Overview

The commercial real estate forecast for 2025 presents a landscape ripe with growth opportunities, especially within the industrial and retail sectors. However, it also faces challenges tied to workforce development and economic fluctuations. Key trends underpinning this outlook include:

- The surge of e-commerce

- The critical importance of sustainability

- The necessity for technological integration

These factors are not merely trends; they are shaping investment strategies and market dynamics as investors adapt to an evolving environment.

As we delve deeper, consider the implications of these trends. The rise of e-commerce is transforming traditional retail, prompting investors to rethink their strategies. Sustainability is no longer optional; it has become a fundamental aspect of investment decisions. Furthermore, technological integration is essential for staying competitive in this fast-paced market.

In conclusion, the 2025 commercial real estate landscape demands that investors remain agile and informed. By recognizing these trends and adapting their strategies accordingly, they can navigate the complexities of the market and seize the opportunities that lie ahead.

Introduction

As we enter 2025, the commercial real estate landscape reveals a complex interplay of optimism and caution, underscoring the sector's resilience in the face of ongoing challenges. Notably, the industrial and retail sectors demonstrate remarkable strength, while office spaces embark on a gradual recovery. Investors must navigate the intricate regional and sector-specific dynamics that characterize this evolving environment.

The surge in e-commerce continues to fuel demand for logistics solutions, compelling retail to adapt through innovative strategies that align with shifting consumer preferences. Additionally, the pressing need for workforce development emphasizes the importance of upskilling as organizations prepare for the future.

This article delves into key trends, economic influences, and potential challenges, illuminating the opportunities available for savvy investors poised to navigate this multifaceted market.

