Overview

The article titled "9 Key Insights in Commercial Real Estate News Today" provides a curated summary of significant trends and developments in the commercial real estate sector. It underscores the necessity of staying informed through data-driven insights, spotlighting various market dynamics. These include:

- The impact of HUD funding cuts

- Trends in office leasing recovery

- The implications of rising foreclosure rates

Collectively, these insights guide investors in making informed decisions about their strategies.

By focusing on the latest trends, the article captures the attention of readers who seek to navigate the complexities of the market. The discussion of HUD funding cuts, for instance, raises critical questions about future investment opportunities and risks. Furthermore, the analysis of office leasing recovery trends offers valuable context for understanding current market conditions. As foreclosure rates rise, the implications for investors become increasingly significant, prompting a need for strategic planning.

Ultimately, this article serves as a vital resource for those in the commercial real estate sector. By synthesizing key insights and trends, it empowers readers to make informed decisions that align with their investment goals. Engaging with this content not only enhances understanding but also equips investors with the knowledge necessary to adapt to an ever-evolving market landscape.

Introduction

The commercial real estate landscape is evolving at a rapid pace, driven by economic shifts, policy changes, and emerging market trends. With insights curated from over 100 sources, Zero Flux equips real estate professionals with the critical information necessary to navigate these changes effectively. Yet, as the sector encounters challenges such as potential HUD funding cuts and rising foreclosure rates, the pressing question arises: how can investors adapt their strategies to capitalize on opportunities while mitigating risks? This article explores nine key insights from today's commercial real estate news, offering a comprehensive roadmap for informed decision-making in an unpredictable market.

Zero Flux: Daily Insights on Commercial Real Estate Trends

Zero Flux delivers a daily newsletter that curates essential insights from over 100 sources, ensuring real estate professionals stay informed about commercial real estate news today and the latest trends and developments in the sector.

By emphasizing data-driven insights, Zero Flux empowers subscribers to make informed decisions grounded in factual information rather than opinions.

This unwavering commitment to quality content solidifies Zero Flux's position as a trusted resource within the industry, ultimately enhancing the decision-making capabilities of its audience.

