Overview

The article provides a comprehensive overview of the commercial real estate industry’s outlook, emphasizing significant trends such as:

- Post-pandemic recovery

- The impacts of remote work

- Increasing sustainability demands

It also addresses the challenges faced by investors. It presents compelling data on market fluctuations and demographic shifts, underscoring the critical need for investors to adapt their strategies to navigate this evolving landscape effectively. By understanding these dynamics, readers are better positioned to make informed investment decisions that align with current market realities.

Introduction

The commercial real estate landscape is experiencing a seismic shift, driven by economic fluctuations and evolving consumer preferences. As investors navigate this complex terrain, grasping the fundamentals—such as property types, investment metrics, and leasing structures—becomes essential for making informed decisions.

Yet, with challenges like market volatility and financing difficulties looming large, how can stakeholders effectively position themselves to capitalize on emerging opportunities?

By exploring the latest trends and demographic shifts, investors can gain valuable insights into the future of commercial real estate investment.

Explore the Fundamentals of Commercial Real Estate

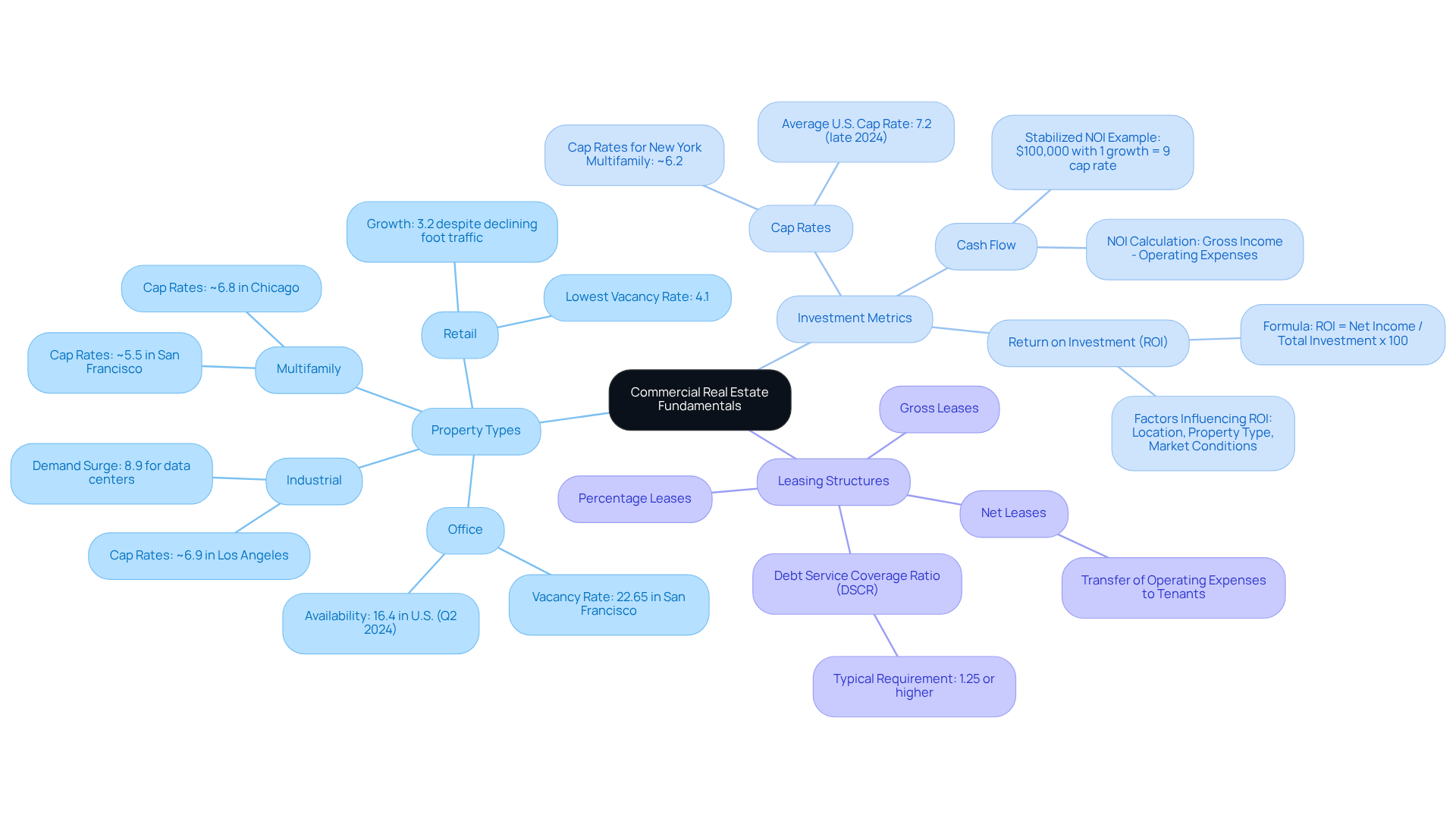

Commercial real estate (CRE) refers to assets utilized exclusively for business activities, encompassing commercial buildings, retail spaces, warehouses, and multifamily housing units. Understanding the fundamentals involves recognizing the different types of commercial properties, their uses, and their valuation methods. Key concepts include:

Property Types: Familiarize yourself with the four main categories: office, retail, industrial, and multifamily. Each category possesses unique characteristics and market dynamics. For instance, office space availability in the U.S. reached 16.4% in Q2 2024, with San Francisco experiencing a notable vacancy rate of 22.65% for office spaces. In contrast, industrial real estate has seen a surge in demand, particularly in secondary markets.

Investment Metrics: It is crucial to learn about cap rates, cash flow, and return on investment (ROI), as these metrics are essential for evaluating potential investments. The average U.S. cap rate increased from 6.4% in 2023 to 7.2% by late 2024. Notably, cap rates for Chicago multifamily units are approximately 6.8%, for San Francisco multifamily residences around 5.5%, and for New York multifamily complexes about 6.2%. Understanding these metrics empowers stakeholders to evaluate real estate profitability effectively.

