Overview

To become a real estate investor with no money, individuals can leverage a variety of strategies, including:

- Partnerships

- Creative financing

- Innovative investment methods such as wholesaling and house hacking

These approaches empower aspiring investors to enter the property market without significant capital. Successful tactics are supported by real-world examples, underscoring the critical role of networking and education in navigating the complexities of real estate investing. By understanding and implementing these strategies, potential investors can effectively position themselves for success in the competitive real estate landscape.

Introduction

In a world where traditional barriers to entry often hinder aspiring investors, the realm of real estate presents innovative pathways to success—even for those without substantial capital. The journey into real estate investing can be daunting; however, with the right strategies, it becomes not only achievable but also rewarding.

By leveraging partnerships, exploring creative financing options, and embracing techniques like wholesaling and house hacking, individuals can carve out a niche in this dynamic market. As trends in crowdfunding and Real Estate Investment Trusts (REITs) continue to reshape the landscape, the potential for growth and income expands, making real estate a viable option for anyone willing to learn and adapt.

This article delves into effective strategies and insights that can empower aspiring investors to navigate the complexities of real estate investing, even when financial resources are limited.

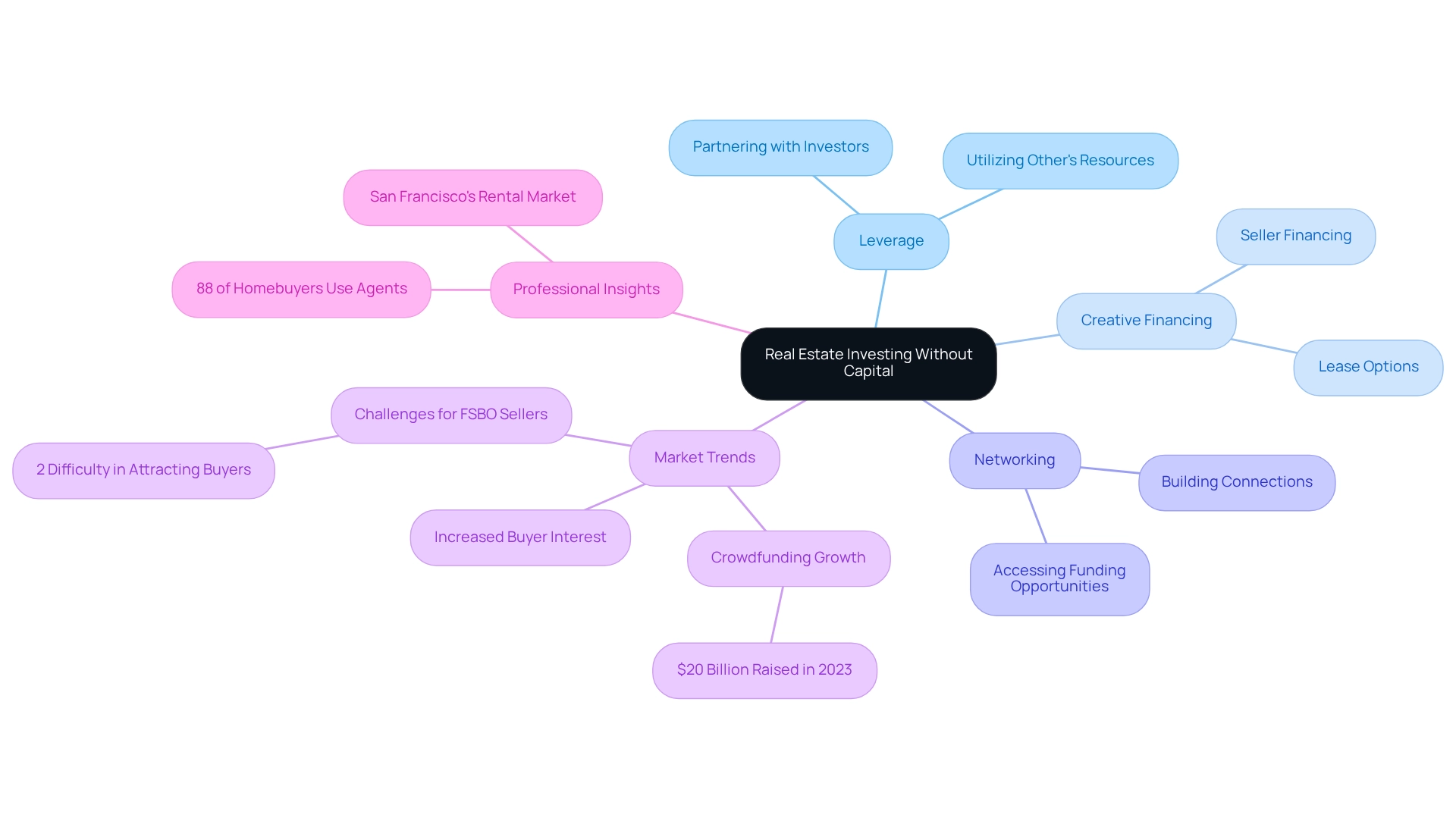

Understanding Real Estate Investing Without Capital

Entering the realm of property investing without funds may appear daunting; however, it is entirely feasible by mastering how to become a real estate investor with no money through various strategic methods. A robust understanding of the current financial landscape is essential. Notably, a significant proportion of successful property investors have discovered how to become a real estate investor with no money, often by employing innovative tactics and forging collaborations.

To embark on your property investing journey without substantial financial assets, consider these essential strategies:

- Leverage: This involves utilizing other individuals' funds or resources to facilitate your purchases. By partnering with investors who possess capital, you can secure funding for properties while sharing the potential profits.

- Creative Financing: Investigate non-traditional financing options such as seller financing, where the property seller provides the loan, or lease options, which allow you to control a property without outright purchase.

- Networking: Cultivating a robust network is crucial. Establishing connections with other financiers, property agents, and industry experts can lead to funding opportunities that require minimal to no personal capital.

