Overview

Creating a real estate amortization table in Excel requires a structured approach that encompasses:

- Setting up the table with the necessary columns

- Inputting financing details

- Employing formulas to accurately calculate payments, interest, and principal

This process is crucial for effective financial planning in real estate investments. By following step-by-step instructions, one can ensure precise calculations that are vital for optimizing loan repayment strategies. Additionally, considering potential extra contributions can significantly enhance the overall repayment plan. Ultimately, this structured methodology not only aids in better financial planning but also empowers investors to make informed decisions in the real estate market.

Introduction

Grasping the intricacies of amortization is crucial for anyone navigating the realm of real estate investing. As loan repayment structures grow increasingly complex, a meticulously crafted amortization table emerges as an invaluable tool. It aids investors in visualizing their financial commitments and strategizing effectively.

But how can one accurately construct and optimize this essential financial document in Excel to reflect true costs and potential savings? This guide will elucidate the step-by-step process of building a real estate amortization table, empowering readers with the knowledge to refine their financial planning and bolster their investment success.

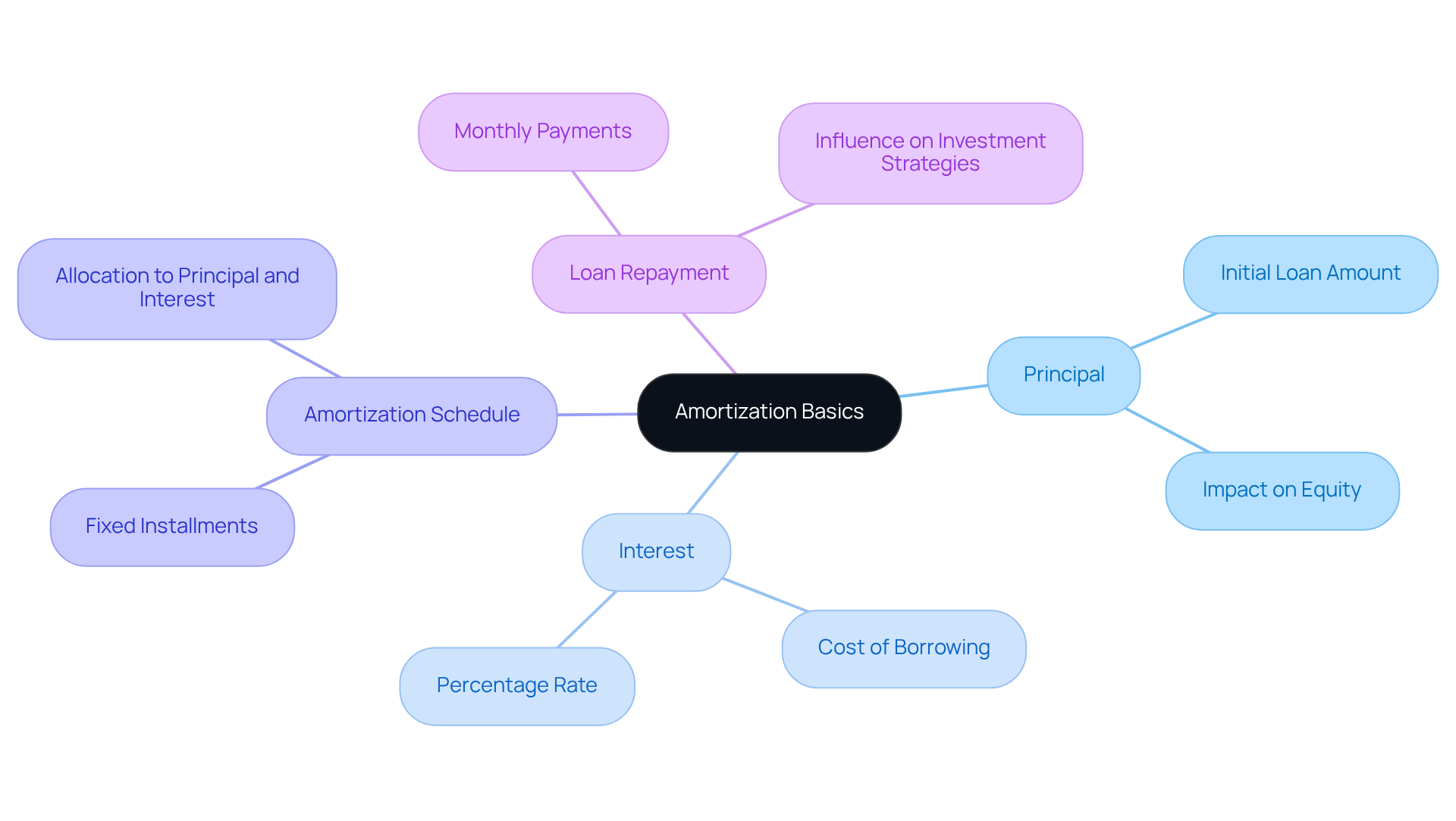

Understand Amortization Basics

Amortization can be illustrated using a real estate amortization table, which allocates a loan into a sequence of fixed installments over time, where each installment encompasses both principal and interest. Understanding the following key terms is essential for real estate investors:

- Principal: The initial amount borrowed.

- Interest: The cost incurred for borrowing the principal, typically expressed as a percentage.

The amortization schedule is represented by the real estate amortization table, which is a comprehensive chart that specifies each installment, indicating how much is allocated to interest and how much reduces the principal.

Grasping the concept of loan repayment is vital in real estate, as it directly influences mortgage costs and the rate at which equity is built. For example, in 2025, average mortgage interest rates are projected to remain elevated, affecting monthly payments and overall investment strategies. A recent survey indicates that 62% of respondents consider a 5.5% mortgage rate to be historically normal, highlighting the importance of understanding current market conditions.

Familiarizing yourself with these concepts will aid in crafting a repayment schedule through a real estate amortization table, facilitating improved financial planning and decision-making in your real estate endeavors. As financial consultant David McMillin states, "Understanding the intricacies of loan repayment can significantly influence your investment approach and long-term financial success." Furthermore, a case study on the effects of debt repayment on real estate investments reveals that investors who effectively manage their repayment schedules can build equity more swiftly, leading to more advantageous refinancing options in the future.

