Overview

The article "9 Factors Behind Commercial Real Estate Prices Dropping" delves into the various reasons contributing to the decline in commercial real estate prices. It identifies critical factors such as:

- Rising interest rates

- Economic uncertainty

- Shifts in consumer behavior

- Oversupply of properties

- Geopolitical influences

These elements create a challenging environment for investors, leading to decreased demand and pricing in the sector. Understanding these dynamics is essential for making informed investment decisions.

Introduction

The commercial real estate landscape is experiencing a seismic shift, marked by a significant decline in prices driven by a confluence of factors. As the market contends with rising interest rates, economic uncertainty, and evolving consumer behaviors, investors are left questioning the stability and future viability of their investments. This article explores nine critical factors influencing the downturn in commercial real estate prices, providing insights that empower stakeholders to navigate this complex and rapidly changing environment.

What strategies can investors implement to mitigate risks and capitalize on opportunities amidst these challenges?

Zero Flux: Essential Insights on Commercial Real Estate Trends

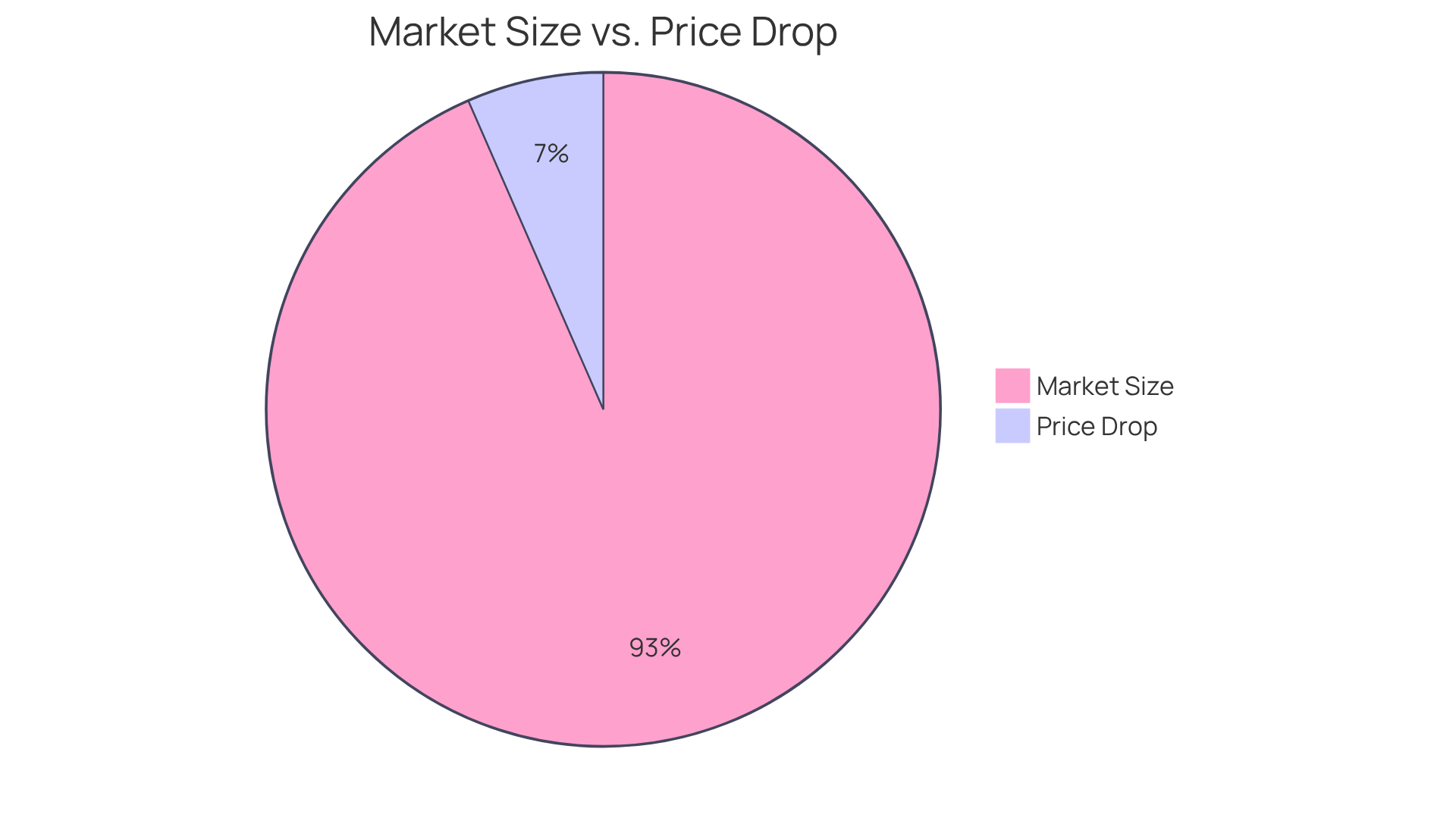

Zero Flux serves as a vital daily newsletter, summarizing key insights on commercial property trends. By meticulously aggregating data from over 100 reputable sources, including those behind paywalls, it offers subscribers a comprehensive overview of the latest industry developments. The commercial property market in the United States is projected to reach US$25.79 trillion by 2025, underscoring the importance of the insights provided by Zero Flux. Subscribers enjoy a succinct format that highlights key trends, making it an essential resource for industry professionals and investors navigating the complexities of the sector.

Despite facing challenges, such as commercial real estate prices dropping by 7% over the past year, Zero Flux remains steadfast in its commitment to factual reporting. This dedication has earned positive feedback from its community, emphasizing the clarity and effectiveness of the information presented. As a leading expert in the distribution of property information, Zero Flux ensures that its audience remains well-informed and prepared to make strategic decisions.

Rising Interest Rates: Driving Up Financing Costs

Rising interest rates have significantly escalated financing costs for commercial real estate transactions, with the 10-year Treasury rate reaching approximately 4.47% as of May 2025. This increase, exceeding 100 basis points from the lows of September 2024, has rendered borrowing considerably more expensive.

