Overview

The article delineates eight essential steps for mastering commercial real estate market reports, underscoring the significance of thorough market analysis, objective setting, and data evaluation. Each step, ranging from the collection of economic data to the synthesis of findings for investment recommendations, is underpinned by a systematic approach that bolsters decision-making and investment strategies within the commercial real estate sector.

Introduction

Mastering the commercial real estate market requires more than mere intuition; it demands a profound understanding of the analytical components that drive property values and investment potential. This guide delves into the essential steps needed to create comprehensive market reports, equipping investors with the insights necessary to navigate the complexities of the market.

With numerous variables at play, one must ask: how can analysis not only reflect current conditions but also anticipate future trends?

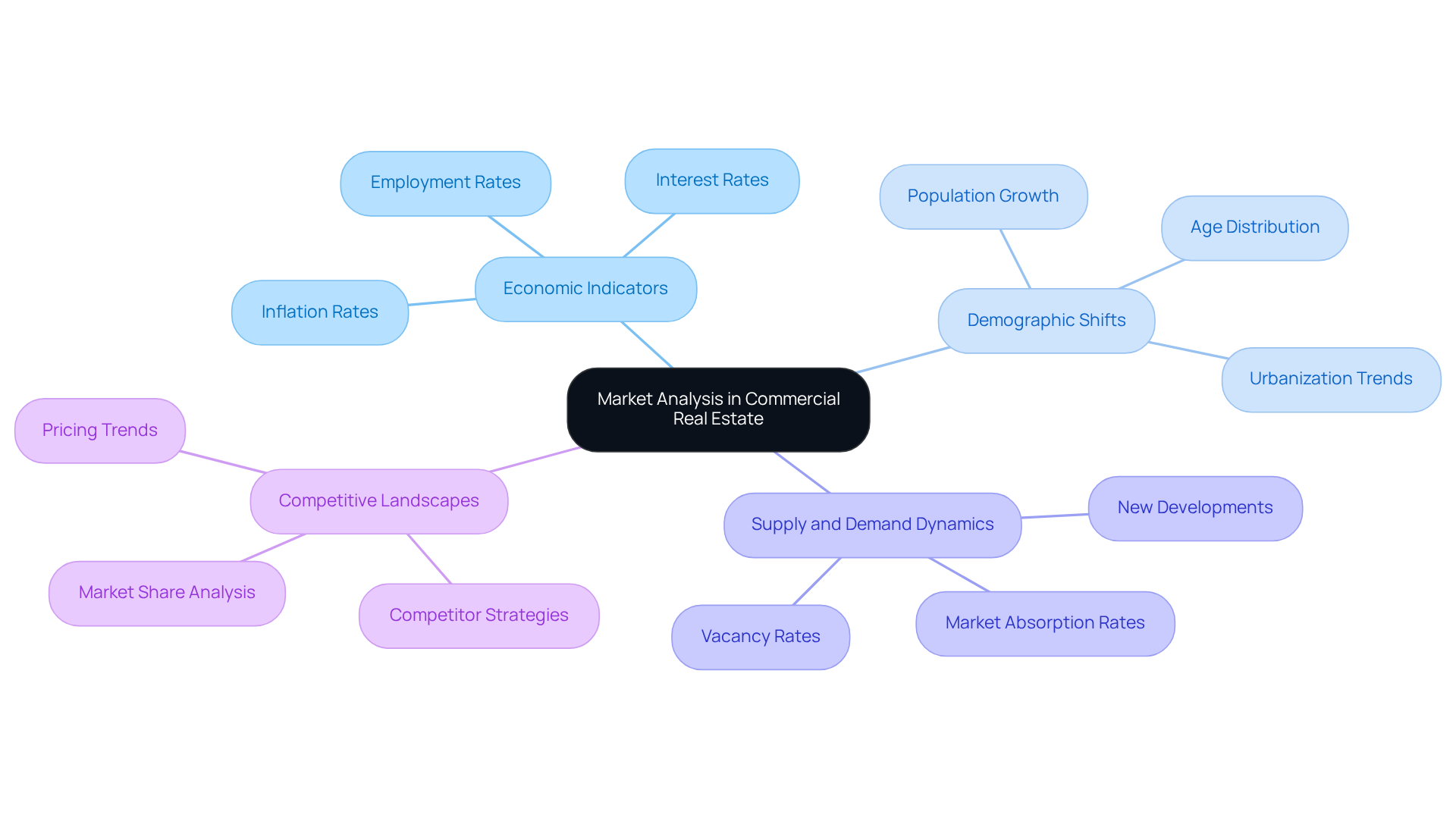

Define Market Analysis in Commercial Real Estate

Market assessment in commercial real estate is a systematic evaluation of critical factors that influence property values and investment opportunities. This process encompasses the analysis of:

- Economic indicators

- Demographic shifts

- Supply and demand dynamics

- Competitive landscapes

By conducting a comprehensive examination of these elements, investors and stakeholders are equipped to make informed decisions, gaining valuable insights into current conditions and emerging trends. Such knowledge not only enhances investment strategies but also positions stakeholders to capitalize on future opportunities.