Set Up Your Amortization Table in Excel

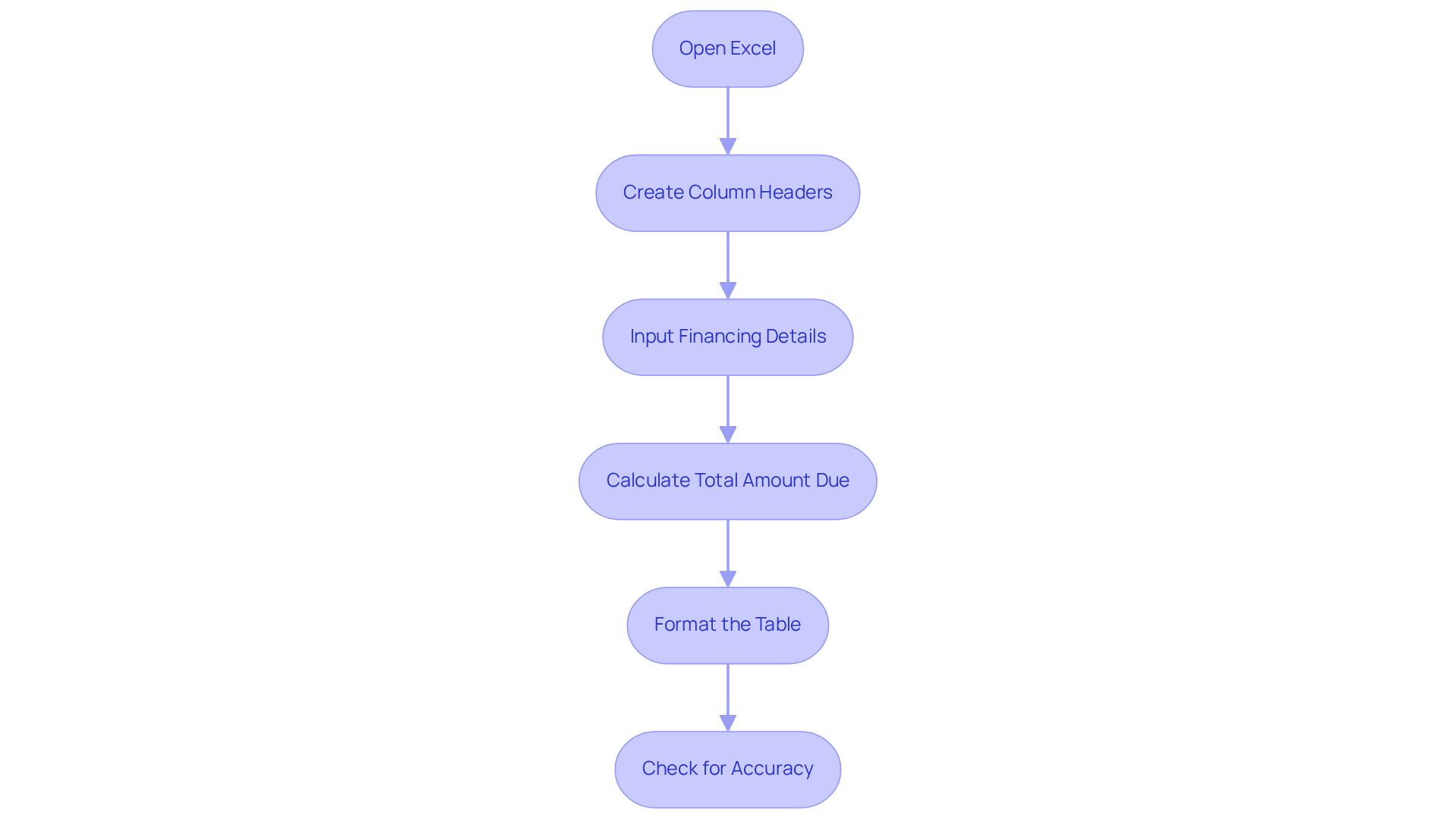

To establish your amortization table in Excel, adhere to the following steps:

- Open Excel: Begin with a new blank workbook.

- Create Column Headers: In the first row, designate the columns as follows:

- A: Period

- B: Starting Balance

- C: Payment

- D: Interest

- E: Principal

- F: Ending Balance

- Input Financing Details: In a separate area, enter your borrowing amount, interest rate, and term (in months). For instance, if you have a 30-year fixed-rate mortgage of $400,000 at a 5.00% interest rate, ensure these figures are prominently noted. Remember, the amortization schedule can accommodate a maximum of 360 installments, which is crucial for your calculations.

- Calculate Total Amount Due: Utilize the PMT function to ascertain the total periodic payment. The formula is

PMT(rate, nper, pv), where 'rate' signifies the monthly interest rate, 'nper' indicates the total number of installments, and 'pv' represents the amount borrowed. - Format the Table: Modify the column widths for clarity and apply borders to differentiate the header row from the data. This enhances readability and mitigates common errors, such as data misalignment or incorrect formulas.

This setup offers a structured approach for inputting your loan data and executing calculations, ensuring that the total principal paid over the term aligns with the original loan amount. Furthermore, confirm that the final balance in your repayment schedule is zero, validating that all contributions have been accounted for. Be vigilant regarding common pitfalls, such as rounding discrepancies or erroneous row references, to preserve accuracy in your calculations.