Recent trends indicate a resurgence in the property market, with increased buyer interest despite elevated mortgage rates. This environment presents unique opportunities for those eager to learn how to become a real estate investor with no money. For instance, crowdfunding platforms have revolutionized the funding landscape, generating nearly $20 billion in 2023, enabling individual investors to pool resources and access significant property opportunities.

This shift underscores how leveraging partnerships can facilitate market entry. Moreover, data reveals that 88% of homebuyers relied on property agents as their primary information source during their home search, highlighting the importance of utilizing professional networks to gather insights and seize opportunities. Additionally, it is noteworthy that 2% of FSBO sellers found attracting potential buyers to be their most challenging task, emphasizing the market difficulties that investors can navigate with the right strategies.

In cities like San Francisco, which remains the most expensive city for renters globally, understanding market conditions is vital for financial planning. By focusing on these data-driven approaches and proven methods, you can uncover how to become a real estate investor with no money, paving a path into property investing even without considerable financial resources. Embrace the potential of innovative strategies and collaborations to navigate the complexities of the market and achieve your investment goals.

Effective Strategies for Investing with Minimal Funds

Investing in real estate with minimal funds is not just a possibility; it is a strategic choice that can lead to significant financial growth. Consider these effective strategies:

- House Hacking: This method involves acquiring a multi-family property, living in one unit, and renting out the others. By doing so, you can cover your mortgage and build equity over time. Many investors have shared their success stories, with Ryan Haywood noting the rewarding interactions with Airbnb guests as a highlight of this strategy.

- Wholesaling: This approach requires identifying distressed properties, negotiating a purchase contract, and selling that contract to another buyer for a profit. With minimal initial investment, wholesalers can achieve returns that significantly surpass traditional investment methods, making it an appealing option for those starting with limited funds.

- Seller Financing: Here, buyers negotiate directly with sellers to finance the purchase, often needing little to no down payment. This arrangement benefits both parties, enabling sellers to sell properties quickly while offering buyers an accessible entry point into real estate.

- Lease Options: This strategy grants investors control over a property through a lease with an option to buy. It allows for income generation while securing the property for future purchase, providing flexibility for those looking to invest without immediate capital.