Navigating the Commercial Real Estate Landscape in 2025

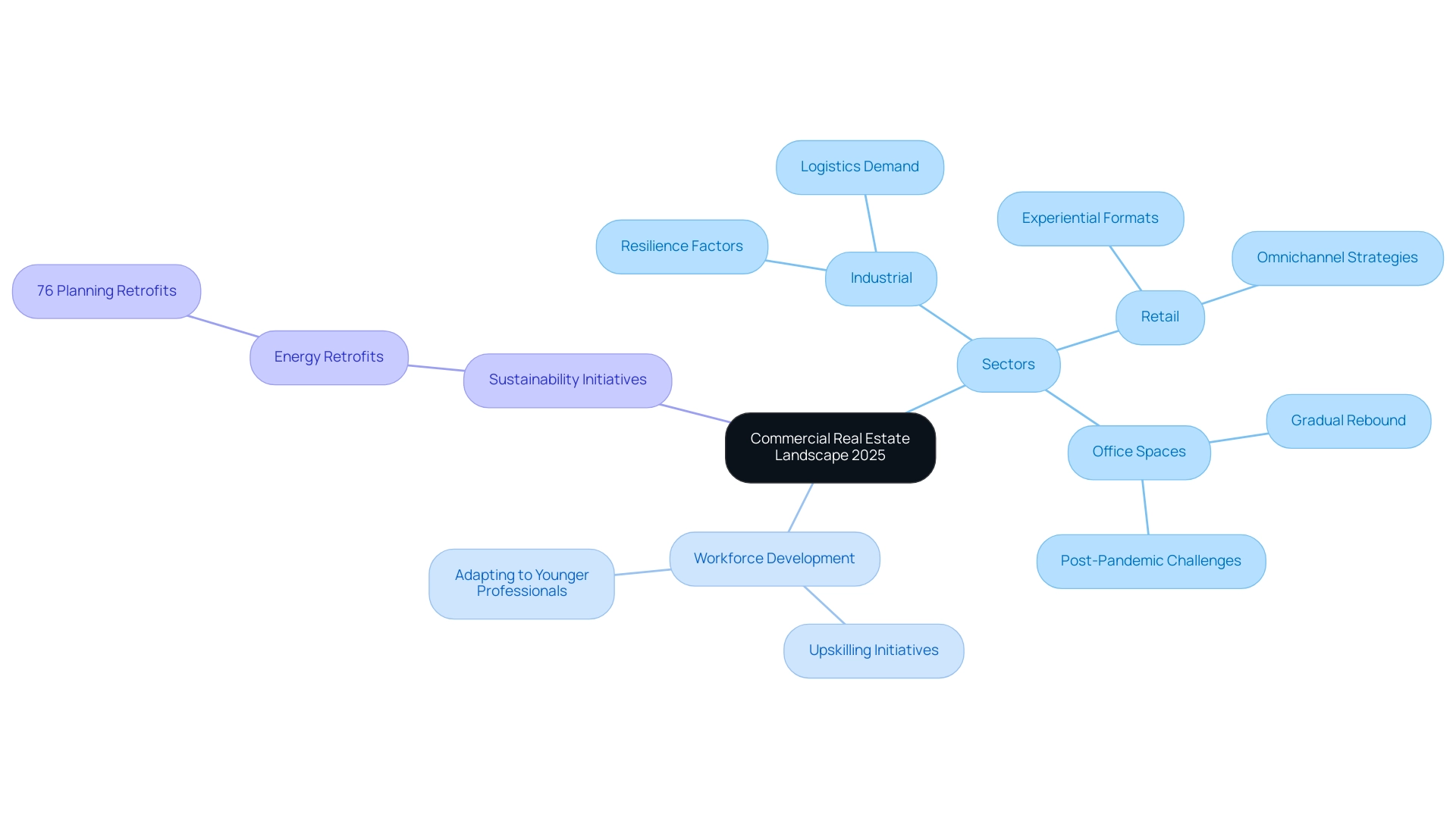

As we approach 2025, the commercial real estate forecast indicates a subtle mix of optimism and caution in the property landscape. Notably, sectors such as industrial and retail are demonstrating resilience, while office spaces are gradually rebounding from the challenges posed by the pandemic. Investors must prioritize an understanding of regional variations and sector-specific dynamics to adeptly navigate this evolving environment.

The industrial sector is poised to lead the market, fueled by sustained demand for logistics and warehousing solutions. This trend is underscored by a growing reliance on e-commerce, which continues to drive the need for efficient supply chain operations. In contrast, the retail sector is experiencing a renaissance, particularly in experiential and omnichannel formats that are redefining consumer engagement. This shift highlights the importance of adaptability in retail strategies, as businesses seek to meet the changing preferences of consumers.

Furthermore, the present condition of commercial property in 2025 is characterized by a pressing need for upskilling and reskilling within the workforce. With a significant portion of the property workforce nearing retirement, organizations are increasingly focused on aligning with the values of younger professionals and enhancing training initiatives to bridge the skills gap. This proactive approach is essential for preparing for future workforce demands and ensuring sustained growth in the sector. A case study titled "Navigating the Workforce Transition in Real Estate" illustrates how companies are addressing these challenges by enhancing upskilling initiatives.

Expert opinions indicate that while there is a cautious optimism surrounding the sector, investors should remain vigilant. A recent survey indicated that 76% of global respondents in commercial property plan to undertake deep energy retrofits within the next 12 to 18 months, reflecting a commitment to sustainability and efficiency that will shape investment strategies moving forward. This survey featured participants from North America, Europe, and Asia Pacific, emphasizing the worldwide viewpoint on the commercial property sector.

In summary, the commercial real estate forecast indicates that the property landscape is characterized by significant opportunities, particularly in the industrial and retail sectors, alongside the necessity for workforce development. With over 30,000 subscribers relying on Zero Flux for essential insights, individuals who stay informed about these trends and adapt their strategies accordingly will be well-positioned to capitalize on the evolving market dynamics.