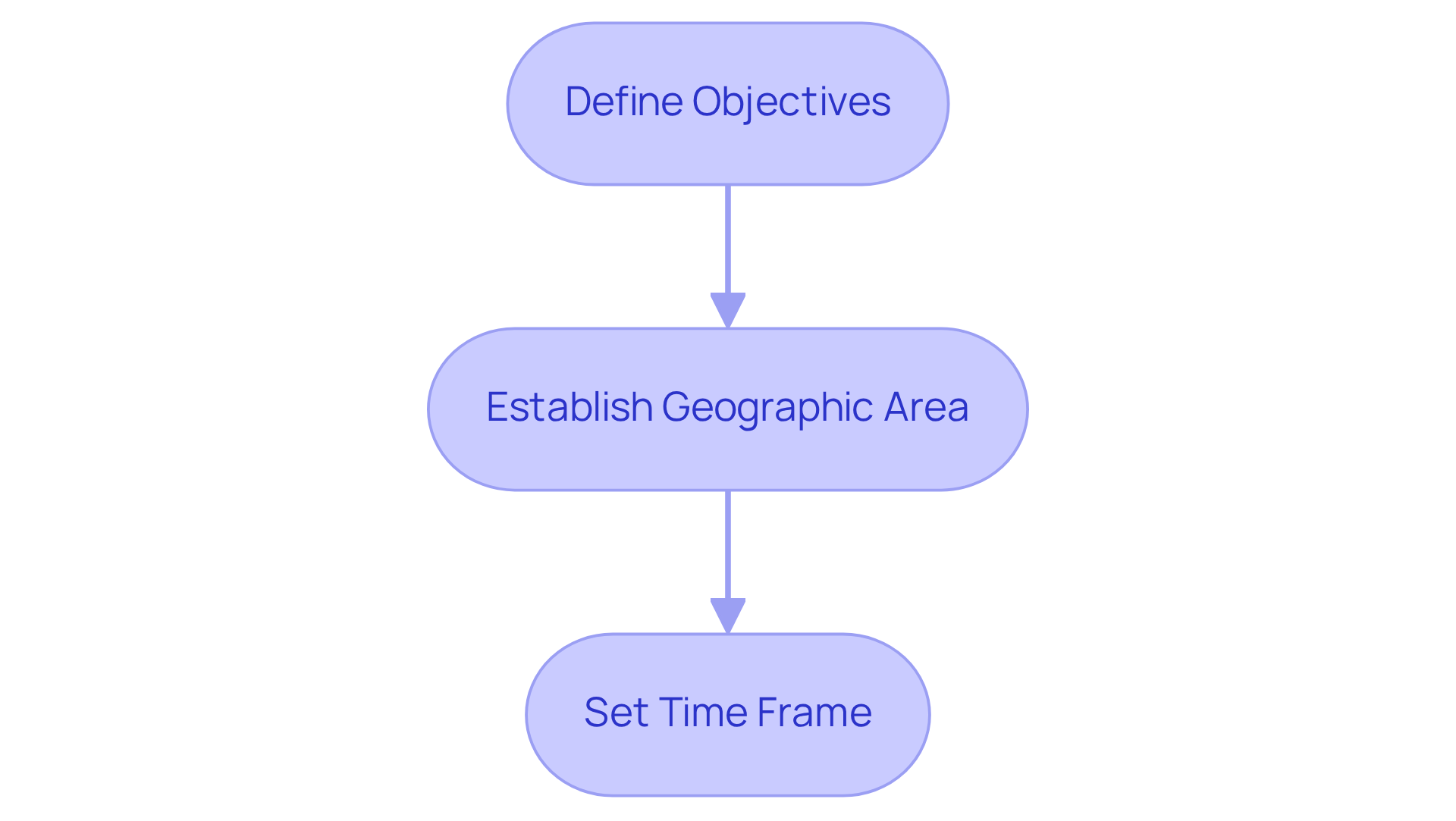

Establish Objectives and Scope for Your Analysis

Begin by clearly defining the primary objectives of your assessment. Are you aiming to invest in a specific type of property, or are you evaluating the overall market for potential opportunities?

Establish the geographic area you will focus on and the time frame for your analysis. This clarity is essential; it will streamline your research process and ensure that the data you gather is relevant and aligned with your investment objectives.

