Overview

Investing $10K in real estate presents a range of effective strategies, including:

- Buy and hold

- Flipping

- Crowdfunding

Each strategy is tailored to meet distinct financial goals and risk appetites. Understanding market dynamics, legal considerations, and budgeting for both initial and ongoing expenses is crucial. This knowledge empowers investors to make informed decisions that optimize potential returns, ensuring that their investment strategies are both sound and strategic.

Introduction

In the vast and intricate world of real estate investment, grasping the foundational concepts is crucial for unlocking potential wealth. The various types of properties and the critical importance of location are vital elements that shape an investor's journey. As market dynamics shift and new trends emerge, investors must adeptly navigate a landscape influenced by economic indicators, legal frameworks, and design preferences.

By focusing on budgeting, financing options, and effective property management, individuals can strategically position themselves for success. This comprehensive exploration delves into essential strategies and insights, empowering prospective investors to make informed decisions and thrive in the competitive realm of real estate.

Understanding Real Estate Investment Basics

Real estate ventures frequently investigate how to invest 10k in real estate, aiming to generate revenue or gain. Understanding the following key concepts is essential for navigating this dynamic landscape:

-

Types of Real Estate: Investments can be categorized into several types, including residential, commercial, industrial, and land. Each category presents unique opportunities and challenges that influence how to invest 10k in real estate, affecting potential returns and risks.

-

Investment Goals: Defining your objectives is crucial—whether you aim for cash flow, appreciation, or a combination of both when learning how to invest 10k in real estate. Recent statistics indicate that approximately 60% of investors prioritize cash flow, while 40% focus on long-term appreciation. As John Sim, Head of Securitized Products Research at J.P. Morgan, observes, "It’s clear that many elements of Trump's policy will affect the housing market," highlighting the importance of understanding how to invest 10k in real estate while considering external factors that shape financial objectives.

-

Market Dynamics: A solid grasp of market dynamics, including how to invest 10k in real estate, as well as supply and demand, interest rates, and economic indicators, is vital. For example, the current trend indicates that eco-friendly real estate is becoming increasingly preferred, often providing greater rental returns and rising values. However, rising insurance expenses, which have surged by 30% since 2020, are also impacting housing affordability. Thus, it is crucial for investors to understand how to invest 10k in real estate while considering how these factors interact in their financial choices.

-

Legal Considerations: Familiarity with legal aspects such as zoning laws, tax obligations, and landlord-tenant regulations is essential for understanding how to invest 10k in real estate. These factors can significantly influence both the feasibility and profitability of your financial venture.

-

Design Trends: Awareness of design trends can enhance property value. Current preferences for soft whites and warm neutrals in home interiors can greatly attract potential buyers and renters, thereby improving financial returns.

By mastering these fundamentals, you can enhance your ability to make informed choices about how to invest 10k in real estate. Furthermore, staying informed about current trends, including the rising insurance expenses and their impact on housing affordability, is essential as they directly influence the feasibility of financial ventures. Grasping these components will enable you to navigate the intricacies of property ventures effectively.