Consequently, potential investors are exercising greater caution, often pausing before committing to new ventures, which has led to a notable decrease in activity. In fact, transaction volumes plummeted nearly 70% in the first quarter of 2023 compared to the previous year.

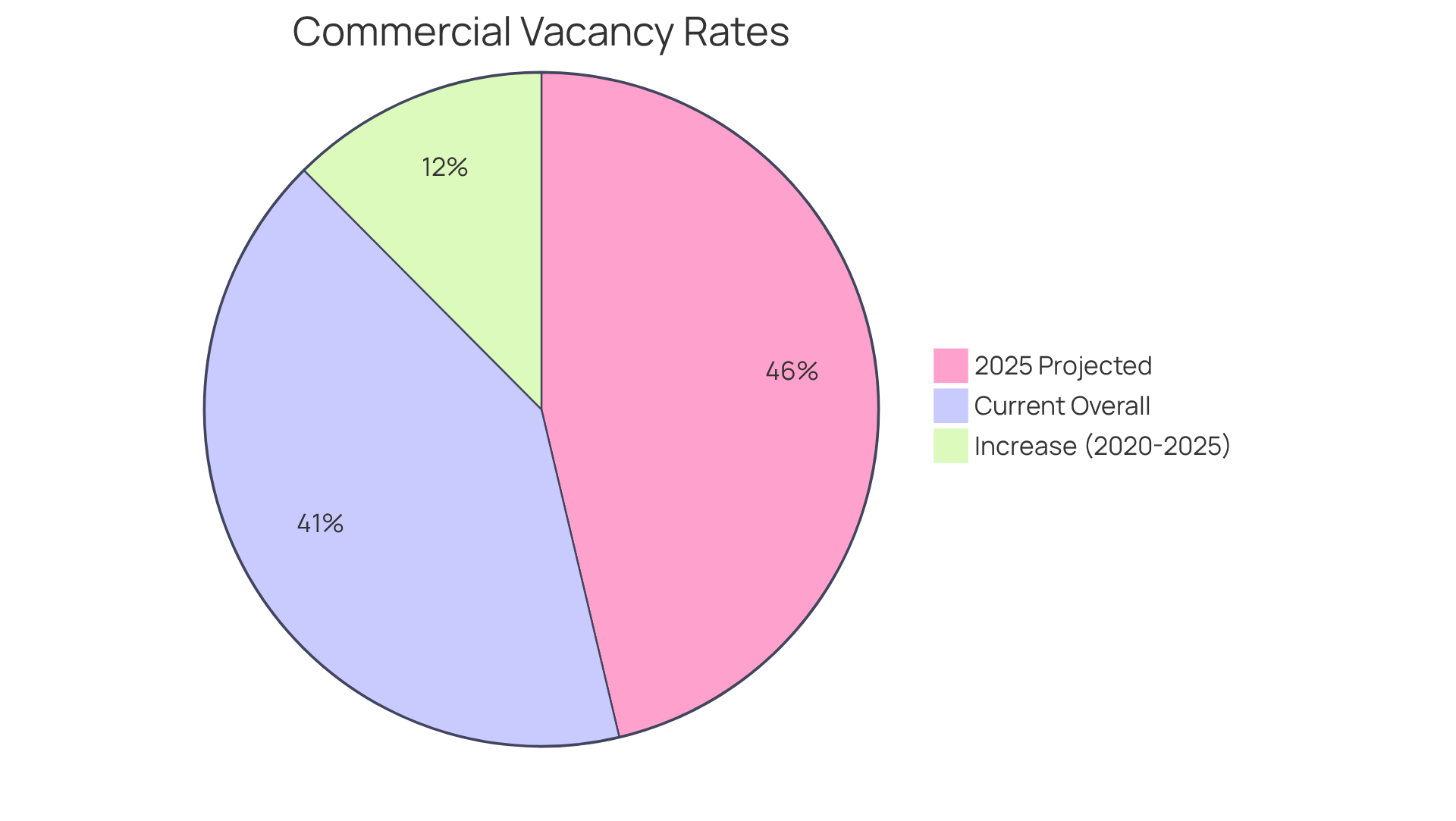

As a result, sellers are compelled to recalibrate their expectations to attract buyers who are contending with heightened capital costs. This recalibration frequently results in commercial real estate prices dropping, especially in the office sector, where vacancy rates are projected to reach 19.7% by the end of 2024.

Alarmingly, nearly three out of five webcast viewers anticipate increased levels of distress in the overall property sector within six months, underscoring the cautious sentiment prevalent among industry professionals.

The interplay between rising interest rates and financing expenses is a crucial consideration for anyone involved in commercial property investment, as it directly influences investment decisions and the overall market dynamics.