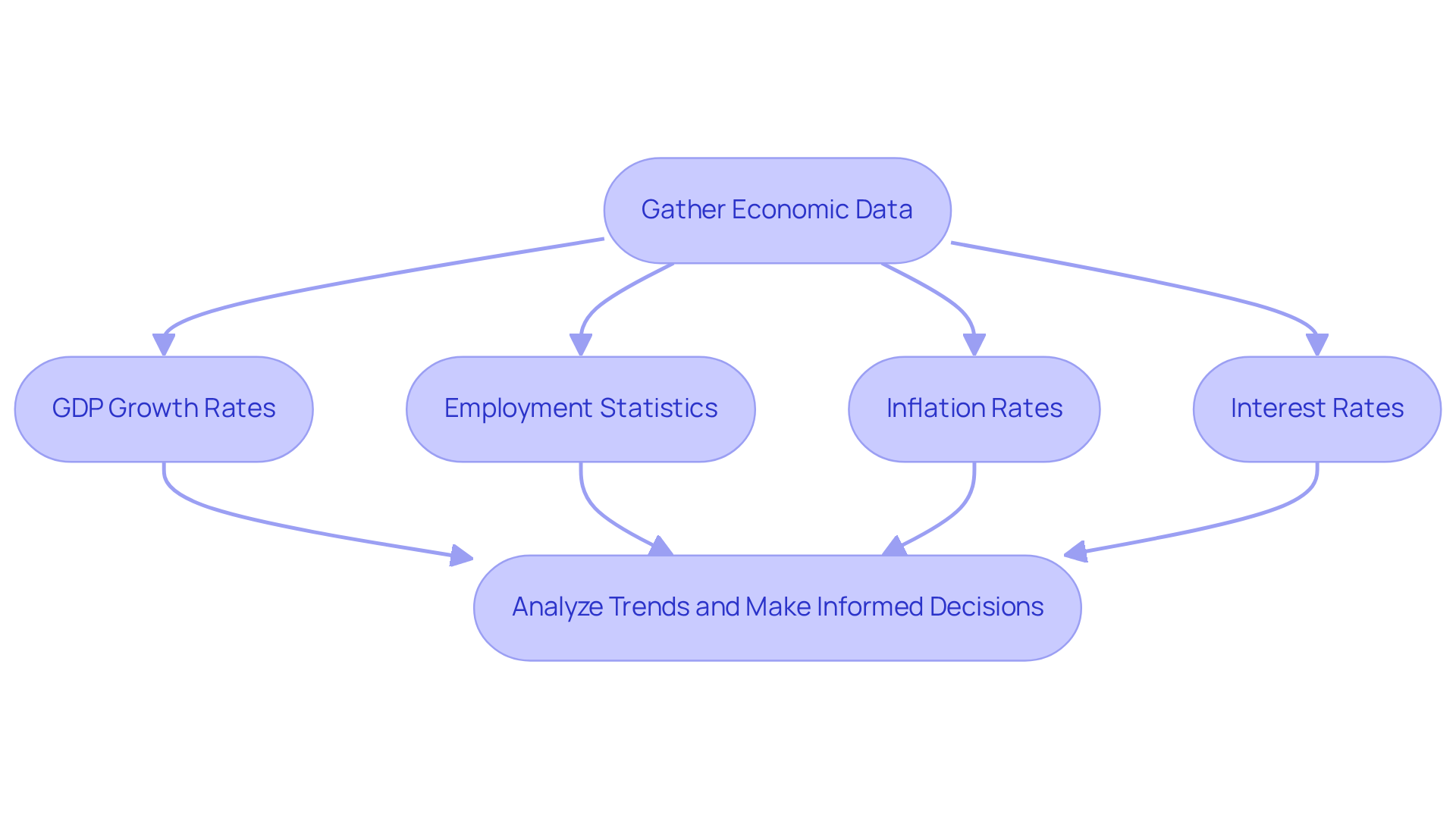

Gather and Analyze Economic Data

To effectively assess the commercial real estate market reports, it is crucial to collect relevant economic data from reliable sources, including government reports, financial institutions, and industry publications. Key indicators to analyze encompass:

- GDP growth rates

- Employment statistics

- Inflation rates

- Interest rates

This information serves as a foundation for evaluating the overall economic environment and its implications for the commercial real estate market reports.

Identifying trends within these indicators can illuminate potential growth or decline in specific sectors. For instance, a rising GDP growth rate may signal a robust economy, fostering confidence in commercial investments. Conversely, increasing inflation rates could indicate economic instability, prompting a cautious approach to investment decisions.