Leasing Structures: Comprehending the differences between gross leases, net leases, and percentage leases is vital, as these structures impact both cash flow and risk. For example, net leases often transfer some operating expenses to tenants, which can enhance the landlord’s cash flow stability. Lenders typically seek a Debt Service Coverage Ratio (DSCR) of 1.25 or higher, indicating that the property generates 25% more income than necessary to cover its debt payments.

By grasping these fundamentals, including the commercial real estate industry outlook that shows a 20% decrease in commercial property values over a two-year period, individuals can make informed choices and better navigate the complexities of the commercial property landscape. As noted by JPMorgan Chase Bank, “Cap rates measure investors’ return expectations, but they’re a forward-looking point-in-time measurement.

Analyze the Current Market Outlook and Trends

The commercial real estate industry outlook is influenced by a multitude of factors, including economic conditions, interest rates, and evolving consumer behaviors. Investors should closely monitor key trends that are currently influencing the landscape:

Post-Pandemic Recovery: Numerous markets are experiencing a resurgence as businesses adapt to new operational models. For example, while the multifamily sector has stabilized with vacancies at 8% and minimal rent growth of 1%, it has also faced a 6.1% decline in value, translating to a staggering $300 billion in losses since 2019. In contrast, the retail sector has emerged as the most resilient category in commercial real estate, showcasing increased demand compared to pre-pandemic levels. Notably, retail is the only product type for which aggregate vacancy has declined since 2019, signaling a significant recovery.

Remote Work Impact: The shift to remote work has dramatically altered the demand for workspace, leading to a 23.3% decrease in total value since 2019, resulting in an astonishing $740 billion loss. This trend has contributed to an overall vacancy rate of 14%, with Class A workspaces experiencing even higher rates at 20%. Demand for workspace has decreased by 160 million square feet since Q1 2019, underscoring the extent of this decline. Smaller metro areas are witnessing some absorption gains as companies seek more affordable locations, indicating a shift in the utilization and valuation of office properties.

Sustainability Trends: An increasing emphasis on sustainability is driving demand for green buildings that not only provide long-term cost savings but also attract environmentally conscious tenants. This trend aligns with the broader market shift towards mixed-use developments that prioritize convenience and community engagement.