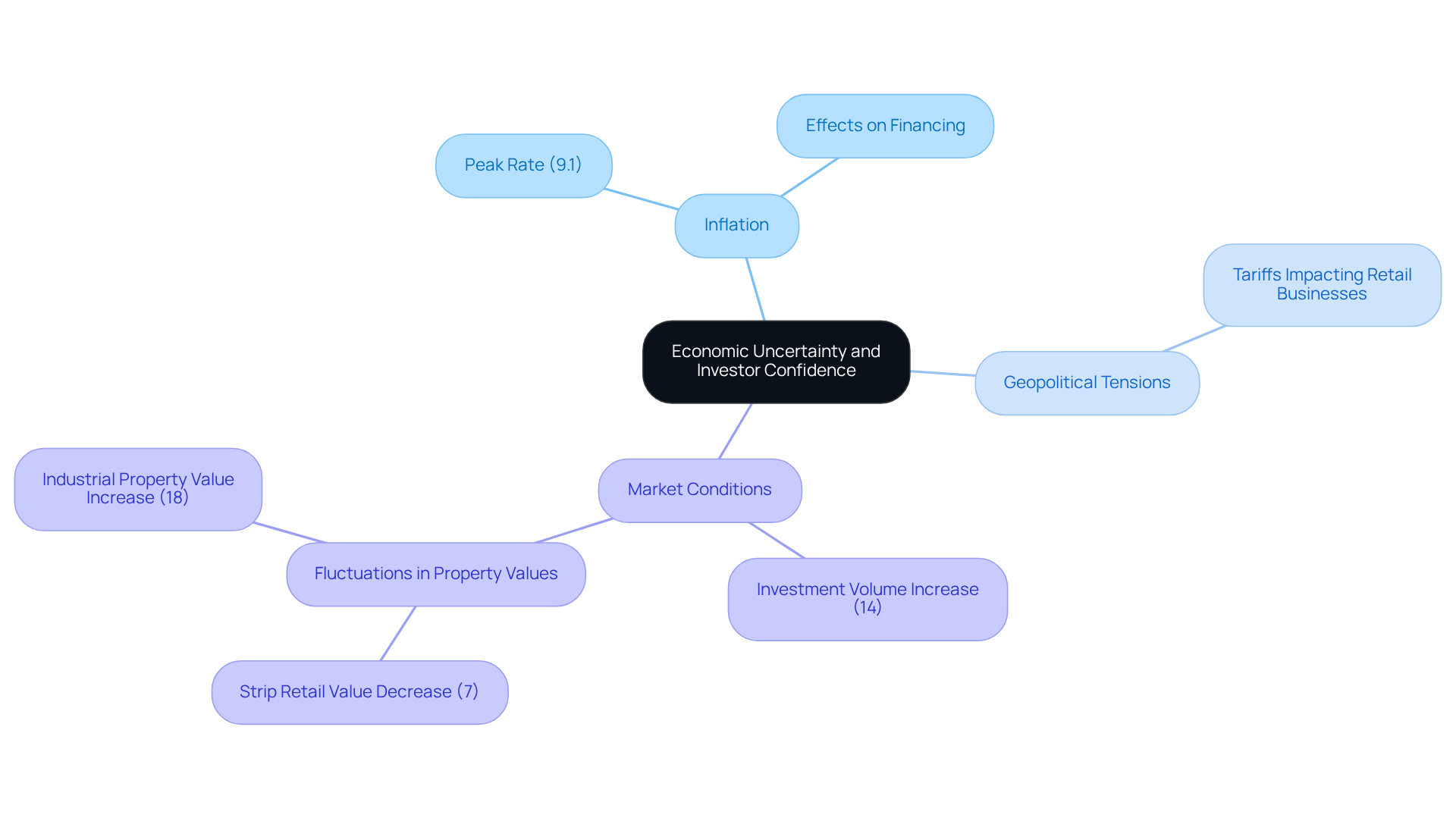

Economic Uncertainty: Eroding Investor Confidence

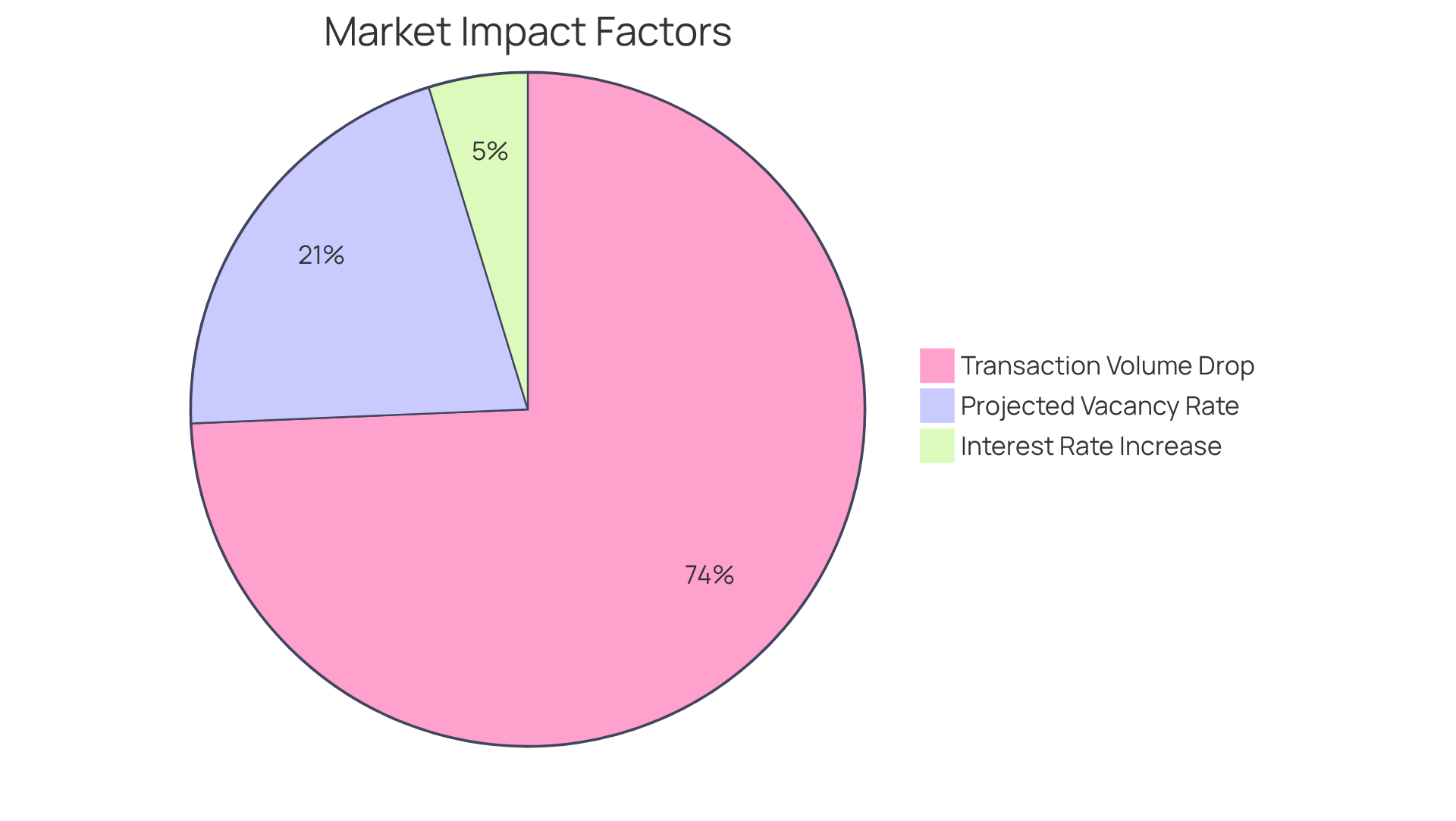

Economic instability significantly undermines investor confidence in the commercial property market. Factors such as inflation, geopolitical tensions, and fluctuating economic indicators foster a climate of hesitation among potential investors. For example, inflation reached a peak of 9.1% in 2022, prompting the Federal Reserve to increase interest rates multiple times. This shift has directly impacted financing conditions and property values. Consequently, commercial real estate investment volume experienced a 14% year-over-year increase in Q1 2025, reflecting a cautious sentiment among investors amid ongoing economic uncertainty.

Geopolitical tensions further heighten this uncertainty, resulting in volatility within market conditions. The implementation of extensive tariffs has escalated operational expenses for retail businesses, forcing companies to choose between absorbing these costs or passing them on to consumers. This dilemma may dampen demand for commercial real estate, which could result in commercial real estate prices dropping and subsequently contributing to price declines. Notably, values of strip retail assets have decreased by 7% in recent months, although they have risen by 15% over the past year, illustrating the mixed performance within the retail sector.

As investor confidence wanes, investment activity typically declines, leading to reduced demand for commercial real estate and commercial real estate prices dropping. For instance, while the industrial real estate sector has recently experienced a decrease in demand due to a slowdown in e-commerce activity, it is crucial to note that industrial real estate values have surged by 18% over the past year. Investors must navigate these uncertainties with caution to make informed decisions in this volatile environment, as the interplay of inflation and geopolitical factors continues to shape the commercial real estate landscape.

Shifts in Consumer Behavior: Redefining Demand for Commercial Spaces

Consumer behavior is undergoing a significant transformation, reshaping the demand for various types of commercial spaces. As online shopping gains traction, traditional retail environments face increasing challenges. In 2023, e-commerce sales accounted for 16.2% of total retail sales (source: external data), reflecting a shift towards digital transactions that necessitates a reevaluation of commercial property types. Retail spaces are now being redefined to accommodate mixed-use developments and flexible environments that align with evolving consumer preferences.

Retail analysts predict that the future of retail spaces will hinge on adaptability and the integration of technology. For instance, Nordstrom's recent digital strategy transformation resulted in a more than 30% month-to-month increase in customer engagement and foot traffic, showcasing the potential for traditional retailers to thrive by embracing digital enhancements.

Moreover, the demand for experiential retail is on the rise, as consumers seek unique shopping experiences. This trend is evident in the retail sector's ability to achieve 3.2% growth despite a 12% drop in foot traffic, demonstrating resilience and adaptability in response to shifting consumer behaviors, particularly in challenging economic conditions and restricted supply.