By synthesizing this data, investors can make informed choices that align with market conditions. Understanding the economic landscape not only enhances strategic planning but also positions investors to capitalize on emerging opportunities within the commercial real estate sector.

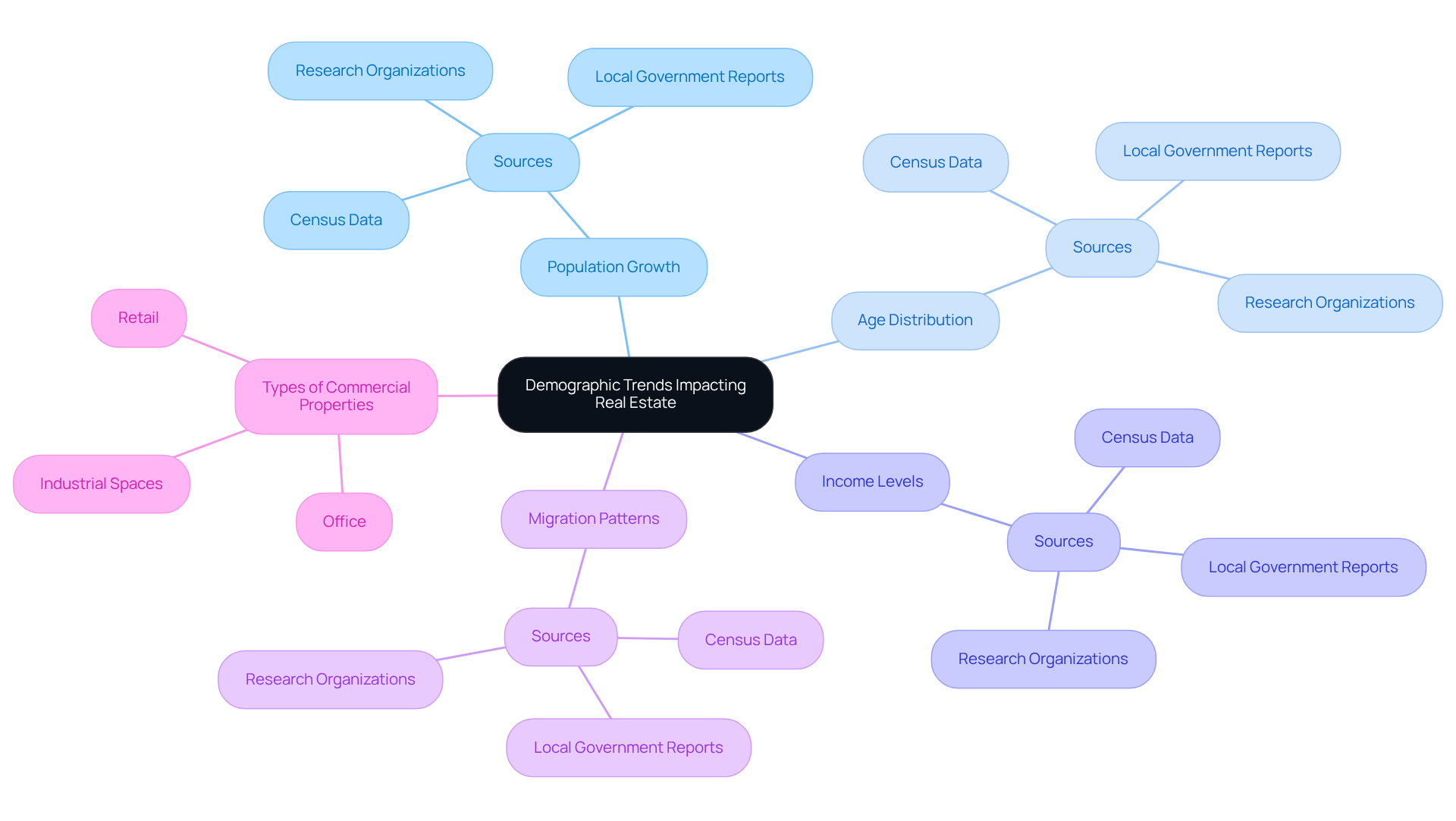

Evaluate Demographic Trends Impacting Real Estate

To effectively analyze demographic data, focus on key aspects such as:

- Population growth

- Age distribution

- Income levels

- Migration patterns

This vital information can be sourced from:

- Census data

- Local government reports

- Reputable research organizations

Consider the trends revealed in commercial real estate market reports that indicate shifts in demand for various types of commercial properties, including:

- Retail

- Office

- Industrial spaces

Understanding these trends not only informs your current strategies but also equips you to predict future demands, ultimately enhancing your investment decisions.

