Overview

In 2025, the key benefits of Detached Accessory Dwelling Units (DADUs) for real estate investors are particularly compelling. These units offer enhanced rental income potential, increased property value, and a strategic response to the growing demand for affordable housing. Notably, DADUs can command rental rates that significantly exceed those of traditional properties, while also appreciating property values by 10-20%. This makes them an attractive investment choice, especially as they help address critical housing shortages amid evolving market dynamics.

Investors should consider the implications of these insights. The ability to generate substantial rental income, coupled with the potential for property value appreciation, positions DADUs as a formidable option in the current real estate landscape. As the demand for affordable housing continues to rise, investing in DADUs not only aligns with market trends but also fulfills a pressing societal need.

In conclusion, the strategic advantages of DADUs cannot be overstated. By leveraging the insights shared, investors can make informed decisions that capitalize on the lucrative opportunities presented by this growing segment of the real estate market.

Introduction

As the real estate landscape evolves, Detached Accessory Dwelling Units (DADUs) have emerged as a pivotal investment opportunity for savvy investors. Urban density is on the rise, and zoning laws increasingly favor DADU development, making the potential for generating rental income and enhancing property values more promising than ever.

In 2025, the demand for these versatile units is expected to soar, driven by a pressing need for affordable housing solutions and creative living arrangements. This article delves into the key trends shaping the DADU market, exploring how investors can capitalize on this growing phenomenon while addressing critical housing shortages and fostering community impact.

From boosting cash flow to embracing sustainable practices, the insights provided will equip investors with the knowledge needed to navigate this dynamic sector effectively.

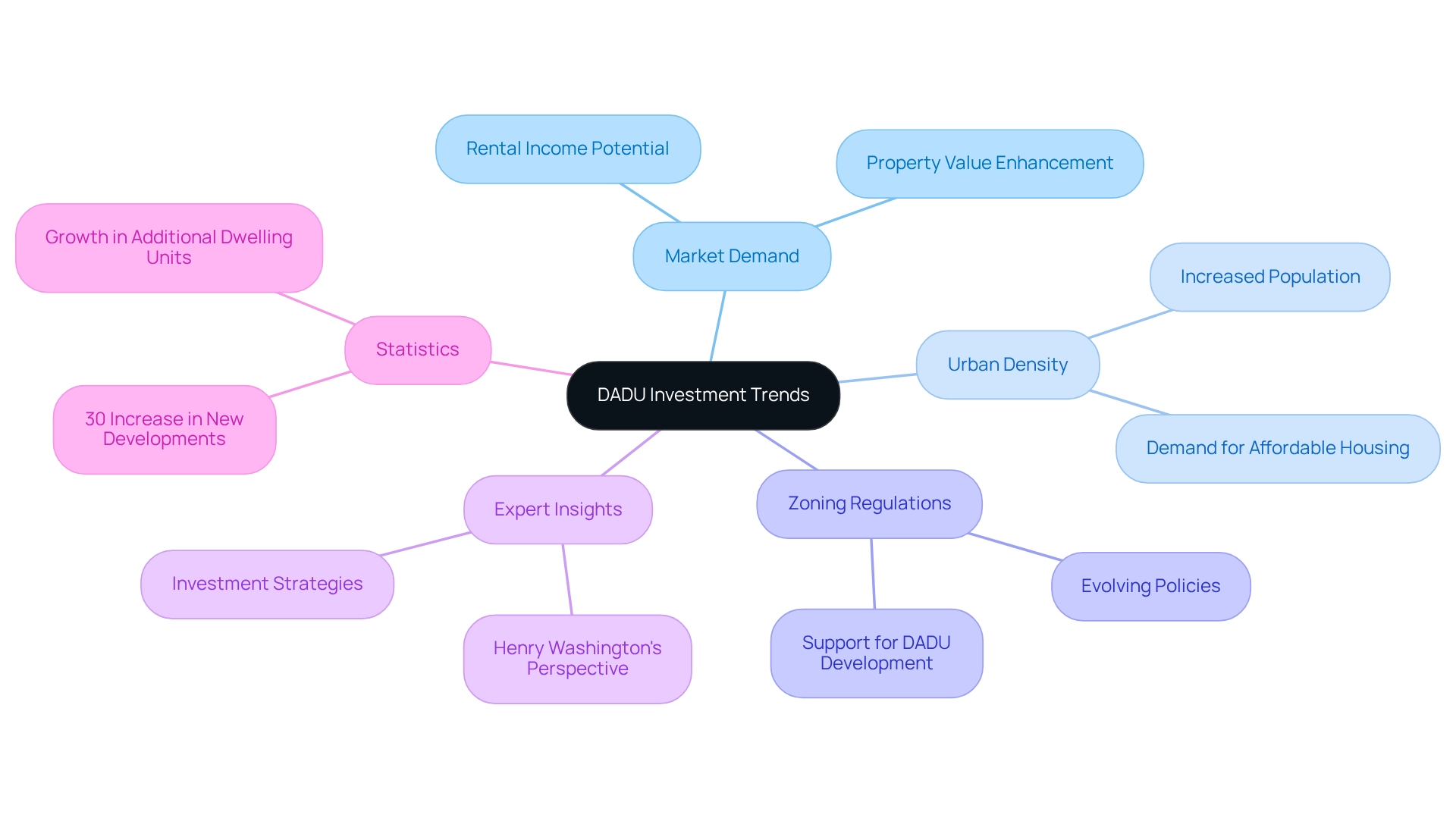

Zero Flux: Essential Insights on DADU Investment Trends

In 2025, the demand for DADUs in dadu real estate is witnessing remarkable growth as individuals increasingly recognize their potential for generating rental income and enhancing property value. Current trends reveal a surge in urban density alongside evolving zoning regulations that bolster accessory dwelling unit development. These factors create an inviting atmosphere for investment, making it imperative for stakeholders to remain attuned to these dynamics to seize emerging opportunities in the dadu real estate market.

Expert opinions highlight the necessity of adapting to these changes. For instance, Henry Washington noted, "If this represents some indication of additional activity in the market, that could assist in revitalizing growth," emphasizing strategies for investing in high-cost markets and underscoring the potential for substantial equity increases through such investments. The capacity to pool small amounts of capital into larger ventures is transforming property financing and management, enabling a broader range of investors to engage in this lucrative sector.

Statistics from 2025 reveal a notable increase in additional dwelling unit projects, with a reported 30% rise in new developments compared to the previous year, propelled by urban density and an escalating demand for affordable housing solutions. Case studies, such as 'Navigating the 2025 Housing Market,' illustrate successful accessory dwelling unit projects thriving in densely populated areas, demonstrating how strategic investments can yield impressive returns. As the market continues to evolve, grasping these trends will be crucial for dadu real estate investors aiming to capitalize on the DADU opportunity.

