Overview

The article titled "9 Key Retail Real Estate News Trends Shaping 2025" identifies significant trends poised to influence the retail real estate market in the coming years. It outlines various dynamics, including:

- The impact of e-commerce growth

- Evolving consumer behaviors

- The critical role of sustainability and technology in shaping investment strategies and operational practices within the retail sector

In 2025, the retail real estate landscape will be shaped by a blend of consumer preferences for experiential shopping and sustainability, alongside technological advancements that bolster operational efficiency. Insights reveal that retailers are adapting their strategies to meet the evolving demands of Millennials and Gen Z. They are also leveraging data and technology to optimize operations and enhance customer engagement in an increasingly competitive market.

Introduction

In a rapidly evolving retail landscape, the dynamics of real estate are being reshaped by a confluence of trends and challenges that demand keen attention from industry professionals. Insights drawn from a myriad of sources illuminate critical developments—from the rising significance of low-tax states and the transformative impact of e-commerce to the sustainability initiatives driving consumer choices.

As the retail sector grapples with issues like rising theft and changing consumer behaviors, understanding these trends becomes essential for stakeholders aiming to navigate the complexities of the market. This article delves into the multifaceted factors influencing retail real estate and explores how strategic adaptations can unlock new opportunities in 2025 and beyond.

Zero Flux: Daily Insights on Retail Real Estate Trends

Zero Flux provides essential daily insights into retail real estate news, meticulously curating information from over 100 diverse sources to deliver a clear overview of market dynamics. Subscribers enjoy a selection of 5-12 handpicked insights that encompass critical topics such as market trends, investment opportunities, and demographic shifts. This targeted approach not only keeps professionals informed but also empowers them to make data-driven decisions in a rapidly changing environment.

As we look toward 2025, the commerce sector faces significant challenges, with 76% of industry executives acknowledging increasing theft as a major hurdle. Despite these challenges, the consumer market has demonstrated resilience, maintaining the lowest vacancy rate among commercial property types at just 2.6%. Notably, net absorption has plummeted by 77% year-over-year; however, rents have risen by 1.9%, indicating a complex yet stable market environment.

Retailers are increasingly prioritizing capital allocation to foster growth and competitive advantage, utilizing accurate data and analytics to enhance customer experiences. This strategic focus is vital as the industry transitions into a more digitized future. Recent case studies highlight regions like Salt Lake City and Norfolk, where rent increases have exceeded 6%, contrasting with notable space losses in Los Angeles. This underscores the varied dynamics across markets. As Jordan B. noted, investor interest is becoming more strategic, favoring durable formats and prime locations, further emphasizing the importance of data in understanding these trends. The insights provided by Zero Flux are indispensable for industry professionals seeking to navigate the trends highlighted in retail real estate news effectively. By prioritizing data integrity and accurate reporting, the newsletter establishes itself as a reliable resource, enabling subscribers to stay ahead in the evolving commercial property landscape.