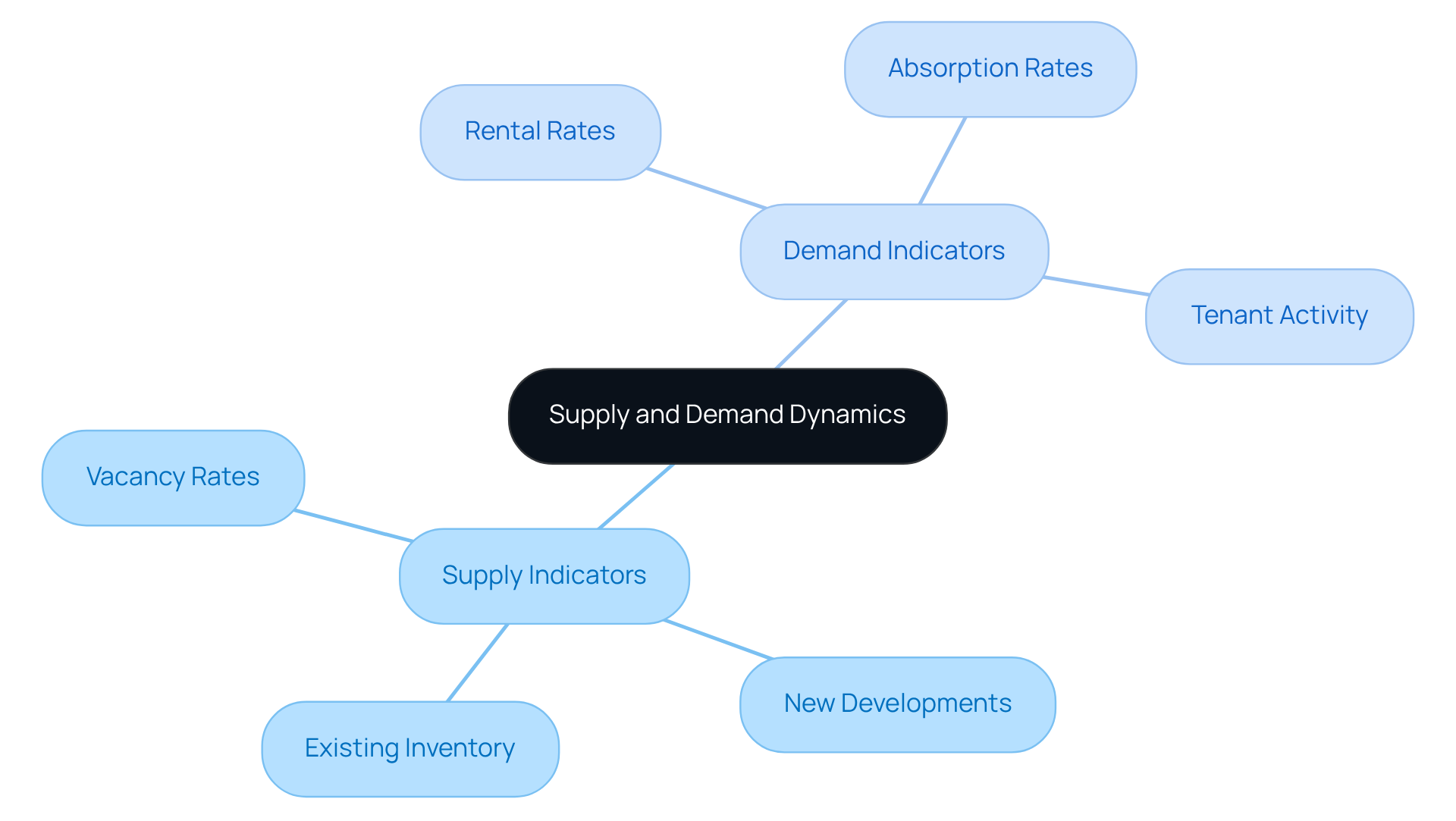

Assess Supply and Demand Dynamics

Begin by assessing the current supply of commercial properties in your target area by reviewing commercial real estate market reports that focus on key statistics such as:

- Vacancy rates

- New developments

- Existing inventory

Next, compare these figures with demand indicators, including:

- Rental rates

- Absorption rates

- Tenant activity

This comprehensive evaluation will not only clarify whether the market is favoring purchasers or vendors but also help identify potential regions for investment based on discrepancies between supply and demand. By understanding these dynamics, you can make informed decisions that align with market trends.

