Overview

Investing in real estate without substantial capital is not only possible but achievable through strategic methods such as:

- Wholesaling

- Seller financing

- Partnerships

These approaches allow individuals to enter the market with minimal or no initial funds. By leveraging creative financing options and collaborative efforts, aspiring investors can navigate the real estate landscape effectively.

This article outlines these methods, demonstrating how they make property investment accessible to those who may otherwise feel excluded due to financial constraints. Embracing these strategies can empower individuals to take actionable steps toward building their real estate portfolios.

Introduction

The allure of real estate investing is undeniable; however, entering this lucrative market without capital can appear overwhelmingly daunting. Innovative strategies exist that enable aspiring investors to navigate this challenge and seize opportunities without the burden of significant upfront costs.

What if practical methods existed to invest in real estate without breaking the bank? This article explores actionable tactics that not only demystify the process but also empower individuals to embark on their investment journey with confidence and creativity.

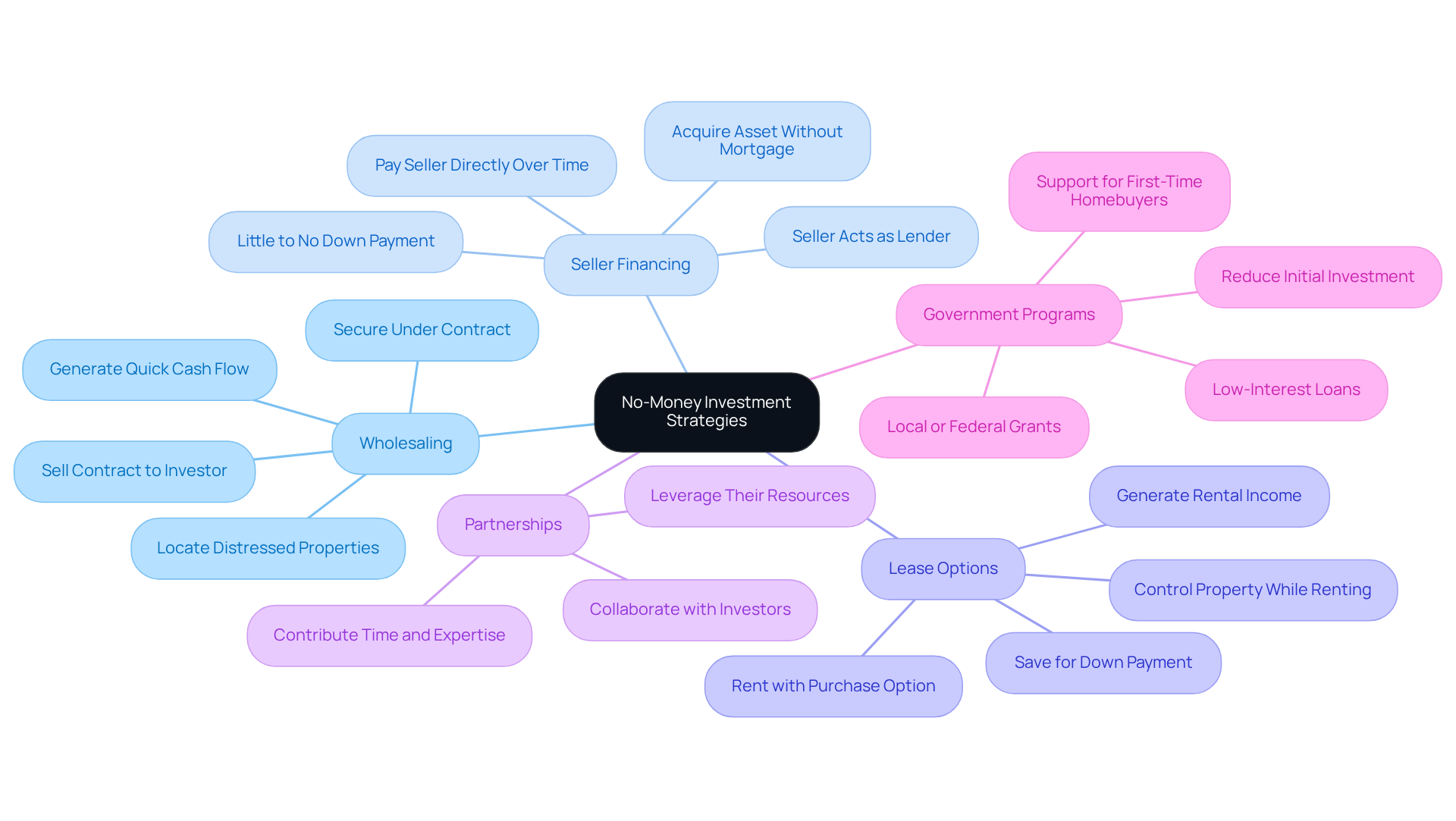

Understand No-Money Investment Strategies

Many people wonder how can I invest in real estate with no money, as it may initially appear daunting; however, several strategies can facilitate your entry into the market. Here are some key approaches:

-

Wholesaling: This strategy involves locating distressed properties, securing them under contract, and subsequently selling the contract to an investor for a fee. With minimal upfront investment required, this method can generate quick cash flow.

-

Seller Financing: In this scenario, the seller acts as the lender, allowing you to acquire the asset without resorting to a conventional mortgage. You agree to pay the seller directly over time, often with little to no down payment, making it an attractive option.

-

Lease Options: This approach permits you to rent a property with the option to purchase it later. You can control the property while generating rental income, all the while saving for a down payment.

-

Partnerships: Collaborating with investors who possess capital can enable you to leverage their resources effectively. You contribute your time and expertise, while they provide the necessary funding.

-

Government Programs: Investigate local or federal programs that offer grants or low-interest loans for first-time homebuyers. These initiatives can significantly reduce your initial investment, making homeownership more accessible.

Understanding these tactics is the first step toward figuring out how can I invest in real estate with no money.

