Overview

This article offers a comprehensive comparison of commercial real estate investment platforms, scrutinizing their features, fees, and returns. Such platforms are indispensable for diversifying investment portfolios, yet they present significant variations in user experience, fee structures, and performance metrics. These factors are critical for investors to consider when making informed financial decisions.

By examining the nuances of these platforms, we uncover key insights that can significantly impact your investment strategy. For instance, understanding the fee structures can reveal hidden costs that may affect overall returns. Furthermore, analyzing performance metrics allows investors to gauge the effectiveness of their chosen platforms.

In conclusion, navigating the landscape of commercial real estate investment platforms requires careful consideration of various elements. By leveraging the insights provided in this article, investors can enhance their decision-making process, ultimately leading to more robust and diversified portfolios.

Introduction

Commercial real estate investment platforms are transforming the landscape of real estate engagement for individuals and institutions alike, offering unparalleled access to a variety of property opportunities. As these platforms continue to evolve, it is crucial for investors to comprehend their features, fee structures, and potential returns to effectively optimize their portfolios. With a plethora of options at hand, one must consider:

- How can investors navigate the intricacies of these platforms to make informed decisions that align with their financial aspirations?

Overview of Commercial Real Estate Investment Platforms

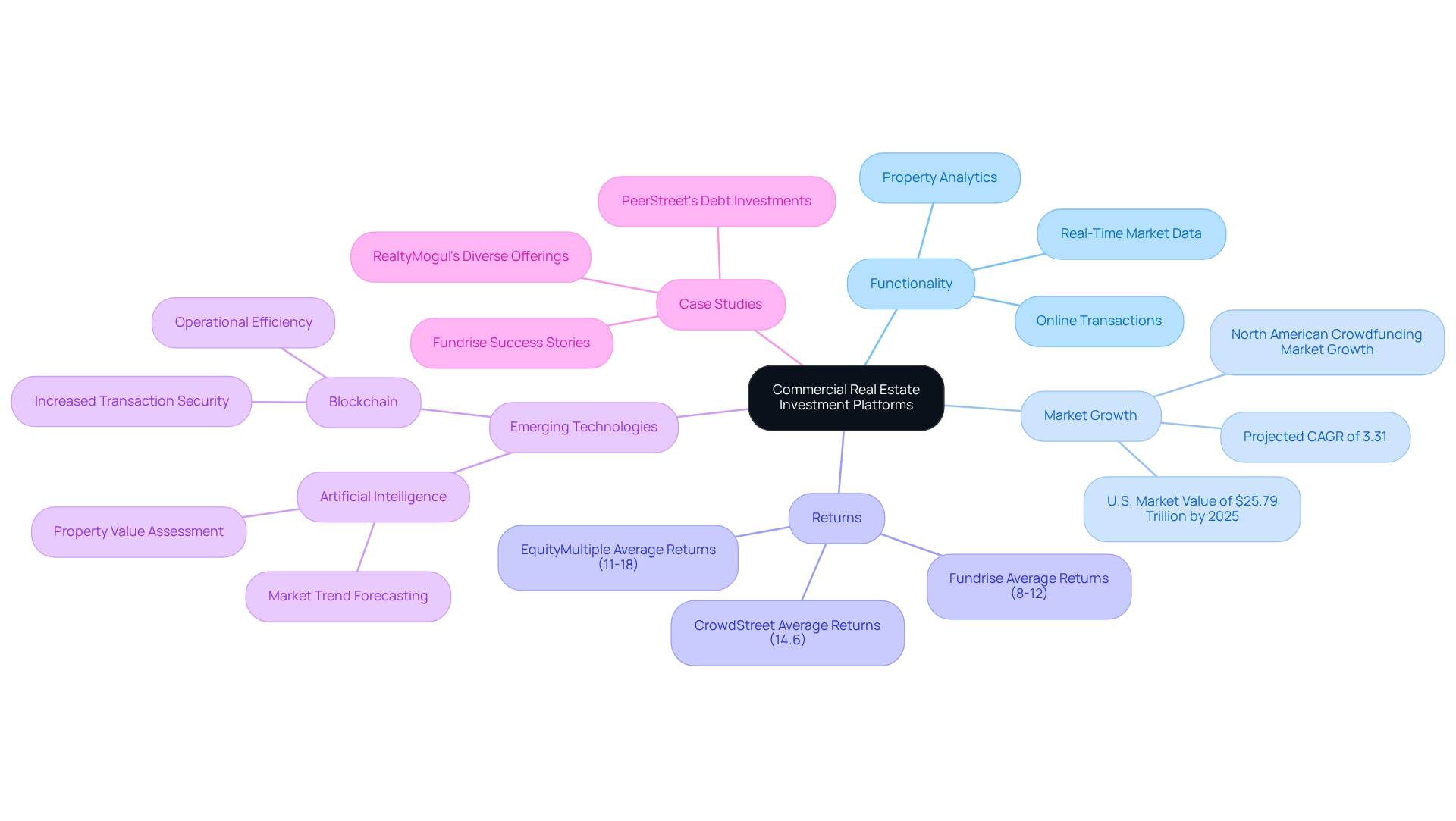

Commercial real estate investment platforms have become essential for individuals aiming to diversify their portfolios and seize profitable opportunities within the real estate sector. These systems serve as a commercial real estate investment platform that facilitates funding across a variety of commercial properties, including office buildings, retail spaces, and industrial facilities, catering to a broad spectrum of investors—from institutional participants to private investors. By democratizing access to opportunities that were once limited to a select few, the commercial real estate investment platform is reshaping the financial landscape.

