Overview

The article "9 Key Insights for Investing in Medical Condominiums" presents essential factors and trends shaping investment decisions within the medical real estate sector.

It emphasizes that the increasing demand for medical condominiums stems from an aging population and a rise in outpatient care needs. This assertion is bolstered by data indicating low vacancy rates and stable cash flows, which render these investments appealing for long-term stability and growth.

Investors are encouraged to consider these insights as they navigate the evolving landscape of medical real estate.

Introduction

The landscape of medical condominium investments is evolving, driven by an aging population and a notable shift towards outpatient care. This transformation presents a compelling opportunity for investors, as healthcare spending continues to surge and occupancy rates remain robust. With these dynamics at play, investors are uniquely positioned to tap into this burgeoning market. However, navigating the complexities of medical real estate can be challenging.

What key insights can help investors make informed decisions in this promising sector?

Zero Flux: Essential Insights on Medical Condominium Investments

Zero Flux delivers a daily newsletter that compiles essential insights on medical condominiums ventures, drawing from over 100 reliable sources. This resource is crucial for investors navigating the complexities of the medical real estate market, providing data-driven analysis free from subjective opinions. Subscribers benefit from curated trends, funding opportunities, and demographic shifts vital for informed decision-making in this specialized sector.

As of 2025, the health-related real estate market is witnessing significant trends, including a notable rebound in outpatient building (MOB) transaction activity, which surged 61% year-over-year in 2024. The average cap rate for MOBs is currently 6.9%, marking the first quarterly decrease since Q2 2022. This reflects a stable investment environment compared to traditional office properties, which have seen cap rates rise to 7.8%. Such changes underscore the growing investor interest in health-related real estate, particularly as the U.S. population aged 65 and above is projected to reach 20% by 2030, thereby increasing demand for health services.

Real estate analysts stress the importance of newsletters like Zero Flux in keeping investors informed about these dynamics. As Paul Leonard, Director of Research, notes, "Medical real estate has swiftly attracted investor attention and for valid reasons," highlighting the anticipated rise in the senior population and its implications for medical demand. This sentiment is echoed by Sandy Romero, who asserts, "MOB remains a top alternative asset class, driven by strong fundamentals and demographics."

Successful investment examples in medical condominiums further illustrate the sector's resilience. For instance, Welltower reported a 2% year-over-year increase in same-store net operating income (NOI), while Ventas achieved nearly 5% growth, propelled by effective lease management and high occupancy rates. These statistics reflect the robust performance of medical real estate, positioning it as an appealing option for investors seeking stability and growth in their portfolios.

In summary, Zero Flux serves as an indispensable tool for investors, offering a comprehensive overview of the latest developments in the medical real estate sector. This ensures they remain well-informed and strategically positioned in this evolving market.