Statistics further underscore this shift: the number of online shoppers in the U.S. is projected to grow from 259 million in 2023 to nearly 302 million by 2026 (source: external data). This surge in online shopping prompts a reevaluation of retail space requirements, with a notable increase in demand for flexible spaces that can accommodate both in-person and online shopping experiences. Additionally, e-commerce is expected to account for 23% of retail sales by 2027, highlighting the ongoing shift in consumer purchasing behavior.

As the commercial property landscape evolves, investors and developers must remain attuned to these trends to capitalize on emerging opportunities. The integration of technology and a focus on mixed-use developments will be crucial in meeting the demands of a digitally-driven consumer base.

Oversupply of Properties: Increasing Vacancy Rates

The commercial real estate sector is currently grappling with an oversupply of listings, leading to rising vacancy rates across various regions. As new developments are finalized, the industry struggles to absorb this additional space, resulting in an overall uptick in vacancy levels. Notably, the office rental vacancy rate is anticipated to reach 21.2% in 2025, marking a 0.6% increase from the previous year. The oversupply, coupled with commercial real estate prices dropping, exerts downward pressure on rental rates, complicating efforts for property owners to sustain profitability.

Analysts highlight that the influx of new office buildings, particularly in prime business districts, has exacerbated this trend, with numerous spaces remaining unleased. Investors must proceed with caution in their acquisition strategies due to commercial real estate prices dropping, as the potential for extended vacancies in an oversupplied market could severely affect returns. The necessity for a strategic approach is underscored by the fact that leasing activity totaled 104.4 million square feet in the first half of 2025, slightly surpassing the seven-year average, yet economic uncertainties continue to temper growth expectations.

According to CBRE Econometric Advisors, the overall office vacancy rate is projected to conclude the year at 18.9%, indicating a complex landscape for investors. This scenario prompts a crucial question for stakeholders: how will you navigate these challenges to optimize your investment outcomes?

Remote Work Trends: Decreasing Demand for Office Spaces

The movement towards remote work has significantly transformed the commercial property landscape, leading to a notable decrease in the demand for conventional office spaces. As companies increasingly embrace flexible work arrangements, they are reassessing their office space requirements, which has resulted in rising vacancy rates across urban centers. For example, the U.S. office vacancy rate reached 19.4% in June 2025, reflecting a year-over-year increase driven by evolving work preferences.

Landlords are responding to this trend by reevaluating their leasing strategies and real estate offerings. Many are now offering shorter lease terms and flexible workspace solutions to attract tenants. This shift is evident in the growing popularity of co-working spaces, which have experienced a 30% increase in average lease size as businesses seek adaptable environments that cater to hybrid work models.