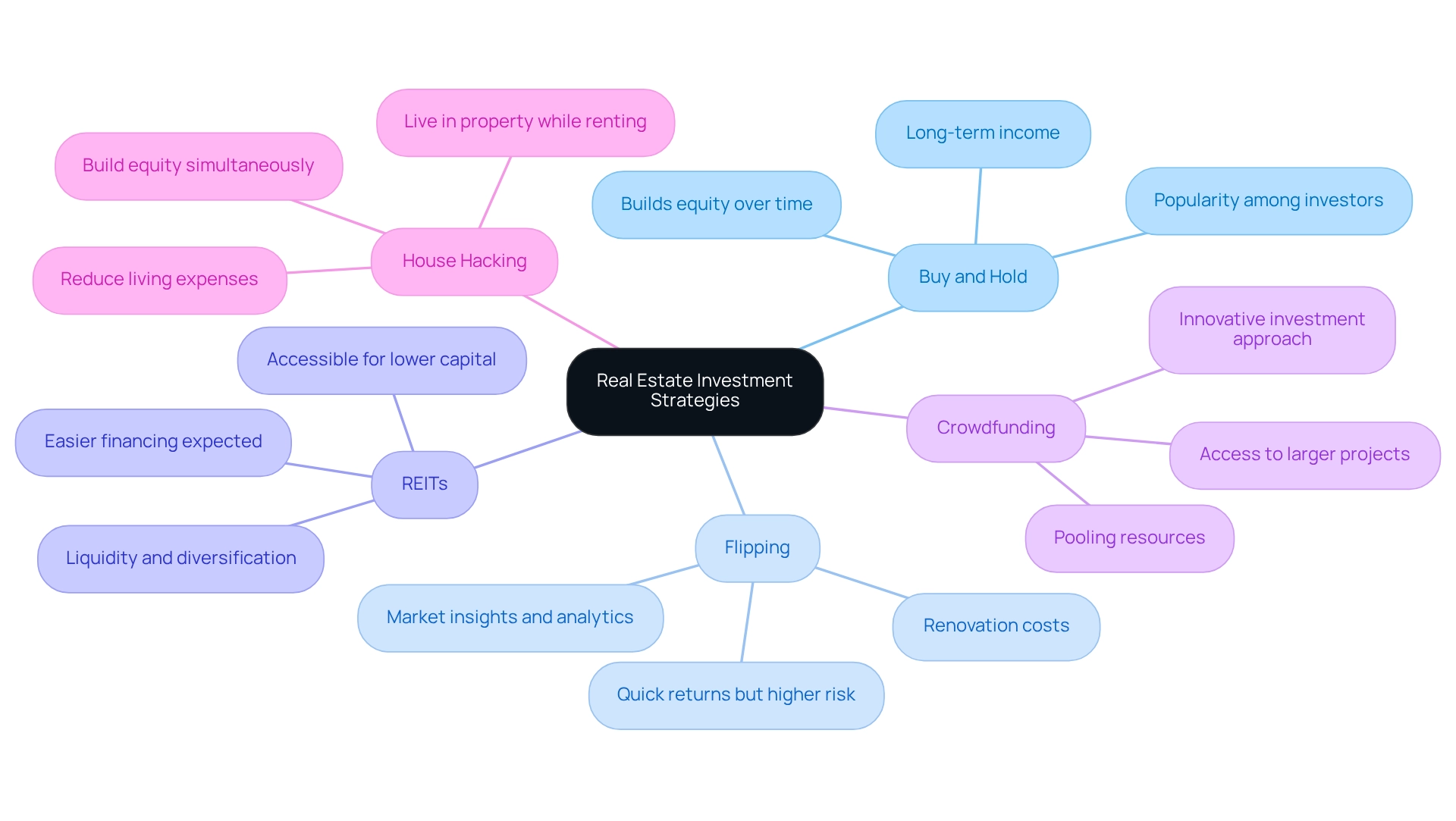

Exploring Different Real Estate Investment Strategies

Investing in property presents a range of strategies, including how to invest 10k in real estate, each tailored to various financial circumstances and investment objectives. Here are several prominent approaches:

- Buy and Hold: This strategy involves acquiring real estate to rent out, generating long-term income. It is favored for its potential to build equity over time and provide a steady cash flow. Recent trends indicate that over half of respondents in the 2025 Asia Pacific Investor Intentions Survey expressed a desire to increase their holdings in land and buildings, underscoring the popularity of this approach.

- Flipping: This method entails acquiring assets, renovating them, and selling them for a profit. While it can yield quick returns, it also carries higher risks due to market fluctuations and renovation costs. Case studies demonstrate that successful flippers frequently utilize market insights and predictive analytics to pinpoint assets with the greatest potential for appreciation.

