Overview

Harnessing commercial real estate technology is essential for investment success. It enables firms to:

- Automate processes

- Reduce costs

- Gain valuable insights through data analytics

Notably, technologies such as AI and blockchain enhance operational efficiency, predict market trends, and streamline transactions. These advancements ultimately lead to more informed investment decisions, empowering firms to stay ahead in a competitive landscape. By leveraging these tools, investors can not only improve their operational capabilities but also make strategic choices that align with market dynamics.

Introduction

As the commercial real estate sector undergoes unprecedented transformations, the integration of technology stands out as a pivotal factor for investors aiming to refine their strategies. Proptech, which includes innovations such as AI, blockchain, and big data analytics, presents a multitude of opportunities to streamline operations, cut costs, and facilitate data-driven decision-making. However, these advancements are not without their challenges, prompting a critical inquiry: how can investors effectively leverage these technologies to remain competitive and maximize their returns in a rapidly changing market?

Understand Proptech: Transforming Commercial Real Estate

Proptech, or real estate innovation, represents a significant evolution in the industry, encompassing a diverse range of digital resources and platforms designed to enhance the efficiency and effectiveness of property operations. This innovation includes essential tools such as:

- Virtual tours

- Digital signatures

- Blockchain technology

All of which streamline real estate transactions and elevate user experiences. By embracing commercial real estate tech, commercial real estate (CRE) firms can automate processes, reduce costs, and extract valuable insights through data analytics.

For instance, companies leveraging AI-driven analytics can predict market trends and optimize asset management, ultimately leading to more informed investment decisions. As the real estate landscape continues to evolve, it becomes increasingly critical for investors to understand and integrate commercial real estate tech into their strategies. The ability to harness these innovations not only fosters competitiveness but also maximizes potential returns in a rapidly changing market.

Explore Key Technologies in Commercial Real Estate

Several key technologies in commercial real estate tech are reshaping the landscape, significantly enhancing operational efficiency and investment strategies.

-

Artificial Intelligence (AI) stands at the forefront of this transformation. By automating data collection and delivering predictive analytics, AI revolutionizes the commercial real estate tech management and investment analysis. For instance, AI algorithms can analyze historical data to forecast property values with up to 95% accuracy, enabling investors to make informed decisions. Additionally, commercial real estate tech utilizing AI can predict optimal rental pricing, potentially leading to a 7% increase in rental revenue. The AI market in real estate is projected to reach USD 41.5 billion by 2033, underscoring its growing importance in the sector. Furthermore, brokers and services in commercial real estate tech might experience a potential 34% rise in operating cash flow due to automation improvements, emphasizing the financial advantages of embracing AI innovations.

-

Blockchain technology enhances transparency and security in transactions. Smart contracts automate processes, reducing the need for intermediaries and minimizing transaction costs. Blockchain also provides a tamper-proof record of ownership, which is essential for establishing trust in property transactions. Successful implementations have demonstrated significant reductions in transaction times and costs, such as a self-storage company that reported a 30% reduction in on-property labor hours through AI-powered staffing optimization.

-

Big Data Analytics plays a crucial role by utilizing extensive data to provide insights into market trends, consumer behavior, and asset performance. This data-driven approach in commercial real estate tech empowers firms to identify emerging opportunities and effectively mitigate risks, which leads to more strategic investment decisions. In fact, 81% of real estate executives recognize data and resources as key areas for increased spending in the upcoming year.

-

Virtual and Augmented Reality (VR/AR) technologies enhance the viewing experience, allowing prospective buyers or tenants to explore spaces remotely. This not only saves time but also expands the market reach for real estate listings, increasing engagement rates by up to 25%.

-

The Internet of Things (IoT) further elevates operational efficiency. IoT devices monitor building performance and tenant satisfaction in real-time, providing valuable data that informs management decisions. AI-driven property management platforms within commercial real estate tech can boost rental income by up to 9% while cutting maintenance costs by 14%, showcasing the potential of integrating IoT with AI.

