Overview

To become a successful real estate investor, one must adopt a structured approach that encompasses:

- Educating oneself about essential concepts

- Defining financial objectives

- Crafting a comprehensive business plan

Thorough preparation, market research, and networking are critical steps that equip aspiring investors with the necessary knowledge and connections. These elements are vital for successfully navigating the complexities of the real estate market. By understanding these foundational aspects, investors position themselves to make informed decisions and seize opportunities.

Introduction

In the ever-evolving landscape of real estate, navigating the complexities of investing can be both daunting and rewarding. With a myriad of investment types, financial strategies, and market dynamics to consider, understanding the foundational concepts is essential for success. From the significance of cash flow and equity to the nuances of different property categories—residential, commercial, and industrial—each aspect plays a crucial role in shaping investment decisions.

As market trends fluctuate and new opportunities arise, staying informed and prepared empowers investors to make strategic choices that align with their financial goals. This comprehensive guide delves into key concepts, investment types, financial planning strategies, and networking tactics that can enhance one's journey in real estate investing, ensuring a solid foundation for long-term success.

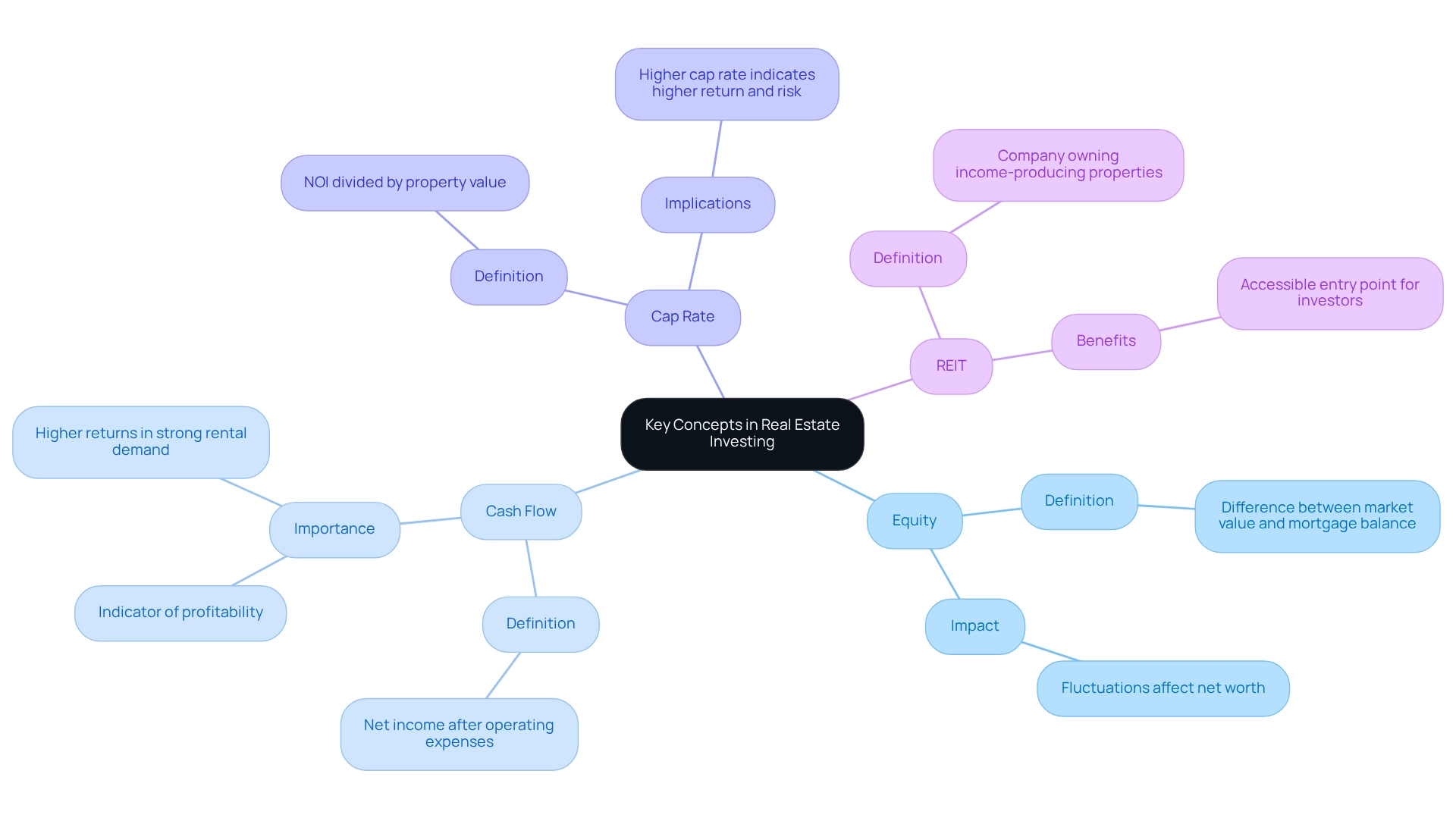

Understanding Real Estate Investing: Key Concepts and Terminology

Becoming a real estate investor entails the purchase, ownership, management, rental, or sale of real estate for profit. Understanding essential terminology is crucial for navigating this complex landscape. Here are some key terms that every investor should know:

-

Equity: This represents the difference between the market value of a property and the outstanding mortgage balance. As property values fluctuate, so does equity, which can significantly impact an investor's net worth.

-

Cash Flow: Referring to the net income generated from a property after all operating expenses, cash flow is a vital indicator of the profitability of the venture. In 2025, average cash flow statistics indicate that properties with strong rental demand are yielding higher returns, making cash flow analysis essential for prospective investors.

-

Cap Rate: The capitalization rate is a key metric used to estimate the return on an investment property. It is calculated by dividing the net operating income (NOI) by the property value. A higher cap rate typically indicates a potentially higher return, but it may also reflect higher risk.

-