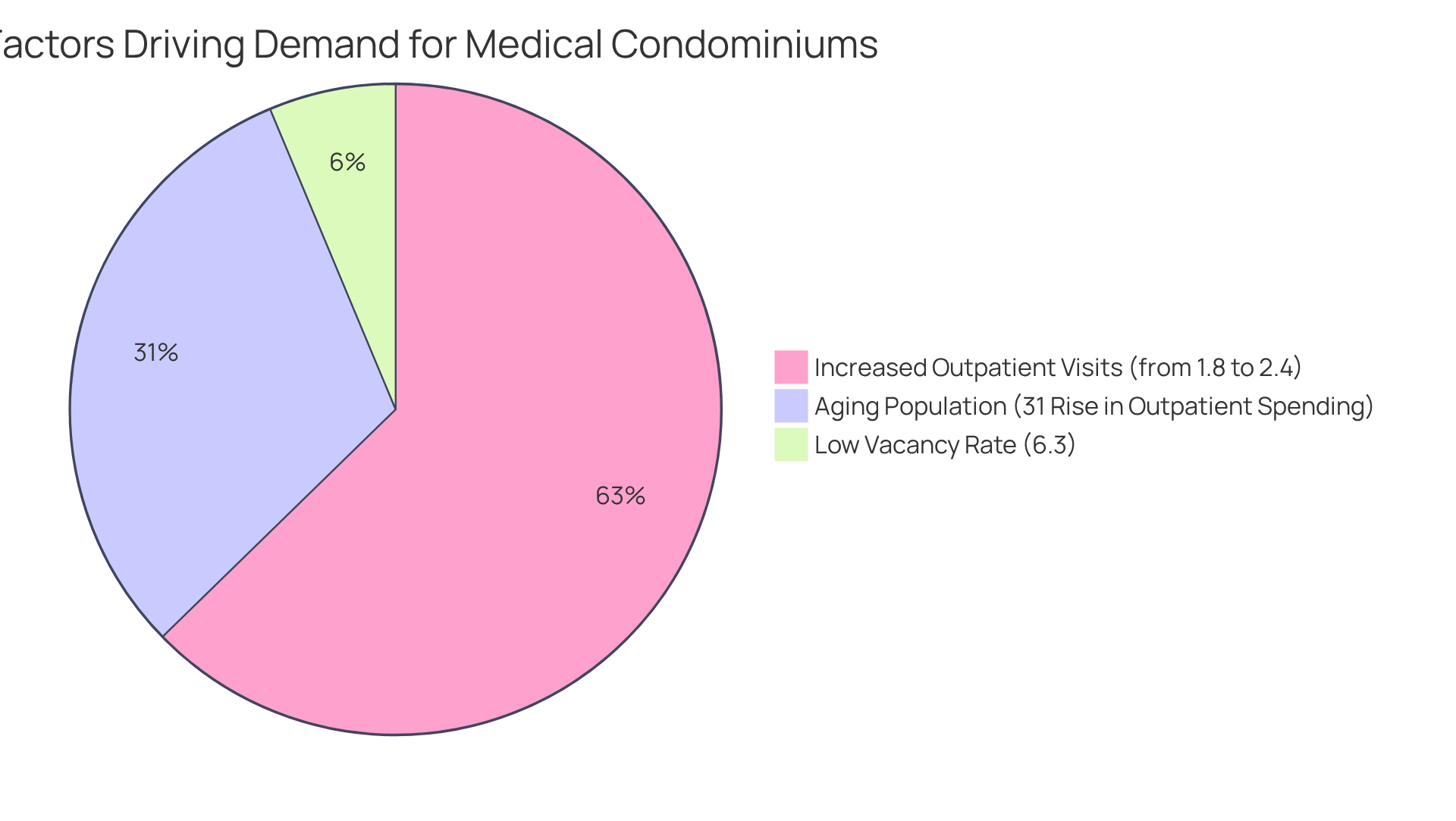

Strong Demand: The Growing Appeal of Medical Office Condominiums

The demand for medical condominiums is surging, driven by an aging population and a notable shift towards outpatient care. As the proportion of individuals over 60 continues to rise, the health services industry is witnessing a related surge in demand for treatment. This demographic trend is projected to lead to a 31% rise in outpatient healthcare spending, reaching nearly $2 trillion by 2030, as the share of senior citizens in the U.S. population is expected to increase to 20%. Investors are increasingly attracted to medical condominiums due to their inherent stability and long-term lease agreements, which provide a reliable income stream.

Recent data shows that these properties boast low vacancy rates, currently around 6.3%, and provide consistent cash flow, making them a wise selection in today's market. Additionally, healthcare office buildings (MOBs) have consistently outperformed conventional office spaces, demonstrating greater resilience and stability. In fact, the health sector has added nearly 2 million jobs since late 2021, further strengthening the outlook for health-related property investments.

With outpatient visitation growing to 2.4 visits per patient in 2022 from 1.8 visits in 2000, it is an opportune time for investors to consider entering this expanding sector. The convergence of these trends underscores the potential for lucrative investment opportunities in medical condominiums, making it essential for informed investors to act decisively.

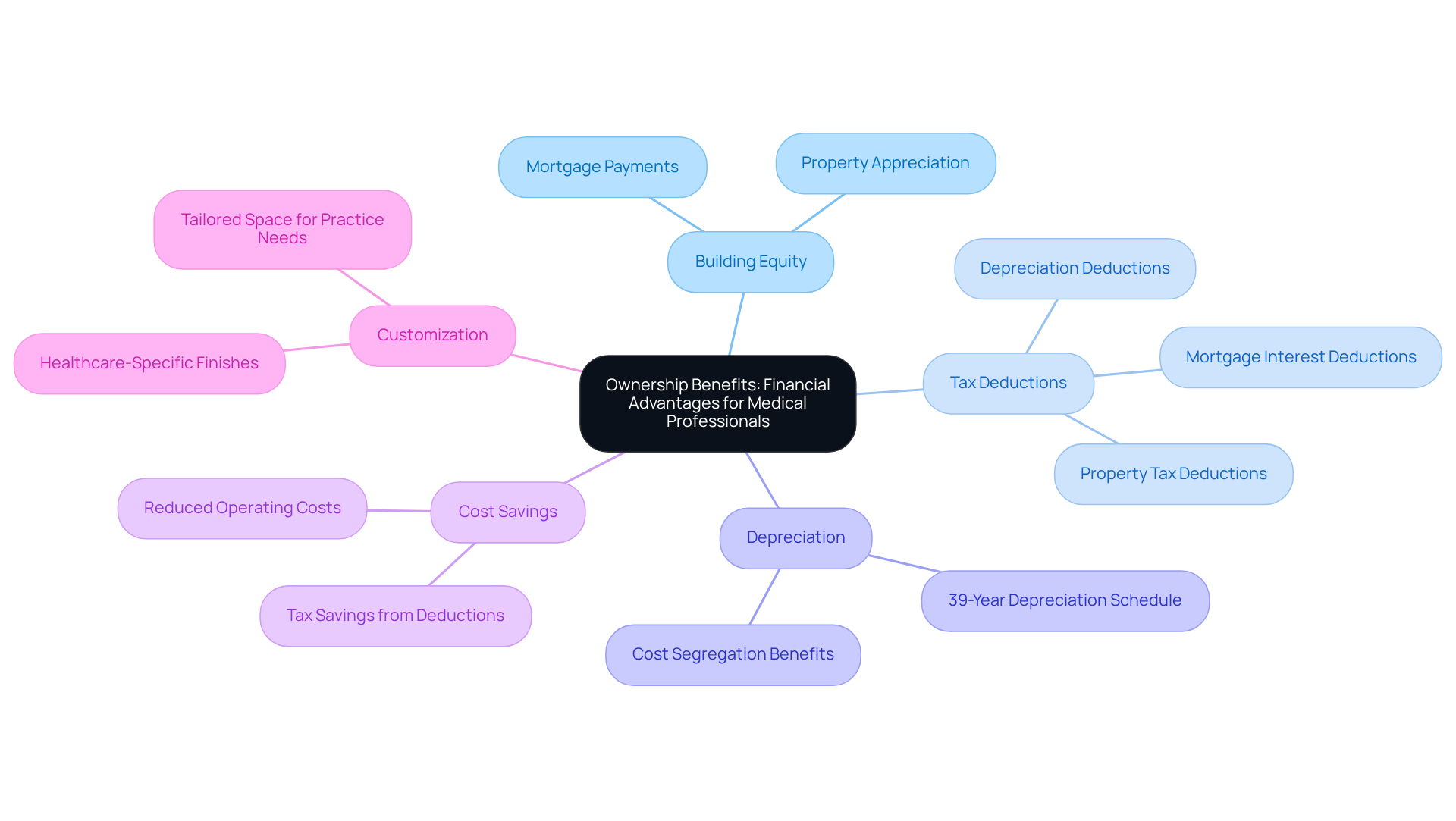

Ownership Benefits: Financial Advantages for Medical Professionals

Owning a medical condominium presents significant financial benefits for professionals in the field. One of the key advantages is the opportunity to build equity over time; mortgage payments contribute to an owned asset rather than simply paying rent. This ownership model not only strengthens financial stability but also facilitates the customization of the space to accommodate specific practice needs, including healthcare-specific finishes that enhance patient care and operational efficiency.

