Overview

Real estate appreciates at an average annual rate of approximately 6-7%. This growth is influenced by various factors, including:

- Location

- Economic conditions

- Market trends

- Property improvements

While recent trends have shown fluctuating appreciation rates, understanding these key elements is crucial for investors. By grasping these insights, investors can make informed decisions and effectively navigate the complexities of the real estate market.

Introduction

In the dynamic realm of real estate, understanding the nuances of property appreciation is essential for both homeowners and investors alike. Property values fluctuate due to various factors, including economic conditions and market trends. Grasping the intricacies of appreciation can significantly influence investment decisions.

With projections indicating stability in the housing market and the challenges faced by Millennial renters, a comprehensive understanding of appreciation trends has never been more critical. This article delves into the following topics:

- Definition of real estate appreciation

- Practical formulas for calculating appreciation

- Factors that influence property appreciation

- Strategies to enhance property value

By equipping readers with this knowledge, we aim to empower them to navigate this ever-evolving landscape effectively.

Define Real Estate Appreciation

Real estate value growth represents the increase in an asset's worth over time, influenced by factors such as market demand, economic conditions, and property improvements. For instance, a home purchased for $300,000 that appreciates to $350,000 over five years showcases a $50,000 increase, highlighting a significant return on investment. This concept is crucial for both investors and homeowners, as value appreciation directly impacts equity and potential profits upon selling an asset.

In 2025, the expected annual real estate value increase in the USA is projected to exhibit ongoing stability. This raises the pertinent question: how much does real estate appreciate per year? Experts suggest that low inventory coupled with high demand will sustain property values. Notably, only 29.7% of Millennial renters currently possess the financial capability to purchase homes, underscoring the challenges within the industry and the importance of understanding value appreciation trends.

Moreover, mortgage rates have reached their highest point since July 2024, affecting the economic landscape and influencing value growth. As Laura Madrigal, a Home Improvement Content Specialist at Fixr.com, emphasizes, collaborating with industry experts and staying informed about trends is essential for making sound investment decisions. Furthermore, experts do not anticipate a housing market crash in 2025, citing stricter lending standards compared to pre-Great Recession times, which bolsters the assertion of stability in property values.

Nevertheless, it is important to recognize that this analysis did not predict future changes in rental increases and did not address how much real estate appreciates annually. This highlights the necessity for investors to remain vigilant in their assessments. As technology and evolving work habits continue to shape the market, grasping the nuances of value becomes increasingly vital for making informed investment choices.