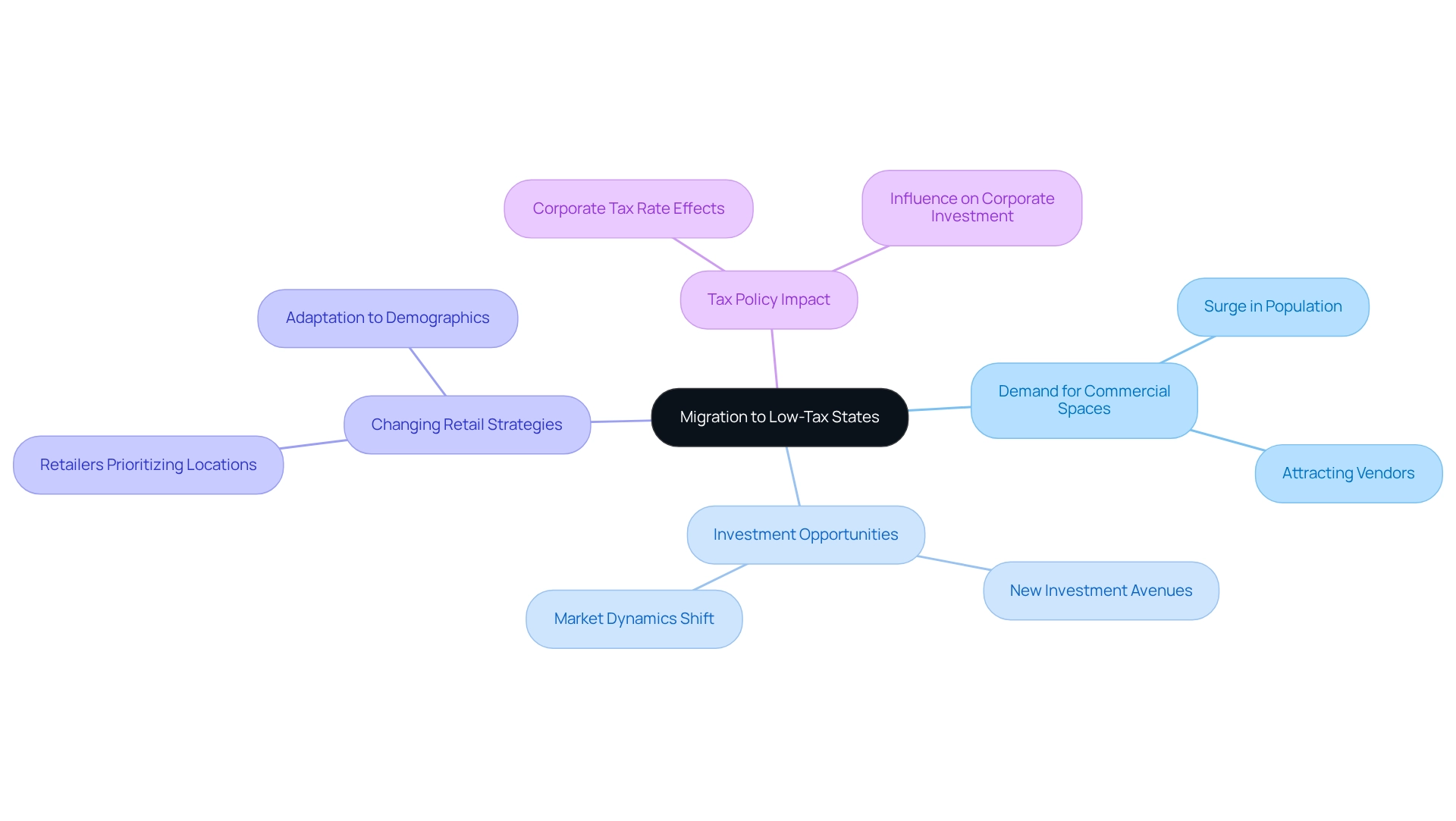

Migration to Low-Tax States: Impact on Retail Real Estate

The movement of people and companies to low-tax states is significantly altering the commercial property landscape. States such as Texas and Florida are witnessing a surge in population as residents seek more favorable tax conditions. This trend not only boosts the demand for commercial spaces but also attracts vendors eager to access the growing consumer base. By 2025, consumer demand in these states is expected to increase significantly, driven by the influx of new residents and companies. Zero Flux offers a daily collection of 5-12 selected property insights that emphasize these trends.

The effect of low-tax states on commercial real estate demand is profound. As more individuals relocate, the demand for commercial services rises, encouraging businesses to invest in these areas. This shift creates new investment opportunities and alters market dynamics, compelling businesses to adapt to changing demographics. For instance, the proposal to raise corporate tax rates under Harris's tax plan could deter investment in higher-tax states, further amplifying the appeal of low-tax environments. This case study illustrates how tax policies influence corporate investment decisions, underscoring the necessity of maintaining competitive tax rates to attract businesses.

Experts highlight that this migration trend is transforming commercial strategies. Katherine Loughead emphasizes that lawmakers should consider economic realities when making changes to tax and economic policies. According to retail real estate news, retailers are increasingly prioritizing locations in Texas and Florida, where the economic climate supports growth. Consequently, these states are becoming hotspots for commercial investment, with projections indicating a continued rise in demand through 2025. The combination of favorable tax policies and a growing population positions low-tax states as essential players in the commercial property market, creating a compelling case for investment in these areas.