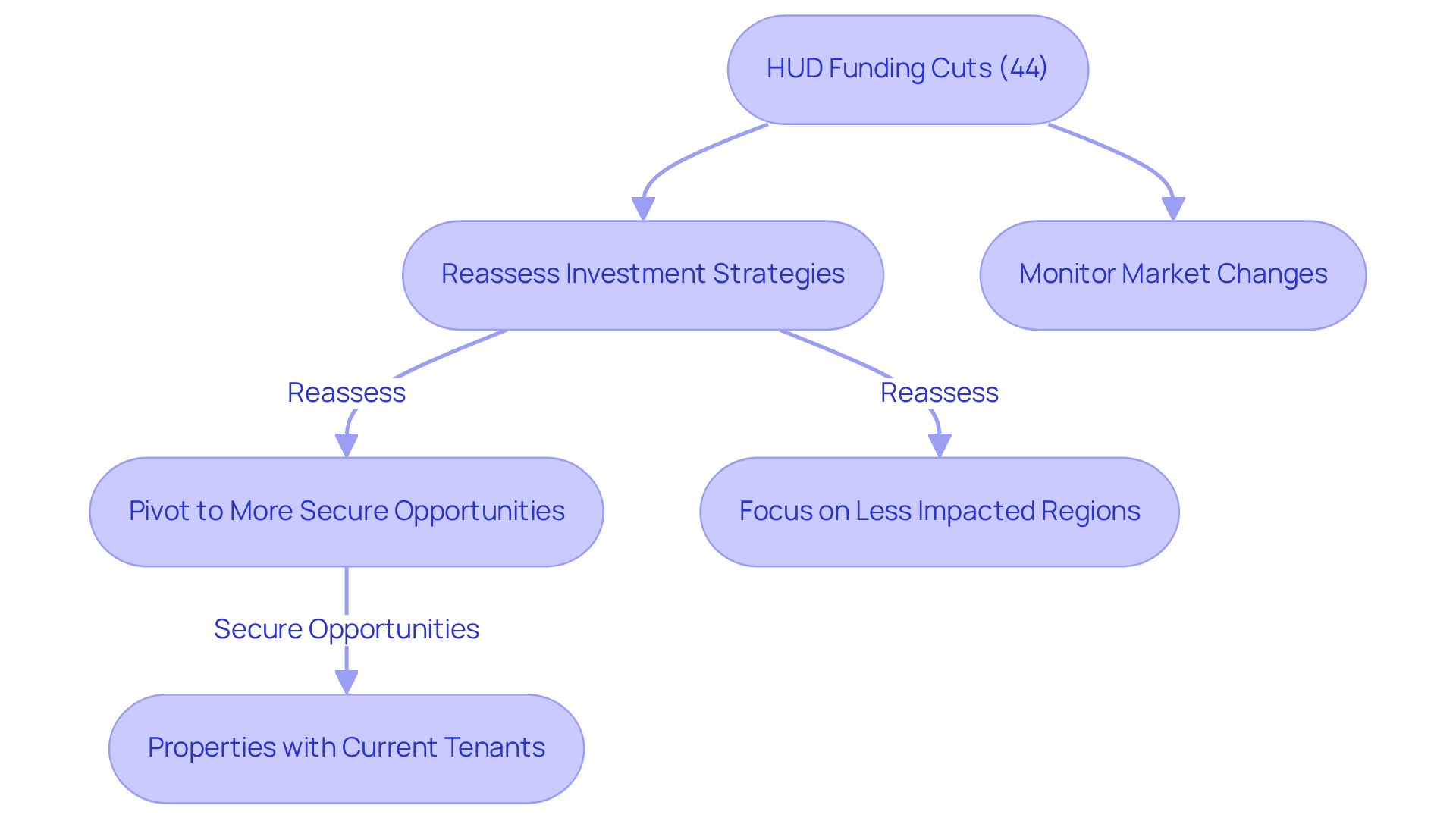

HUD Cuts: Implications for Real Estate Investment Strategies

Recent proposals to cut HUD funding by nearly 44% warrant serious attention, as they could have far-reaching effects on the affordable housing sector. Investors must reassess their strategies, particularly in markets heavily reliant on federal funding. The potential decline in asset values and stakeholder confidence raises critical questions:

- How will this shift impact your investment choices?

As a result, there may be a pivot towards more secure opportunities, such as properties with current tenants or those located in less impacted regions. Investors should closely monitor commercial real estate news today and adjust their portfolios accordingly to navigate this evolving landscape.