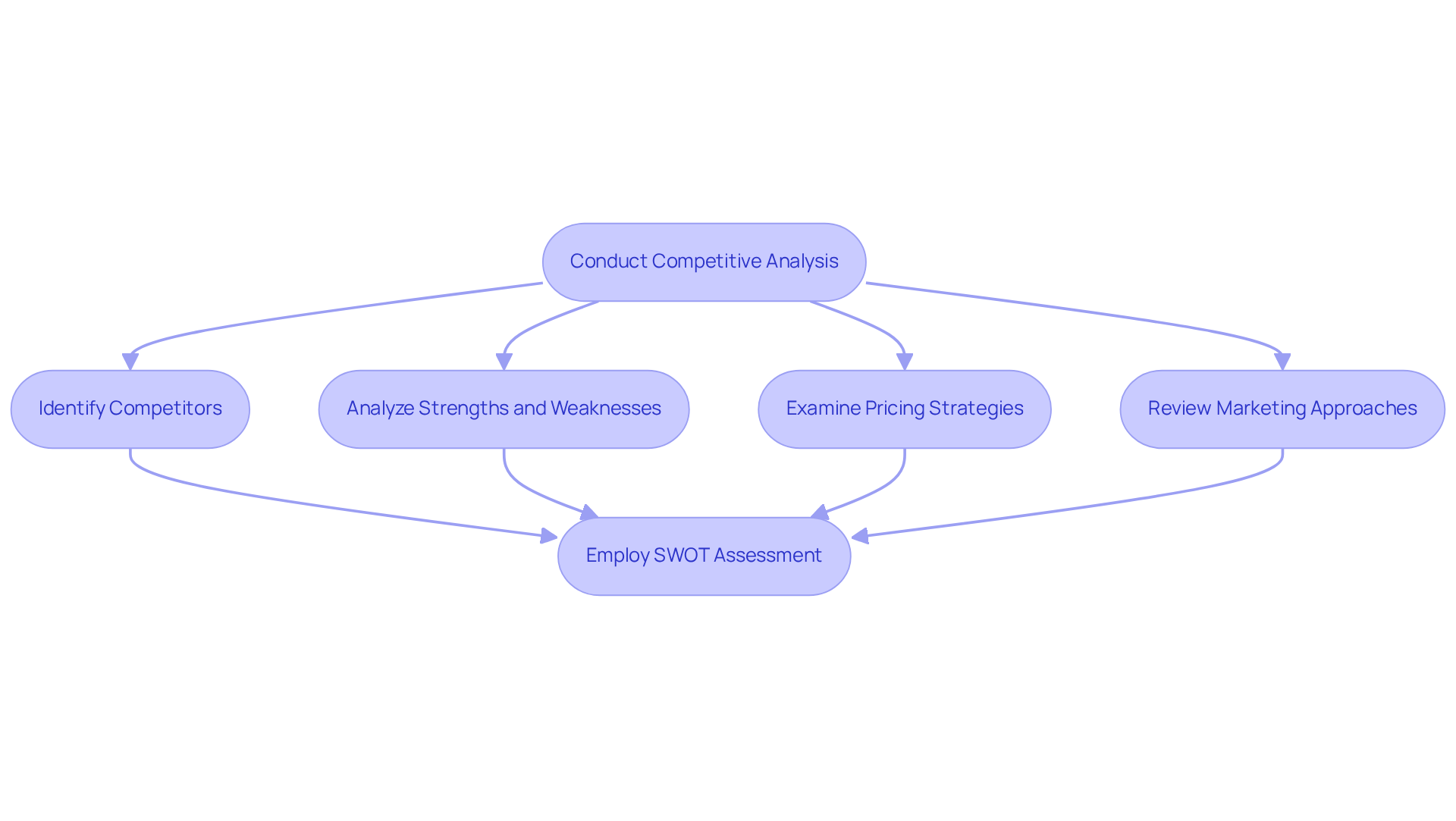

Conduct Competitive Analysis of the Market

Identify key competitors in your target market by thoroughly researching similar properties and their performance metrics.

- Analyze their strengths and weaknesses.

- Examine their pricing strategies.

- Review their marketing approaches.

Employing tools such as a SWOT assessment (Strengths, Weaknesses, Opportunities, Threats) can be particularly beneficial in this evaluation. Understanding the competitive environment will enable you to position your capital effectively and recognize unique selling propositions that can differentiate your investments. This strategic insight is crucial for making informed decisions in a dynamic market.