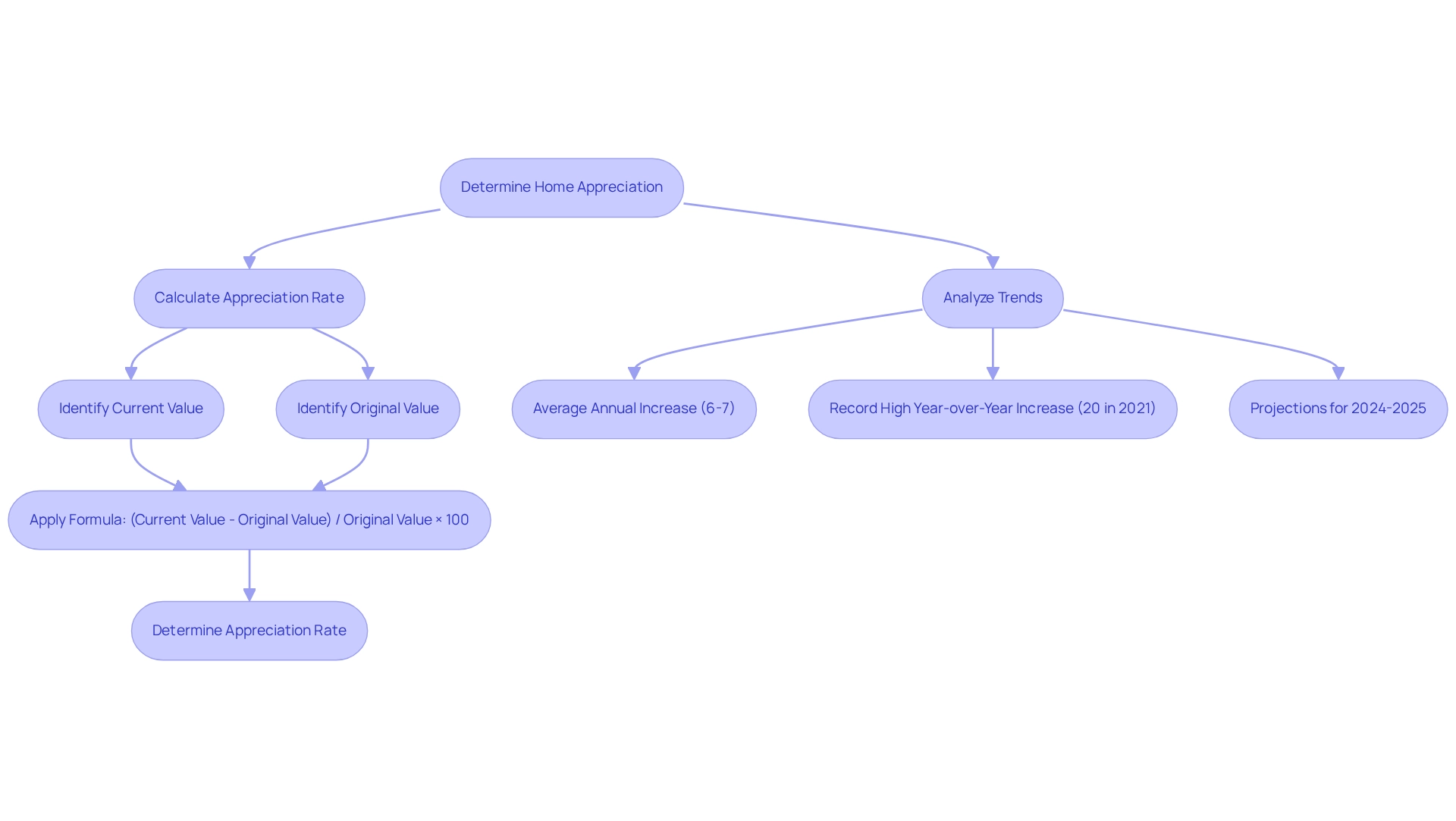

Apply the Home Appreciation Formula

To determine home appreciation, apply the following formula:

Appreciation Rate = (Current Value - Original Value) / Original Value × 100.

For instance, if a property was purchased for $250,000 and is currently valued at $300,000, the calculation would be:

Appreciation Rate = (300,000 - 250,000) / 250,000 × 100 = 20%.

This indicates that the property has appreciated by 20% during the ownership period. Understanding this formula is crucial for homeowners and investors alike, as it helps them effectively monitor how much real estate appreciates per year and track property value changes over time. Recent trends highlight that from 2014 to 2024, national home prices experienced an average annual increase of approximately 6-7%. This prompts an inquiry into how much real estate appreciates per year, culminating in a total rise of about 100% over the decade. Significantly, the S&P CoreLogic Case-Shiller Index reported record-high year-over-year increases of around 20% in 2021, underscoring the fluctuations in the sector. However, projections for 2024-2025 indicate a moderation in growth rates due to increasing interest rates and affordability challenges. This raises the question of how much real estate appreciates per year and suggests a return to more usual increase rates, as discussed in the case study titled 'Future Projections for Home Price Growth.' Moreover, the National Association of Realtors observed that the median price of an existing residence hit a record high of $426,900 in June 2024, emphasizing current economic conditions. By mastering the property value calculation, investors can make informed choices based on historical data and future predictions, ensuring they remain competitive in the evolving real estate market.