Rental Income Potential: Boost Your Cash Flow with DADUs

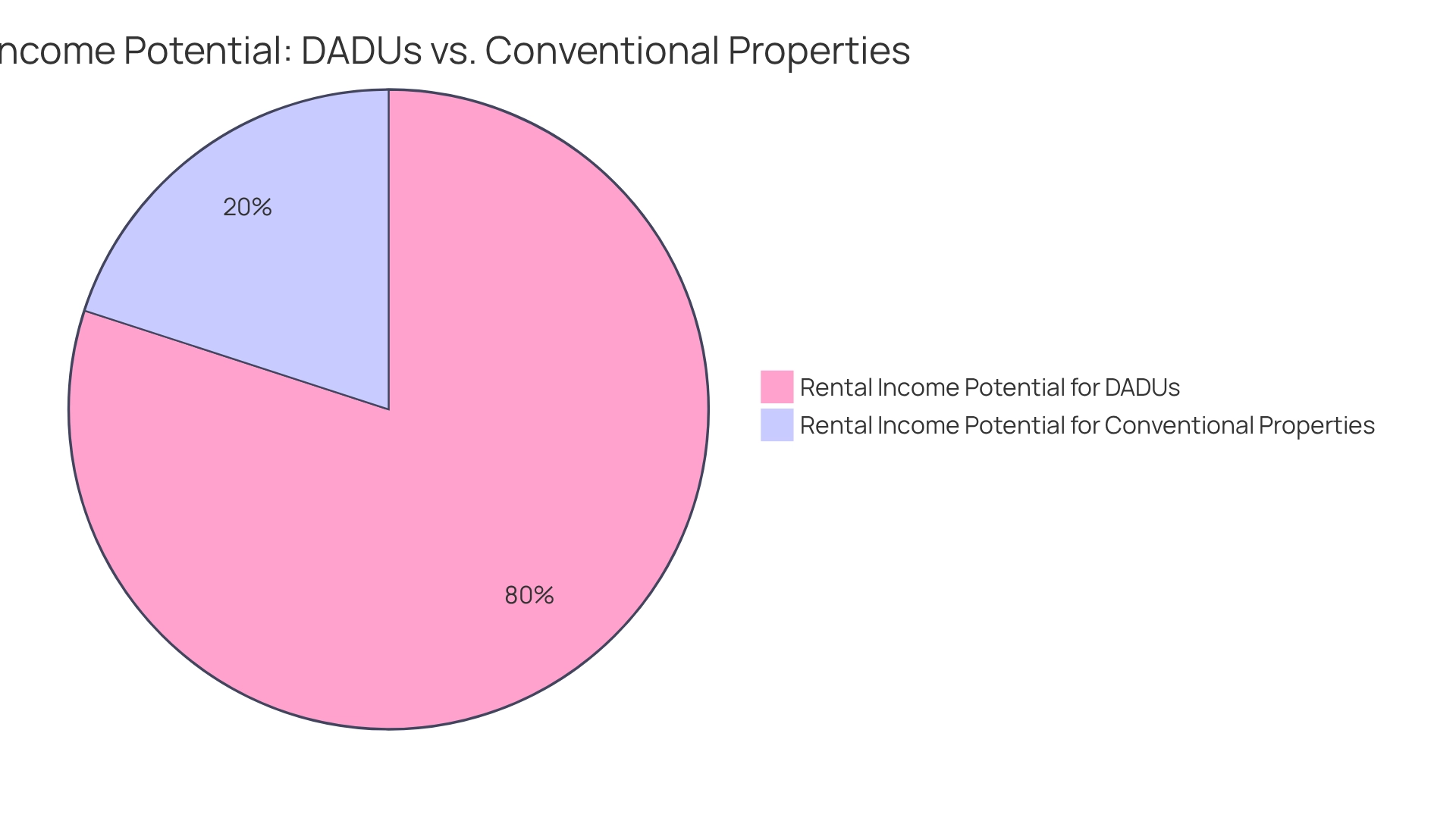

Accessory dwelling units present a compelling opportunity for rental income in the dadu real estate market, often outperforming conventional rental properties in terms of returns. Investors can anticipate charging premium rents in dadu real estate, attributed to the privacy and autonomy these units offer. In urban markets, accessory dwelling units can achieve rental rates that are 20-30% higher than similar apartments, significantly enhancing cash flow potential in dadu real estate.

Real estate analysts project that the rental yields for accessory dwelling units will continue to rise in 2025, driven by increasing demand for flexible living spaces. A recent case study from Seattle illustrates that homeowners can sell a Detached Accessory Dwelling Unit (DADU) separately from the main property, contingent on local zoning regulations. This flexibility not only increases property value but also enhances rental income prospects, making secondary dwelling units an appealing choice for dadu real estate investors.

Moreover, properties in dadu real estate featuring secondary dwelling units have been shown to sell for 10-15% more than similar homes without them, as noted by real estate appraiser Mark Ellison. This further underscores their financial viability. As the market evolves, dadu real estate units are poised to become a cornerstone of investment strategies, providing robust rental income potential and appealing cash flow advantages.