- Property Investment Trusts (REITs): By investing in publicly traded REITs, individuals can acquire shares in property portfolios without the need to purchase assets directly. This method opens the door to the property market and serves as an excellent way to diversify your portfolio with minimal financial commitment.

These strategies illustrate how to embark on a real estate investment journey with little to no money, while also enabling investors to build equity and generate income over time. Aspiring investors can leverage these methods to navigate the complexities of property investment and set themselves up for long-term success. Furthermore, with over 30,000 subscribers, Zero Flux stands as a reputable source of real estate insights, ensuring that investors remain well-informed about market dynamics.

As noted by Corby Goade, a Property Manager Agent Pro Member Investor, "Keep in mind that cap rates do not apply to residential properties with 4 or fewer units," highlighting the importance of understanding financial metrics in relation to these strategies. Additionally, findings from the case study titled "Zillow's Unique Home Search Trends for 2024" reveal shifting consumer preferences that may impact investment strategies and decisions in the current market.

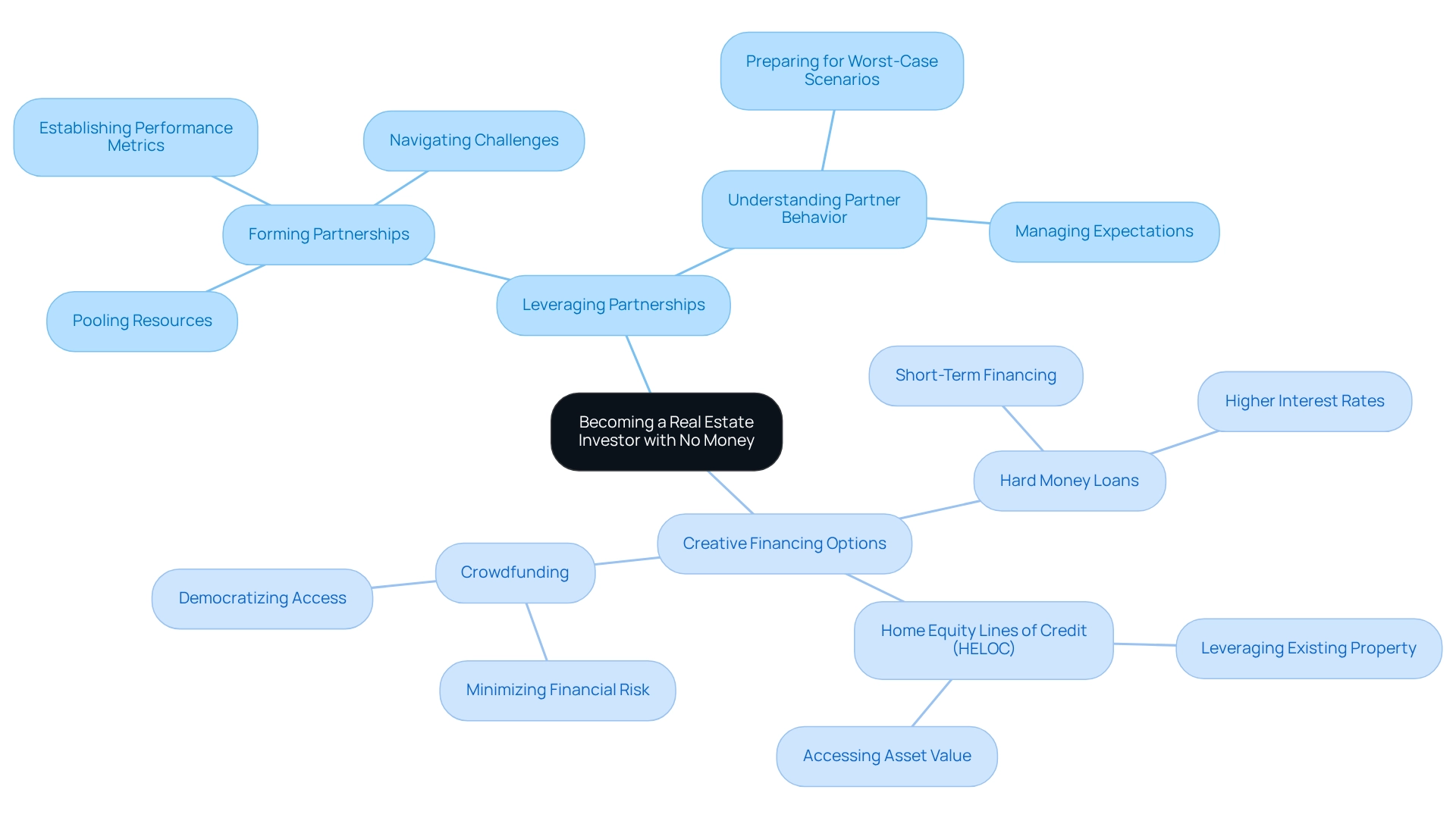

Leveraging Partnerships and Creative Financing

Leveraging collaborations and innovative funding methods can significantly enhance your understanding of how to become a real estate investor with no money. Here are some effective approaches:

-

Forming Partnerships: Collaborating with other investors enables you to pool resources, share financial responsibilities, and combine expertise to identify lucrative opportunities. It is crucial to establish clear performance metrics and exit strategies within these partnerships. This alignment ensures that all parties are focused on shared goals and can effectively navigate challenges, particularly in unconventional partnerships centered on sustainability and technology. Such frameworks not only aid in evaluating progress but also in managing potential dissolution, ultimately fostering stability and adaptability in the evolving property landscape. Furthermore, comprehending partners' behaviors during challenging times is essential for managing expectations and enhancing partnership outcomes. As Akash Soomro, a partner in McKinsey’s Dubai office, notes, "Deeper partnerships with diverse companies and industries can help developers execute on this expansive list of goals."

-

Creative Financing Options: Explore various methods to access capital:

- Hard Money Loans: These short-term loans, secured by real estate, are often utilized for quick purchases or renovations. They provide immediate funding but typically come with higher interest rates.

