Overview

This article serves as a comprehensive guide for real estate investors aiming to create a reliable amortization chart. It focuses on systematic debt repayment through regular installments, underscoring the significance of accurate calculations. Common pitfalls, such as rounding errors and incorrect input values, are addressed, as these can greatly influence financial outcomes and investment strategies. By understanding these factors, investors can make informed decisions that enhance their financial stability and growth potential.

Introduction

Understanding the intricacies of amortization is essential for real estate investors who aim to make informed financial decisions. An amortization chart not only provides clarity on how debt is repaid over time but also empowers investors to strategize their cash flow effectively.

However, many face challenges in creating accurate charts, which can lead to potential pitfalls in their investment strategies. How can one navigate these complexities to create a reliable amortization chart that truly reflects their financial commitments?

By mastering this skill, investors can significantly enhance their decision-making process and optimize their financial outcomes.

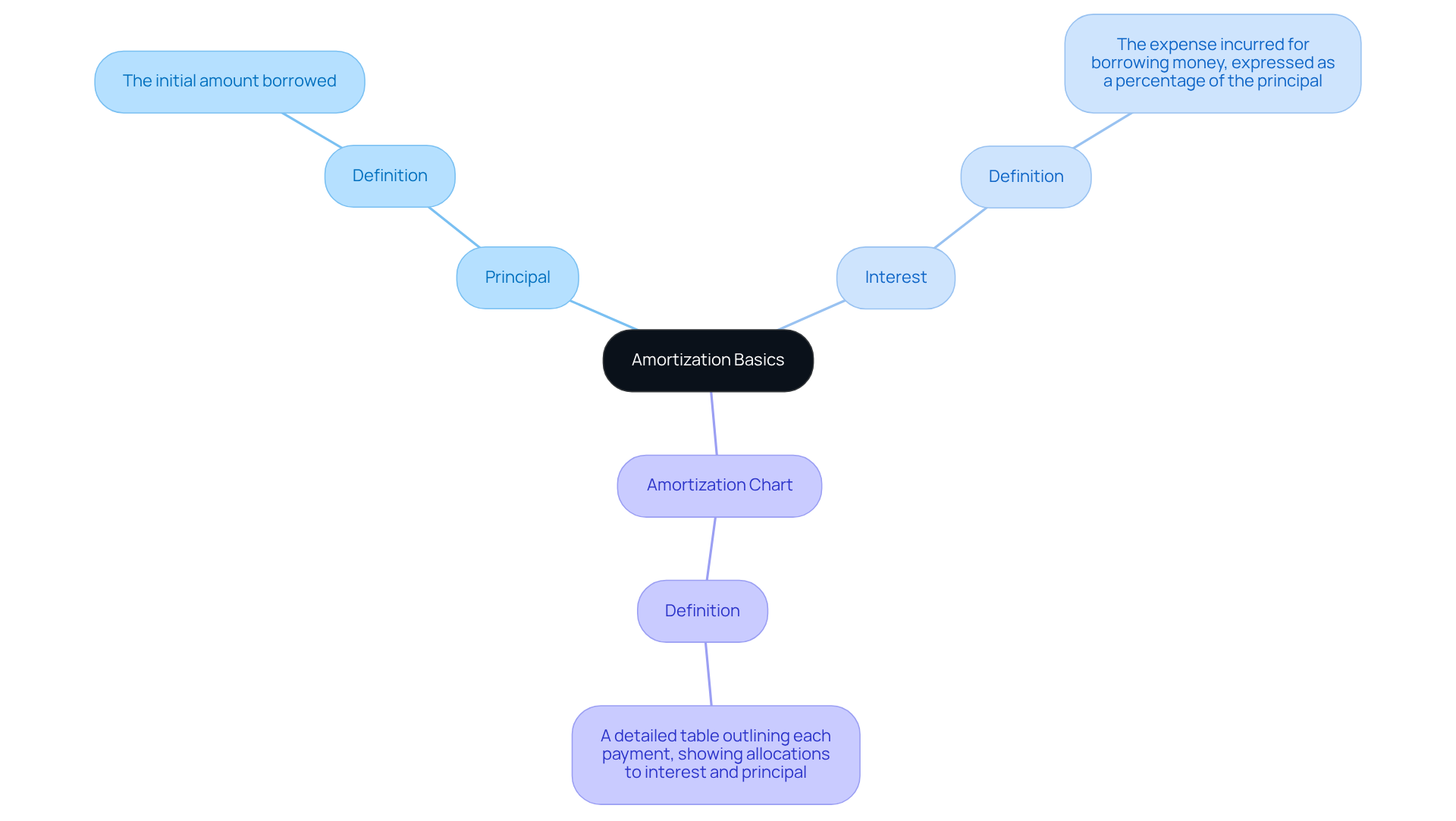

Understand Amortization Basics

An amortization chart real estate illustrates how amortization represents a systematic approach to gradually settling a debt through regular installments. In the amortization chart real estate, each payment consists of both principal and interest, with the interest component diminishing as the principal balance decreases. To navigate this concept effectively, it is crucial to understand the following key terms:

- Principal: The initial amount of money borrowed or invested.