Versatile Usage: Maximize Space and Functionality with DADUs

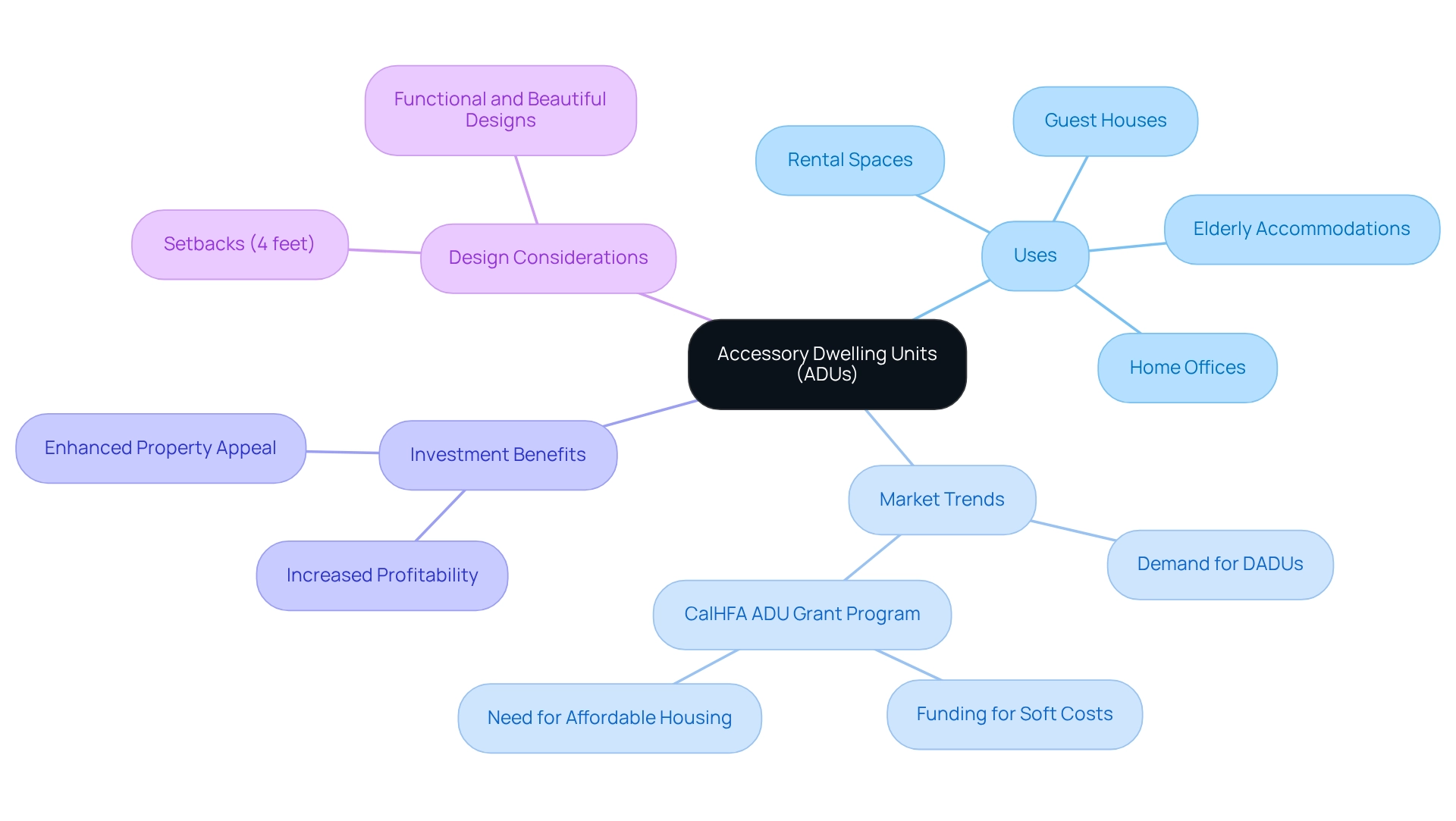

Accessory dwelling units (ADUs) offer remarkable versatility, functioning as rental spaces, guest houses, home offices, or accommodations for elderly family members. This flexibility empowers stakeholders to tailor their ADUs to meet current market demands, addressing both short-term rental opportunities and long-term family needs. By optimizing the functionality of these units, stakeholders can significantly enhance their property's appeal and profitability.

In 2025, the demand for dadu real estate, particularly detached accessory dwelling units (DADUs), is especially strong, as many investors recognize their potential for generating income through short-term rentals. The CalHFA ADU Grant Program exemplifies this trend, highlighting the growing interest in ADUs as a viable solution for affordable housing. Although the program is currently out of funds, its success underscores the necessity for continued support in ADU construction, indicating a promising future for dadu real estate investments.

Furthermore, side and rear setbacks for ADUs are typically set at 4 feet unless local laws dictate otherwise, which is a critical consideration for investors during the planning and construction phases. As Modern ADU Plans states, 'For homeowners seeking a strategic and forward-thinking approach to property ownership, the addition of an ADU is more than an acronym; it's an investment in a dynamic and sustainable future.'

As the market continues to evolve, the strategic use of alternative dwelling units will remain a key factor in maximizing space and enhancing property value.

Property Value Appreciation: Enhance Your Investment with DADUs

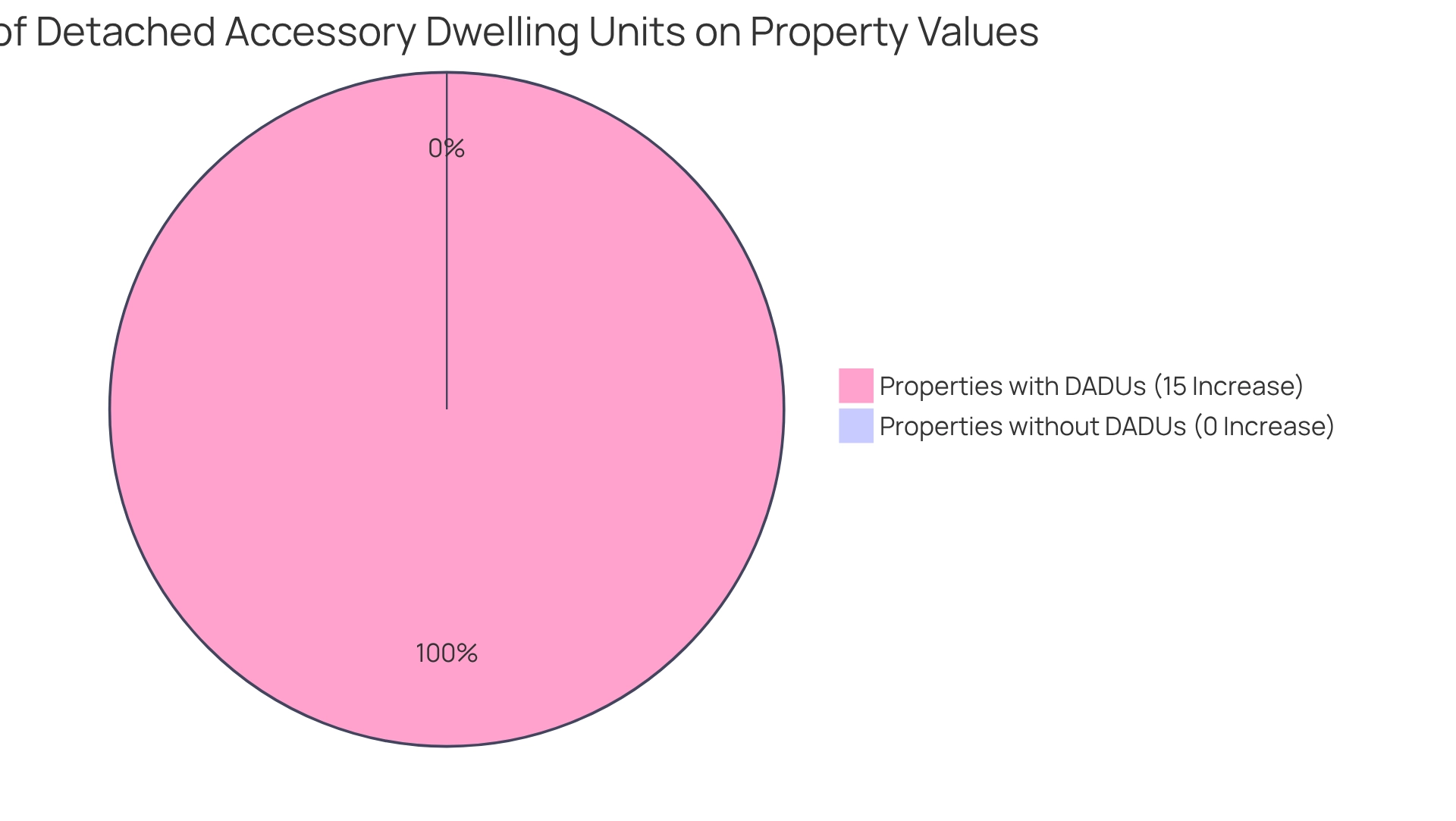

Investing in Detached Accessory Dwelling Units can significantly enhance property values. Research indicates that homes with accessory dwelling units can command selling prices that are 10-20% higher than similar properties without these units. This increase in value is largely attributed to the additional living space and the rising demand for versatile housing solutions. As more purchasers seek properties that offer flexibility, accessory dwelling units are increasingly recognized not merely as income-producing assets but as strategic improvements that elevate overall property value.

