Overview

The article emphasizes the critical role of essential real estate market analysis tools that investors can leverage for informed decision-making in the property market. It showcases a range of platforms, including:

- Zero Flux

- BiggerPockets

- Mashvisor

These platforms deliver valuable data and insights on market trends, property values, and investment strategies. These resources equip stakeholders with the necessary tools to navigate a complex and evolving real estate landscape effectively. By utilizing these platforms, investors can enhance their understanding of the market, ultimately leading to more strategic investment decisions.

Introduction

In the ever-evolving landscape of real estate investing, staying informed is paramount for success. As market dynamics shift and new data emerges, investors require reliable resources to navigate the complexities of property valuation, market trends, and investment strategies. This article delves into a selection of essential platforms and tools that empower real estate professionals with data-driven insights.

From Zero Flux's curated daily newsletter to Mashvisor's rental property analysis and Placer.ai's location-based analytics, these resources equip investors with the knowledge needed to make informed decisions in a competitive market. By leveraging these innovative tools, investors can enhance their strategies, recognize emerging opportunities, and ultimately thrive in a challenging economic environment.

Zero Flux: Daily Insights on Real Estate Market Trends

Zero Flux delivers a daily newsletter that curates 5-12 essential insights from over 100 diverse sources, including exclusive paywalled content. This resource is indispensable for real estate stakeholders aiming to navigate industry dynamics using real estate market analysis tools, without the clutter of subjective opinions. By focusing exclusively on data, Zero Flux empowers its 30,000+ subscribers with the knowledge necessary for making informed investment decisions through real estate market analysis tools.

Recent trends reveal a decline in home prices, with the MLS® Home Price Index indicating a 1.2% decrease month-over-month and a 3.6% drop year-over-year as of April 2025, reflecting a national average home price of $679,866. As Nadia Evangelou, Senior Economist and Director of Real Estate Research, emphasized at the 2025 Real Estate Forecast Summit, understanding these trends is crucial for stakeholders who rely on real estate market analysis tools. Such insights enable stakeholders to recognize the shifting environment, enhancing their negotiating power in a challenging market where real estate market analysis tools may give buyers greater influence. The newsletter's commitment to data integrity not only bolsters its credibility in property information distribution but also positions it as an essential resource for those seeking clarity in an ever-evolving industry, especially when using real estate market analysis tools.

BiggerPockets: Comprehensive Guides for Real Estate Market Analysis

BiggerPockets stands as a premier resource hub, offering an extensive array of articles, podcasts, and forums dedicated to real estate investing. This platform's comprehensive guides on real estate market analysis tools delve into critical aspects of market analysis, empowering individuals to understand property values, discern market trends, and formulate effective investment strategies.

For both novice and experienced investors, BiggerPockets serves as an invaluable tool to deepen their understanding and refine their investment approaches. By engaging with this wealth of information, users can significantly enhance their investment acumen and make informed decisions in the dynamic real estate landscape.