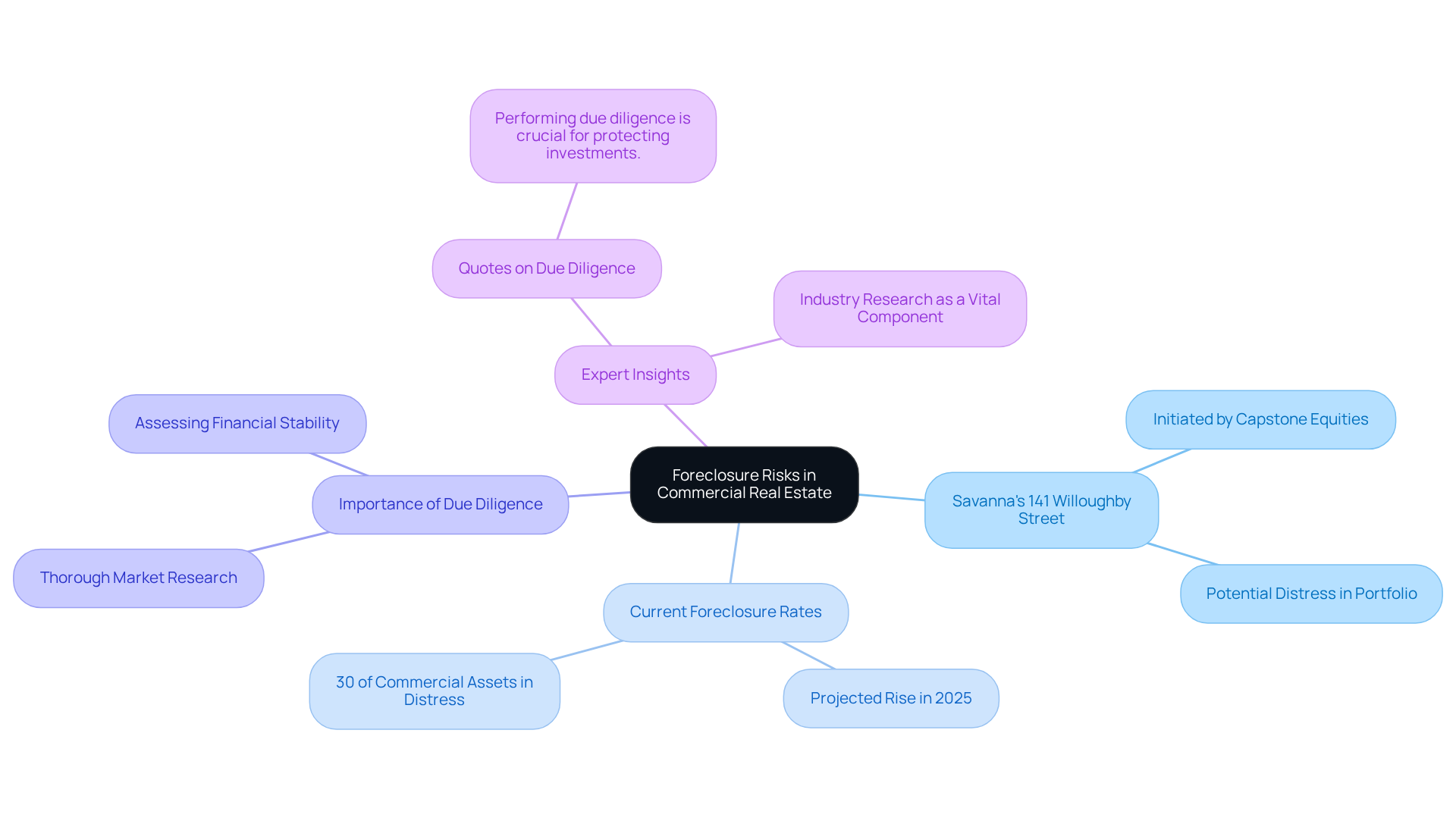

Savanna's 141 Willoughby Street: A Case Study in Foreclosure Risks

Savanna's 141 Willoughby Street in Brooklyn has entered foreclosure, highlighting the inherent risks tied to commercial real estate investments, as reported in commercial real estate news today. This foreclosure, initiated by Capstone Equities, signals potential distress within Savanna's portfolio. It serves as a crucial reminder for investors to engage in thorough due diligence and assess the financial stability of assets prior to committing funds. Understanding the indicators of financial distress can empower investors to mitigate risks and make more informed decisions.

Looking ahead, commercial real estate news today indicates that foreclosure rates are projected to rise in 2025, with nearly 30% of commercial assets currently facing financial difficulties. This statistic reflects broader trends within the sector. Expert opinions emphasize that extensive industry research and financial assessment are vital components of successful property investments. Such diligence aids stakeholders in navigating the complexities of the market and avoiding costly missteps.

