Overview

The article presents critical insights and trends in Manhattan real estate that investors must consider. It highlights a notable 5.6% rise in average sale prices and a significant increase in cash transactions, indicating a competitive market landscape influenced by affluent buyers and evolving buyer preferences. These statistics not only capture attention but also reflect the dynamic nature of the market, prompting investors to reassess their strategies. Understanding these trends is essential for making informed decisions in this competitive environment.

Introduction

The Manhattan real estate landscape is undergoing a profound transformation, driven by shifting buyer demographics, economic pressures, and emerging trends. Investors are presented with a wealth of insights, revealing both opportunities and challenges in this dynamic market.

As the average sale price climbs and cash transactions surge, questions arise regarding the sustainability of these trends and their implications for future investments. Savvy investors must consider what strategies can be employed to navigate this evolving terrain and capitalize on the latest developments in Manhattan's real estate scene.

Zero Flux: Essential Insights on Manhattan Real Estate Trends

Zero Flux delivers a daily newsletter that distills essential real estate insights from over 100 sources, spotlighting the dynamic region. By meticulously analyzing substantial data volumes, it highlights key trends crucial for investors navigating the complexities of property. Recent analyses indicate notable shifts reported in the Manhattan real estate news.

For example, the average sale price in the borough has escalated to $1,320,000, marking a 5.6% year-over-year increase, while the average price per square foot stands at $1,588, reflecting a 5.7% rise from the previous year. Overall inventory has increased by 3% compared to last year, providing a broader context for these economic dynamics.

However, according to Manhattan real estate news, contracts signed in Manhattan have dropped by 11% year-over-year, totaling 434, suggesting a potential cooling in buyer activity, despite an overall increase of about 12% in signed contracts compared to last summer.

In the under $1 million segment, a dynamic environment is anticipated, characterized by sideways price action and an influx of frustrated renters entering the market. Conversely, properties priced between $2 million and $4 million may experience modest price increases, driven by seller dynamics favoring those listings.

The luxury sector, particularly for condos and co-ops, has reached a median price of $6.52 million in the second quarter of 2025, although luxury inventory has decreased by 21%, highlighting challenges in that segment. Expert opinions suggest that elevated mortgage rates are significantly impacting home purchases, especially in lower price points, compelling buyers to negotiate with clarity, particularly in the under-$2 million sector.

As the industry transitions into summer, localized strength is expected, yet overall deal volume may decline, presenting unique opportunities for prepared buyers and sellers. Zero Flux's dedication to delivering data-driven insights empowers investors with the knowledge necessary to make informed decisions in this evolving landscape.