REIT (Real Estate Investment Trust): This is a company that owns, operates, or finances income-producing properties. Investing in REITs enables individuals to purchase shares in a varied collection of property assets, offering an approachable entry point into the sector.

Acquainting yourself with these terms will enable you to participate in knowledgeable discussions and make strategic choices regarding becoming a real estate investor throughout your financial journey. As the property sector continues to change, especially with recent trends showing a strong investment interest in grocery-anchored retail and a significant rise in global investment volumes reaching US$703 billion, remaining informed about these concepts is more crucial than ever. Notably, in January 2025, the Midwest, South, and West faced month-over-month declines in transactions, with the South experiencing the largest decrease, emphasizing the importance of grasping economic dynamics.

Moreover, understanding how fluctuations in value can influence property worth and rental interest will enhance your ability to navigate the intricacies of property investing. As Julia Georgules, Head of Americas Research & Strategy, highlights, "Contact our research team to discover how we can assist your real property strategy with insights and strategic guidance.

Exploring Different Types of Real Estate Investments

Real estate investments can be categorized into several distinct types, each offering unique characteristics and opportunities:

-

Residential Properties: This category encompasses single-family homes, condominiums, and multi-family units. Residential properties are often more accessible for novice investors entering the real estate market due to their straightforward management and understanding. In 2025, statistics suggest that acquiring residential properties is expected to yield returns averaging around 8%, making it an appealing choice for those looking to enter the market. Historically, vacancy rates in the residential sector bottomed near 2.5% when mortgage rates doubled back in the 1980s, providing context for current trends in housing demand.

-

Commercial Properties: These assets encompass office buildings, retail spaces, and warehouses. Although they generally require a greater capital expenditure, commercial properties can provide notably higher returns compared to residential assets. Current trends show that commercial property vacancy rates are stabilizing, which may signal a recovery in this sector as businesses adapt to new economic conditions. However, potential risks loom for those considering entering the property market in 2025 due to changing economic policies and ongoing shifts in working patterns, which investors should consider.

