Overview

The article titled "9 Essential Real Estate Data Sources for Informed Investing" identifies critical resources that investors can leverage to make informed decisions in the real estate market. It emphasizes various data sources, including:

- FHFA House Price Index

- Canadian Real Estate Association

These resources supply essential statistics and trends. They empower investors to effectively assess market conditions and identify lucrative opportunities. By utilizing these insights, investors can enhance their strategies and make more knowledgeable investment choices.

Introduction

In the fast-paced realm of real estate investing, access to reliable data is paramount; it can spell the difference between success and failure. Investors are in constant pursuit of the most relevant insights to inform their decisions. However, the sheer volume of available information makes identifying the right sources a daunting challenge. This article unveils nine essential real estate data sources that provide clarity in a complex market, empowering investors to make informed choices.

What key platforms can transform data into actionable strategies, and how can they assist in navigating the uncertainties of the real estate landscape?

Zero Flux: Daily Insights on Real Estate Market Trends

Zero Flux serves as a tailored daily newsletter that consolidates essential property sector trends and insights from over 100 diverse sources. By focusing on factual information without opinions, it provides subscribers with a comprehensive overview of the latest developments in the property sector. The concise format of Zero Flux allows real estate professionals and stakeholders to quickly grasp the most pertinent information impacting the industry. This makes it an indispensable tool for effectively navigating the complexities of real estate investing.

FHFA House Price Index: Key Indicator of Housing Market Trends

The Federal Housing Finance Agency (FHFA) House Price Index serves as a pivotal tool for monitoring fluctuations in single-family home prices throughout the United States. This index is indispensable for stakeholders, as it reveals the overarching state of the housing market. By delving into this index, investors can uncover significant trends in property values, which empowers them to make astute decisions regarding the optimal timing for buying or selling properties.

Understanding the dynamics of the FHFA House Price Index not only provides clarity on market movements but also equips investors with the knowledge necessary to navigate the complexities presented by real estate data sources. As they analyze the data, they can identify patterns that indicate when to seize opportunities or exercise caution. This informed approach is crucial for maximizing returns and minimizing risks in property investments.

In conclusion, leveraging the insights offered by the FHFA House Price Index is essential for any investor aiming to thrive in the competitive real estate landscape. By staying attuned to these trends, stakeholders can enhance their strategic decision-making, ensuring they remain ahead in the ever-evolving housing market.