Millennials and Gen Z Mobility: Shaping Retail Real Estate Strategies

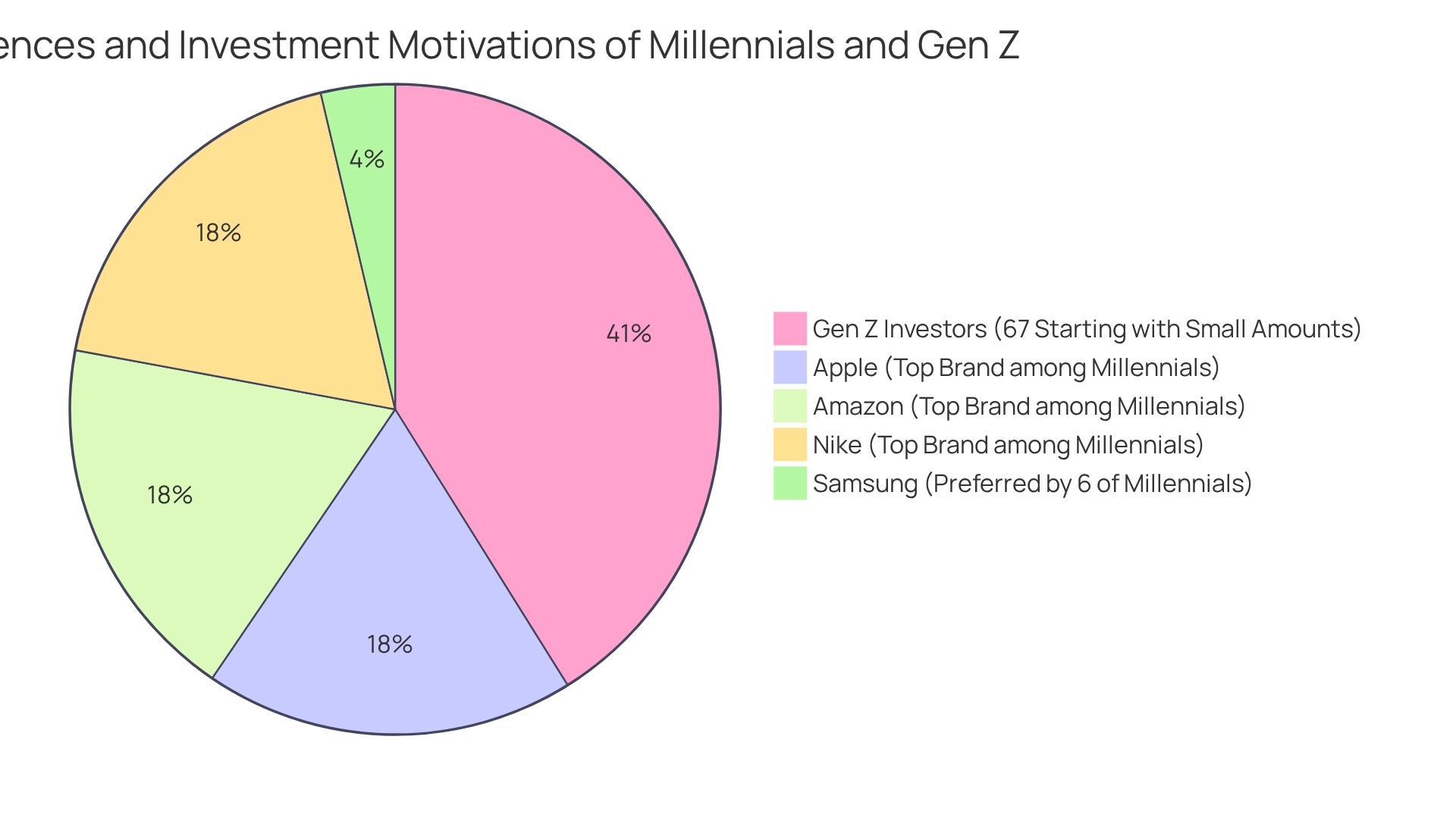

Millennials and Gen Z are fundamentally transforming commercial real estate strategies through their unique mobility patterns and preferences. These generations exhibit a strong inclination towards urban environments that offer a blend of amenities and experiential opportunities. Consequently, retailers are reassessing their location selections and store designs to align with these changing buyer demands, as highlighted in retail real estate news, which shows that investments in mixed-use developments have surged to meet the lifestyle aspirations of younger shoppers. This trend is not merely a response to market pressures; it reflects a strategic pivot to ensure relevance in an increasingly competitive landscape.

For instance, a recent case study emphasizes that brands such as Apple, Amazon, and Nike resonate strongly with Millennials, suggesting a preference for technology, online shopping, and clothing that seamlessly integrate into urban living. Moreover, Samsung has emerged as the most favored electronics brand among Millennials, with 6% identifying it as their preferred choice, underscoring the importance of brand alignment with buyer values.

Statistics reveal that 67% of Gen Z investors initiated their investment journeys due to the ease of starting with small sums of money, illustrating their proactive approach to financial involvement. This demographic's preferences are compelling sellers to adopt innovative strategies that prioritize urban living trends, ensuring that shopping spaces are not merely transactional but also experiential. Additionally, HubSpot notes that 84% of Gen Z are more likely to buy from companies that treat their workers well, highlighting the significance of corporate responsibility in attracting younger consumers. As we approach 2025, staying informed about retail real estate news will be essential for stakeholders striving to succeed in the commercial real estate sector.