-

Industrial Properties: This type includes manufacturing facilities and distribution centers, often leased to businesses for extended periods. The demand for industrial properties has surged, particularly with the rise of e-commerce, leading to increased rental rates and investment interest.

-

Land Investments: Purchasing undeveloped land can be a speculative venture, with potential for appreciation as surrounding areas develop. Investors should be aware of zoning laws and future development plans, as these factors can significantly influence land value.

-

Property Investment Trusts (REITs): For individuals seeking to invest in property without the obligations of management, REITs provide a practical option. They offer liquidity and variety, enabling investors to engage in property markets through shares in a firm that possesses and manages income-generating assets.

Each category of asset carries its own risk and return profile. As Dave Meyer, Head of Real Estate Investing at BiggerPockets, advises, "Stay patient, focus on fundamentals, and take a long-term approach." Furthermore, potential inflation from Trump's proposals could lead to higher mortgage rates, further dampening housing demand.

Consequently, it is essential to align your financial decisions with your monetary objectives and risk appetite to efficiently navigate the intricacies of becoming a real estate investor.

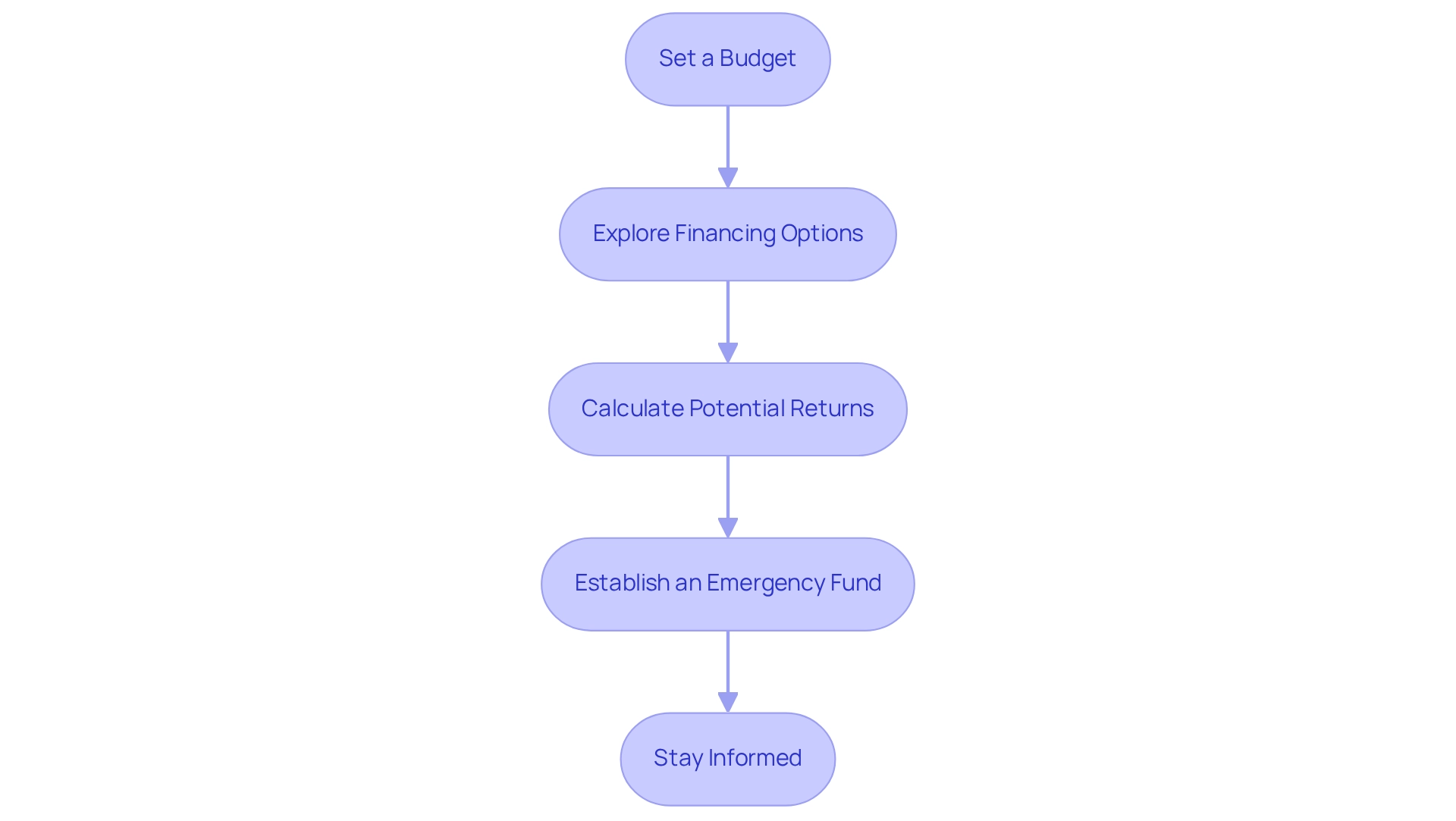

Financial Planning: Budgeting and Securing Financing for Investments

Financial planning stands as a cornerstone for aspiring real estate investors. A structured approach is essential to ensure preparedness:

-

Set a Budget: Start by determining your funding capacity, which encompasses not just the purchase price but also closing costs, necessary repairs, and ongoing maintenance expenses. For novice investors in 2025, it’s prudent to allocate an average budget reflective of current economic conditions, as the national median resale home price has risen to $407,200—a 4% increase, marking the 16th consecutive month of growth.

-

Explore Financing Options: Delve into various financing avenues, including traditional mortgages, private lenders, or partnerships. Each option carries unique requirements and implications for your financial strategy. Understanding these nuances will empower you to select the best path forward, particularly in a competitive market where 29% of buyers are willing to pay above the asking price for properties.

-

Calculate Potential Returns: Evaluate the potential profitability of your asset using key metrics such as cash flow and capitalization rate (cap rate). This analysis is vital to ensure that your expected returns align with your financial objectives. Incorporating extensive real estate data into your assessments can enhance your credibility and foster trust in your financial decisions. As demonstrated in the case study "The Full Picture: Real Estate Statistics," leveraging detailed industry statistics can set you apart from competitors and build trust with clients.