Key Trends Shaping Commercial Real Estate in 2025

Several pivotal trends are poised to influence the commercial real estate landscape in 2025:

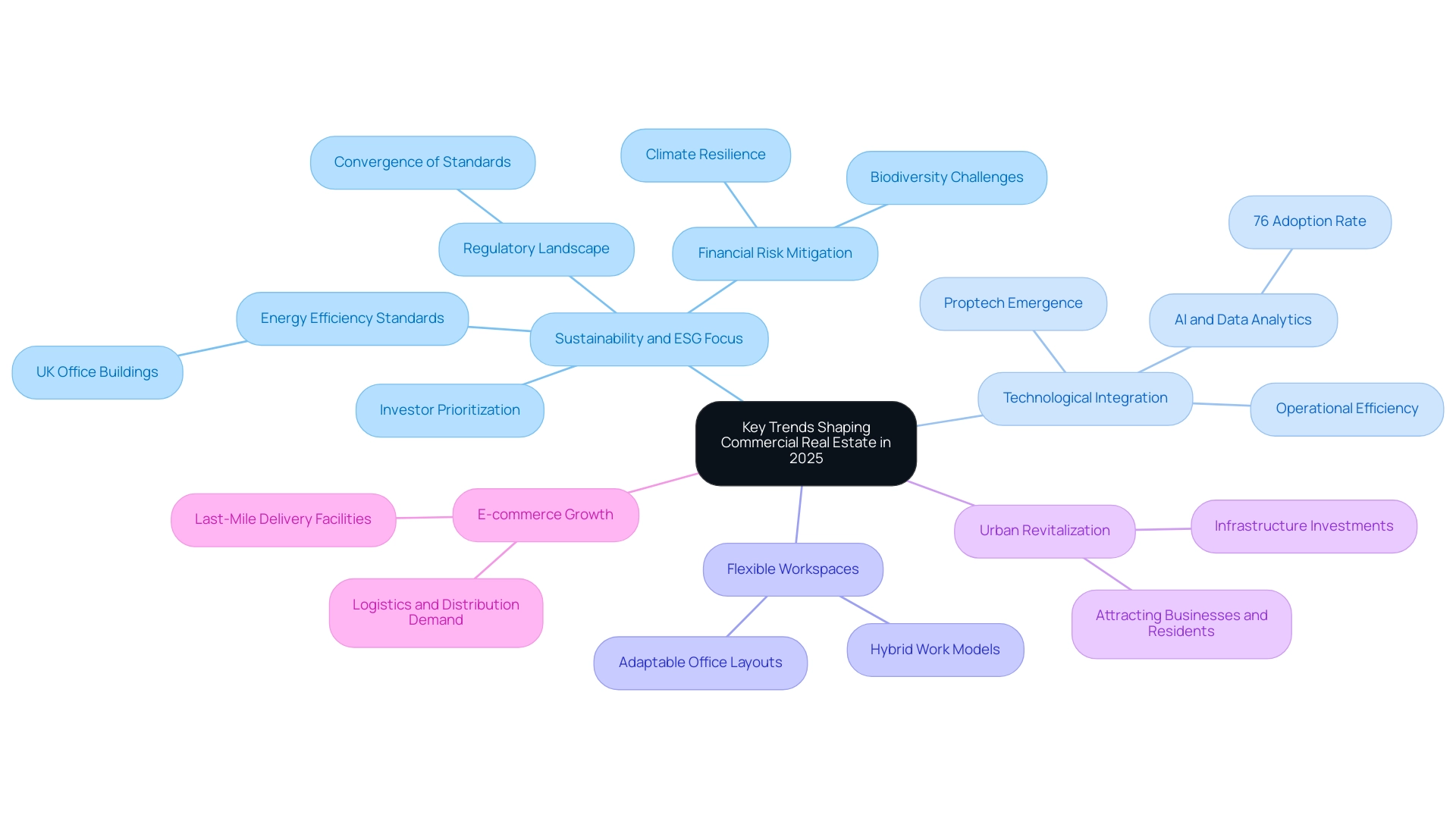

- Sustainability and ESG Focus: A growing number of investors are prioritizing properties that align with environmental, social, and governance (ESG) criteria. This shift is driven by the recognition that sustainable practices not only mitigate financial risks but also enhance long-term asset value. As noted by Carli Schoenleber, Senior Communications Manager, "Through sustainability, CRE firms can protect value by mitigating financial risks, strengthening climate resilience, optimizing insurance, and addressing biodiversity challenges." Furthermore, the convergence between international standards and EU regulations will continue to shape the regulatory landscape, despite potential pushback on regulatory overload. In the UK, nearly two-thirds of office buildings are rated below the required energy efficiency standards, presenting opportunities for deep energy retrofits.

