Overview

This article delivers a comprehensive, step-by-step guide on the intricacies of buying and selling real estate notes. It underscores the necessity of grasping the various types of notes and the significance of conducting thorough market research. Key steps are meticulously outlined, including:

- Identification of investment goals

- Evaluation of notes

- Assurance of legal compliance

By doing so, it equips investors with essential knowledge, enabling them to navigate the complexities of real estate transactions with confidence and effectiveness.

Introduction

In the intricate landscape of real estate investing, grasping the nuances of real estate notes is essential for those aiming to maximize their returns. These legal documents, which delineate the terms of loans secured by properties, manifest in various forms, each presenting distinct risks and rewards.

Consider the stability of performing notes contrasted with the potential high returns of non-performing notes; investors must adeptly navigate a complex array of options.

Furthermore, differentiating between first and second lien notes, alongside commercial versus residential offerings, adds layers of complexity to the decision-making process.

As the market evolves, remaining informed about these dynamics empowers investors to make strategic choices that align with their financial goals.

Understand Real Estate Notes and Their Types

Real estate agreements are legal documents that delineate the conditions of loans secured by real property. Understanding the various types of documents is crucial for investors looking to make informed decisions.

- Performing Notes: These loans are marked by borrowers making regular payments, which generally positions them as lower risk. They provide a consistent income stream, appealing to those in search of reliable returns.

- Non-Performing Loans: Conversely, non-performing loans involve borrowers who have defaulted or are behind on payments. Although these documents carry a higher risk, they can yield substantial returns if the borrower is successfully rehabilitated.

- First and Second Lien Instruments: First lien instruments take precedence over other claims on the property, offering a safer investment. In contrast, second lien securities are subordinate, presenting increased risk, as they are compensated after first lien holders in the event of a default.

- Commercial vs. Residential Documents: Commercial documents are backed by commercial properties, while residential documents pertain to homes. Each category exhibits unique risk characteristics and market behaviors, influencing investment strategies.

In 2025, the share of successful assets in the real estate sector is approximately 75%, indicating a stable investment environment. Recent statistics reveal that the average unpaid principal balance (UPB) of non-performing loans (NPLs) sold was around $183,055, underscoring the potential value in acquiring these assets. Understanding the nuances between performing and non-performing instruments, along with their respective advantages and challenges, enables investors to align their strategies with their financial goals effectively, particularly in the context of buying and selling real estate notes.

A case study on acquiring mortgage instruments illustrates that investors can source these assets from various avenues, including banks, brokers, online platforms, and private lenders. Each option presents distinct benefits, such as lower costs through online platforms or personalized support from private financiers, alongside factors like the potential for increased risk with second lien instruments. By leveraging insights from industry experts, investors can navigate the complexities of property paper investing with greater confidence. As noted by the Federal Housing Finance Agency, the average UPB of NPLs sold was $183,055, highlighting the potential worth in these assets.