- Home Equity Lines of Credit (HELOC): If you own property, you can leverage the equity in your existing home to finance new investments, allowing you to tap into your asset's value without selling.

- Crowdfunding: Property crowdfunding platforms enable you to invest modest sums alongside other investors, democratizing access to property opportunities and minimizing individual financial risk.

By employing these approaches, you can uncover pathways to becoming a real estate investor with no money. This strategy provides access to funding and assets that might otherwise be unattainable, positioning you to enter the property market more efficiently and with increased confidence. Additionally, the insights gathered daily by Zero Flux, which includes 5-12 selected property insights, can offer valuable information to inform your financial decisions.

Exploring Wholesaling and House Hacking Techniques

Wholesaling and house hacking stand out as two effective methods for aspiring real estate investors looking to enter the market with little to no capital.

-

Wholesaling: This technique involves identifying undervalued or distressed properties, negotiating a purchase agreement, and then selling that agreement to another buyer for a fee. The process can be broken down into key steps:

- Research: Begin by identifying potential properties and motivated sellers. Employ various marketing methods, such as online advertising and networking, to uncover opportunities.

- Negotiate: Secure a purchase agreement at a price that allows for a profit margin when selling the contract. Successful wholesalers often emphasize the importance of negotiation skills in closing deals. As Jose Castillo, a flipper and rehabber, states, "I chose the path because it was my preferred approach. I love negotiating, marketing, and crunching numbers. It took me about 8 months to get a deal but I did it! It's a dedication thing! It's like love for a sport."

- Market the Contract: After obtaining a signed agreement, find buyers interested in the property. Assign the contract to them for a profit, effectively acting as a middleman. Statistics indicate that wholesalers typically employ five common marketing methods to locate discounted off-market properties, enhancing their chances of success. For instance, Alex Made, a prosperous wholesaler, doubled his transactions after adopting advanced marketing approaches with REsimpli, showcasing the efficacy of utilizing technology in this domain.

-

House Hacking: This strategy enables you to live in a property while renting out part of it to generate income. Here’s a step-by-step guide:

- Purchase a Multi-Family Property: Seek out duplexes or triplexes that allow you to reside in one unit while renting out the others.

- Rent Out Units: By living in one unit and renting out the others, you can cover your mortgage payments, significantly reducing your living expenses.