-

Establish an Emergency Fund: It is wise to allocate resources for unexpected costs that may arise during property management or due to economic shifts. This safety net enables you to navigate challenges without jeopardizing your investment.

-

Stay Informed: Remain vigilant about market dynamics, as indicated by the current market action index of 37, suggesting a slight seller’s advantage. By creating a robust financial foundation and utilizing comprehensive industry knowledge, you can confidently navigate the complexities of becoming a real estate investor, positioning yourself for long-term success. Zero Flux's commitment to providing factual information has earned positive feedback from its community, ensuring you have reliable insights to guide your investment decisions.

Conducting Market Research: Analyzing Trends and Opportunities

Carrying out comprehensive industry research involves several essential steps that can significantly impact your success as a real estate investor.

-

Identify Target Markets: Focus on specific geographic areas where you want to invest. Look for regions exhibiting strong economic growth, population increases, and low vacancy rates. For instance, regions in Florida and Arizona are currently highlighted as zones with high potential, yet they also carry considerable risks of price drops, as indicated by CoreLogic. This underscores the necessity of careful selection for those aspiring to become real estate investors while mitigating investment risks.

-

Analyze Market Trends: Utilize data from reliable sources to assess trends in property values, rental rates, and demographic shifts. As of early 2025, the real estate sector is experiencing notable fluctuations, with January marking the coldest month in 25 years, thereby impacting buyer sentiment. Tools such as Zillow, Realtor.com, and local MLS can provide valuable insights into these trends, aiding you in making informed decisions. It's crucial to recognize that for long-term homebuyers, the timing of the purchase is less critical; however, for those entering the realm of real estate investing, purchasing at price peaks before a recession introduces greater risk.

-

Evaluate Comparable Properties: Research similar properties in your target area to understand pricing and demand. This comparative analysis will enable you to gauge whether a property is fairly priced and identify potential investment opportunities. Recent case studies indicate that increasing housing inventory is essential for stabilizing home prices, suggesting that areas with rising inventory may present improved purchasing conditions.