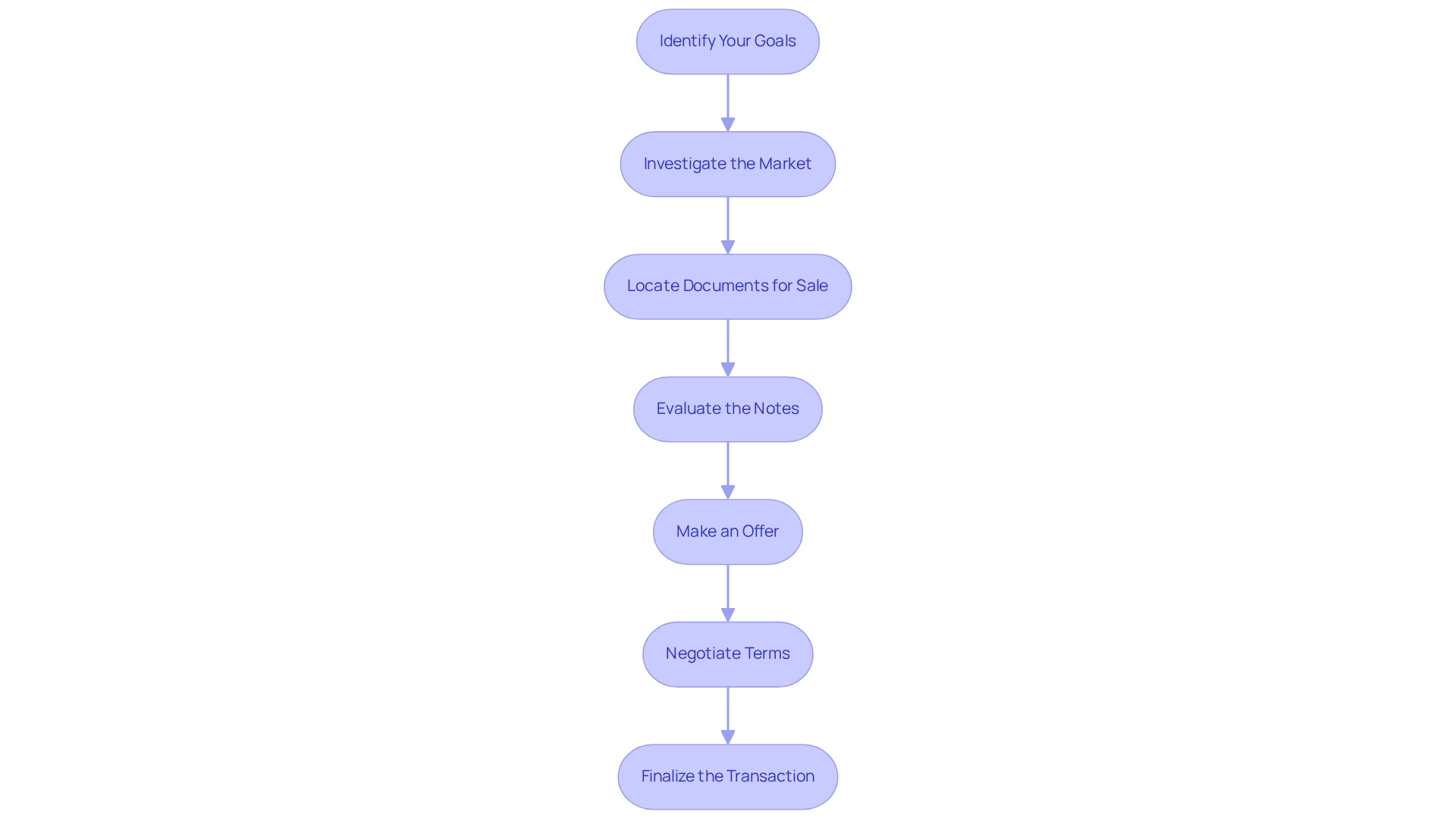

Follow the Step-by-Step Process for Buying and Selling Notes

To efficiently engage in buying and selling real estate notes in 2025, follow these steps:

- Identify Your Goals: Clearly define your intention—whether to purchase or sell documents—and outline your specific investment objectives.

- Investigate the Market: Acquire a thorough understanding of existing market conditions, including interest rates and current trends in property agreements. Notably, 24% of investors anticipate a significant market shift in 2024, with 13% projecting it for 2025. This insight is crucial for aligning your strategy with market dynamics.

- Locate Documents for Sale: Explore various channels, such as online marketplaces, banks, and brokers, to identify available documents. Engaging with real estate investment groups can also uncover valuable opportunities.

- Evaluate the Notes: Conduct a thorough assessment of the borrower's financial health, the property's value, and the terms of the agreement. Consider consulting licensed contractors and industry experts to ensure accuracy in your evaluation. Obtaining performing assets may present lower risk, while non-performing assets could provide potentially higher returns.

- Make an Offer: When buying and selling real estate notes, submit a competitive offer based on your evaluation. If selling, establish a realistic price that reflects current market conditions.

- Negotiate Terms: Be prepared to negotiate key terms, including price, payment schedules, and any contingencies that may arise.

- Finalize the Transaction: After reaching an agreement, complete all necessary paperwork and ensure adherence to legal requirements.

Understanding the dynamics of the property market is crucial, especially as it is projected to reach $5,388.87 billion by 2026, growing at a CAGR of 9.6%. This growth underscores the importance of informed decision-making in property transaction agreements. Furthermore, the increase in virtual home tours, which have surged by over 300% since 2020, reflects changing buyer preferences that may impact your approach when purchasing or selling.

