Overview

The article underscores pivotal concepts and trends in commercial real estate (CRE), highlighting its critical role in the economy and the shifting market dynamics shaped by demographic changes and economic influences. Understanding these trends—such as the increasing prevalence of flexible office spaces and the significant impact of e-commerce on logistics—is essential for investors. By grasping these insights, investors can make informed decisions and seize emerging opportunities in a rapidly evolving landscape.

Introduction

Commercial real estate (CRE) is a cornerstone of economic growth, encompassing a diverse array of properties, from office buildings to industrial sites. As the landscape undergoes significant transformation due to shifting work patterns and demographic changes, grasping these trends is essential for investors and industry professionals.

How can stakeholders adeptly navigate this intricate environment to unveil lucrative opportunities amid rising vacancy rates and evolving consumer demands?

Define Commercial Real Estate: Key Concepts and Importance

Commercial business assets, known as commercial real estate (CRE), refer to locations utilized exclusively for business objectives, generating revenue through leasing or capital growth. This category includes:

- Office buildings

- Retail spaces

- Warehouses

- Industrial sites

Unlike residential properties, which focus on housing, commercial properties play a crucial role in the economy by providing spaces for businesses to operate, thus fostering job creation and economic development.

Understanding the various categories of commercial properties and their roles is vital for investors and industry experts navigating the commercial real estate update. By comprehending these distinctions, stakeholders can make informed decisions that align with market trends and investment opportunities. As the demand for commercial spaces evolves, the potential for capital growth and revenue generation highlights the importance of staying informed with the commercial real estate update for investors.

Explore Recent Trends in Commercial Real Estate: Market Dynamics and Influences

The current trends highlighted in the commercial real estate update underscore a significant shift towards flexibility and adaptability in response to evolving demands. The surge in remote work has notably amplified interest in flexible office spaces and co-working environments.