- Technological Integration: The commercial property sector is undergoing substantial change due to the emergence of proptech. Advanced technologies, including artificial intelligence and data analytics, are revolutionizing property management and marketing strategies. A recent survey revealed that 76% of organizations in the sector are either researching or implementing AI processes, underscoring the urgency for firms to adapt to these innovations to remain competitive. This technological shift is anticipated to enhance operational efficiency and improve decision-making processes.

- Flexible Workspaces: The demand for flexible office solutions is surging as businesses continue to embrace hybrid work models. This trend reflects a broader shift in workplace dynamics, prompting landlords to rethink traditional office layouts and offer adaptable spaces that cater to diverse tenant needs.

- Urban Revitalization: Many urban centers are experiencing a renaissance, driven by investments in infrastructure and amenities aimed at attracting businesses and residents. This revitalization is not only boosting the attractiveness of downtown areas but also generating opportunities for business property investments that align with urban development objectives.

- E-commerce Growth: The relentless expansion of e-commerce is significantly impacting the demand for logistics and distribution centers, particularly in urban locales. As online shopping continues to gain traction, the need for strategically located facilities that can efficiently support last-mile delivery is becoming increasingly critical.

These trends highlight the evolving characteristics of the commercial property market, which are crucial to the commercial real estate forecast for 2025. As sustainability, technology, and shifting consumer behaviors transform investment strategies and operational practices, a recent survey conducted by the Deloitte Center for Financial Services suggests an optimistic shift in sentiment concerning property prospects. Expectations of heightened revenue growth and transaction activity are influenced by factors such as geopolitical stability and interest rates.

Economic Influences on Commercial Real Estate Investment

Economic factors are pivotal in shaping the commercial real estate landscape in 2025, with several key influences at play:

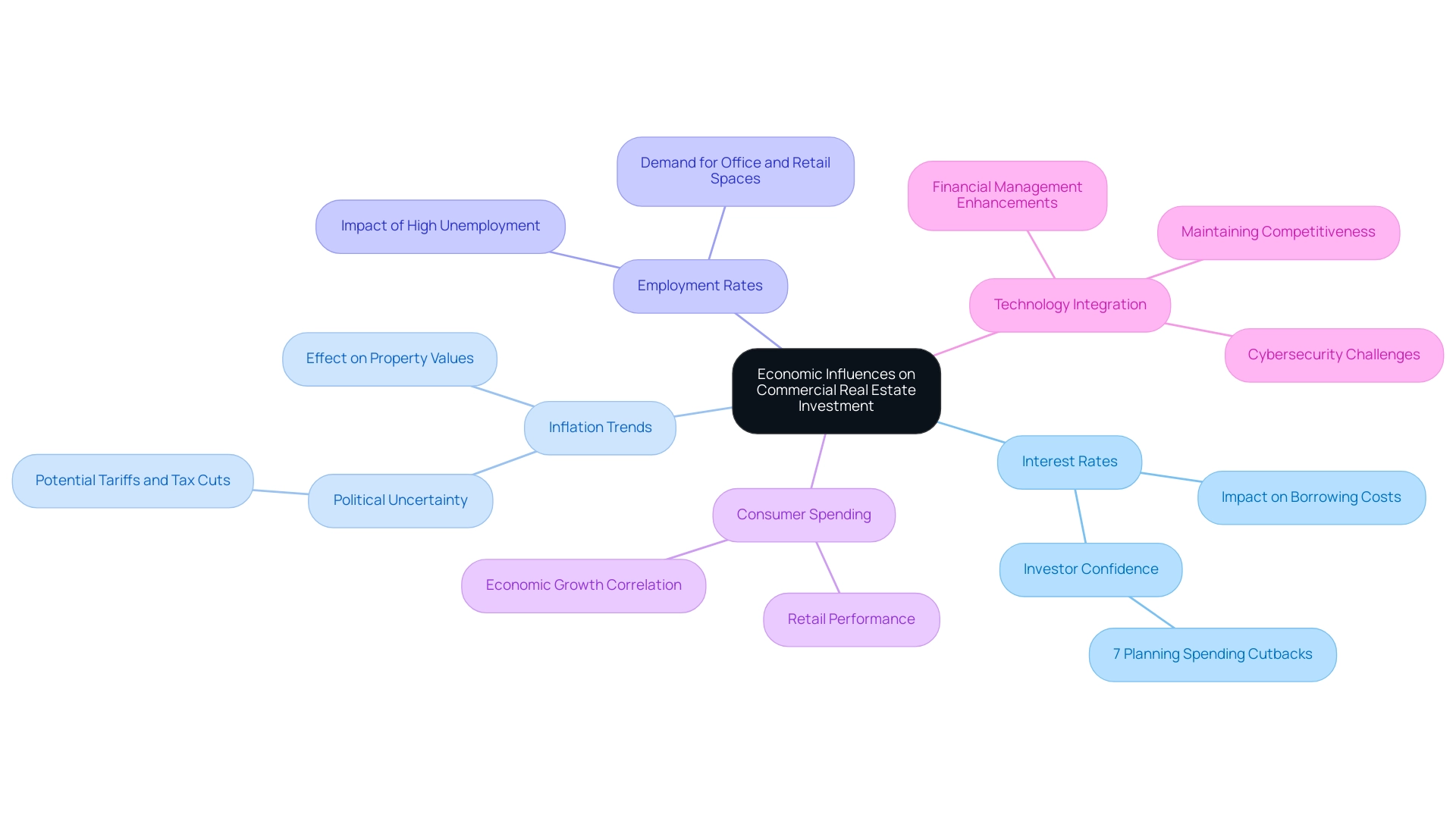

- Interest Rates: As central banks navigate monetary policies, interest rates are projected to stabilize. This stabilization will significantly affect borrowing costs for those seeking funds, making financing more accessible and potentially stimulating investment activity in the sector. Notably, only 7% of real estate professionals are planning spending cutbacks, indicating a resilient outlook despite economic fluctuations. This statistic reflects a broader confidence in the economy, suggesting that many investors are optimistic about future opportunities.

- Inflation Trends: Inflationary pressures are anticipated to affect property values and rental rates. Investors must conduct careful analysis of economic conditions to adapt their strategies accordingly. Political uncertainty, including potential tariffs and tax cuts from a new administration in 2025, could further exacerbate inflation, necessitating vigilance in investment planning.

- Employment Rates: A robust job environment is essential for driving demand for office and retail spaces. Conversely, high unemployment rates can lead to increased vacancies, impacting rental income and property values. Investors should monitor employment trends closely to gauge market health and adjust their portfolios as needed.

- Consumer Spending: Economic growth and consumer confidence are critical for retail performance. As consumer spending rises, it can enhance the attractiveness of retail investments, influencing strategic decisions in this sector. Investors should remain attuned to shifts in consumer behavior to capitalize on emerging opportunities.

In addition to these factors, the integration of technology into operations is becoming increasingly vital. Investors are focusing on tech enhancements to address challenges such as cybersecurity and financial management, even amidst potential budget constraints due to rising interest rates. Embracing technology is viewed as essential for maintaining competitiveness and improving investment outcomes.

Expert insights suggest that the likelihood of lower interest rates could bolster confidence among capital providers, promoting higher investment in commercial real estate. Noel Roberts, Manager of the CRE Portfolio Monitoring team at Acuity Knowledge Partners, states, "The likelihood of lower interest rates would increase confidence among investors, promoting higher investment in CRE." This sentiment underscores the importance of staying informed about the commercial real estate forecast for 2025 and the economic influences that shape the investment landscape.

Furthermore, Zero Flux's commitment to data integrity and sourcing information from a wide array of credible outlets reinforces the reliability of the insights presented here, ensuring that stakeholders are equipped with accurate and trustworthy information.