- Real Estate Investment Trusts (REITs): Understanding how to invest 10k in real estate through REITs enables individuals to purchase shares in firms that own or finance income-generating realty. This strategy offers liquidity and diversification, making it accessible for those with lower capital. According to Deloitte’s 2025 commercial property outlook survey, 69% of investors believe financing will be easier to obtain, which may further enhance opportunities in this sector.

- Crowdfunding: This innovative approach exemplifies how to invest 10k in real estate by pooling resources with other investors to fund property projects. It broadens access to property opportunities, enabling individuals to engage in larger transactions that would normally be unattainable.

- House Hacking: This strategy illustrates how to invest 10k in real estate by allowing investors to live in a property while renting out a portion to help cover mortgage expenses. It’s an effective way to reduce living expenses and build equity simultaneously.

Each of these strategies presents unique risk and reward profiles. For example, while buy and hold strategies usually produce average returns over time, flipping can provide greater short-term profits but with heightened volatility. As the property market evolves, particularly with the emergence of AI and predictive analytics that reshape financial choices by examining data to uncover profitable opportunities, investors are urged to remain knowledgeable about the latest trends and tactics to make informed decisions. Furthermore, the current market faces challenges, such as substantial value loss in office and retail assets due to shifting investor preferences, emphasizing the significance of adapting to evolving dynamics. Zero Flux’s commitment to sourcing information from diverse outlets ensures that subscribers receive reliable insights to navigate these complexities effectively.

Conducting Market Research and Analysis

To conduct effective market research in real estate investment, consider the following steps:

- Identify Target Markets: Focus on areas with significant growth potential, such as emerging neighborhoods or cities experiencing robust job market expansion. Researching local economic conditions can reveal hidden gems that may not yet be on the radar of larger investors.

- Analyze Market Trends: Examine historical data on property values, rental rates, and vacancy rates. This analysis will assist you in comprehending the trajectory of the market and recognizing patterns that could impact future financial decisions. For instance, recent data indicates that homeowners have gained an average of $147,000 in housing wealth over the past five years, highlighting the potential for appreciation in certain markets.

- Evaluate Economic Indicators: Consider key economic factors such as employment rates, population growth, and local economic conditions. These indicators are crucial for assessing the viability of a market. For instance, a monthly questionnaire distributed to more than 50,000 property professionals uncovered insights into market confidence, which can be a key indicator of upcoming trends. As Lawrence Yun, NAR Chief Economist, noted, "It is unclear if the coldest January in 25 years contributed to fewer buyers in the market, and if so, expect greater sales activity in upcoming months. However, it’s evident that elevated home prices and higher mortgage rates strained affordability."

- Use Data Tools: Leverage online platforms and databases to gather relevant data and insights. Tools that provide access to the Housing Affordability Index can help you determine whether a typical family can qualify for a mortgage on a typical home, which is essential for understanding market dynamics. This index is particularly important as it reflects the economic conditions affecting buyer affordability.

By thoroughly understanding the market landscape through these steps, you can make strategic financial choices that align with your financial goals and adapt to current trends. As housing costs are expected to rise gradually, with an estimated median home price of $410,700 in 2025, remaining knowledgeable will be crucial for managing the intricacies of property financing. The REALTORS® Confidence Index, published on March 20, 2025, serves as a key indicator of housing market strength, providing insights into the confidence of REALTORS® in the market and helping gauge future market conditions.