- Interest: The expense incurred for borrowing money, generally expressed as a percentage of the principal.

- Amortization Chart Real Estate: A detailed table that outlines each payment throughout the life of the debt, indicating how much is allocated to interest and how much reduces the principal.

Grasping these concepts empowers investors to assess their financing options and repayment strategies more effectively. This understanding ultimately leads to more informed financial decisions, enhancing their investment outcomes.

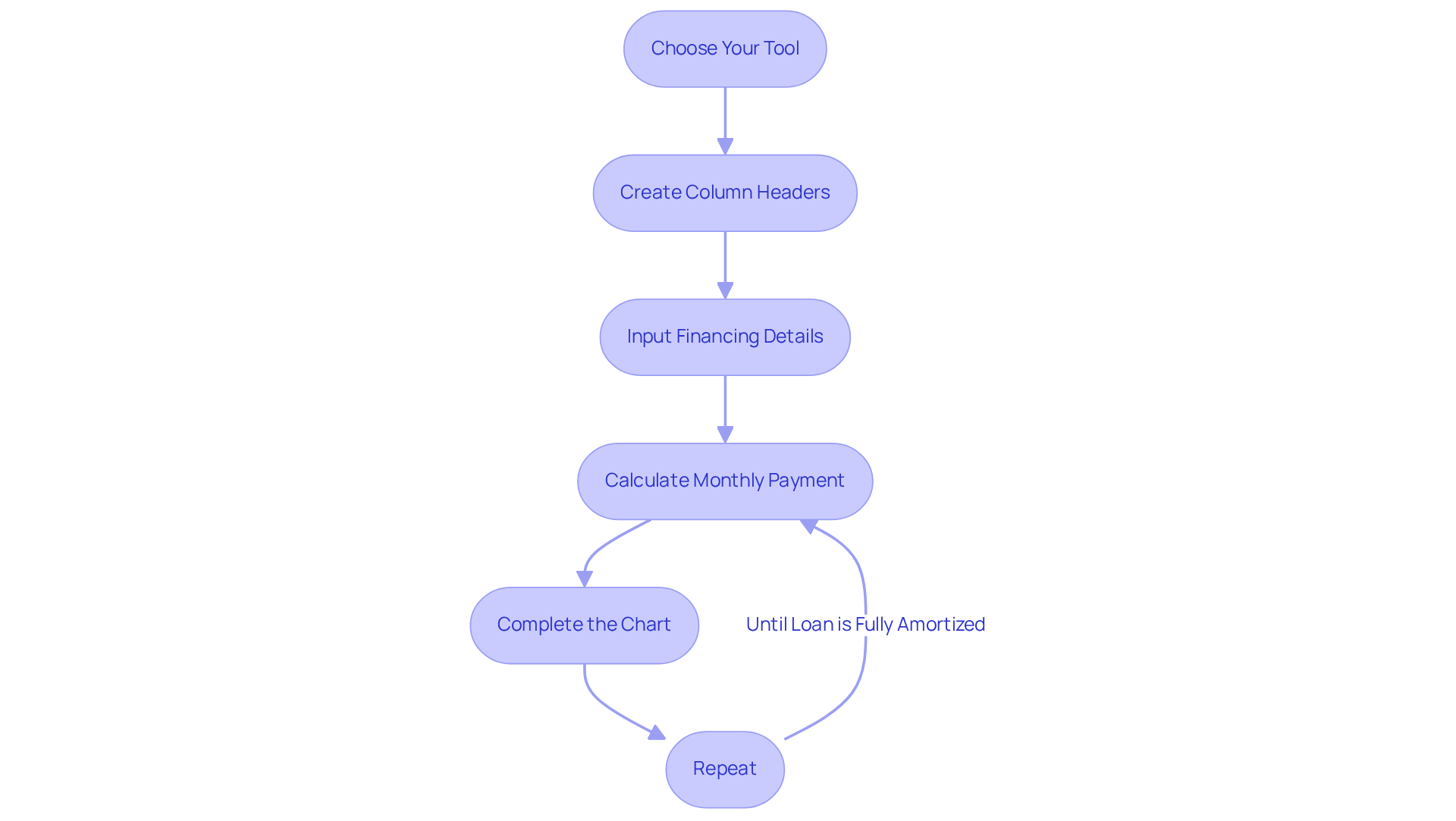

Set Up Your Amortization Chart

To create an effective amortization chart, follow these essential steps:

- Choose Your Tool: Select spreadsheet software such as Microsoft Excel or Google Sheets, both of which offer templates designed to simplify the process.

