Overview

This article provides a comprehensive comparison of leading real estate analytics companies—CoreLogic, CoStar Group, and HouseCanary—by examining their features, pricing, and performance. Each company specializes in distinct areas of real estate analytics:

- CoreLogic is known for its comprehensive data.

- CoStar Group excels in the commercial real estate sector.

- HouseCanary offers predictive insights tailored for residential investors.

This analysis not only highlights the unique strengths of each provider but also guides users in selecting a service that aligns with their specific needs and investment strategies.

Introduction

As the real estate landscape becomes increasingly data-driven, the demand for advanced analytics tools has surged. Investors are now prompted to seek out the best resources for informed decision-making. This article delves into a comparative analysis of leading real estate analytics companies—CoreLogic, CoStar Group, and HouseCanary—highlighting their unique features, pricing structures, and overall performance. Each firm carves out its niche within the industry, raising a critical question: how can investors discern which analytics provider aligns best with their specific needs and investment strategies in a rapidly evolving market?

Overview of Leading Real Estate Analytics Companies

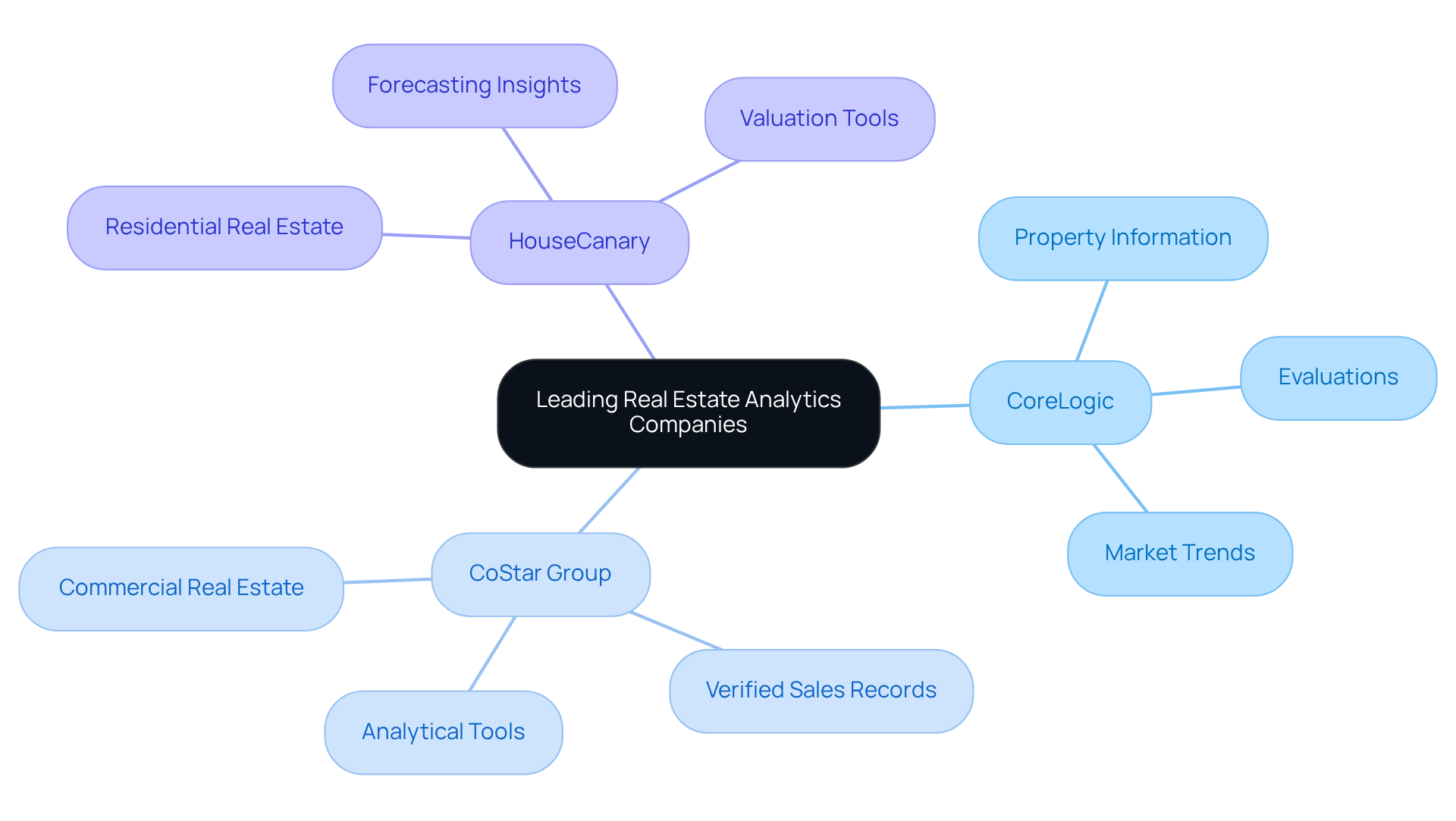

In 2025, the real estate analytics companies represented prominently include:

- CoreLogic

- CoStar Group

- HouseCanary

Each excelling in distinct areas:

- CoreLogic is renowned for its extensive property information and evaluations, providing valuable insights into property values and trends. This makes it a preferred resource for comprehensive analysis.

- CoStar Group stands out in the commercial real estate domain, boasting a vast database that includes up to a million verified sales records. Its advanced analytical tools are tailored for investors and brokers, facilitating informed decision-making in commercial transactions.

- HouseCanary focuses on residential real estate, offering forecasting insights and valuation tools that enable investors to navigate the housing sector efficiently.

Each of these companies has developed a unique niche, catering to specific segments of the real estate industry. This specialization is essential for potential users to consider when choosing a provider. As the industry evolves, understanding the strengths and offerings of these analytics firms will be crucial for making informed investment decisions.

