Overview

To successfully identify real estate syndication deals, investors must establish essential criteria:

- Location

- The syndicator's track record

- Funding structure

- Property type

- Current market conditions

Understanding these factors is crucial. By employing effective research strategies—such as utilizing online platforms, networking, and direct outreach—investors can pinpoint promising syndication opportunities that align with their financial goals. Are you ready to leverage these insights for your investment strategy?

Introduction

Navigating the world of real estate syndication presents a unique blend of excitement and challenges, particularly for investors eager to enhance their portfolios. This collaborative investment strategy enables individuals to pool resources, thereby unlocking access to larger and more lucrative properties that may otherwise remain unattainable. However, the crux of the matter lies in the ability to identify credible syndication deals and trustworthy syndicators.

What essential steps must investors undertake to uncover these opportunities and secure their financial success in an increasingly competitive landscape?

Understand Real Estate Syndication Basics

Real estate collaboration represents a strategic approach wherein multiple investors pool their resources to acquire properties. This model empowers individuals by teaching them how to find real estate syndication deals, allowing them to engage in larger, often more lucrative real estate ventures than they could undertake alone. Key players in this process include:

- Syndicator: The individual or entity responsible for organizing the syndication, identifying investment opportunities, and managing the property.

- Investors: Individuals who contribute funds to the group in exchange for a share of the profits.

Understanding how to find real estate syndication deals is crucial for potential investors, as it enables them to assess the credibility and track record of the syndicator, which can significantly influence the success of their investment. Furthermore, familiarize yourself with the types of properties typically associated with partnerships, including multifamily units, commercial properties, and development projects. This foundational knowledge will prepare you for the subsequent stages of understanding how to find real estate syndication deals and evaluating partnerships.