- Manage Tenants: Building and maintaining good relationships with your tenants is crucial for maximizing rental income and ensuring smooth operations.

Both wholesaling and house hacking are effective strategies for learning how to become a real estate investor with no money, as they generate income and help build equity in property without significant upfront investment. As the property landscape evolves, methods like virtual wholesaling are gaining popularity, enabling investors to expand their businesses and access wider markets effectively.

Utilizing REITs and Crowdfunding for Investment Opportunities

Real Estate Investment Trusts (REITs) and crowdfunding platforms represent innovative avenues for investing in real estate with minimal capital outlay.

REITs: These entities own, operate, or finance income-generating real estate. By purchasing shares in a REIT, investors can gain access to various property markets without the necessity for direct ownership. The advantages of investing in REITs are significant:

- Liquidity: Shares are traded on stock exchanges, allowing for easy buying and selling.

- Diversification: Investing in a portfolio of properties mitigates risk, as performance is not tied to a single asset.

- Strong Performance: The REIT market is currently experiencing a recovery, bolstered by improving economic conditions and decreasing interest rates. According to Kevin Brown, a senior analyst at Morningstar, "We believe that high-quality retail locations will continue to produce sales and rent growth above the national average, occupancy should stabilize at current levels, and re-leasing spreads will be in the high single digits for many years." Additionally, projections suggest a growth of 93.9% in the UK REIT sector, emphasizing the potential for financial returns. Furthermore, mortgage REITs offer over $1 trillion in funding by investing in property mortgages and mortgage-backed securities, highlighting the magnitude and influence of this funding option.

Crowdfunding: This funding approach allows numerous investors to combine resources to support property projects. Platforms such as Fundrise and RealtyMogul enable individuals to invest with as little as $500. Key benefits of real estate crowdfunding include:

- Access to Larger Projects: Investors can participate in commercial real estate deals that might otherwise be financially unattainable.

- Passive Income: Investors can earn returns through rental income and property appreciation without the burdens of direct management.

- Case Studies: Successful crowdfunding initiatives have demonstrated the potential for significant returns, showcasing how collective funding can lead to profitable outcomes.

By utilizing these investment choices, you can effectively explore how to become a real estate investor with minimal capital while creating a varied property portfolio and reducing financial commitment. This strategy makes real estate investment an attainable goal for aspiring investors.

The Importance of Education and Market Research

Education and market analysis are essential foundations for successful property investing. To enhance your knowledge and skills, consider the following strategies:

- Continuous Learning: Engage in online courses, webinars, and workshops focused on property investing. Platforms such as BiggerPockets and local property clubs offer invaluable insights and networking opportunities. The increasing popularity of vocational property courses reflects a growing demand for structured education that equips investors with practical skills. This trend is particularly significant, as a study by McKinsey & Company revealed that 43% of employers surveyed struggled to find enough skilled workers, underscoring the critical role of education and training in addressing this skills gap.

- Market Research: Staying updated on local market trends, property values, and economic indicators is vital. Leverage advanced market research tools like Zillow, Redfin, and local MLS listings to analyze potential property areas. By 2025, utilizing these tools will provide a competitive edge, as data-informed decisions increasingly correlate with financial success.

- Networking: Building relationships with experienced investors, property agents, and mentors can significantly enhance your learning curve. Attend industry events and participate in online forums to broaden your network. Engaging with professionals who prioritize education can yield valuable insights and opportunities. As noted by the National Association of REALTORS®, 72% of sellers would choose the same agent again, highlighting the importance of forging strong connections in the industry.

Emphasizing education and thorough market analysis not only empowers you to make informed decisions but also enhances your investment strategy, ultimately increasing your chances of success in the competitive property landscape. In light of concerns regarding traditional education's inadequacies in preparing students for property careers, it becomes clear that practical skills and applied knowledge are indispensable for aspiring investors.

