Overview

This article provides a comparative analysis of real estate data analytics companies, designed to assist investors in identifying the platforms that best meet their needs. It highlights the distinctive features of key players such as Reonomy, HouseCanary, and CoreLogic. In doing so, it underscores the critical importance of assessing:

- Pricing models

- Performance metrics

- Reliability

Such evaluations are essential for making informed investment decisions that align with individual strategies.

Introduction

Navigating the complex landscape of real estate investment requires more than mere intuition; it demands a profound understanding of data analytics. As property values fluctuate and market dynamics shift, investors increasingly turn to specialized analytics companies to secure a competitive edge. This article explores the essential features, pricing models, and performance metrics of leading real estate data analytics firms, offering insights that can significantly influence investment strategies. However, with a multitude of options available, how can investors discern which platform truly aligns with their needs and maximizes their potential for success?

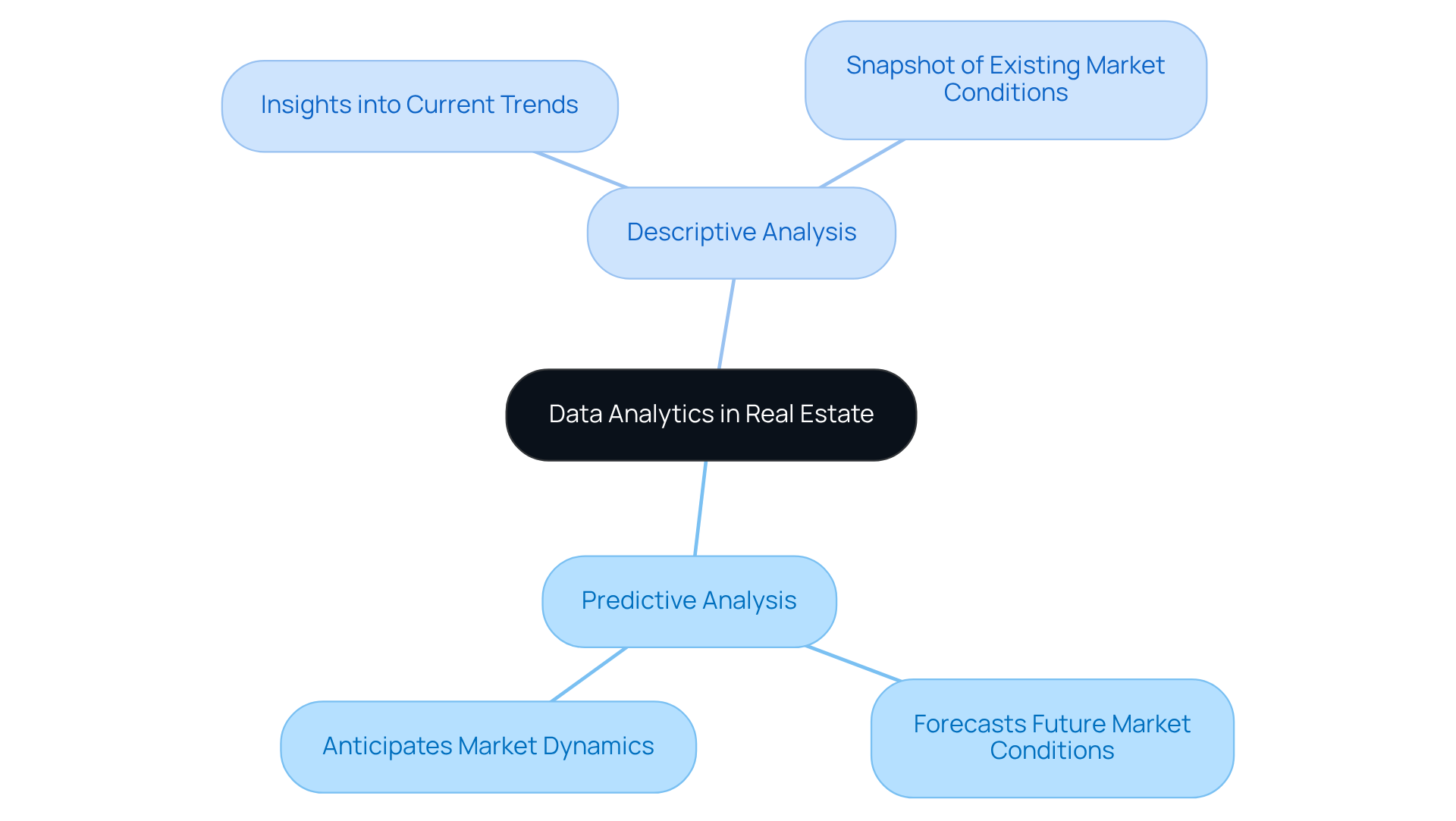

Understanding Data Analytics in Real Estate

Data evaluation in real estate is a critical process that involves the systematic examination of information regarding property values, market trends, and demographic shifts. By employing various instruments and techniques to gather insights from extensive datasets, stakeholders are empowered to make informed decisions. Key components include:

- Predictive analysis, which forecasts future market conditions.

- Descriptive analysis, which provides valuable insights into current trends.

Understanding these concepts is essential for individuals seeking to leverage data for strategic advantages in property acquisition and management.

As the market continues to evolve, staying abreast of these analytical methods is paramount. By harnessing predictive analytics, investors can anticipate shifts in market dynamics, positioning themselves advantageously. Similarly, descriptive analytics offers a snapshot of existing trends, enabling stakeholders to adapt their strategies accordingly.

In conclusion, comprehending the intricacies of data evaluation not only enhances decision-making capabilities but also fosters a competitive edge in the real estate sector. For those committed to maximizing their investment potential, integrating these analytical approaches into their strategies is not just beneficial—it is imperative.

