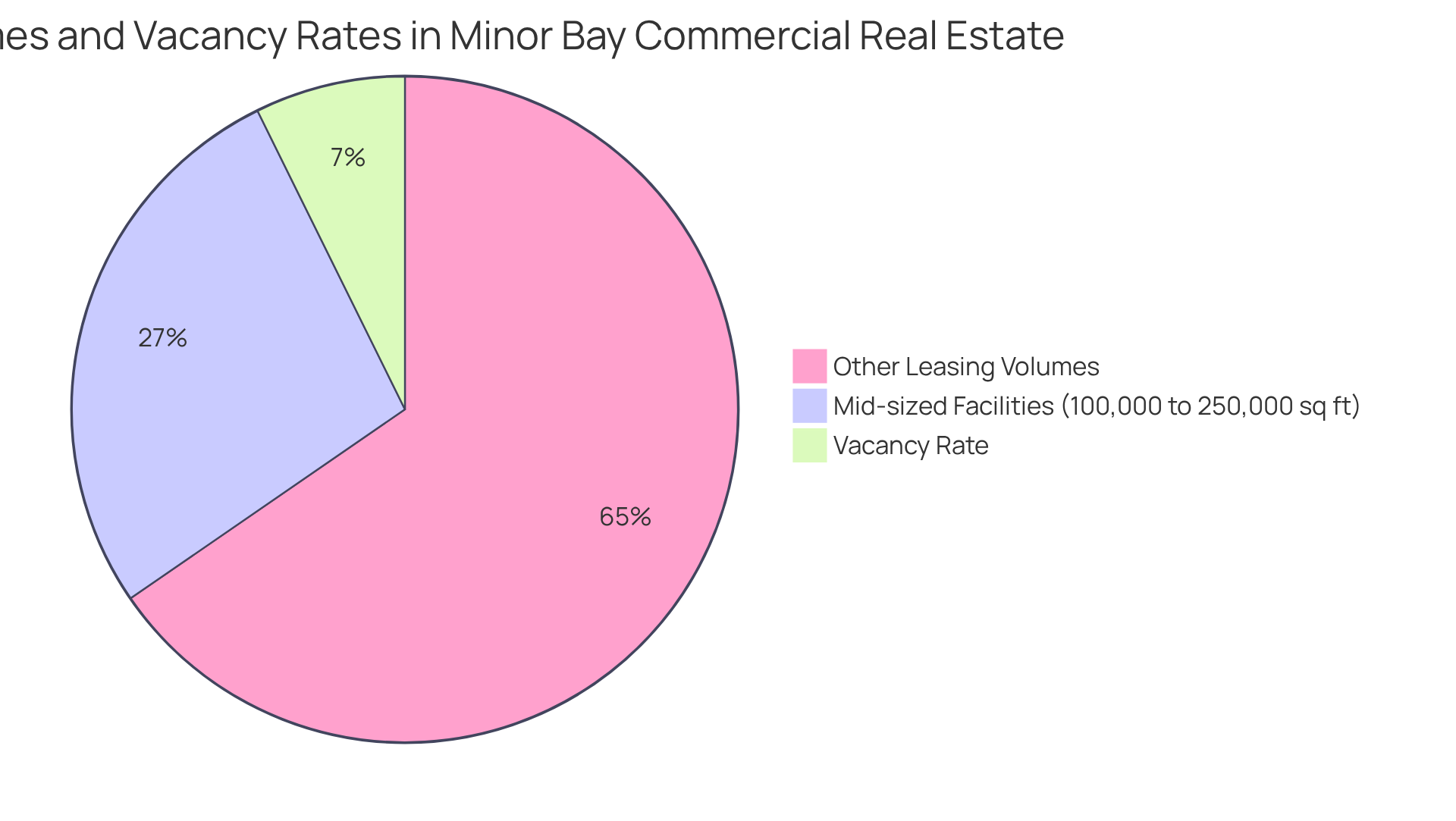

Zero Flux delivers daily insights into the minor bay commercial real estate market by meticulously gathering data from over 100 reliable sources. This dedication to precise reporting offers subscribers a comprehensive understanding of the market forces influencing small bay industrial real estate. Notably, recent trends reveal a growing preference for mid-sized facilities, with leases ranging from 100,000 to 250,000 square feet accounting for 27.3% of total leasing volume. In contrast, the broader sector has faced 10 consecutive quarters of increasing vacancy rates, which have climbed to 7.3%—a 20 basis-point rise from the previous quarter. Nevertheless, small bay industrial real estate properties remain a focal point for investors seeking opportunities in a transforming landscape.

