Overview

Corporate real estate trends are currently being reshaped by the rise of remote work, sustainability initiatives, and technological advancements. These factors are redefining how companies manage their property assets. As organizations adapt to hybrid work models and prioritize energy efficiency, they must leverage data analytics and market research. This strategic approach is essential for navigating challenges such as market volatility and rising interest rates effectively.

In this evolving landscape, understanding these trends is crucial for informed investment decisions. By focusing on energy efficiency and utilizing data-driven insights, companies can position themselves advantageously in a competitive market. The implications of these shifts are significant, prompting businesses to rethink their real estate strategies and investment approaches.

Ultimately, the ability to adapt to these changes will determine success in the corporate real estate sector. Embracing innovation and sustainability not only addresses current challenges but also paves the way for future growth and resilience.

Introduction

As the landscape of corporate real estate continues to evolve, businesses find themselves at a critical juncture. Here, strategic property management can significantly influence operational success. The rise of remote work is reshaping traditional office demands, while sustainability is becoming a focal point for new developments. Understanding these current trends is essential for organizations aiming to optimize their real estate portfolios.

How can companies effectively navigate these shifting dynamics? They must address challenges like market volatility and rising interest rates. This article delves into the latest trends and strategies in corporate real estate, offering insights that empower investors and decision-makers to thrive in an increasingly complex environment.

Define Corporate Real Estate and Its Importance

Corporate property (CRE) encompasses the assets owned or rented by companies to fulfill their operational needs, including office spaces, warehouses, and retail locations. The importance of CRE management cannot be overstated; it directly influences a company's operational efficiency and employee productivity. Organizations that strategically manage their property portfolios can realize significant cost reductions and improved performance metrics. For instance, a Fortune 500 firm successfully reduced its corporate property portfolio by 40%, illustrating the potential for enhanced operational efficiency through meticulous space management. This reduction not only streamlined costs but also boosted overall employee productivity by optimizing the use of available space.

Moreover, with employees averaging 3.5 days per week in the office, understanding how to optimize these spaces is crucial for enhancing workplace productivity. As the competitive landscape evolves, the strategic importance of corporate real estate trends continues to escalate, making them an essential focus for investment and management. Expert insights reveal that leveraging key performance indicators (KPIs) related to commercial properties, such as occupancy and energy consumption metrics, can significantly enhance business impact. This alignment ensures that property decisions resonate with broader organizational objectives, highlighting the necessity for businesses to prioritize corporate real estate trends as a vital component of their overarching strategy. This is particularly pertinent in light of the projected 13% decrease in demand for office space by 2030.

