Overview

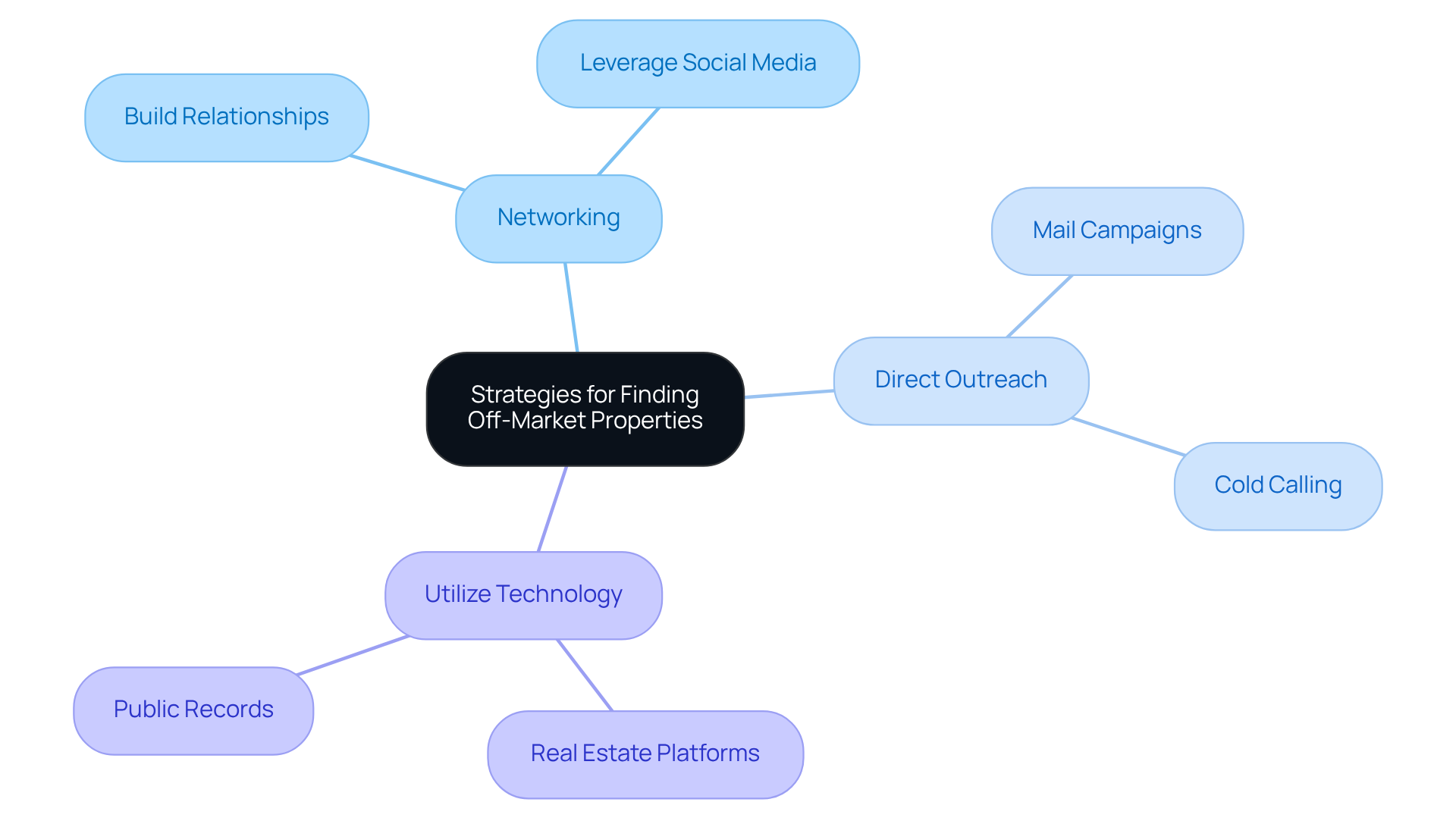

To discover off-market real estate deals, investors should leverage a variety of strategies, including:

- Networking

- Direct outreach

- Technology utilization to identify properties not publicly listed

Key methods outlined in the article include:

- Cultivating relationships with real estate professionals

- Executing targeted mail campaigns

- Employing platforms such as PropStream and BatchLeads

These tools provide valuable data and insights, illuminating potential off-market opportunities that can significantly enhance investment strategies.