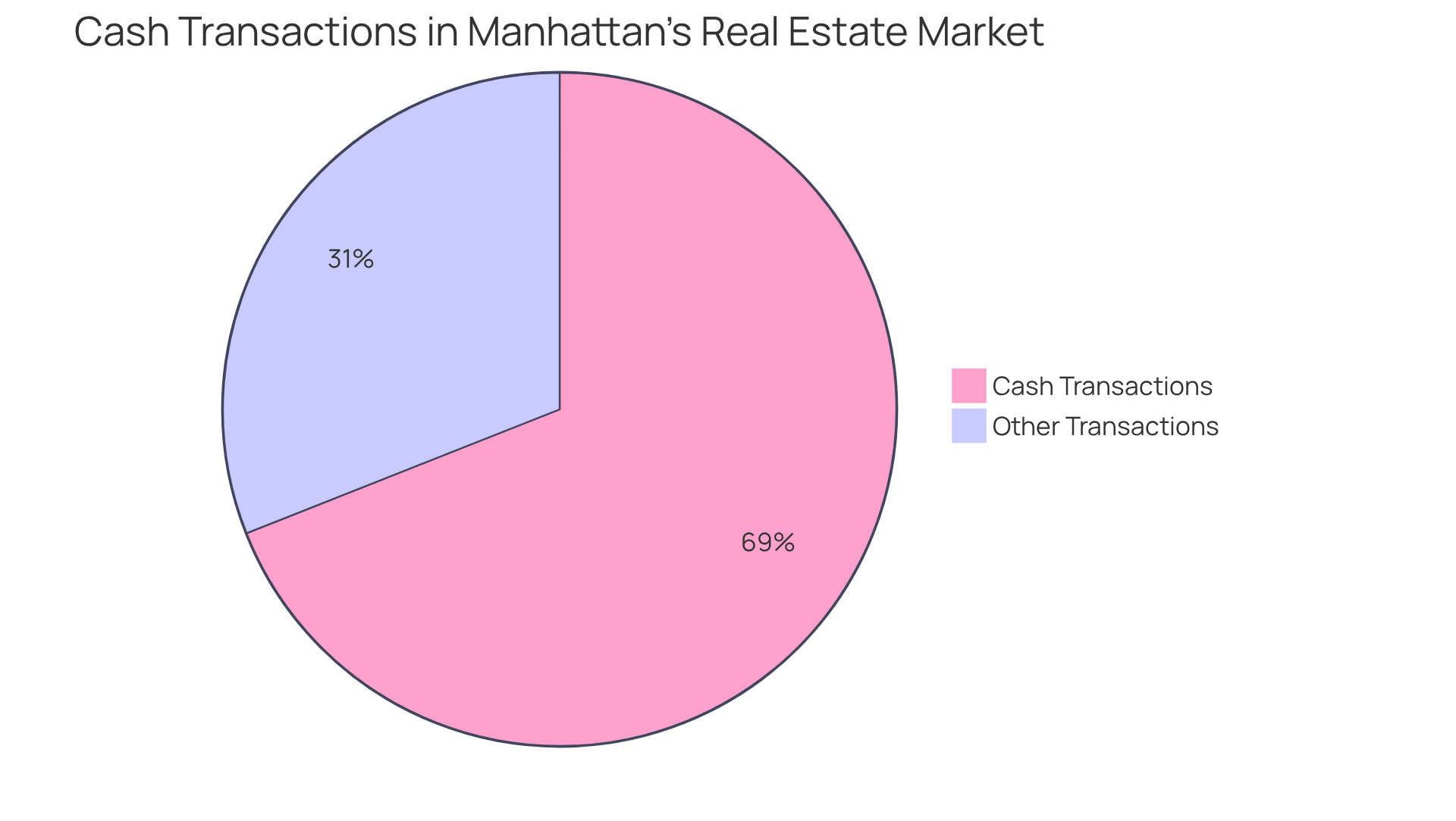

Wealthy Cash Buyers: Driving Forces in Manhattan's Real Estate Market

Manhattan real estate news reports that in the second quarter of 2025, cash transactions soared to an unprecedented 69% of all home purchases in Manhattan, marking a remarkable 23% increase in cash deals compared to the previous year. This trend underscores the growing influence of affluent consumers in the market, eager to capitalize on favorable conditions. The prominence of cash transactions not only reflects the financial strength of these buyers but also signifies a competitive advantage in a landscape characterized by rising prices and limited inventory.

As luxury transactions rose by 18% annually, with the median price of luxury property acquisitions climbing by 8.8% to just above US$6.5 million, the implications for the overall sector are profound. Furthermore, total home sales in the city increased by 17% in Q2, as reported in the Manhattan real estate news, demonstrating that cash buyers are not merely participants but pivotal players in the real estate market.

As Jonathan Miller, president of Miller Samuel, aptly noted, "The sector is demonstrating resilience, but the impact of cash purchasers is undeniable in shaping current trends." This insight not only highlights the current market dynamics but also encourages investors to consider the strategic importance of cash transactions in their investment decisions.

Emerging Buyer’s Market: Shifts in Supply and Demand Dynamics

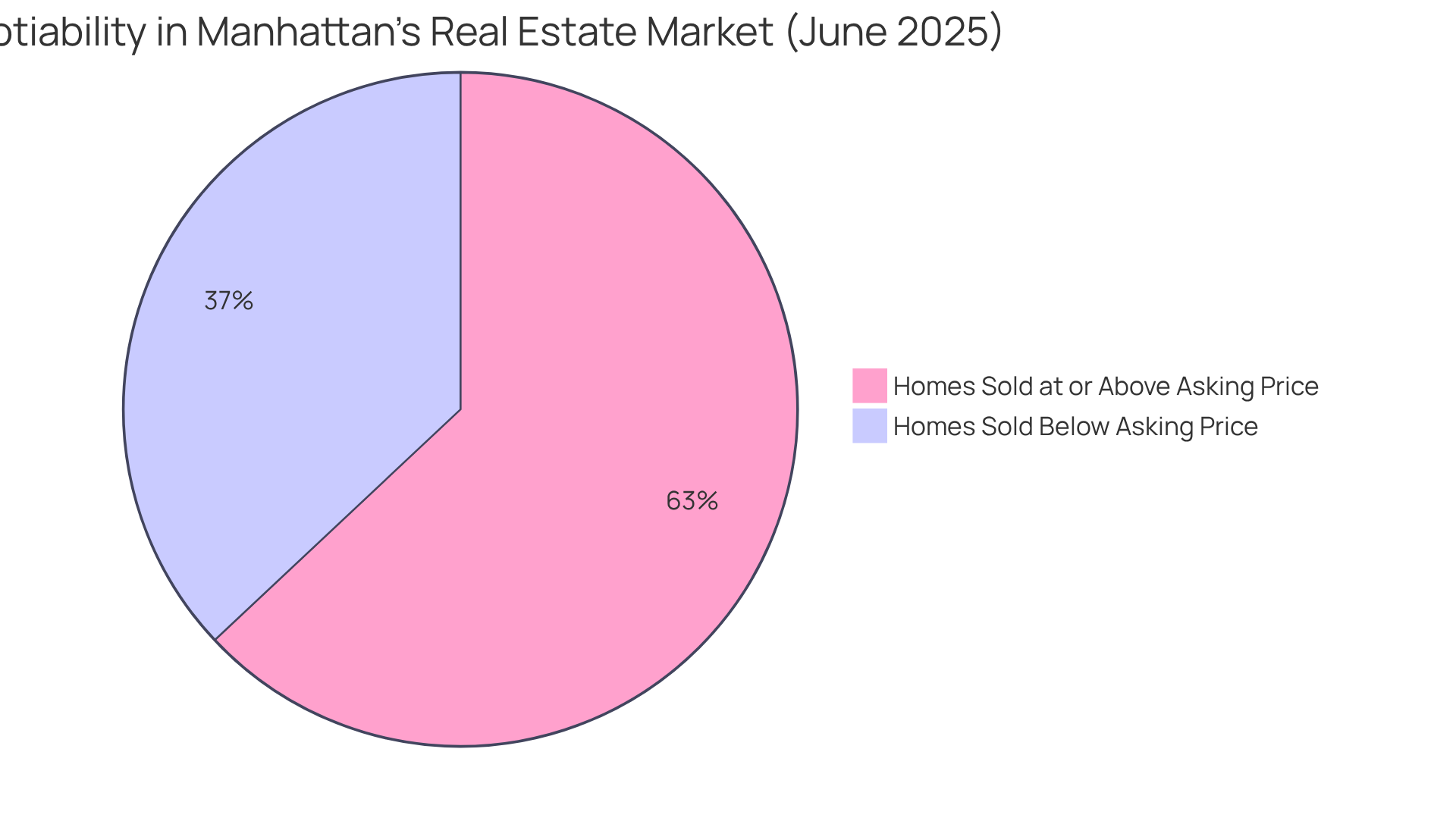

According to Manhattan real estate news, the real estate environment in the city is shifting towards a purchaser's market as of mid-2025. This change is characterized by a notable rise in inventory, currently totaling 21,969 homes available—slightly above the 10-year average by 4%—and a slowdown in price growth.