In Q1 2025, new commercial deliveries held steady at 79.6 million square feet, reflecting ongoing deliveries of unoccupied space. Yet, the demand for smaller units continues to demonstrate resilience. As the market evolves, Zero Flux emerges as an invaluable resource, sifting through extensive data to spotlight relevant trends. This ensures that industry professionals and investors can navigate complexities with clarity and precision, empowering them to make informed investment decisions.

Urban Demand: Increasing Need for Small Bay Industrial Spaces

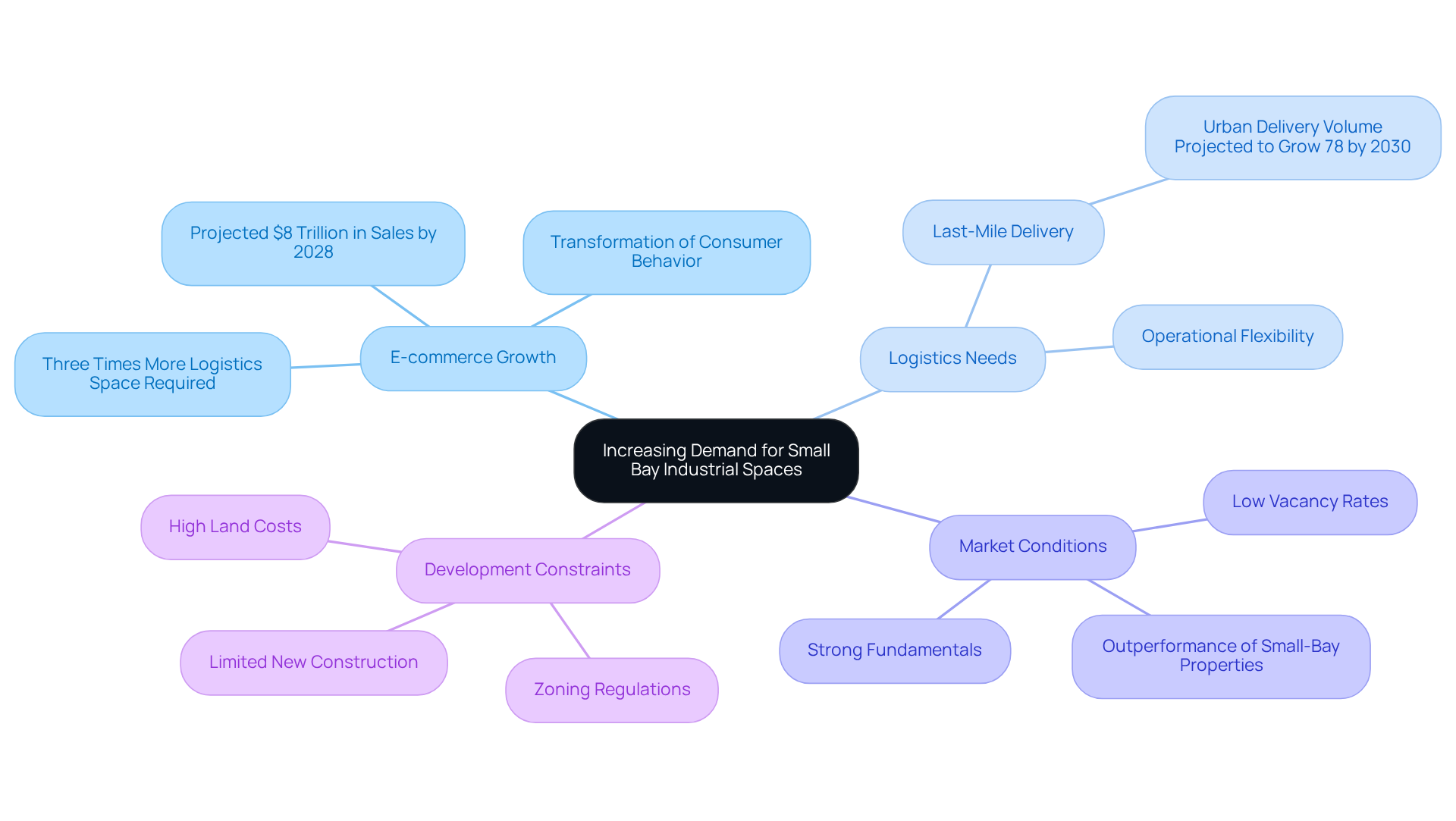

The demand for small bay industrial real estate is witnessing remarkable growth, especially in urban areas where businesses prioritize proximity to their customer base. As e-commerce continues its upward trajectory, companies increasingly seek small bay industrial real estate that facilitates last-mile delivery and efficient logistics operations. This trend is underscored by historically low vacancy rates for small bay industrial real estate across numerous cities, reflecting a robust and competitive market.

With urban last-mile delivery volume projected to surge by 78% by 2030, the necessity for small bay industrial real estate is expected to expand, positioning these properties as vital assets in contemporary logistics strategies. Furthermore, e-commerce requires three times more logistics area than traditional retail, highlighting the escalating demand for these facilities.

The shortage of accessible small bay industrial real estate, combined with constraints on new development due to zoning regulations and land costs, further enhances the appeal of small bay industrial real estate, establishing it as a standout performer in the real estate sector.