The integration of technology has significantly enhanced the functionality of these systems, transforming them into a commercial real estate investment platform that streamlines the financial process through features such as online transactions, comprehensive property analytics, and real-time market data. By 2025, the commercial real estate investment market is projected to grow at a compound annual growth rate (CAGR) of 3.31%, with the U.S. commercial real estate market anticipated to reach a staggering $25.79 trillion. Notably, services like Fundrise and RealtyMogul have reported average returns ranging from 7% to 14.6%, while CrowdStreet boasts average returns of 14.6% and EquityMultiple delivers returns between 11% and 18%, attracting a diverse group of backers.

Emerging technologies, such as artificial intelligence and blockchain, are further revolutionizing the commercial real estate investment platform by enhancing transparency and operational efficiency. For example, AI algorithms are employed to forecast market trends and evaluate property values, thereby improving decision-making for investors. Moreover, blockchain technology is setting the stage for increased security and efficiency in transactions, drawing in tech-savvy individuals.

Successful case studies underscore the effectiveness of the commercial real estate investment platform. For instance, Fundrise has raised millions for various real estate initiatives, showcasing its ability to connect backers with high-quality opportunities. Furthermore, with 70% of investors planning to expand their real estate involvement in 2025, the demand for these services is expected to rise. As the commercial real estate market continues to evolve, understanding the characteristics, costs, and returns of different funding avenues, along with challenges such as market fluctuations and regulatory changes, is crucial for making informed financial decisions.

Key Features of Leading Platforms

Prominent commercial real estate investment platforms are designed to enhance user experience and empower informed financial decisions. Key features that define these platforms include:

-

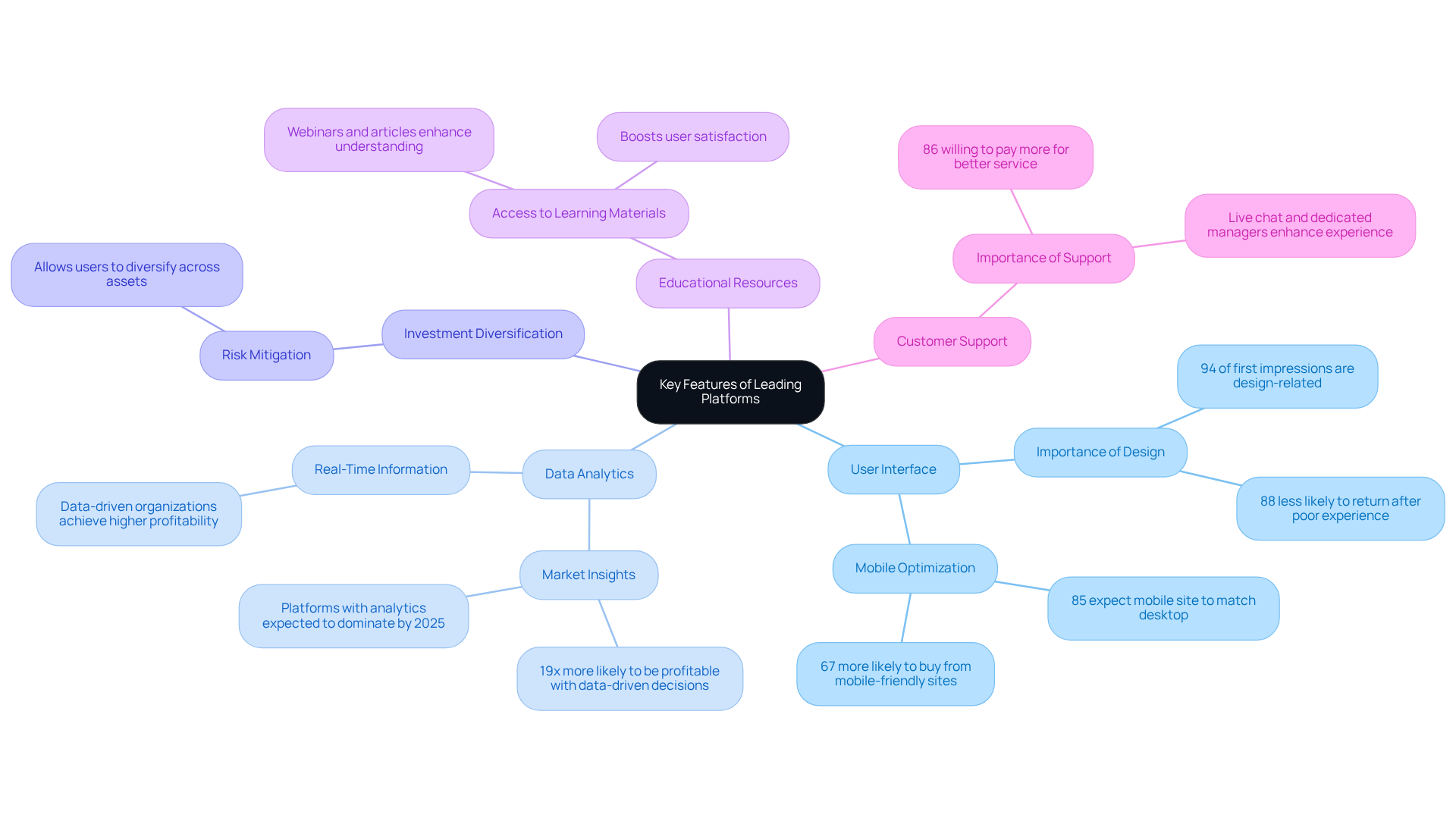

User Interface: A clean and intuitive interface is essential, allowing users to navigate effortlessly through property listings and investment opportunities. Research shows that 94% of first impressions about a website stem from its design, highlighting the necessity of a well-crafted user interface for user retention and engagement. Moreover, 88% of users are less likely to revisit a website after a poor experience, underscoring the critical role of UI in user retention.

-

Data Analytics: Advanced analytics tools are vital for offering insights into market trends, property performance, and demographic data. As the demand for data-driven decision-making grows, investors are increasingly favoring commercial real estate investment platforms that are equipped with robust analytics capabilities. By 2025, platforms with advanced data analytics are expected to dominate the market, enabling users to make informed decisions based on real-time information. Notably, data-driven organizations are 19 times more likely to achieve profitability, emphasizing the significance of strong analytical skills in financial systems.

-

Investment Diversification: Opportunities for investing in multiple properties or funds are crucial for risk mitigation. By allowing users to diversify their holdings across various assets, a commercial real estate investment platform helps minimize exposure to market fluctuations, which is a necessity in the evolving real estate sector.

-

Educational Resources: Access to webinars, articles, and guides is a significant feature that empowers individuals to grasp market dynamics and enhance their financial strategies. Platforms that emphasize educational content can boost user satisfaction and cultivate a more knowledgeable investor base.