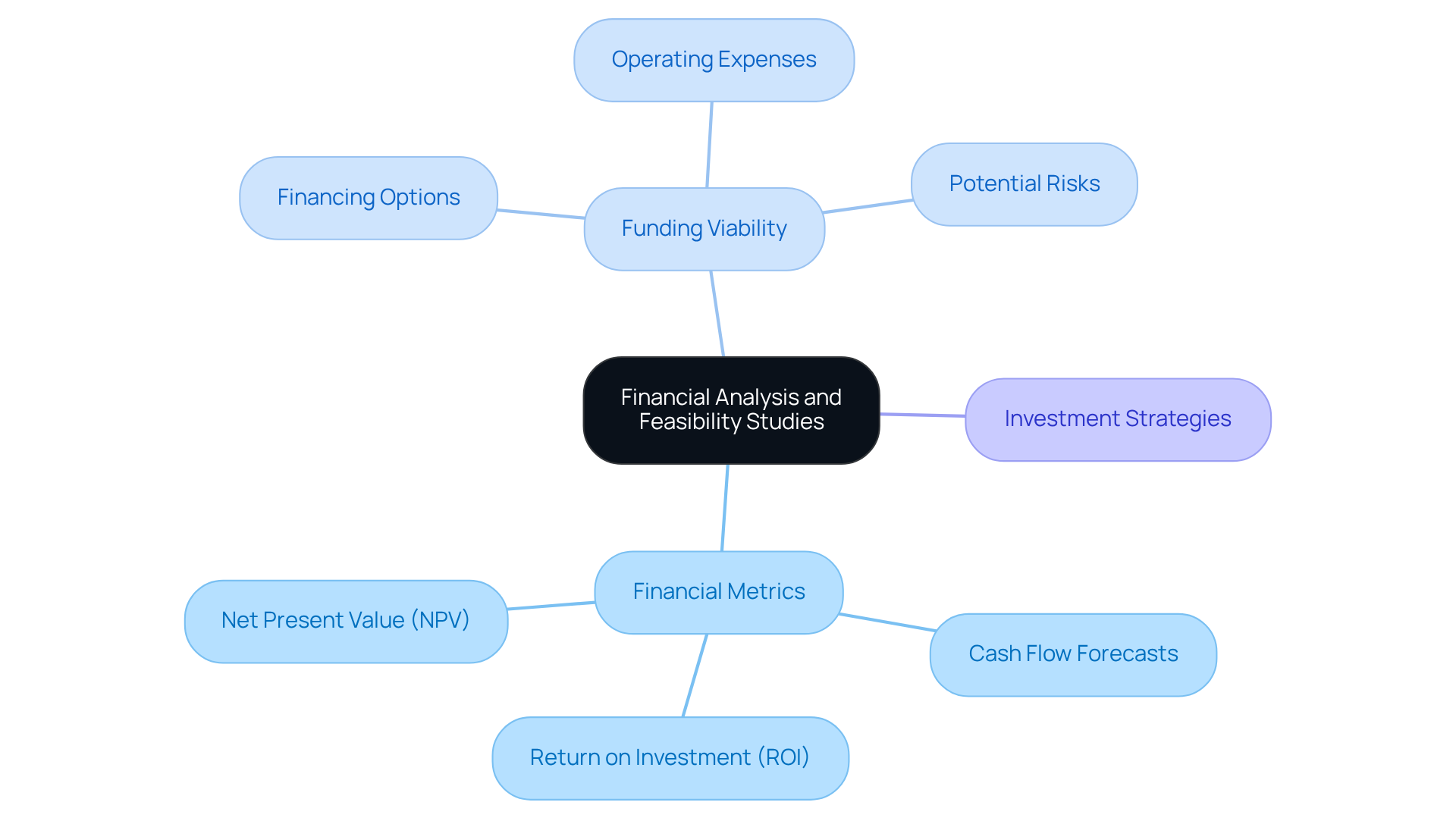

Perform Financial Analysis and Feasibility Studies

Conduct a thorough financial assessment of potential ventures, incorporating cash flow forecasts, return on investment (ROI), and net present value (NPV) calculations. It is essential to evaluate the viability of funding by examining various factors, including:

- Financing options

- Operating expenses

- Potential risks

This comprehensive analysis will provide a clear understanding of the financial implications of your funding decisions, allowing for informed investment strategies.

