Overview

The article "Commercial Real Estate Investing 101: Essential Steps for Success" presents a comprehensive overview of the fundamental concepts and strategies vital for successful investment in commercial real estate. It emphasizes critical elements such as:

- Understanding key financial metrics

- Evaluating various property types

- Assessing financial readiness

- Conducting thorough market research

- Effectively managing tenant relationships

Collectively, these components equip investors with the necessary knowledge and tools to make informed decisions in the dynamic commercial real estate market.

Introduction

Navigating the world of commercial real estate investing can seem daunting, particularly for those embarking on this journey. With a diverse array of property types and financial metrics to comprehend, establishing a solid foundation of knowledge and strategic planning is essential. This guide illuminates the crucial steps that empower investors to make informed decisions.

From grasping key concepts like net operating income and cap rates to evaluating financial readiness and conducting effective market research, each element plays a vital role in the investment process.

However, what challenges lie ahead for those who venture into this complex landscape? More importantly, how can they overcome these obstacles to achieve lasting success?

Understand the Basics of Commercial Real Estate Investing

To embark on your journey in commercial real estate investing 101, it is crucial to familiarize yourself with key terms and concepts. Commercial real estate (CRE) encompasses assets used for business purposes, such as office buildings, retail spaces, and industrial facilities. Understanding the following terms will significantly enhance your investment acumen:

-

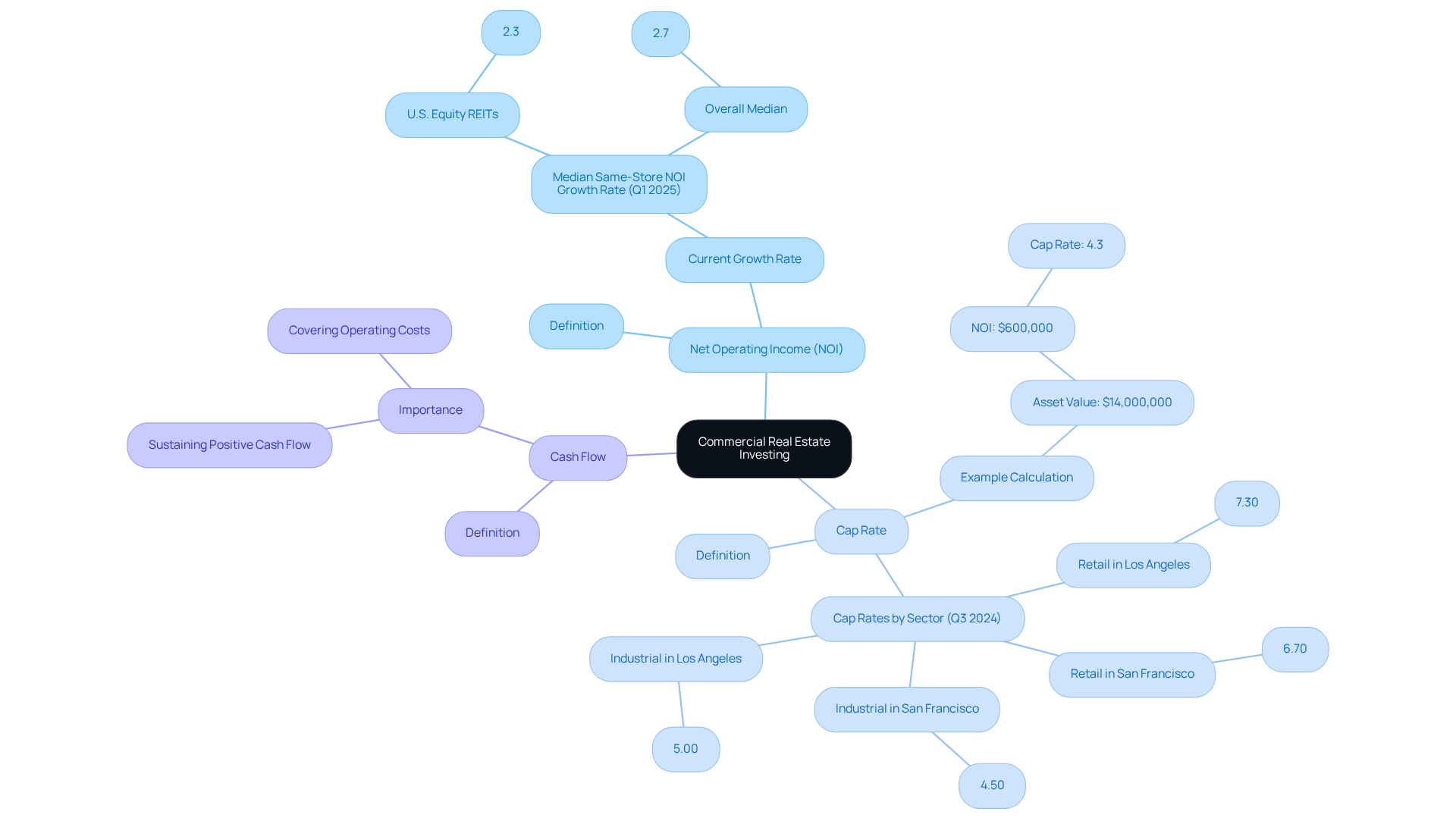

Net Operating Income (NOI): This figure represents the income generated from a property after deducting operating expenses. As of the first quarter of 2025, the median same-store NOI growth rate across U.S. equity REITs was 2.3%, while the overall median same-store NOI growth rate was 2.7%, reflecting the ongoing performance of various sectors.

-

Cap Rate: This essential metric estimates the return on an investment asset, determined by dividing the NOI by the acquisition price. For example, an asset valued at $14,000,000 with an NOI of $600,000 produces a cap percentage of 4.3%. In 2025, average capitalization percentages for commercial sectors vary, with retail assets in major cities such as San Francisco at 6.70% and Los Angeles at 7.30%. Furthermore, industrial real estate in San Francisco had a cap rate of 4.50% and in Los Angeles at 5.00% in Q3 2024, providing a broader context for understanding cap rates across various sectors.

-

Cash Flow: This term refers to the net amount of cash being transferred into and out of your asset, which is vital for assessing the financial health of your property. For instance, sustaining positive cash flow is essential for covering operating costs and ensuring the longevity of your capital.

By mastering these concepts, you will be well-prepared to navigate the complexities of commercial real estate investing 101 and make informed choices that align with your financial objectives.

Explore Different Types of Commercial Properties

Commercial properties encompass several categories, each presenting unique investment potential and market dynamics.

-

Office Buildings: These spaces are leased to businesses for administrative functions, ranging from single-tenant structures to expansive multi-tenant complexes. The investment potential for office buildings is influenced by factors such as location, tenant demand, and market trends. In 2025, the office sector is encountering difficulties, with vacancy levels hitting 16.4% and values decreasing by 14% over the previous year. Major cities such as San Francisco have even higher vacancy percentages at 22.65%. However, strategic allocations in prime locations can yield significant returns as the market stabilizes.

-

Retail Properties: These locations facilitate the sale of goods and services, including shopping centers and standalone stores. The retail industry is adjusting to evolving consumer habits, with certain establishments sustaining lower vacancy rates at 4.1% despite difficulties encountered by conventional malls, which contend with an 8.6% vacancy rate. Successful retail investments often hinge on understanding market dynamics and tenant needs, ensuring long-term occupancy and profitability.

-

Industrial Properties: Used for manufacturing, warehousing, and distribution, industrial properties are critical in the evolving e-commerce landscape. The national industrial vacancy rate has risen to 6.4%, yet rent growth remains robust at 4.7% over the past year. Investors should focus on logistics hubs and emerging sectors, such as data centers, which have seen an 8.9% surge in demand.

-

Multifamily Properties: These residential buildings, such as apartment complexes, offer consistent cash flow through rental income. As real estate is frequently regarded as a safeguard against inflation, multifamily assets can offer stability and growth potential in variable markets.

Understanding the unique traits, risks, and benefits associated with each asset type is essential for anyone studying commercial real estate investing 101 to align investments with their overall strategy. As noted by industry experts, "Tenants are the lifeblood of commercial real estate. Comprehending their requirements, likes, and trends is essential for effective management and long-term occupancy, emphasizing the significance of insight and knowledgeable decision-making in navigating market changes.