Explore Current Trends in Corporate Real Estate

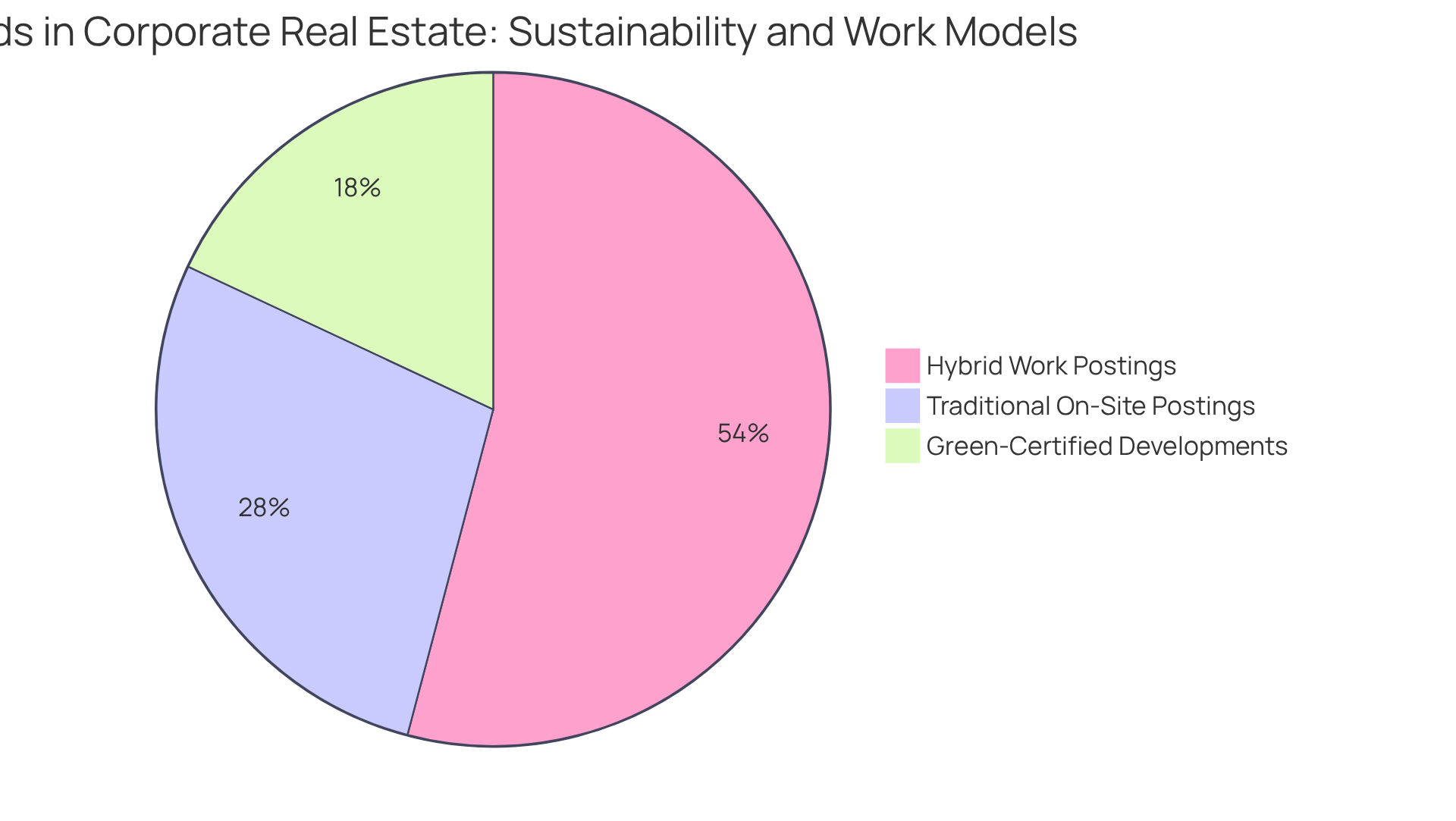

The transformation of the corporate property environment is significantly influenced by corporate real estate trends driven by the rise of remote work. As companies increasingly adopt flexible work arrangements, the demand for traditional office spaces is witnessing a decline. In fact, the percentage of fully on-site job postings has decreased from 83% to 66% during 2023, reflecting a broader acceptance of hybrid work models. This shift has prompted a notable increase in co-working spaces, which cater to businesses seeking flexibility without the long-term lease commitments.

Sustainability is also emerging as a key trend within the corporate property sector. Businesses are prioritizing energy-efficient buildings and sustainable practices to align with regulatory requirements and consumer expectations. For instance, green-certified buildings now account for 22% of new commercial developments, indicating a growing commitment to environmental responsibility.

Moreover, the incorporation of technology is revolutionizing how businesses manage their property assets. Over 80% of companies have boosted their investment in collaboration technology and cybersecurity tools to support remote work, thereby enhancing operational efficiency and reducing costs. As remote work continues to influence corporate strategies, the demand for creative and flexible property solutions will only escalate, emphasizing the necessity for businesses to stay ahead of corporate real estate trends.