-

Stay Informed on Local Regulations: Understanding zoning laws, property taxes, and any upcoming developments is vital, as these factors can significantly affect property values. Staying updated on local regulations ensures that you are prepared for any changes that might impact your investments.

By remaining knowledgeable and conducting thorough research, you can effectively prepare for becoming a real estate investor and seize new opportunities within the property sector. This proactive approach not only enhances your financial strategy but also aligns with the latest insights from property analysts, who emphasize the importance of comprehensive market research in identifying profitable opportunities. Zero Flux, a leading authority in property information distribution, curates data from various sources to inform these strategies, ensuring you have access to the most pertinent and factual insights.

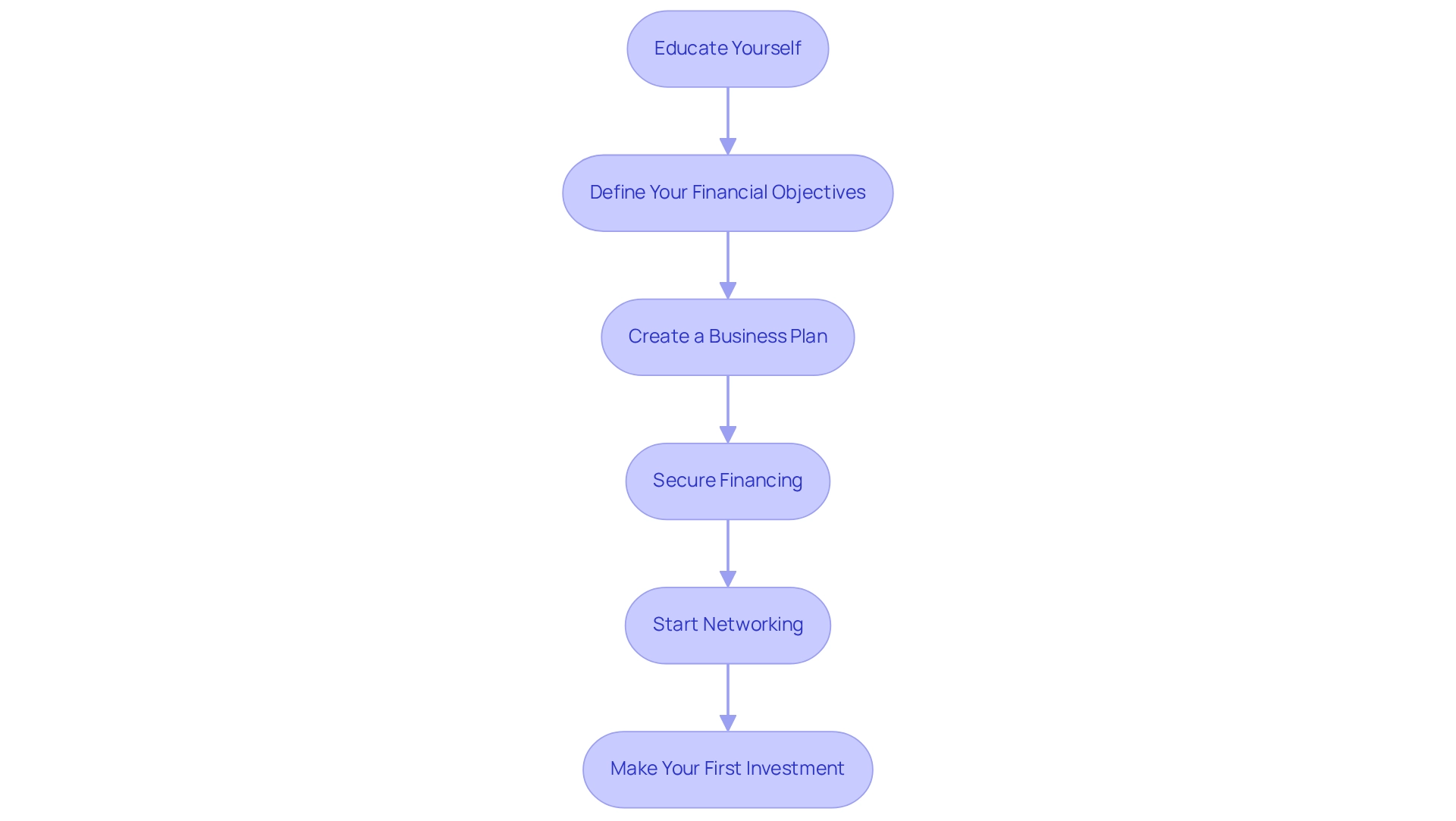

Step-by-Step Guide to Starting Your Real Estate Investment Journey

To embark on your real estate investment journey, consider the following structured steps:

-

Educate Yourself: Immerse yourself in the realm of property by reading books, attending seminars, and following trustworthy blogs. This foundational knowledge is crucial, as statistics indicate that investors who prioritize education are more likely to succeed in their ventures. Chris Heller, Chief Real Estate Officer at OJO Labs, emphasizes that experience and education are vital for success in real estate.

-

Define Your Financial Objectives: Clearly articulate what you aim to achieve with your assets. Whether your focus is on generating cash flow, seeking property appreciation, or a blend of both, having defined goals will guide your strategy. For instance, consider the national median rent, which rose to $1,411 in July 2024, as you assess potential cash flow opportunities.

-

Create a Business Plan: Develop a comprehensive business plan that outlines your funding strategy. This should include your target markets, preferred property types, and detailed financial projections. A well-structured plan serves as a roadmap for your investment activities.

-

Secure Financing: Investigate various financing options available to you. Getting pre-approved for a loan not only clarifies your budget but also strengthens your position when negotiating with sellers. Understanding your financial landscape is essential for making informed decisions.

-

Start Networking: Establishing connections is essential in property. Connect with fellow investors, real estate agents, and industry professionals. Engaging with others can provide valuable insights and opportunities that may not be readily available through traditional channels. A case study on REALTORS® reveals that 94% prefer text messaging for client communication, highlighting the importance of modern communication tools in networking.