Rising mortgage rates, projected to average 6.4% in the latter half of 2025, alongside a slight decline in purchasing enthusiasm, are influencing this shift. Manhattan real estate news revealed that in June 2025, homes in Manhattan sold for an average of 2.54% below asking price, with 37% of homes sold in New York under asking price. This indicates a growing negotiability factor that investors must navigate.

While this industry evolution offers opportunities for buyers, it also necessitates strategic negotiation and careful selection of properties that promise long-term value. Investors should stay alert, as the dynamics of the financial landscape continue to evolve amidst these changes.

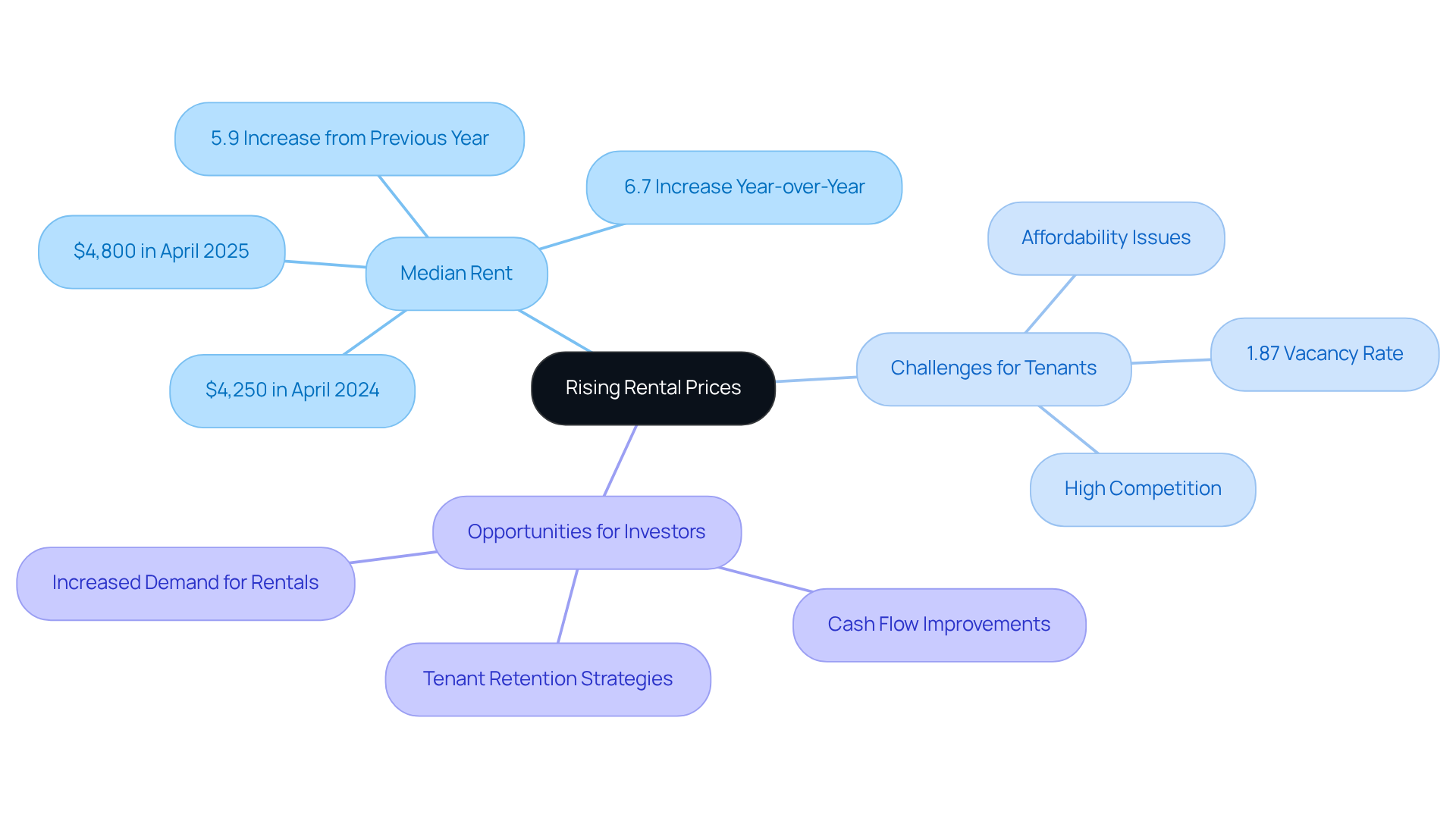

Rising Rental Prices: Challenges for Tenants and Investors

According to Manhattan real estate news, the median asking rent soared to an unprecedented $4,800 in April 2025, reflecting a substantial 6.7% increase from the previous year. This increase follows a rise from $4,250 in April 2024, marking a 5.9% year-over-year growth. Such ongoing increases in rental prices pose significant difficulties for tenants, particularly those with lower incomes, who may struggle to afford housing in an increasingly competitive environment, as indicated by a vacancy rate of only 1.87%.