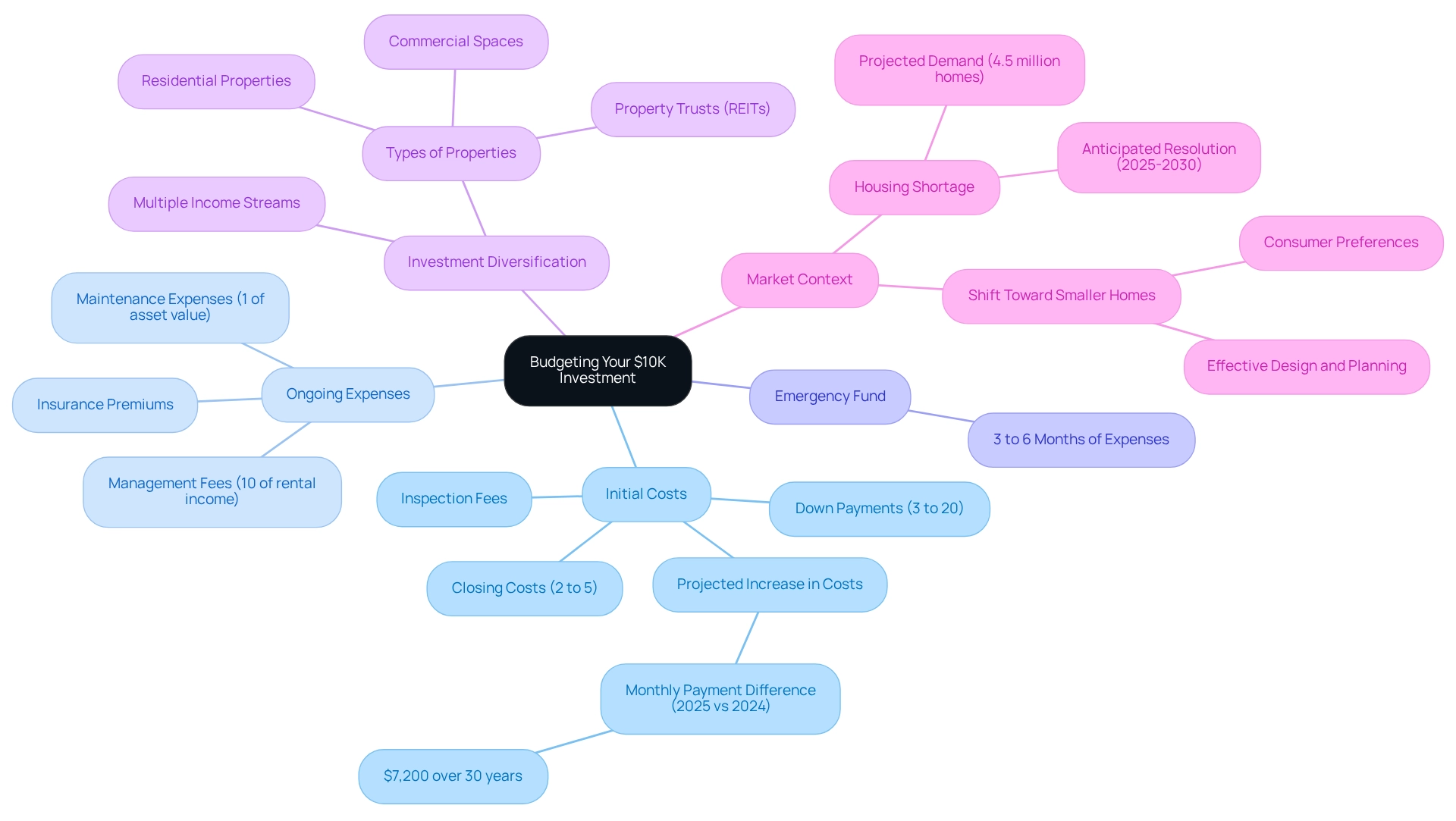

Budgeting Your $10K Investment Wisely

When arranging your $10K allocation in property, creating a thorough budget that encompasses various financial elements is essential:

- Initial Costs: Begin by accounting for essential expenses such as down payments, typically ranging from 3% to 20% of the real estate price, closing costs adding another 2% to 5%, and inspection fees that ensure the asset is in good condition. In 2025, average initial expenses for real estate ventures are anticipated to rise due to increasing asset values and interest rates, making it crucial to prepare accordingly. Notably, the difference in monthly payments between 2025 and 2024 accumulates to nearly $7,200 over the life of a 30-year loan, underscoring the importance of budgeting for interest rates and long-term costs.

