Overview

The article outlines best practices for engaging with developers in the Los Angeles real estate market, highlighting the critical importance of:

- Building relationships

- Leveraging data

- Ensuring clear communication

It elaborates on strategies such as:

- Proactive networking

- A deep understanding of developer objectives

It also cautions against common pitfalls. These elements collectively foster enhanced collaboration and drive investment success in a competitive landscape.

Introduction

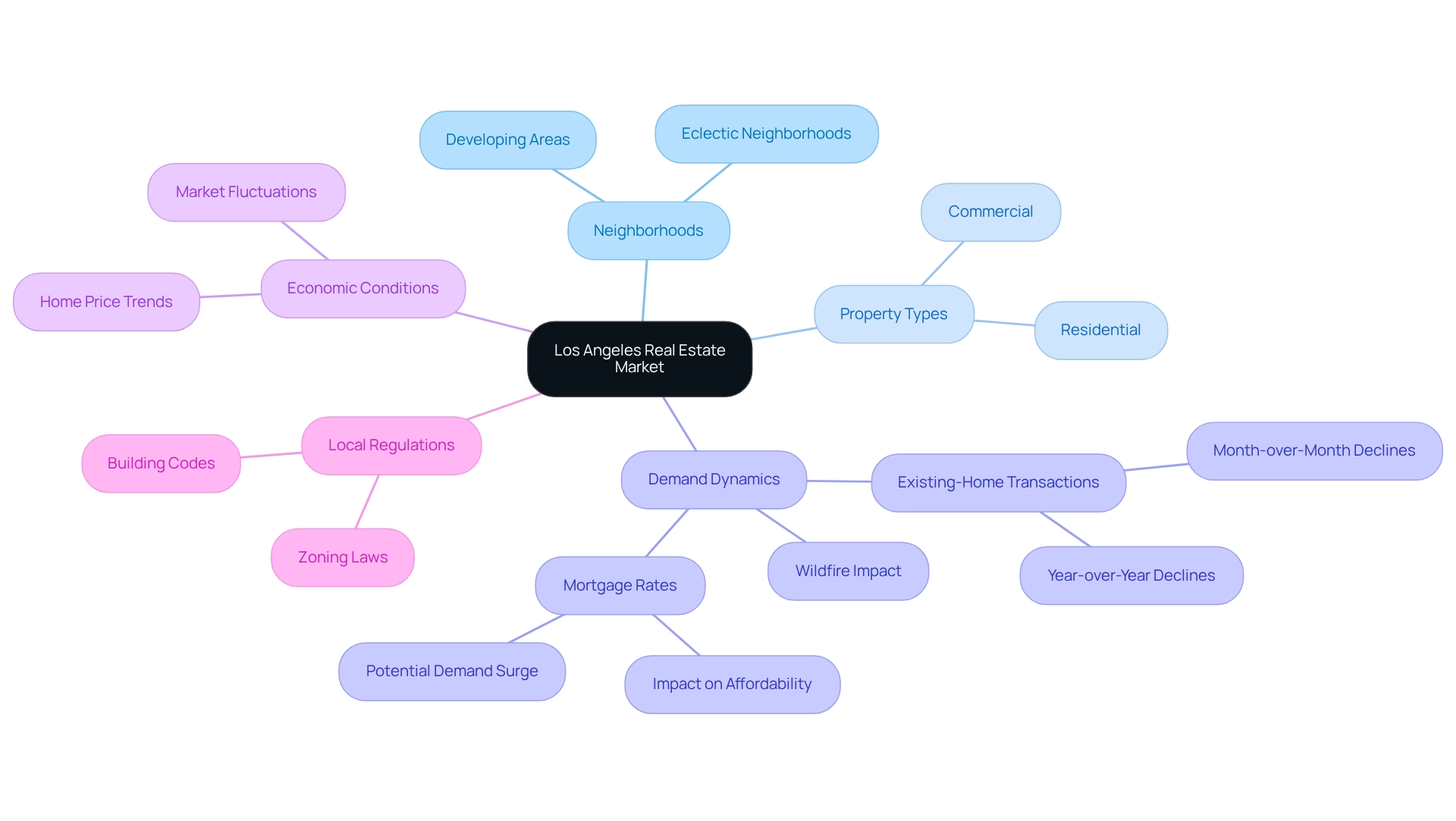

In the bustling realm of Los Angeles real estate, opportunities abound against a backdrop of fluctuating market dynamics and evolving investor-developer relationships. As the landscape shifts due to demographic changes, economic conditions, and local regulations, savvy investors must navigate these complexities with strategic foresight. Understanding the nuances of the market—from zoning laws to emerging neighborhoods—is crucial for identifying lucrative prospects.

Furthermore, fostering strong collaborations with developers can unlock pathways to successful projects, emphasizing the importance of clear communication and shared objectives. This article delves into effective strategies for engaging with developers, leveraging networking opportunities, and aligning investor goals with developer visions. Staying informed about market trends and regulations that shape the competitive Los Angeles real estate environment is essential for making informed investment decisions.