Key Features and Tools Offered by Each Company

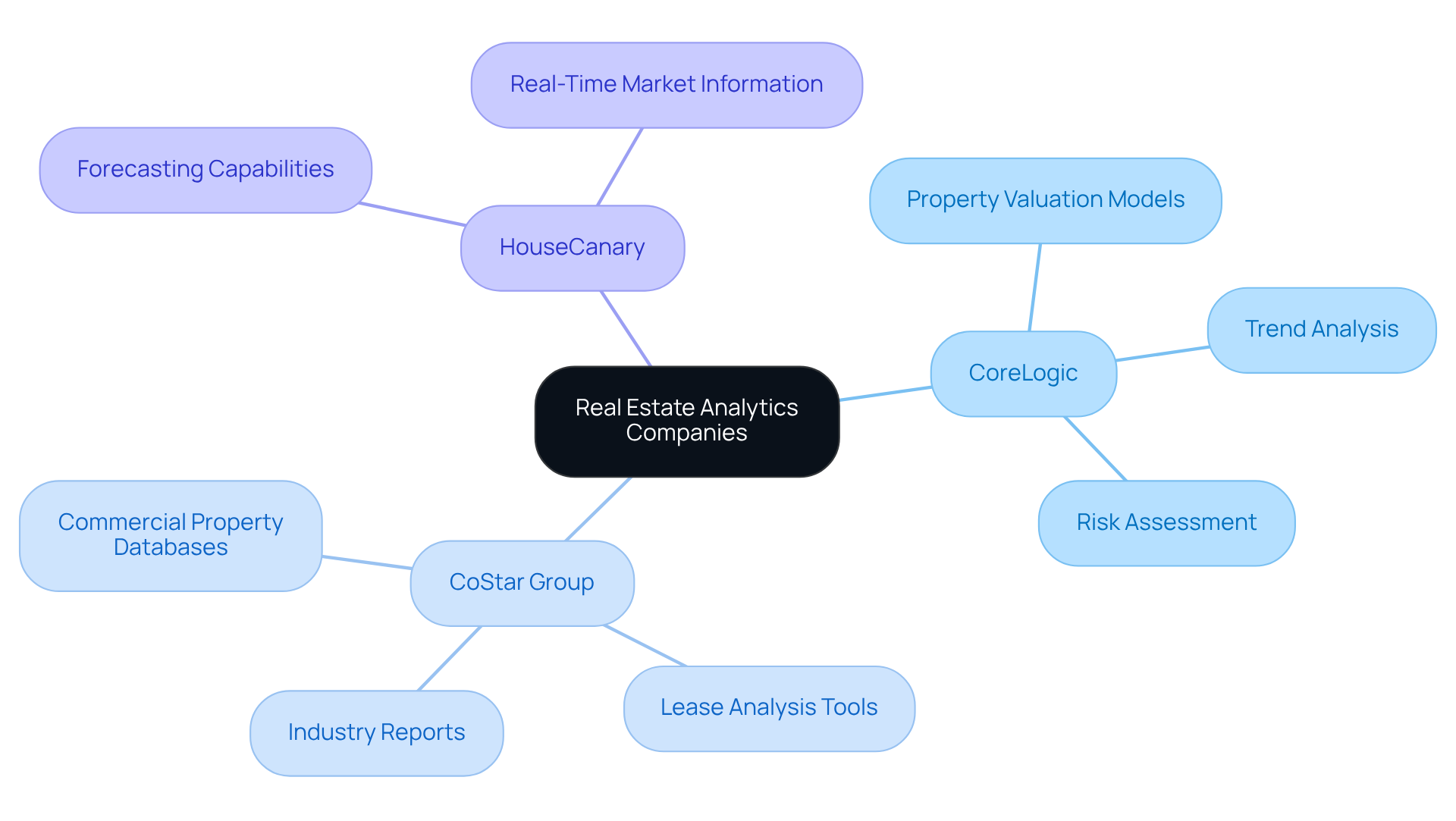

CoreLogic provides an array of tools that encompass property valuation models, trend analysis, and risk assessment features. Meanwhile, CoStar Group offers extensive commercial property databases, lease analysis tools, and industry reports that are indispensable for commercial real estate professionals. HouseCanary sets itself apart with its exceptional forecasting capabilities, delivering real-time information on property values and market trends, particularly beneficial for residential investors. Each of these real estate analytics companies addresses distinct aspects of real estate analytics, making it essential for investors to identify which features align most closely with their investment strategies.