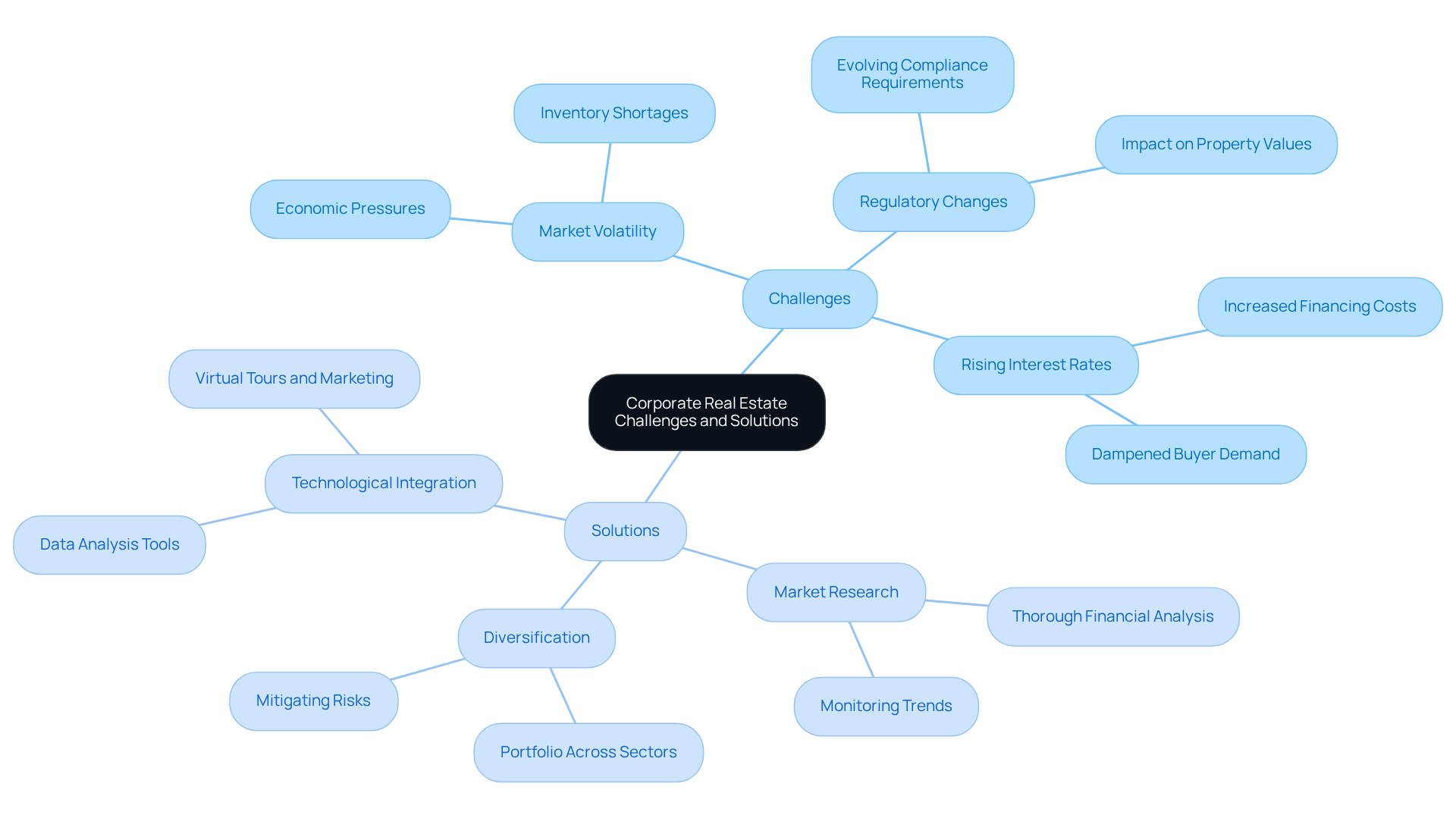

Identify Challenges and Solutions for Corporate Real Estate Investors

Corporate real estate trends indicate that stakeholders are currently navigating a landscape marked by significant challenges, including market volatility, rising interest rates, and evolving regulatory frameworks. As interest rates have risen, the cost of financing has increased, dampening buyer demand and leading to a more competitive market environment. For instance, the typical mortgage interest rate for a 30-year fixed mortgage was approximately 6.2% as of mid-September 2024, a decrease from 7.8% in October 2023. Such variations are crucial for stakeholders to monitor closely.