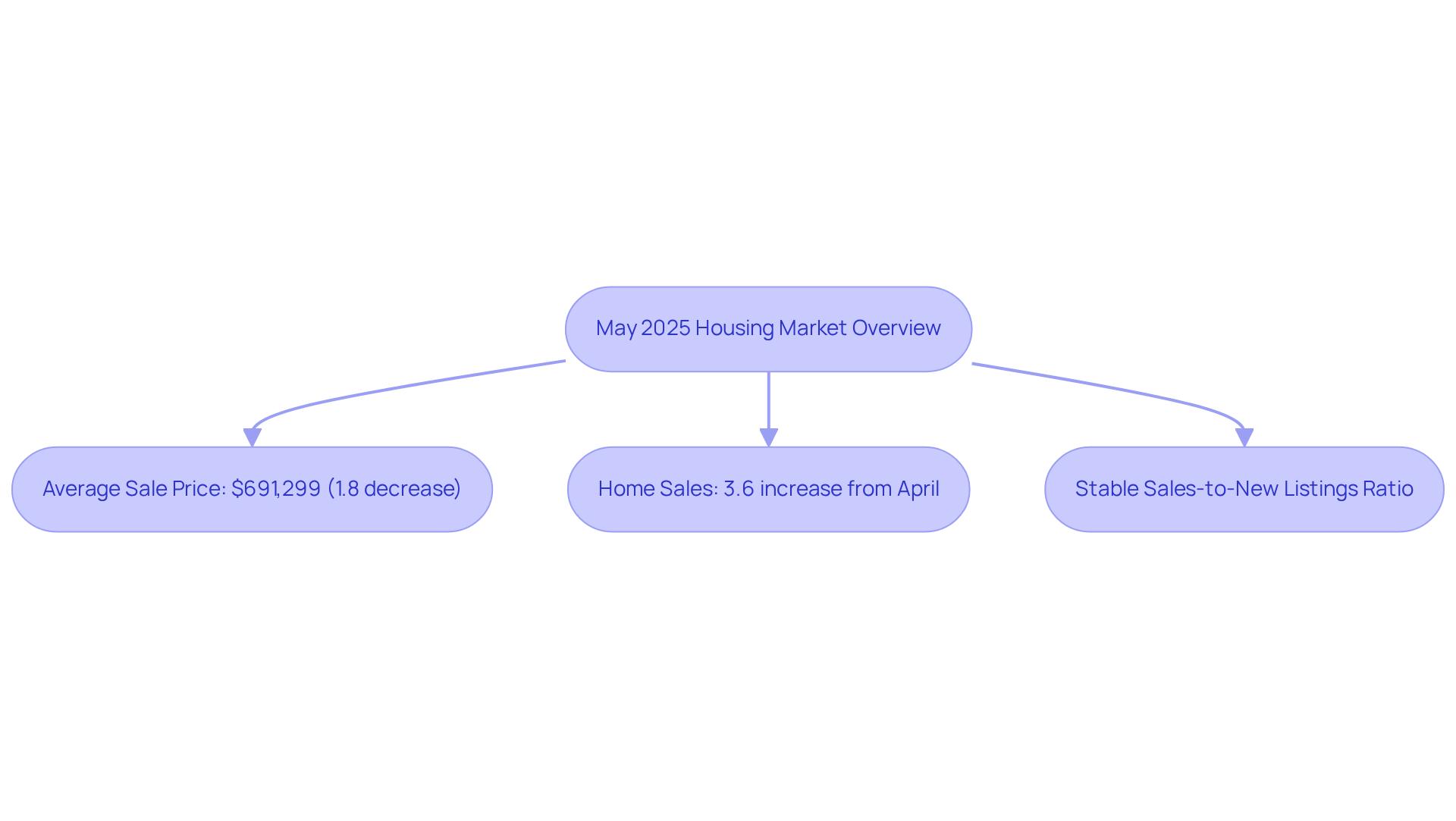

Canadian Real Estate Association: Comprehensive Housing Market Statistics

The Canadian Real Estate Association (CREA) offers essential statistics from real estate data sources that are crucial for understanding housing conditions across Canada. This includes detailed sales data, average home prices, and emerging industry trends sourced from real estate data sources. For those navigating the Canadian real estate landscape, CREA's insights are indispensable.

In May 2025, the national average sale price was reported at $691,299, reflecting a 1.8% decrease from the previous year. However, home sales experienced a 3.6% increase from April, marking the first gain in activity since November 2024. This trend may indicate a potential recovery in the market.

Furthermore, the national sales-to-new listings ratio remained stable, enhancing confidence among purchasers. CREA's comprehensive statistics derived from real estate data sources not only assist in strategic planning but also empower stakeholders to capitalize on favorable conditions as they arise.

To remain informed, individuals should routinely check CREA's updates for the latest statistics and insights.