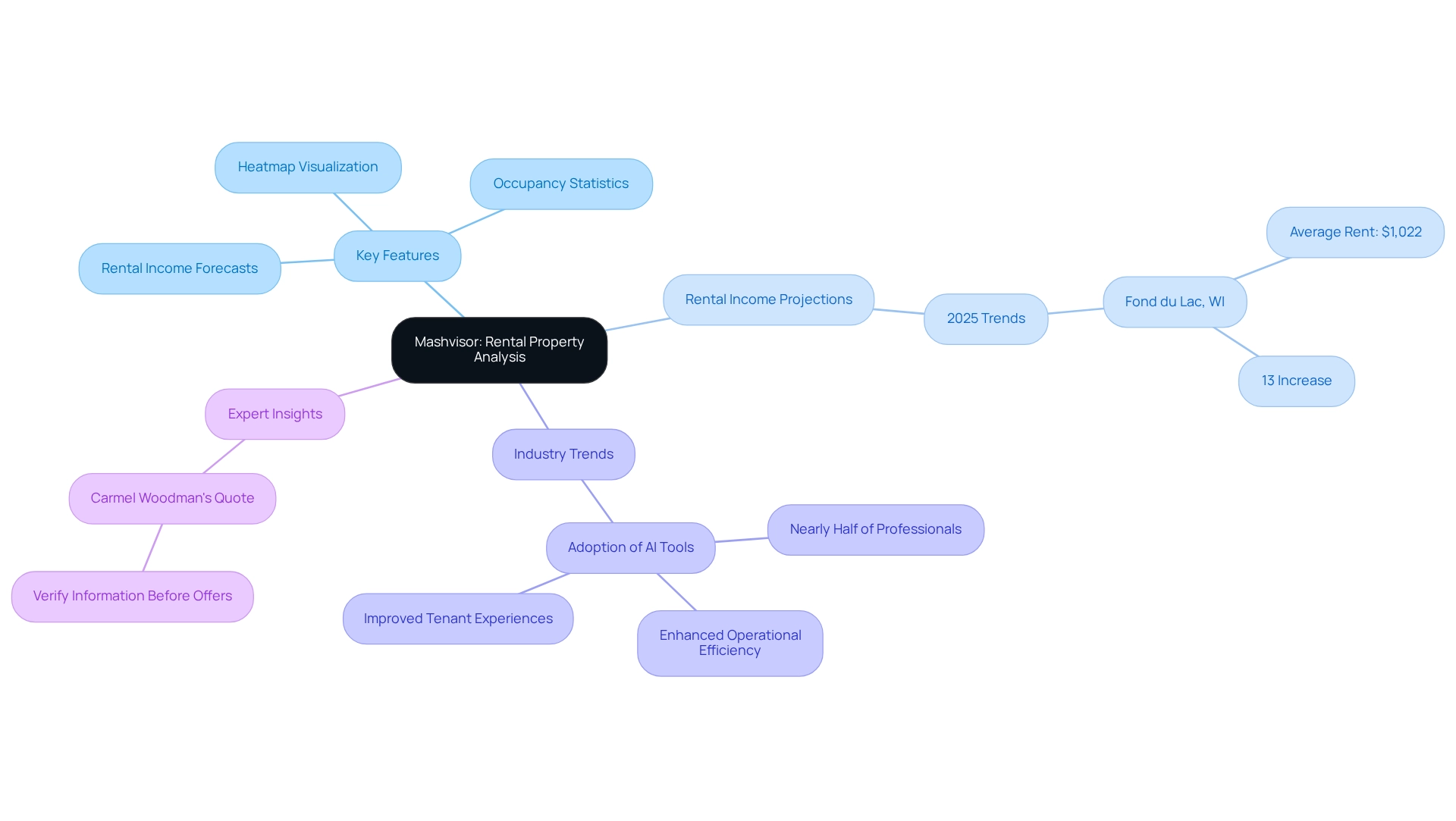

Mashvisor: Data-Driven Insights for Rental Property Analysis

Mashvisor stands out as a powerful option among real estate market analysis tools for individuals seeking to analyze rental properties effectively. This platform provides essential information, including rental income forecasts, occupancy statistics, and comprehensive neighborhood analyses, empowering stakeholders to make informed choices that align with their financial goals. Notably, Mashvisor's heatmap feature enables users to visualize high-performing neighborhoods, facilitating targeted investment strategies.

In 2025, rental income projections indicate a significant upward trend, with cities like Fond du Lac, WI, experiencing an average rent of $1,022—a notable 13% increase from previous years. Such statistics underscore the necessity for stakeholders to leverage real estate market analysis tools in their property assessments. Zero Flux emphasizes the importance of sifting through large quantities of information to highlight only the most pertinent trends, which is essential for effective decision-making in the property market.

Furthermore, case studies reveal that nearly half of property management professionals are planning to adopt AI tools, reflecting a broader industry shift towards technology-driven solutions. This integration not only enhances operational efficiency but also improves tenant experiences, reinforcing the value of data in real estate market analysis tools for analyzing rental properties.

Expert insights indicate that utilizing platforms such as Mashvisor can simplify the investment process, allowing individuals to concentrate on properties with the greatest potential returns. As Carmel Woodman, a former content manager, aptly noted, "While this data may be very useful, you should still verify the information before you make an offer on a property." As the property market evolves, the importance of data-informed decision-making becomes increasingly evident, making real estate market analysis tools like Mashvisor essential for knowledgeable stakeholders.