Understanding the Los Angeles Real Estate Market Landscape

Los Angeles stands as a vibrant real estate sector, distinguished by its eclectic neighborhoods, diverse property types, and ever-changing demand dynamics. Investors must stay attuned to current trends, particularly the influence of demographic shifts, economic conditions, and local regulations. For instance, the consequences of recent wildfires have notably influenced housing demand and inventory levels, creating both challenges and opportunities for astute individuals.

In January 2025, noted as the coldest January in 25 years, the region experienced notable fluctuations. Existing-home transactions declined month-over-month across various areas, particularly in the South, which saw the steepest drop. Year-over-year, contract signings declined in all U.S. regions, highlighting the necessity for stakeholders to adjust to changing economic conditions. Lawrence Yun, Chief Economist at NAR, emphasized that elevated home prices coupled with higher mortgage rates have strained affordability, further complicating the landscape.

Experts warn that if mortgage rates fall too quickly, it could lead to a surge in demand that negates any inventory gains, causing home prices to rise. To navigate these complexities, analyzing historical data on property values and rental rates is crucial. This analysis can uncover developing neighborhoods ready for expansion, enabling stakeholders to recognize profitable possibilities. Furthermore, case studies, like those shared by Lawrence Yun at the 2025 Real Estate Forecast Summit, offer valuable insights into residential and commercial trends, equipping stakeholders with the knowledge necessary for strategic planning.

By understanding these market nuances, stakeholders can engage effectively with Los Angeles developers, ensuring their proposals are well-aligned with the conditions of the property market in Los Angeles. This strategic approach not only enhances the potential for successful investments but also fosters stronger relationships within the industry.