To effectively address these challenges, investors should adopt a proactive approach that includes:

- Conducting thorough market research focused on corporate real estate trends and financial analysis.

- Diversifying portfolios across various sectors to mitigate risks associated with specific market segments, particularly in times of economic uncertainty.

For example, while the office sector has faced a 14% decline in real estate values and a vacancy rate of 22.65% in San Francisco, other sectors, such as industrial real estate, have seen a surge in leasing activity driven by e-commerce growth.

Staying informed about corporate real estate trends and regulatory changes is crucial for adjusting financial strategies. Engaging with local authorities can provide insights into upcoming regulations that may impact property values and investment opportunities. Furthermore, applying technological solutions for data analysis can enhance decision-making processes, enabling stakeholders to recognize corporate real estate trends and opportunities more effectively. The utilization of virtual home tours has risen by more than 300% since 2020, indicating a transition towards digital interaction that stakeholders can leverage. Additionally, with 97% of homebuyers utilizing the internet for property searches, the significance of digital tools cannot be overstated.

In summary, by adopting a multifaceted approach that involves diversification, regulatory awareness, and technological integration, corporate property investors can navigate the complexities of the current market environment and align their strategies with corporate real estate trends to position themselves for success.

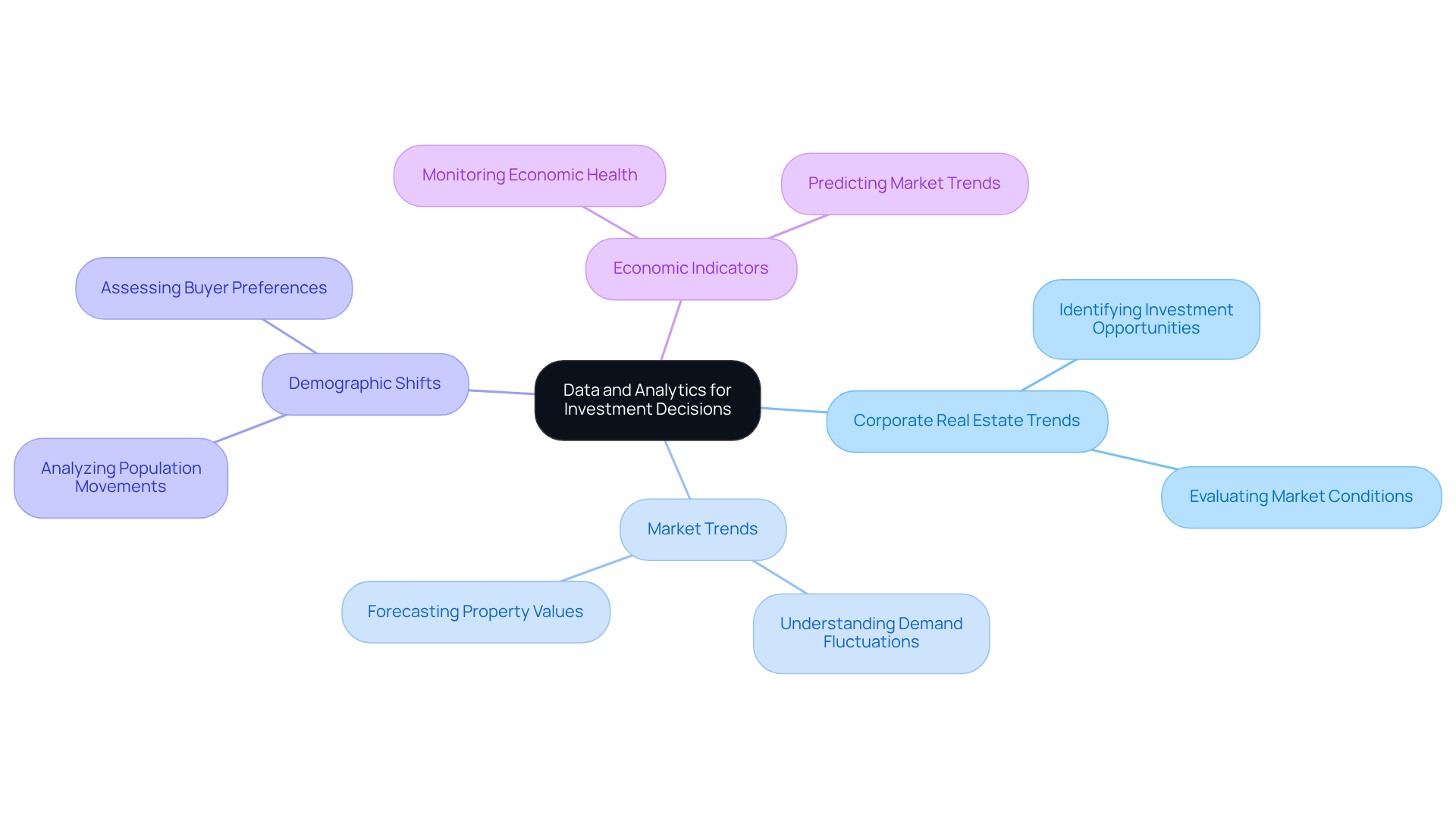

Utilize Data and Analytics for Informed Investment Decisions

Data and analytics are essential for understanding corporate real estate trends and making informed funding decisions. Investors can tap into a variety of data sources, including:

- Corporate real estate trends

- Market trends

- Demographic shifts

- Economic indicators