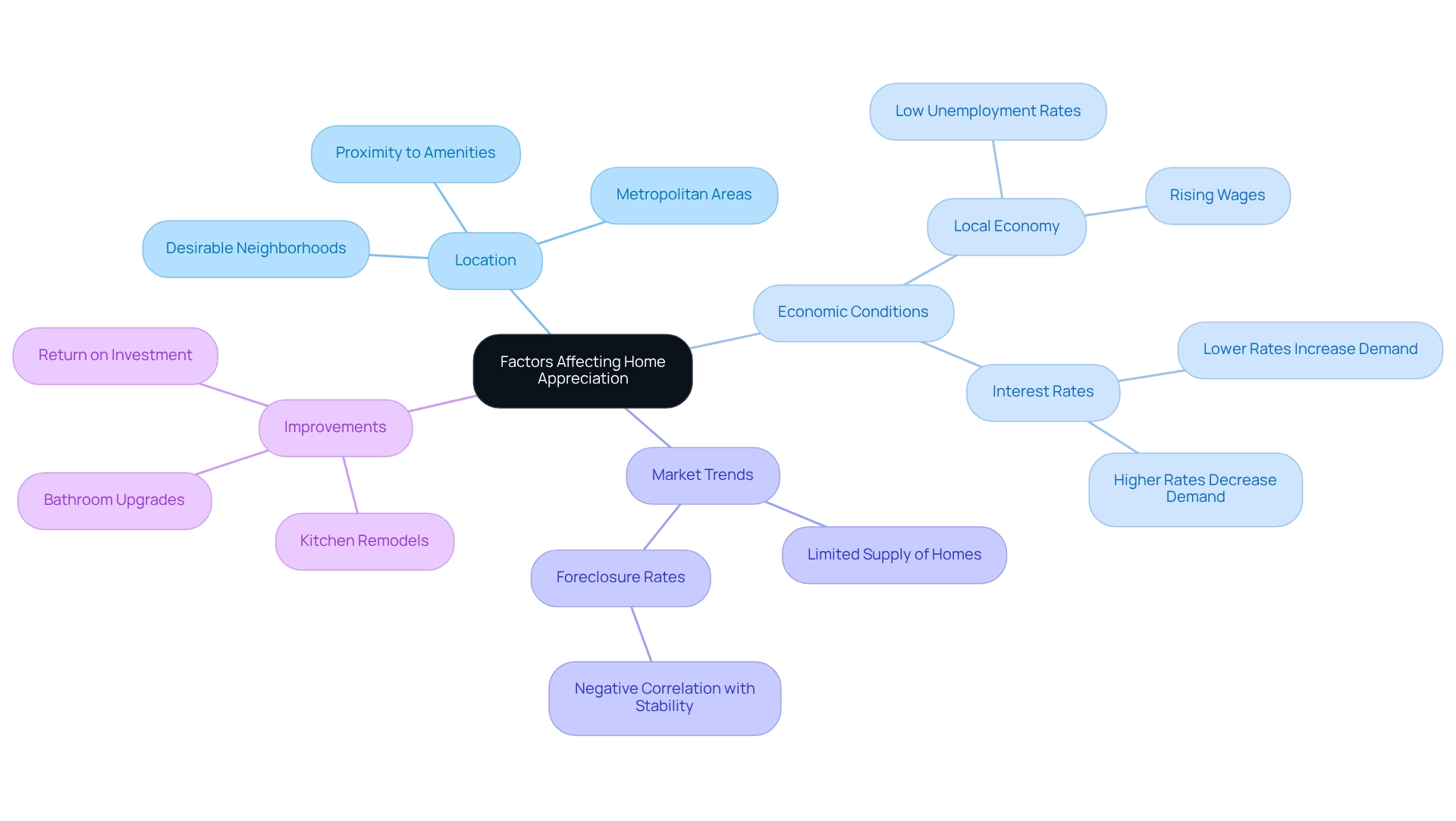

Identify Factors Affecting Home Appreciation

Several critical elements significantly influence the increase in property value.

- Location is paramount. Properties situated in desirable neighborhoods, characterized by excellent schools and convenient amenities, typically experience quicker value growth. For instance, residences in metropolitan areas with robust infrastructure often see heightened demand, leading to elevated real estate values.