Looking ahead to 2025, the trend of property value appreciation associated with accessory dwelling units is expected to persist. U.S. home values typically rise around 4% annually during stable periods, reinforcing the potential for these units to contribute positively to property investments. Jon Wade, a real estate expert, emphasizes, "This isn’t just a niche preference anymore—it’s becoming a mainstream expectation as people look for homes that align with a greener lifestyle." This perspective underscores the growing importance of decentralized autonomous digital units in today’s market.

Moreover, understanding local market conditions is crucial for making informed real estate choices, as these factors can significantly influence the value of properties equipped with accessory dwelling units. By staying informed and adapting to these trends, investors can strategically position themselves to maximize their returns.

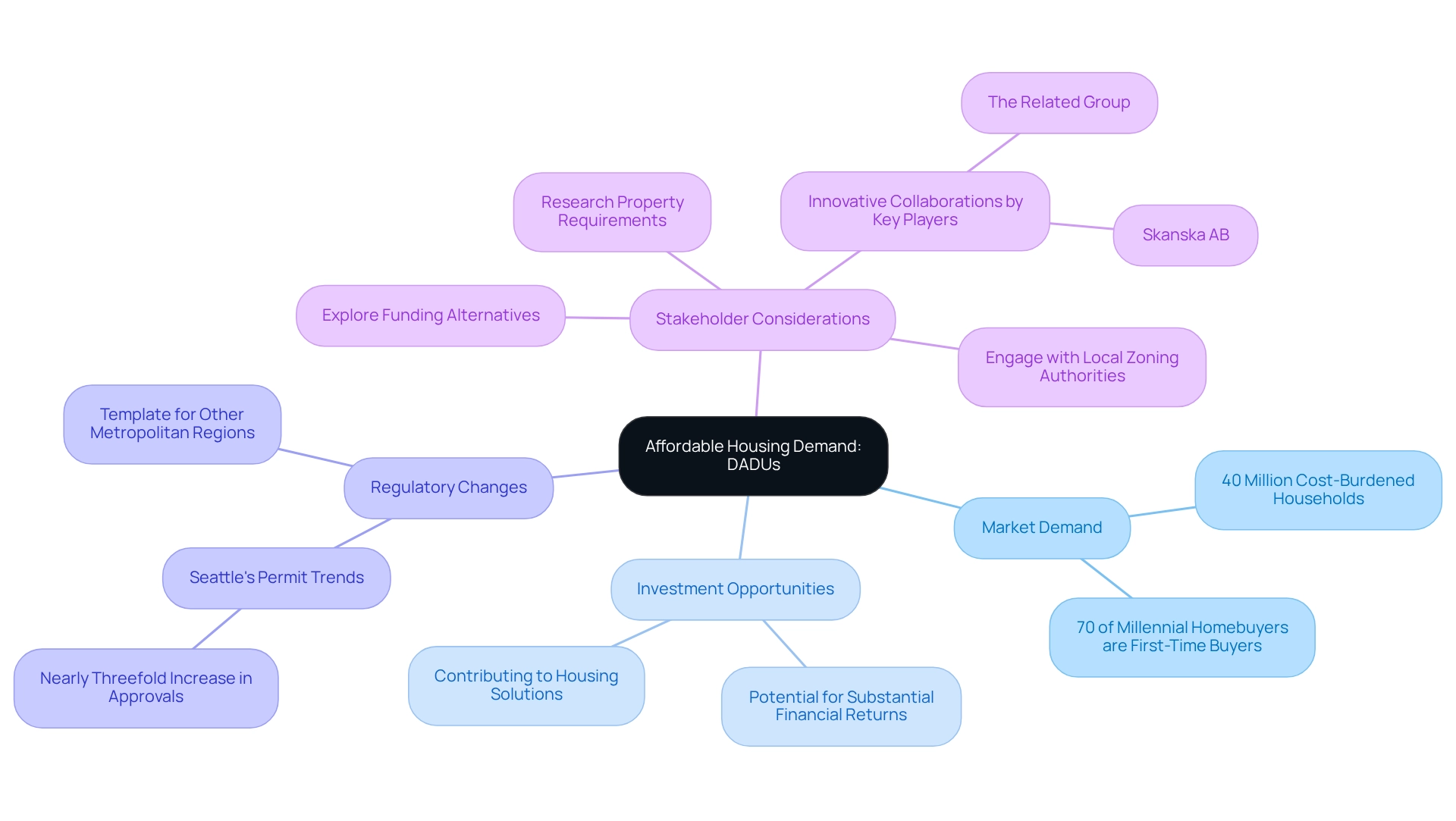

Affordable Housing Demand: Capitalize on the Growing Need for DADUs

The escalating demand for budget-friendly residences positions Detached Accessory Dwelling Units as a compelling investment opportunity. With over 40 million households in the U.S. grappling with cost burdens, the urgency for solutions like accessory dwelling units is more pronounced than ever, particularly in urban areas facing significant housing shortages. These units emerge as a cost-effective solution, catering to families and individuals seeking affordable living options. By investing in additional dwelling units, investors not only have the opportunity to contribute to alleviating this pressing need but can also realize substantial financial returns from rentals.

Recent trends indicate a surge in permits for these structures, especially in cities like Seattle, where the implementation of new codes has led to nearly threefold increases in approvals. This shift serves as a template for other metropolitan regions encountering similar accommodation shortages, illustrating how regulatory modifications can foster the development of accessory dwelling units as a viable living alternative. Key players in the affordable housing sector, including Skanska AB and The Related Group, are exploring innovative collaborations and solutions specifically related to accessory dwelling units, further affirming their potential in addressing housing challenges.

As the environment evolves, expert insights underscore the importance of accessory dwelling units in meeting the needs of a changing demographic. With 70% of millennial homebuyers being first-time buyers, the demand for affordable options is more critical than ever. Homeowners interested in accessory dwelling units should familiarize themselves with specific property requirements and navigate the design and permitting processes effectively. For individuals considering accessory dwelling units, it is prudent to conduct thorough market analysis, engage with local zoning authorities, and explore funding alternatives tailored for accessory dwelling unit projects.

By investing in accessory dwelling units, stakeholders can not only capitalize on a lucrative market but also play a vital role in shaping the future of urban living.