By remaining vigilant to these trends, investors can strategically position themselves within the evolving commercial real estate industry outlook.

Navigate Challenges in Commercial Real Estate Investment

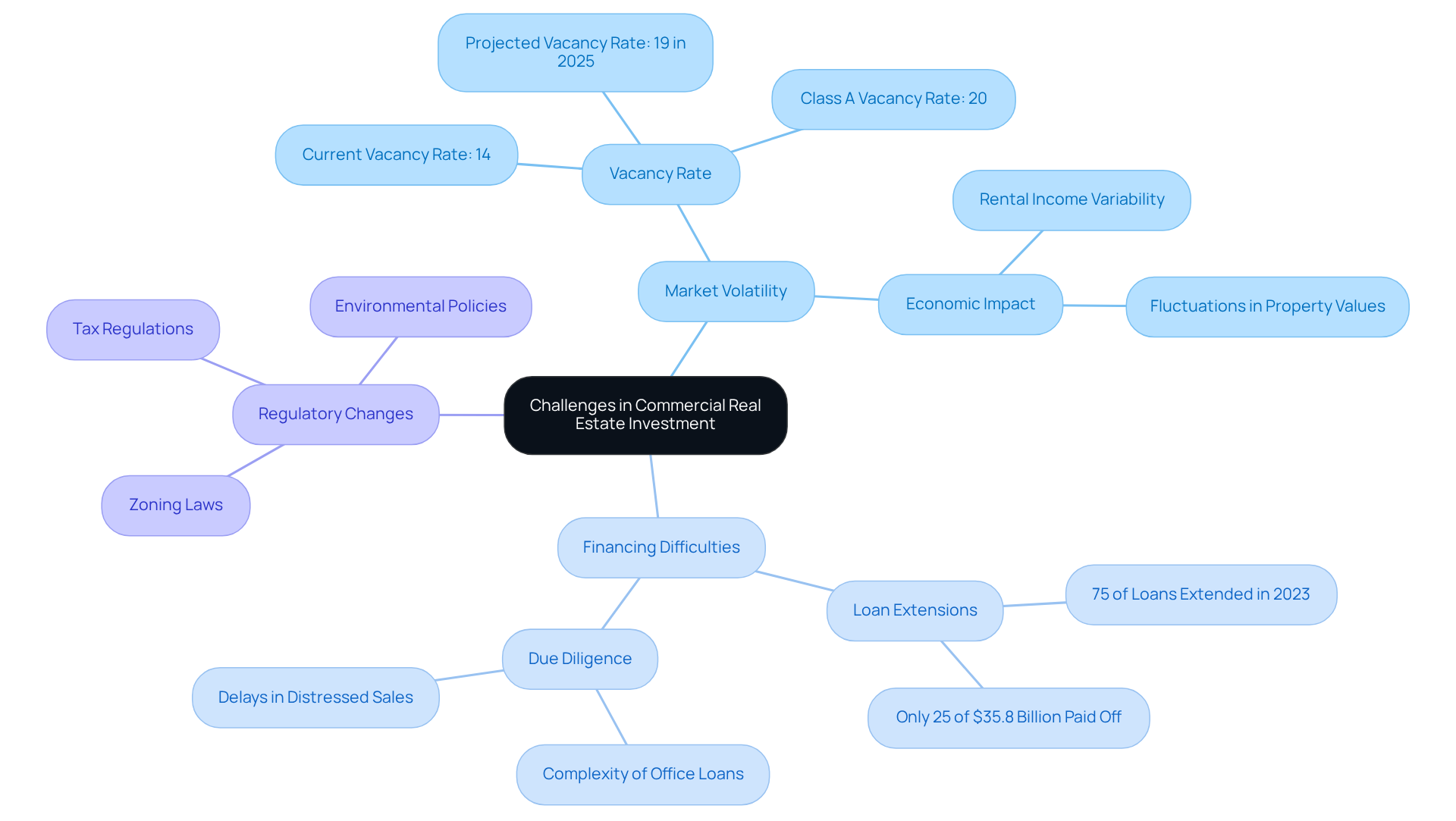

Investing in the commercial real estate industry outlook presents a unique set of challenges that require careful navigation. Key issues include:

Market Volatility: Economic downturns can lead to significant fluctuations in property values and rental income. For instance, the vacancy rate for workspace has increased to 14%, with forecasts suggesting it might reach 19% in 2025. Additionally, the vacancy rate for Class A workspace is currently at 20%. Investors must be prepared for these shifts and develop contingency plans to mitigate risks associated with market instability.