As industry experts assert, "Performing due diligence is not merely a best practice; it's crucial for protecting investments in today's unstable environment." This statement underscores the importance of leveraging comprehensive industry insights, particularly commercial real estate news today, such as those provided by Zero Flux, which consolidates information from over 100 sources to keep investors informed about the latest developments. By utilizing these insights, investors can enhance their strategies and safeguard their financial interests.

Office Leasing Recovery: Trends and Opportunities for Investors

According to commercial real estate news today, the office leasing sector is experiencing a robust recovery as of mid-2025, characterized by a significant increase in leasing activity. Companies are actively reinforcing return-to-office policies, with 44% of global real estate decision-makers now mandating five days a week in the office, a notable rise from 34% just two years prior. This shift has resulted in an average office attendance of approximately three days per week, which has led to a marked decline in move-outs.

This trend not only signals a stabilization in the market, as evidenced by the overall vacancy rate decreasing slightly to 18.9% in the fourth quarter of 2024, but according to commercial real estate news today, it also creates profitable opportunities for buyers to acquire office spaces at advantageous prices before a full market recovery occurs. The average sale price of an office building in 2025 is projected to be $254 per square foot. According to commercial real estate news today, investors should focus on high-quality assets located in prime areas, as these properties are well-positioned to attract tenants who are seeking modern amenities and flexible workspace solutions.

Analysts suggest that the current environment favors those who act decisively. The demand for premium office spaces is anticipated to rise, driven by the evolving needs and preferences of the workforce. Are you ready to seize these opportunities?