The Importance of Building Relationships with Developers

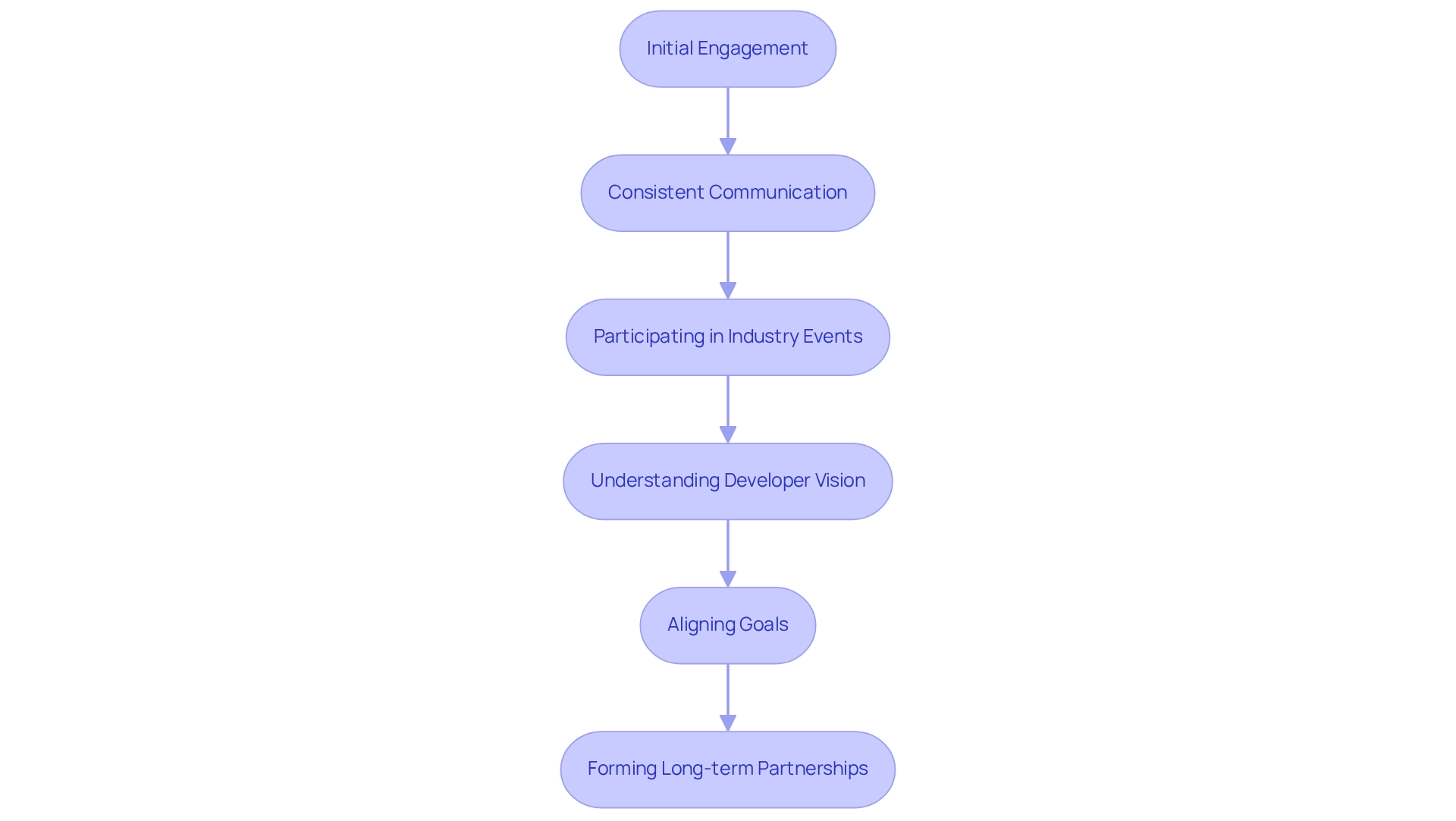

In the competitive landscape of Los Angeles real estate, establishing strong connections with local developers is essential for those funding projects. Rather than viewing programmers merely as transactional partners, financiers should embrace a collaborative approach. This mindset can be cultivated through consistent communication, participation in industry events, and engagement in community initiatives that professionals prioritize.

For instance, attending local planning meetings or events hosted by builders allows investors to gain valuable insights into upcoming projects and the strategic objectives of these developers.

A significant illustration of the investment opportunities available through solid builder relationships is the recent $35,300,000 funding in a 363-unit multifamily complex. Demonstrating genuine interest in the creators' work and aligning with their goals can lead to the formation of long-term partnerships that yield mutual benefits. As one first-time client remarked, "I wanted to compliment your team and the work that they have done for my family this year. Niko, Dominic, and Marithess were wonderful to work with on both deals. Their efforts made for a smooth lending process!"

Successful collaborations often hinge on understanding the developer's vision and the community's needs, which can enhance project outcomes and financial returns. The case study on capitalization rates (cap rates) illustrates how grasping economic metrics can influence investor-developer partnerships and decision-making. By prioritizing these relationships, stakeholders can position themselves advantageously within the dynamic Los Angeles market, ultimately contributing to sustainable and innovative developments that enrich local communities.

Properties are curated to enhance communities, underscoring the shared objectives between stakeholders and builders in promoting such developments. Moreover, the recent announcement of a quarterly dividend by KKR Real Estate Finance Trust Inc. reflects stakeholders' confidence in the real estate sector, further underscoring the importance of strategic partnerships.