Introduction

Unlocking the potential of off-market real estate deals can be a game-changer for savvy investors. These hidden gems, often overlooked by the general market, present unique opportunities for reduced competition and favorable pricing.

However, the challenge lies in identifying these elusive properties and comprehending the motivations of sellers who prefer discretion.

What strategies and tools can investors employ to tap into this treasure trove of real estate opportunities? By exploring these avenues, investors can position themselves advantageously in a competitive landscape.

Understand Off-Market Real Estate Deals

Off-market real estate transactions refer to assets that are not publicly listed for sale, meaning they are not advertised on Multiple Listing Services (MLS) or other public platforms. These properties can present unique opportunities for buyers, such as reduced competition and potentially better pricing. Understanding the motivations behind private sales—such as privacy, financial distress, or a desire for a quick sale—provides valuable insights into how to approach sellers effectively. Moreover, understanding how to find off market real estate deals often allows for more flexible negotiation terms, making them particularly appealing to savvy investors.

Key Characteristics of Off-Market Deals

- Privacy: Sellers may prefer to keep their sale discreet.

- Less Competition: Fewer buyers are aware of these listings, which reduces the likelihood of bidding wars.

- Negotiation Flexibility: Sellers may be more open to creative financing options or lower offers.

Advantages and Disadvantages

- Advantages: There is potential for lower prices, exclusive access to unique properties, and the ability to negotiate directly with sellers.

- Disadvantages: Limited information may be accessible, there is potential for concealed problems with real estate, and more proactive searching methods may be required.

Identify Strategies for Finding Off-Market Properties

To successfully identify off-market properties, consider the following strategies:

Networking

- Build Relationships: Establish connections with local real estate agents, wholesalers, and fellow investors. By engaging in industry events and joining property investment groups, you can learn how to find off market real estate deals while broadening your network and uncovering potential opportunities.

- Leverage Social Media: Utilize platforms like Facebook and LinkedIn to connect with groups dedicated to real estate investing, which can provide insights on how to find off market real estate deals that are frequently shared. Notably, 51% of buyers found their homes through the internet, underscoring the significance of online networking.

Direct Outreach

- Mail Campaigns: Implement targeted mail campaigns to homeowners in desirable neighborhoods, expressing your interest in purchasing their properties. This proactive approach can yield positive responses from owners contemplating a sale, which is essential for understanding how to find off market real estate deals.

- Cold Calling: Directly contact real estate owners to discover how to find off market real estate deals, particularly those who have recently removed their listings from the market. This method can uncover concealed prospects, illustrating how to find off market real estate deals that may not be publicly advertised.

Utilize Technology

- Real Estate Platforms: Leverage tools like PropStream or BatchLeads to access off-market listings and analyze property data effectively. These platforms can provide insights into how to find off market real estate deals that are not listed on traditional real estate sites.

- Public Records: Investigate public records as a way to learn how to find off market real estate deals, including assets with tax liens, foreclosures, or other indicators of potential sales. This data can assist in recognizing motivated sellers who might be receptive to private transactions.