Tax deductions further enhance the financial benefits of ownership. Healthcare professionals can deduct mortgage interest payments from their taxable income, which is especially advantageous in the early years of a mortgage when interest payments tend to be higher. As Rich Shelor notes, mortgage interest can represent one of the largest deductible expenses, particularly with substantial commercial loans. Additionally, taxes paid on healthcare condos are fully deductible, providing further relief on overall tax obligations. These deductions can significantly improve cash flow, allowing for reinvestment in practice growth, such as technology upgrades or staffing enhancements.

Moreover, the IRS permits the depreciation of commercial real estate over 39 years, allowing healthcare condo owners to deduct the asset's expense throughout its useful life. This strategic approach to depreciation, coupled with cost segregation, can yield considerable tax savings over time, freeing up resources for other essential areas of the practice.

Healthcare professionals frequently emphasize the significance of these financial advantages. For example, owning a healthcare condo not only ensures a stable operating cost structure but also positions practitioners to benefit from property appreciation, potentially leading to substantial capital gains upon sale. In summary, the combination of equity building, tax benefits, and customization options positions owning a medical condominium as a strategic investment for providers.

Market Resilience: Stability Amid Economic Uncertainty

The market for medical condominiums has demonstrated remarkable resilience amidst economic uncertainty. Medical office spaces typically sustain high occupancy rates, with numerous markets reporting figures exceeding 96%. For example:

- Baton Rouge, Louisiana, boasts an occupancy rate of 96.5%

- McAllen, Texas, follows closely at 96.7%

- Winston-Salem, North Carolina, reports a rate of 96.1%

This stability is primarily due to the essential nature of medical services, which ensures a consistent demand even during economic downturns. Consequently, rental income from these properties remains steady, positioning them as an attractive option for investors aiming to mitigate risks associated with market fluctuations.

Looking ahead to 2025, occupancy rates in medical real estate are projected to remain robust, with forecasts suggesting a decline in vacancy rates to below 9.5%. This trend is supported by the ongoing demand for medical office buildings (MOBs), which are increasingly favored by medical providers for their strategic locations and the financial backing of large hospital networks and physician groups. Investors have reported favorable experiences during economic downturns, as the medical sector continues to thrive, showcasing resilience against broader economic challenges.

Insights from real estate analysts reveal that the average cap rate for MOBs has recently decreased to 6.9%, indicating a positive market outlook. This reduction of 10 basis points quarter-over-quarter, combined with expected rent growth of 1.4% to 1.8% over the next two years, highlights the stability and appeal of healthcare real estate as a long-term investment. Furthermore, the average rent for healthcare office space in Baton Rouge is $29.42 per square foot, while in McAllen, it stands at $15.46 per square foot, and in Winston-Salem, it is $21.13 per square foot. Overall, the medical condominiums market emerges as a reliable asset category, offering consistent cash flow and low vacancy rates, even amidst economic uncertainties.