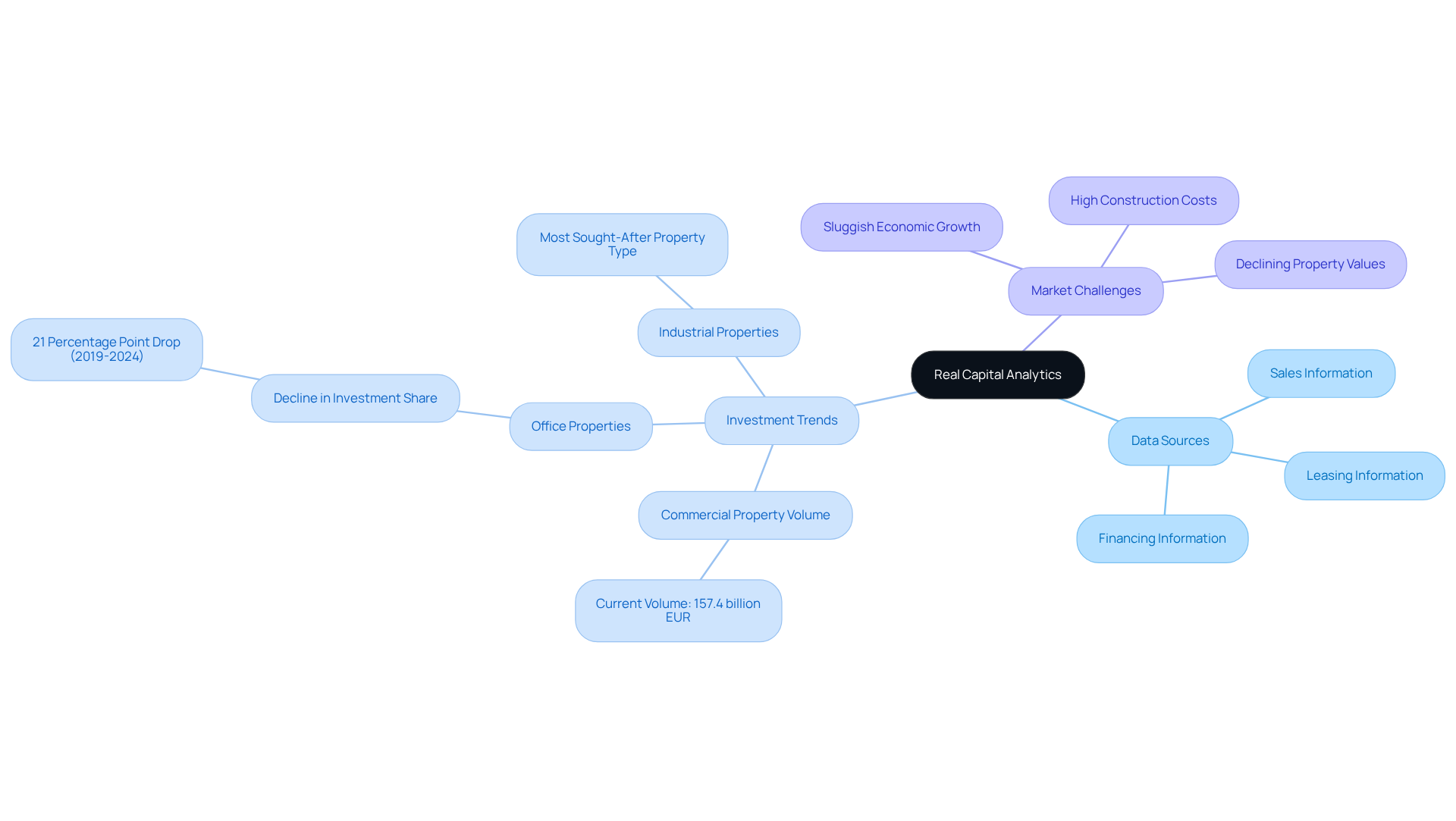

Real Capital Analytics: Extensive Data for Informed Investment Decisions

Real Capital Analytics excels in delivering comprehensive data on commercial real estate transactions by leveraging various real estate data sources, which encompass sales, leasing, and financing information. This information from real estate data sources is crucial for individuals aiming to make informed decisions in the commercial sector. By analyzing trends and transaction volumes, investors can pinpoint emerging opportunities and effectively assess risks within the economy. As of July 2025, the commercial property investment volume in Europe is reported at 157.4 billion EUR, highlighting the overall market size and the significance of current trends.

The commercial property landscape is undergoing transformation, facing challenges such as sluggish economic growth and elevated construction costs that impact investment patterns. Notably, the share of investment allocated to office properties has decreased by 21 percentage points from 2019 to 2024. In contrast, industrial properties have gained immense popularity, emerging as the most sought-after type among occupants and investors in Europe. This transition emphasizes the necessity of leveraging real estate data sources to maintain a competitive edge in the market.

MRI Software: Big Data and AI Solutions for Real Estate Investment

MRI Software delivers cutting-edge big data and AI solutions specifically designed for real estate investment by leveraging real estate data sources. This innovative platform empowers stakeholders to analyze vast amounts of real estate data sources, uncovering insights that are often overlooked by traditional methods. By harnessing these sophisticated tools, individuals can not only optimize their portfolios but also enhance property management and make informed, data-driven decisions that resonate with current market trends. In today's competitive landscape, leveraging such advanced analytics is crucial for staying ahead and maximizing investment potential.