- Create Column Headers: Establish the following columns: Number, Amount, Interest Charge, Principal Payment, and Remaining Balance.

- Input Financing Details: Enter the loan amount, interest rate, and term in months.

- Calculate Monthly Payment: Utilize the formula

PMT(rate, nper, pv)where:raterepresents the monthly interest rate (annual rate divided by 12),npersignifies the total number of payments,pvdenotes the present value or loan amount.

- Complete the Chart: For each transaction, compute the interest amount (Remaining Balance multiplied by Monthly Interest Rate), the principal amount (Monthly Amount minus Interest Amount), and the updated remaining balance (Previous Balance minus Principal Amount).

- Repeat: Continue this process until the loan is fully amortized, ensuring that each row accurately reflects the calculations made.

By adhering to these steps, you can create a comprehensive amortization chart that will serve as a valuable tool in managing your financial commitments.

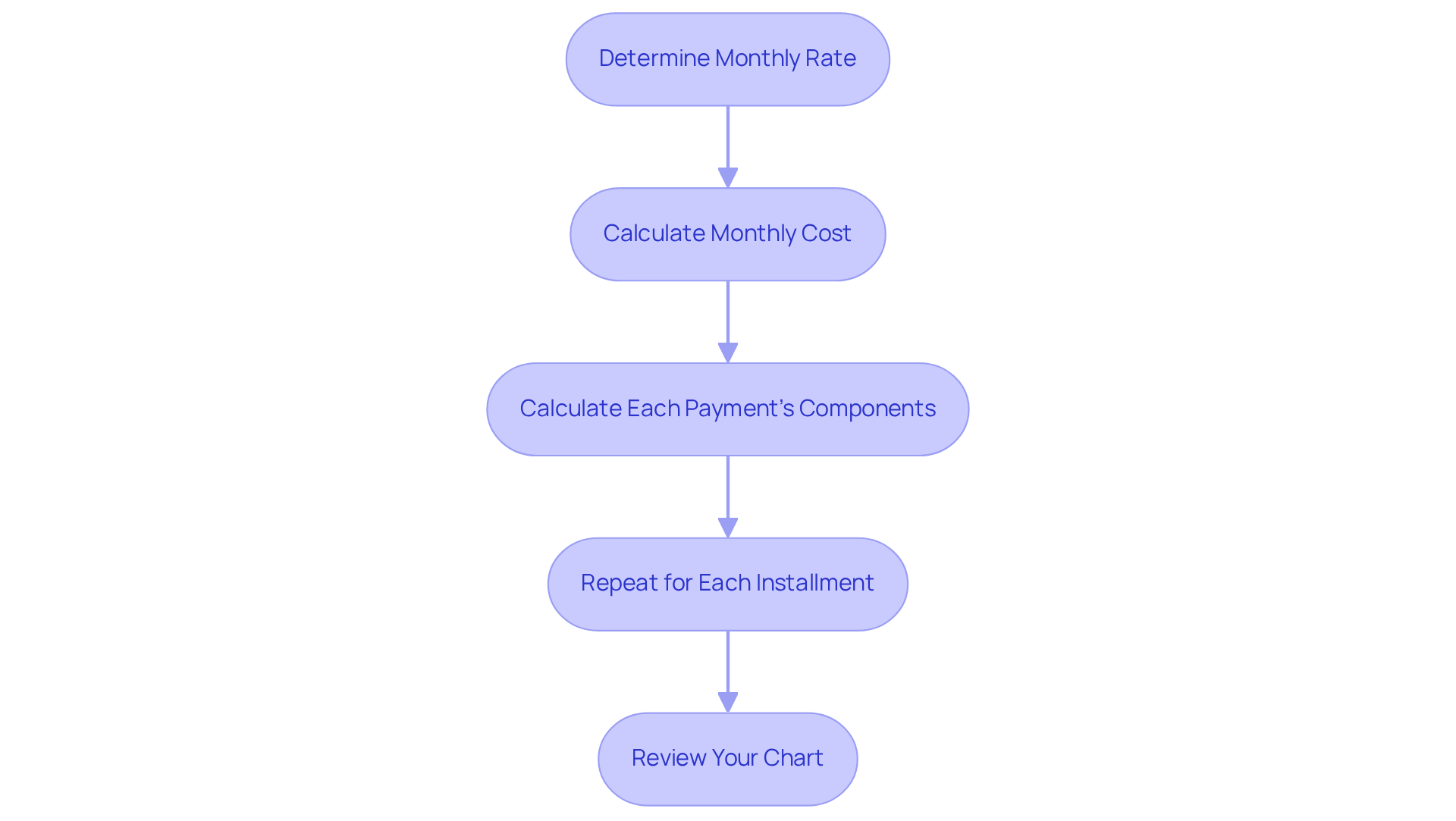

Calculate Payments and Balances

To accurately calculate payments and balances, follow these essential steps:

- Determine Monthly Rate: Divide the annual rate by 12. For instance, with an annual rate of 6.93%, the monthly rate is approximately 0.5775% (0.0693/12).

- Calculate Monthly Cost: Utilize the PMT formula to determine the fixed monthly cost amount based on the loan amount, rate, and loan term.

- Calculate Each Payment's Components:

- For the first payment, compute the interest payment as

Remaining Balance * Monthly Interest Rate. - Deduct the fee for borrowing from the total monthly amount to determine the principal sum.

- Adjust the remaining balance by subtracting the principal amount from the prior balance.

- For the first payment, compute the interest payment as

- Repeat for Each Installment: Continue this process for each following installment, adjusting the remaining balance and recalculating the interest and principal components until the loan is fully amortized.

- Review Your Chart: Ensure all calculations are precise and accurately represent the billing schedule, as even minor errors can lead to significant discrepancies over time.

Accurate payment calculations are crucial for real estate investors, as they directly impact cash flow and investment strategies. Financial analysts emphasize that understanding these components can lead to better financial decisions and improved investment outcomes. As the average US mortgage borrowing rate is projected to be 6.93% in 2025, being precise in these calculations is more important than ever.

Troubleshoot Common Amortization Issues

Creating an accurate amortization chart presents several challenges that, if not addressed, may lead to significant discrepancies. Understanding these common issues is crucial for ensuring reliable calculations.

-