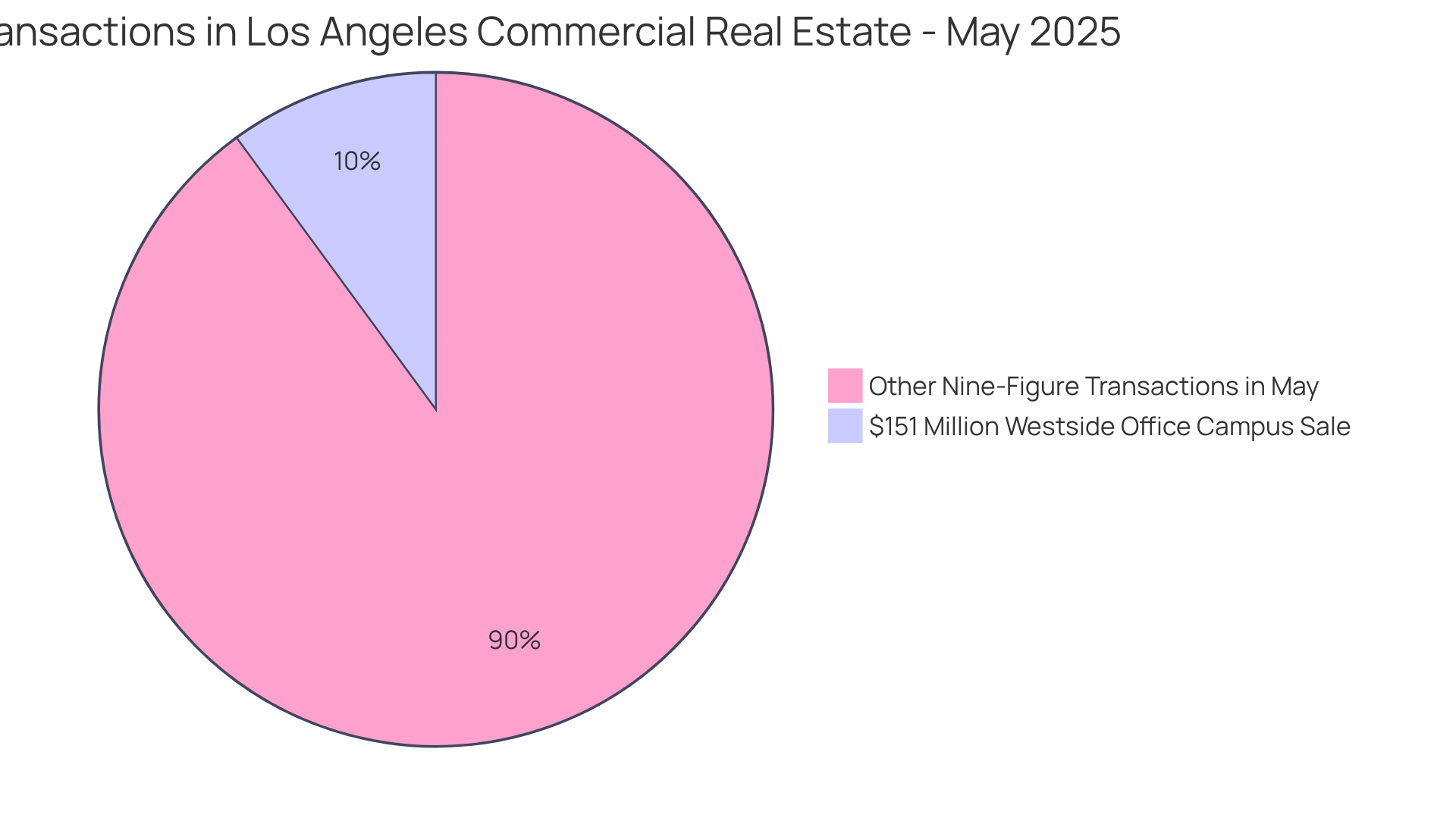

$151M Westside Office Campus Sale: Market Activity Insights

The recent sale of a Westside office campus for $151 million stands out as one of the largest transactions in Los Angeles for 2025, reflecting a robust demand for high-quality office spaces. This significant transaction underscores the ongoing investor interest in premium real estate, which is a key topic in commercial real estate news today, even amidst the challenges facing the sector.

Notably, in May, 45 nine-figure transactions were completed, up from 43 in April, as reported in the commercial real estate news today, indicating strong activity in the commercial property sector. Analysts observe that such substantial sales not only reflect strong pricing dynamics but also serve as essential benchmarks for future investments.

This is particularly relevant as the U.S. office sector navigates a divide between distressed assets and high-quality properties. As the sector experiences fluctuations, understanding these key transactions can provide valuable insights into recovery trajectories and evolving demand patterns within the commercial real estate news today.