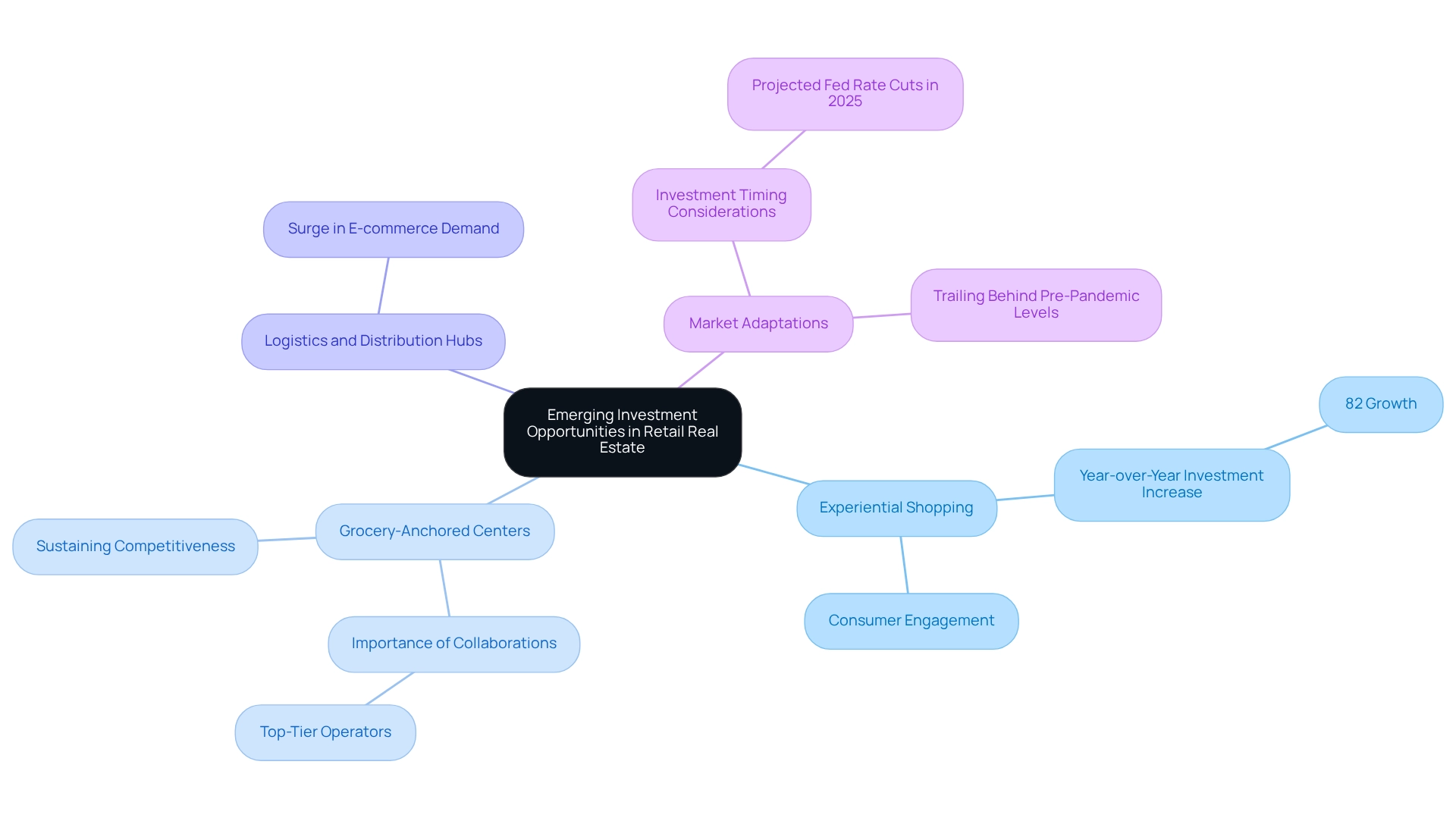

Emerging Investment Opportunities in Retail Real Estate

The commercial landscape is experiencing a remarkable transformation, unveiling a spectrum of emerging investment opportunities. Experiential shopping, which merges purchasing with entertainment, is gaining traction as consumers increasingly seek engaging buying experiences. This trend is underscored by an impressive year-over-year increase of 82% in investments in larger commercial formats, reflecting a robust interest in properties that offer distinctive interactions and experiences.

Grocery-anchored shopping centers are also proving to be exceptionally attractive to investors. Collaborations with top-tier operators are critical for effective scaling and tenant management in these centers, ensuring they sustain competitiveness and relevance in the market. As buyer demand rebounds, larger-scale commercial investments are projected to persist through 2025, with investors keen on acquiring properties at costs lower than their replacement values. As freelance author Kristen Smithberg notes, "Value-add opportunities for larger-box, trophy power centers or malls are anticipated to remain appealing to well-capitalized investors taking advantage of the ongoing recovery in consumer demand for these shopping formats."

Moreover, the surge in e-commerce has amplified the demand for logistics and distribution hubs, further expanding investment opportunities within commercial properties. It is crucial to recognize that despite the uptick in lending, commercial real estate markets still lag behind pre-pandemic levels, which may affect investment strategies. Additionally, with two Fed rate cuts projected in 2025, investors should carefully consider the timing of their investments as the market continues to evolve. These trends highlight the importance of adapting investment approaches to leverage the shifting dynamics of consumer behavior and commercial operations.

Office Leasing Recovery: Implications for Retail Spaces

The revival of office renting in urban areas is poised to significantly benefit commercial spaces. As employees return to the office, foot traffic in nearby commercial establishments is expected to rise, leading to increased sales and heightened demand for retail locations. Notably, average office attendance currently hovers around three days per week, a trend anticipated to correlate directly with an uptick in shopping foot traffic, thus providing a steady influx of potential clients for local vendors.

Retailers are strategically positioning themselves in proximity to office buildings to capitalize on this surge in foot traffic. A prime example is Boston's recent leasing activity, underscored by Biogen's substantial 580,000-square-foot lease, which exemplifies the renewed momentum in office markets and its positive repercussions on commercial dynamics. As Coy Davidson, Senior Vice President, remarked, 'Construction remains restricted,' indicating challenges in the office market that may indirectly affect commercial spaces, which is important in retail real estate news.