Investors must carefully consider the long-term implications of remote work on office space demand. The rise of alternative work environments and the movement of offices from urban to suburban locations underscore the need for a strategic approach to commercial property investments. As companies prioritize flexibility and employee well-being, the future of office environments is likely to involve a hybrid model that balances remote work with in-office collaboration. This evolving landscape presents both challenges, such as rising vacancy rates and increased competition for tenants, and opportunities, such as the potential to repurpose underutilized spaces and invest in flexible work solutions for owners and investors alike, especially with commercial real estate prices dropping.

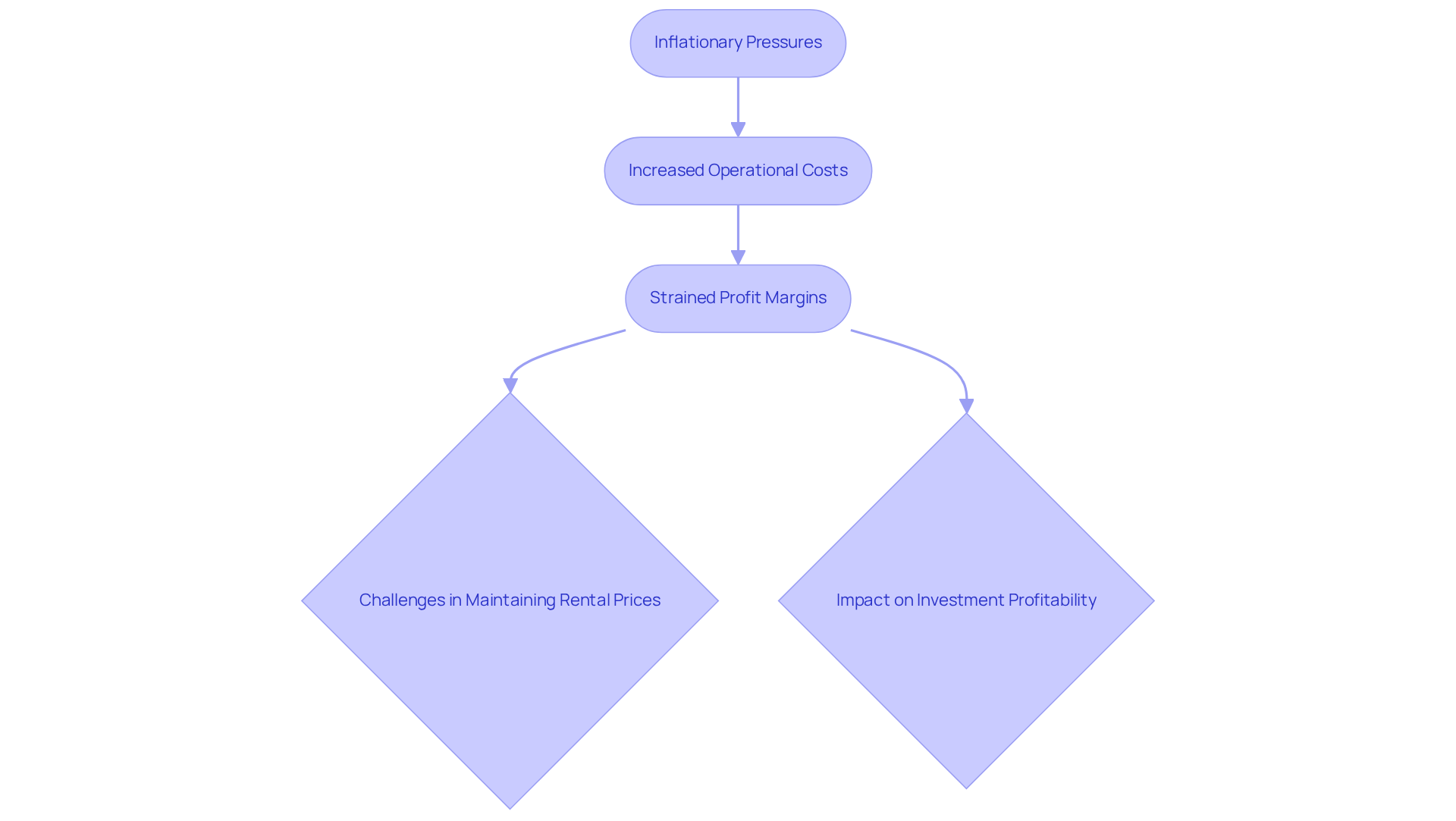

Inflationary Pressures: Rising Operational Costs

Inflationary pressures are significantly increasing operational expenses for commercial real estate assets, directly impacting investment profitability. As of 2025, operational costs have surged, with a typical 3% increase in inflation correlating directly to a 3% rise in operating expenses. This 1:1 relationship underscores the challenges real estate owners face in sustaining profitability amidst escalating utility, maintenance, and labor expenses. While utility companies are offering rebates to help mitigate initial costs for energy efficiency projects, these expenses continue to strain profit margins overall.

As costs rise, landlords may struggle to maintain rental prices, especially with commercial real estate prices dropping, potentially harming their profits. In high-demand markets, asking rents can increase faster than inflation; however, this trend is not universally applicable. Properties with longer lease terms may find it particularly challenging to adjust rents in response to rising costs, especially since these leases often include pre-negotiated annual rent increases, limiting opportunities to enhance net operating income (NOI).

Case studies illustrate these dynamics: one analysis highlights that inflation can hinder new construction, resulting in a limited supply of inventory, which subsequently increases the value of existing assets. Furthermore, properties with shorter lease terms, such as hospitality and multifamily units, tend to exhibit greater resilience to inflation, allowing quicker adjustments in rental rates.

Investors must remain vigilant and consider these inflationary trends when evaluating the viability of their commercial property investments. The ability to adapt to rising operational costs will be crucial for protecting cash flows and ensuring long-term profitability.