- Economic Conditions also play a vital role. A thriving local economy, marked by low unemployment rates and rising wages, can stimulate housing demand. This demand frequently translates into appreciation, as more individuals seek to purchase properties in economically stable regions. Additionally, interest rates are crucial; lower rates make mortgages more accessible, driving demand for real estate, while higher rates can suppress demand and reduce prices.

- Market Trends are essential in determining asset values. A limited supply of homes, particularly in sought-after locations, can exert upward pressure on prices as buyers compete for available properties. Notably, there is a strong negative correlation between foreclosure rates and overall market stability; fewer foreclosures contribute to healthier appreciation rates. This constrained supply, coupled with persistent demand for real estate, results in upward pressure on values.

- Improvements to properties can also significantly raise their value. For example, a kitchen remodel often yields a high return on investment, enhancing the home's marketability and overall worth. Homeowners who undertook renovations in 2023 cited various motivations for their projects, with frequency data indicating that kitchen and bathroom upgrades were among the most prevalent, underscoring the importance of enhancements in driving appreciation.

Understanding these factors is crucial for investors aiming to navigate the complexities of the real estate landscape effectively, particularly regarding annual real estate appreciation. By focusing on location, economic conditions, market trends, and improvements, investors can make informed decisions that align with appreciation potential.

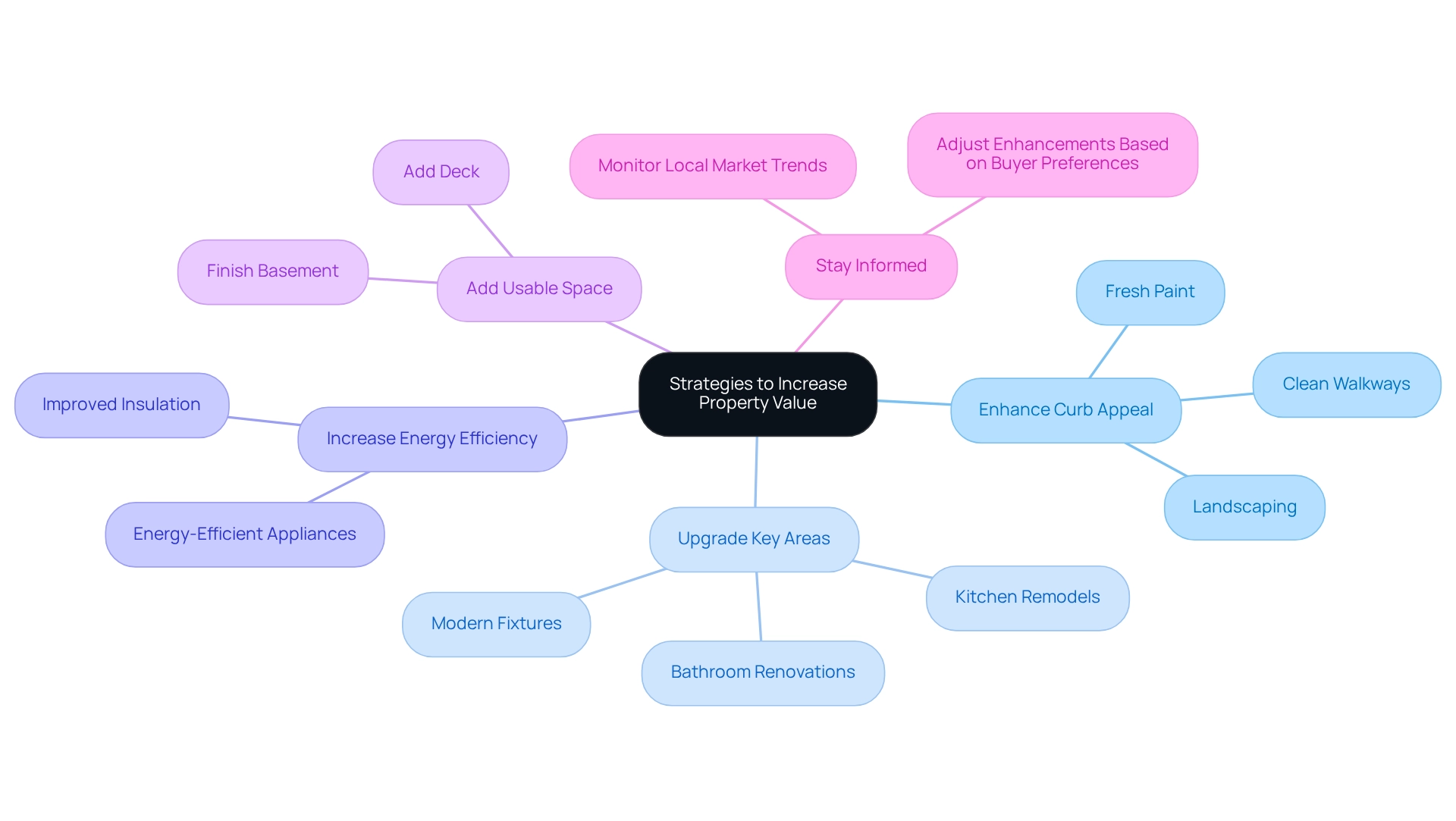

Implement Strategies to Increase Property Value

To effectively increase property value, consider implementing the following strategies:

- Enhance Curb Appeal: Simple improvements such as landscaping, fresh paint, and clean walkways can significantly elevate a property's first impression. Curb appeal not only attracts potential buyers but also creates a welcoming atmosphere for visitors.

- Upgrade Key Areas: Prioritize renovations in kitchens and bathrooms, as these spaces typically yield the highest returns on investment. Strategic upgrades, like modern fixtures and efficient layouts, can greatly enhance marketability. For instance, the case study titled "Home Upgrades and Their Return on Investment" emphasizes that kitchen remodels often yield the highest returns, making them a smart investment.