Challenges Ahead: What Investors Need to Know

Investors in the commercial real estate sector must navigate several significant challenges in 2025:

-

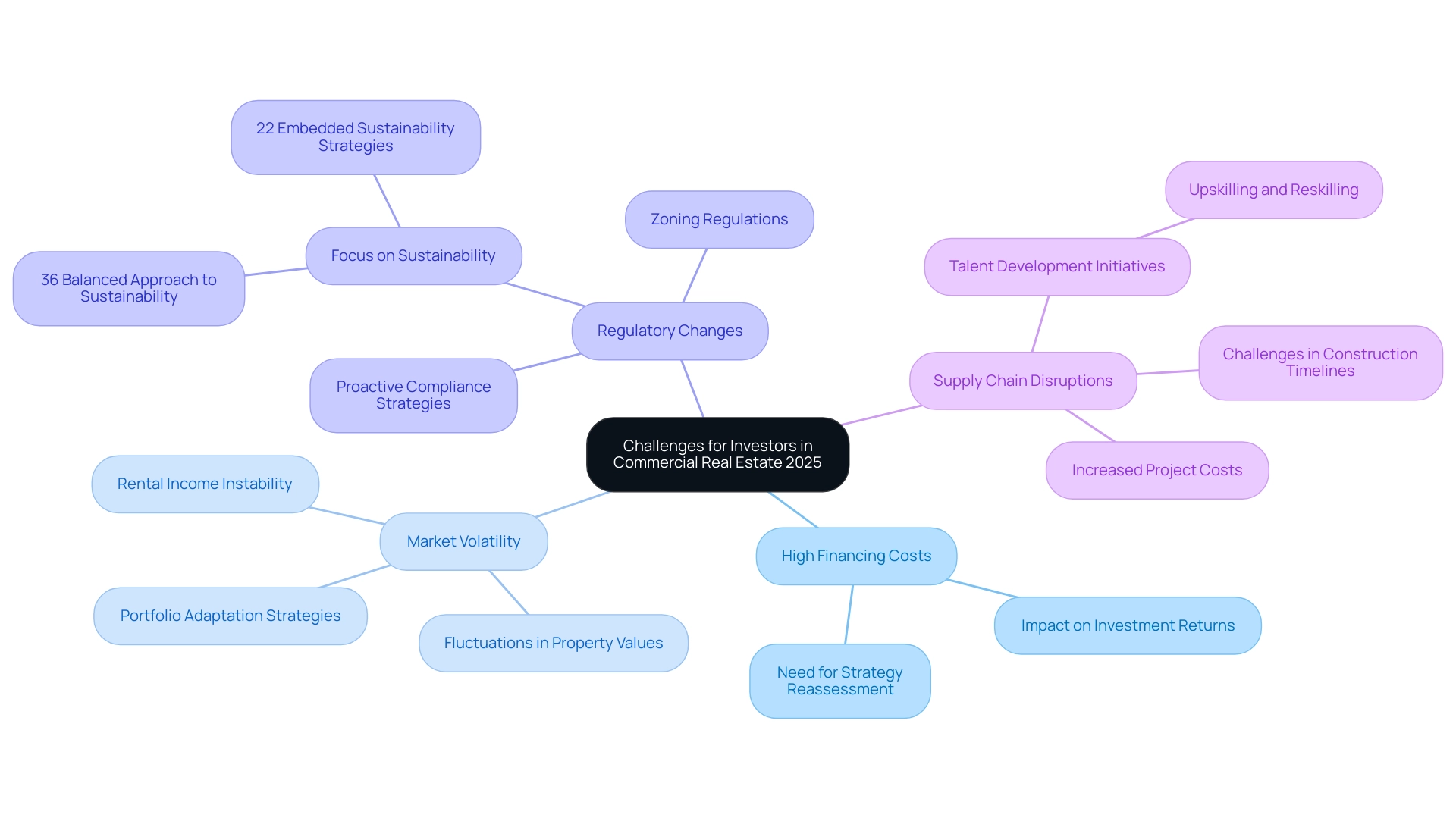

High Financing Costs: The ongoing rise in interest rates is anticipated to elevate borrowing costs, substantially impacting investment returns. As financing becomes more expensive, investors may need to reassess their strategies to maintain profitability.

-

Market Volatility: Economic uncertainties are likely to induce fluctuations in property values and rental income. Investors must remain agile and responsive to these changes, adapting their portfolios to mitigate risks associated with market instability.

