Overview

To become a real estate investor with limited funds, it is essential to grasp the fundamentals of real estate, explore low-cost investment strategies, secure appropriate financing, and cultivate a strong network. Mastering these areas not only equips individuals for successful investments but also unveils practical approaches, such as:

- House hacking

- Utilizing Real Estate Investment Trusts (REITs)

These approaches can significantly reduce the barriers to entry in real estate investing. By focusing on these strategies, aspiring investors can navigate the market more effectively and make informed decisions that lead to long-term success.

Introduction

Navigating the world of real estate investment can seem daunting, particularly for those with limited financial resources. However, the potential for wealth creation in this sector is undeniable. Strategies exist that enable aspiring investors to enter the market without breaking the bank. This article delves into essential steps that empower individuals to embark on their real estate journey. It reveals how to:

- Leverage low-cost strategies

- Secure financing

- Build a robust network

But what if the key to unlocking financial freedom lies in understanding the right fundamentals and making informed choices?

Understand Real Estate Investment Fundamentals

To become a successful real estate investor, it is crucial to familiarize yourself with several key concepts:

-

Real Estate Types: Differentiate between residential, commercial, and industrial properties. Each category offers distinct financial opportunities and related risks. For instance, residential real estate often generates consistent rental income, while commercial real estate can provide greater returns but may entail longer vacancy times. Significantly, over 70% of purchasers consider green-certified residences, which typically sell for 15% more than non-certified units, emphasizing the financial potential in sustainable real estate.

-

Market Dynamics: Understand how supply and demand influence property values and rental rates. Keeping abreast of local market trends is essential for identifying lucrative opportunities. For example, the average home value in the U.S. has surged by over 65% in the last five years, reflecting strong demand amidst limited supply. This trend highlights the significance of observing market conditions to make informed financial choices.

-

Financial Metrics: Familiarize yourself with critical metrics such as cash flow, return on capital (ROI), and capitalization rate (cap rate). These metrics are essential for assessing possible opportunities and making informed choices. A solid understanding of these figures can significantly improve your financial strategy.

-

Legal Considerations: Acquire understanding of the legal facets of land investing, including ownership rights, zoning regulations, and landlord-tenant laws. Understanding these legal frameworks is essential to avoid potential pitfalls and ensure compliance with local laws. For instance, understanding zoning regulations can affect development prospects and financial feasibility.

By mastering these fundamentals, you will be better prepared to understand how to become a real estate investor with little money and navigate the complexities of property investing while capitalizing on emerging opportunities.