Effective Strategies for Engaging with Developers

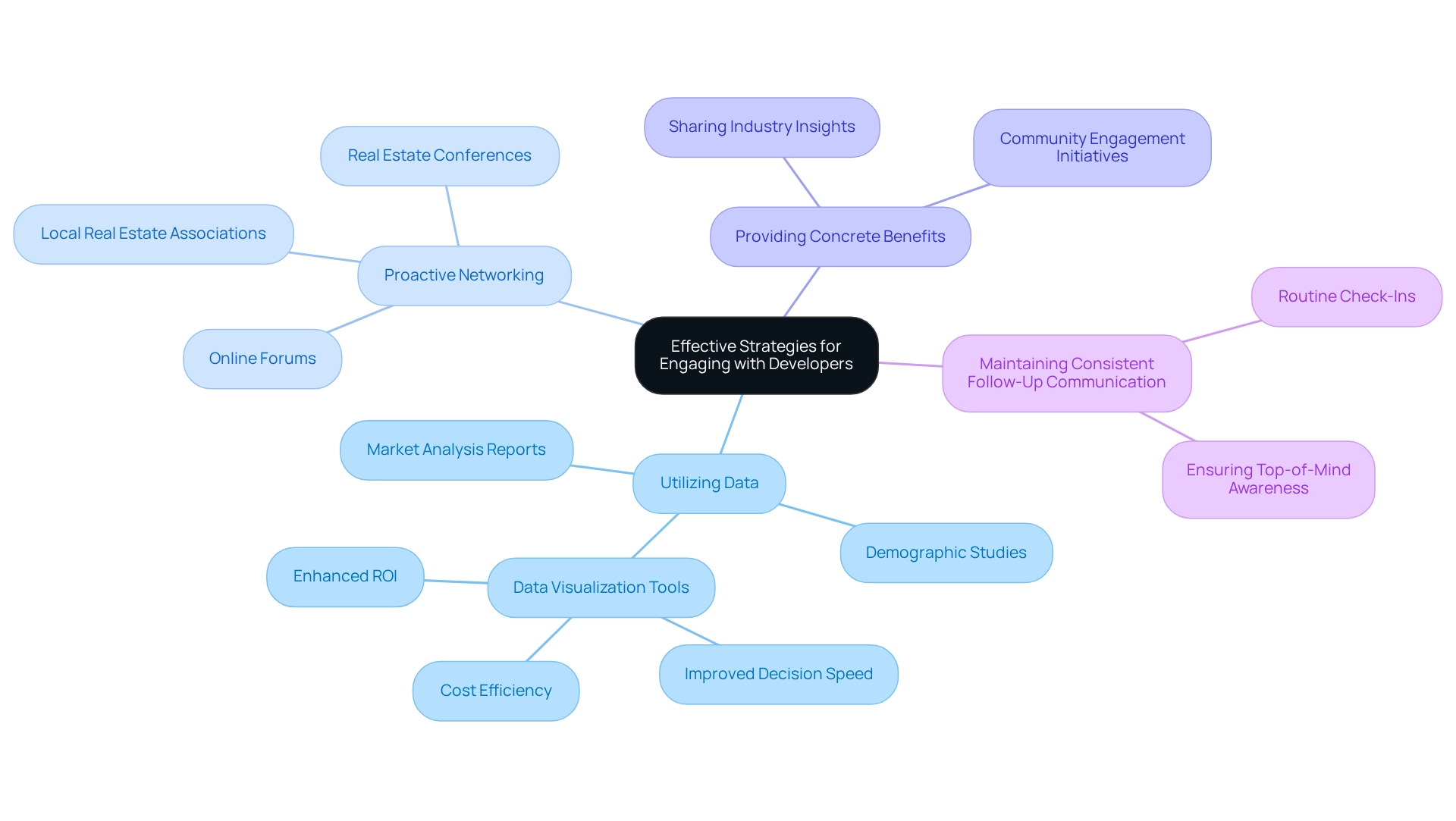

To effectively engage with developers, investors must adopt a comprehensive strategy that encompasses several key elements. First and foremost, utilizing data is essential; presenting investment proposals that clearly detail potential returns and demand significantly enhances credibility. Tools such as market analysis reports and demographic studies not only strengthen the proposal but also demonstrate a thorough understanding of the market landscape.

Data visualization tools, for instance, can convey complex data effectively, showcasing significant improvements in decision speed, cost efficiency, and ROI through data-driven leadership.

Second, proactive networking is crucial. Investors should actively participate in real estate conferences, join local real estate associations, and engage in online forums to build connections with builders. These interactions can lead to valuable partnerships and insights into upcoming projects.

As highlighted in a case study on collaboration between proposal and procurement teams, both sides must work together to optimize the full-circle RFP process, enhancing efficiency and effectiveness.

Third, providing concrete benefits to creators can distinguish backers. By sharing industry insights or aiding with community engagement initiatives, funders can position themselves as strategic allies rather than mere financial supporters. This collaborative approach fosters trust and opens doors to future opportunities.

Lastly, maintaining consistent follow-up communication is vital. Routine check-ins can ensure that funders remain top-of-mind for creators when new projects emerge, solidifying their position as a favored option for collaboration. As Sarah Lee aptly stated, "In a world driven by data, leadership excellence is about turning vast information into decisive action."

By applying these strategies and being fully prepared through heightened examination of RFP opportunities, property owners can effectively navigate the complexities of engaging with Los Angeles developers in the competitive market.