Conversely, for investors, these rising rents signal a flourishing rental environment, presenting opportunities for improved cash flow and investment gains. However, it is crucial for investors to assess how these high costs impact tenant retention and the long-term viability of rental income. As Jonathan Miller, president and CEO of appraisal firm Miller Samuel, noted in the latest Manhattan real estate news, 'New York City is seeing more growth in rents than the rest of the country.'

Investors should contemplate adopting tenant retention strategies to navigate the complexities of tenant demands and economic conditions. By proactively addressing these challenges, they can ensure sustained profitability in a rapidly evolving market.

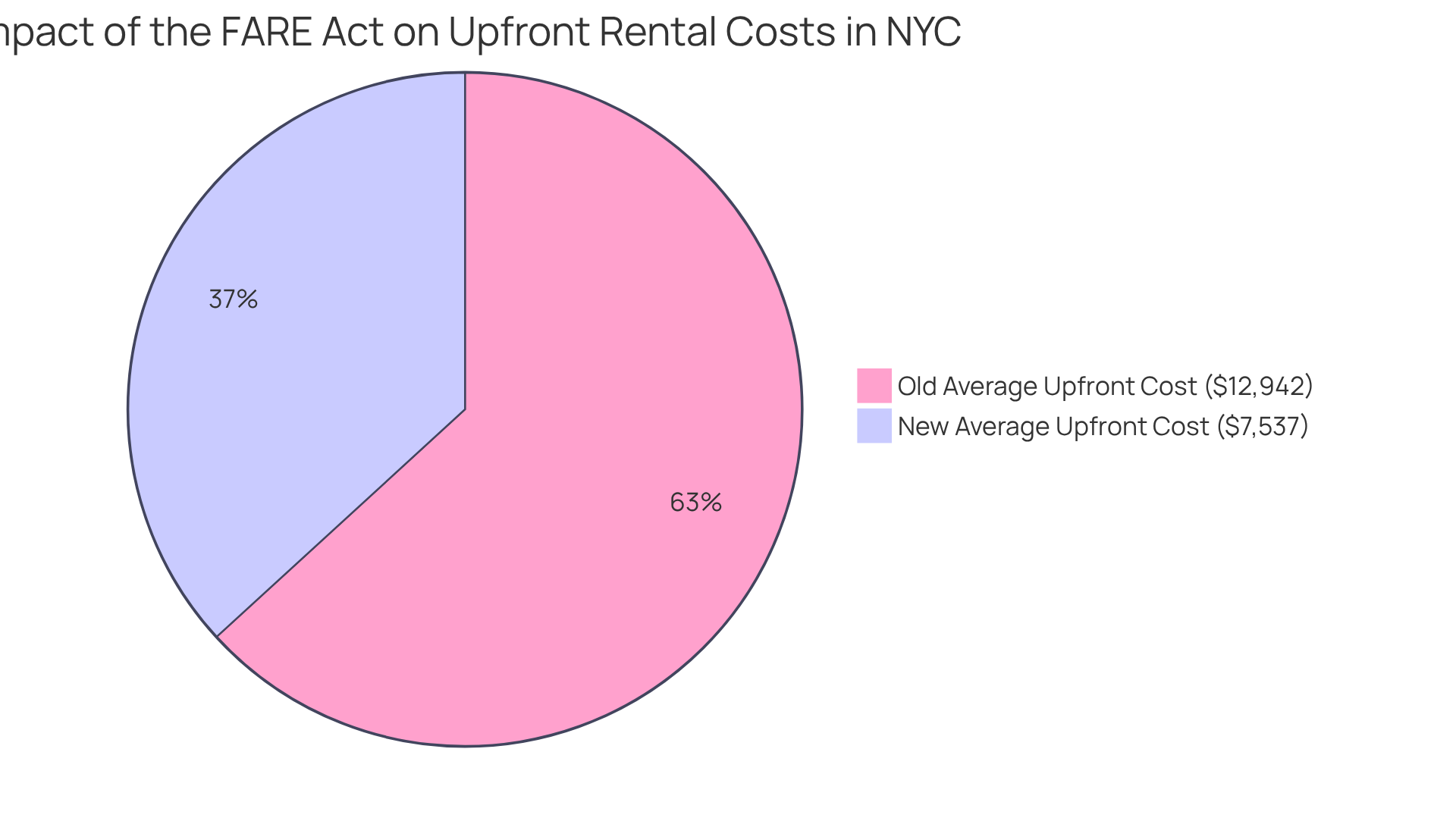

Broker Fee Reforms: Transforming Real Estate Transactions in Manhattan

The Fairness in Apartment Rental Expenses (FARE) Act, effective June 11, 2025, has fundamentally transformed the rental landscape in New York City by eliminating broker fees for renters. This landmark reform shifts the financial responsibility from tenants to landlords, making rental transactions more accessible and potentially increasing demand for rental properties. Investors should note that this change may intensify competition in the industry, as tenants now face significantly lower upfront costs.

Projections indicate that the average upfront cost of signing a new lease is expected to decrease by nearly 42%, from approximately $12,942 to $7,537. This shift not only enhances affordability for renters but also alters the dynamics of rental negotiations, as reported in Manhattan real estate news. The sector responded sharply to the FARE Act, with UrbanDigs reporting a 30% decrease in available apartments, illustrating the immediate effect of the law on the rental sector.