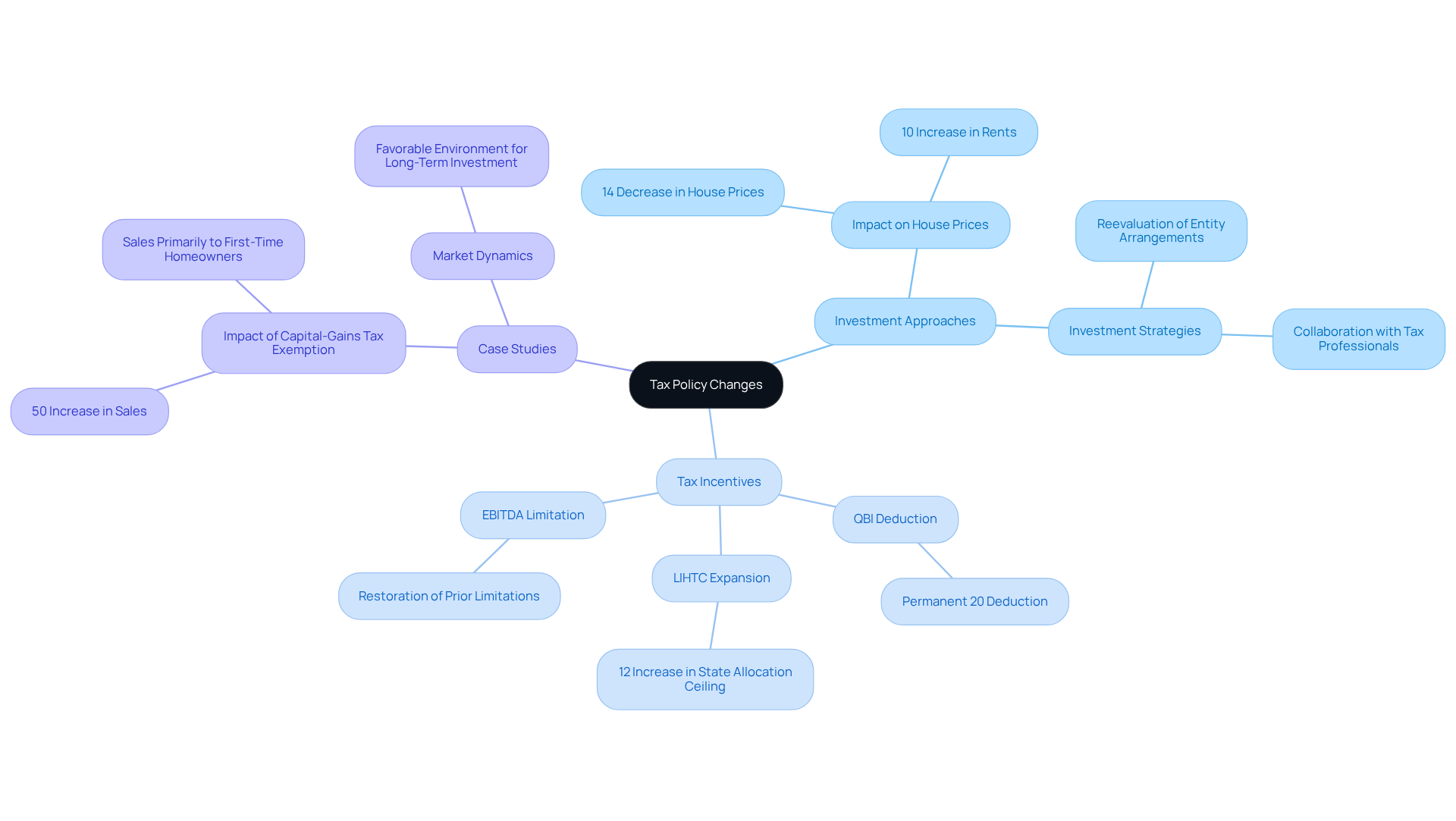

Tax Policy Changes: Influencing Investment Decisions

Recent modifications to tax policies are transforming investment approaches within the commercial property sector. Changes in tax incentives, deductions, and capital gains taxes significantly influence the financial landscape for investors. For instance, a one percentage-point rise in investor sales has been shown to result in a 14% drop in house prices and a 10% rise in rents on new leases. This emphasizes the sector's responsiveness to investor actions and the necessity for strategic planning in changing conditions.

Tax incentives play a pivotal role in guiding property decisions. The One Big Beautiful Bill Act (OBBBA) has made the Qualified Business Income (QBI) deduction permanent, allowing eligible taxpayers to deduct up to 20% of their qualified business income. This enhancement can improve cash flow for investors. Additionally, the expansion of the Low-Income Housing Tax Credit (LIHTC) by 12% is expected to spur investment in affordable housing projects, creating new opportunities in the market. The restoration of the EBITDA limitation under the OBBBA further emphasizes the importance of tax efficiency in investment strategies.

Tax professionals stress the importance of understanding these evolving policies. They recommend that investors reevaluate their entity arrangements to enhance tax situations, particularly considering the proposed rise in the inheritance and gift tax exemption to an inflation-adjusted $15 million beginning in 2026. Moreover, collaboration between tax, finance, and project teams is essential for navigating these changes effectively.

Case studies illustrate the tangible effects of tax policy on investment behavior. For instance, a study on property investors in Israel revealed a 50% increase in sales following a capital-gains tax exemption, primarily involving rental units sold to first-time homeowners. This demonstrates how favorable tax conditions can stimulate economic activity and influence pricing dynamics—a trend that could be reflected in the U.S. environment under similar circumstances, particularly with commercial real estate prices dropping.

In summary, remaining knowledgeable about tax policy changes is essential for stakeholders in the commercial real estate sector. By understanding how these incentives influence investment decisions, investors can better position themselves to optimize returns and navigate the complexities of the evolving landscape. Investors are encouraged to regularly consult with tax professionals and adjust their strategies accordingly to leverage these changes effectively.