- Ongoing Expenses: Beyond the initial investment, consider the recurring costs associated with real estate ownership. This includes management fees, approximately 10% of rental income, maintenance expenses averaging 1% of the asset value each year, and insurance premiums that safeguard your asset. Understanding these ongoing expenses is vital, as they can significantly impact your cash flow over time.

- Emergency Fund: It’s prudent to set aside a portion of your budget for unexpected repairs or vacancies. An emergency fund should ideally cover 3 to 6 months of expenses, providing a financial cushion that helps navigate unforeseen challenges without jeopardizing your investment.

- Investment Diversification: To reduce risk, consider distributing your funds among various types of property ventures. This could involve investing in a combination of residential properties, commercial spaces, or property trusts (REITs). Diversification not only disperses risk but also creates multiple income streams, enhancing your overall financial strategy. As Leo Pareja, CEO of eXp Realty, notes, transparency in real estate transactions is crucial, relating to budgeting considerations and ensuring awareness of all costs involved.

- Market Context: Being aware of the broader market conditions influencing your financial choices is important. A housing shortage is projected to persist through the end of the 2020s, with an estimated pent-up demand for up to 4.5 million homes. This context can affect your financial strategy and timing. Case Study: Consider the growing trend towards smaller homes, which can still make a significant impression with the right strategies. This trend signifies a change in consumer preferences towards compact living areas, implying that efficient design and planning can improve the attractiveness and utility of smaller residences, essential for those exploring how to invest $10K in real estate.

A well-organized budget that includes these components will enable you to manage your funding efficiently, paving the way for sustained success in the ever-changing property market.