Realty experts stress the significance of adjusting to these changes, as they could result in a more fair rental environment. As Sydney Harewood, a seasoned realty professional, indicates, 'As NYC deals with elevated expenses and policy ambiguities, the environment benefits well-prepared purchasers in outer boroughs and prudent sellers.' Ralph Ragetté Jr. also warns that shifting broker fees to landlords may result in higher rents, as landlords could pass the costs into monthly payments.

Grasping the implications of the FARE Act is crucial for investors seeking to navigate the changing real estate transactions highlighted in Manhattan real estate news.

Demographic Shifts: Millennials and Gen Z Impacting Housing Demand

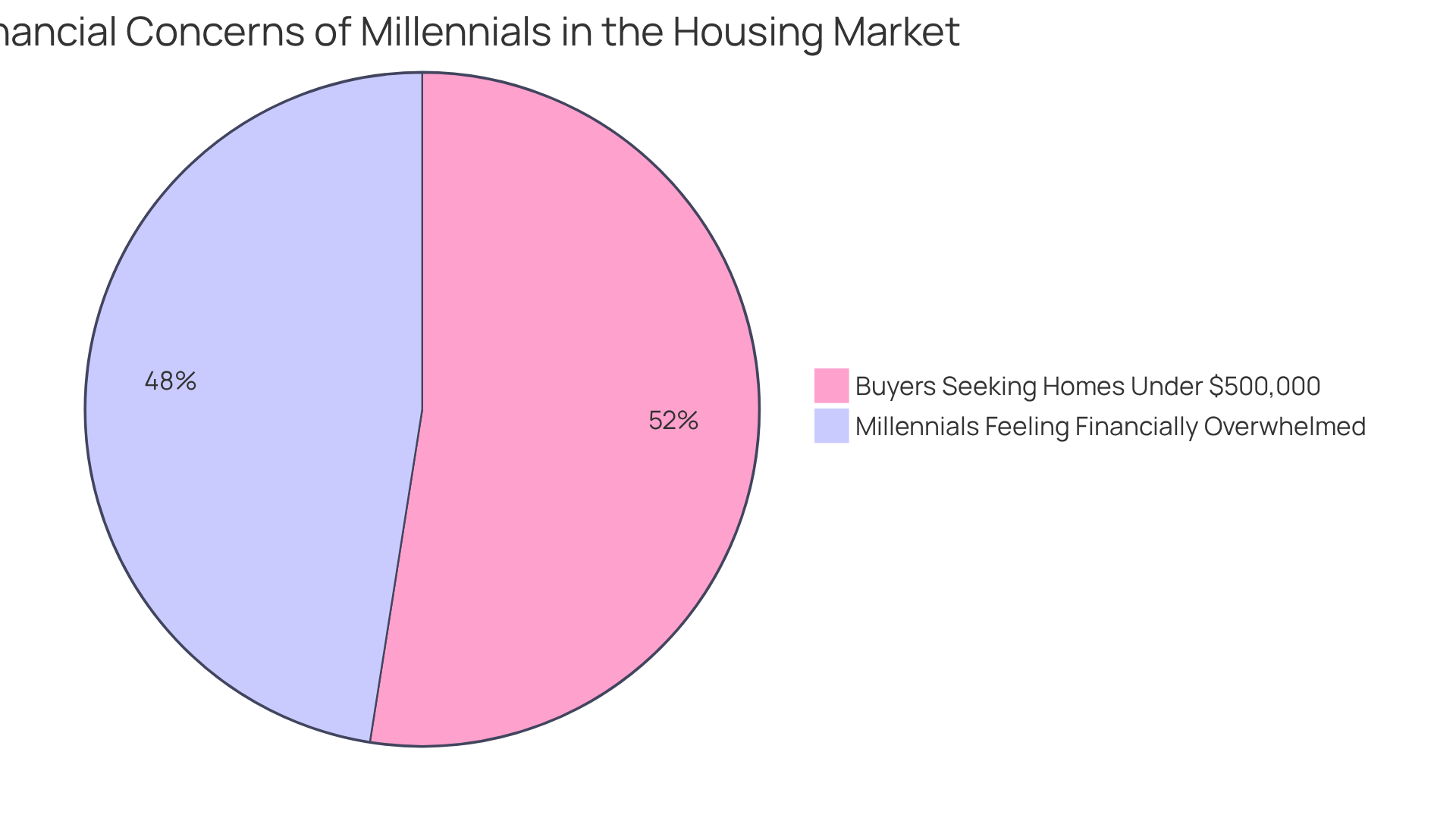

According to recent Manhattan real estate news, Millennials and Gen Z are significantly reshaping Manhattan's housing landscape, with their preferences increasingly steering demand for affordable and flexible living options. A notable trend is the rise of co-living spaces, which cater to younger generations seeking community-oriented environments that also provide cost-effective solutions. For instance, 67% of millennials feel financially overwhelmed by the prospect of buying a home, underscoring the appeal of co-living arrangements.

As these demographics prioritize urban living and sustainability, properties that align with these values are becoming more attractive to investors. The demand for eco-friendly developments is on the rise, reflecting a broader shift towards environmentally conscious living. In reality, the millennial homeownership rate in New York is merely 26.6%, the fifth lowest among major metropolitan areas, emphasizing the challenges these generations face in the housing sector.

This changing environment offers distinct opportunities for astute investors to capitalize on the shifting preferences of these impactful generations, especially as they follow Manhattan real estate news while navigating the complexities of homeownership in a challenging economic climate. Investors should consider properties that not only meet affordability criteria—74% of buyers are looking for homes priced under $500,000—but also incorporate sustainable features to align with the values of these younger buyers.