As office leasing improves, investors should closely monitor these trends, as the interplay between office occupancy and commercial performance becomes increasingly vital in retail real estate news. Emerging commercial strategies are focused on leveraging proximity to office workers, offering convenient services and products tailored to their needs. Furthermore, specialists suggest that the rise in foot traffic from office employees will enhance the sustainability of commercial areas, particularly those that adapt to the evolving demands of shoppers in this new landscape.

It is also crucial to recognize that certain obsolete properties may deter further investment, underscoring potential risks in the commercial market as office leasing recovers.

Mixed Retail Performance: Navigating Challenges and Opportunities

The commerce sector is currently navigating a landscape marked by mixed performance, driven by evolving consumer behaviors and economic pressures. E-commerce continues to thrive, experiencing substantial growth that surpasses conventional shopping, while other sectors face considerable difficulties. Increasing business expenses, price competition, and theft in stores are not merely operational challenges; they directly affect the viability and profitability of commercial real estate investments. Notably, 69% of industry leaders indicate that weakened public trust, exacerbated by next-gen technology, presents a significant challenge for their companies, underscoring the urgent necessity for strategic adjustment.

Store closures and decreasing foot traffic have emerged as common problems, compelling stakeholders to reconsider their approaches. Successful retailers are fostering a feedback-driven culture, encouraging frontline teams to share insights that enhance the customer journey. This proactive strategy not only fosters innovation but also assists retailers in adapting to changing buyer preferences.

Current performance metrics reveal that while Walmart U.S. faced a 0.6% drop in inventory levels last quarter, it still achieved mid-single-digit comparable growth, demonstrating the varied outcomes within the sector. As businesses confront these challenges, they must strategically allocate capital and manage expenditures to remain competitive. Optimized capital allocation is essential; as Daniel Edsall, Global Grocery practice co-lead at Deloitte Consulting LLP, observes, outperformers allocate capital strategically, with lower debt reliance and excellent capital expenditure management.

In summary, the commercial landscape in 2025 is characterized by both challenges and opportunities. Stakeholders who focus on innovative strategies and adapt to consumer needs will be better positioned to succeed in this dynamic environment, particularly in their property investments.