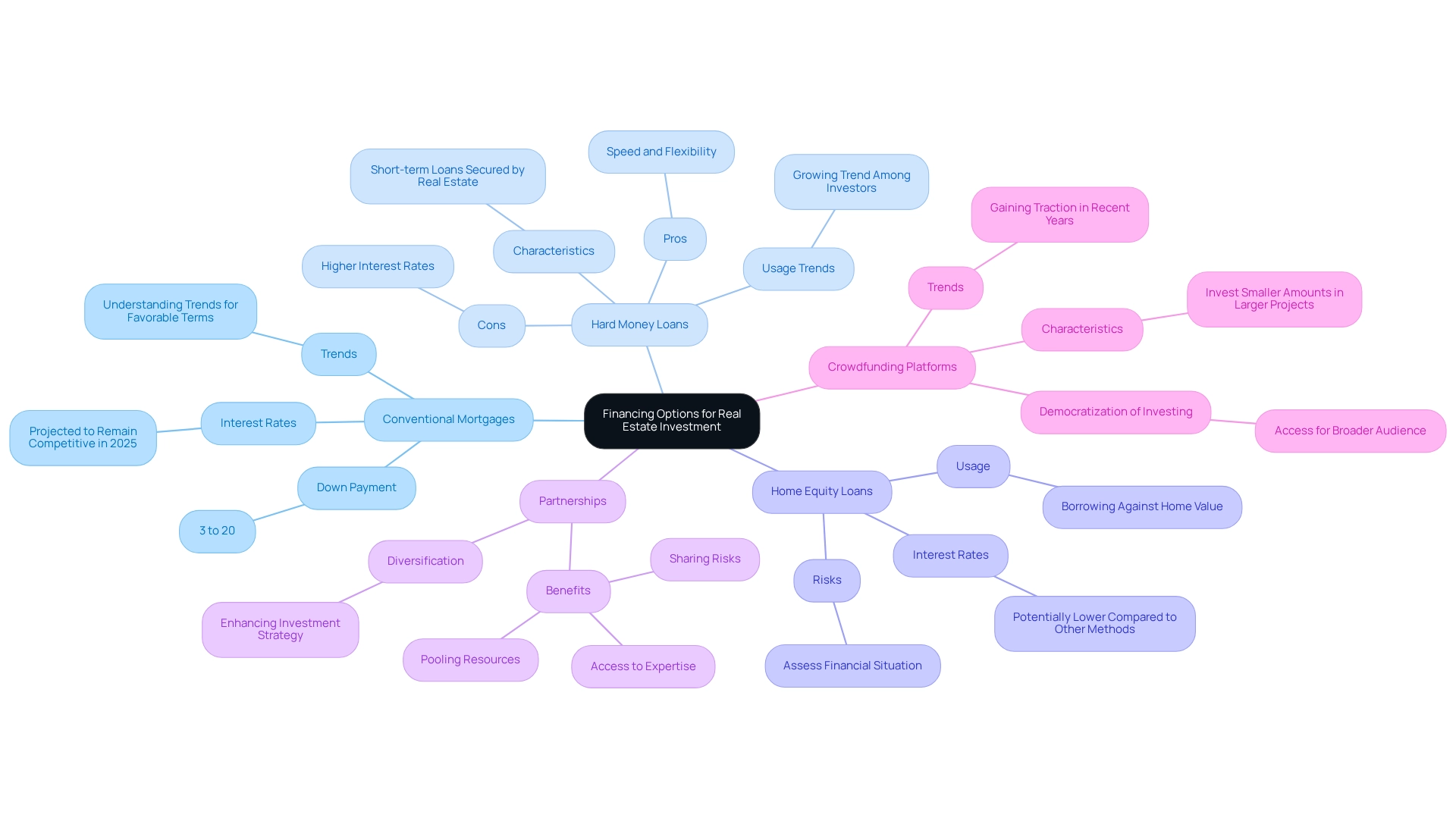

Exploring Financing Options for Your Investment

When considering financing options for your real estate investment, it is essential to explore a variety of avenues that can align with your budget and investment goals.

- Conventional Mortgages: These traditional loans, offered by banks and credit unions, typically require a down payment ranging from 3% to 20%. In 2025, the current interest rates for conventional mortgages are projected to remain competitive, making them a viable option for many investors. Understanding the trends in conventional mortgages can help you secure favorable terms.

- Hard Money Loans: These are short-term loans secured by real estate, often utilized for property flipping. Investors appreciate hard money loans for their speed and flexibility, although they usually come with higher interest rates. Recent statistics indicate a growing trend in hard money loan usage, particularly among investors looking to capitalize on quick turnaround opportunities.

- Home Equity Loans: If you possess a house, you can utilize its equity to finance your venture. This option allows you to borrow against the value of your home, providing a potentially lower interest rate compared to other financing methods. It is crucial to assess your financial situation and the risks involved before proceeding.

- Partnerships: Collaborating with other investors can be an effective way to pool resources and share risks. This strategy not only diversifies your investment portfolio but also allows you to benefit from the expertise of your partners, enhancing your overall investment strategy.

- Crowdfunding Platforms: These online platforms allow you to invest smaller amounts in larger property projects. Crowdfunding has gained traction in recent years, providing access to opportunities that may have been previously out of reach for individual investors. This method democratizes real estate investing, allowing participation from a broader audience.

In the words of Warren Buffett, "Investing is a lifelong journey. Stay disciplined, keep learning, and never stray from the principles that have built enduring wealth." Choosing the appropriate financing alternative is vital for improving your strategy on how to invest 10k in real estate and maximizing potential returns.

By understanding the nuances of each option and considering the importance of knowledgeable financial advisors, as highlighted in the case study "Choosing Financial Advisors Wisely," you can make informed decisions that align with your financial goals. The commitment to quality content enhances subscriber engagement and authority in the industry, reflecting the newsletter's focus on factual information.