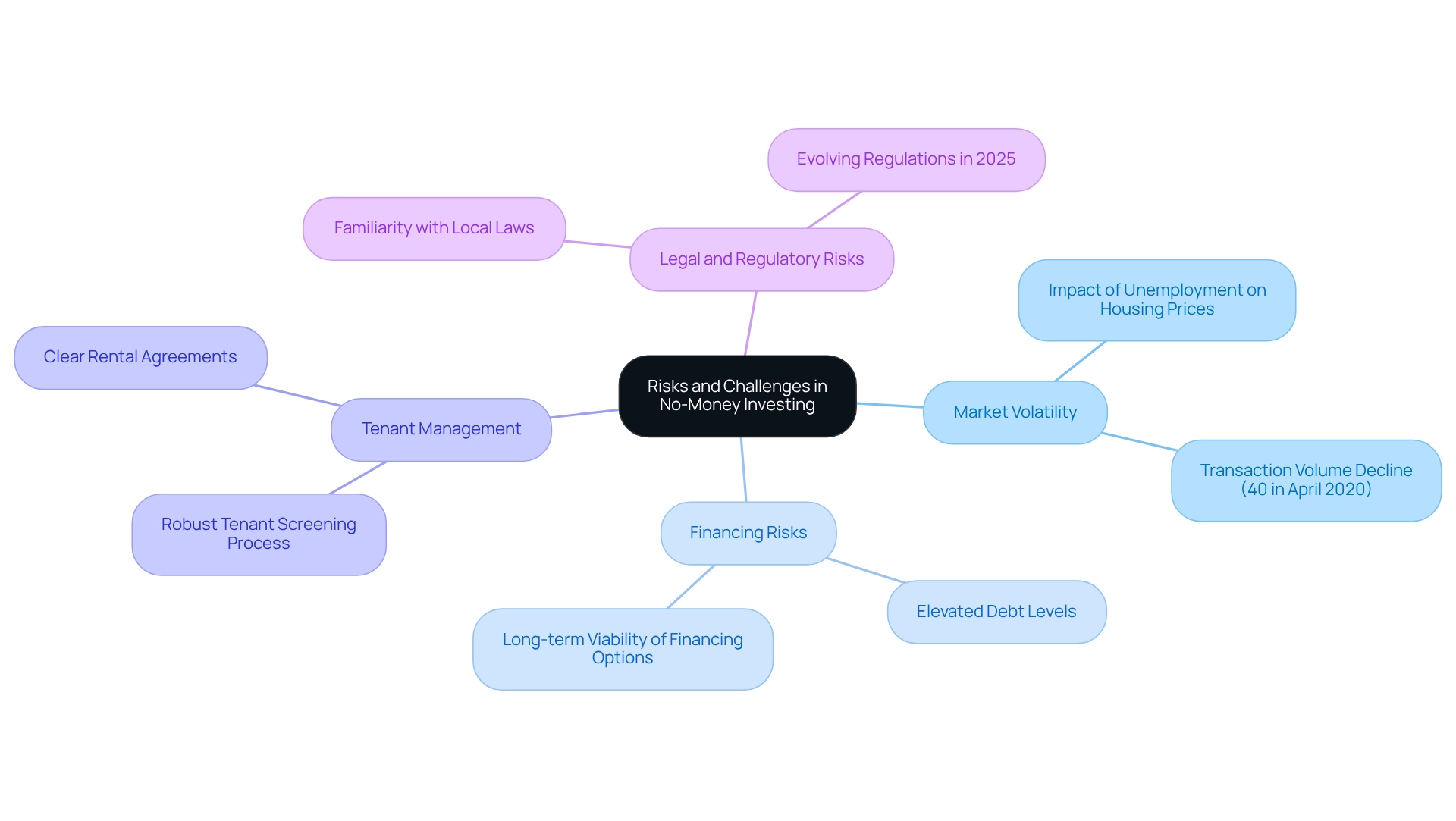

Navigating Risks and Challenges in No-Money Investing

Understanding how to become a real estate investor with no money requires a keen awareness of the distinct risks and challenges associated with investing in property without financial resources. Here are some critical factors to keep in mind:

-

Market Volatility: The real estate market is inherently volatile, with fluctuations that can significantly impact property values and rental income. For instance, a notable decline in transaction volume was observed in April 2020, with a 40% decrease compared to the previous year. This trend underscores the necessity of staying informed about current market conditions, particularly as higher unemployment rates correlate with larger house price declines, as evidenced by empirical checks in cities like New York and Los Angeles. Understanding these dynamics is vital for mitigating risks and making timely financial decisions.