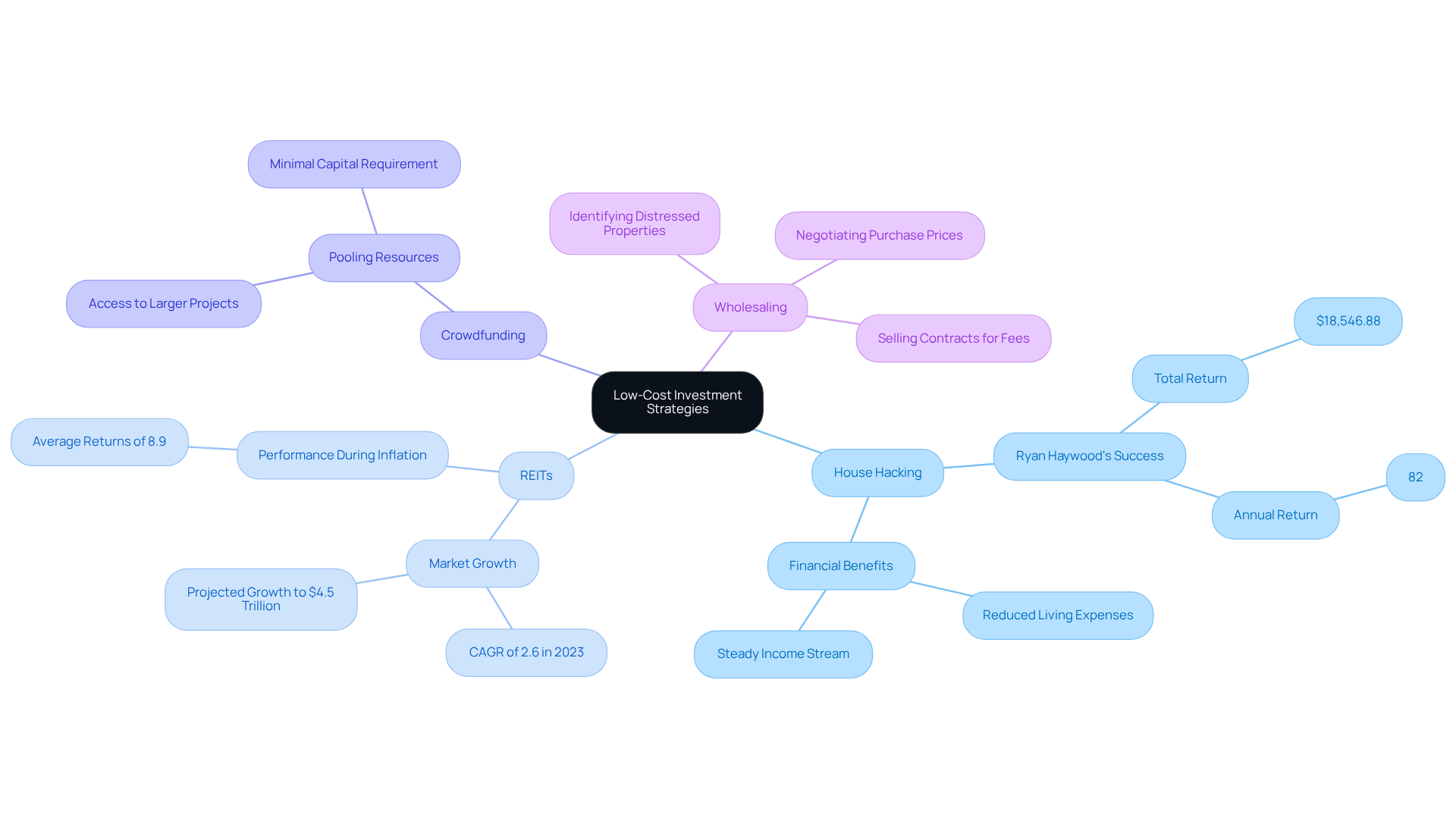

Explore Low-Cost Investment Strategies

Consider these effective low-cost strategies to kickstart your real estate investment journey:

-

House Hacking: Acquire a multi-family property, reside in one unit, and rent out the others. This approach not only significantly reduces your living expenses but also generates a steady income stream. For instance, Ryan Haywood effectively transformed a duplex into a complete rental after residing in it for a year, realizing a total return of $18,546.88 from cash flow and loan paydown. This equates to an impressive annual return of 82% based on his overall expenditure of $22,670.49.

-

Property Investment Trusts (REITs): Investing in publicly traded REITs enables you to acquire shares in diversified property portfolios without the necessity of buying properties directly. The U.S. REIT market is projected to grow at a CAGR of 2.6% in 2023, reflecting renewed investor confidence and stability in this sector. Notably, during high inflation, REITs provided average returns of 8.9%, making them an appealing choice for investors.

-

Crowdfunding Platforms: Utilize property crowdfunding platforms to combine resources with other investors. This approach allows you to engage in larger projects with minimal capital, democratizing access to real estate opportunities.

-

Wholesaling: Identify distressed properties, negotiate a favorable purchase price, and sell the contract to another investor for a fee. This strategy necessitates minimal to no financial outlay but requires strong negotiation skills and market knowledge.

As Kathy Fettke highlights, putting money into property is wise due to the ongoing demand for housing. By examining these approaches, you can discover how to become a real estate investor with little money, while taking advantage of current trends and success narratives in the property market.