As realty agent Alexandra Gupta observes, 'Patience, planning, and the appropriate guidance are essential in today’s environment.

Luxury Developments: Responding to High-End Market Demand

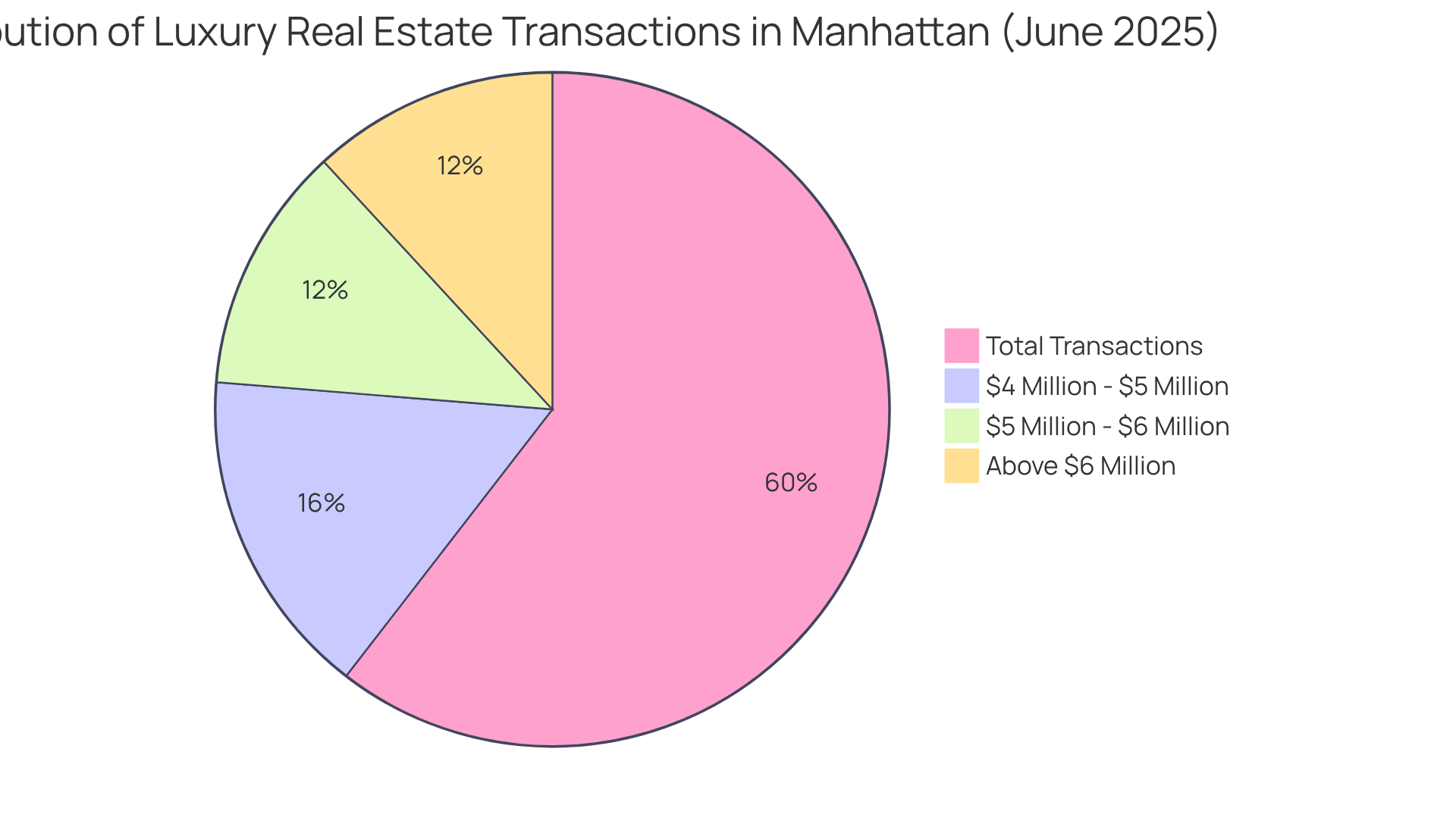

According to the latest Manhattan real estate news, Manhattan's luxury real estate sector is witnessing a remarkable upswing, with 153 high-end transactions valued at $4 million and above recorded in June 2025. The recent Manhattan real estate news highlights that this notable increase in luxury deals underscores a strong demand for premium properties, driven by affluent buyers seeking exclusive living experiences. The median price for luxury apartments has risen nearly 9% year-over-year to $6.525 million, although it has experienced a quarterly drop of 5%, reflecting the competitive nature of this segment.

Investors should closely monitor Manhattan real estate news about emerging luxury developments, as these properties often influence broader economic trends and present opportunities for significant returns on investment. As highlighted by Coury Napier, Director of Research at Serhant, 'Inventory dynamics in the second quarter demonstrated a sector struggling with both scarcity and pricing pressure,' further emphasizing the importance of strategic investment in high-end properties.

Additionally, the broader sector has seen a slight median sales price rise of 1.6% to $1.2 million compared to 2024, providing further context for investors regarding overall sector health. This information not only highlights the current market dynamics but also encourages investors to consider the implications for their investment strategies.