Baskin.io: Specialized Occupancy Data Sources for Investors

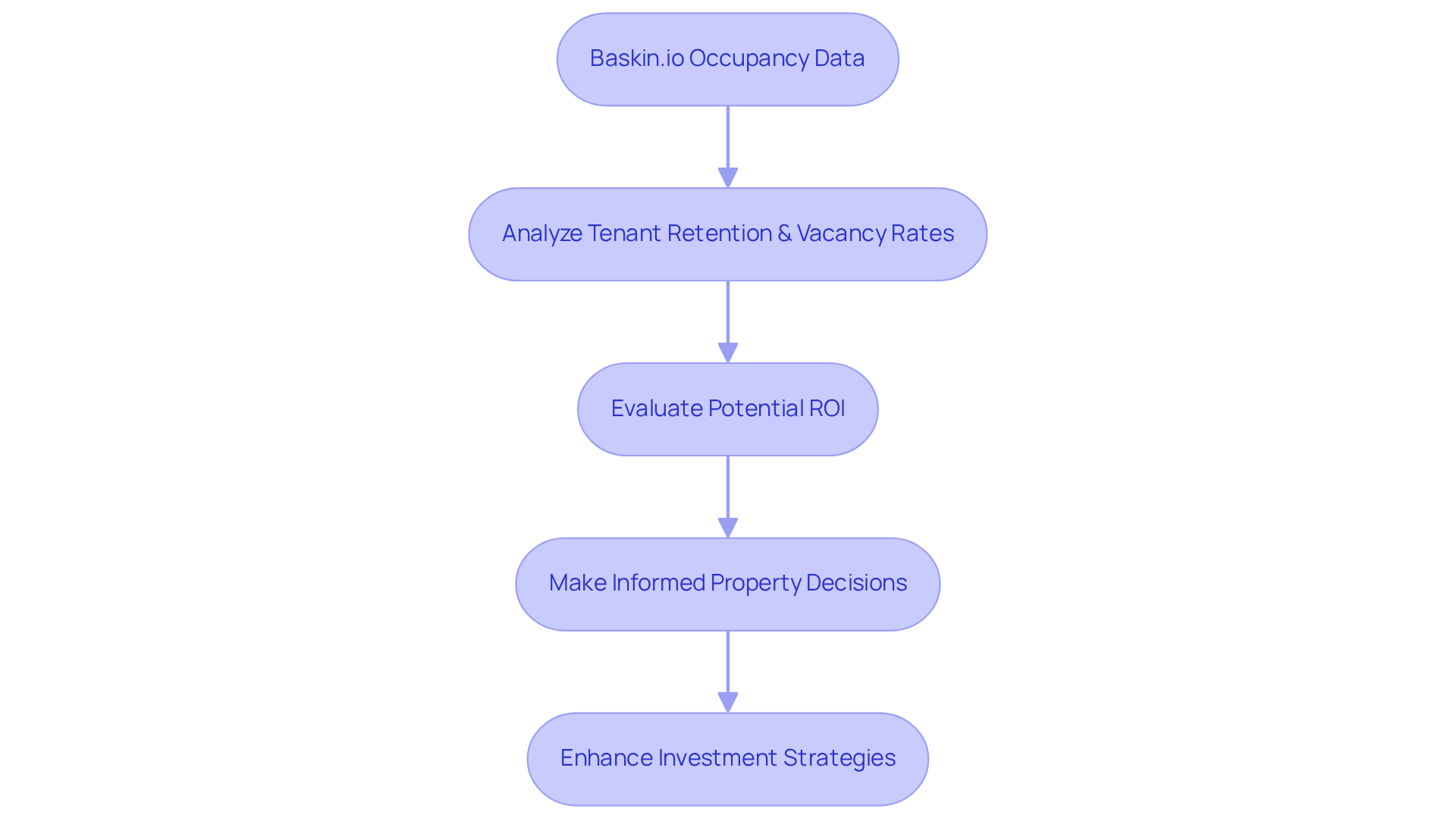

Baskin.io delivers essential occupancy data that empowers stakeholders to understand property performance in terms of tenant retention and vacancy rates. This information is crucial for evaluating the potential return on investment for rental properties. By analyzing occupancy trends, stakeholders can make informed decisions regarding property acquisitions and management strategies.

Understanding these trends not only aids in assessing current performance but also highlights opportunities for improvement. For instance, a thorough analysis of retention rates can reveal patterns that inform future leasing strategies. Consequently, stakeholders are better equipped to enhance their investment portfolios.

Incorporating this data into decision-making processes allows for a strategic approach to property management. By leveraging occupancy insights, investors can optimize their assets and anticipate market shifts, ensuring sustained profitability. This proactive stance ultimately leads to more effective investment strategies and improved financial outcomes.