Affordability: Cost-Effective Entry Point for Investors

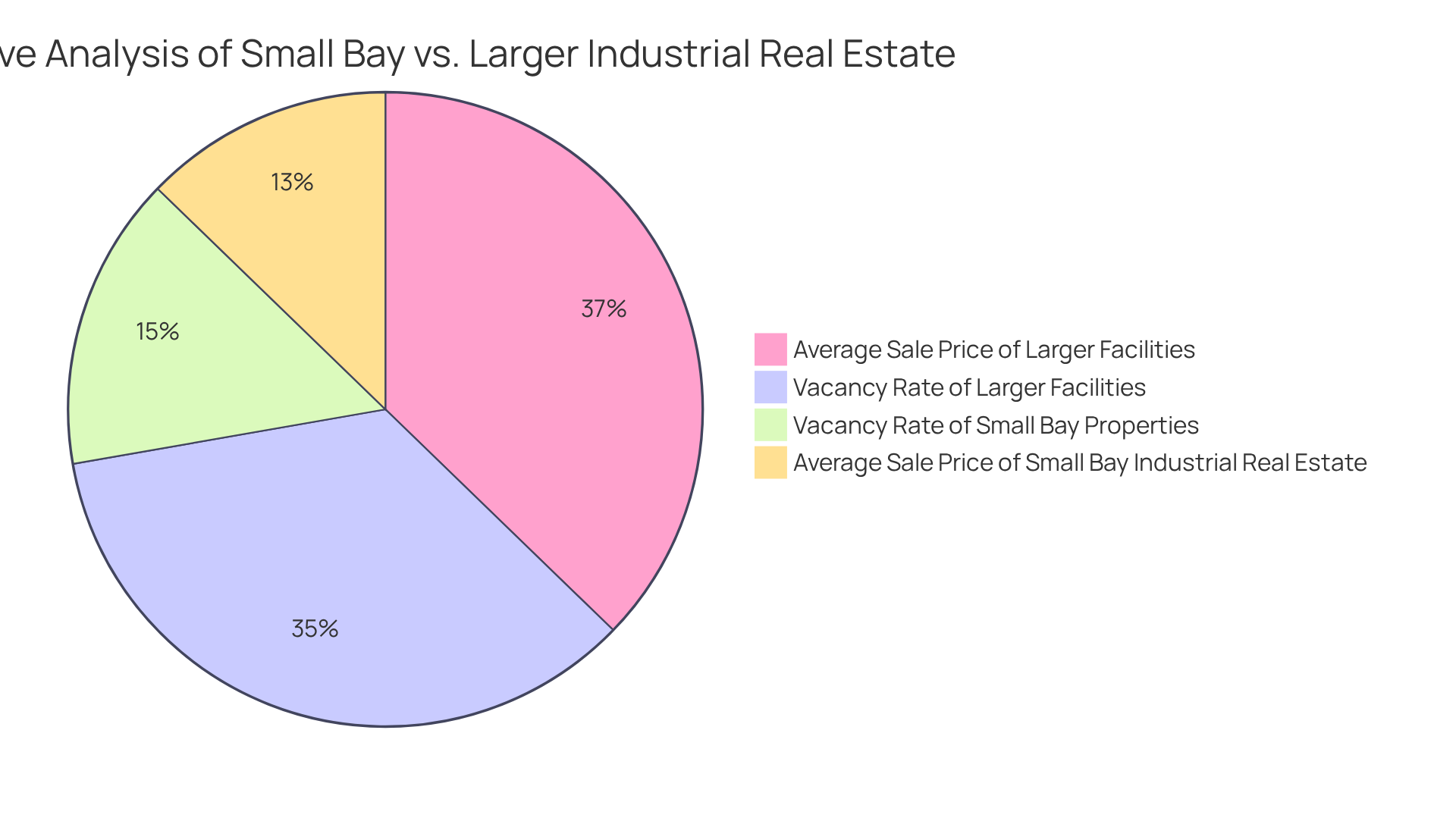

Small bay industrial real estate presents an appealing and economical entry point for investors, particularly when juxtaposed with larger industrial facilities. The typical acquisition expenses for these assets are significantly lower, with projections for 2025 indicating an average sale price of around $106 per square foot. In stark contrast, larger facilities in markets such as Los Angeles average $311 per square foot, rendering compact bay spaces accessible to a wider range of investors. This cost analysis underscores the financial advantages of investing in small bay industrial real estate.

The allure of small bay industrial real estate is further accentuated by their potential for enhanced returns, driven by a sustained interest in logistics and distribution. As companies increasingly prioritize supply chain optimization, the demand for small bay industrial real estate, which offers smaller, strategically located spaces, is anticipated to grow. This trend is reflected in the low vacancy rates for compact bay assets, which remain robust compared to larger logistics facilities that face higher vacancy challenges, with larger assets experiencing rates as high as 9%.

Investor success stories highlight the benefits of entering the small bay industrial real estate market, with many investors reporting favorable outcomes from their investments. For example, seasoned real estate investors assert that current cap rates provide advantageous conditions for investment, marking this as an opportune moment to enter the market. As the commercial landscape evolves, small bay industrial real estate assets are recognized as a prudent choice for individuals looking to diversify their portfolios and capitalize on emerging opportunities.