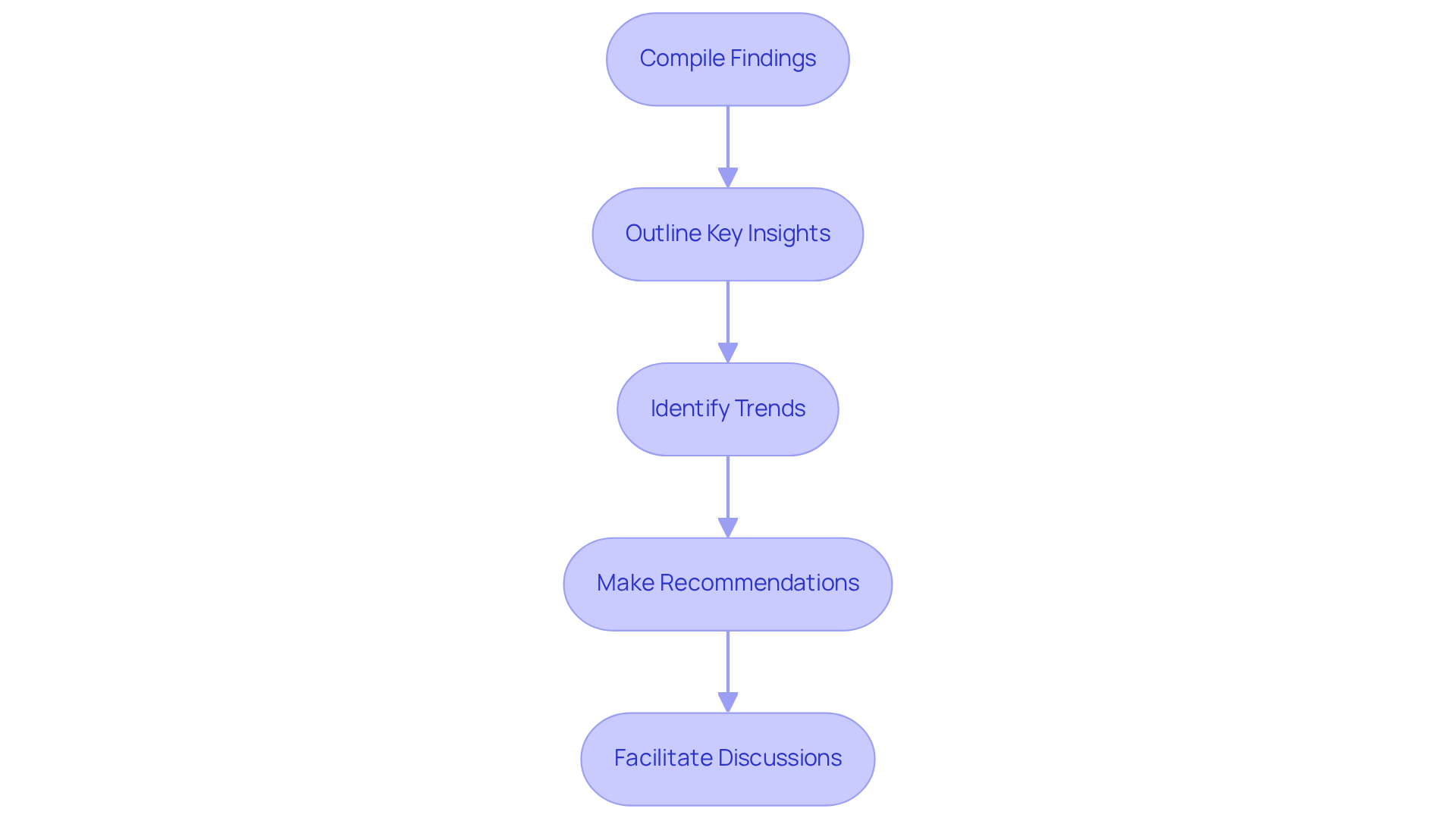

Synthesize Findings and Make Investment Recommendations

Compile all findings into a comprehensive report that outlines key insights, trends, and recommendations. This report should highlight the most promising financial opportunities based on your analysis, providing a clear rationale for each recommendation. Such a document will serve as a valuable tool for decision-making, facilitating discussions around potential investments among stakeholders. By presenting this information effectively, you empower decision-makers to act with confidence and clarity.

Conclusion

Mastering commercial real estate market reports necessitates a strategic approach that encompasses various analytical components. By grasping the intricate dynamics of market analysis, stakeholders can make informed decisions that significantly enhance their investment strategies. The insights derived from comprehensive evaluations of economic indicators, demographic trends, supply and demand dynamics, competitive landscapes, and financial assessments are vital for navigating the complexities of the commercial real estate market.

Key arguments presented throughout the article underscore the importance of:

- Defining objectives and scope

- Gathering relevant economic data

- Evaluating demographic trends

- Assessing supply and demand

- Conducting competitive analyses

- Performing financial assessments

- Synthesizing findings into actionable recommendations

Each step plays a crucial role in empowering investors and decision-makers to identify opportunities and mitigate risks effectively.

Ultimately, mastering market reports in commercial real estate not only fosters informed investment choices but also positions stakeholders to adapt to emerging trends and capitalize on future growth. Engaging in thorough market analysis is essential for anyone looking to thrive in this competitive landscape. Investing time to refine these skills can lead to significant advantages, ensuring that investments are both strategic and profitable.