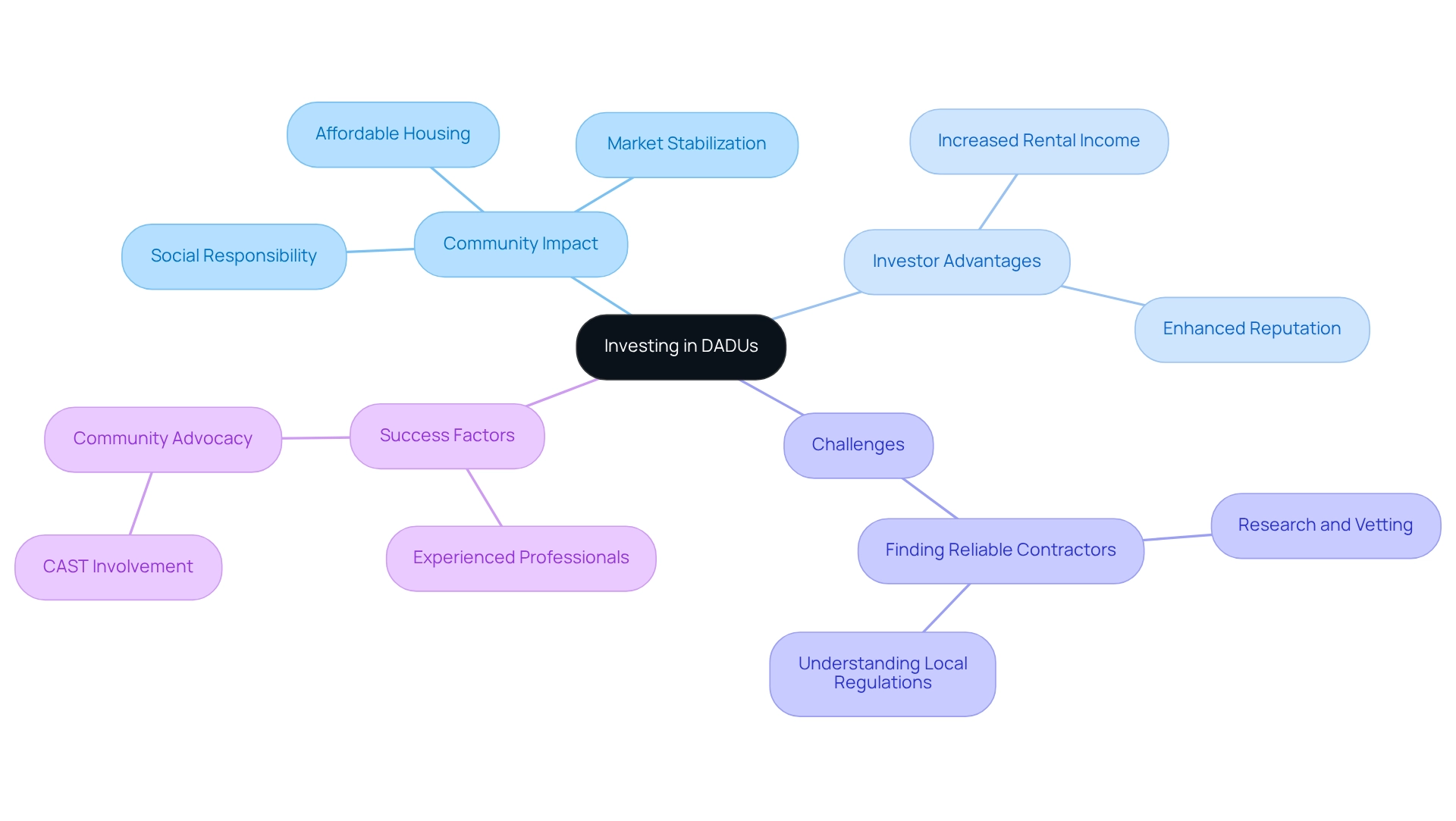

Addressing Housing Shortages: Invest in DADUs for Community Impact

Investing in dadu real estate, particularly in Detached Accessory Dwelling Units (DADUs), presents significant advantages, not only for individual investors but also for the broader community, as they address critical accommodation shortages. These units provide additional living options that can stabilize local markets and serve as affordable alternatives for residents. As we approach 2025, the U.S. continues to face a long-term accommodation deficit—further intensified by underbuilding and demographic changes—making DADUs a compelling solution. The combination of low new household formations and robust demand from diverse demographic groups, as highlighted in recent studies, underscores the necessity for innovative residential solutions.

Moreover, accessory dwelling units can enhance a property owner's reputation by demonstrating a commitment to community well-being, attracting socially conscious tenants who value sustainable living options. For instance, in Culver City, ADU builders are creating stylish and functional living spaces that maximize property potential while fulfilling local residential needs. This community-focused approach not only benefits stakeholders through increased rental income but also fosters a sense of belonging by providing diverse living options in the dadu real estate market. The impact of accessory dwelling units on local real estate markets is further evidenced by case studies showcasing their effectiveness in mitigating housing shortages. Considering that approximately 30% of construction laborers are immigrants, their contributions to the real estate sector are vital, particularly in high-demand areas. By investing in dadu real estate, investors can significantly influence market stabilization and support community development, ultimately fostering a more resilient living environment.

To ensure the success of dadu real estate projects, it is crucial to identify reliable contractors; thorough research, vetting, and an understanding of local regulations are essential. Seek experienced, licensed professionals with strong reviews and local expertise to guarantee a successful ADU project. Additionally, organizations like CAST are actively involved in policy advocacy and design for affordable housing solutions, further emphasizing the community impact of these investments.