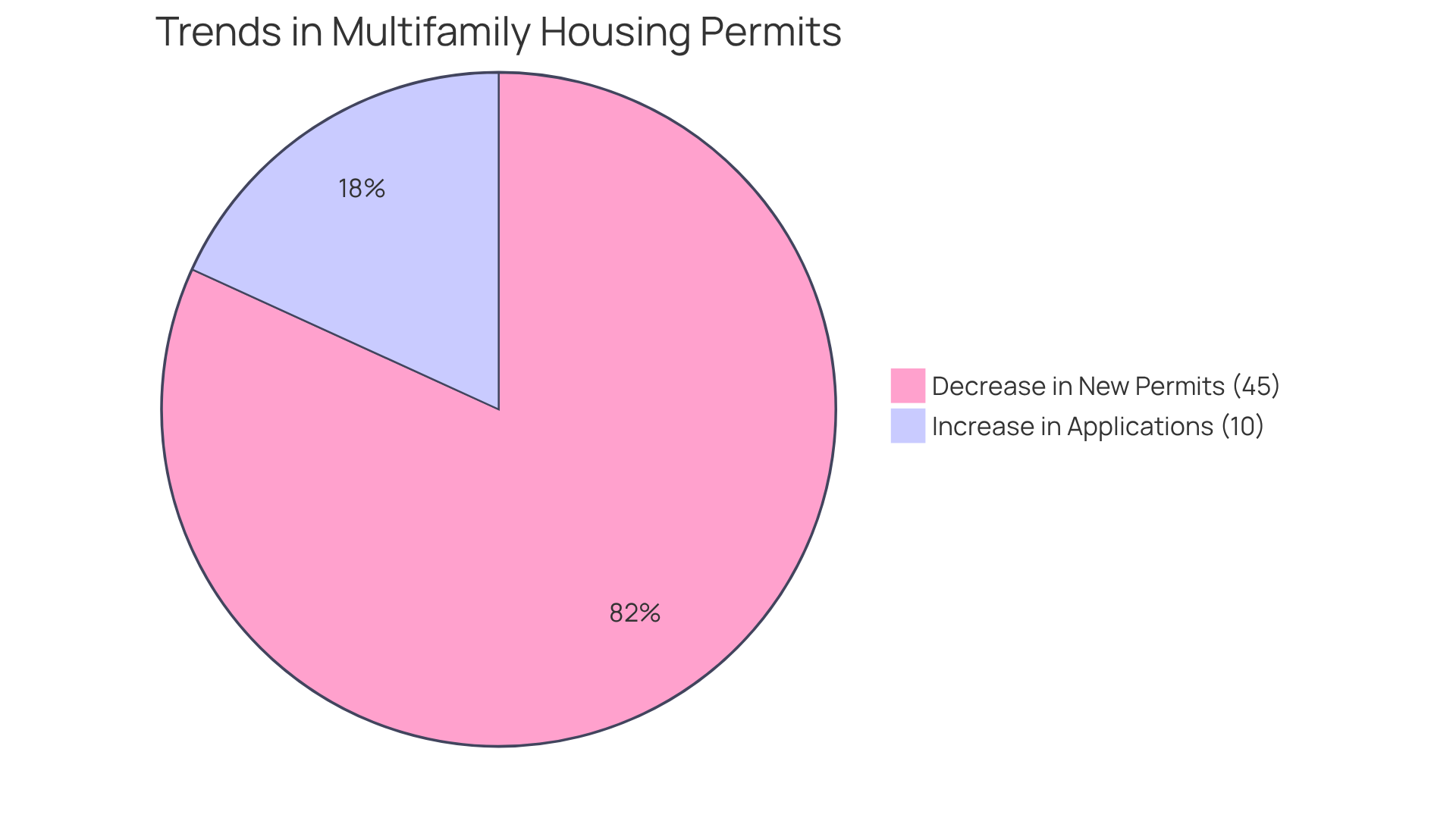

Multifamily Permitting Levels: Key Market Trends for Investors

As of early 2025, multifamily permitting levels are stabilizing, marked by a modest uptick in applications—a 10% increase compared to the previous quarter. However, this rise is overshadowed by a significant decline in new permits relative to pre-pandemic figures. In fact, multifamily permits have plummeted by 45% since 2020, reflecting a broader trend of reduced production in this sector. This decline poses potential challenges for the rental market, as tighter supply could lead to higher rents in the coming years, with an anticipated rent growth slowdown of 1.2% in 2024.

Industry experts emphasize the importance of closely monitoring trends highlighted in commercial real estate news today, as the ramifications of reduced permitting could profoundly impact investment strategies. Investors are encouraged to consider older multifamily units, which have historically shown stronger rent growth, averaging 4.6% annually over the past decade compared to 3.4% for newer assets. Given the multifamily sector's current dynamics, strategic foresight—such as focusing on properties with established rent growth and understanding local conditions—will be crucial for navigating the evolving landscape.

$549M Multifamily Portfolio Refinance: Financing Trends to Watch

The recent $549 million refinancing of a multifamily portfolio is a topic covered in commercial real estate news today, exemplifying the dynamic nature of financing strategies within the property sector.

With the U.S. private commercial real estate credit sector valued at $4.8 trillion, the commercial real estate news today indicates that such refinancing activities hold significant weight within a broader context.

As interest rates continue to fluctuate, individuals are increasingly motivated to refinance existing debt in search of more favorable terms, which is a topic covered in commercial real estate news today.