Placer.ai: Location-Based Analytics for Real Estate Investors

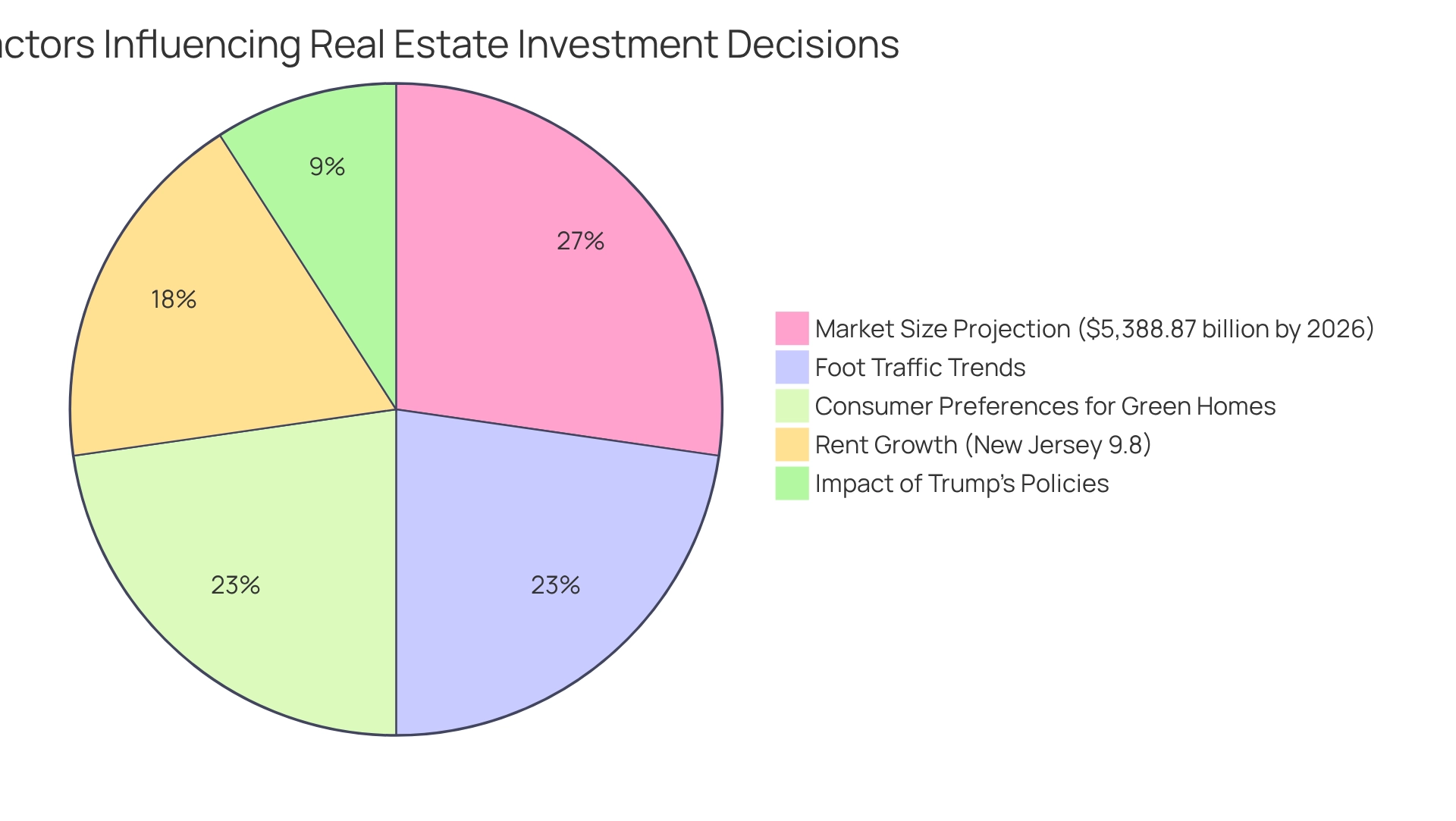

Placer.ai stands out in delivering location-based analytics that uncover foot traffic trends and demographic shifts, essential for real estate stakeholders who utilize real estate market analysis tools to pinpoint high-potential investment locations. By analyzing consumer habits and location patterns, buyers can make informed decisions regarding property acquisitions, thereby increasing their chances of capitalizing on emerging economic opportunities. As we approach 2025, comprehending foot traffic patterns will prove particularly crucial, given their direct impact on investment choices. For example, regions witnessing a surge in foot traffic often correlate with heightened demand for commercial properties, rendering them appealing for investment.