Assess Your Financial Readiness for Investment

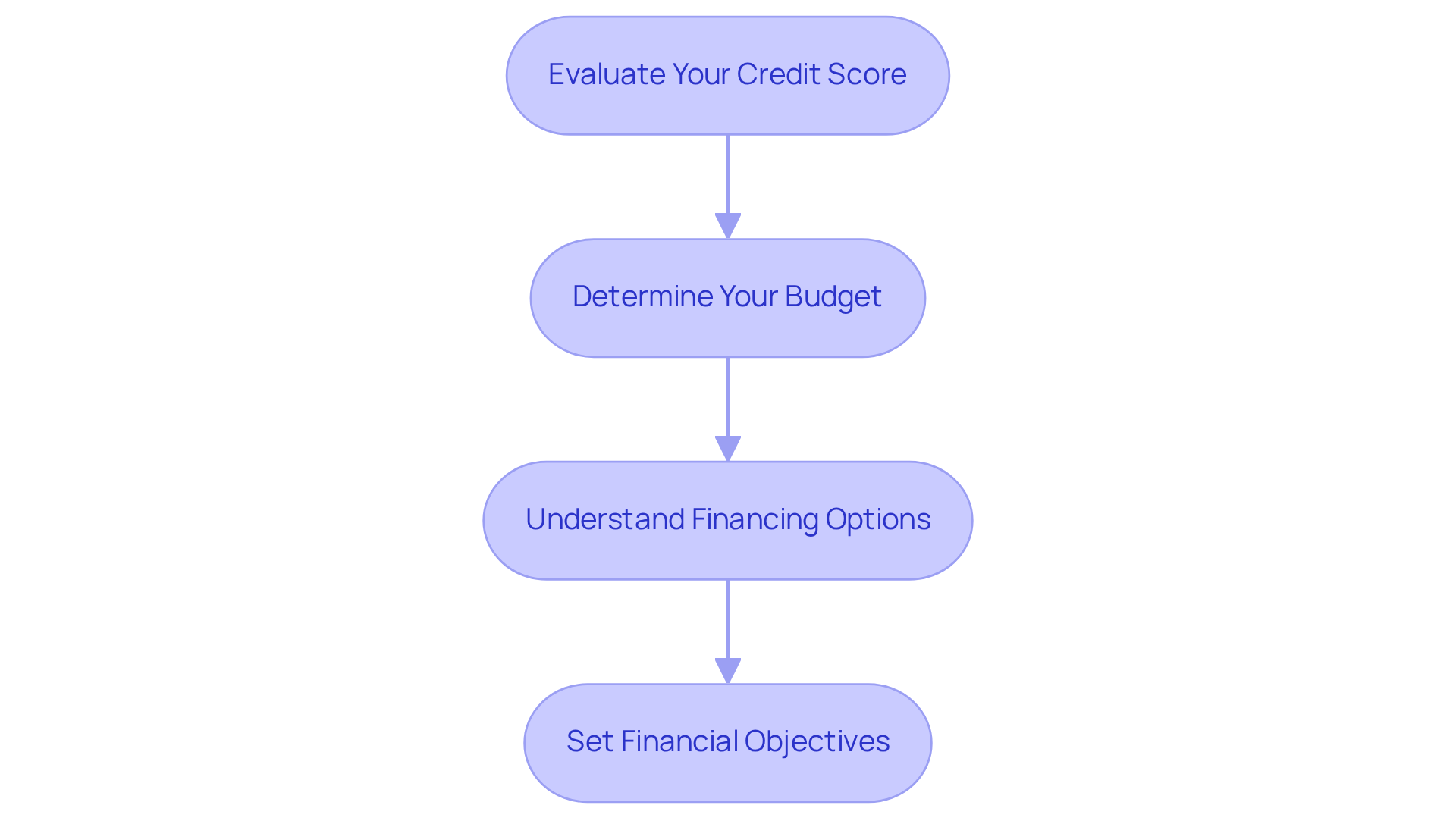

Before embarking on commercial real estate investing, it is crucial to assess your financial readiness by considering the following steps:

- Evaluate Your Credit Score: A robust credit score is essential, as it can significantly improve your financing options.