While these innovations present considerable prospects, challenges such as high upfront expenses, data privacy issues, and the necessity for employee training must also be considered. By comprehending and applying these advancements, investors can enhance their operational capabilities and drive investment success in the competitive commercial real estate tech market.

Implementing Proptech Solutions: Best Practices

To successfully implement Proptech solutions, it is essential to consider the following best practices:

-

Assess Your Needs: Begin by evaluating your current operations and identifying areas where advancements can enhance efficiency or reduce costs. This initial assessment will help prioritize which Proptech solutions to adopt, ensuring that your investments align with your operational goals.

-

Select the Appropriate Tools: Investigate and choose solutions that align with your business objectives. Consider factors such as scalability, user-friendliness, and integration capabilities with existing systems. The right tools can significantly impact your overall performance and adaptability in a competitive market.

-

Invest in Training: Ensure that your team is well-trained in utilizing new tools. Comprehensive training will facilitate smoother transitions and maximize the effectiveness of the tools, empowering your staff to leverage Proptech to its fullest potential.

-

Monitor Performance: After implementation, continuously monitor the performance of Proptech solutions. Utilize key performance indicators (KPIs) to measure success and identify areas for improvement. This ongoing evaluation will allow you to make data-driven decisions that enhance operational efficiency.

-

Stay Updated: The Proptech landscape is rapidly evolving. Staying informed about emerging technologies and trends is crucial to ensure your firm remains competitive and can adapt to changes in the market. Regularly engaging with industry news and insights will position you ahead of the curve.

By adhering to these best practices, commercial property investors can effectively utilize Proptech to improve their operations and achieve investment success.