Conduct Due Diligence and Comply with Legal Requirements

Conducting thorough research in real estate transactions is essential for securing a solid financial opportunity. Here are the key steps to follow:

- Review Loan Documents: Examine the promissory agreement and mortgage documents meticulously to understand the terms and conditions governing the transaction.

- Assess Borrower Creditworthiness: Investigate the borrower's credit history, income, and payment patterns to evaluate their reliability. Understanding borrower creditworthiness is crucial, as it directly impacts the likelihood of timely payments. Notably, a LendingTree analysis reveals that single women living alone are more likely to own homes than single men in 47 out of 50 states, underscoring the importance of assessing borrower demographics in due diligence.

- Evaluate Property Value: Conduct a property appraisal to determine its current market value and condition. As of 2025, average property appraisal values have shown significant fluctuations, making this step vital for accurate investment assessments.

- Check for Liens or Encumbrances: Ensure there are no outstanding liens or legal issues that could diminish the note's value. This step is critical to avoid unexpected financial burdens.

- Understand Legal Requirements: Familiarize yourself with local laws and regulations governing property transactions to ensure compliance. Insights from property lawyers emphasize the significance of adhering to these legal structures to mitigate risks.

- Consult Experts: Collaborate with property attorneys or financial consultants to review documents and provide professional advice throughout the process. Their expertise can be invaluable in navigating complex legal requirements and ensuring thorough due diligence. As industry expert Maggie Davis notes, "The number of delinquencies and foreclosures hasn’t dramatically increased compared to before the pandemic," highlighting the importance of careful assessment in the current market.

By following these steps, investors can make informed choices and enhance their prospects for success in the property financing market.

Select Reliable Brokers and Define Investment Criteria

To effectively navigate the real estate note market, consider the following strategies:

- Choose a Trustworthy Broker: Seek brokers who specialize in property notes and possess a proven track record. Referrals from trusted sources can be invaluable, and verifying their credentials is essential for ensuring reliability. As Steph Matarazzo, Marketing Director at FastExpert, emphasizes, "The bottom line is that you should not let the commission rate be the only factor you consider when choosing a real estate agent."

- Define Your Funding Criteria: Establish clear funding guidelines tailored to your objectives. Consider factors such as risk tolerance, expected returns, and the duration of your asset allocation. This clarity will guide your broker in identifying suitable opportunities.

- Evaluate Broker Fees: Familiarize yourself with the fee structures of potential brokers. On average, commission rates gathered from 734 partner agents indicate that sellers in Colorado pay about 2.47% of the home's purchase price in closing costs. Understanding these costs upfront is crucial, as broker fees for buying and selling real estate notes can significantly impact your overall returns.

- Communicate Your Goals: Clearly articulate your financial objectives and criteria to your broker. Effective communication ensures that they can present options that align with your expectations and financial strategy.

- Monitor Market Trends: Stay informed about market trends and be prepared to adjust your criteria as necessary. This proactive approach empowers you to capitalize on emerging opportunities and make informed decisions in a dynamic market.

By following these guidelines, you can enhance your chances of success in buying and selling real estate notes, ensuring that you select brokers who align with your investment goals and criteria. Furthermore, the case study titled "Importance of Choosing the Right Agent" underscores that selecting a broker based on experience and service quality, rather than merely commission rates, can lead to superior outcomes.

Conclusion

Understanding real estate notes and their various types is essential for investors aiming to optimize their strategies. The distinctions between performing and non-performing notes, as well as first and second lien notes, underscore the importance of risk assessment in making informed investment decisions. Furthermore, the differences between commercial and residential notes introduce another layer of complexity, necessitating a thorough understanding of market dynamics.

The step-by-step process for buying and selling notes offers a clear roadmap for investors. It emphasizes the need to:

- Identify goals

- Conduct market research

- Evaluate notes meticulously

As the real estate market continues to evolve, remaining vigilant about trends and market shifts is crucial for successful transactions.

Conducting due diligence is paramount in ensuring sound investments. Key steps such as:

- Reviewing loan documents

- Assessing borrower creditworthiness

- Understanding legal requirements

can significantly mitigate risks. Engaging professionals in the field enhances the decision-making process, enabling investors to navigate complexities with confidence.

Ultimately, success in real estate note investing hinges on informed choices and strategic planning. By arming themselves with the right knowledge and resources, investors can effectively navigate the intricate landscape of real estate notes, aligning their strategies with their financial goals and maximizing potential returns.