-

Financing Risks: While innovative financing techniques may seem appealing, they can lead to elevated debt levels. If a financial commitment fails to yield the expected returns, managing this debt may become increasingly challenging. It is essential to evaluate the long-term viability of financing options and their potential impact on your financial stability. Recent studies utilizing a revised difference-in-differences methodology illustrate how COVID-19 has influenced housing prices, highlighting the critical need for careful financial planning in uncertain times.

-

Tenant Management: Renting out properties introduces the complexities of tenant management. A robust tenant screening process is imperative to minimize issues such as late payments or property damage. Establishing clear rental agreements and maintaining open communication can foster positive landlord-tenant relationships, essential for long-term success.

-

Legal and Regulatory Risks: Navigating the legal landscape of property ownership and rental agreements is crucial. Familiarizing yourself with local laws and regulations can avert legal complications stemming from non-compliance. This knowledge is particularly significant in 2025, as evolving regulations may impact financial strategies. Current policy implications suggest a focus on recovering housing demand in lower-priced markets, which could present opportunities for investors aiming to stabilize their portfolios during adverse shocks.

By acknowledging these risks and implementing effective management strategies, you can deepen your understanding of how to become a real estate investor with no money, thereby enhancing your ability to make informed financial choices in the property market.

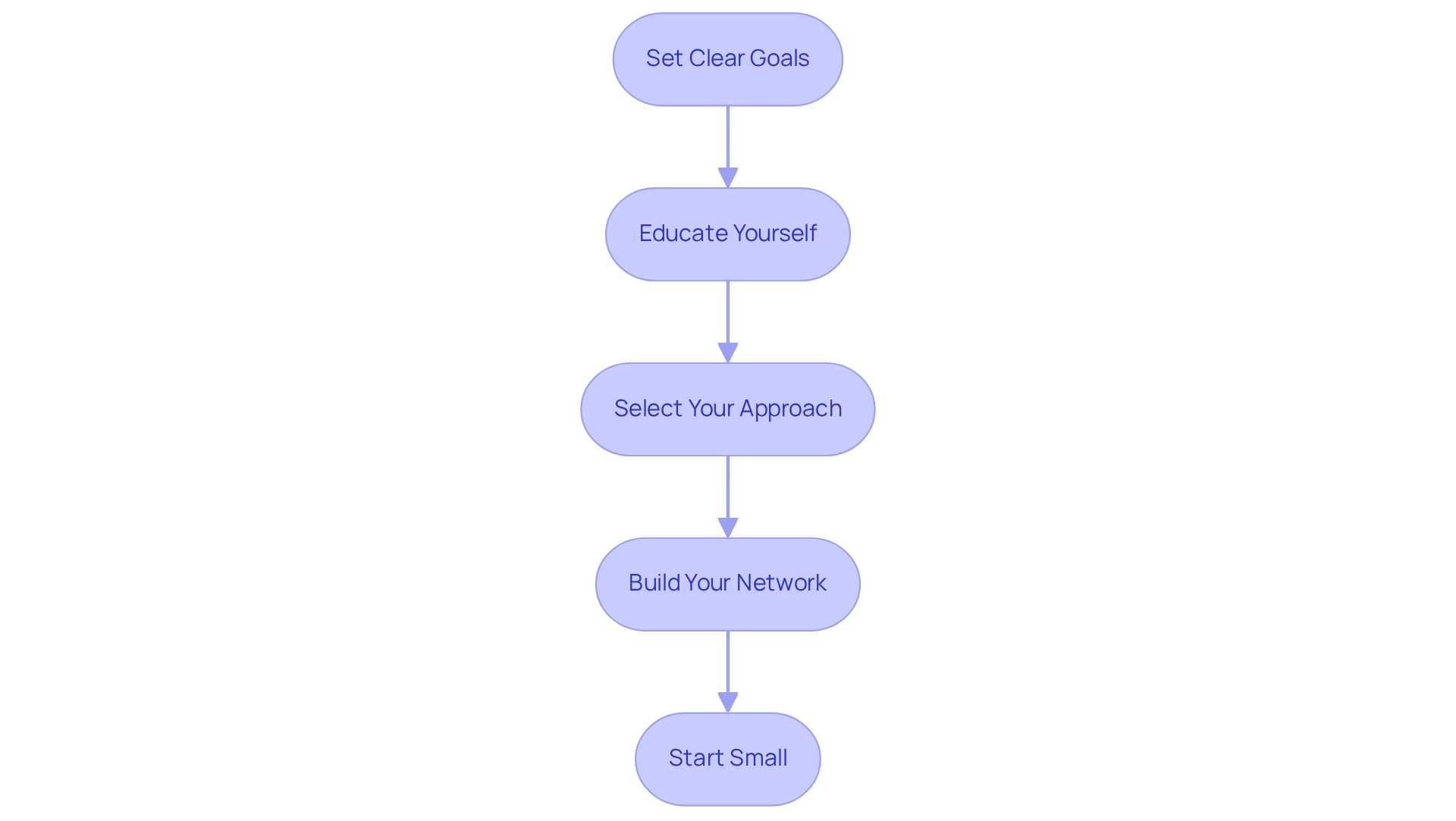

Taking Action: Your Path to Becoming a Real Estate Investor

With a strong understanding of how to become a real estate investor with no money, it’s time to take decisive action. Here are the essential steps to get started:

- Set Clear Goals: Clearly define your objectives for real estate ventures. Whether your aim is to generate passive income, build equity, or flip properties for profit, having specific goals will guide your strategy. As Jordan Belfort wisely stated, "The only thing standing between you and your goal is the false story you keep telling yourself as to why you can’t achieve it." Furthermore, adhering to legal and regulatory standards is vital; a compliance rate of 90% can significantly lower risks in your financial journey.

- Educate Yourself: Dedicate time to learning about property investing through various resources such as online courses, literature, and connecting with experienced investors. Ongoing education is essential for remaining aware of market trends and financial approaches. Understanding real estate investing metrics is crucial for guiding your decisions and tracking performance to identify potential issues.