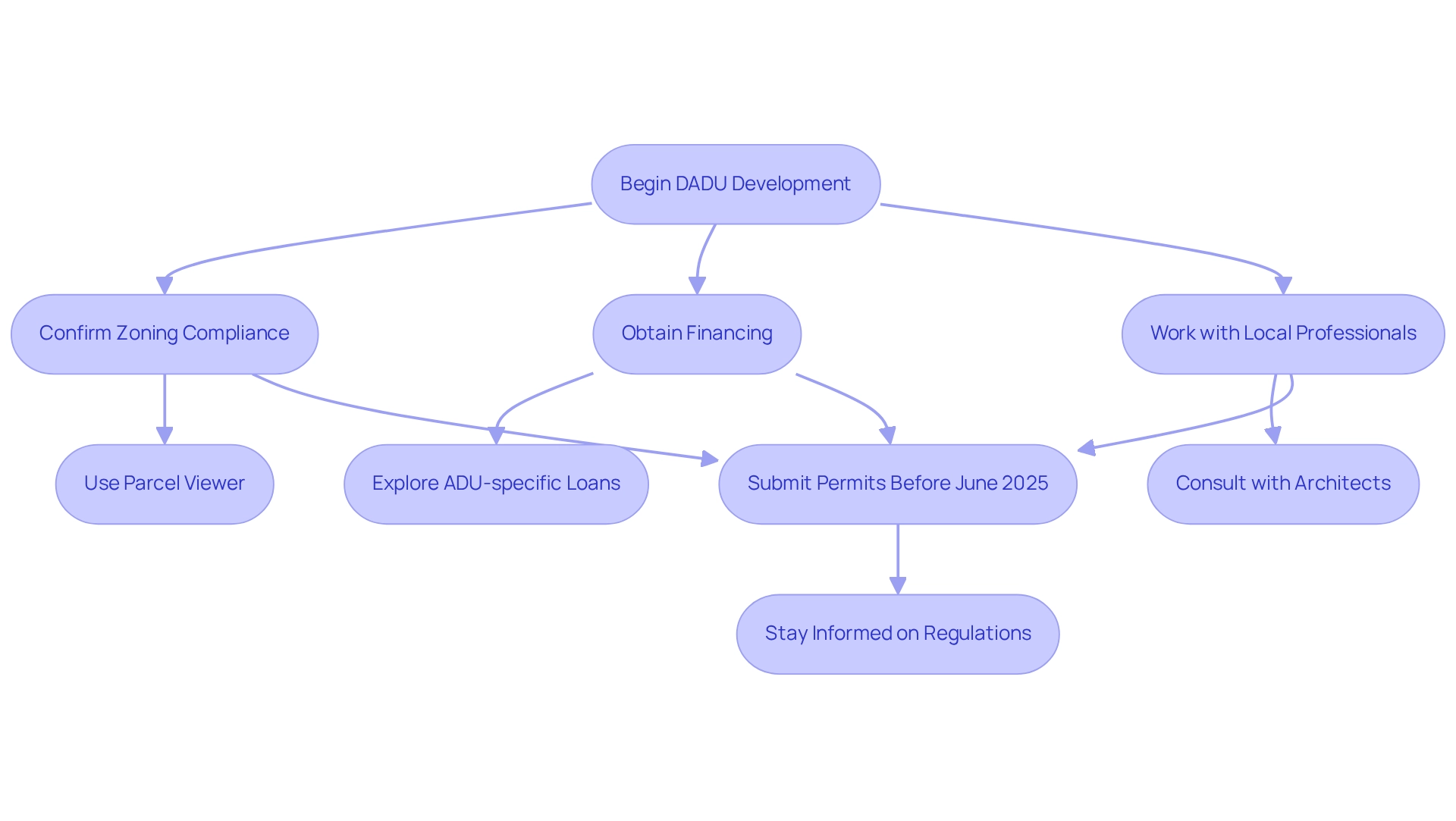

Favorable Regulations: Navigate DADU Development with Ease

The regulatory environment for Detached Accessory Dwelling Units (DADUs) is increasingly favorable, as numerous cities are easing zoning restrictions to promote their construction. Investors must remain vigilant about local regulations, which can differ widely from one jurisdiction to another. Knowledge of the permitting process and accessible incentives is essential, as it can greatly facilitate ADU development and improve potential returns on investment.

For example, homeowners in King County are encouraged to:

- Use the Parcel Viewer to confirm zoning compliance

- Obtain financing through local credit unions that provide ADU-specific loans

- Work with local professionals for strategic design

It is essential for investors to submit permits before June 2025 to avoid increased impact fees, highlighting the importance of proactive planning for successful accessory dwelling unit projects.

As the housing landscape in Washington evolves, the challenges of building an accessory dwelling unit can be mitigated through careful planning and partnerships with skilled professionals, such as architects and contractors experienced in ADU construction. Those who adapt to these changes stand to reap substantial rewards. Additionally, prefab ADUs offer a compelling option for faster, more affordable construction, as noted by Seattle ADU Builders. This underscores the importance of staying informed and engaged with the latest developments in DADU regulations, including verifying up-to-date laws and regulations before finalizing DADU plans.

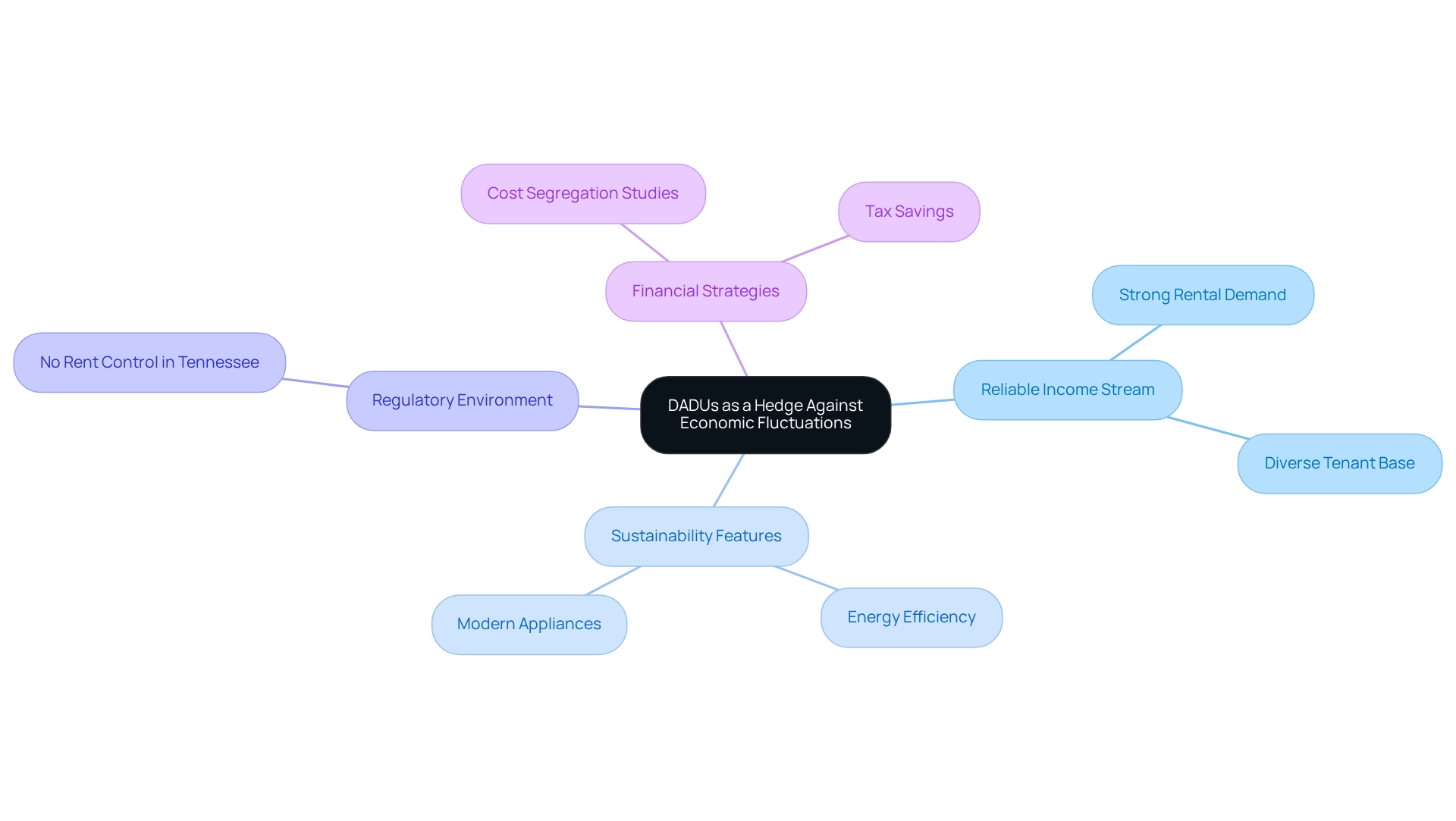

Market Stability: Use DADUs as a Hedge Against Economic Fluctuations

Detached Accessory Dwelling Units (DADUs), which fall under dadu real estate, are increasingly recognized as a robust safeguard against economic fluctuations, providing a reliable income stream during downturns. With the persistent demand for affordable housing, particularly in urban areas, dadu real estate offers investors a unique opportunity to sustain cash flow even in challenging economic climates through accessory dwelling units. Recent trends underscore this resilience, indicating that rental demand for accessory dwelling units remains strong, catering to a diverse tenant base seeking cost-effective living solutions.