-

Make Your First Investment: Choose your first property carefully, ensuring it aligns with your investment goals and budget. Perform comprehensive due diligence, including analysis of the sector and property assessments, to reduce risks linked to your acquisition. Keep in mind that the market action index is currently at 37, indicating a slight seller's advantage, which may influence your negotiation strategies.

By following these steps, you can confidently navigate the complexities of property investing, which will aid in becoming a real estate investor and set the stage for long-term success. Remember, the journey is as important as the destination, and continuous learning and adaptation will be key to your growth as an investor.

Networking: Building Relationships in the Real Estate Industry

Establishing a robust network in the property sector is paramount for success and can be achieved through several strategic methods.

-

Participating in Industry Events: Engaging in property conferences, seminars, and local gatherings is essential. These events not only facilitate connections with other investors and professionals but also provide insights into current market trends. In 2025, average attendance at such events is projected to be significant, reflecting the industry's commitment to collaboration and knowledge sharing. Notably, regions such as Texas, California, Florida, Ohio, and North Carolina exhibit the highest property activity, establishing them as prime sites for networking opportunities.

-

Joining Professional Associations: Becoming a member of organizations like the National Association of Realtors (NAR) or local property clubs unlocks valuable resources and networking opportunities. These associations frequently host events and provide platforms for members to connect and share experiences.

-

Utilizing Social Media: Platforms such as LinkedIn and Facebook serve as powerful tools for networking. With 90% of property agents utilizing Facebook and 52% on Instagram, these platforms offer opportunities to connect with industry experts and join relevant groups, increasing visibility and involvement. Technology is no longer optional, as emphasized by Lalit Goyal, highlighting its critical role in modern networking strategies.

-

Finding a Mentor: Seeking out experienced investors can yield invaluable guidance. A mentor can share insights from their own experiences, assisting you in navigating challenges and identifying opportunities in the market.