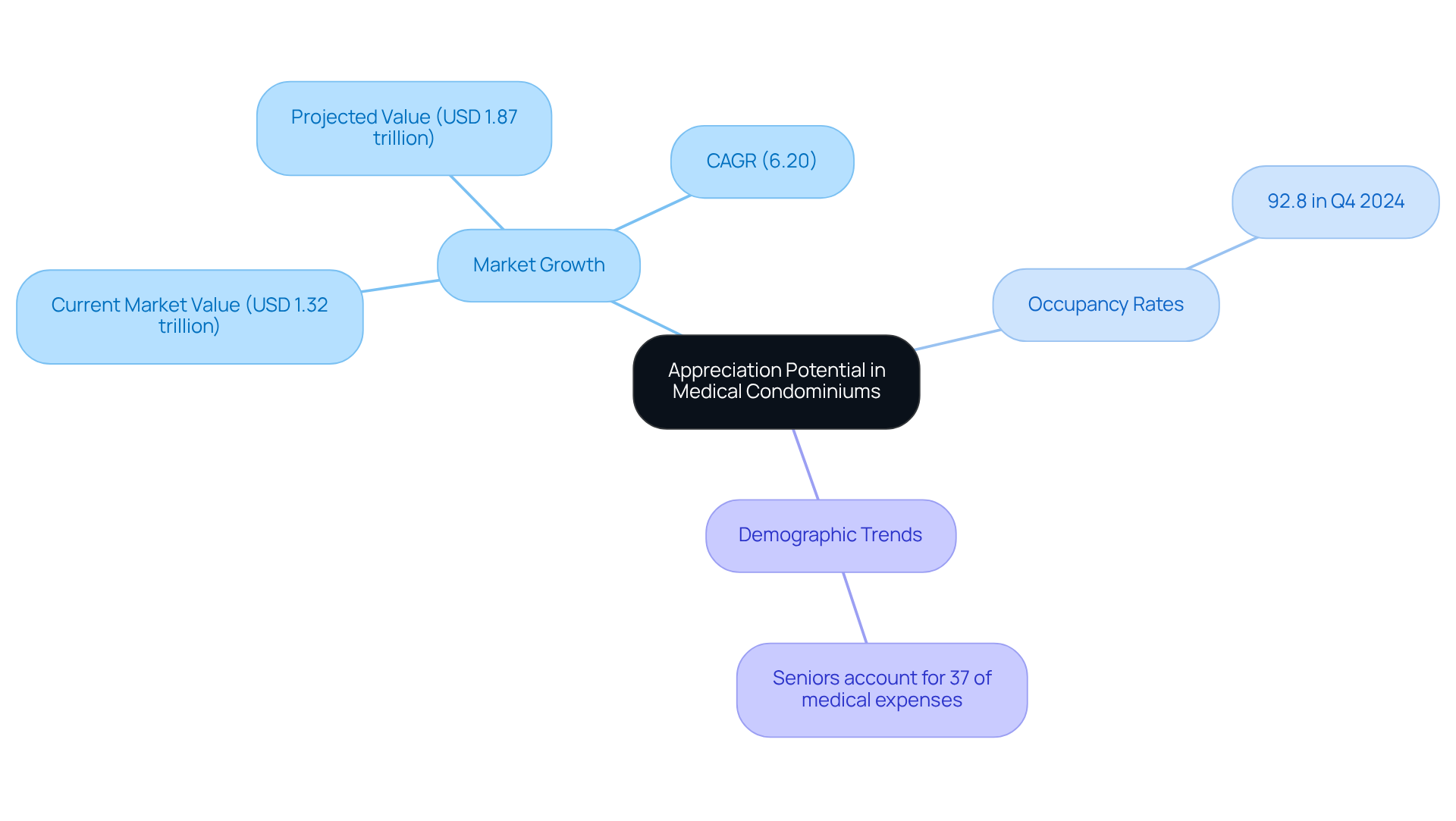

Appreciation Potential: Long-Term Value Growth in Medical Condominiums

Investing in medical condominiums offers substantial appreciation potential, particularly in regions experiencing heightened demand for health services. Properties situated near hospitals or in bustling areas are poised for significant value increases as the demand for healthcare services escalates. The U.S. Healthcare Real Estate Market, valued at USD 1.32 trillion in 2024, is projected to surge to USD 1.87 trillion by 2030, reflecting a compound annual growth rate (CAGR) of 6.20%. This trend underscores the growing importance of healthcare facilities within real estate financial strategies.

Historical data reinforces the idea that medical condominiums have consistently appreciated, establishing them as a wise long-term investment choice. The average occupancy rates for Medical Outpatient Buildings (MOBs) reached an impressive 92.8% in Q4 2024, signaling robust demand for these assets. Furthermore, as the population ages—seniors are expected to account for 37% of national medical expenses—the necessity for health-related real estate is anticipated to rise, further driving real estate values upward. Investors should take these dynamics into account when assessing opportunities in the healthcare real estate sector.

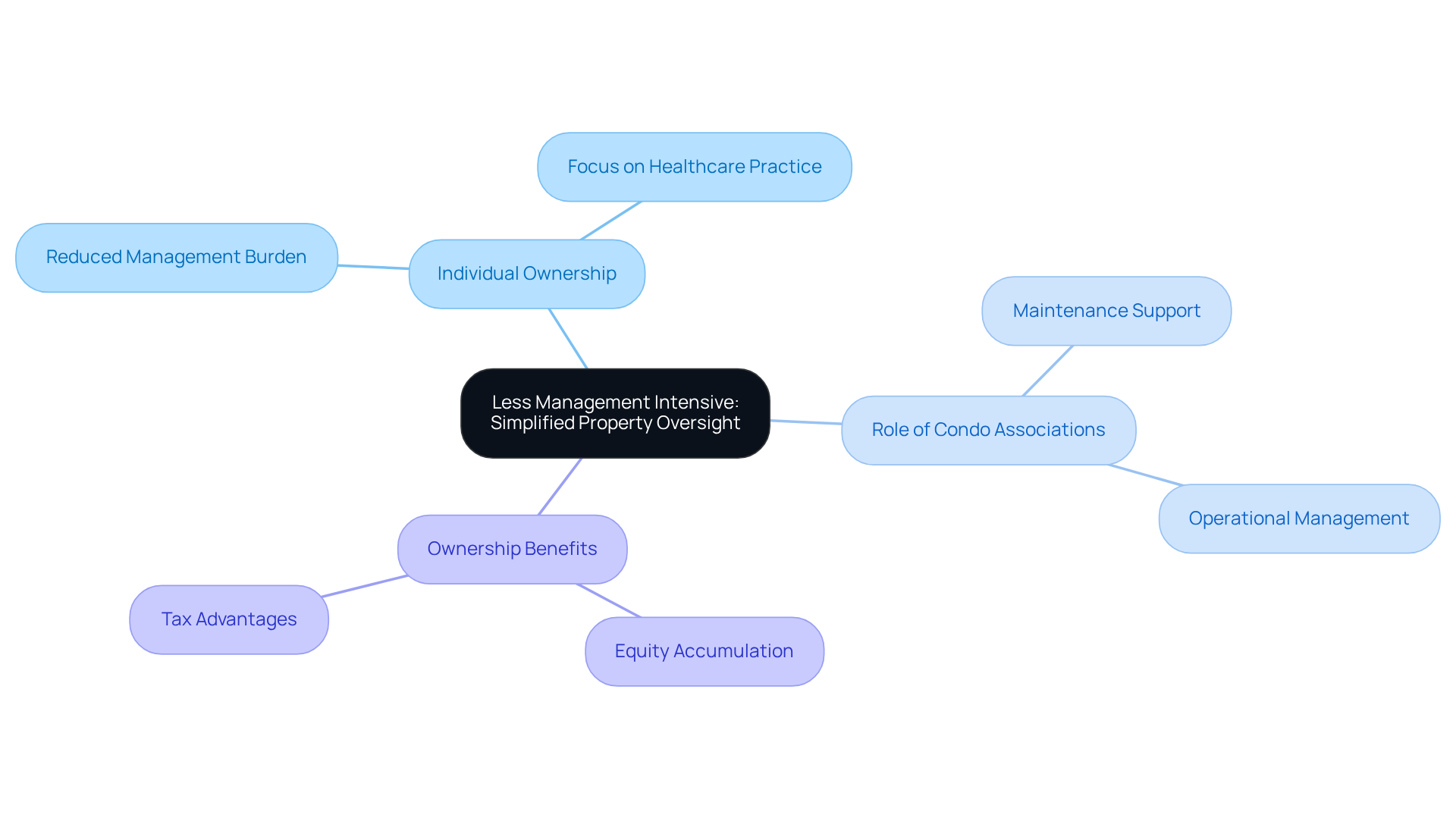

Less Management Intensive: Simplified Property Oversight

Medical condominiums represent a significantly less management-intensive option compared to conventional commercial real estate. In these arrangements, individual ownership means that management duties—particularly regarding exterior upkeep and shared spaces—are typically handled by the condo association. This framework allows healthcare professionals to concentrate on their practice without the burden of daily management tasks.