Notably, New Jersey has recorded the fastest industrial rent growth at 9.8% year-over-year, underscoring a specific opportunity for investors. Moreover, insights from Placer.ai, supported by real estate market analysis tools, have facilitated successful investments by identifying areas with promising growth trajectories, emphasizing the significance of data-driven strategies in navigating the complexities of the property sector. As buyers increasingly pursue homes that resonate with a greener lifestyle, understanding these evolving consumer preferences will be vital for investment decisions. Furthermore, the global property sector is projected to reach $5,388.87 billion by 2026, with a CAGR of 9.6%, highlighting the importance of real estate market analysis tools to leverage analytics and maintain an edge in market trends. The U.S. housing market recorded approximately 4.1 million home sales, showcasing resilience amid economic pressures, further reinforcing the argument for employing analytics to effectively navigate investment opportunities.

However, stakeholders must also acknowledge that 28.75% of Americans perceive Trump's policies as potentially challenging for the property market, which could influence their decision-making processes. As the landscape continues to evolve, harnessing such analytics will be crucial for individuals striving to stay ahead of trends and make strategic choices.

CoreLogic: Real Estate Data and Analytics Solutions

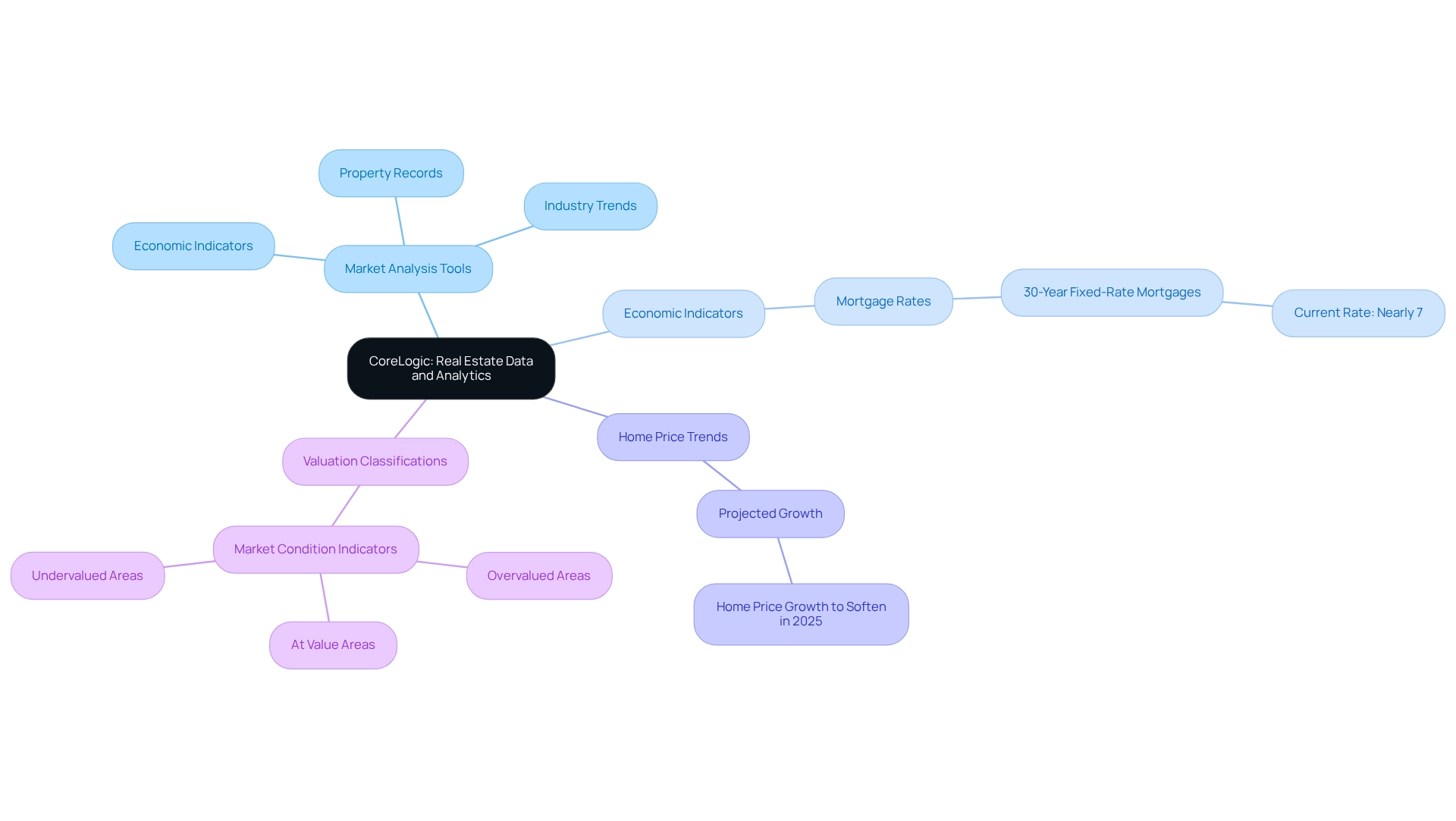

CoreLogic provides a comprehensive suite of real estate market analysis tools and analytics solutions tailored for real estate professionals. Their extensive database includes real estate market analysis tools that encompass property records, industry trends, and economic indicators, empowering stakeholders to conduct in-depth analyses. By leveraging CoreLogic's insights, stakeholders can accurately assess economic conditions, pinpoint potential risks, and make informed, data-driven decisions that significantly enhance their investment strategies.

As CoreLogic notes, "Home price growth is anticipated to ease in 2025," underscoring the importance of staying informed in a fluctuating market. Additionally, CoreLogic's Condition Indicators classify metropolitan areas as overvalued, at value, or undervalued based on long-term fundamental values, providing concrete examples of how these insights assist investors in understanding market dynamics.

This analytical approach is crucial, especially as the property landscape evolves, with current statistics indicating that 30-year fixed-rate mortgages have surged to nearly 7% at the start of 2025, the highest level since July 2024. Such insights are invaluable for navigating the complexities of the industry by utilizing real estate market analysis tools and optimizing investment outcomes.

Furthermore, Zero Flux serves as an essential resource for anyone involved in the property sector, enhancing the value of CoreLogic's services within the broader property landscape.