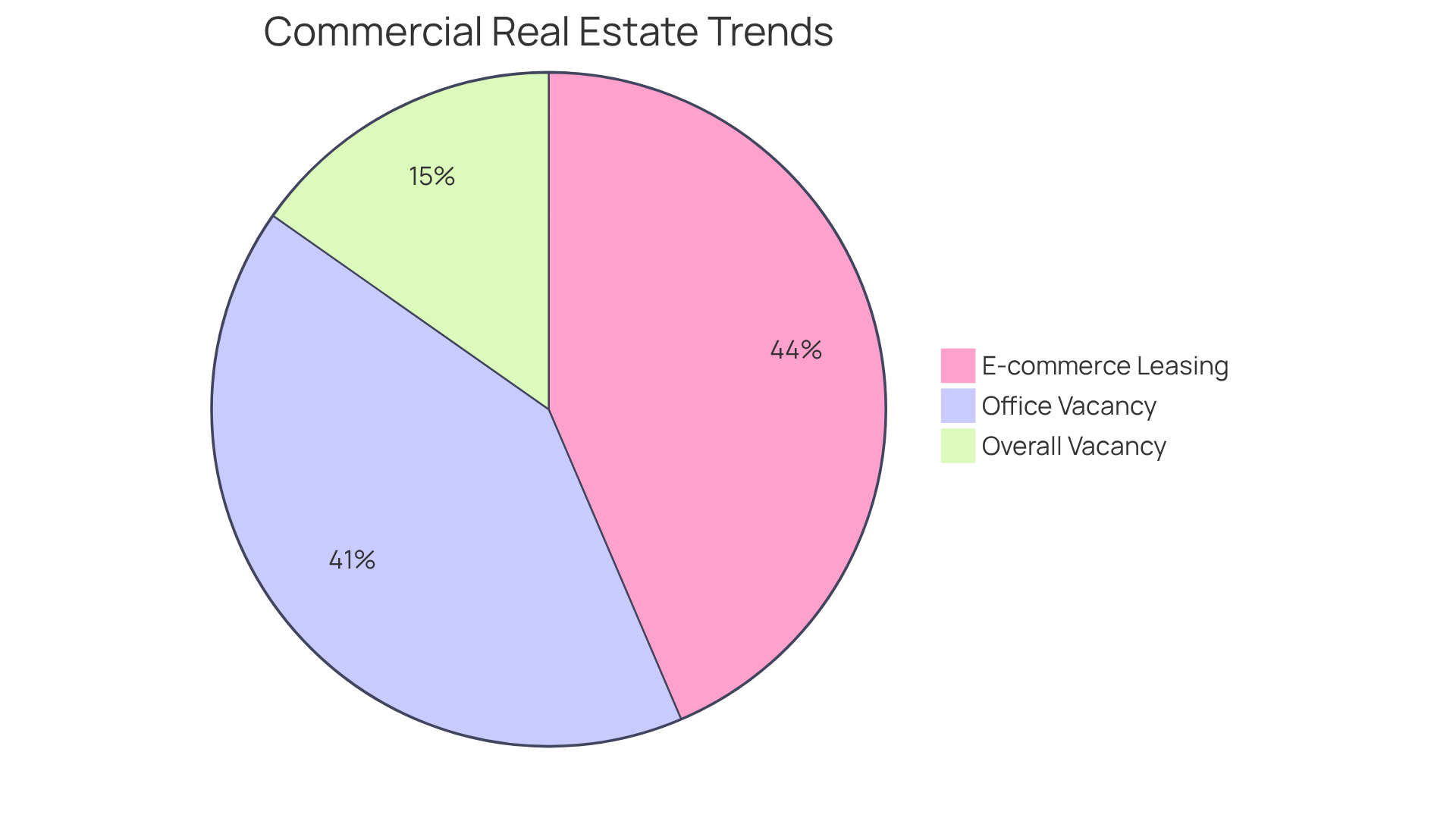

Statistics reveal that:

- The overall office vacancy rate is projected to rise to 18.9% by year-end 2025.

- The overall vacancy rate across the sector is anticipated to reach 7.0% by the same year.

This transition is further intensified by the growing demand for logistics and distribution hubs, propelled by e-commerce expansion, which now accounts for approximately 20% of new leasing in logistics properties, up from less than 5% just five years ago.

Retail spaces are also undergoing transformation, integrating experiential elements to captivate consumers, as illustrated by the record-high 1.4% of total retail square footage being classified as obsolete.

Economic factors, including fluctuations in interest rates and inflation, play a pivotal role in shaping market dynamics, influencing investment strategies and property valuations. Understanding these trends is essential for stakeholders aiming to capitalize on emerging opportunities highlighted in the commercial real estate update.