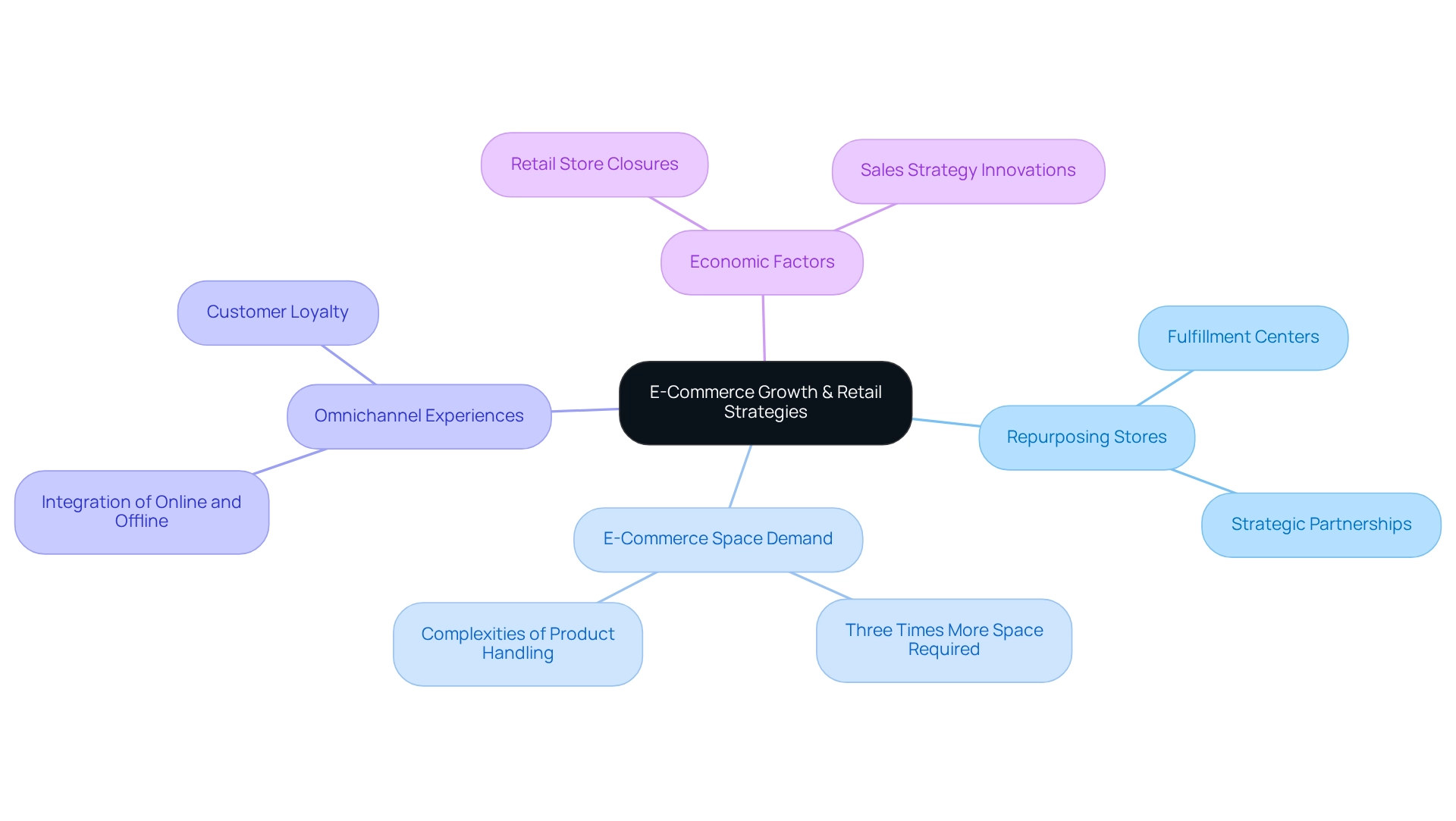

E-Commerce Growth: Transforming Retail Real Estate Strategies

Retail real estate news indicates that the explosive growth of e-commerce is fundamentally transforming commercial property strategies as businesses strive to provide a unified omnichannel experience. By 2025, physical stores are increasingly being repurposed as fulfillment centers, facilitating rapid order pickups and returns. This shift not only enhances customer convenience but also optimizes inventory management. Retailers are investing heavily in technology to enrich in-store experiences, ensuring that their physical locations remain vital in a predominantly digital landscape.

The demand for e-commerce space is substantial; it necessitates around three times more area than conventional commerce due to the complexities of product handling and distribution. According to retail real estate news, this trend presents significant opportunities for real estate developers, particularly in transforming vacant commercial spaces into fulfillment centers. By forming strategic partnerships with e-commerce companies, developers can stay informed through retail real estate news about the evolving landscape of warehousing demand.

As e-commerce sales in the U.S. market surged by nearly nine percentage points from 2015 to 2024, the need for innovative sales strategies has never been more essential. Specialists emphasize that successful omnichannel shopping experiences depend on merging physical and digital platforms, enabling sellers to effectively satisfy buyer expectations. Susan Hall, a contributor to Shoptrial.co, asserts that "the integration of online and offline experiences is essential for retailers to thrive in today's market." This integration not only drives sales but also enhances customer loyalty, positioning retailers to flourish in an increasingly competitive environment.

Moreover, economic factors influencing shop closures are under analysis, highlighting the broader challenges facing the industry. Retailers must adapt to these changes to remain relevant and competitive.