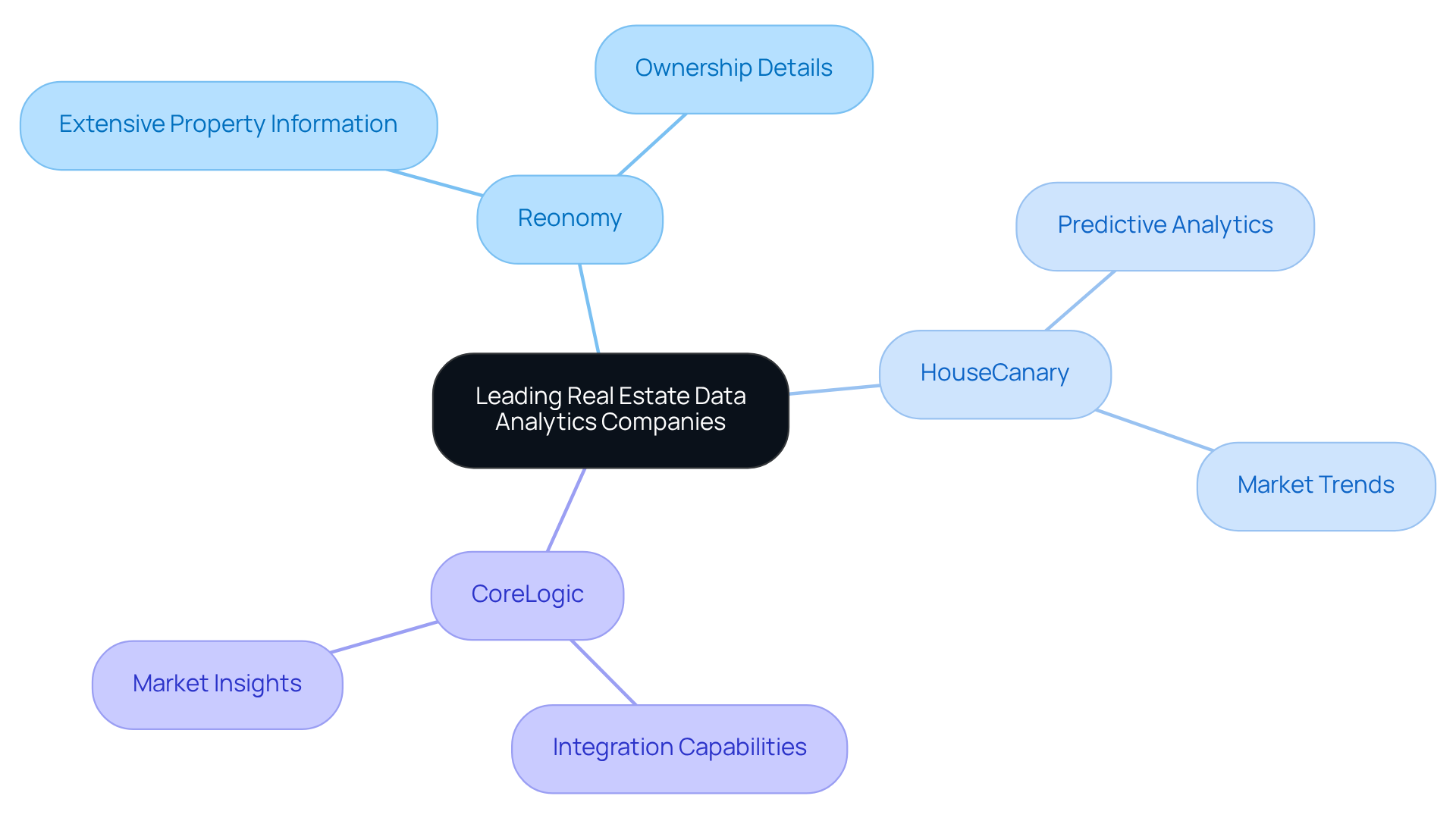

Comparing Features of Leading Data Analytics Companies

Real estate data analytics companies, such as Reonomy, HouseCanary, and CoreLogic, are prominent firms that offer a range of features tailored to meet investors' needs.

- Reonomy stands out by providing extensive property information and ownership details, which can significantly aid investors in their decision-making processes.

- HouseCanary focuses on predictive analytics for property valuations, equipping investors with foresight in market trends.

- CoreLogic is well-regarded for its robust integration capabilities, allowing users to access a comprehensive array of market insights seamlessly.

Each platform possesses unique strengths, underscoring the necessity for investors to evaluate which features align best with their investment objectives, particularly among real estate data analytics companies.