-

Customer Support: Robust customer service options, such as live chat and dedicated account managers, are essential for assisting users with inquiries and ensuring a seamless experience. Data indicates that 86% of buyers are willing to pay more for an enhanced customer experience, highlighting the importance of attentive support in financial services.

These characteristics vary significantly among systems, directly impacting user satisfaction and financial outcomes. As the commercial real estate landscape evolves, the integration of user-friendly interfaces and advanced data analytics will remain pivotal in shaping successful financial experiences.

Fee Structures and Cost Analysis

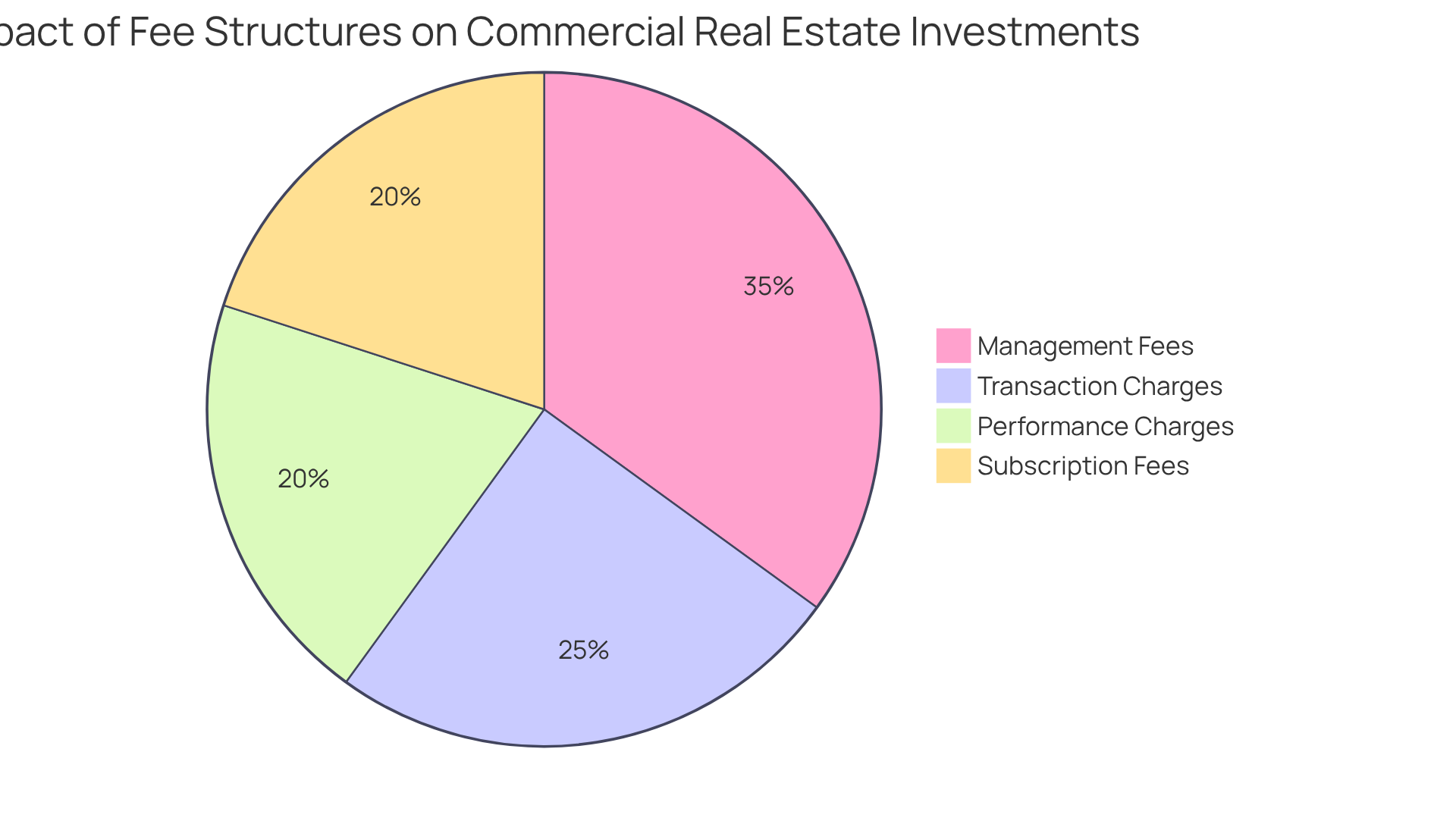

Fee structures among the commercial real estate investment platform significantly influence the overall profitability of ventures. Understanding the various types of fees is crucial for making informed investment decisions on a commercial real estate investment platform. Key fee types include:

-

Management Fees: Typically charged as a percentage of the total investment, these fees cover the platform's operational costs and can range from 1% to 4% for accredited investors. For instance, Yieldstreet's management charges fluctuate between 1.5% and 4%, while Fundrise offers reduced costs ranging from 0.15% to 1.85%. Yieldstreet has achieved a net annualized return of 9.7% since its inception, underscoring the importance of evaluating costs in relation to performance.

-

Transaction Charges: These costs arise during the buying or selling of properties and can vary based on the platform's pricing model. Understanding these charges is essential, as they can erode profits if not factored into the financial strategy. For example, eviction charges typically amount to around $400 per removal, in addition to court expenses, which can significantly affect total returns.

-

Performance Charges: Certain services impose fees based on the profits generated from assets, aligning their interests with those of the capital providers. This arrangement can incentivize platforms to optimize returns, but stakeholders should be aware of how these charges are calculated.

-

Subscription Fees: Some platforms may require a monthly or yearly subscription fee for access to premium features or exclusive investment opportunities. These charges can accumulate, particularly for investors utilizing a commercial real estate investment platform as well as multiple other platforms.

Investors must conduct a thorough cost assessment of these charges in relation to the anticipated returns from the commercial real estate investment platform. A case study on Yieldstreet revealed that while it has demonstrated strong historical performance with a net annualized return of 9.6% before fees, the associated fees can impact net returns. Similarly, Fundrise's transparent fee structure and lower overall expenses make it an attractive option for those seeking to maximize profitability. Furthermore, both Fundrise and Yieldstreet offer educational resources to help individuals understand fee structures and make informed decisions. By carefully evaluating these fee structures, investors using a commercial real estate investment platform can identify the most cost-effective option that aligns with their financial strategy.