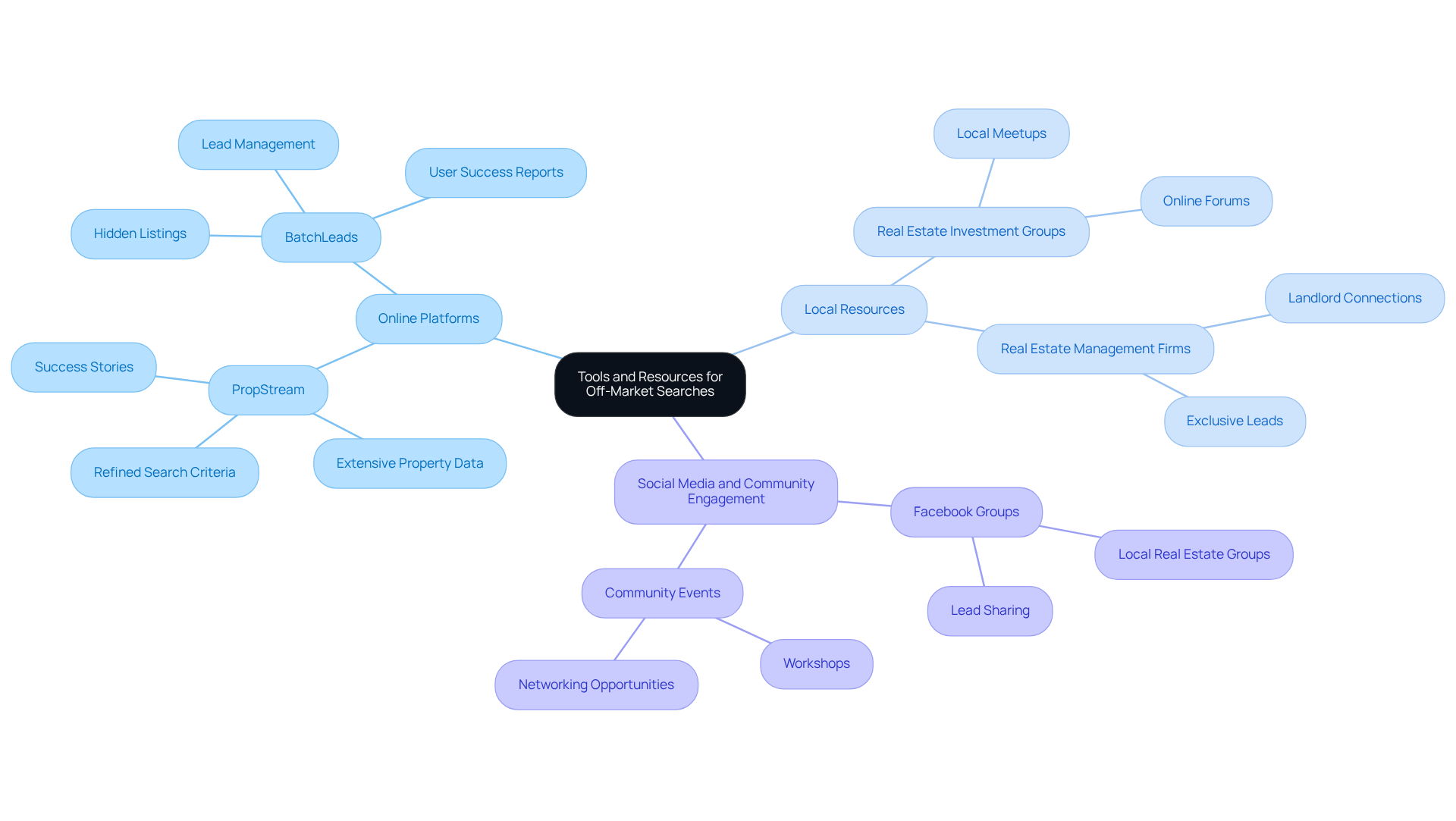

Utilize Tools and Resources for Off-Market Searches

For real estate investors, learning how to find off market real estate deals can be a game-changer. In 2025, several effective tools and resources stand out:

Online Platforms

- PropStream: This robust platform offers extensive data on properties, including off-market leads. Users can refine searches according to specific criteria, facilitating the identification of potential investment options. Success stories highlight how investors have leveraged PropStream to uncover hidden gems in competitive markets.