Sustainability Trends: Driving Change in Retail Real Estate Development

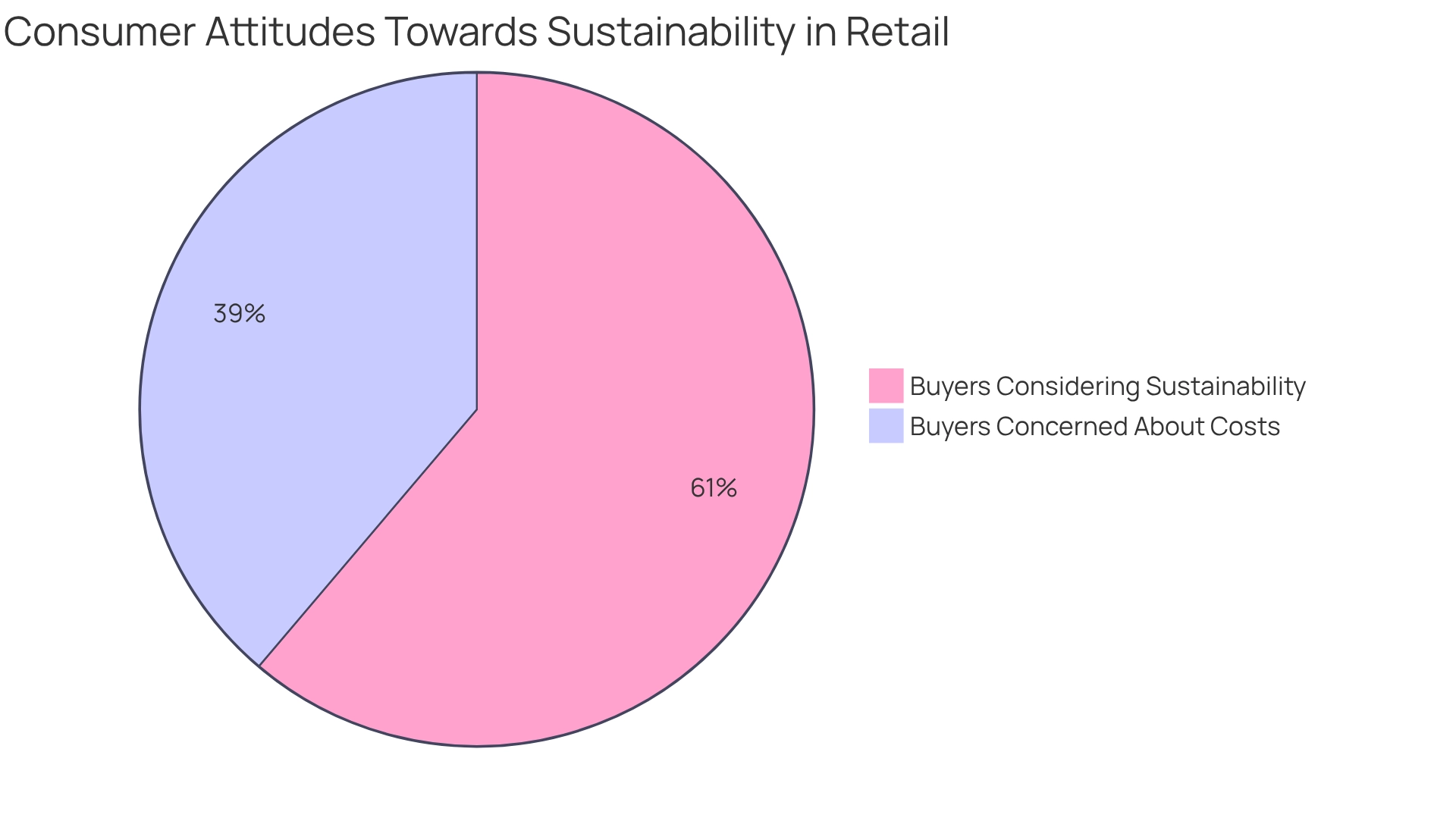

Sustainability trends in retail real estate news are fundamentally reshaping development, driven by a growing public demand for eco-friendly practices. Notably, 82% of buyers now consider sustainability in their purchasing decisions, compelling retailers to adopt greener operations and innovative store designs. However, 52% of buyers express concerns that sustainable products might carry a higher cost, highlighting the nuanced relationship between sustainability and purchasing behavior. This shift not only enhances brand reputation but also attracts a rapidly expanding demographic of eco-conscious shoppers.

In response, retail developers are prioritizing green building certifications and energy-efficient designs, as reported in retail real estate news, to meet evolving buyer expectations. Successful eco-friendly developments, such as those highlighted by Taylor's commitment to sustainability, illustrate how the incorporation of recycled materials and energy-efficient technologies can position brands as leaders in environmentally responsible commercial solutions. Taylor's initiatives reflect consumer preferences and set a benchmark for developers aiming to meet the demands of a more informed market.

As we advance through 2025, the emphasis on sustainability in commercial property will continue to shape design and operational strategies, mirroring the preferences of a market increasingly aware of its environmental impact.