GeoWarehouse: Detailed Property Insights and Analytics

GeoWarehouse provides comprehensive property insights and analytics, covering ownership history, zoning information, and property assessments. This information is vital for stakeholders conducting due diligence prior to acquisitions. By leveraging GeoWarehouse's extensive insights, investors can effectively identify potential risks and opportunities associated with specific properties, thereby enabling informed investment decisions.

In 2025, the understanding of zoning regulations has become increasingly crucial, as they can substantially influence property value and development potential. Notably, according to Zero Flux, which tracks essential trends in the real estate industry, 90% of millionaires build their wealth through real estate. This statistic underscores the importance of utilizing tools like GeoWarehouse.

Such real estate data sources, along with the data-driven insights from Zero Flux, are essential for navigating the complexities of the industry and making strategic investment decisions, particularly in an era where information overload can obscure significant trends.

Fraser Valley Real Estate Board: Localized Market Statistics

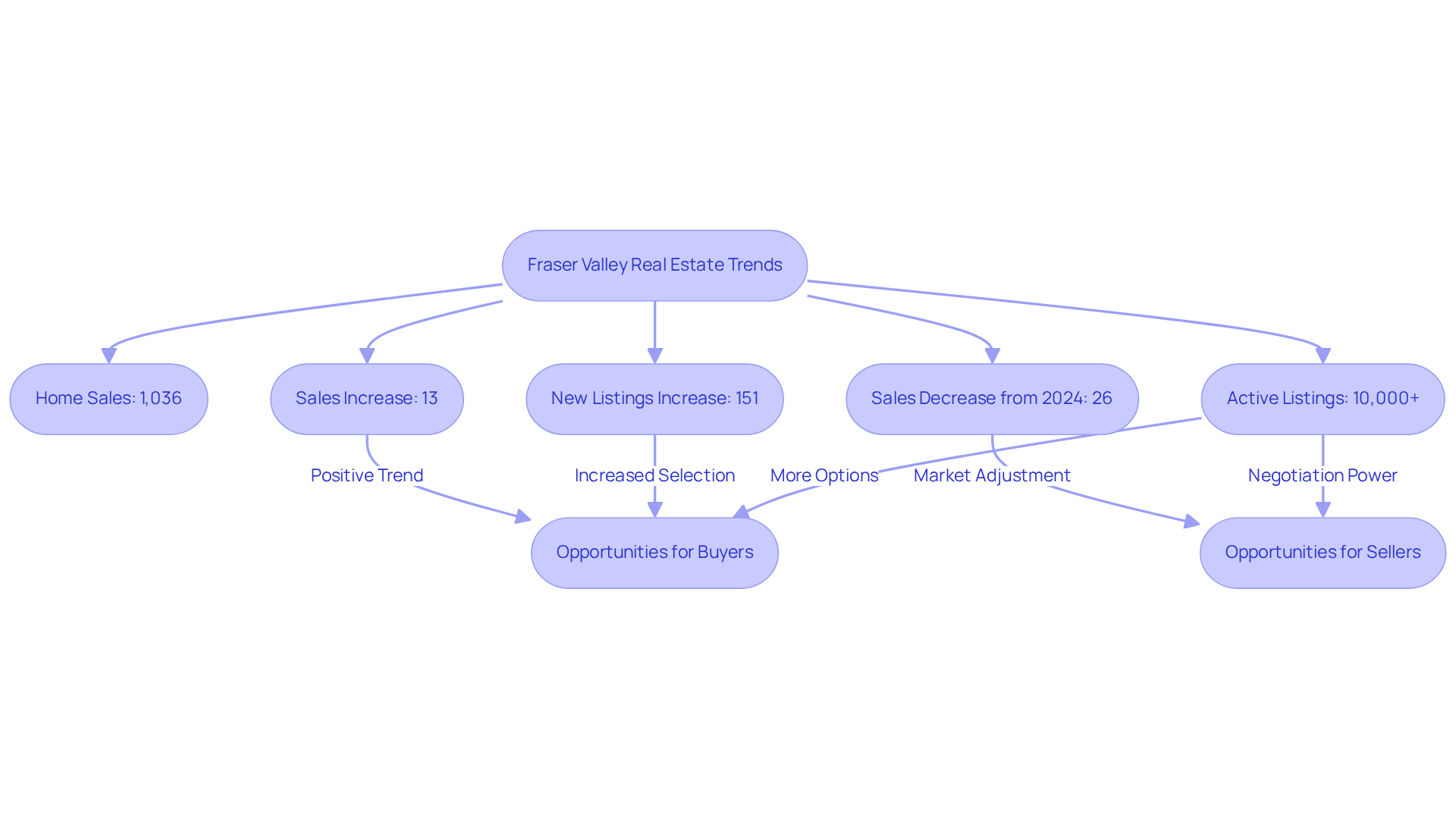

The Fraser Valley Real Estate Board offers essential localized real estate data sources that illuminate housing trends, sales activity, and pricing dynamics within the Fraser Valley region. For investors, understanding these localized insights is crucial for making informed investment decisions. Recent data indicates that in March 2025, home sales in the Fraser Valley reached 1,036 transactions, marking a 13% increase from February. However, these sales were still 26% below the levels recorded in March 2024. This uptick, alongside a significant rise in new listings—up 151% in January—suggests a potential shift in market conditions.