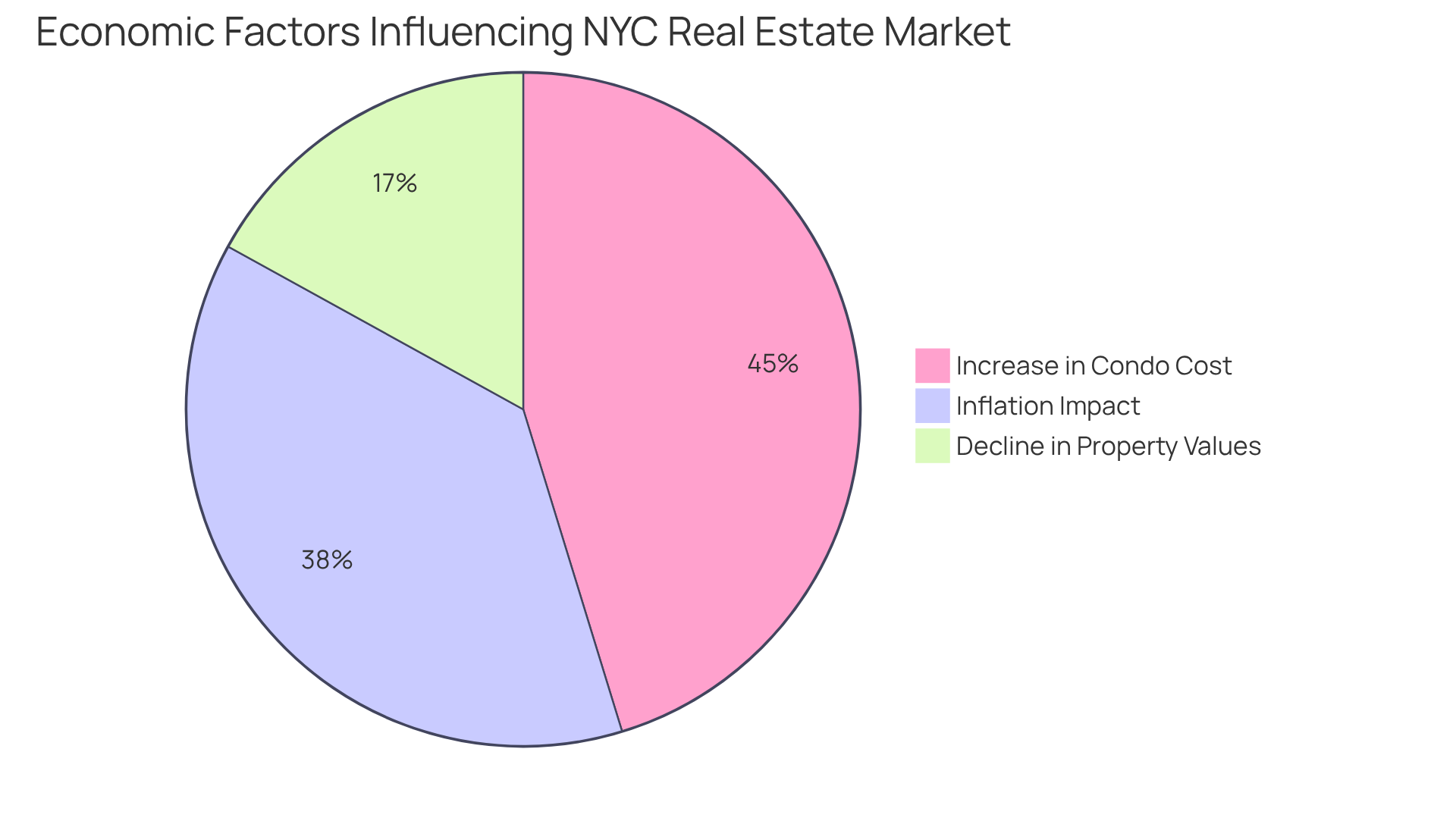

Economic Factors: Inflation and Interest Rates Affecting Real Estate

As of mid-2025, the New York City real estate market is navigating a complex landscape shaped by inflation concerns and fluctuating interest rates. Currently, mortgage rates are averaging approximately 6.4%, leading to increased financing costs and prompting prospective purchasers to adopt a more cautious approach, which in turn impacts overall demand.

Economists forecast a slight decline in property values in the coming year, with predictions indicating a -1.2% change by May 2026. Furthermore, the average cost per square foot for condos in New York City stands at $2,045, reflecting a 3.2% rise compared to the previous year.

Investors should closely monitor these economic factors, including inflation recorded at 2.67% as of June 2025, as they significantly influence property values and potential investment returns. The interplay between rising expenses and consumer sentiment underscores the importance of strategic decision-making in this evolving environment.

Remote Work Trends: Shaping Housing Preferences in Manhattan

The ongoing shift towards remote work is significantly reshaping housing preferences in the city. Many individuals are now prioritizing larger living spaces that can accommodate dedicated home offices, reflecting a broader trend towards flexible living arrangements. This increased demand for properties featuring adaptable layouts and amenities tailored for remote work is noteworthy. In fact, median rents in areas like Brooklyn surpass $3,000 per month, indicating a strong market for such properties.

Investors should take these evolving preferences into account when assessing potential investments, as properties designed to meet the needs of remote workers are likely to experience sustained interest. As noted by an unnamed source, "This flexibility has given people the freedom to prioritize comfort and space, an enduring shift from pre-pandemic urban norms."

Additionally, the significant population decline in New York City, with over 631,000 residents departing, underscores the importance of understanding these dynamics for making informed investment decisions.