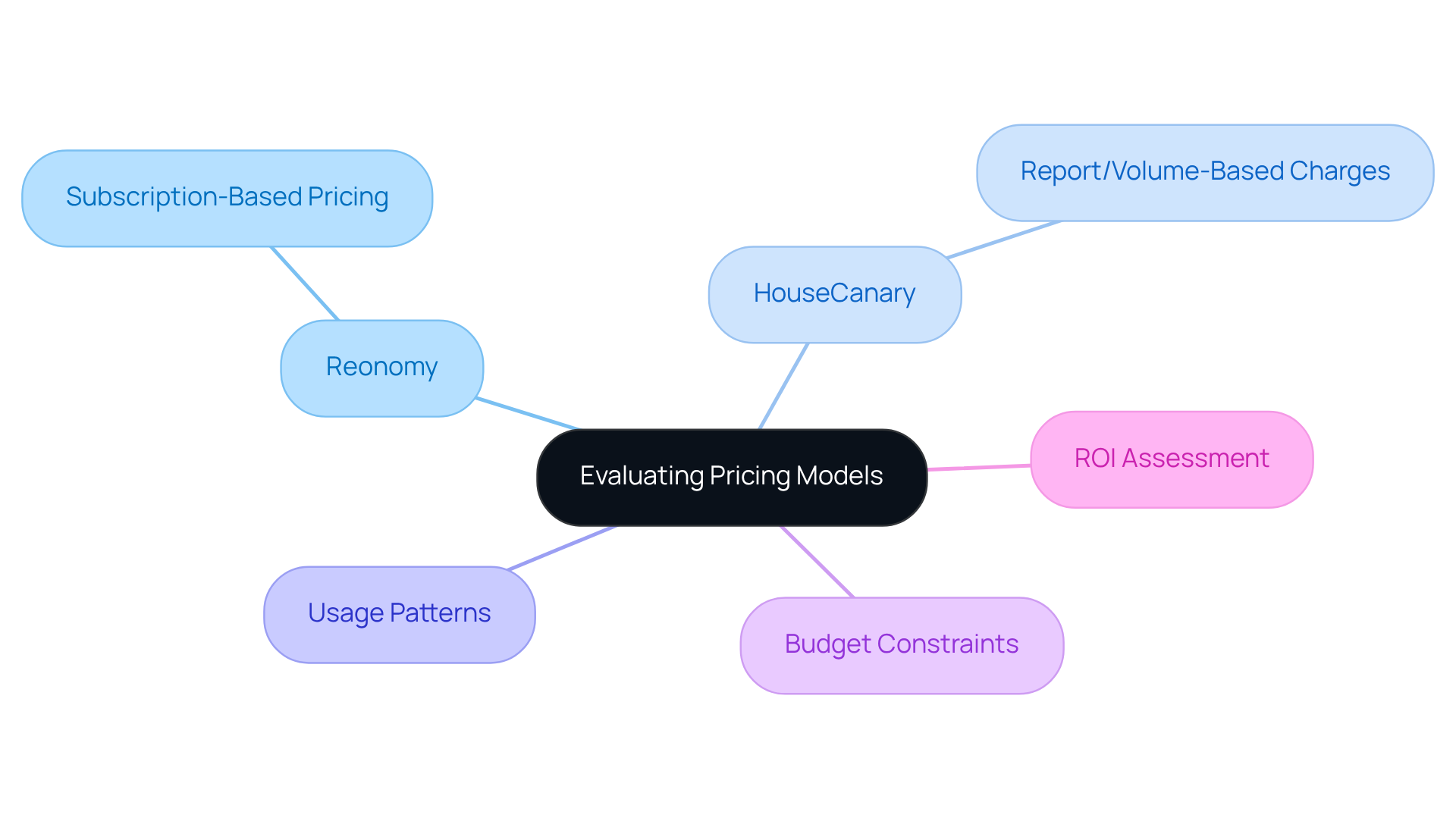

Evaluating Pricing Models and Cost-Effectiveness

Pricing models for real estate data analytics companies exhibit significant variation. For instance:

- Reonomy adopts a subscription-based pricing structure, which can be particularly cost-effective for frequent users.

- HouseCanary may implement charges based on the number of reports generated or the volume of information accessed.

Investors must carefully consider their usage patterns alongside budget constraints when evaluating the pricing models of real estate data analytics companies. Furthermore, assessing the return on investment (ROI) associated with these tools is crucial, as it can yield valuable insights into their overall cost-effectiveness and inform strategic investment decisions.