Investors leveraging this data can pinpoint emerging areas and evaluate growth potential in specific neighborhoods. The current balanced trading conditions, characterized by a sales-to-active listings ratio of 19%, present opportunities for both buyers and sellers. As Baldev Gill, CEO of the Fraser Valley Real Estate Board, stated, "Current balanced conditions provide opportunities for both buyers and sellers." Regional analysts stress that comprehending these localized trends is vital for making strategic investment choices. The growing inventory of over 10,000 active listings offers buyers increased selection and negotiating power—a scenario not witnessed in over a decade. This context underscores the importance of utilizing real estate data sources, such as the Fraser Valley Real Estate Board's data, to effectively navigate the complexities of the property market.

Philadelphia Federal Reserve: Economic Surveys and Real Estate Data

The Philadelphia Federal Reserve conducts economic surveys that provide crucial insights into regional economic conditions and their impact on the property sector. For investors, grasping these economic indicators is vital for making informed decisions. By analyzing this information, stakeholders can evaluate consumer sentiment and anticipate potential shifts in property demand.

Recent survey findings indicate a projected house price growth of 3.9% for 2025, according to the S&P CoreLogic Case-Shiller index, highlighting the necessity of remaining informed about economic trends. Furthermore, with a potential decline in actual GDP for 2025 estimated at 23.3%, it becomes increasingly important for stakeholders to monitor these indicators closely.

Zero Flux plays a pivotal role in curating and presenting these insights, aiding stakeholders in effectively navigating market fluctuations. To enhance their economic analysis, individuals should regularly review real estate data sources such as the Philadelphia Federal Reserve's surveys to stay attuned to evolving economic conditions and identify real estate opportunities.