Technology Integration: Revolutionizing Real Estate Transactions

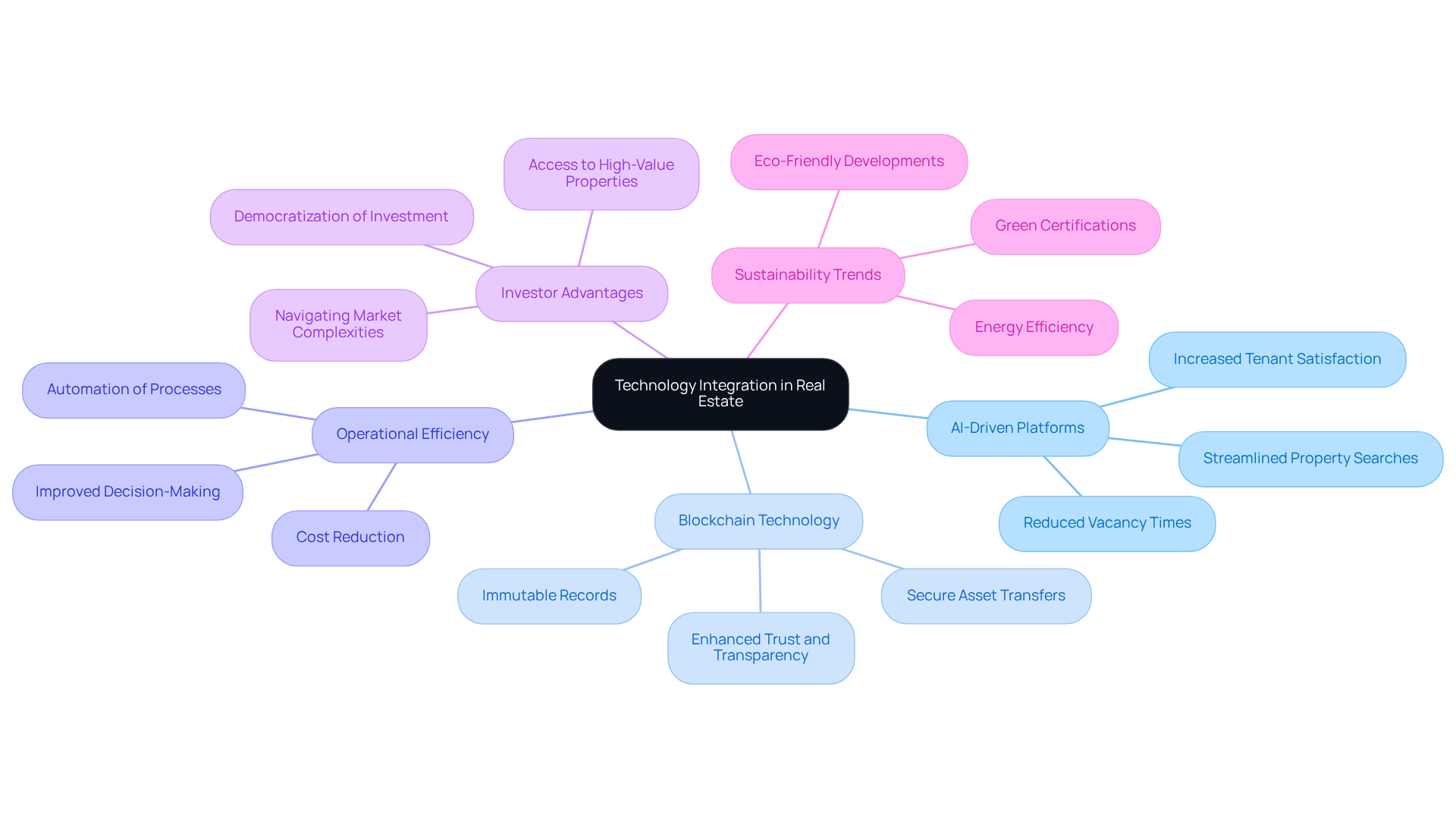

In 2025, technology is fundamentally reshaping property transactions, as reported in Manhattan real estate news. AI-driven platforms are streamlining property searches, allowing investors to swiftly identify opportunities that meet their criteria. Notably, 80% of property managers utilizing AI-driven systems have reported increased tenant satisfaction and reduced vacancy times, underscoring the significant impact of AI on operational efficiency.

Meanwhile, blockchain technology is revolutionizing transaction security by providing immutable records and secure environments for asset transfers, thereby enhancing trust and transparency in ownership and agreements. This integration of advanced technologies not only boosts operational efficiency but also transforms the competitive landscape for property professionals.

Investors who leverage these innovations can expect to gain a substantial advantage in navigating the complexities of the industry. As industry experts observe, the evolution of proptech is shifting from optional enhancements to essential tools for success in real estate. Furthermore, the rising significance of sustainability and green certifications is becoming a pivotal consideration for investors, reflecting a broader trend in the market.

Conclusion

The landscape of Manhattan real estate in 2025 presents a complex yet intriguing environment for investors. Significant trends, such as rising average sale prices and a notable increase in cash transactions, underscore the necessity of understanding these dynamics for informed investment decisions. The shift towards a buyer's market, alongside the impact of demographic changes and economic factors, highlights the need for strategic planning in this evolving sector.

Key insights reveal that while the luxury market continues to thrive, challenges such as rising rental prices and the implications of recent broker fee reforms are reshaping the rental landscape. The growing influence of Millennials and Gen Z on housing demand emphasizes the need for properties that align with their values, particularly in terms of affordability and sustainability. Furthermore, the integration of technology into real estate transactions is revolutionizing how investors navigate the market, enhancing operational efficiency and transparency.

Investors are encouraged to remain vigilant and adaptable as these trends unfold. By leveraging data-driven insights and understanding the shifting preferences of today’s buyers, opportunities abound in Manhattan's real estate market. Embracing these changes not only positions investors for success but also contributes to a more sustainable and equitable housing environment in this iconic city.