Technological Innovations: Redefining Retail Real Estate Operations

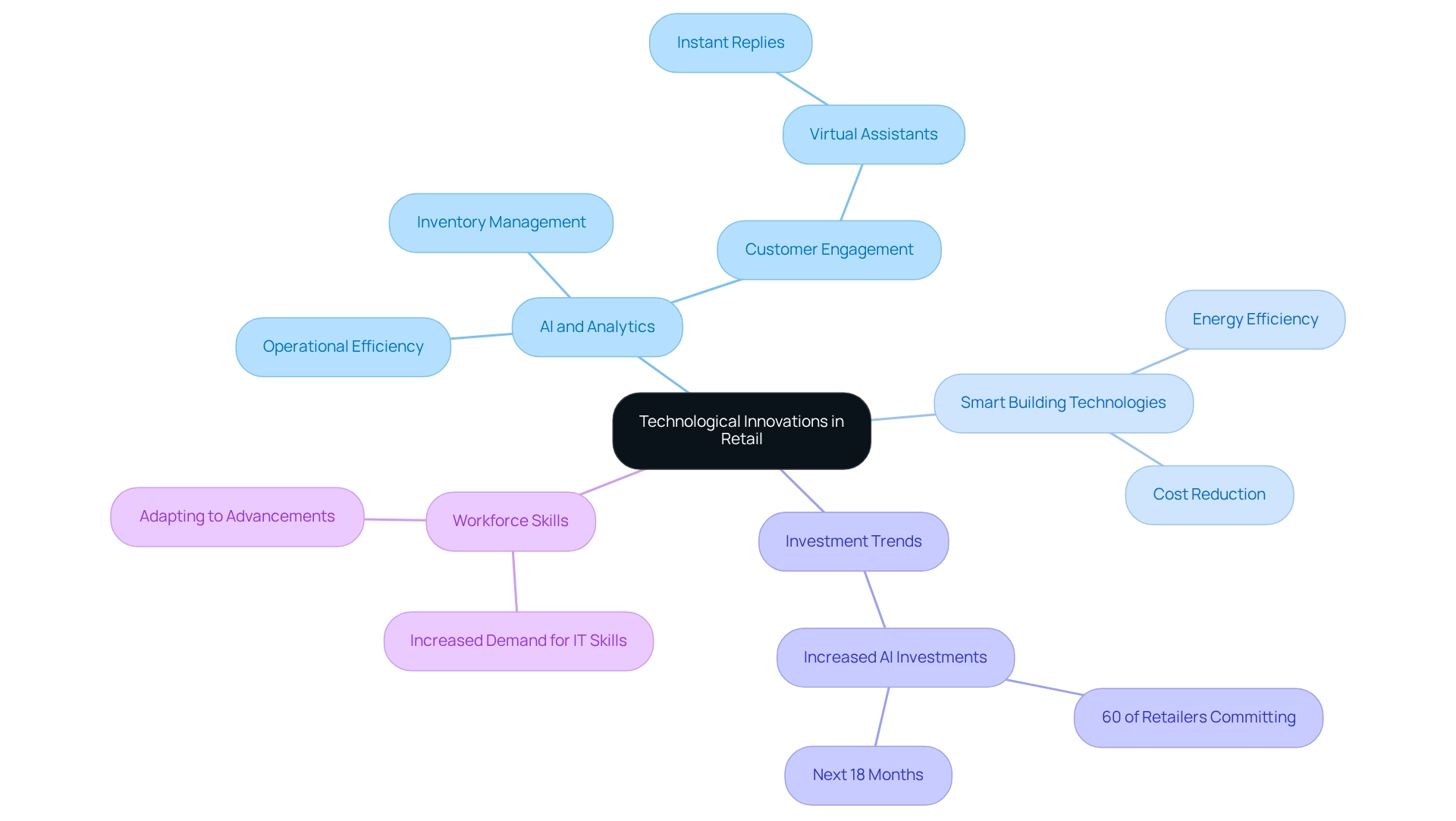

Technological advancements are fundamentally transforming commerce property operations, with sophisticated analytics and artificial intelligence at the forefront. Retailers are increasingly leveraging data to optimize inventory management, enhance customer experiences, and streamline operational processes.

For example, smart building technologies are being embraced to improve energy efficiency and reduce costs, while automated systems are refining operational workflows. Notably, over 60% of retailers are committing to increase their investments in AI infrastructure within the next 18 months. This reflects a recognition of AI's potential to revolutionize customer engagement and operational efficiency.

Such a strategic focus on technology positions retailers to thrive in an increasingly competitive landscape, making innovation not just advantageous but essential for success in 2025. Furthermore, the integration of these technologies may require enhanced IT skills, underscoring the importance of a skilled workforce in adapting to these advancements.

As eBay highlights, "This virtual assistant quickly responds to shoppers’ questions, providing instant replies and saving time for everyone," showcasing a practical application of AI that enriches customer interactions. Overall, the anticipated impact of AI on commerce operations emphasizes the transformative potential of these innovations.

Regulatory Changes: Navigating the Retail Real Estate Landscape

Navigating regulatory changes is crucial for stakeholders in the retail property sector. In 2025, new zoning laws, tax policies, and environmental regulations are set to significantly impact development timelines and costs. Local governments frequently contend with outdated zoning rules that can impede progress. As Harlan W. Robins, a leading commercial property attorney, points out, the only way to advance projects under such constraints is through a variance process until legislative updates occur.

Retailers and investors must remain vigilant regarding retail real estate news about these evolving regulations to effectively adjust their strategies. This proactive approach not only ensures compliance but also reveals opportunities for growth in a rapidly changing market. Successful adaptations to new zoning laws have already been documented, demonstrating how informed stakeholders can capitalize on these changes to their advantage.

Moreover, as businesses increasingly embrace AI technologies to foster innovation and efficiency, comprehending these regulatory shifts becomes even more essential. By staying informed through resources like Zero Flux, which curates 5-12 handpicked retail real estate news insights daily, industry players can adeptly navigate the complexities of the regulatory landscape and position themselves for success.

Conclusion

The retail real estate landscape in 2025 is characterized by a complex interplay of trends and challenges that demand astute navigation by industry professionals. Notable developments, including the migration to low-tax states, the rise of e-commerce, and the increasing emphasis on sustainability, are reshaping market dynamics. Retailers are recalibrating their strategies to resonate with Millennials and Gen Z, who prioritize experiential shopping and corporate responsibility.

As the sector confronts rising theft and shifting consumer behaviors, it is essential for stakeholders to harness data-driven insights to guide their decisions. The resilience of the retail market, underscored by low vacancy rates and rising rents, indicates that opportunities abound for those willing to innovate and adapt. Furthermore, the resurgence of office leasing is anticipated to boost retail foot traffic, enhancing the viability of strategically located retail spaces.

Ultimately, success in retail real estate hinges on a proactive approach that embraces technological advancements, sustainable practices, and regulatory compliance. By concentrating on these areas, stakeholders can not only navigate challenges but also capitalize on emerging opportunities within this evolving landscape. As the market continues to transform, those who remain informed and agile will be best positioned to thrive in the future.