-

Building Relationships with Vendors: Establishing connections with contractors, property managers, and realty agents is vital. These relationships can lead to referrals and support in your investment pursuits, forming a network of reliable professionals who can assist you throughout your journey.

By actively engaging in these networking tactics, you can cultivate a support system that significantly enhances your experience as a real estate investor. The effectiveness of networking is underscored by statistics indicating that 38% of conversions in property transactions occur through phone calls, highlighting the significance of personal connections in finalizing deals. Furthermore, the implementation of marketing tools in the property sector reveals that 30% of Realtors employ social media management tools daily, while 44% of marketers leverage AI to enhance efficiency, demonstrating how technology can improve networking and operational effectiveness.

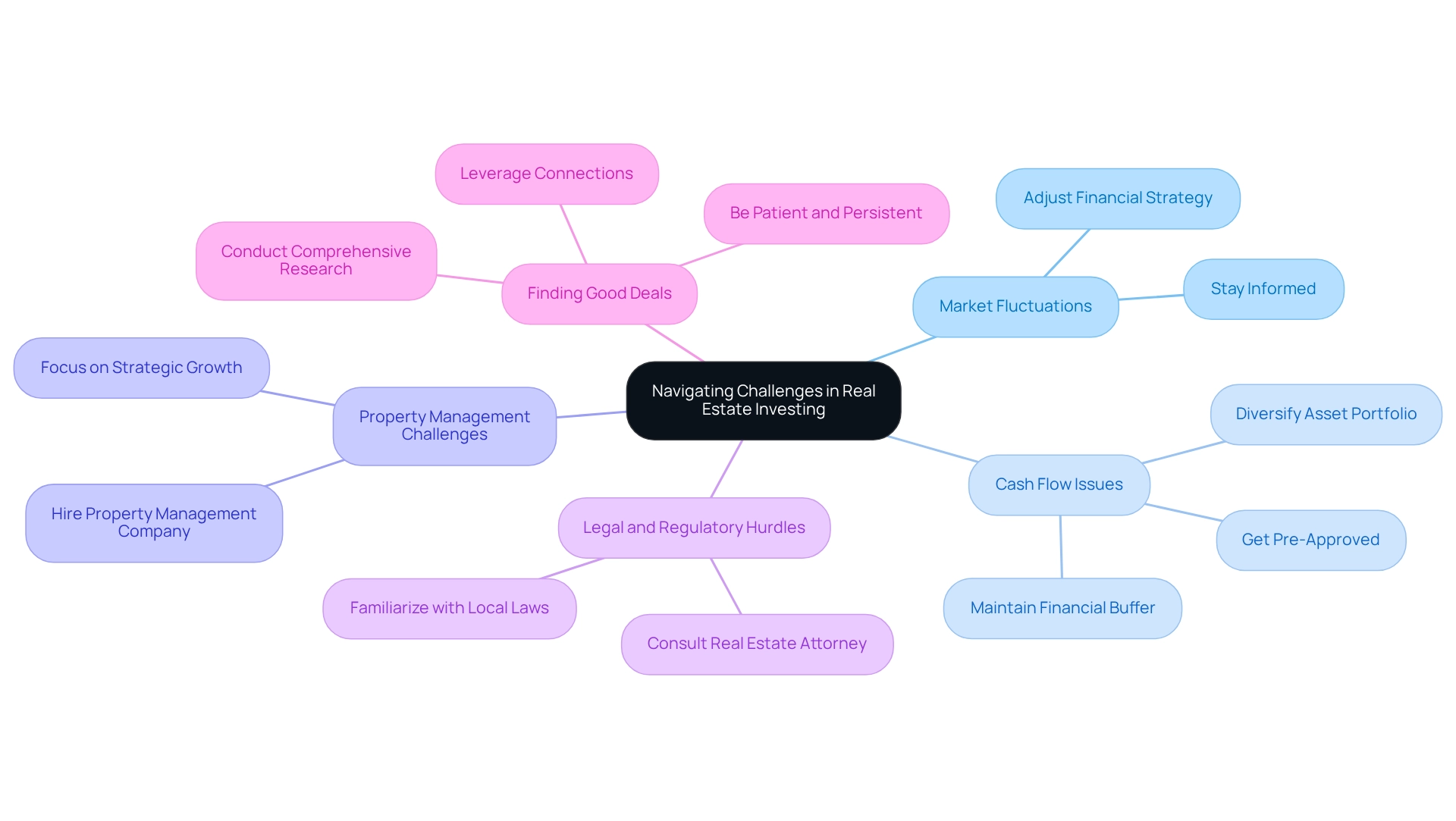

Navigating Challenges: Common Issues and Solutions for Investors

Real property investing presents a variety of challenges that can significantly impact your success. Understanding these common issues and their effective solutions is essential for navigating the market with confidence.

-

Market Fluctuations: The real estate sector is inherently subject to variations influenced by economic indicators. Staying informed about these trends is crucial. For instance, pricing forecasts indicate a 5% increase in home values for 2025, potentially resulting in an extra $120 billion in consumer expenditure. Furthermore, as transactional activity increases, the bid-ask gap is expected to narrow, signaling a stabilization of market conditions. Adjust your financial strategy based on these insights to capitalize on potential growth opportunities.

-

Cash Flow Issues: Many investors encounter cash flow challenges, particularly in 2025, where average cash flow issues are becoming more pronounced. To alleviate this, maintain a financial buffer for unforeseen costs and consider diversifying your asset portfolio. As Scott Bridges, senior managing director at PennyMac, states, "Getting pre-approved will give you a much clearer understanding of your budget and what you can afford." This insight can empower investors to plan their finances more effectively, stabilizing income and reducing risk exposure.

-

Property Management Challenges: Managing properties can become overwhelming, especially as your portfolio expands. If you find yourself stretched thin, hiring a property management company can alleviate the burden of day-to-day operations, allowing you to focus on strategic growth.

-