Leveraging Networking Opportunities in the Real Estate Sector

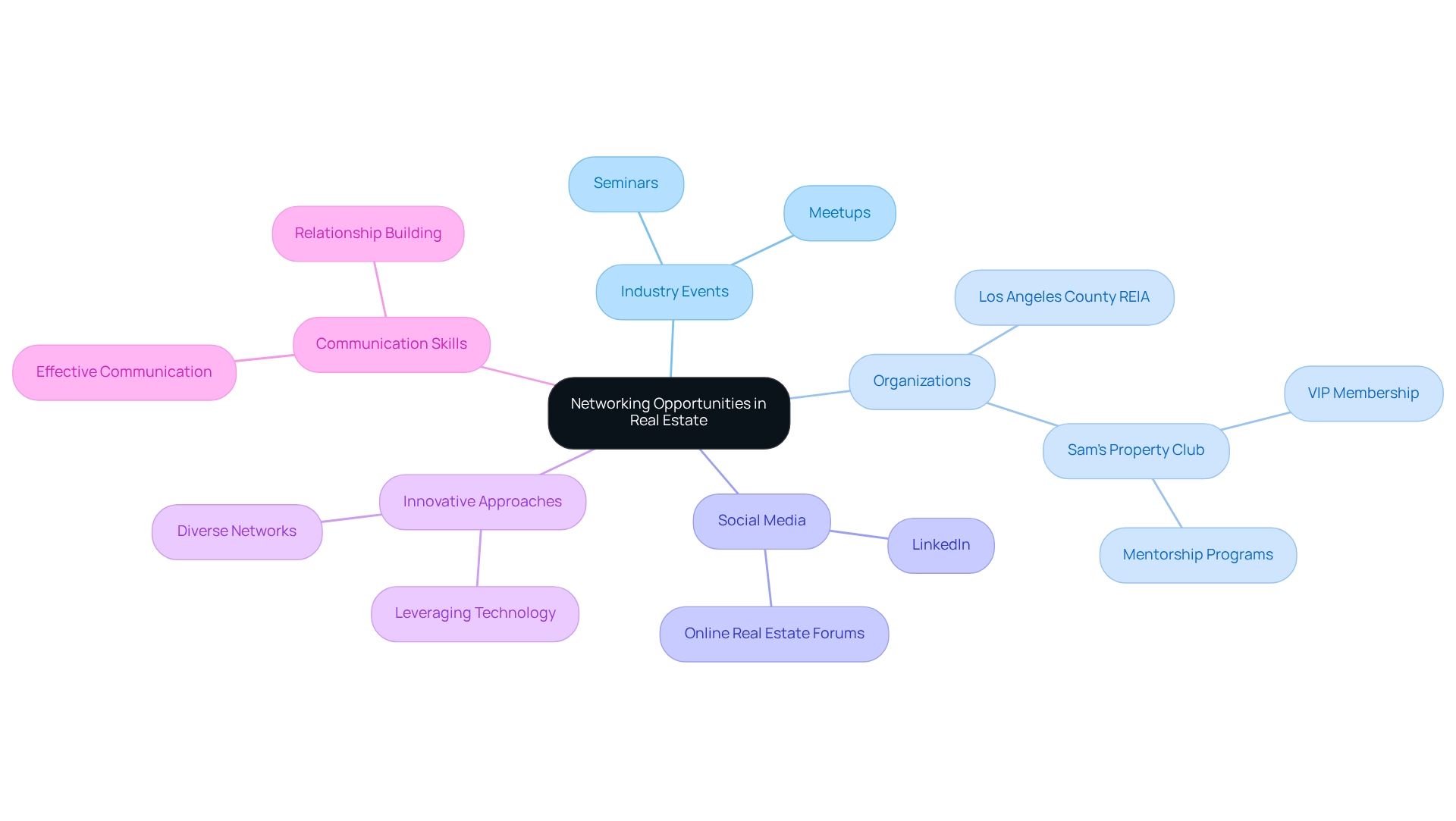

Networking serves as a crucial foundation for success among Los Angeles developers in the property market. Investors are strongly encouraged to actively pursue networking opportunities through a diverse array of industry events, seminars, and local meetups. Membership in organizations such as the Los Angeles County Real Estate Investor's Association provides significant advantages, including access to valuable resources, mentorship programs, and a community of like-minded professionals.

These organizations not only facilitate networking opportunities but also enhance knowledge for stakeholders through shared experiences and insights. For example, Sam’s Property Club, the parent company of the Greater LA REIA, offers VIP membership and mentorship for serious stakeholders, supporting individuals dedicated to succeeding in property. This initiative provides direction and resources to refine investment strategies, illustrating how effective networking can lead to success.

In addition to conventional networking, leveraging social media platforms like LinkedIn can substantially increase visibility and assist in forging connections with creators and other stakeholders. Engaging in discussions within online real estate forums allows individuals to stay informed about industry trends and developer activities, further enriching their understanding of the landscape.

As 2023 progresses, innovative networking approaches are emerging in California's real estate industry, underscoring the importance of diverse networks and technology in fostering meaningful connections. Effective communication skills and a commitment to relationship-building are essential for those looking to maximize their networking efforts. As Paul, a mentor in the industry, wisely advised, adapting strategies to meet the unique needs of various sectors is critical.

By cultivating a robust network, individuals can unlock a wealth of knowledge and opportunities that may not be readily accessible through traditional channels, ultimately enhancing their investment strategies and success in the competitive market driven by Los Angeles developers. With over 30,000 followers, Zero Flux stands as a reliable source of information, further aiding individuals in navigating these networking opportunities.