Calculate Payments and Remaining Balances

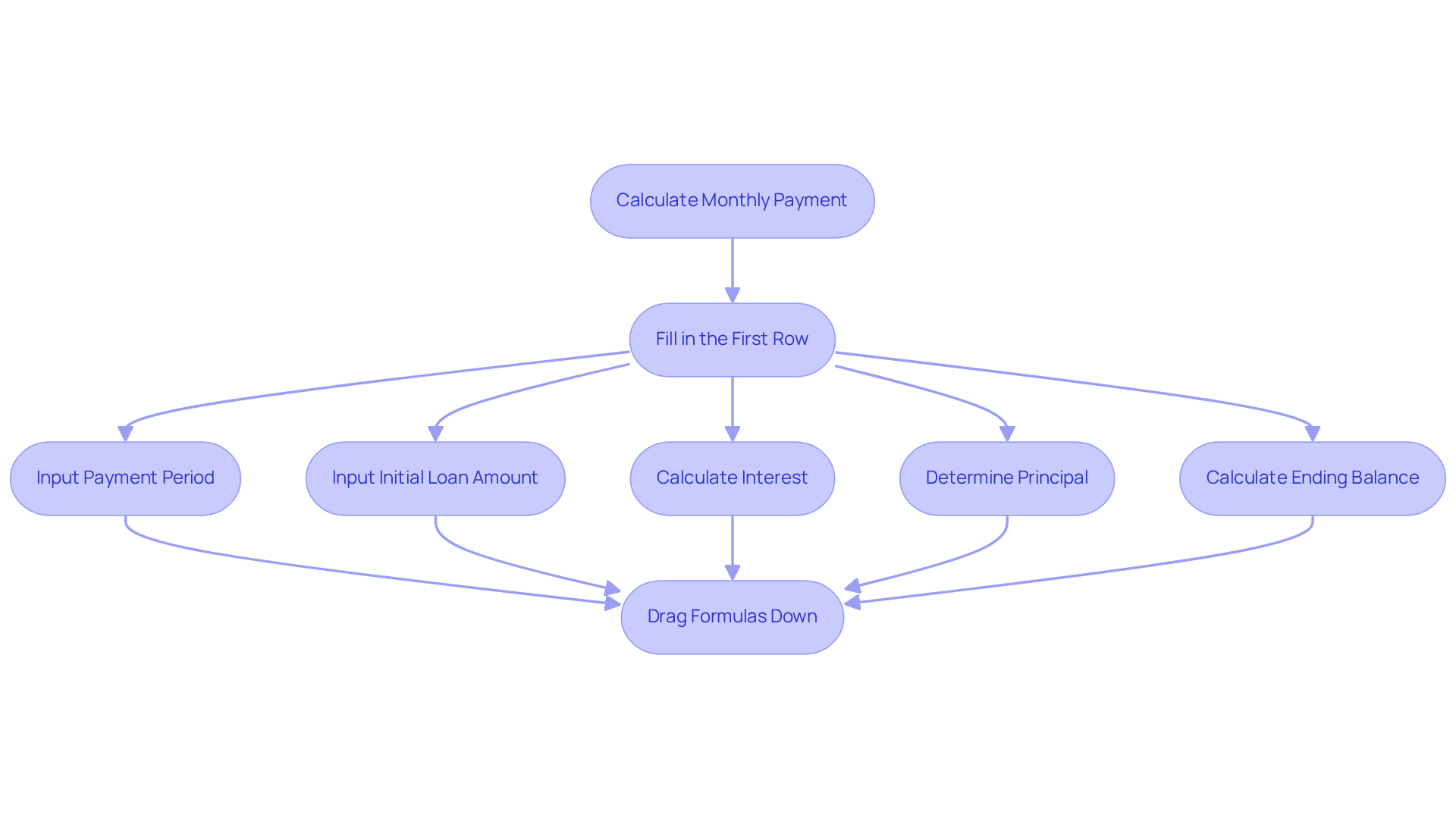

To effectively calculate payments and remaining balances in your amortization table, follow these essential steps:

-

Calculate Monthly Payment: In cell C2, utilize the PMT function:

=PMT(interest_rate/12, loan_term, -loan_amount)Ensure you replace

interest_rate,loan_term, andloan_amountwith the respective cell references. -

Fill in the First Row:

- In cell A2, enter

1to indicate the first payment period. - In cell B2, input the initial loan amount.