A survey conducted by the Deloitte Center for Financial Services reveals that the commercial real estate forecast for 2025 points to a potential revival in the global commercial property industry, suggesting a positive shift in sentiment regarding revenue growth and transaction activity.

-

Regulatory Changes: The landscape of commercial property is evolving, with new regulations focusing on sustainability and zoning. These changes can significantly influence property development and investment strategies, necessitating a proactive approach to compliance and adaptation. Notably, 36% of survey respondents maintain a balanced approach to sustainability investment, underscoring the growing importance of sustainability in business strategies.

-

Supply Chain Disruptions: Persistent global supply chain issues continue to pose challenges for construction timelines and costs. These disruptions can influence project feasibility, urging stakeholders to consider potential delays and increased expenses when planning new developments. Furthermore, accelerated upskilling and reskilling initiatives have remained a top three response over the past two years, highlighting the significance of talent development in addressing these challenges. As the commercial property sector evolves, understanding these challenges will be essential for stakeholders aiming to make informed choices and seize emerging opportunities. With over 30,000 subscribers, Zero Flux serves as a vital resource for industry professionals, providing essential insights to help navigate these complexities.

Identifying Opportunities in the 2025 Commercial Real Estate Market

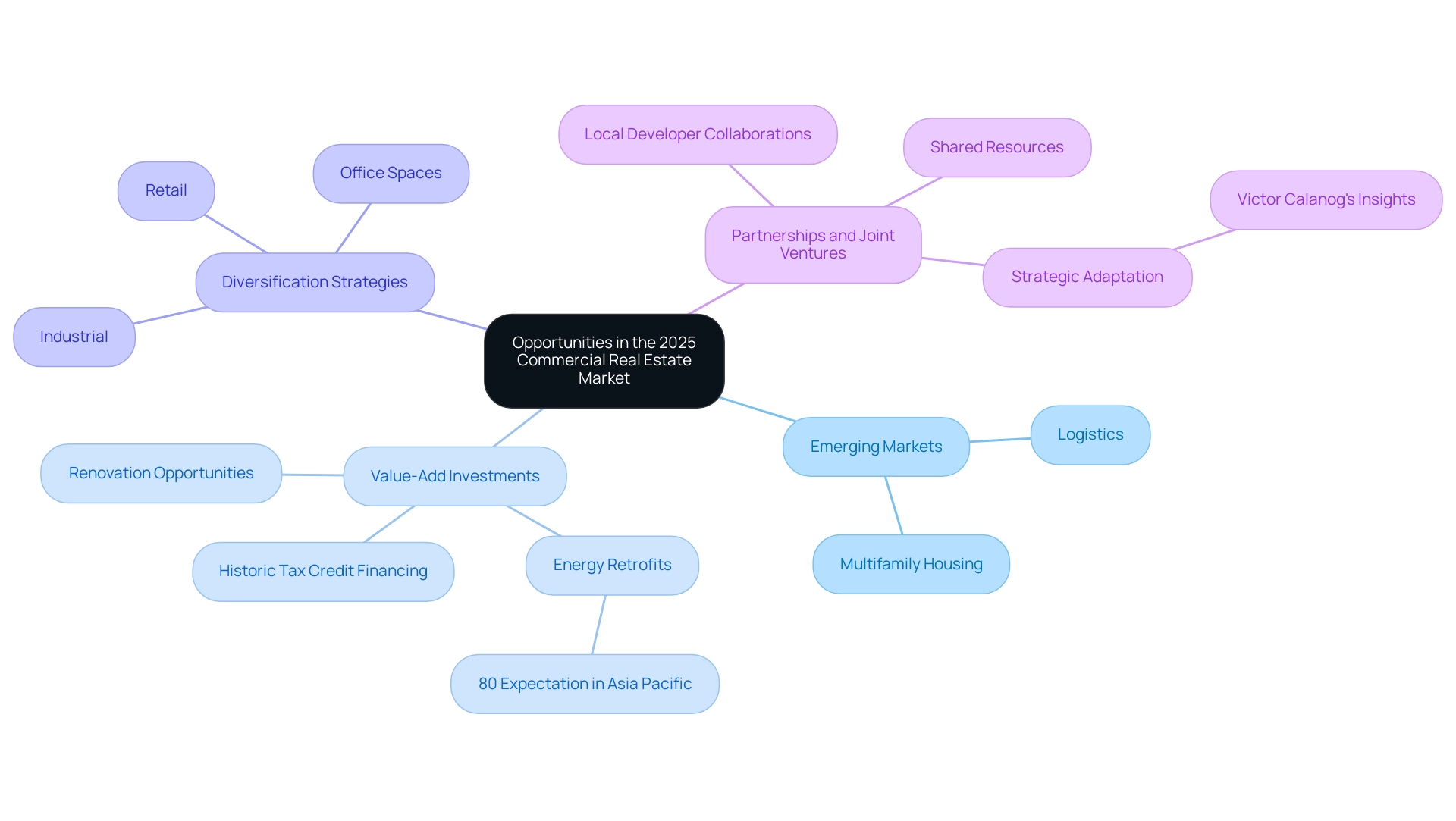

Despite the challenges confronting the commercial real estate market, numerous opportunities are emerging for investors in 2025.

Emerging Markets: Investors are encouraged to explore emerging markets, particularly in logistics and multifamily housing, where growth potential remains robust. These sectors are poised for expansion, driven by increasing demand for efficient supply chains and urban living solutions.

Value-Add Investments: Properties requiring renovation or repositioning present significant upside potential, especially in urban areas. By investing in these properties, individuals can capitalize on the growing trend of urban revitalization, transforming underperforming assets into profitable ventures. Notably, 80% of survey participants in Asia Pacific anticipate undertaking deep energy retrofits in the next 12 to 18 months, indicating a strong shift towards sustainable enhancements. Additionally, utilizing Historic Tax Credit financing can provide valuable funding options for rehabilitating older affordable housing structures, making these investments even more attractive.