Investors often assert that this setup not only simplifies their responsibilities but also enhances the overall appeal of condos as a viable investment opportunity. Condo management experts emphasize that associations provide essential support, ensuring that maintenance and operational issues are managed effectively, which ultimately boosts the stability and attractiveness of these properties.

Furthermore, ownership of medical condominiums offers substantial benefits, including equity accumulation and tax advantages, making them an even more compelling choice. As one property management expert noted, 'Condo associations play a crucial role in maintaining property value and ensuring that owners can focus on their core business without distraction.'

This combination of reduced management intensity and the benefits of ownership positions medical condominiums as a prudent investment in the real estate market.

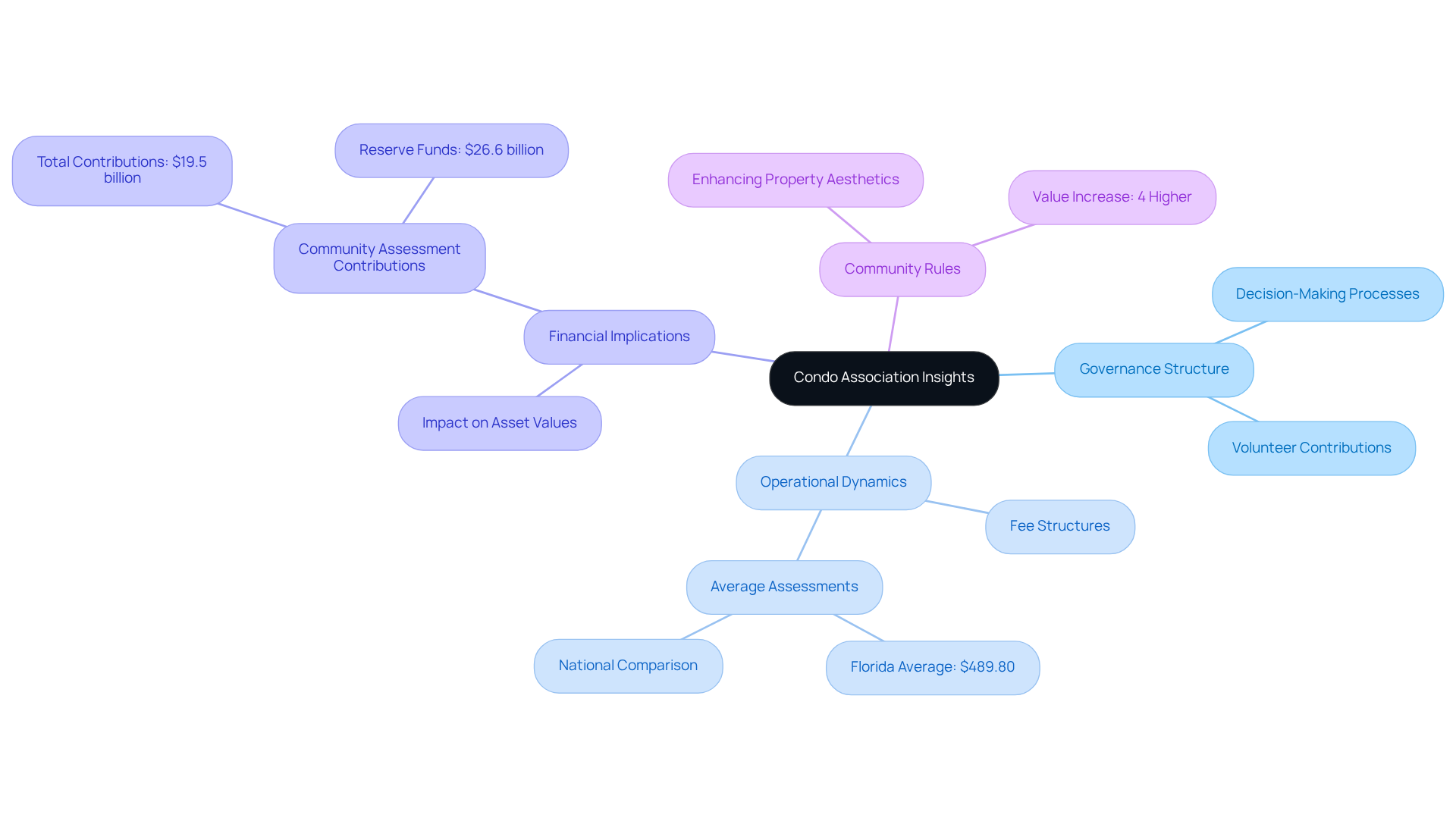

Condo Association Insights: Navigating Governance and Operations

Investors in medical condominiums must gain a thorough understanding of the governance structure of condo associations, as these associations play a pivotal role in maintaining common areas and enforcing community rules. Knowledge of operational dynamics—including fee structures and decision-making processes—is crucial for ensuring a positive ownership experience in medical condominiums and for protecting asset values. For instance, in Florida, the average monthly condominium assessment is approximately $489.80, positioning the state fourth in the nation for the highest average condominium assessment fees. This reflects the financial obligations that accompany ownership. Legal specialists emphasize that grasping these regulations is essential for medical condominiums, as they can significantly impact financial outcomes.