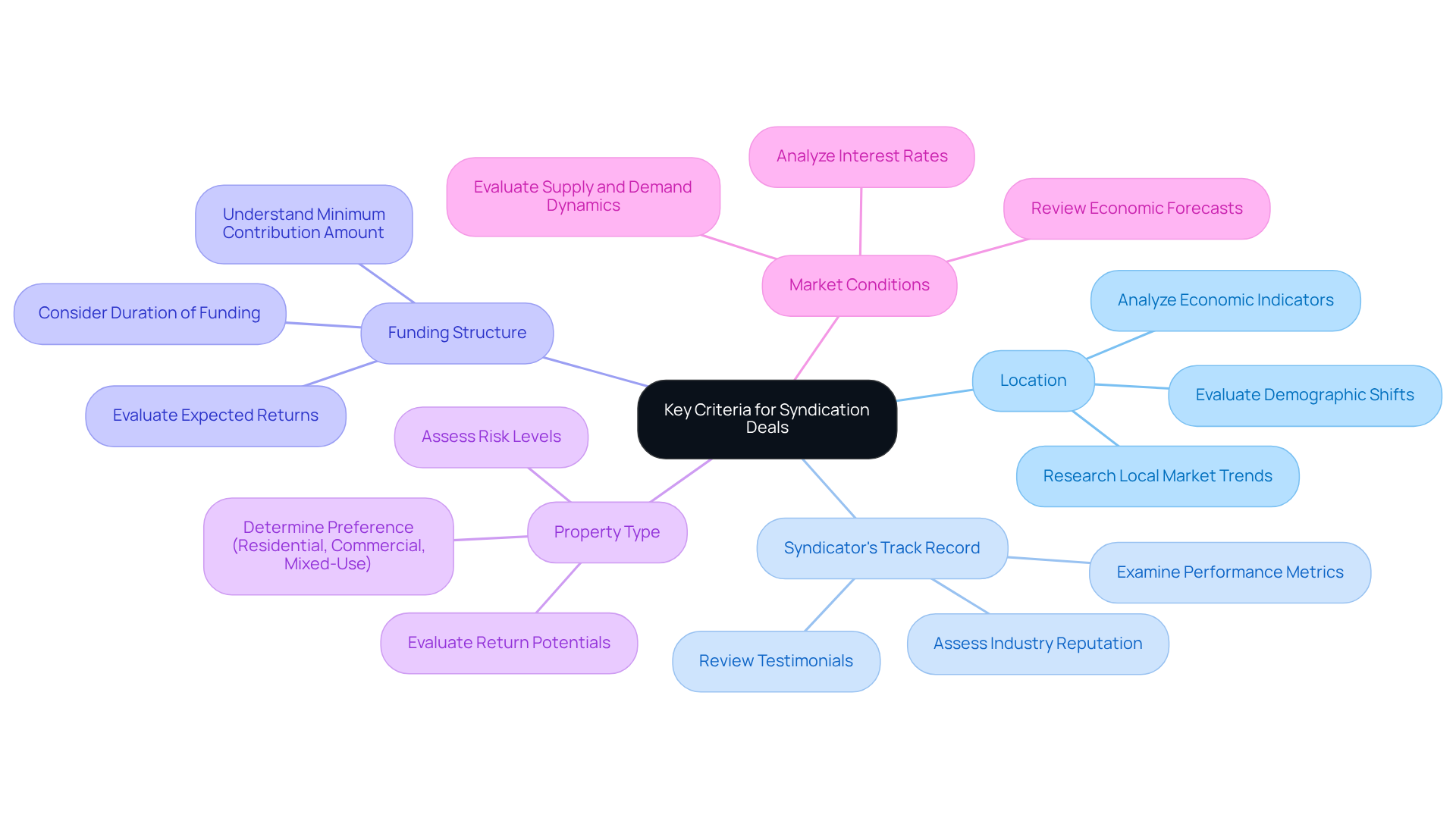

Identify Key Criteria for Syndication Deals

When considering how to find real estate syndication deals, establishing key criteria that align with your financial strategy is crucial. Consider these essential factors:

- Location: The property's location profoundly influences its potential for appreciation and rental income. Conduct thorough research on local market trends, economic indicators, and demographic shifts to pinpoint promising areas.

- Syndicator's Track Record: Scrutinize the syndicator's history with previous deals. Look for testimonials, performance metrics, and their reputation within the industry. A proven track record can signify reliability and expertise.

- Funding Structure: Understand the conditions of the funding, including the minimum contribution amount, expected returns, and the duration of the funding. Ensure that these elements align with your financial goals.

- Property Type: Different property types present varying risk levels and return potentials. Assess whether you prefer residential, commercial, or mixed-use properties based on your risk tolerance and financial objectives.

- Market Conditions: Evaluate current market conditions, including supply and demand dynamics, interest rates, and economic forecasts. This analysis will aid you in assessing the feasibility of the funding.

By establishing these criteria, you can effectively narrow down your options and learn how to find real estate syndication deals that are most likely to align with your investment objectives.