Analyze Demographic Shifts and Economic Factors Impacting Commercial Real Estate

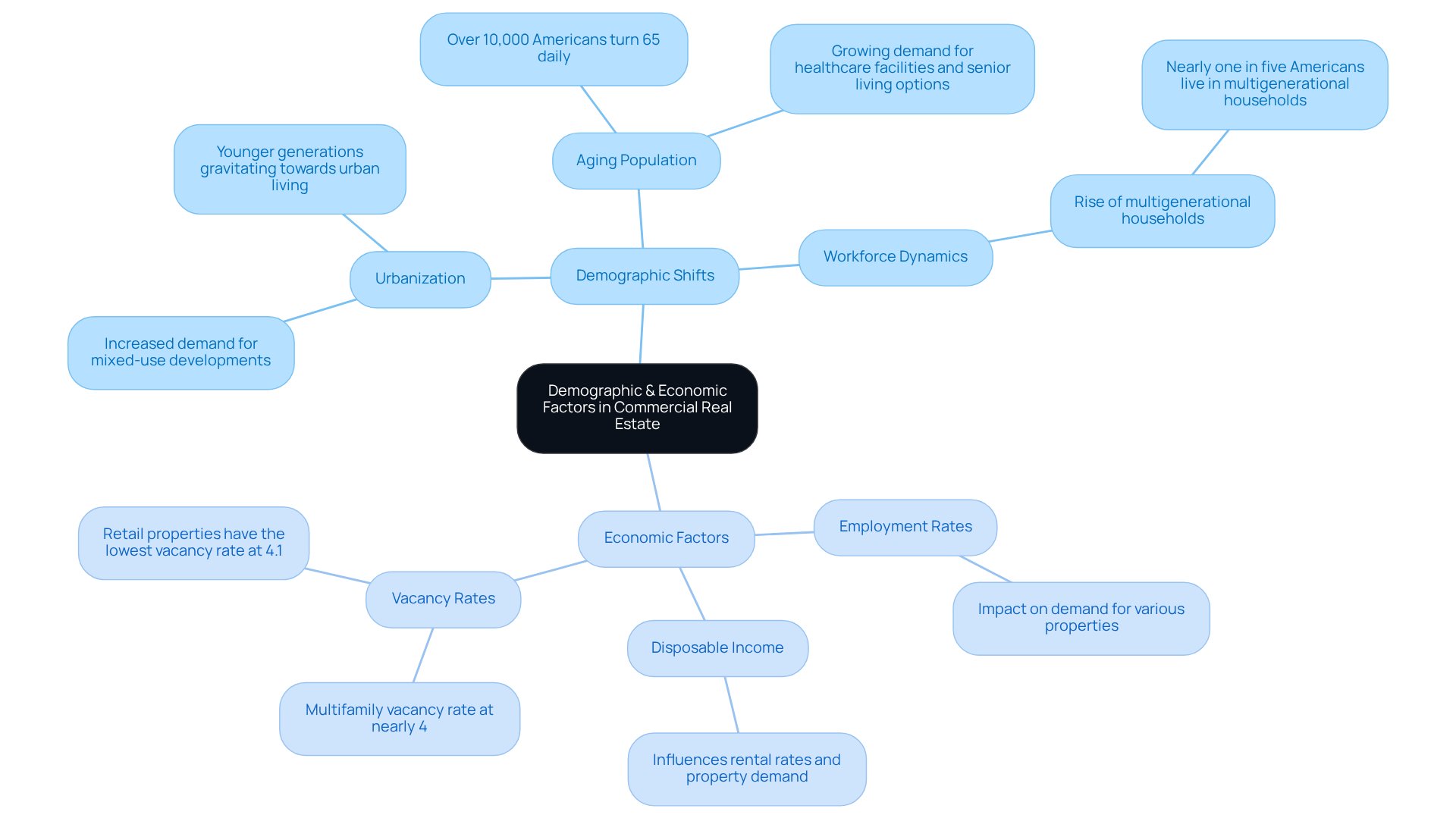

Demographic shifts, particularly urbanization, aging populations, and evolving workforce dynamics, are fundamentally reshaping the commercial real estate update. With over 10,000 Americans turning 65 daily, the demand for healthcare facilities and senior living options intensifies, highlighting the necessity of accommodating this growing demographic. Simultaneously, younger generations are increasingly gravitating towards urban living, fueling the need for mixed-use developments that seamlessly integrate residential, retail, and office spaces. This trend is underscored by the fact that nearly one in five Americans now live in multigenerational households—a statistic that has more than doubled in the last four decades—further driving the demand for versatile living environments that cater to diverse family structures.

Economic factors, such as employment rates and disposable income levels, are crucial in the commercial real estate update as they determine the demand for various properties. For instance, the general multifamily vacancy rate has fallen to almost 4% in the initial half of 2025, suggesting robust absorption rates and a competitive rental environment. Investors must remain vigilant and adaptable to these demographic and economic changes to identify profitable opportunities and make informed decisions in a constantly evolving landscape.

Summarize Key Insights for Investors: Navigating the Commercial Real Estate Landscape