- In cell D2, calculate the interest:

=B2*(interest_rate/12)- In cell E2, determine the principal:

=C2-D2- In cell F2, calculate the ending balance:

=B2-E2 - In cell A2, enter

-

Drag Formulas Down: Select cells A2 to F2 and drag down to fill in the subsequent rows for each installment period. Adjust the starting balance for each row based on the ending balance of the previous row.

This procedure will yield a comprehensive real estate amortization table that illustrates how each installment impacts the principal and interest charges over time. Understanding this timetable is crucial; making additional contributions can significantly reduce the overall interest incurred throughout the borrowing period, potentially saving you thousands of dollars. For example, paying an extra $155 a month could save you $43,174 over the life of the loan. Furthermore, consider strategies such as biweekly installments or lump sums to expedite your mortgage settlement. However, remain cautious of potential prepayment fees that may arise when altering your payment schedule; always consult with your lender. This knowledge is vital for making informed financial decisions in real estate.

Troubleshoot and Optimize Your Amortization Table

To effectively troubleshoot and optimize your amortization table, consider these strategies:

-

Verify Formulas: Begin by double-checking that all formulas accurately reference the correct cells. Common pitfalls include incorrect cell references and missing parentheses, which can lead to significant errors in calculations.

-

Include Additional Contributions: If you plan to make further contributions, establish a specific column for these added amounts and modify the principal calculation accordingly to account for their effect on the balance due. For instance, making bi-weekly installments can reduce 5-7 years from a debt, illustrating the potential savings from enhancing your repayment approach.

-

Utilize Conditional Formatting: Implement conditional formatting to highlight any rows where the ending balance falls below zero. This visual cue can help identify calculation errors promptly.

-

Experiment with Scenarios: Adjust the borrowing amount, interest rate, or term to see how these alterations influence your payments and remaining balances. This practice enhances your understanding of various loan conditions and their financial implications.

-

Save as a Template: Once your table is functioning optimally, save it as a template for future use. This enables rapid development of new payment schedules without the necessity to begin from scratch each time.

By employing these troubleshooting and optimization methods, you can maintain a precise and efficient repayment schedule as outlined in a real estate amortization table, which is vital for informed financial planning in real estate investing. As Ana Gotter states, "A repayment plan and a real estate amortization table will show your year-to-year breakdown of how much principal and interest you can expect to pay," underscoring the importance of these tools in managing your investments. Additionally, consider the case of Sarah, who strategically analyzed her portfolio's amortization schedules, allowing her to save thousands in unnecessary closing costs by refinancing at the right time.

Conclusion

Creating a real estate amortization table in Excel is not just a skill; it is an essential tool for any investor aiming to manage loan repayments effectively. By grasping the core concepts of amortization, particularly the allocation of principal and interest, individuals position themselves to make informed decisions that significantly impact their financial success in real estate.

This article presents a comprehensive step-by-step guide, beginning with the fundamentals of amortization and progressing to the practical setup of an Excel table. Key points include:

- The critical nature of accurate calculations

- The application of Excel functions such as PMT to determine monthly payments

- Strategies to optimize the repayment schedule

Additionally, insights into common pitfalls and troubleshooting tips are provided, ensuring users can uphold accuracy in their calculations and enhance their financial planning capabilities.

Ultimately, mastering the creation of a real estate amortization table serves a dual purpose: it aids in tracking loan payments and empowers investors to make strategic decisions that can lead to substantial savings over time. By leveraging these insights and tools, real estate investors can navigate their financial journeys with increased confidence and clarity, ultimately optimizing their investment outcomes.