Financing Difficulties: Obtaining funding continues to be a significant obstacle, especially for newcomers. With approximately 75% of business loans due in 2023 being extended rather than paid off, it is crucial to understand various financing options and maintain a robust credit profile for accessing capital. Significantly, merely 25% of the ~$35.8 billion in commercial loans maturing in 2023 were settled completely, emphasizing the difficulties stakeholders encounter in obtaining financing. Case studies demonstrate that numerous stakeholders encounter delays in distressed sales because of the intricacy of office loans, highlighting the necessity for comprehensive due diligence.

Regulatory Changes: Staying informed about zoning laws, tax regulations, and environmental policies is vital, as these factors can significantly influence property use and profitability. Government policies can cause temporary increases in demand, so individuals should actively monitor legislative developments to adjust their strategies accordingly.

By proactively tackling these challenges, investors can improve their chances of success in light of the commercial real estate industry outlook, ensuring they are well-prepared to navigate the complexities of this dynamic industry.

Understand Demographic Shifts and Their Impact on the Market

Demographic changes, such as an aging population and urbanization, have a significant impact on the commercial real estate industry outlook. Key factors to consider are:

Aging Population: The U.S. population is aging rapidly, with seniors projected to comprise nearly 25% of the population by 2050. This demographic shift is driving a heightened demand for healthcare facilities and senior housing, creating substantial investment opportunities in these sectors. The U.S. healthcare property market is anticipated to expand from USD 1.32 trillion in 2024 to USD 1.87 trillion by 2030, driven by this demand and heightened healthcare expenditure. Notably, the number of people over 80 is expected to more than double in the next 40 years, underscoring the urgency for healthcare facilities.

Urbanization Trends: Urban areas are experiencing significant population influxes, leading to increased demand for multifamily housing and mixed-use developments. As more people pursue the comforts of urban life, the demand for flexible property solutions becomes essential. This trend is transforming commercial property, emphasizing spaces that accommodate urban lifestyles.

Generational Preferences: Younger generations, particularly Millennials and Gen Z, prioritize walkable communities and sustainable living options. Notably, Gen Z shows a 100% preference for green amenities in real estate assets, indicating a shift towards environmentally conscious developments. Furthermore, 67% of stakeholders plan to enter the senior living market by 2028, highlighting the growing interest in sustainable and senior living developments. Comprehending these preferences is essential for individuals seeking to align their portfolios with changing market demands.

By closely examining these demographic trends, investors can uncover emerging opportunities and strategically position their investments in light of the commercial real estate industry outlook to meet the changing needs of the market.

Conclusion

The commercial real estate industry is undergoing significant transformations, shaped by a variety of market dynamics and emerging trends. Understanding these changes is essential for investors and stakeholders aiming to navigate the complexities of this sector effectively. By grasping the fundamentals of commercial real estate—property types, investment metrics, and leasing structures—individuals can make informed decisions that align with the current market outlook.

Key insights reveal that the industry is recovering from the impacts of the pandemic. Sectors like retail are demonstrating resilience, while others, such as office space, face challenges due to shifting work patterns. The emphasis on sustainability, along with demographic shifts—including an aging population and urbanization trends—complicates the landscape but also presents new investment opportunities. Furthermore, awareness of the challenges posed by market volatility, financing difficulties, and regulatory changes is crucial for success in this field.

Ultimately, staying informed and adaptable in response to these trends and challenges is vital for anyone involved in commercial real estate. As the market continues to evolve, embracing innovative strategies and aligning investments with demographic preferences will be essential. Engaging with these insights not only enhances understanding but also positions investors to thrive in the dynamic world of commercial real estate.