Versatility: Diverse Applications of Small Bay Industrial Spaces

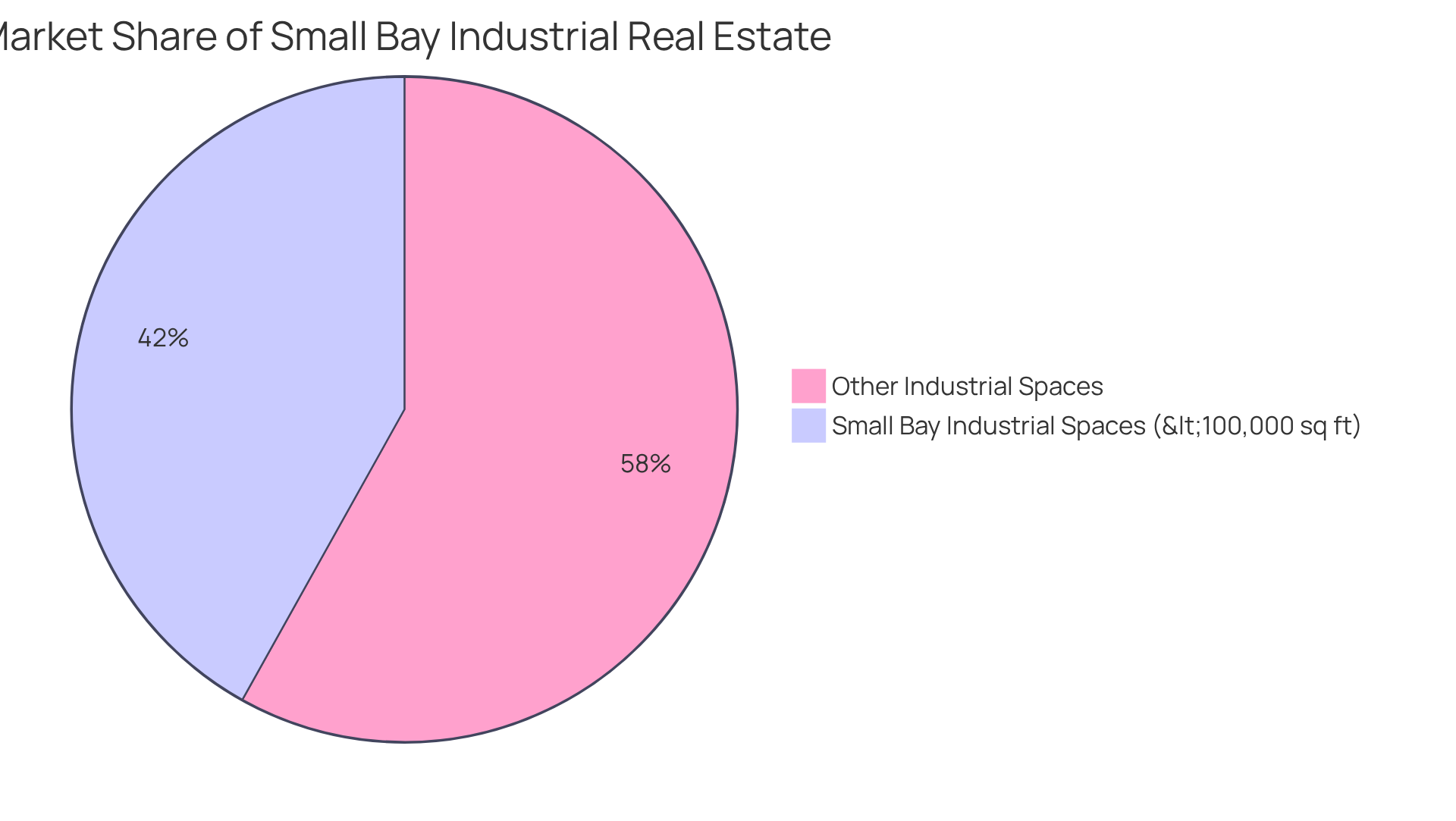

Small bay industrial real estate demonstrates exceptional versatility, accommodating a wide range of businesses, including light manufacturing, warehousing, and distribution. This adaptability allows landlords to attract a diverse tenant base, which is crucial for sustaining high occupancy rates. Notably, spaces below 100,000 square feet account for 41.9% of the sector, boasting a low vacancy rate of just 4%. This statistic highlights the strong demand for such spaces, as they can be easily reconfigured to accommodate various operational needs.

Landlords frequently emphasize the advantages of tenant diversity, asserting that it not only enhances the stability of their investments but also cultivates a collaborative environment among tenants. As one landlord remarked, "Diverse tenants not only bring stability but also create a vibrant community that benefits everyone involved." The ability to cater to a variety of business types—from startups to established companies—renders small bay industrial real estate particularly appealing in today’s dynamic market, where adaptability is paramount for success.

Moreover, businesses such as e-commerce fulfillment centers, artisanal manufacturing, and tech startups are increasingly finding their niche in these adaptable spaces. This trend further illustrates the versatility and broad applications of small bay industrial real estate, making it an attractive option for investors looking to capitalize on evolving market demands.

E-Commerce Growth: Driving Demand for Logistics in Small Bay Properties

The rapid expansion of e-commerce is a pivotal factor driving the demand for small bay industrial real estate. As online retailers seek to optimize their logistics operations, there is a growing need for small bay industrial real estate that facilitates swift deliveries and efficient order fulfillment. This shift is reflected in the increasing number of small bay industrial real estate sites being developed, specifically designed to meet the logistical demands of e-commerce businesses. For example, logistics companies are utilizing these spaces to bolster their last-mile delivery capabilities, thereby enhancing their competitiveness in a fast-paced market.

Insights from logistics experts highlight that compact bay facilities must adhere to specific criteria, such as proximity to urban centers and access to major transportation routes, to ensure timely deliveries. The demand for these properties is further emphasized by statistics indicating that mobile commerce alone is projected to account for nearly 59% of total e-commerce sales by 2025, with mobile online retail traffic expected to represent 77% of global online retail visits.

Case studies illustrate how the expansion of e-commerce is intensifying the need for small bay industrial real estate. Companies that have adapted their logistics strategies to incorporate compact bay facilities report improved delivery times and heightened customer satisfaction. This trend not only reflects the evolving landscape of e-commerce but also underscores the vital role that compact bay commercial spaces play in supporting the logistics framework essential for online retail success.