Moreover, case studies illustrate how these units have effectively maintained cash flow during economic downturns. Properties equipped with energy-efficient features, such as solar panels and modern appliances, not only attract tenants but also align with the growing emphasis on sustainability. This trend is further reinforced by economic incentives for landlords, enhancing the appeal of investing in accessory dwelling units. Notably, Tennessee state law prohibits local governments from enacting rent control measures, establishing a favorable regulatory environment for landlords and bolstering the stability of rental income from accessory dwelling units.

Real estate analysts assert that the consistency of rental income from accessory dwelling units during economic downturns makes dadu real estate a strategic enhancement to any investment portfolio. As D. Langston, an Event Director, aptly states, "Real estate is indeed a key for legacy building. How do you determine the right balance between risk and return in such investments?" This perspective underscores the significance of dadu real estate in mitigating risks related to economic fluctuations, ensuring a steady return on investment. Additionally, employing cost segregation studies can accelerate depreciation schedules for short-term tax savings, further enhancing the financial viability of dadu real estate investments.

Multi-Generational Living: Foster Family Connections with DADUs

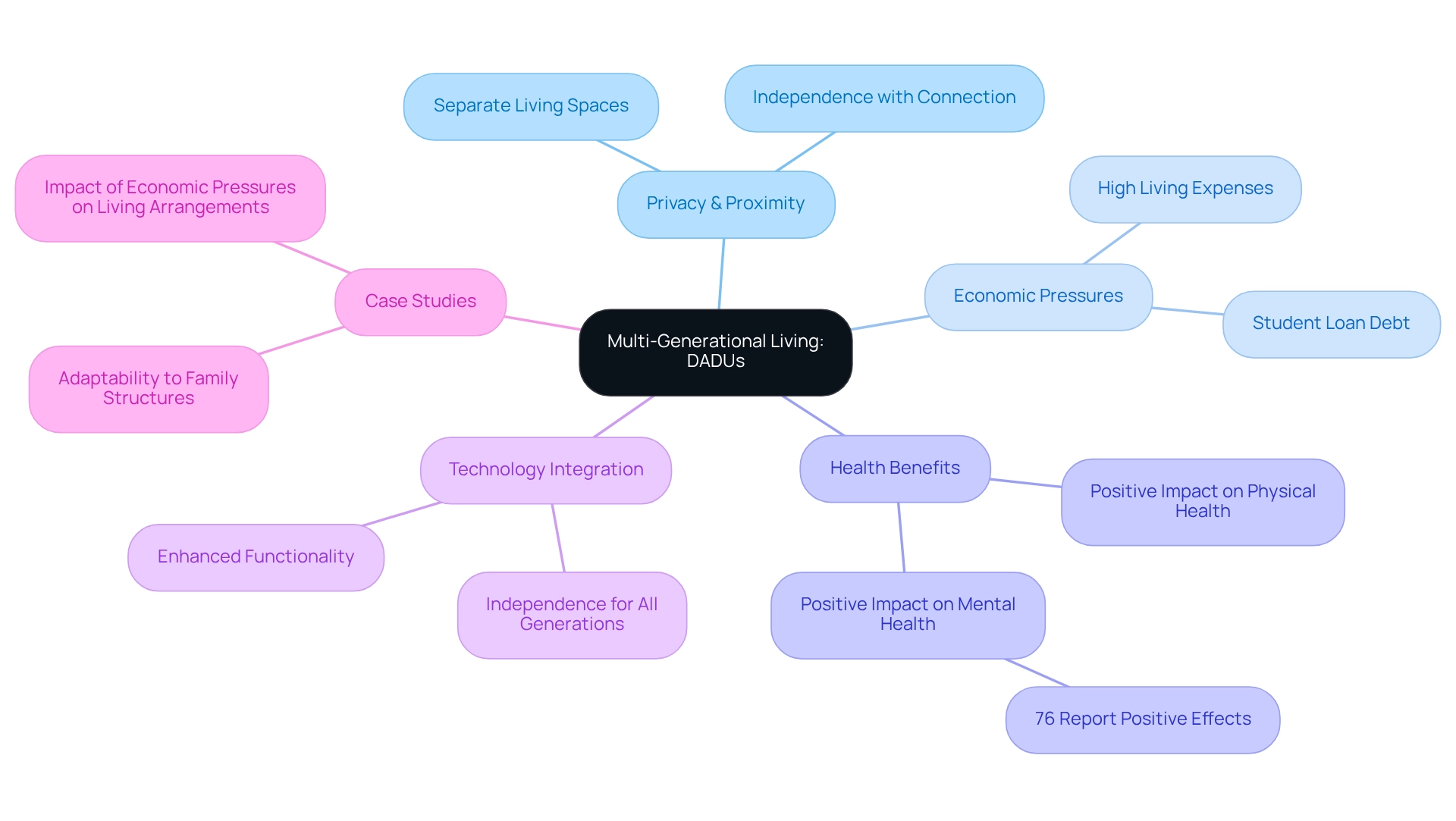

Detached Accessory Dwelling Units are increasingly recognized as optimal solutions for multi-generational living, offering families an ideal balance of privacy and proximity. These units provide separate living spaces, allowing family members to maintain their independence while fostering meaningful connections. As economic pressures, such as high living expenses and student loan debt, compel more families to consider multigenerational arrangements, detached accessory dwelling units emerge as a timely investment opportunity.

Investors can effectively position accessory dwelling units as ideal accommodations for aging parents or adult children, tapping into a significant demographic trend. A recent survey revealed that 76% of individuals living in multigenerational homes reported positive impacts on their mental and physical health, underscoring the benefits of such living arrangements. Moreover, incorporating technology into the design of these units can enhance functionality and independence for all generations, making accessory dwelling units even more appealing. This aligns with the notion that modern designs can cater to the diverse needs of families, ensuring that everyone can enjoy their own space while remaining connected.

Case studies illustrate the growing acceptance of detached accessory dwelling units for family living arrangements, showcasing their adaptability to various family structures. For instance, the case study titled "Impact of Economic Pressures on Living Arrangements" highlights how families are increasingly opting for accessory dwelling units as a practical solution to economic challenges. As the trend towards multigenerational living continues to expand, accessory dwelling units will play a vital role in offering adaptable living arrangements that address the evolving dynamics of family life in 2025. As Tom Moser aptly puts it, "I think it’s a natural way to live. Communal living fosters love and commitment, and all the good values we want.