- Select Your Approach: Determine which investment methods align with your interests and risk tolerance. Options include wholesaling, house hacking, or investing in Real Estate Investment Trusts (REITs). Each strategy presents its own set of advantages and challenges.

- Build Your Network: Establish connections with other investors, real estate agents, and mentors who can offer valuable insights and support. A robust network can provide guidance and create pathways to potential funding opportunities. Utilizing technology, such as NetSuite ERP, can help track key metrics and provide real-time visibility into your financial and operational performance, enhancing your efficiency.

- Start Small: Begin with manageable contributions that align with your financial circumstances. This approach allows you to gain experience and confidence before scaling up your investments.

By following these steps, you can uncover how to become a real estate investor with no money and embark on your journey to becoming a successful property investor. Remember, setting clear goals is vital; statistics show that individuals who set specific goals are more likely to achieve them, thereby enhancing your chances of success in the competitive real estate market.

Conclusion

Entering the world of real estate investing without substantial capital may seem daunting; however, numerous strategies can pave the way for success. Key approaches include:

- Leveraging partnerships

- Utilizing creative financing

- Exploring innovative methods like wholesaling and house hacking

These strategies empower aspiring investors to navigate the market effectively. By understanding and implementing these techniques, individuals can seize opportunities even in a competitive landscape.

Furthermore, the rise of Real Estate Investment Trusts (REITs) and crowdfunding platforms has democratized access to real estate investments, allowing individuals to participate with minimal financial commitment. These avenues not only provide exposure to diverse investment opportunities but also enable investors to build a robust portfolio over time. Coupled with continuous education and diligent market research, these strategies create a solid foundation for informed decision-making.

Ultimately, the journey into real estate investing is accessible to anyone willing to learn and adapt. By embracing innovative strategies and fostering valuable networks, aspiring investors can overcome financial barriers and achieve their investment goals. The potential for growth in the real estate market is vast; with the right mindset and tools, anyone can carve out their niche and thrive in this dynamic field.