Rounding Errors: Consistency in decimal places is paramount. Rounding can create discrepancies in the final balance; therefore, it is essential to maintain the same level of precision in all calculations. As noted, even small rounding errors can result in significant differences in the remaining balance, such as the remaining balance after five years being $130,275.99.

-

Incorrect Input Values: Ensure that the borrowing amount, rate, and term are entered accurately. Even minor errors can drastically alter the outcome of your calculations. Remember, as Nathan W. Morris states, "Every time you borrow money, you're robbing your future self."

-

Payment Schedule Confusion: Understanding the frequency of your payments—whether monthly, bi-weekly, or otherwise—is vital, as this directly impacts your calculations. Misinterpreting this can lead to negative amortization, where your contributions do not meet the costs, resulting in an increase in your balance.

-

Negative Amortization: If your contributions do not meet the required expenses, your loan balance may rise. Confirm that your transaction amount is sufficient to cover at least the interest accumulated. Robert Kiyosaki emphasizes that financial freedom requires action, urging individuals to ensure their payments are adequate.

-

Software Issues: When using spreadsheet software, ensure that formulas are applied correctly across all relevant cells. Utilize the fill handle to accurately copy formulas down the column. This attention to detail is essential for maintaining the integrity of your calculations.

By recognizing these common pitfalls and implementing these solutions, you can create a reliable amortization chart that serves as a trustworthy tool in your investment strategy. Zero Flux's commitment to data integrity and sourcing information from credible outlets can further support your efforts in achieving accurate financial calculations.

Conclusion

Creating an amortization chart is an essential skill for real estate investors, enabling effective debt management and informed financial decisions. This systematic approach clarifies the repayment process and highlights the interplay between principal and interest, ensuring that investors can plan their cash flow with confidence.

Throughout this article, we have thoroughly explored the key aspects of crafting an amortization chart. From understanding the basics of amortization to setting up the chart using spreadsheet tools, each step is crucial for accurate calculations. Common pitfalls, such as rounding errors and incorrect input values, have been identified, emphasizing the importance of meticulousness in maintaining the integrity of financial data.

Ultimately, the creation of a reliable amortization chart transcends mere mathematics; it serves as a foundational practice that empowers real estate investors to take control of their financial future. By mastering these techniques and remaining vigilant against common errors, investors can enhance their strategies and achieve greater success in their ventures. Embrace the knowledge shared in this guide and take actionable steps toward financial clarity and empowerment in real estate investment.