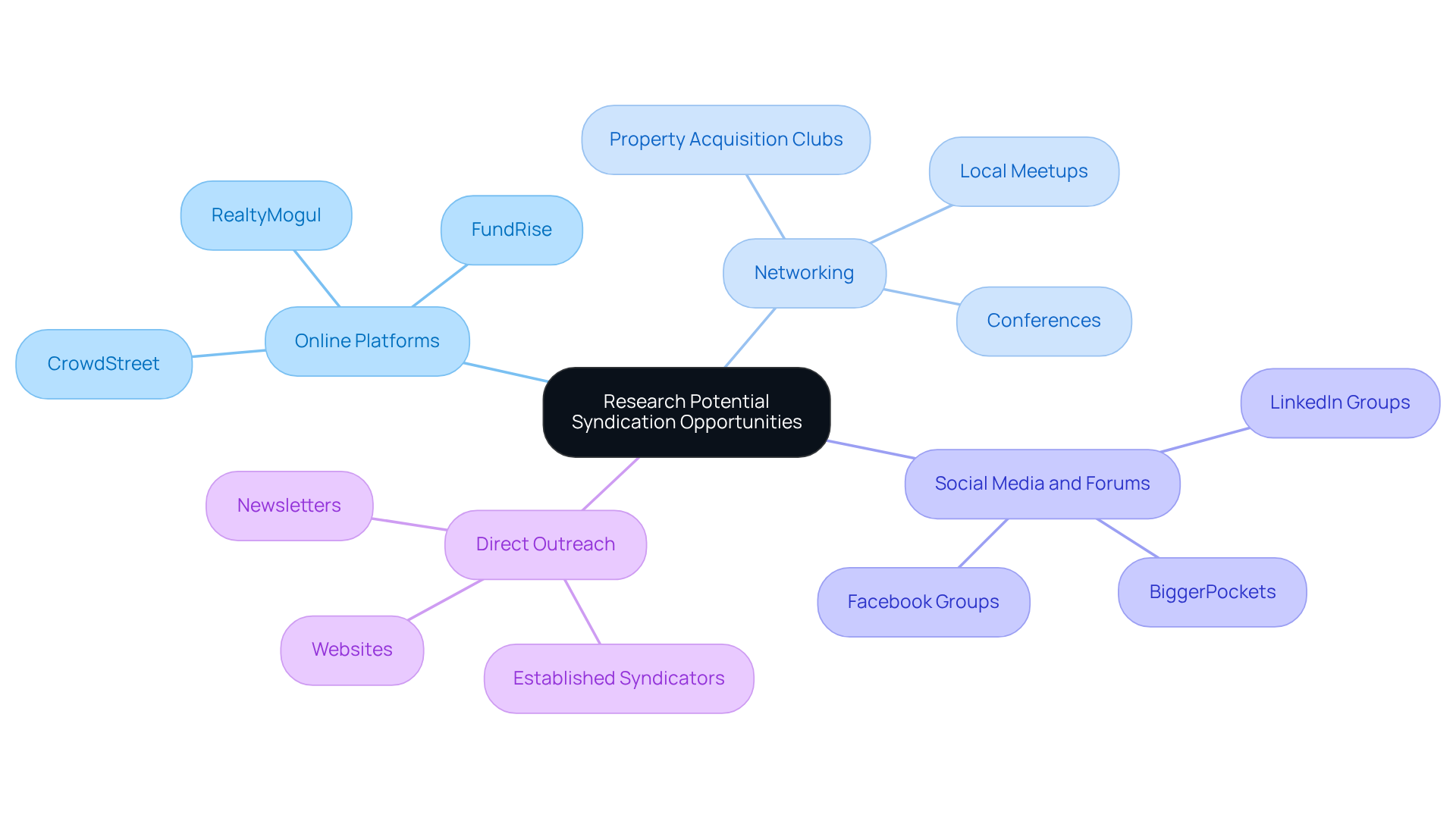

Research Potential Syndication Opportunities

To identify potential real estate syndication opportunities, consider employing the following strategies:

- Online Platforms: Leverage real estate crowdfunding platforms such as FundRise, CrowdStreet, and RealtyMogul. These platforms frequently showcase various syndication agreements and provide comprehensive information regarding each opportunity.

- Networking: Engage in property acquisition clubs, conferences, and local meetups. By connecting with fellow investors and syndicators, you can discover how to find real estate syndication deals that are not publicly promoted.

- Social Media and Forums: Join real estate discussions on platforms like LinkedIn, Facebook groups, and forums such as BiggerPockets. These communities can offer valuable insights and recommendations on how to find real estate syndication deals and trustworthy syndicators.

- Direct Outreach: Proactively reach out to established syndicators. Many have websites or newsletters where they announce new funding opportunities. Cultivating a relationship with them can provide insights on how to find real estate syndication deals.

By implementing these research strategies, you can uncover a diverse range of syndication opportunities that align with your investment criteria.

Conclusion

Understanding how to find real estate syndication deals is essential for investors aiming to expand their portfolios and engage in larger ventures. By pooling resources with others in a structured partnership, individuals can access opportunities that would otherwise remain out of reach. This collaborative model not only enhances investment potential but also underscores the importance of selecting the right syndicator and property type to ensure success.

Throughout this article, the key steps for identifying lucrative syndication deals have been outlined. Establishing criteria such as:

- Location

- The syndicator's track record

- Funding structure

- Property type

- Current market conditions

serves as a foundation for making informed investment decisions. Furthermore, employing various research strategies—ranging from utilizing online platforms and networking to engaging in social media discussions—can significantly broaden the scope of potential opportunities available to investors.

The significance of these insights cannot be overstated. As the real estate landscape evolves, staying informed and proactive in seeking out syndication deals is crucial for maximizing returns. By applying the strategies discussed, investors can position themselves advantageously in the market, ultimately leading to more successful and rewarding real estate investments.