- BatchLeads: Recognized for its effectiveness, BatchLeads assists real estate investors in identifying hidden listings and managing their leads efficiently. Many users report significant success in closing deals that would otherwise remain undiscovered.

Local Resources

- Real Estate Investment Groups: Engaging with local meetups or online forums can provide valuable insights and leads on off-market opportunities. Connecting with other investors frequently uncovers real estate opportunities before they become available.

- Real Estate Management Firms: These companies often possess information about landlords contemplating selling without advertising their assets. Building connections with real estate managers can generate exclusive leads.

Social Media and Community Engagement

- Facebook Groups: Local real estate groups on social media platforms are excellent for discovering off-market deals. Members often share leads and insights that can lead to lucrative investments.

- Community Events: Participating in local workshops and gatherings enables investors to connect with potential sellers and other industry experts, enhancing the likelihood of discovering properties not listed on the market.

Utilizing these tools and resources effectively can significantly enhance your ability to understand how to find off market real estate deals, ultimately resulting in increased investment success. Remember, as Warren Buffett wisely noted, "The most important quality for an investor is temperament, not intellect." Consistency in your search efforts is essential to discovering the best prospects.

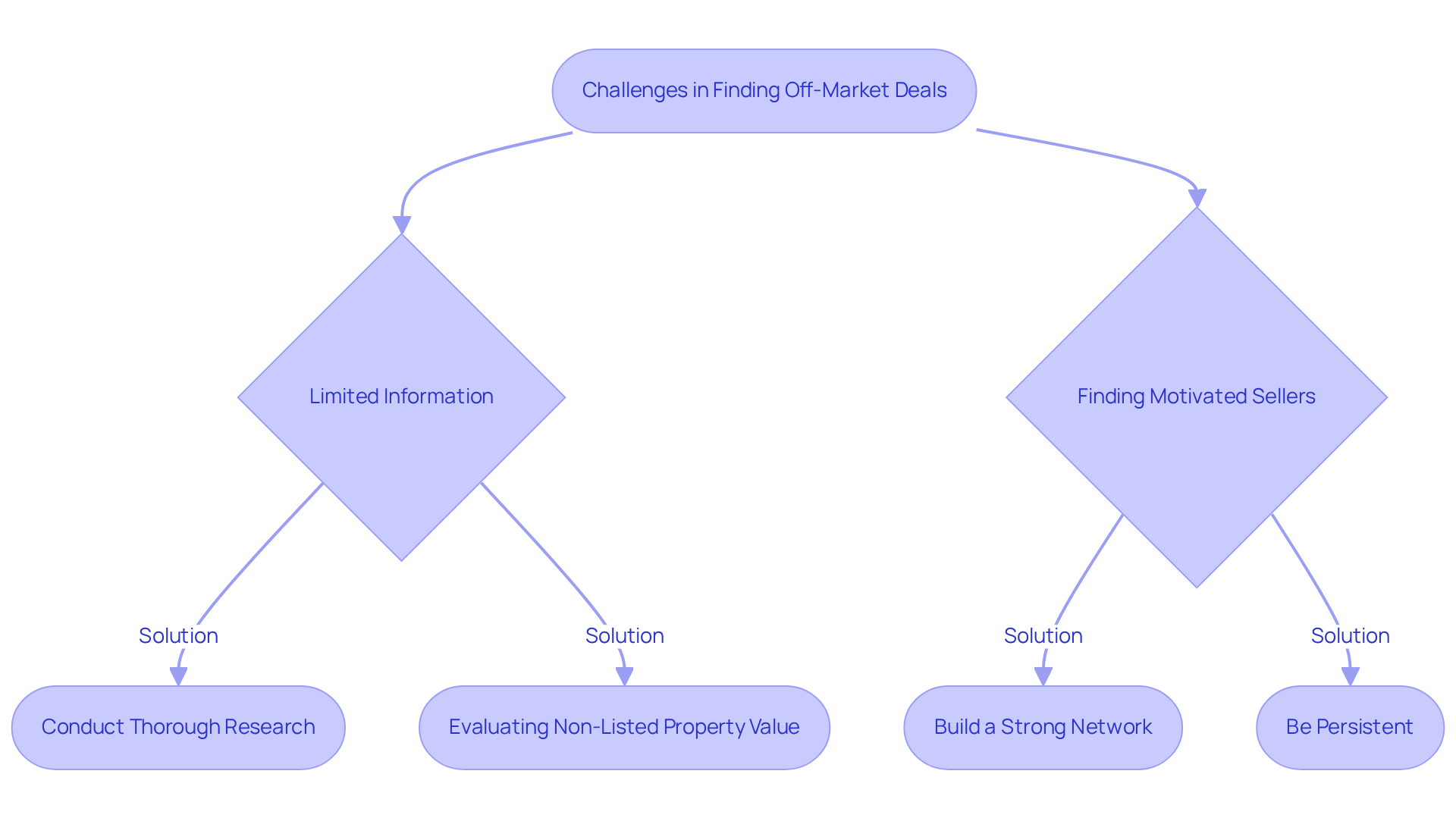

Overcome Challenges in Finding Off-Market Deals

Finding off-market deals can present several challenges; however, with the right approach, these obstacles can be effectively addressed.

Common Challenges

- Limited Information: Off-market properties often lack the detailed information available for listed properties, complicating the assessment of their value. Statistics indicate that approximately 20-30% of real estate transactions occur outside traditional listings, yet many investors struggle to obtain crucial details about these opportunities.

- Finding Motivated Sellers: Identifying sellers willing to sell off-market can be challenging, as these individuals may not actively advertise their intent to sell.

Solutions

- Conduct Thorough Research: Leverage public records and local market data to gather comprehensive information about potential properties. As Thomas Edison wisely stated, "Opportunity is missed by most people because it is dressed in overalls and looks like work," underscoring the importance of diligent research.