Performance Metrics and Investment Returns

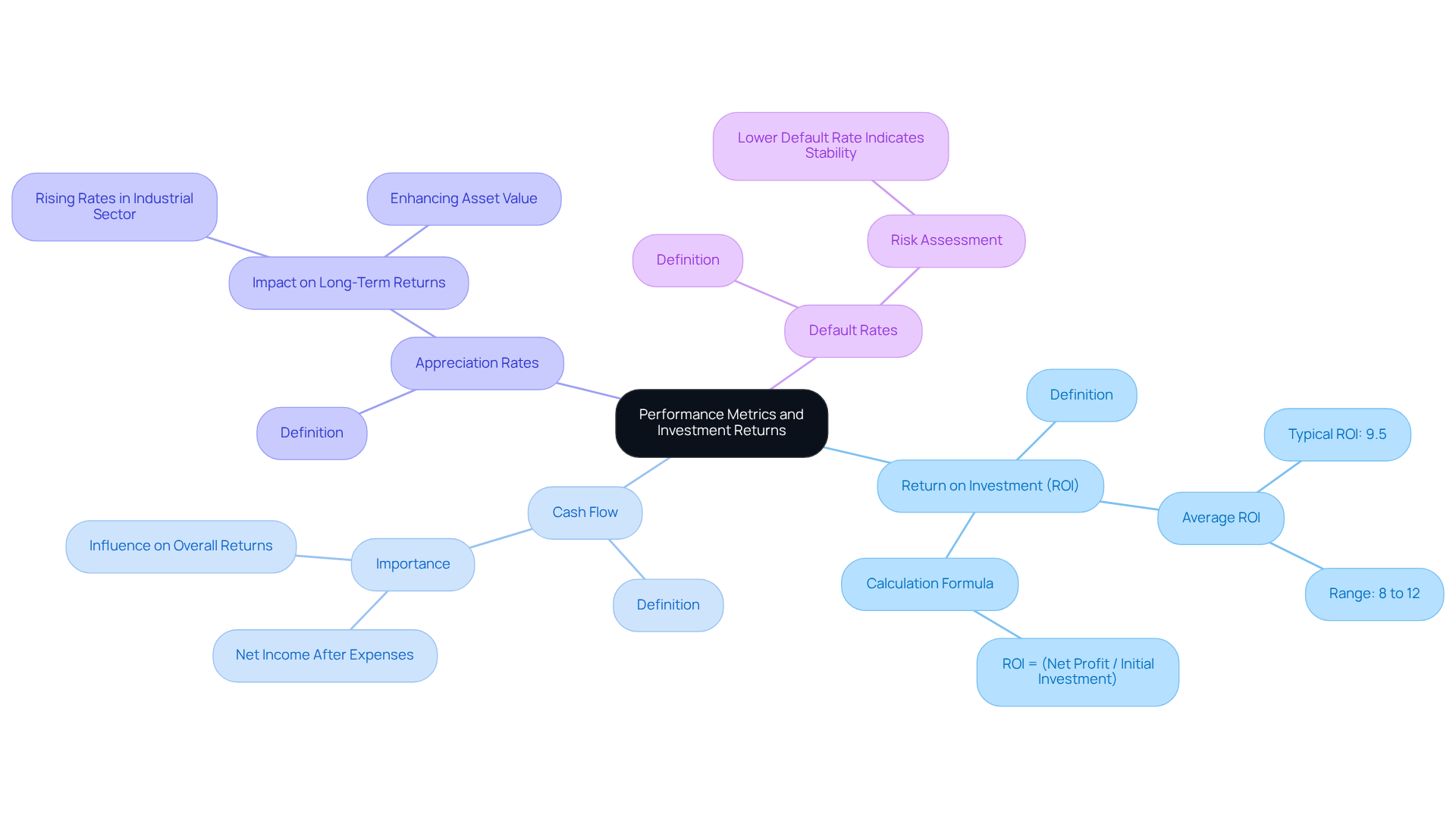

When assessing commercial real estate funding systems, understanding performance metrics and returns is crucial. Key metrics to consider include:

- Return on Investment (ROI): A vital measure of profitability, ROI is calculated as net profit divided by the initial investment cost. In commercial real estate, the average ROI typically hovers around 9.5%, with some platforms offering returns ranging from 8% to 12%.

- Cash Flow: This represents the net income generated from properties after deducting expenses, making it essential for evaluating ongoing profitability. For instance, the typical cash flow for multifamily properties can significantly influence an individual's overall returns, underscoring its importance in financial analysis.

- Appreciation Rates: The rate at which property values increase over time is a critical factor impacting long-term financial returns. Recent trends indicate that specific sectors, such as industrial real estate, have seen rising appreciation rates, enhancing overall asset value and providing a favorable outlook for investors.

- Default Rates: Monitoring the occurrence of defaults on assets can yield insights into the risk level associated with a system. A lower default rate generally suggests a more stable financial environment, which is essential for effective risk assessment.

By thoroughly analyzing these metrics, investors can make informed decisions about which commercial real estate investment platform aligns best with their investment objectives, ultimately maximizing their potential returns.

Conclusion

The landscape of commercial real estate investment platforms is evolving at an unprecedented pace, offering unparalleled access and opportunities for investors from diverse backgrounds. By harnessing technology and innovative features, these platforms not only democratize investment but also enhance the overall user experience, simplifying the navigation through the complexities of real estate investment.

Key aspects such as user-friendly interfaces, advanced data analytics, and robust customer support are essential components that contribute to the effectiveness of these platforms. Furthermore, understanding the various fee structures and performance metrics is crucial for investors looking to maximize returns while minimizing costs. Insights into leading platforms like Fundrise, RealtyMogul, and CrowdStreet highlight the diverse options available, each presenting unique advantages and potential returns.

As the commercial real estate market continues to expand, it is vital for investors to remain informed and proactive. By assessing the features, fees, and performance metrics of different platforms, individuals can make strategic decisions aligned with their financial goals. Embracing advancements in technology, such as AI and blockchain, will further enhance investment opportunities and security. Engaging with educational resources and seeking platforms that prioritize transparency will empower investors to navigate this dynamic landscape with confidence.