Diversification Strategies: To mitigate risks, individuals should consider diversifying their portfolios across various asset classes, including industrial, retail, and office spaces. This method not only distributes risk but also enables participants to benefit from various economic dynamics.

Partnerships and Joint Ventures: Collaborating with local developers or investors can unlock new opportunities and provide access to shared resources. Such partnerships can enhance investment success by leveraging local knowledge and networks, which are crucial for navigating the complexities of commercial real estate. Victor Calanog, Global Head of Research and Strategy at Manulife Investment Management, observes that "there are some suburban office sectors that are showing signs of cap rate flatness or even declines," highlighting the importance of strategic partnerships in adapting to conditions.

As the market evolves, staying informed about the commercial real estate forecast for 2025 will be essential for making strategic investment decisions. For further insights, Zero Flux serves as a leading authority in real estate information dissemination, providing data-driven resources that can aid investors in navigating these opportunities.

Conclusion

The commercial real estate landscape in 2025 is characterized by a compelling blend of resilience and adaptability across various sectors. With industrial and retail markets exhibiting remarkable strength, particularly fueled by the ongoing e-commerce boom, investors are presented with unique opportunities to capitalize on emerging trends. The significance of upskilling and workforce development cannot be overstated, as organizations prepare for a future that necessitates a more agile and knowledgeable workforce.

Technological integration and sustainability have emerged as central themes driving investment strategies. As firms increasingly prioritize properties that adhere to environmental, social, and governance (ESG) criteria, the push for energy efficiency and innovative technologies will profoundly shape the market's trajectory. Investors must remain vigilant in adapting to these shifts, ensuring compliance with evolving regulations while positioning themselves to benefit from the resulting opportunities.

Challenges such as high financing costs, market volatility, and supply chain disruptions loom large; however, they also serve as catalysts for strategic thinking and innovation. By exploring value-add investments, diversifying portfolios, and forming strategic partnerships, investors can effectively navigate these complexities. The commercial real estate sector in 2025 is rich with potential for those willing to adapt and embrace change.

In conclusion, staying informed and agile is crucial for success in this dynamic environment. As the market continues to evolve, those who leverage the insights and trends discussed will be best positioned to thrive in the competitive landscape of commercial real estate.