Zoning Advantages: Favorable Regulations for Small Bay Developments

Beneficial zoning regulations are pivotal in the development of small bay industrial real estate. Urban regions increasingly recognize the necessity for smaller commercial spaces, resulting in more adaptable zoning regulations that foster development. This regulatory assistance simplifies the approval process for new projects and significantly enhances the appeal of investing in small bay industrial real estate. Urban planners assert that such regulations can rejuvenate manufacturing areas, promoting economic expansion and attracting companies seeking effective operational spaces.

Cities with favorable zoning for small bay industrial real estate often experience a surge in local investments. Developers are incentivized to create tailored solutions that meet market demands, driving growth and innovation. Experts note that these zoning benefits can transform underused regions into thriving business centers, ultimately benefiting both investors and the community.

In conclusion, understanding and leveraging these zoning regulations can provide strategic advantages for investors looking to navigate the evolving landscape of small bay industrial real estate.

Urbanization: Shift Towards Smaller, Centralized Industrial Locations

As urbanization continues to advance, a significant shift is occurring towards smaller, centralized manufacturing sites. Businesses are increasingly prioritizing accessibility and proximity to urban centers, resulting in a growing demand for small bay industrial real estate. This trend not only reflects evolving consumer preferences but also underscores the critical importance of location within the real estate market. Understanding this shift can empower investors to make informed decisions, aligning their strategies with current market dynamics.

Appreciation Potential: Long-Term Value in Small Bay Investments

Small bay industrial real estate is increasingly recognized for its long-term value growth potential, driven by a combination of rising demand and limited supply. As urban areas expand and online commerce flourishes, the value of strategically located small bay industrial real estate is anticipated to increase significantly. Recent market evaluations indicate that small bay industrial real estate has outpaced traditional business real estate in appreciation rates, with certain regions experiencing annual growth rates exceeding 5%.

Successful case studies underscore the investment potential within this sector. A notable example is a compact small bay industrial real estate asset in an urban area that saw its value double over the course of ten years, largely due to its proximity to key transportation hubs and the growing demand for last-mile delivery solutions. Financial analysts emphasize that factors such as zoning regulations, infrastructure improvements, and the shift towards more flexible manufacturing spaces are critical drivers of value growth in small bay industrial real estate assets.

Market forecasts suggest that the trend of rising value will continue, making small bay industrial real estate a compelling addition to diversified real estate portfolios. Investors are urged to consider small bay industrial real estate not only for its short-term cash flow prospects but also for its long-term capital growth, which is increasingly becoming a hallmark of successful real estate investment strategies.