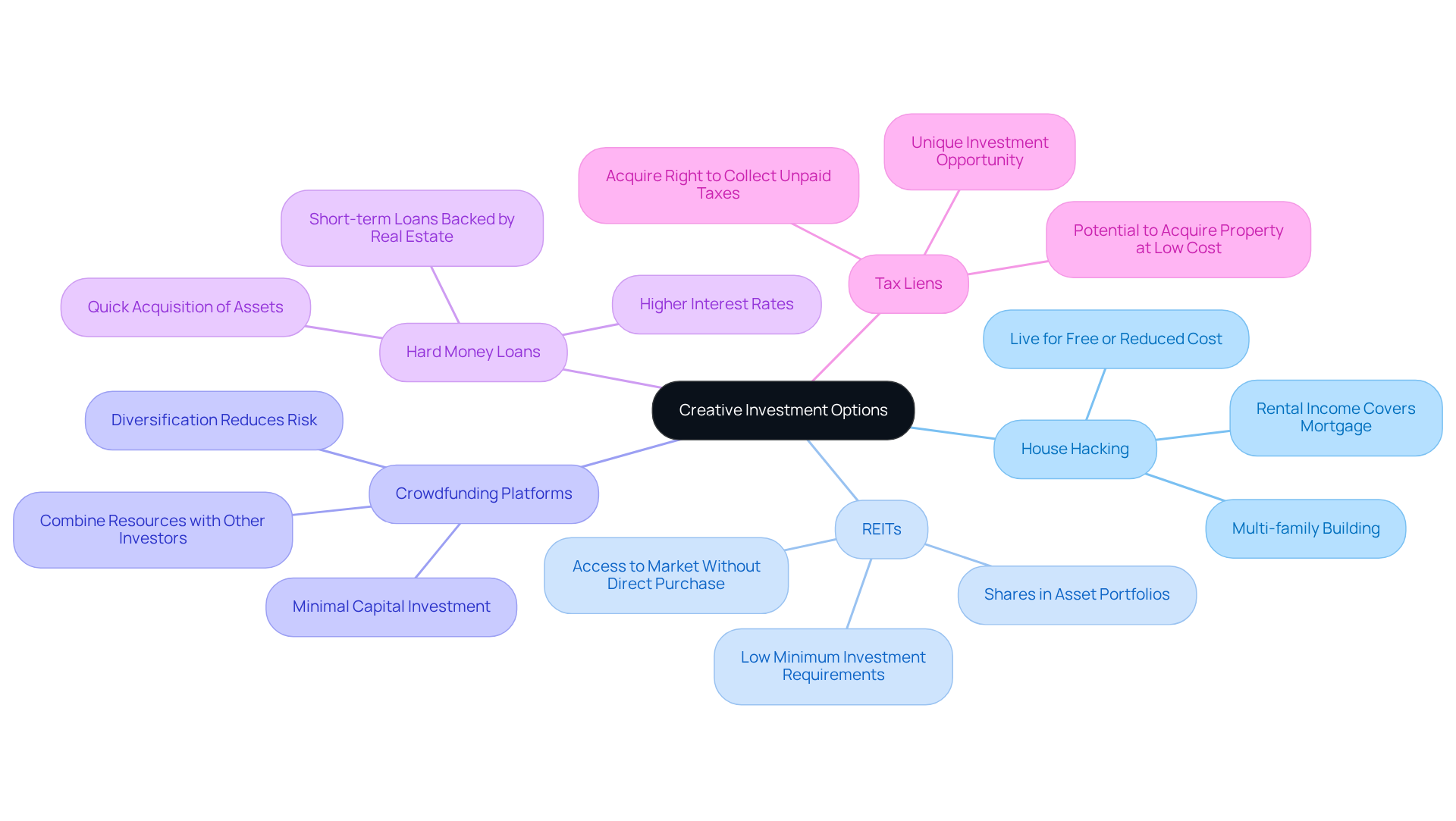

Explore Creative Investment Options

Innovative investment choices can illustrate how can I invest in real estate with no money, creating pathways to property opportunities without the need for substantial funds. Here are some innovative strategies that can empower your investment journey:

-

House Hacking: This strategy involves acquiring a multi-family building, residing in one unit, and leasing out the others. The rental income can cover your mortgage, allowing you to live for free or at a reduced cost.

-

Real Estate Investment Trusts (REITs): Investing in REITs enables you to acquire shares in asset portfolios, offering access to the market without the necessity to buy holdings directly. Many REITs have low minimum investment requirements, making them accessible to a broader range of investors.

-

Crowdfunding Platforms: Online platforms allow several investors to combine their resources to finance property projects. This method enables you to invest with minimal capital while diversifying your portfolio, reducing risk.

-

Hard Money Loans: These short-term loans are backed by real estate and are frequently utilized by investors to acquire assets quickly. While they carry elevated interest rates, they can be a practical choice for those seeking to renovate real estate and increase its value.

-

Tax Liens: Investing in tax liens entails acquiring the right to collect unpaid real estate taxes. If the property owner fails to pay, you can acquire the property at a fraction of its value, presenting a unique investment opportunity.

Exploring these creative options can significantly enhance your ability to understand how can I invest in real estate with no money, enabling you to build a robust investment portfolio.