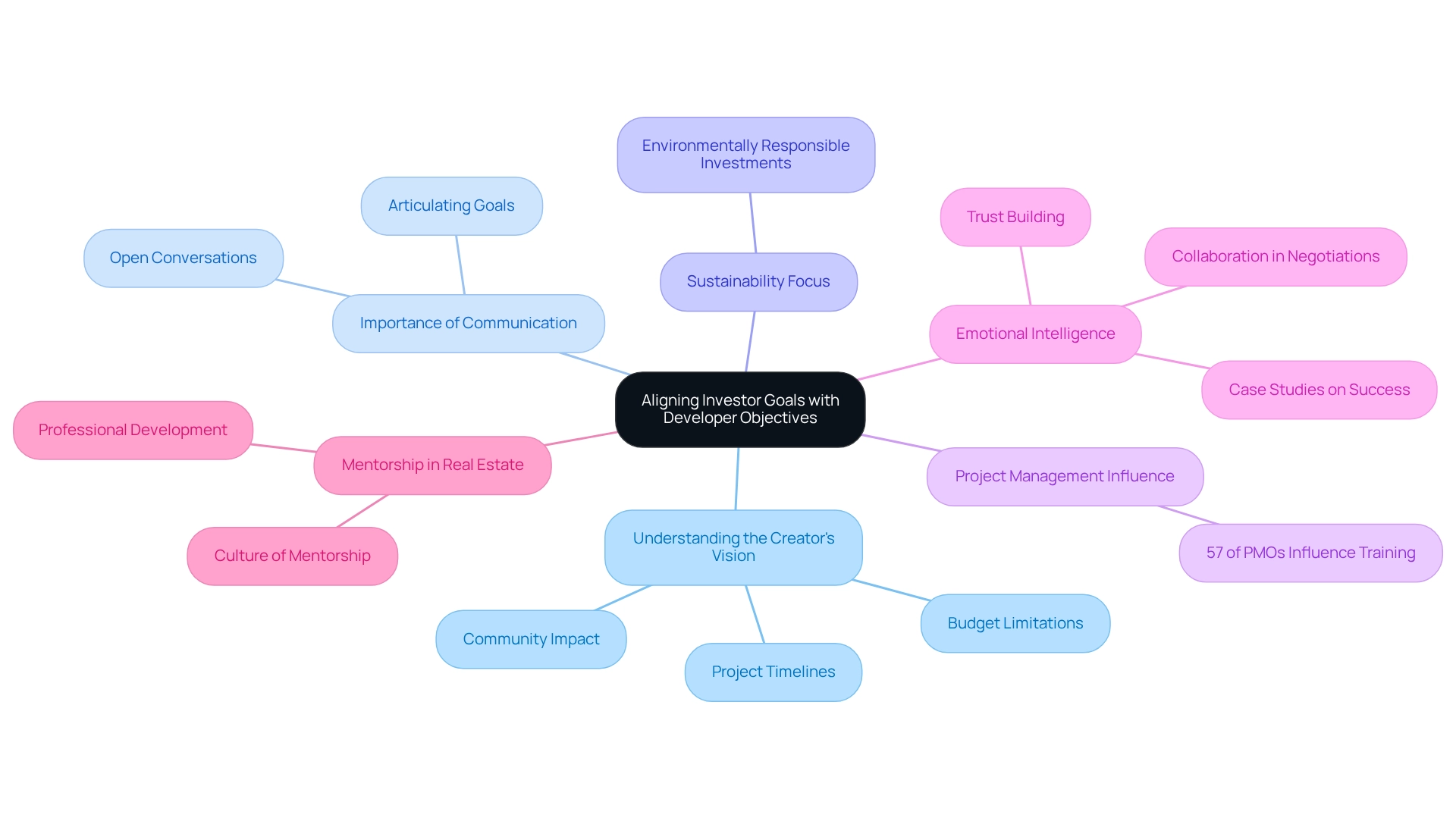

Aligning Investor Goals with Developer Objectives

Successful partnerships in real estate among Los Angeles developers hinge on the alignment of investor objectives with those of builders. This alignment commences with a profound comprehension of the creator's vision, encompassing essential aspects such as project timelines, budget limitations, and the anticipated impact on the community. Investors should initiate open conversations to articulate their goals and explore how they can effectively support the creator's aims.

For instance, if a developer prioritizes sustainable building practices, a stakeholder can underscore their commitment to environmentally responsible investments. This proactive approach not only fosters a sense of collaboration but also positions stakeholders as vital contributors to the project's success rather than mere financial supporters.

Statistics reveal that 57% of project management offices (PMOs) significantly influence project management training, underscoring the necessity for stakeholders to be well-versed in project dynamics and educational resources. By cultivating a shared vision, stakeholders can negotiate more favorable terms and facilitate a smoother development process, ultimately enhancing the likelihood of project success.

Case studies illustrate that when backers and builders collaborate toward a common goal, the outcomes are often more advantageous. For example, projects that emphasize emotional intelligence in negotiations have demonstrated an ability to foster trust and collaboration, leading to long-term success. As highlighted in a case study on emotional intelligence, developing this skill enables professionals to navigate the emotional landscape of transactions effectively, promoting trust and collaboration for enduring success.

By grasping the vision of Los Angeles developers and aligning it with their own objectives, investors can cultivate a synergistic relationship that benefits all parties involved.

Furthermore, as Howard Hanna, a notable leader in the property industry, observed, "Howard Hanna Real Estate has established a strong reputation by investing in professional advancement and promoting a culture of mentorship, ensuring long-term employee success." This sentiment reinforces the importance of aligning objectives and fostering cooperation in real estate. Additionally, aspiring agents and leaders should prioritize emotional intelligence and integrate it with technology to thrive in the industry.