Community rules not only enhance property aesthetics but also contribute to overall property value. Homes within community associations are typically valued at least 4% higher than those outside such frameworks, collectively valued at nearly $11 trillion. Investors should also be aware that most condo associations assess fees uniformly across units, regardless of size, which can lead to financial implications for owners of smaller units. Engaging in the governance of medical condominiums offers insights into how these fees are established and the rationale behind community regulations, ultimately fostering a more informed approach to financial decisions.

Notably, nearly 90% of homeowners and condominium association residents rate their overall experience as 'very good' or 'good,' indicating a generally positive sentiment towards condo associations. Furthermore, community association board and committee members contribute approximately 98.5 million hours of volunteer service annually, underscoring their dedication and the importance of investor involvement.

Build-Out Costs: Assessing Financial Viability for Investors

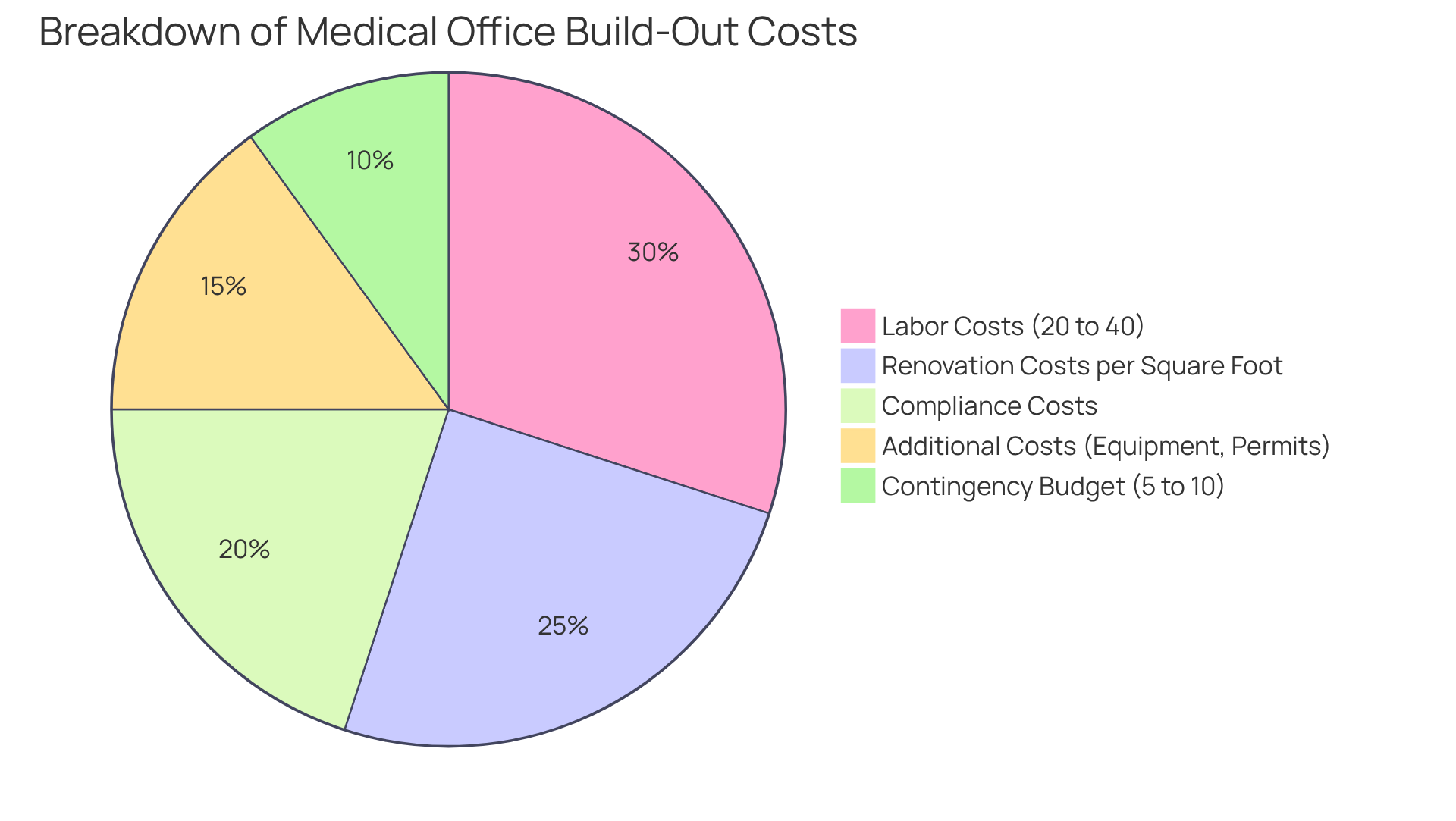

Investing in medical condominiums demands a comprehensive evaluation of potential build-out expenses, which can fluctuate based on the unit's current condition and its intended application. Renovation costs are a pivotal element in assessing the overall financial feasibility of the investment. Notably, the national average for healthcare office build-outs ranges from $150 to $300 per square foot, with actual expenses varying significantly depending on specific project nuances.

Investors should anticipate additional costs to guarantee compliance with healthcare standards, which may include expenditures for specialized equipment and infrastructure. Typically, labor costs constitute about 20% to 40% of total construction expenses, and healthcare facilities often incur higher construction costs due to intricate finishes.

Conducting a thorough cost analysis prior to acquisition is crucial to mitigate the risk of unforeseen financial challenges. As one investor aptly stated, "It's vital to clarify all key details before signing a lease or starting construction," emphasizing the necessity of meticulous planning.

Furthermore, developing a detailed budget and timeline is essential for effective project management. By performing extensive financial viability assessments and exploring construction loans to assist in managing expenses and cash flow, investors can make informed decisions that align with their long-term financial strategies in the medical condominiums sector.