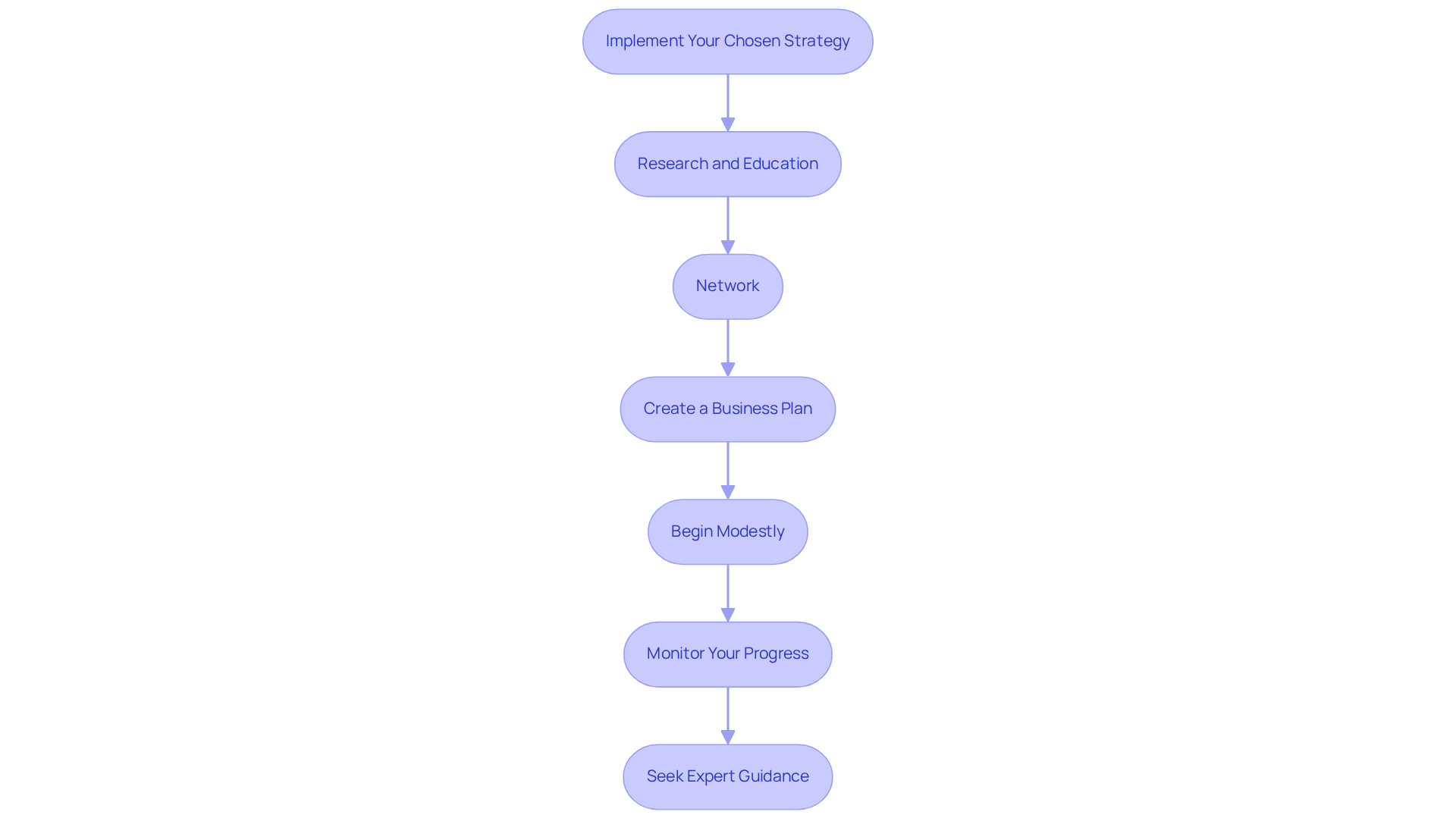

Implement Your Chosen Strategy

Once you've identified a method for how can I invest in real estate with no money that resonates with you, it's time to implement it. Here’s how:

-

Research and Education: Begin by informing yourself about your selected approach. Read books, attend workshops, and follow industry experts to gain insights and knowledge.

-

Network: Connect with other investors, property agents, and professionals in the field. Networking can provide valuable contacts, mentorship opportunities, and potential partnerships.

-

Create a Business Plan: Outline your investment objectives, approaches, and financial forecasts. A solid business plan will help you stay focused and organized as you move forward.

-

Begin Modestly: If you're new to property investing, consider starting with a smaller project or investment. This approach allows you to gain experience without overwhelming financial risk.

-

Monitor Your Progress: Keep track of your investments and analyze their performance regularly. Modify your approaches as necessary according to market conditions and your financial objectives.

-

Seek Expert Guidance: Don’t hesitate to consult with property professionals, financial advisors, or mentors who can offer advice and assistance as you navigate your investment journey.

By following these steps, you can effectively implement your chosen strategy and start your journey into real estate investing, exploring how can I invest in real estate with no money.

Conclusion

Investing in real estate without upfront capital may appear daunting; however, numerous strategies can make this journey attainable. By leveraging innovative approaches such as:

- Wholesaling

- Seller financing

- Creative partnerships

aspiring investors can penetrate the market and build wealth despite financial limitations.

This article has explored key strategies, including:

- House hacking

- REITs

- Crowdfunding

Each providing distinct pathways to property investment. These methods not only diminish the necessity for substantial initial capital but also empower individuals to diversify their portfolios and mitigate risks. Furthermore, the significance of thorough research, networking, and formulating a robust business plan is underscored as essential steps for successfully implementing these strategies.

Ultimately, the potential to invest in real estate without money is within reach for those willing to explore alternative financing methods and creative investment options. By taking actionable steps and remaining dedicated to learning and networking, individuals can transform their real estate aspirations into reality, paving the way for financial growth and stability.