to evaluate potential funding opportunities. Advanced analytics tools, such as machine learning algorithms and time series analysis, empower stakeholders to identify patterns related to corporate real estate trends and predict future market conditions. This enables individuals to ground their strategies in empirical evidence rather than intuition. By integrating data analytics into their financial strategies, corporate property stakeholders can significantly enhance their risk evaluation capabilities, optimize their portfolios, and achieve improved monetary results in alignment with corporate real estate trends.

For instance, a striking 86% of property investors consider big data analysis crucial for uncovering profitable opportunities, underscoring the importance of a data-driven strategy. Successful case studies, such as 'The Power of Data-Driven Decision-Making in Commercial Real Estate Investing,' illustrate that leveraging data not only improves investment accuracy and mitigates risks but also provides a competitive advantage in navigating corporate real estate trends. As the real estate landscape continues to evolve, the ability to effectively harness data will be a key determinant of success.

Conclusion

The landscape of corporate real estate is undergoing a significant transformation, influenced by evolving work dynamics, sustainability initiatives, and technological advancements. Understanding the intricacies of corporate real estate is essential for organizations aiming to optimize their property assets and enhance operational efficiency. By strategically managing their real estate portfolios, businesses can not only reduce costs but also improve employee productivity, making corporate real estate a fundamental aspect of overall business strategy.

Key trends such as the shift towards hybrid work models, the rise of co-working spaces, and the increasing emphasis on sustainability are reshaping the corporate real estate sector. Additionally, challenges like market volatility and rising interest rates necessitate a proactive approach from investors. Embracing data analytics and advanced technologies enables stakeholders to make informed decisions, identify new opportunities, and mitigate risks associated with market fluctuations.

Ultimately, the future of corporate real estate hinges on adaptability and strategic foresight. Organizations are encouraged to stay informed about current trends and leverage data-driven insights to navigate the complexities of the market. By prioritizing corporate real estate as a critical component of their business strategy, companies can position themselves for success in an ever-evolving environment.