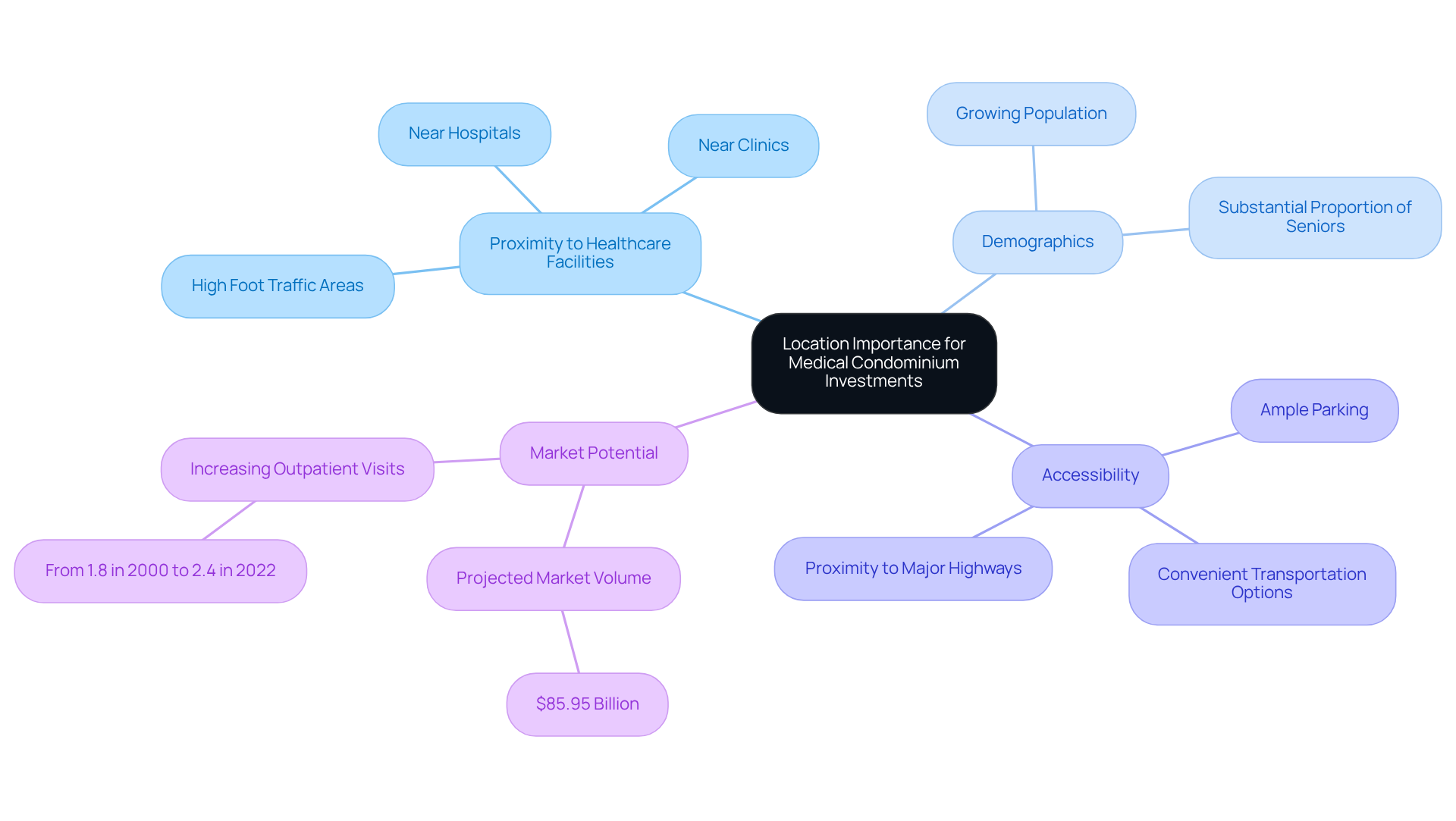

Location Importance: Key to Successful Medical Condominium Investments

The success of medical condominiums projects hinges significantly on location. Properties situated near hospitals, clinics, and high foot traffic areas are more likely to attract patients, thereby ensuring a consistent demand for services.

For instance, outpatient visitation has grown from 1.8 visits per patient in 2000 to 2.4 visits in 2022, underscoring the increasing reliance on outpatient facilities. Investors should focus on regions characterized by favorable demographics, such as a growing population and a substantial proportion of seniors, as these factors directly influence medical needs.

The expanding elderly American population is a pivotal element in healthcare demand, rendering such demographics particularly attractive for investment. Accessibility is also crucial; locations with convenient transportation options, ample parking, and proximity to major highways enhance patient visits, further solidifying the appeal of these investments.

By prioritizing these strategic locations, particularly in medical condominiums, investors can maximize their potential returns in the evolving healthcare real estate landscape, especially as the market volume for healthcare offices is projected to reach $85.95 billion.