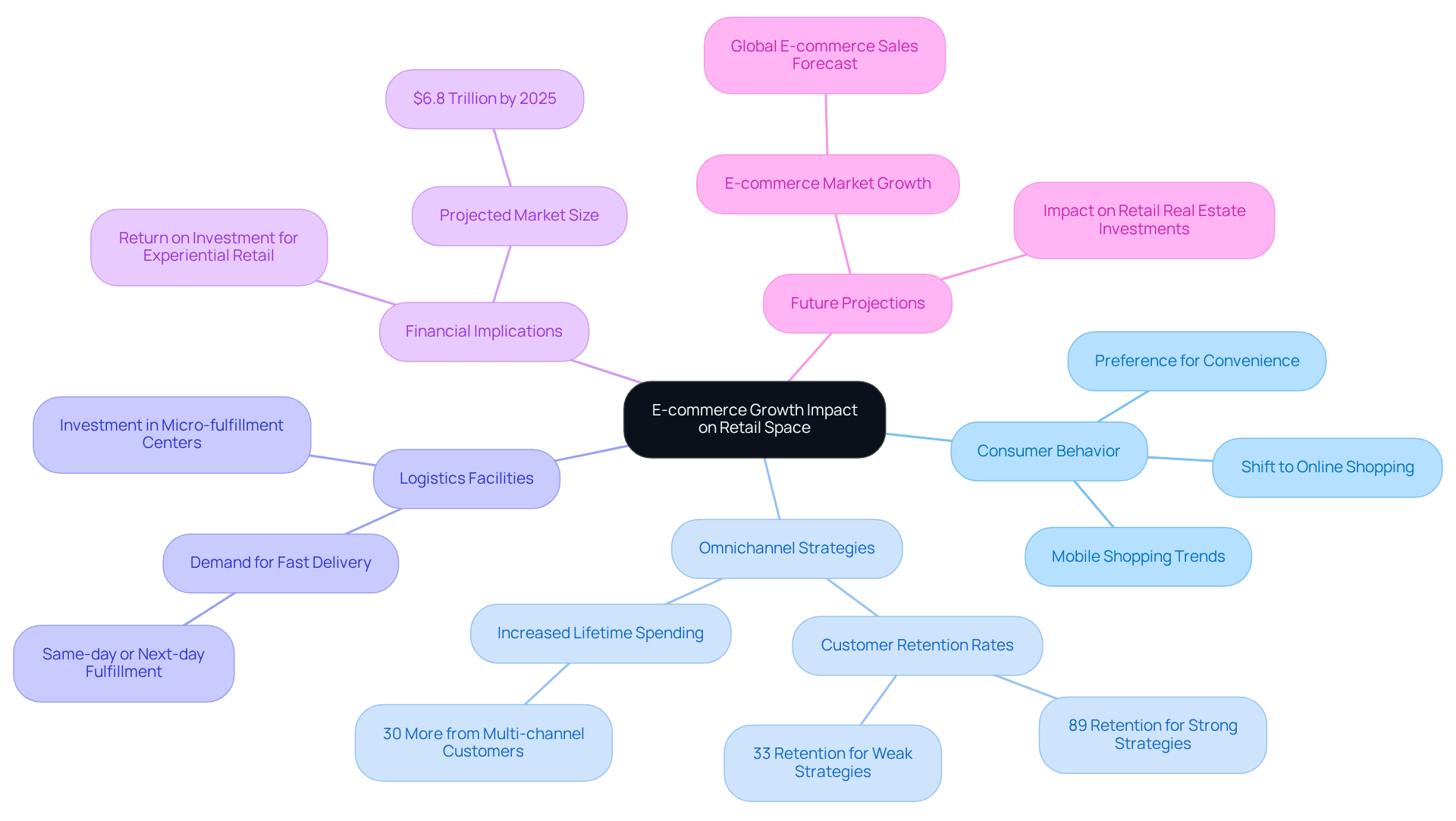

E-commerce Growth: Impacting Retail Space Viability

The rapid expansion of e-commerce is fundamentally reshaping the landscape of traditional retail spaces. As a significant portion of consumers now favor online shopping, brick-and-mortar stores face mounting challenges in attracting foot traffic and maintaining sales. This shift necessitates a critical reassessment of retail space utilization, leading to a heightened focus on experiential retail and logistics facilities that cater to e-commerce demands.

For instance, businesses that adopt omnichannel strategies—integrating both online and physical shopping experiences—have witnessed customer retention rates soar to 89%. Moreover, multi-channel customers tend to spend 30% more over their lifetime, underscoring the financial benefits of a seamless shopping journey.

Furthermore, the rise of logistics facilities is essential for supporting the swift delivery expectations of online shoppers. As convenience becomes a priority for buyers, the demand for same-day or next-day delivery is transforming retail real estate investments. The expectation for faster deliveries is reshaping e-commerce logistics, with same-day or next-day fulfillment becoming the norm.

Investors must remain vigilant to these trends, recognizing that assets designed for experiential engagement and efficient logistics are likely to yield better returns in this evolving landscape. The global e-commerce market is projected to reach $6.8 trillion by 2025, emphasizing the significance of these trends. Consequently, the future of retail real estate investments hinges on adapting to these transformative shifts, ensuring that investments align with the changing preferences of consumers.