Call Porter: Market Analysis Tools for Real Estate Wholesalers

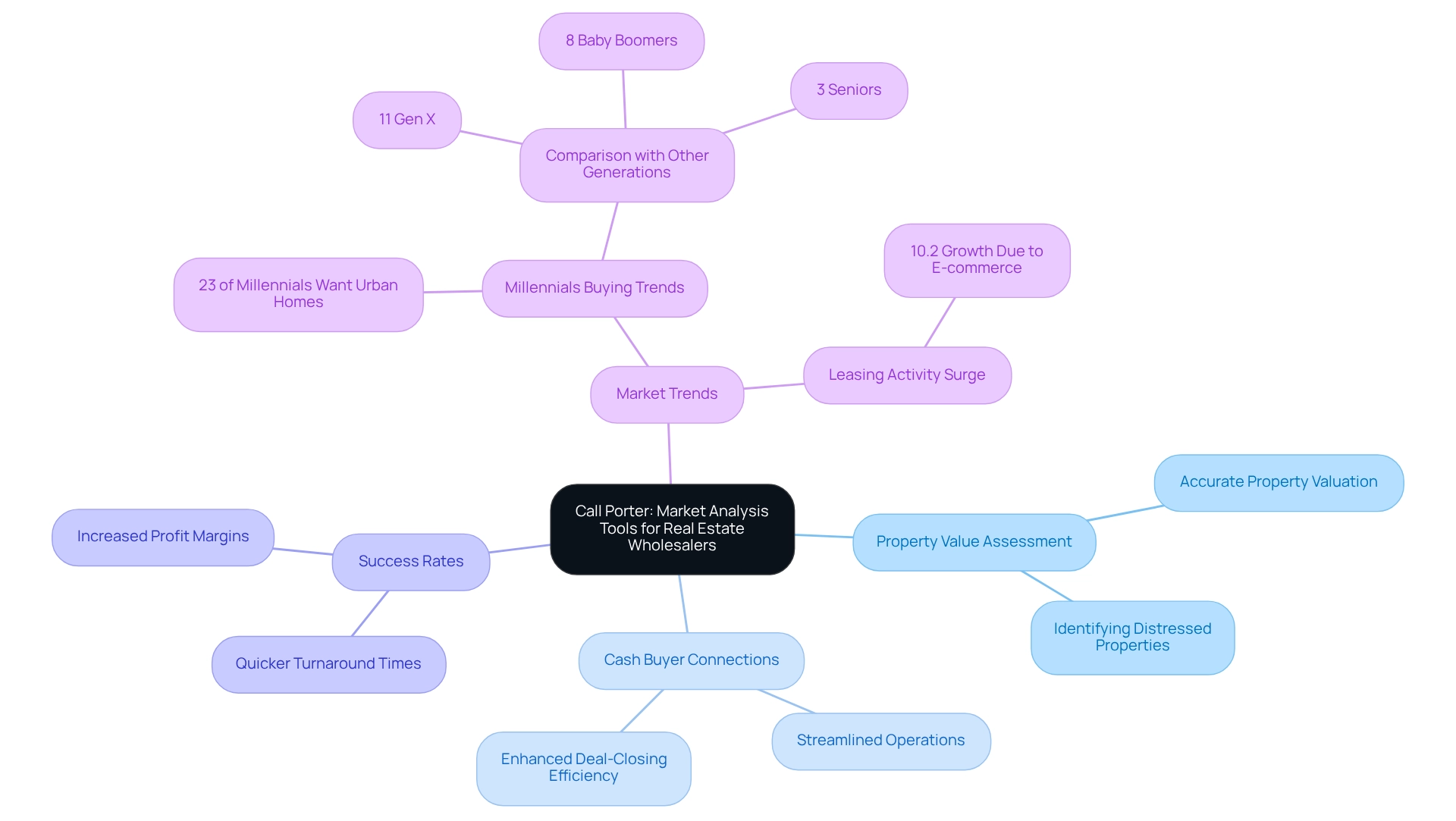

Call Porter offers specialized real estate market analysis tools designed for wholesalers, allowing investors to accurately assess property values and identify distressed properties. These tools foster connections with cash buyers, streamlining operations and enhancing deal-closing efficiency.

In 2025, wholesalers utilizing real estate market analysis tools have reported significant improvements in success rates, with many experiencing quicker turnaround times and increased profit margins. For instance, a case study from Warner Robins, Georgia, illustrates how a wholesaler leveraged Call Porter’s analysis to pinpoint a three-bedroom home listed at $85,000 in a high-yield rental zone. By sharing comprehensive insights with a list of cash buyers, the wholesaler secured a $9,500 profit without any renovations.

This underscores the essential role of effective commerce analysis in successful wholesaling strategies, highlighting the importance of real estate market analysis tools like Call Porter in navigating the complexities of the property sector.

Furthermore, it's noteworthy that 23% of millennials express a strong desire to purchase homes in urban hubs, a figure that surpasses those of Gen X, baby boomers, and seniors. Additionally, industrial property has witnessed a 10.2% surge in leasing activity attributed to e-commerce, reflecting current industry dynamics that wholesalers must consider. As buyers increasingly opt for smaller homes due to rising prices and tightening affordability, grasping these trends becomes crucial for wholesalers striving to thrive in today’s competitive landscape.

Freddie Mac: Economic Research for Housing Market Insights

Freddie Mac plays a pivotal role in conducting extensive economic research that illuminates housing sector trends, mortgage rates, and key economic indicators. Their reports serve as crucial real estate market analysis tools for individuals navigating the complexities of the real estate landscape. By examining Freddie Mac's conclusions, stakeholders can better foresee changes in the economy and adjust their investment approaches accordingly.

In 2025, Freddie Mac's housing sector economic research highlights significant trends, particularly the effect of fluctuating mortgage rates on property investments. Current statistics project that mortgage rates will average around 5.5% throughout the year, influencing buyer behavior and investment decisions. Comprehending these dynamics is essential for individuals looking to capitalize on emerging opportunities.

Moreover, Freddie Mac's insights into housing market trends underscore the importance of data integrity in real estate market analysis tools. Their rigorous research approach not only enhances the reliability of the information but also empowers individuals to make informed decisions based on factual data. As property developer Akira Mori aptly states, "In my experience, in the property business, past success stories are generally not applicable to new situations. We must continually reinvent ourselves, responding to changing times with innovative new business models." This perspective emphasizes the necessity for stakeholders to adjust their strategies based on Freddie Mac's research.