This trend underscores the critical need for adaptable financing strategies that can respond to evolving economic conditions, as discussed in commercial real estate news today, particularly due to the growing demand for debt capital driven by loan maturities and modernization efforts.

Regular evaluations of portfolios are vital for pinpointing refinancing opportunities that can enhance cash flow and reduce costs.

Financial advisors stress the importance of a proactive approach in adjusting financing strategies to effectively navigate these changes.

Michael Searles, Head of North America - Capital Solutions, remarks, "In this Q&A, I explain why capital solutions strategies continue to gain attention despite the current uncertain backdrop and looming maturity wall."

As lower interest rates enhance liquidity and decrease loan loss reserves for banks, the potential for significant returns through strategic refinancing remains considerable.

Moreover, cautious optimism for economic expansion in 2025 may shape investor sentiment and influence decision-making regarding refinancing and investment strategies.

Housing Market Risks: Understanding the Recession Threat for Investors

As 2025 unfolds, the housing sector faces increasing scrutiny due to rising inventory levels and a slowdown in residential investment—factors many analysts view as precursors to a potential recession. Economists emphasize that the 8.1% increase in home inventory from February to March, coupled with a nearly 6% drop in existing-home sales, underscores the fragility of the current market. Citi Research has identified housing as the primary danger to the U.S. economy, stressing the necessity for stakeholders to remain vigilant.

To mitigate risks associated with a recession, investors should consider diversifying their portfolios. Strategies may involve:

- Prioritizing cash flow-positive properties, which can offer stability during economic downturns

- Exploring alternative asset classes that are less vulnerable to value fluctuations

For instance, sectors like grocery-anchored retail have demonstrated resilience, with vacancy rates at a low of 3.5% and grocery sales increasing nearly 16% year-over-year. This resilience is particularly crucial as the overall housing sector encounters challenges, suggesting that not all areas are equally impacted by economic pressures.

Furthermore, as economic conditions evolve, participants might benefit from adopting a 'wait-and-see' strategy, especially in light of the 3.9% drop in commercial property transaction activity noted in March 2025. Analysts observe that this cautious approach enables participants to assess economic conditions before making substantial commitments. By staying informed and adaptable, real estate investors can navigate the complexities of the current landscape and position themselves for future opportunities.

Memphis Industrial Market: Capitalizing on the Manufacturing Boom

The Memphis industrial sector is witnessing a remarkable boom, fueled by heightened construction activity and a surging demand for manufacturing space. As of early 2025, Memphis stands out among significant U.S. sectors, boasting over 12.5 million square feet in development. Investors should closely evaluate this market for promising opportunities, especially in logistics and distribution centers, as the demand for industrial space continues to escalate. Grasping the local economic drivers will be crucial for making informed investment decisions.

Conclusion

Zero Flux offers a vital perspective on the evolving landscape of commercial real estate, providing insights that empower investors to make informed decisions. This article underscores the necessity of adapting strategies in response to significant trends, such as the implications of HUD funding cuts and the ongoing recovery in office leasing. By prioritizing data-driven insights, stakeholders can effectively navigate the complexities of the market and mitigate risks associated with potential downturns.

Key insights from the article emphasize the critical nature of thorough due diligence, particularly in light of foreclosure risks exemplified by Savanna's 141 Willoughby Street case. Furthermore, the increase in multifamily permitting and refinancing trends highlights the dynamic nature of financing strategies within the sector. As the Memphis industrial market thrives, identifying opportunities in logistics and distribution becomes increasingly essential.

Ultimately, staying informed through resources like Zero Flux is crucial for real estate investors aiming to flourish in a fluctuating environment. By adopting a proactive approach and diversifying portfolios, stakeholders can not only weather potential economic challenges but also capitalize on emerging opportunities. The significance of these insights reinforces the need for vigilance and adaptability in the ever-evolving world of commercial real estate.