- Determine Your Budget: Accurately calculate how much you can invest, taking into account down payments and ongoing expenses.

- Understand Financing Options: Familiarize yourself with various loan types available for commercial properties, including conventional loans, SBA loans, and bridge loans.

- Set Financial Objectives: Clearly define your investment goals, whether they involve cash flow, appreciation, or a combination of both.

By thoroughly evaluating your financial circumstances, you can make more strategic allocation choices that align with your investment aspirations in the context of commercial real estate investing 101.

Conduct Effective Market Research and Analysis

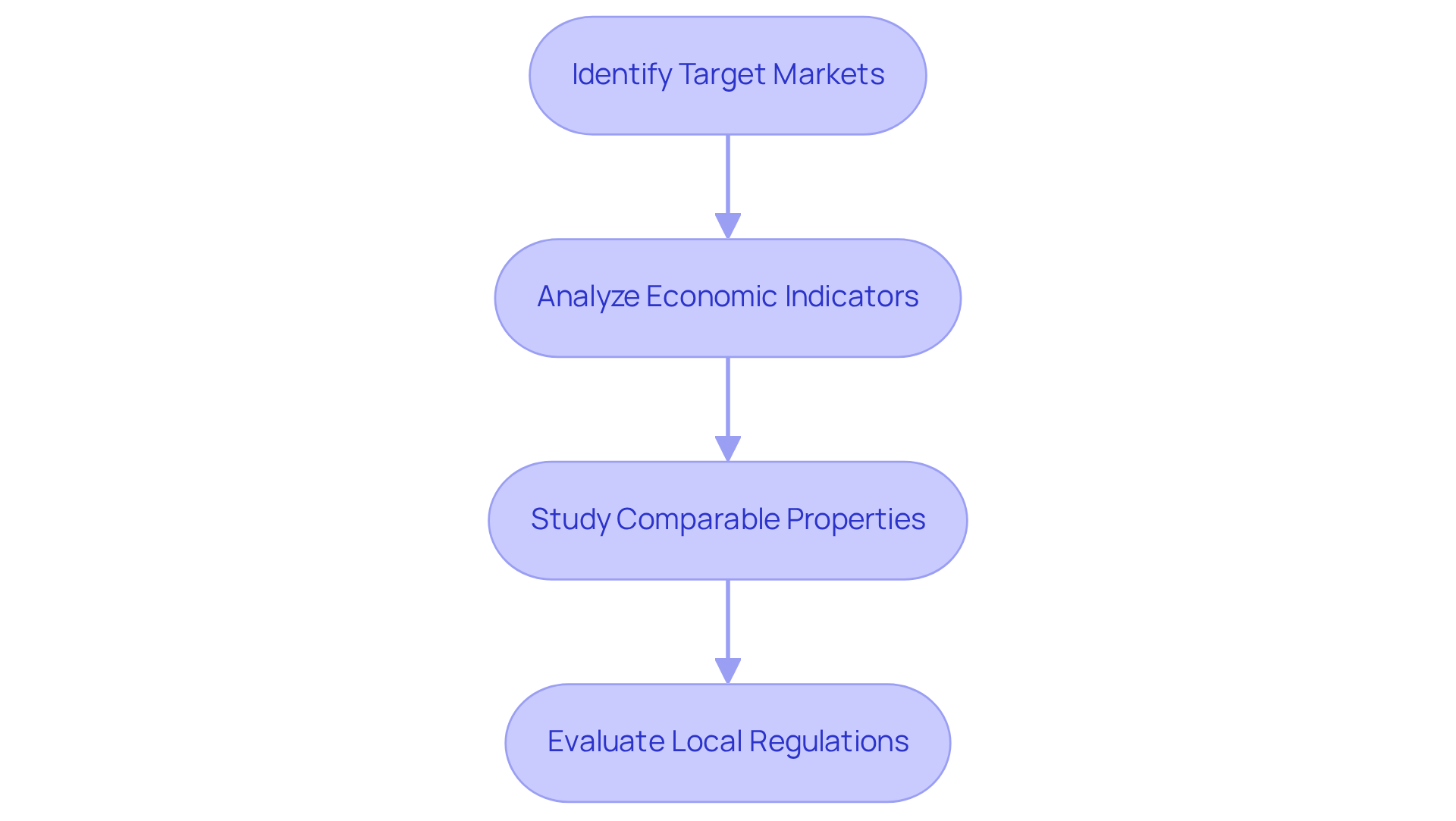

Conducting thorough market research is essential for successful investment in commercial real estate and involves several key steps:

-

Identify Target Markets: Begin by selecting geographic areas that align with your investment goals and risk tolerance. Consider population growth levels, as regions with rising populations often indicate greater demand for commercial spaces.

-

Analyze Economic Indicators: Examine local employment rates, economic trends, and demographic shifts that can significantly influence property values. For instance, understanding that millennials constitute 65% of first-time homebuyers can shape decisions in residential sectors. Moreover, with commercial real estate values having decreased by 20% over a two-year span, a thorough analysis is crucial for making informed financial decisions.

-

Study Comparable Properties: Investigate similar properties in the area to assess pricing, occupancy rates, and rental income potential. This analysis is vital for setting realistic expectations and identifying competitive advantages in the market.

-

Evaluate Local Regulations: Familiarize yourself with zoning laws and regulations that may impact your financial commitment. Awareness of these factors can prevent costly missteps and ensure compliance with local standards.

As W. Edwards Deming famously stated, "Without data, you're just another person with an opinion." By following these steps in commercial real estate investing 101, you can gain valuable insights into the market and make informed investment decisions, ultimately enhancing your chances of success in the commercial real estate landscape.

Manage Properties and Build Tenant Relationships

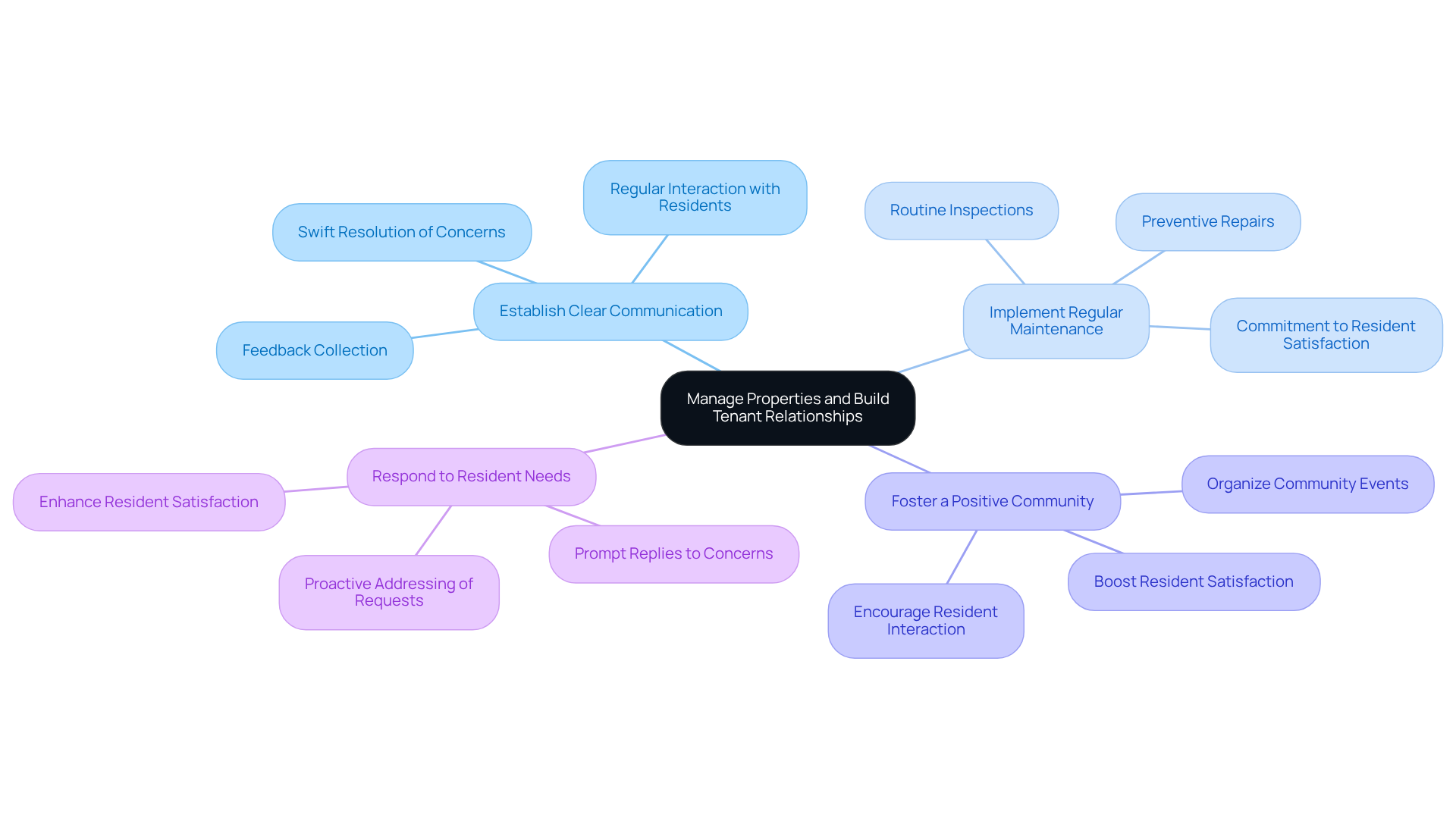

Effectively managing a commercial property post-acquisition is crucial for long-term success. Consider the following key strategies to enhance tenant relationships and improve retention rates:

- Establish Clear Communication: Open lines of communication are vital. Regularly interacting with residents allows for swift resolution of concerns and collection of feedback, fostering a transparent relationship.

- Implement Regular Maintenance: Schedule routine inspections and maintenance to ensure the property remains in excellent condition. This proactive approach can prevent expensive repairs and demonstrates a commitment to resident satisfaction.

- Foster a Positive Community: Organize events or initiatives that promote resident interaction. Creating a sense of community not only boosts resident satisfaction but also encourages longer lease agreements.

- Respond to Resident Needs: Be proactive in addressing resident requests and concerns. Prompt replies can significantly enhance resident satisfaction, leading to increased retention rates.