- Increase Energy Efficiency: Installing energy-efficient appliances and improving insulation can appeal to eco-conscious buyers while reducing utility costs. This trend is increasingly important as buyers prioritize sustainability in their home choices.

- Add Usable Space: Expanding usable square footage, such as finishing a basement or adding a deck, can significantly enhance appeal and value. These enhancements provide additional living space that many buyers seek.

- Stay Informed: Regularly monitor local market trends and adjust your enhancements to align with buyer preferences. As buyers increasingly prioritize convenience to their offices, quality of the neighborhood, and affordability, understanding demographic shifts and community developments can guide your investment decisions effectively.

In 2025, concentrating on these strategies can result in significant increases in real estate value, leading to inquiries about how much real estate appreciates per year, as shown by case studies emphasizing successful home improvements that produce high returns. By adopting a data-driven approach, investors can make informed decisions that enhance their properties' marketability. With Zero Flux providing a daily compilation of 5-12 handpicked real estate insights, staying informed about market trends is crucial for making sound investment choices.

Conclusion

Understanding real estate appreciation is essential for homeowners and investors aiming to navigate the complexities of the property market. This article has explored the definition of appreciation, practical formulas for its calculation, various factors influencing property values, and strategies to enhance those values. By grasping these concepts, individuals can make informed decisions that align with market trends and maximize their investment potential.

The appreciation of a property is not merely a matter of chance; it is influenced by location, economic conditions, market dynamics, and property improvements. Recognizing these factors allows investors to strategically position themselves in the market, ensuring they capitalize on favorable conditions while mitigating risks associated with downturns. Moreover, by applying effective strategies to increase property value—such as enhancing curb appeal and upgrading key areas—homeowners can significantly boost their return on investment.

As the real estate landscape continues to evolve, staying informed about market trends and economic indicators will be crucial for success. With projections indicating stability in the housing market, understanding property appreciation trends is more important than ever. By leveraging the knowledge shared in this article, individuals can empower themselves to make sound investment choices and achieve their financial goals in real estate.