Investment Considerations: Key Factors for Successful Medical Condo Investments

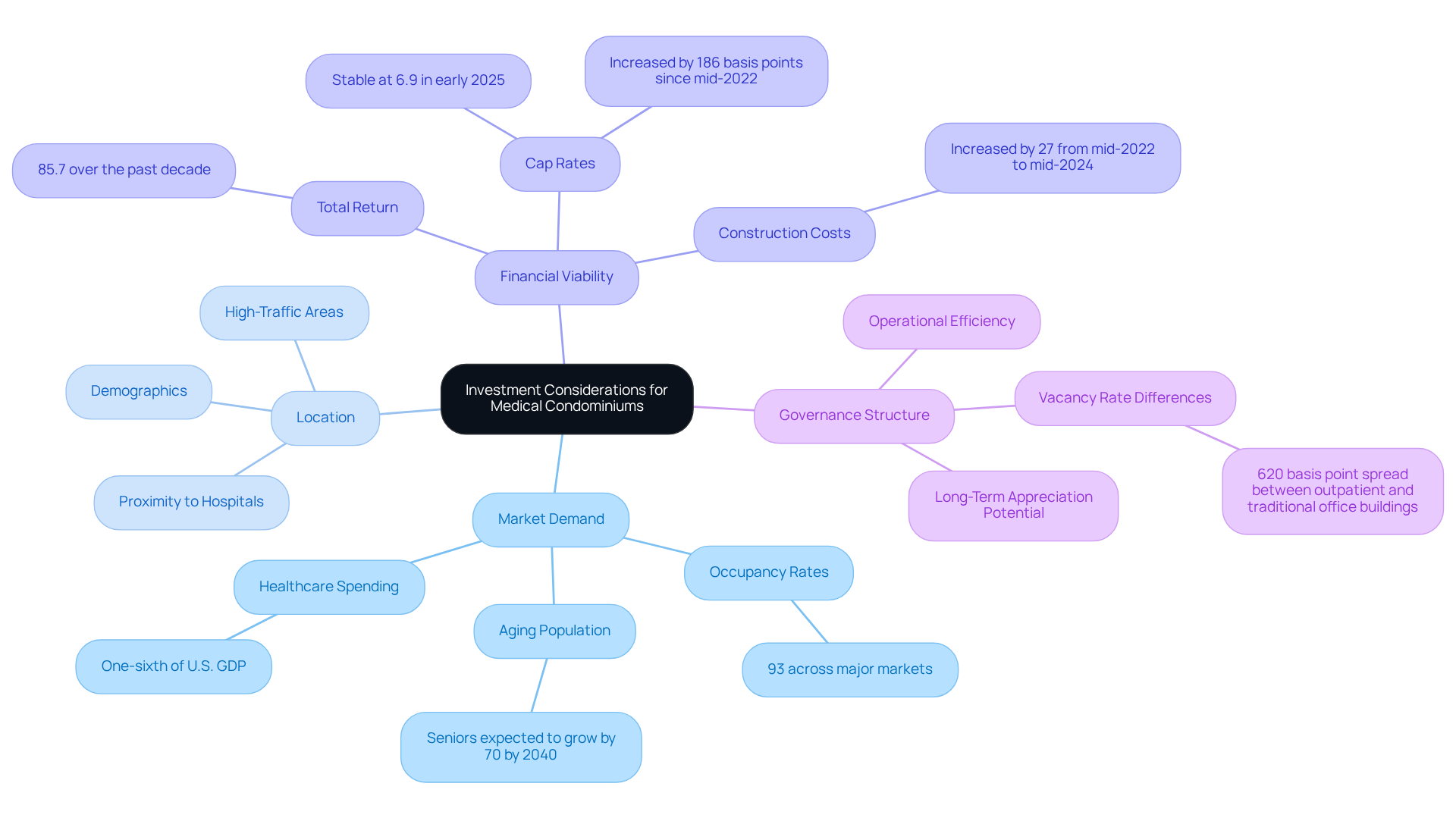

Investing in medical condominiums necessitates a comprehensive evaluation of several pivotal factors:

- Market demand

- Location

- Financial viability

- Governance structure of the condo association

Current statistics reveal that the medical office sector has demonstrated resilience, with occupancy rates for medical outpatient buildings reaching an impressive 93% across major markets. This reflects strong demand, driven by an aging population and escalating healthcare spending, which now constitutes one-sixth of the U.S. GDP. Moreover, medical office building (MOB) sales surged by 61% year-over-year in 2024, underscoring renewed investor confidence in the sector.

Location is paramount; medical condominiums located near hospitals or high-traffic areas for patients typically attract more tenants and ensure elevated occupancy rates. Grasping build-out costs is critical, as these can significantly influence the overall investment. The average price per square foot for new construction has escalated by 27% from mid-2022 to mid-2024, mirroring broader trends of rising construction costs and emphasizing the necessity of budgeting for these expenses.

Financial viability stands as another vital consideration. Investors should evaluate potential gains, as the healthcare office sector has yielded an impressive 85.7% total return over the past decade, outpacing the overall real estate index. Furthermore, while the stability of cap rates averages 6.9% in early 2025, it is essential to recognize that the average cap rate has risen by nearly 186 basis points since mid-2022, indicating shifts in market conditions.

Lastly, the governance structure of the medical condominiums association can significantly influence both operational efficiency and long-term appreciation potential. By meticulously assessing these factors, including the notable vacancy rate difference between outpatient facilities and conventional office buildings, investors can strategically position themselves for success in the healthcare real estate market. As one expert aptly noted, "People will always need medical care, and many services cannot be delayed indefinitely," highlighting the importance of thorough market analysis in this sector.

Conclusion

Investing in medical condominiums presents a unique opportunity, driven by a combination of demographic trends, financial benefits, and market resilience. As healthcare demand continues to rise, particularly among the aging population, the medical real estate sector is becoming increasingly attractive for investors seeking stable and long-term returns. Understanding the nuances of this specialized market allows investors to position themselves to capitalize on the growth potential inherent in medical condominiums.

Key insights from the article highlight the importance of factors such as:

- Location

- Financial viability

- Governance structure of condo associations

The robust performance of medical office buildings, coupled with low vacancy rates and consistent cash flow, underscores the sector's resilience even amid economic uncertainties. Furthermore, the financial advantages of ownership, including equity building and tax deductions, make medical condominiums a compelling choice for healthcare professionals.

In light of these insights, it is crucial for potential investors to conduct thorough market analyses and consider strategic investment practices. By prioritizing informed decision-making and leveraging resources like Zero Flux for ongoing market updates, investors can navigate the complexities of medical condominium investments effectively. Embracing this growing sector not only supports financial goals but also contributes to the evolving landscape of healthcare services, ensuring that communities receive the medical attention they need.