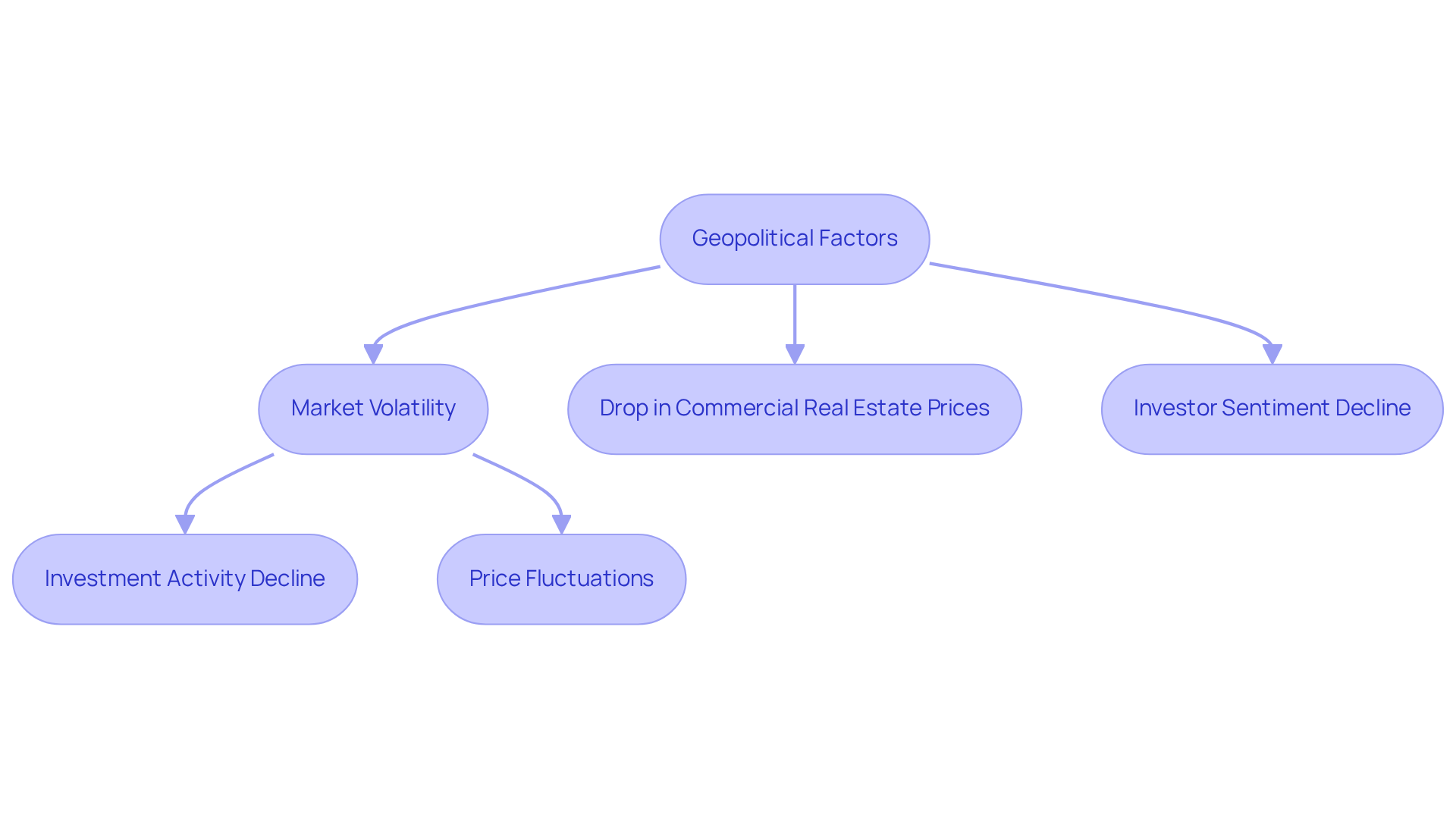

Geopolitical Factors: Creating Market Volatility

Geopolitical influences serve as a significant source of instability within the commercial real estate sector, contributing to commercial real estate prices dropping and profoundly affecting asset values and investor sentiment. Recent statistics reveal a direct correlation between fluctuations in real estate values and geopolitical events. Notably, investment activity has seen a marked decline during periods of heightened political instability, coinciding with commercial real estate prices dropping. For example, the global demand for real estate investment plummeted by 36% year-over-year in 2023, primarily due to uncertainties arising from trade disputes and international conflicts, which contributed to commercial real estate prices dropping, marking the weakest year since 2012.

Market analysts emphasize the importance of understanding these risks, as they can lead to unpredictable shifts in asset values. A case study examining the impact of the war in Ukraine exemplifies how geopolitical tensions can trigger immediate market reactions. In affected regions, there has been a significant decline, with commercial real estate prices dropping by as much as 20%, while demand has surged in more stable areas, such as neighboring countries that provide safer investment climates. Investors are urged to remain vigilant and adaptable, closely monitoring geopolitical developments that may influence their investment strategies.

Moreover, ongoing concerns regarding a potential US economic slowdown, coupled with international conflicts, have prompted a cautious stance among investors due to commercial real estate prices dropping. As political instability persists, the ability to navigate these complexities becomes essential for success, especially with commercial real estate prices dropping. By staying informed and adjusting strategies accordingly, investors can better position themselves to seize opportunities that arise amidst volatility, such as investing in sectors aligned with emerging trends in sustainability and technology.

Conclusion

The current landscape of commercial real estate is characterized by a marked decline in prices, influenced by a multitude of factors that warrant careful consideration from investors and stakeholders. As rising interest rates, economic uncertainty, and shifts in consumer behavior converge, the market dynamics are evolving, necessitating a strategic investment approach.

Key arguments highlight the significant impact of rising financing costs, which have prompted potential investors to adopt a more cautious stance, leading to reduced transaction volumes. Furthermore, ongoing economic instability and geopolitical tensions have further eroded investor confidence, contributing to a notable drop in demand for commercial properties. The oversupply of listings, coupled with the growing trend of remote work, has compounded these challenges, resulting in increased vacancy rates and a reevaluation of space requirements.

In light of these developments, it is essential for investors to remain vigilant and adaptable. Understanding the interplay of these factors is crucial for navigating the complexities of the commercial real estate market. By staying informed about trends such as the rise of e-commerce and the importance of flexible workspaces, stakeholders can position themselves to capitalize on emerging opportunities. Embracing innovation and strategic planning will be key to thriving in this shifting landscape, ensuring that investments align with the evolving needs of consumers and the broader economic environment.