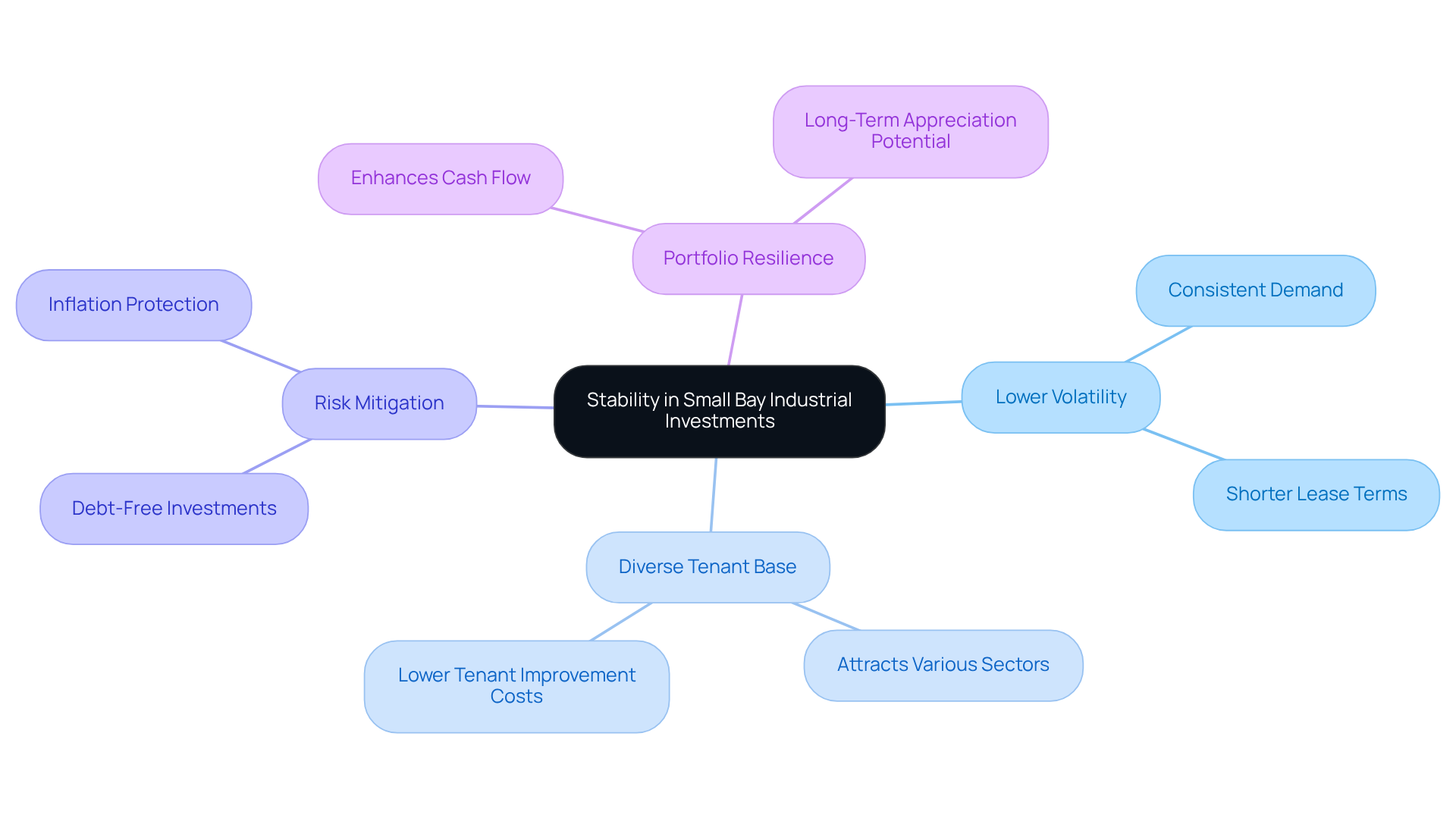

Stability: Lower Volatility in Small Bay Industrial Investments

Investing in small bay industrial real estate offers a compelling advantage: lower volatility compared to larger commercial assets. This stability arises from a diverse tenant base and consistent demand for small bay industrial real estate, making it a reliable investment choice. For investors aiming to mitigate risks in their portfolios, this characteristic is particularly appealing. By incorporating small bay industrial real estate, investors can enhance their portfolio's resilience while capitalizing on steady returns.