Staying Informed: Navigating Regulations and Market Trends

Navigating the complexities of the Los Angeles property market requires investors to remain vigilant about local regulations and trends shaped by developers in the area. A thorough grasp of zoning laws, building codes, and upcoming legislation is vital for successful property development. For example, zoning laws can significantly impact real estate development, affecting everything from project feasibility to investment returns.

Investors are encouraged to regularly consult resources such as updates from the Los Angeles Housing Department and actively engage in local government meetings. This proactive approach provides valuable insights into regulatory changes that could influence their strategies.

Moreover, subscribing to industry newsletters like Zero Flux is essential for monitoring trends, including shifts in housing demand and emerging financing options. With over 30,000 subscribers, Zero Flux exemplifies how a data-driven strategy can empower investors by delivering concise, factual insights that aid in navigating the financial landscape. Its commitment to data integrity and unique sourcing from more than 100 reliable outlets further establishes its authority as a crucial resource for stakeholders.

In January 2025, existing-home sales in the South saw a notable month-over-month decline, underscoring the importance of being aware of broader economic dynamics. Additionally, the Housing Affordability Fund plays a pivotal role in tackling ongoing affordability challenges in California, which can significantly influence investment strategies. As David Bitton, Co-founder at DoorLoop, noted, "The rent increase has been approximately 11%, reaching around $2,644 per month," a trend that stakeholders must consider in their planning.

By staying informed and adaptable, investors can refine their strategies to align with current conditions and regulatory requirements, ultimately enhancing their investment outcomes in the competitive property sector, guided by insights from Los Angeles developers.

Fostering Clear Communication and Transparency

Effective communication and transparency serve as cornerstones for successful interactions between creators and investors in the Los Angeles real estate market. Investors must prioritize establishing open lines of communication from the outset, ensuring that all stakeholders have a clear understanding of project expectations, timelines, and financial arrangements. Regular updates and check-ins are crucial for maintaining alignment and swiftly addressing any concerns that may arise.

Incorporating digital project management tools can significantly enhance transparency, enabling both stakeholders and creators to track progress and exchange information seamlessly. These tools not only streamline communication but also provide a centralized platform for monitoring project milestones and financial metrics, which is essential for informed decision-making.

Fostering a culture of openness is vital for building trust between investors and Los Angeles developers. This trust can lead to more productive collaborations and ultimately successful project outcomes. Case studies demonstrate that effective communication strategies can transform ordinary interactions into exceptional experiences, resulting in increased customer loyalty and repeat business.

For instance, the case study titled "The Gift of Caring" underscores the importance of demonstrating care in customer interactions, suggesting that it can elevate ordinary experiences to something truly special.

Furthermore, as the property market evolves, the significance of clarity in investor-developer partnerships cannot be overstated. Investors who prioritize clear communication and transparency, mirroring the practices of Los Angeles developers, are better equipped to navigate the complexities of property development, ensuring that projects are completed on schedule and within budget. The future of business will hinge on its ability to adapt to social and environmental changes, making Corporate Social Responsibility (CSR) essential for meeting stakeholder expectations.

By adopting these best practices, investors can strengthen their connections with builders and contribute to the overall success of their projects. With over 30,000 subscribers, Zero Flux highlights the demand for clear communication in real estate, indicating that a well-informed audience is crucial for successful projects.