- Build a Strong Network: Foster relationships with real estate professionals who can provide leads on motivated sellers. Networking is essential in this field, as numerous opportunities often arise through personal connections.

- Be Persistent: Discovering hidden opportunities requires consistent effort and follow-up. Engage regularly with your network and maintain outreach efforts to uncover concealed prospects. As Brian Tracy aptly noted, "Every no gets you closer to a yes," highlighting the significance of resilience in the pursuit of success.

- Evaluating Non-Listed Property Value: Employ comparative market analysis (CMA) and other valuation techniques to estimate the worth of non-listed properties. A solid understanding of local market dynamics and recent sales can provide clarity regarding potential investment value.

By embracing these strategies, investors can learn how to find off-market real estate deals and navigate the challenges associated with them, unlocking a wealth of opportunities within the market. Zero Flux's commitment to data integrity, sourcing information from over 100 diverse outlets, further empowers investors to make informed decisions.

Conclusion

Unlocking the potential of off-market real estate deals presents unique investment opportunities that can significantly enhance an investor's portfolio. These properties, often concealed from public view, not only diminish competition but also facilitate more favorable negotiation terms. It is essential to understand the nuances of off-market transactions, including the motivations behind sellers' decisions, to successfully navigate this segment of the real estate market.

This guide has explored key strategies for identifying off-market properties, emphasizing the importance of networking, direct outreach, and leveraging technology. Building relationships with local professionals, utilizing targeted mail campaigns, and engaging with online platforms like PropStream and BatchLeads can lead to the discovery of valuable opportunities. Moreover, overcoming challenges such as limited information and identifying motivated sellers necessitates diligence, persistence, and a proactive approach to research and networking.

Ultimately, finding off-market real estate deals transcends mere tactics; it is also about the investor's mindset. Embracing a consistent and resilient approach can yield significant rewards in uncovering hidden gems within the real estate market. By implementing the strategies and tools discussed, investors can position themselves to seize these lucrative opportunities, reinforcing the notion that the effort invested in searching for off-market deals can lead to substantial financial success.