Pricing Models and Cost Comparisons

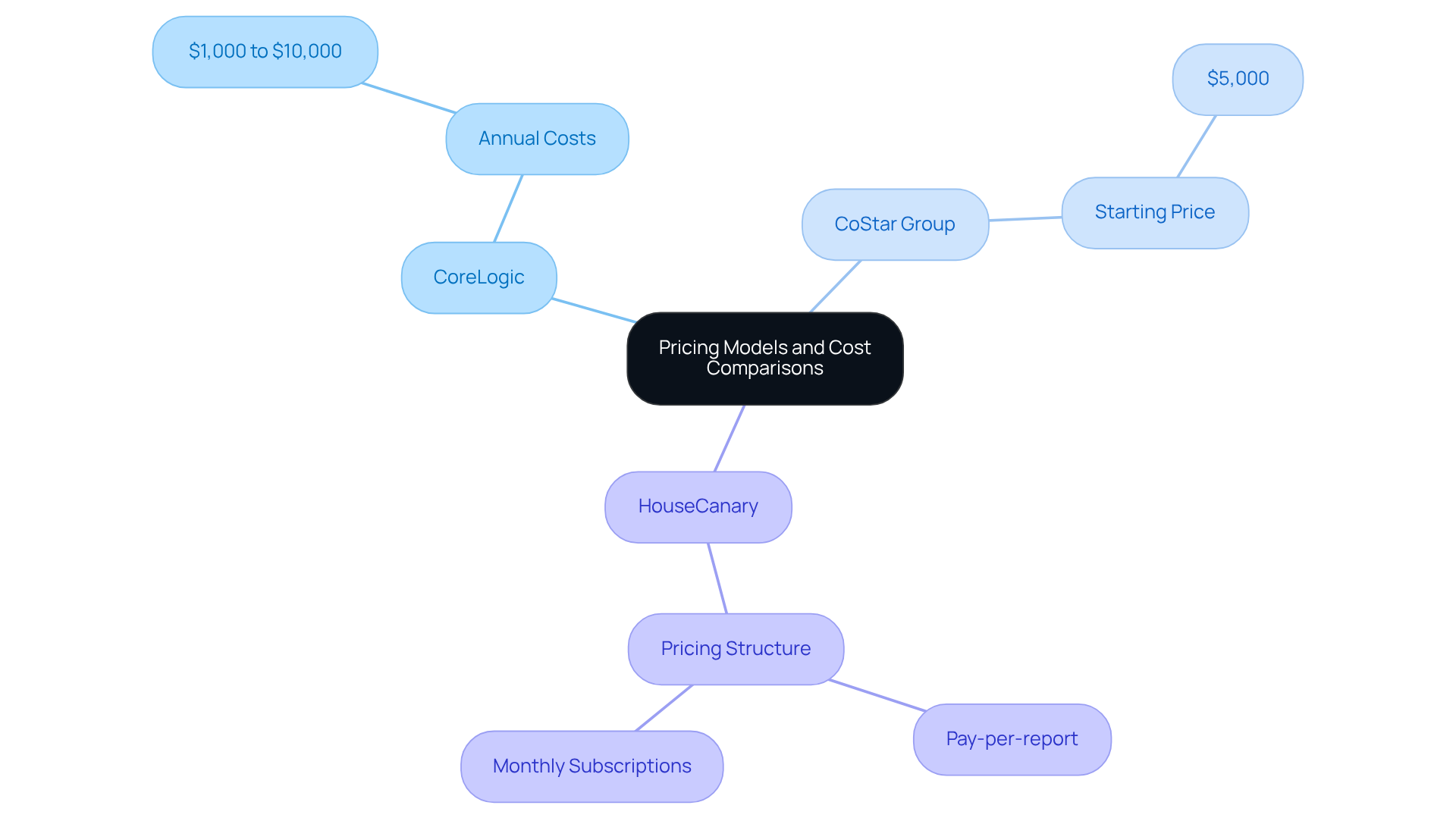

CoreLogic operates primarily on a subscription model, with annual costs ranging from $1,000 to $10,000 based on the level of access and features required. In contrast, CoStar Group's pricing tends to be higher, reflecting its extensive commercial data offerings, with subscriptions starting around $5,000 per year. HouseCanary presents a more flexible pricing structure, offering options for pay-per-report or monthly subscriptions, thereby making its services accessible for smaller investors. This diversity in pricing models empowers users to select a service that aligns with their budget while fulfilling their analytical needs.

Given that the U.S. housing sector value reached an impressive $49.7 trillion in 2024, comprehending these pricing models becomes paramount for investors navigating this intricate landscape. As industry experts assert, "the market is always evolving, and the best choices are those based on factual, current information." This statement underscores the significance of selecting the appropriate analytics service to inform investment decisions effectively.

Performance Analysis and User Feedback

CoreLogic distinguishes itself through its robust information services and intuitive interface, earning high acclaim from users for its precision and thoroughness. Notably, the CoreLogic Mortgage Application Fraud Risk Index increased by 8.3% year-over-year in Q2 2024, underscoring the critical need for reliable information in navigating the evolving fraud landscape.

Conversely, CoStar Group is recognized for its extensive commercial real estate information; however, some users have noted that its interface can be challenging for newcomers to navigate effectively. This complexity may hinder user experience, especially given the rising fraud risks in the mortgage sector, where accurate data is vital for informed decision-making.

HouseCanary, in contrast, is celebrated for its predictive analytics capabilities and user-friendly design, making it particularly attractive to residential investors. Its focus on predictive insights empowers users to anticipate market trends, which is essential in a rapidly changing environment.