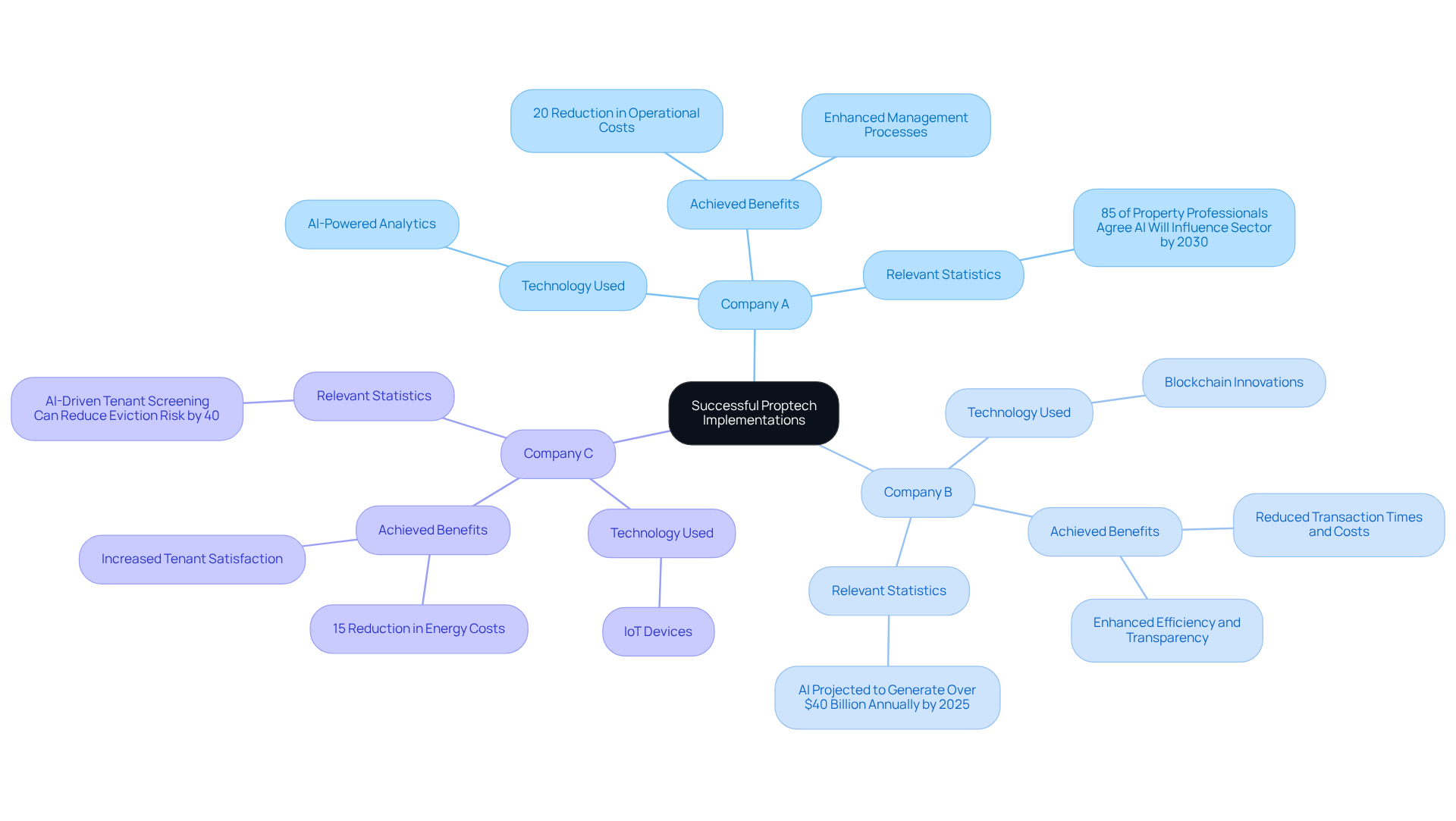

Case Studies: Successful Proptech Implementations

Analyzing successful case studies reveals the transformative influence of commercial real estate tech in the commercial property sector. Consider the following examples:

Company A: A commercial property firm utilized AI-powered analytics to enhance management processes. By analyzing tenant data, they accurately predicted maintenance needs, achieving a remarkable 20% reduction in operational costs. Significantly, 85% of property professionals agree that AI will greatly influence the sector by 2030, underscoring the importance of such advancements.

Company B: A real estate investment trust (REIT) integrated blockchain innovations into their transaction processes. This innovation significantly reduced transaction times and costs, thereby enhancing efficiency and transparency across their operations. The adoption of AI is projected to generate over $40 billion annually for the global commercial sector by 2025, emphasizing the financial implications of these advancements.

Company C: A real estate management firm deployed IoT devices to monitor energy consumption throughout their portfolio. This initiative not only increased tenant satisfaction but also led to a 15% reduction in energy costs. Furthermore, AI-driven tenant screening can reduce the risk of eviction by up to 40%, illustrating the effectiveness of AI in enhancing tenant management.

These case studies underscore the potential of commercial real estate tech to drive efficiency and cost savings, serving as a valuable reference for investors looking to adopt similar solutions in their operations. However, it is crucial to consider the potential privacy risks associated with AI in property management, ensuring a balanced perspective on the technology's impact.

Conclusion

Harnessing the power of commercial real estate technology is no longer merely an option; it has become a necessity for investors striving for success in a dynamic market. The integration of Proptech not only enhances operational efficiency but also equips firms with essential tools for making informed investment decisions. By adopting innovations such as AI, blockchain, big data analytics, and IoT, investors can optimize their strategies and maximize returns.

Throughout this article, key technologies have been explored, showcasing their transformative impact on the commercial real estate landscape. From AI-driven analytics that predict market trends to blockchain solutions that enhance transaction transparency, these advancements are fundamentally reshaping how businesses operate. Best practices for implementing Proptech solutions underscore the importance of:

- Assessing needs

- Selecting appropriate tools

- Investing in training

- Staying updated on industry trends

As the commercial real estate sector continues to evolve, embracing these technologies will be crucial for maintaining a competitive edge. Investors are encouraged not only to adopt these innovations but also to remain vigilant regarding emerging trends and potential challenges. The future of commercial real estate investment is intricately intertwined with technology; thus, proactive engagement with Proptech will be pivotal in driving success and ensuring sustainability in a rapidly changing market.