ScienceDirect: Research on Property Prices and Socio-Economic Indicators

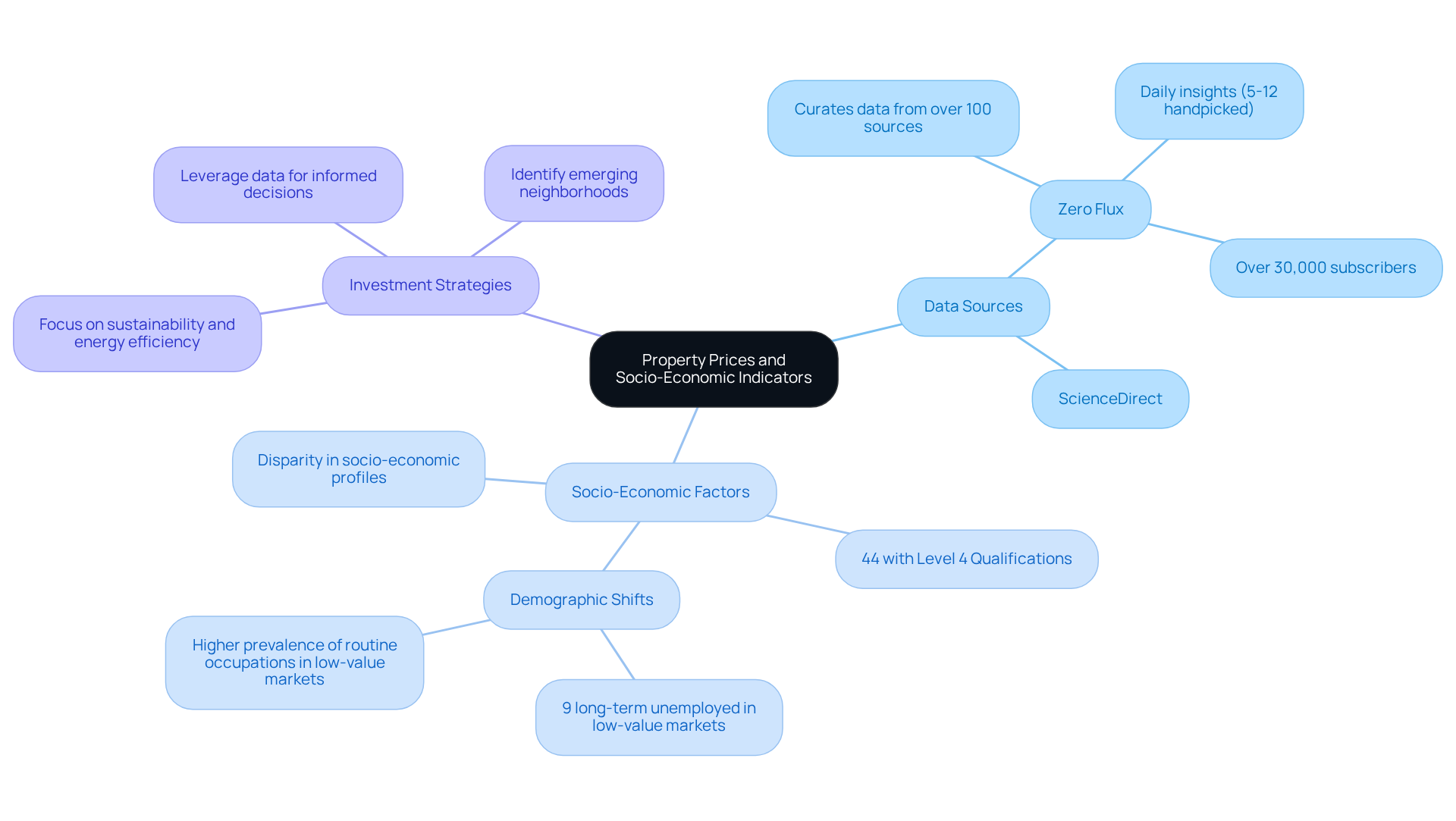

ScienceDirect serves as a vital archive of scholarly research focused on property prices and socio-economic factors, offering stakeholders essential insights using real estate data sources that influence property values. This extensive research encompasses a dataset featuring 43 variables from 4,201 transactions in England and Wales, spanning from 1995 to 2012, which can significantly inform investment strategies. By leveraging this data, investors can develop informed strategies that align with current trends and socio-economic conditions.

Recent studies indicate that 44% of residents in high-value areas possess level 4 qualifications. This statistic illustrates how demographic shifts and economic performance can impact investment outcomes. As the property market evolves, utilizing real estate data sources becomes indispensable for navigating complexities and optimizing returns. Positive feedback from Zero Flux subscribers emphasizes the clarity and precision of the information presented, reinforcing the value of credible real estate data sources like ScienceDirect for informed investing.

By integrating insights from both ScienceDirect and the Zero Flux newsletter, investors are strategically positioned to capitalize on emerging opportunities within the real estate landscape.

Conclusion

Informed investing in real estate fundamentally relies on access to reliable data sources that illuminate market trends and dynamics. This article underscores nine essential platforms, each offering unique insights that empower investors to make strategic decisions. From Zero Flux's daily updates to the comprehensive analytics provided by ScienceDirect, these resources collectively enhance the understanding of the real estate landscape, enabling stakeholders to navigate complexities with confidence.

Key insights discussed include:

- The pivotal role of the FHFA House Price Index in tracking housing market trends.

- The necessity of localized data from the Fraser Valley Real Estate Board.

- The transformative capabilities of big data solutions from MRI Software.

- The importance of occupancy data from Baskin.io.

- Economic surveys from the Philadelphia Federal Reserve emphasize how diverse data sources can inform investment strategies and optimize returns.

The significance of leveraging these data sources cannot be overstated, as they equip investors with the knowledge needed to seize opportunities and mitigate risks. By integrating insights from these platforms, stakeholders are better positioned to navigate the ever-evolving real estate market. Embracing these tools not only fosters informed decision-making but also sets the stage for long-term success in property investments.