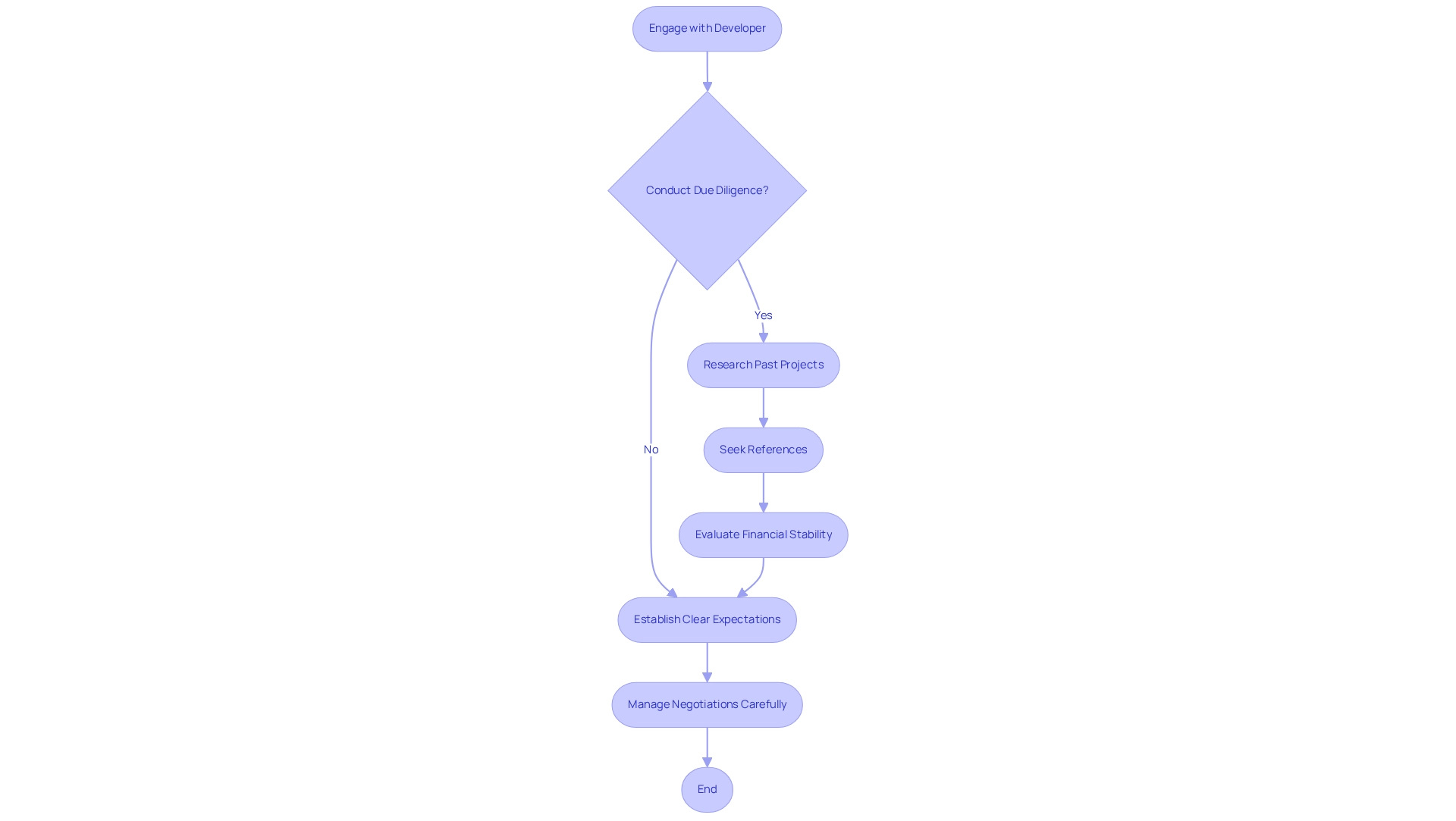

Avoiding Common Pitfalls in Developer Engagement

Investors must remain vigilant about common pitfalls when engaging with creators to foster successful collaborations. A significant error is neglecting comprehensive due diligence on a contractor's track record and reputation. This entails researching past projects of Los Angeles developers, seeking references, and evaluating the developer's financial stability.

Due diligence is a comprehensive process encompassing legal, financial, physical, and market analyses, all crucial for assessing the viability and risks associated with a property. Another common misstep is failing to establish clear expectations and agreements from the outset. Without this clarity, misunderstandings can arise, complicating the development process and potentially jeopardizing the project. Stakeholders should also be cautious about adopting an overly aggressive stance during negotiations, as such an approach can strain relationships and limit future collaboration opportunities.

As Jeff Sage aptly puts it, "Whether one is an experienced participant or a novice in the field, the mantra remains the same: due diligence is the key to unlocking the true potential of any real estate investment." By acknowledging these pitfalls and implementing proactive measures to avoid them, investors can significantly enhance their engagement with Los Angeles developers. This strategic approach not only mitigates risks but also sets the stage for successful project outcomes, ultimately leading to more favorable investment returns.

The importance of due diligence is further illustrated in the case study titled "The Importance of Due Diligence in Real Estate Investment," which highlights how thorough research and analysis can lead to better negotiation outcomes and reduced risks.

Conclusion

Navigating the Los Angeles real estate market demands a multifaceted approach. Understanding market dynamics, cultivating strong relationships with developers, and staying informed about regulations and trends are paramount. The landscape is shaped by various factors, including demographic shifts and economic conditions, necessitating a keen awareness of emerging opportunities and challenges. Investors who leverage historical data and case studies are better positioned to identify promising neighborhoods and investment prospects.

Establishing collaborative partnerships with developers is essential for success. By fostering open communication and aligning goals, investors can cultivate long-term relationships that enhance project outcomes. Engaging in proactive networking and providing valuable insights distinguishes investors as strategic partners, facilitating smoother collaborations that benefit all parties involved.

Moreover, the significance of clear communication and transparency cannot be overstated. By maintaining consistent dialogue and utilizing digital tools, investors ensure that all stakeholders remain aligned and informed throughout the development process. Avoiding common pitfalls—such as neglecting due diligence and failing to set clear expectations—further reinforces the foundation for successful engagements.

Ultimately, success in the competitive Los Angeles real estate market hinges on a comprehensive strategy that encompasses market knowledge, strong partnerships, and effective communication. By prioritizing these elements, investors can enhance their investment outcomes and contribute to the development of sustainable and thriving communities. Embracing these principles empowers investors to navigate the complexities of the market and seize the myriad opportunities that await.