In 2025, the significance of rental relationships in commercial real estate cannot be overstated. Studies indicate that content renters are 73% more inclined to extend their leases and recommend their managers. As Marc Frenkiel observes, "Content tenants are 73% more inclined to be considering renewing their lease and over five times more probable to endorse their manager." Moreover, 41% of residents intending to renew cite satisfaction with their manager or landlord as a primary reason for their desire to stay. By prioritizing efficient asset management and nurturing resident relationships, you can secure the long-term success of your commercial real estate investing 101. Furthermore, leveraging technology such as AI-driven chatbots can enhance communication and responsiveness, further elevating resident satisfaction. With the property management market projected to reach $98.88 billion by 2029, focusing on tenant relationships is more critical than ever.

Conclusion

Understanding the fundamentals of commercial real estate investing is essential for anyone aiming to thrive in this dynamic field. By grasping key concepts such as Net Operating Income, Cap Rate, and Cash Flow, investors can make informed decisions aligned with their financial goals. Furthermore, recognizing the various types of commercial properties—ranging from office buildings to multifamily units—equips investors with the knowledge necessary to navigate market trends and identify lucrative opportunities.

The journey toward successful commercial real estate investing requires careful financial assessment, thorough market research, and effective property management. Evaluating credit scores, determining budgets, and understanding financing options establish a strong foundation for investment readiness. Additionally, conducting in-depth market analysis ensures that investors are well-informed about economic indicators, comparable properties, and local regulations. Ultimately, managing properties effectively and fostering positive tenant relationships are vital for ensuring long-term success and maximizing returns.

Ultimately, commercial real estate investing presents significant potential for growth and profitability. By following the essential steps outlined in this guide, investors can position themselves for success in a competitive market. Embracing a proactive approach to learning and adapting to market changes will not only enhance investment outcomes but also contribute to building a sustainable and rewarding investment portfolio.