As the property sector continues to evolve, leveraging Freddie Mac's economic analysis can provide stakeholders with a competitive advantage. By staying informed about the latest mortgage rates and housing trends, individuals can strategically position themselves to maximize returns and minimize risks in a constantly changing environment. This long-term approach to property investment is vital for achieving sustained success.

Appraisal Institute: Resources for Market Analysis and Valuation

The Appraisal Institute offers an extensive collection of resources centered on analysis and property valuation, which serve as essential real estate market analysis tools for stakeholders. Their educational programs and publications are meticulously designed to equip professionals with the essential knowledge necessary for accurate property assessments. By leveraging these resources, individuals can refine their valuation techniques, a vital step for making informed investment decisions. Indeed, precise property assessment not only impacts investment strategies but also shapes overall economic dynamics.

For instance, consider the case study titled 'Impact of Service Nature on Valuation Standards.' This study illustrates how the nature of the service provided influences which valuation standards are pertinent, ensuring that stakeholders apply the appropriate methodologies for their specific needs. Furthermore, the Appraisal Institute's resources are indispensable for navigating the complexities of analysis, offering insights that are particularly relevant in today's evolving property landscape.

As of September 2023, the average residential property price in the United States stands at approximately $411,868, serving as a critical reference point for individuals assessing market trends and property values. Moreover, the utilization of real estate market analysis tools from the Appraisal Institute has seen a notable increase among property professionals, highlighting their importance in fostering precise property evaluations and informed investment decisions. These resources also play a pivotal role in the due diligence process during property acquisitions, assisting purchasers in scrutinizing financials and evaluating factors such as zoning and permitting.

Additionally, the Uniform Standards of Professional Appraisal Practice (USPAP) defines an 'Appraiser' as one who is expected to perform valuation services competently, emphasizing the necessity of expertise in valuation services.

HousingWire: Insights on Predictive Analytics in Real Estate

HousingWire highlights the transformative role of predictive analytics in real estate, equipping stakeholders with essential real estate market analysis tools to anticipate trends and uncover new opportunities. By leveraging these advanced analytics and real estate market analysis tools, stakeholders can make data-driven decisions that provide a competitive advantage in a rapidly evolving business landscape.

The integration of big data into property markets is not merely a trend; it is fundamentally altering how investment strategies are devised with the help of real estate market analysis tools. For instance, real estate market analysis tools can utilize predictive analytics to analyze historical data and identify patterns that signal future movements, enabling individuals to anticipate changes before they occur.

As Sires notes, stakeholders can 'model various risk factors to understand their influence on your supply chain and integrate information from diverse locations or sources into one model to obtain the most precise, pertinent view of your operation.' This proactive approach is crucial for harnessing economic dynamics and ensuring investment success in 2025 and beyond, particularly with the use of real estate market analysis tools.

A compelling case study titled 'Can Predictive Analytics Forecast Real Estate Market Trends?' demonstrates how real estate market analysis tools assist individuals in making informed decisions by providing insights into future market conditions. To begin leveraging predictive analytics, investors should consider incorporating multiple data sources into their analyses to refine their investment strategies.

Conclusion

In the competitive realm of real estate investing, leveraging the right tools and resources is essential for navigating market complexities. This article has explored several platforms that empower investors to make informed decisions, including:

- Zero Flux, which offers curated daily insights

- BiggerPockets, known for its comprehensive guides on market analysis

These resources equip both novice and seasoned investors with critical knowledge, enabling them to understand property values and market trends effectively.

Furthermore, tools like:

- Mashvisor, which provides data-driven insights for rental property analysis

- Placer.ai, known for its location-based analytics

These platforms underscore the importance of understanding emerging market opportunities and consumer behavior, allowing investors to capitalize on trends such as rising rental incomes and shifting demographics.

CoreLogic and Freddie Mac further enhance the investor's toolkit with robust data analytics and economic research, offering insights into mortgage rates and market conditions that are vital for strategic decision-making.

Ultimately, the integration of data-driven strategies and advanced analytics is crucial for real estate investors seeking to thrive in a dynamic environment. As market dynamics continue to evolve, utilizing these innovative tools will not only enhance investment strategies but also provide a competitive edge. By staying informed and adapting to changes, investors can navigate the complexities of the real estate market with confidence and foresight, positioning themselves for long-term success.