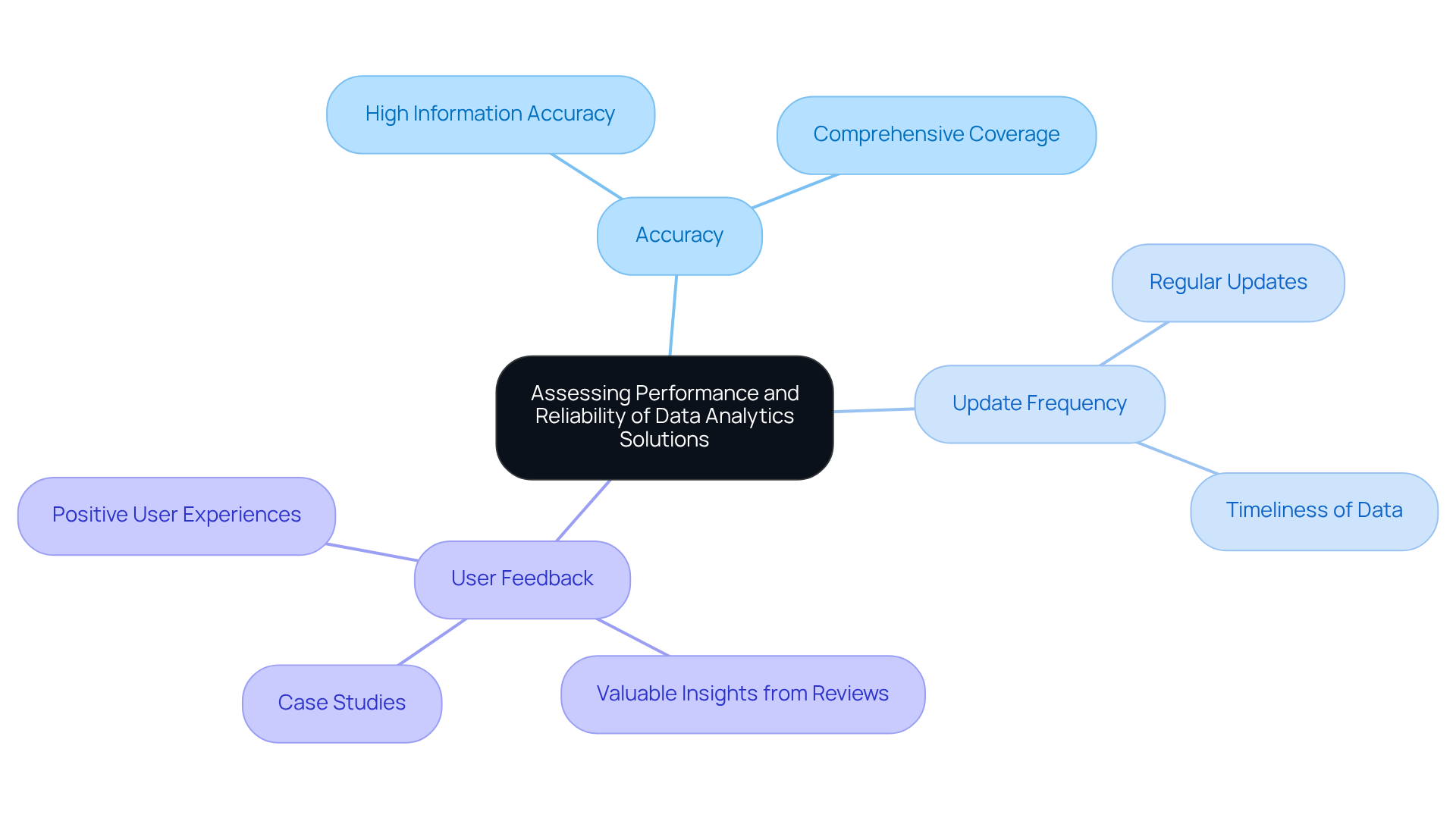

Assessing Performance and Reliability of Data Analytics Solutions

When evaluating the performance and reliability of analytics solutions, it is essential to consider factors such as:

- Accuracy

- Update frequency

- User feedback

Platforms like CoreLogic are renowned for their high information accuracy and comprehensive coverage, establishing them as trustworthy options for investors.

How do user reviews and case studies enhance our understanding of these tools? They provide valuable insights into the practical performance of analytics solutions in real-world scenarios.

Investors must prioritize platforms that demonstrate consistent reliability and positive user experiences, ensuring they make informed decisions based on trustworthy data.

Conclusion

Understanding the role of data analytics in real estate is vital for investors aiming to gain a competitive edge. By leveraging predictive and descriptive analysis, stakeholders can make informed decisions that enhance their investment strategies. The ability to anticipate market trends and assess current conditions is not merely advantageous but essential in navigating the complexities of the real estate landscape.

The article delves into the features, pricing models, and performance metrics of leading data analytics companies, such as:

- Reonomy

- HouseCanary

- CoreLogic

Each of these platforms offers unique strengths tailored to different investor needs, from extensive property information to predictive valuations and robust integration capabilities. Additionally, evaluating the cost-effectiveness of these tools is crucial, as investors must align their budget with their usage patterns to maximize ROI.

Ultimately, the significance of data analytics in real estate cannot be overstated. As the market evolves, embracing these analytical tools will empower investors to make data-driven decisions that enhance their investment outcomes. By carefully assessing the features, pricing, and reliability of various platforms, investors can position themselves for success in a competitive market. Engaging with these insights will not only streamline investment processes but also cultivate a deeper understanding of the real estate landscape, paving the way for strategic growth and opportunity.