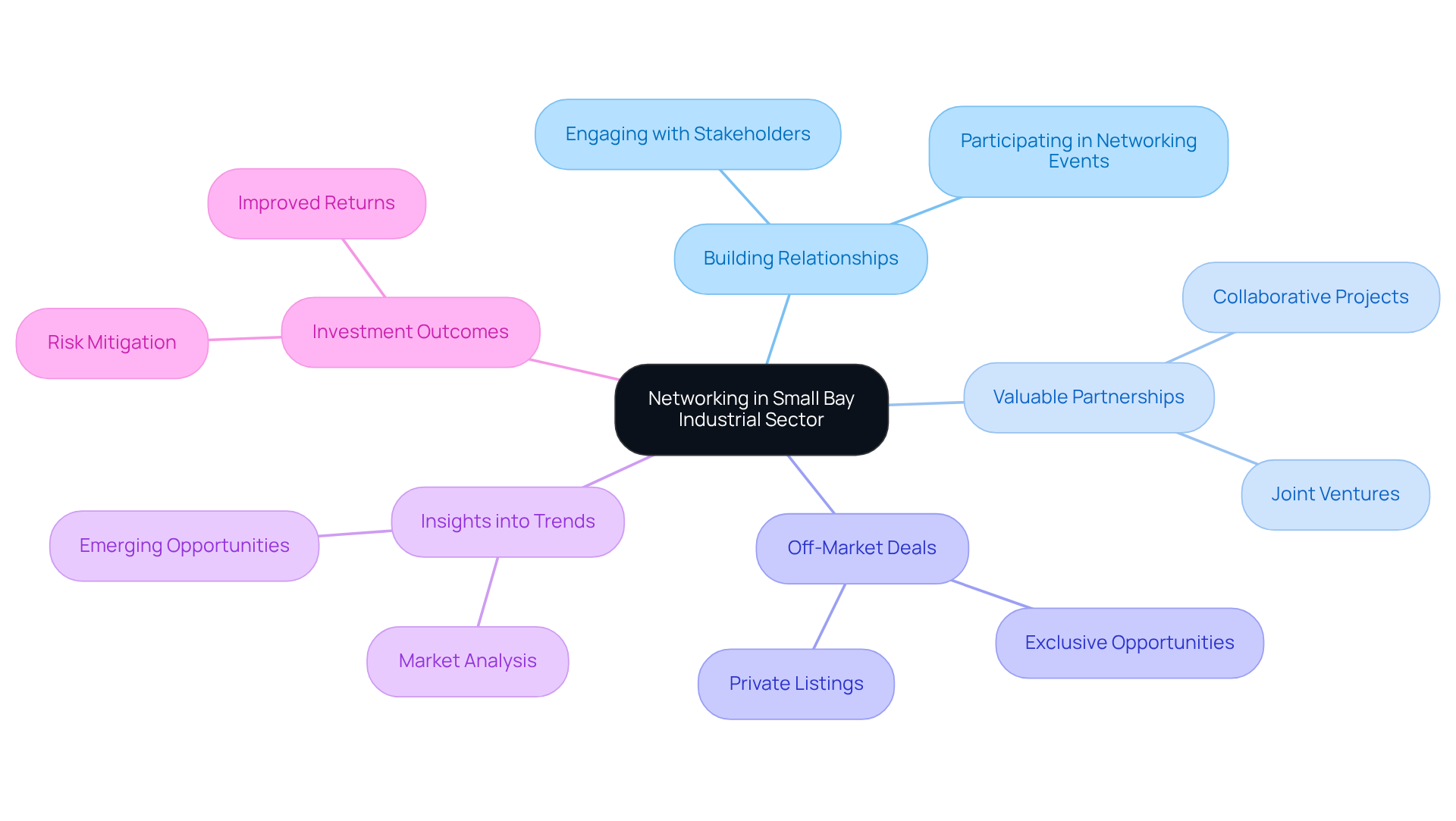

Networking: Building Connections in the Small Bay Industrial Sector

Establishing relationships within the local bay business sector is essential for investors and industry experts. Networking not only fosters valuable partnerships but also opens doors to off-market deals and provides insights into emerging trends. Engaging with diverse stakeholders enhances the ability to navigate the complexities of the local bay market, empowering investors to capitalize on opportunities effectively.

Successful collaborations have proven pivotal in driving growth, as highlighted by the rising demand for small bay industrial real estate, which has surged in recent years. Statistics reveal that partnerships in this sector can significantly improve investment outcomes, with many professionals underscoring the importance of building relationships. Industry leaders assert that cultivating a robust network is not merely advantageous; it is a fundamental strategy for success in real estate.

By actively participating in networking opportunities, investors can position themselves favorably in a competitive landscape, ensuring they remain informed and prepared to seize the next significant opportunity.

Conclusion

The landscape of small bay industrial real estate is evolving, driven by a multitude of factors that underscore its growing significance in the commercial real estate sector. As urbanization accelerates and e-commerce reshapes logistics needs, small bay properties are emerging as essential assets for both investors and businesses. The increasing demand for these spaces, particularly in urban areas, highlights their critical role in facilitating efficient operations and meeting consumer expectations in a rapidly changing market.

Insights reveal a consistent trend towards smaller, strategically located industrial spaces, catering to a diverse range of businesses. Factors such as affordability, versatility, and favorable zoning regulations enhance the appeal of small bay industrial real estate. Furthermore, the potential for long-term appreciation and stability makes these properties an attractive choice for investors seeking to diversify their portfolios while minimizing risk.

In light of these insights, it is crucial for stakeholders in the real estate market to recognize the opportunities presented by small bay industrial properties. As demand for these spaces continues to rise, engaging in networking and staying informed about market trends will be vital for success. Embracing the dynamics of this niche sector can lead to strategic advantages, ensuring that investors and businesses alike are well-positioned to thrive in the future of industrial real estate.