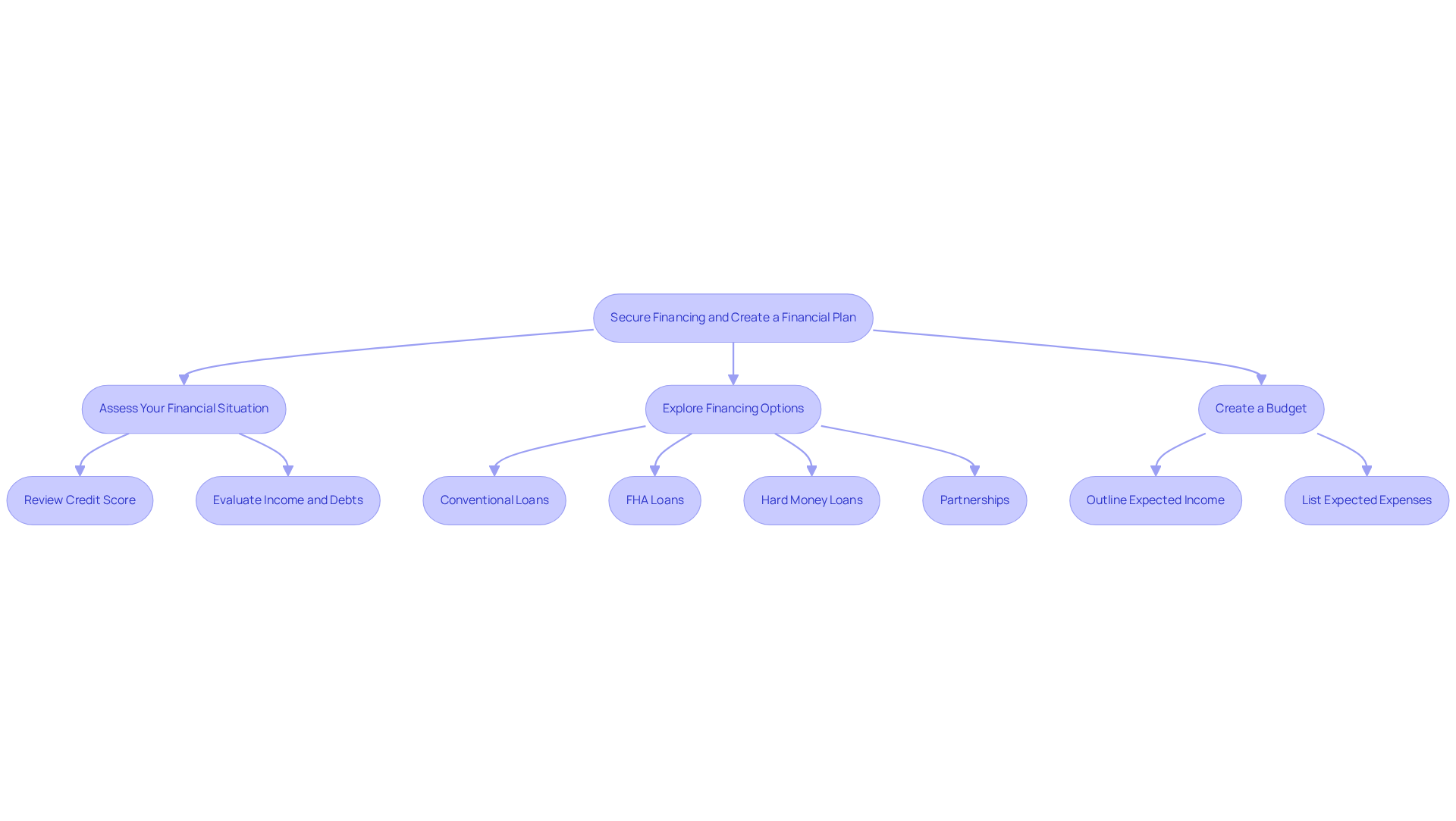

Secure Financing and Create a Financial Plan

To secure financing and create a robust financial plan, consider the following steps:

-

Assess Your Financial Situation: Begin by reviewing your credit score, income, and existing debts. Understanding your financial health is crucial; a higher credit score can significantly improve your financing options. As of July 2025, the average credit score in the U.S. is 702, with super-prime borrowers (those with scores above 720) making up 78.9% of new mortgage debt. This statistic underscores the importance of maintaining a good credit score to access favorable financing terms.

-

Explore Financing Options: Investigate various financing methods that can accommodate your situation:

- Conventional Loans: These traditional mortgages typically require a down payment, making them suitable for those with solid credit histories.

- FHA Loans: Government-backed loans that allow for lower down payments, making them accessible for first-time buyers.

- Hard Money Loans: Short-term loans backed by properties, often utilized for property flipping, which can be advantageous for investors aiming to renovate and sell swiftly.

- Partnerships: Collaborating with other investors can help pool resources and share risks, which is essential for learning how to become a real estate investor with little money.

-

Create a Budget: Develop a detailed budget outlining your expected income and expenses related to your financial activities. This will help you manage cash flow effectively and ensure you can cover costs. Case studies show that first-time buyers often make down payments averaging $8,220, primarily from personal savings, highlighting the financial challenges they face in entering the housing market. Additionally, analysts predict a drop in the average 30-year mortgage rate from 6.5% to around 5.8% by year-end, which could improve affordability for new investors.

By obtaining the appropriate funding and creating a clear financial strategy, you can learn how to become a real estate investor with little money while confidently progressing your property investments.

Build a Real Estate Network and Leverage Resources

To cultivate a robust real estate network, it is essential to implement effective strategies that resonate with industry dynamics.

-

Attend Industry Events: Engaging in local real estate meetups, seminars, and conferences is crucial for connecting with fellow investors and professionals. These gatherings not only provide networking opportunities but also offer insights into current market trends that can inform your investment decisions.

-

Join Online Communities: Actively participating in forums and social media groups focused on property investing can significantly expand your network. Platforms such as LinkedIn and Facebook host numerous groups where you can engage with like-minded individuals, share experiences, and gain valuable advice.

-

Work with Experts: Establishing connections with property agents, lenders, and managers is vital. These professionals can offer invaluable insights and potential funding opportunities that can enhance your investment strategy.

-

Leverage Resources: Utilizing tools like networking applications and property investment platforms can help you discover partners and resources that will support your investment journey.

By actively networking and leveraging available resources, you can not only enhance your knowledge but also increase your chances of success in real estate investing.

Conclusion

Mastering the art of real estate investing, even with limited funds, is a journey that begins with a solid understanding of key concepts and strategies. Familiarizing oneself with the fundamentals of real estate—including various property types, market dynamics, financial metrics, and legal considerations—enables aspiring investors to lay a strong foundation for their investment endeavors. This knowledge not only equips them to identify lucrative opportunities but also helps mitigate risks associated with property investing.

Several practical strategies for low-cost investments are highlighted, including:

- House hacking

- Investing in REITs

- Utilizing crowdfunding platforms

- Wholesaling

Each of these methods offers unique advantages, allowing individuals to enter the real estate market without substantial capital. Furthermore, securing financing and creating a comprehensive financial plan are critical steps that enable investors to manage their finances effectively while pursuing their investment goals. Building a robust real estate network through industry events and online communities enhances the chances of success by providing valuable insights and support.

Ultimately, the path to becoming a successful real estate investor with little money is paved with knowledge, strategic planning, and a willingness to engage with others in the industry. By embracing these principles and actively seeking out opportunities, individuals can transform their financial futures and capitalize on the ever-growing demand for real estate. Taking the first step towards investment today can lead to long-term financial growth and stability in the dynamic world of real estate.