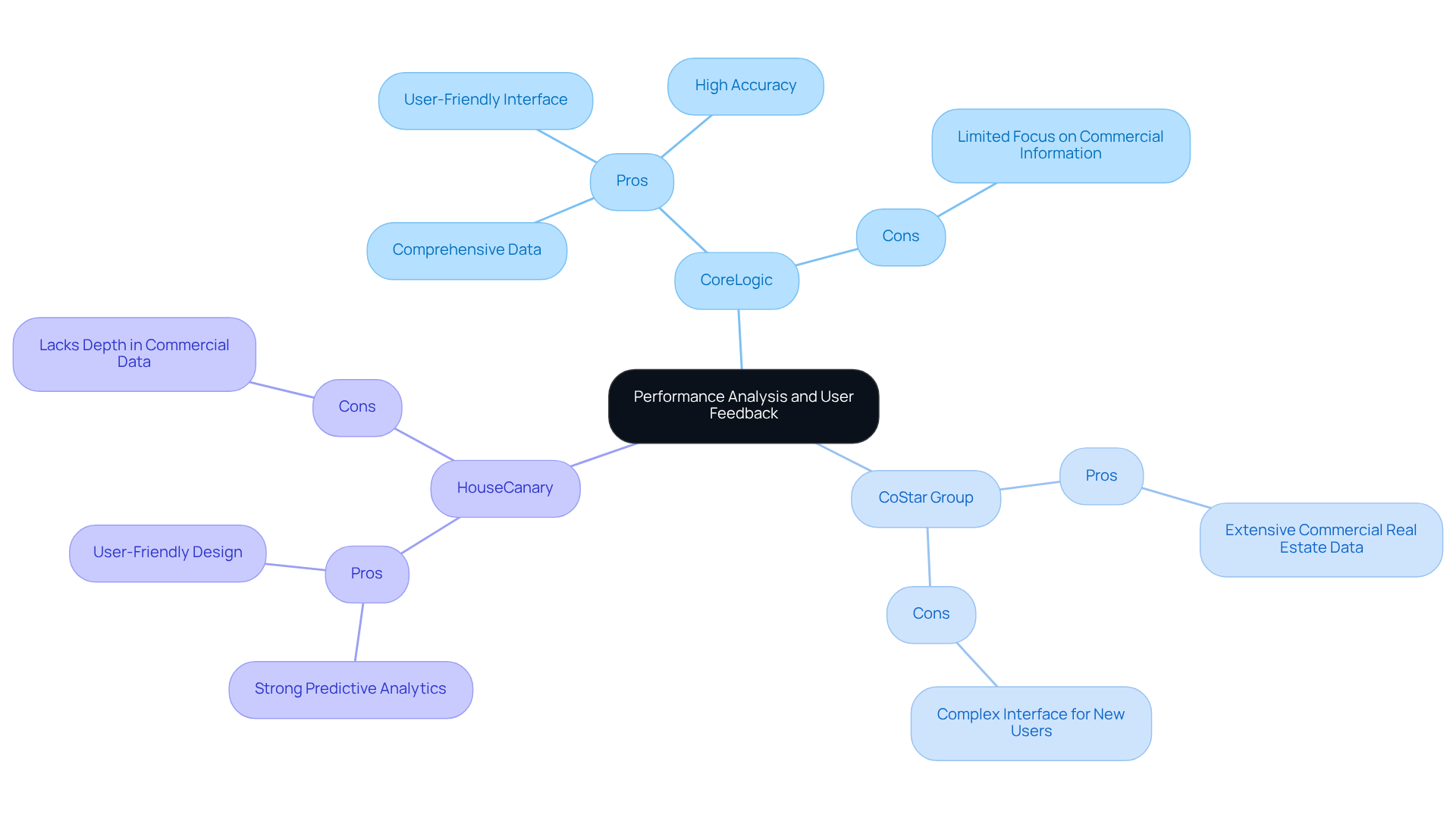

In summary, user feedback indicates that while each platform, particularly real estate analytics companies, offers valuable insights, the best choice depends on individual needs and expertise. Here’s a summary of the strengths and weaknesses of each platform:

-

CoreLogic:

- Pros: Comprehensive data, user-friendly interface, high accuracy.

- Cons: Limited focus on commercial information compared to competitors.

-

CoStar Group:

- Pros: Extensive commercial real estate data.

- Cons: Complex interface for new users, potentially affecting usability.

-

HouseCanary:

- Pros: Strong predictive analytics, user-friendly design.

- Cons: May lack depth in commercial data compared to CoStar.

This structured approach emphasizes the necessity of aligning analytics tools with the investment strategies of real estate analytics companies.

Conclusion

Understanding the landscape of real estate analytics companies is essential for investors aiming to make informed decisions in a complex market. Each leading firm—CoreLogic, CoStar Group, and HouseCanary—brings unique strengths, catering to different segments of the real estate industry. By recognizing the specialized features and tools offered by these companies, users can better align their choices with their investment strategies.

Key insights reveal that:

- CoreLogic excels in comprehensive property evaluations,

- CoStar Group dominates in commercial real estate data, and

- HouseCanary shines with its predictive analytics for residential investments.

Pricing structures vary significantly, with options ranging from subscription models to flexible pay-per-report plans. This variety allows investors to select services that fit their budgets and analytical needs. User feedback further emphasizes the importance of choosing a platform that aligns with individual expertise and objectives.

As the real estate market continues to evolve, the necessity for accurate and timely analytics becomes increasingly critical. Investors are encouraged to thoroughly evaluate these platforms, not only to enhance their investment strategies but also to stay ahead in a competitive environment. Embracing the right analytics tools empowers users to navigate market trends effectively, ensuring they make data-driven decisions that contribute to their success in real estate investments.