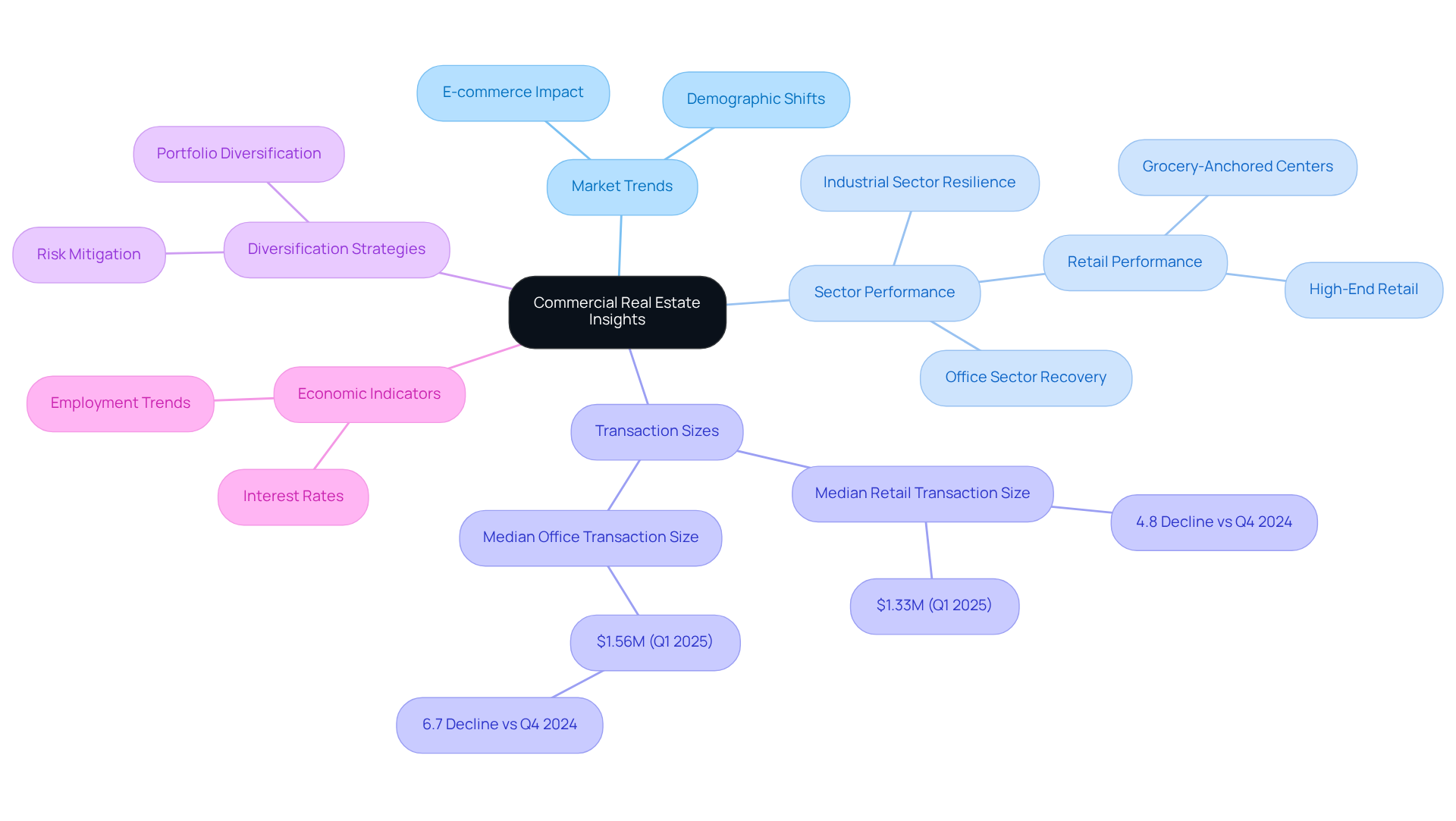

To effectively navigate the current commercial real estate update, investors must prioritize several key insights. A thorough understanding of market trends and demographic shifts is crucial for identifying high-potential investment opportunities. Notably, the industrial sector has shown resilience, driven by e-commerce demands, while retail spaces, particularly grocery-anchored centers, continue to perform well despite certain vulnerabilities. The median transaction size for retail assets in Q1 2025 was $1.33 million, presenting a strategic opportunity for diversification, albeit reflecting a 4.8% decline compared to Q4 2024.

Furthermore, diversifying portfolios across various property types—such as office, retail, and industrial—can significantly mitigate risks associated with economic fluctuations. Awareness of economic indicators, including interest rates and employment trends, empowers investors to anticipate changes in the financial landscape effectively. For instance, the office sector's vacancy rate has recently decreased to 20.0%, following record-high levels for three consecutive quarters, indicating a potential recovery phase.

Ultimately, leveraging technology and data analysis enhances decision-making processes, enabling investors to make informed choices in a rapidly evolving environment. Understanding local market trends and conducting thorough market research are also critical components of this strategy. By applying these insights, investors can position themselves for success in the dynamic commercial real estate update.

Conclusion

Commercial real estate (CRE) stands as a pivotal sector within the economy, providing essential spaces for businesses to thrive and generate revenue. Its significance transcends mere property ownership, influencing job creation and economic development. As the landscape of commercial real estate evolves, grasping its key concepts and trends becomes crucial for investors and industry professionals seeking to navigate this dynamic market effectively.

This article delves into various aspects of the commercial real estate update, highlighting recent trends such as:

- The shift towards flexible office spaces driven by remote work

- The growing demand for logistics properties due to e-commerce

- The transformation of retail spaces aimed at enhancing consumer experiences

Additionally, it emphasizes the impact of demographic shifts and economic factors, including urbanization and employment rates, which are reshaping the demand for different property types. Investors are urged to remain vigilant and adaptable to these changes to identify lucrative opportunities.

In conclusion, the commercial real estate market presents both challenges and opportunities that necessitate a keen understanding of its intricacies. By leveraging insights from market dynamics, demographic shifts, and economic indicators, investors can strategically position themselves for success. Staying informed and embracing a multifaceted approach to investment will be vital in navigating the evolving landscape of commercial real estate, ultimately contributing to sustainable growth and profitability in this vital sector.