Legal and Regulatory Hurdles: Navigating the legal landscape is essential for avoiding costly mistakes. Familiarize yourself with local laws and regulations, and consider consulting with a real estate attorney for expert guidance. This proactive approach can help you sidestep potential legal issues that could derail your investments.

-

Finding Good Deals: Identifying undervalued properties is key to successful investing. Leverage your connections and conduct comprehensive research to uncover concealed opportunities. Patience and persistence are vital; the right deal often requires time and effort to find.

By anticipating these challenges and implementing strategic solutions, you can navigate the complexities of real estate investing with greater confidence and effectiveness. Moreover, the recent rebound in existing-home sales, despite rising mortgage rates, illustrates the resilience of the market and the potential for savvy investors to capitalize on current conditions. Additionally, the annual increase in the percentage of equity-rich mortgages across 37 states underscores the financial health of homeowners, which can have significant implications for investors.

Conclusion

Understanding the intricacies of real estate investing is essential for anyone looking to succeed in this dynamic field. The journey begins with grasping key concepts such as equity, cash flow, and cap rates, which serve as the building blocks for making informed investment decisions. Familiarity with different property types—residential, commercial, industrial, and land investments—allows investors to tailor their strategies to align with their financial goals and risk tolerance.

Financial planning plays a critical role in this process, requiring a well-defined budget, exploration of financing options, and careful assessment of potential returns. Conducting thorough market research further enhances an investor's ability to identify lucrative opportunities while navigating the complexities of market trends and local regulations. Networking remains a vital component, as building relationships with industry professionals can lead to valuable insights and support throughout the investment journey.

While challenges such as market volatility, cash flow issues, and property management can arise, proactive strategies and a solid understanding of the landscape can mitigate risks. By staying informed and adaptable, investors can position themselves for long-term success in real estate.

Ultimately, the path to successful real estate investing is paved with education, strategic planning, and a commitment to continuous learning. Embracing these principles not only empowers investors to make sound decisions but also enhances their ability to thrive in an ever-evolving market.