Sustainable Investment: Embrace Eco-Friendly DADU Development

Investing in small accessory dwelling units presents a unique opportunity to align with sustainable development goals. These accessory dwelling units (ADUs) are increasingly constructed using eco-friendly materials and equipped with energy-efficient systems, significantly reducing their carbon footprint. In 2025, the movement towards sustainability in development is underscored by statistics revealing that automation in measuring emissions can lead to a staggering 100x increase in the number of data points for environmental assessments, thereby enhancing the precision of sustainability assertions.

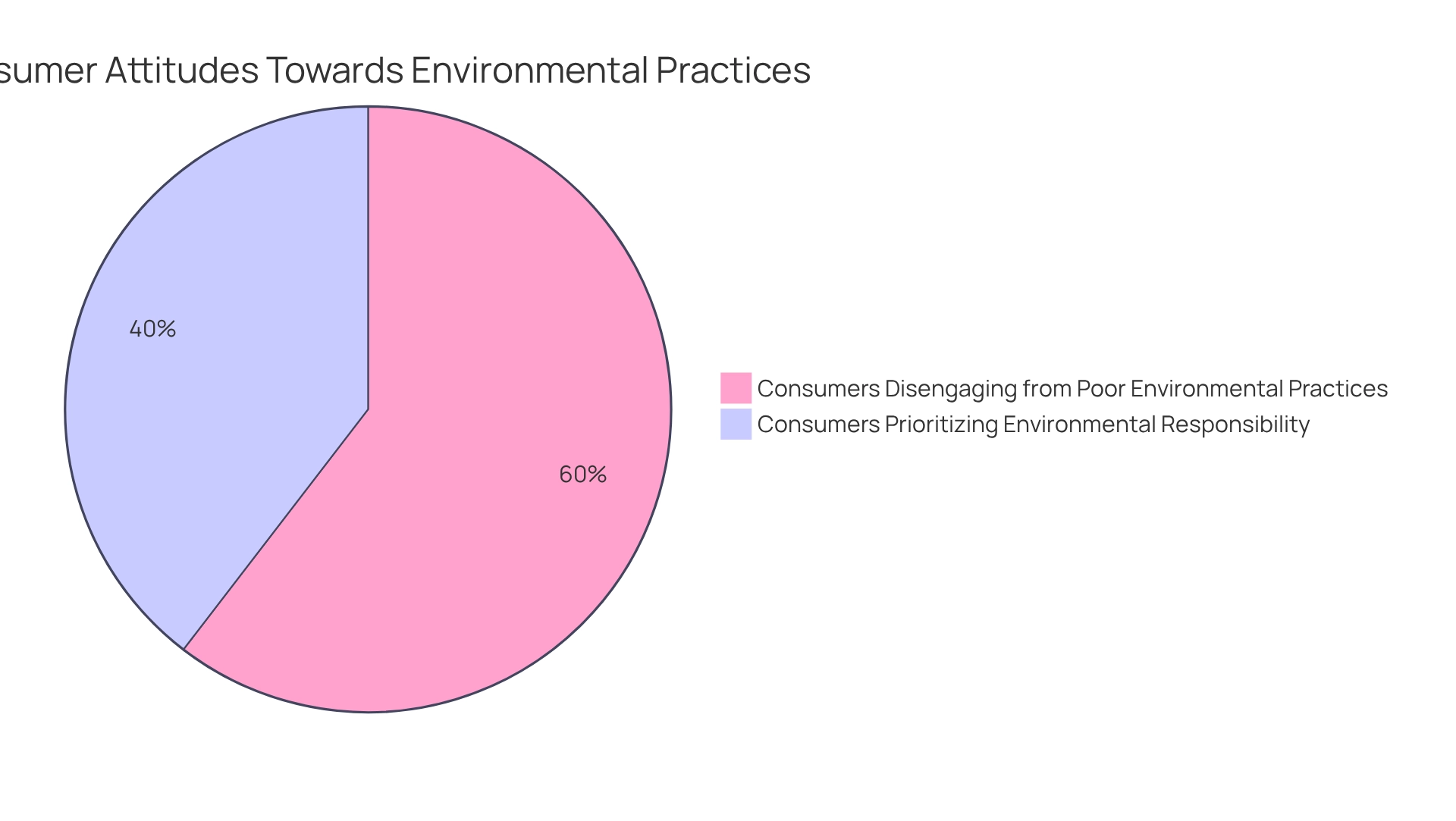

By promoting these structures as sustainable housing alternatives, stakeholders can attract environmentally conscious tenants who prioritize green living. Research indicates that a considerable 84% of consumers may disengage from brands with poor environmental practices, underscoring the importance of maintaining a robust eco-friendly reputation. Moreover, 55% of consumers assert that environmental responsibility is very or extremely significant when selecting a brand, emphasizing the necessity for stakeholders to adopt sustainable practices. This shift not only benefits the environment but also strategically positions stakeholders advantageously in a competitive market.

Furthermore, the incorporation of sustainable materials and practices in construction aligns with the growing demand for responsible investment options. As the green cement market expands, characterized by diverse applications in residential and commercial sectors, investors can leverage these trends to enhance their portfolios while positively impacting their communities. The growth of the green cement market particularly benefits DADU real estate by providing environmentally friendly building materials that meet the increasing demand for sustainable housing. Adopting eco-friendly structures not only fulfills a market requirement but also supports broader sustainability efforts, positioning DADU real estate as a strategic investment option for 2025. The case study titled 'Impact of Poor Environmental Practices on Customer Loyalty' illustrates that inadequate environmental practices can alienate customers, reinforcing the necessity for sustainable development in DADU real estate. By aligning with sustainable development goals, investors can ensure their contributions foster a more sustainable future.

Conclusion

The rising demand for Detached Accessory Dwelling Units (DADUs) in 2025 signifies a transformative investment opportunity within the real estate landscape. The interplay of urban density, evolving zoning laws, and the pressing need for affordable housing positions DADUs as a strategic asset for investors eager to enhance property values and generate substantial rental income. By capitalizing on emerging trends, investors can effectively navigate this dynamic market, ensuring they remain informed and agile in their investment strategies.

DADUs not only promise robust financial returns but also address critical community needs. Their versatility allows for a range of uses, from rental units to accommodations for family members, making them an appealing option for a diverse array of buyers. As the market continues to evolve, understanding local regulations and prioritizing sustainable development practices will be essential to maximizing the potential of DADUs.

Ultimately, investing in DADUs transcends mere profit; it embodies a commitment to fostering community growth and addressing housing shortages. By embracing this innovative housing solution, investors can play a pivotal role in shaping the future of urban living, contributing to a more sustainable and resilient housing market. With interest in DADUs on the rise, now is the opportune moment to seize this investment opportunity and make a meaningful impact in both the real estate sector and the communities served.