Choosing the Right Property for Investment

When selecting a property for investment, several critical factors warrant careful consideration:

- Location: Prioritize assets located in desirable neighborhoods characterized by robust school districts, accessible amenities, and low crime rates. In 2025, statistics indicate that 74% of home purchasers are focusing on residences priced below $500,000, underscoring the importance of location in attracting potential buyers and renters. As Kelly Pearl, Vice President of Exchange Counsel at Investment Property Exchange Services, Inc., observes, 'Location remains a key factor in real estate success, particularly in a competitive market.'

- Asset Condition: Conduct a thorough assessment of the asset's condition, including any necessary repairs. Typical repair expenses for rental units in 2025 can vary significantly, making it essential to understand these costs in advance for effective budgeting and financial planning.

- Market Demand: Examine the demand for rental units in the area. A robust rental market ensures steady cash flow, which is vital for the sustainability of your investment. With 51% of Americans intending to purchase a home in 2025, particularly among younger generations, the demand for rental units is expected to remain strong. This trend emphasizes the importance of selecting locations that cater to this growing demographic.

- Future Growth Potential: Investigate upcoming developments or infrastructure projects that could enhance land values. Areas positioned for growth often attract more buyers and renters, rendering them ideal for investment. For instance, new transportation connections or commercial projects can significantly boost real estate desirability.

- Cash Flow Analysis: Perform a detailed cash flow analysis by calculating potential rental income against all expenses, including mortgage payments, property taxes, and maintenance costs. With recent changes in the property market, such as a federal lawsuit permitting negotiable realtor fees, it's vital to factor in these potential savings when assessing your overall financial strategy. Ensuring positive cash flow is essential for long-term financial success.

By conducting a comprehensive assessment of these factors, you can make informed decisions that significantly enhance your chances of achieving success in the dynamic real estate market.

Managing Your Investment: Property Management Essentials

To manage your investment effectively, focus on these essential practices:

- Tenant Screening: A comprehensive tenant screening process is vital for identifying reliable tenants. Statistics suggest that thorough screening can significantly reduce the risk of delayed payments and asset damage, thereby enhancing overall financial security. According to the US Department of Housing and Urban Development, in 2019, there were 43.6 million rent-based households in America, underscoring the importance of effective tenant screening in a competitive rental market.

- Lease Agreements: Drafting clear and concise lease agreements is crucial. These documents should outline all terms and responsibilities, ensuring both parties understand their obligations and rights, which can prevent disputes down the line.

- Maintenance and Repairs: Establishing a proactive system for regular maintenance and prompt repairs is essential for tenant satisfaction. A well-cared-for asset not only retains tenants but also attracts new ones, contributing to a stable income stream. Understanding global trends in real estate management, as emphasized in the case study 'Global Comparison of Property Management Markets,' can guide best practices for preserving your investment.

- Communication: Maintaining open lines of communication with tenants fosters positive relationships and encourages them to voice concerns. This approach can lead to quicker resolutions of issues, enhancing tenant retention and satisfaction. A focus on tenant experience is crucial for commercial real estate landlords, as it directly impacts tenant loyalty and overall satisfaction.

- Financial Tracking: Maintaining comprehensive records of income and expenses is essential for assessing your asset's financial performance. This practice enables you to recognize trends, manage budgets efficiently, and make informed decisions regarding future expenditures.

Applying these property management best practices will help ensure your asset remains lucrative and well-maintained, positioning you for success in the competitive housing market. With over 30,000 subscribers, Zero Flux provides reliable insights that can effectively guide your financial strategies.

Navigating Challenges and Risks in Real Estate Investing

Understanding how to invest 10k in real estate involves navigating a range of challenges that can significantly impact your success. Recognizing these challenges is crucial for developing effective strategies to mitigate risks and safeguard your investments. Key challenges include:

- Market Volatility: Economic fluctuations can lead to unpredictable changes in property values and rental demand. Recent trends indicate that market volatility has escalated, particularly in light of shifting economic policies under a new presidential administration and demographic movements favoring regions like the Sun Belt. As noted by Dolde and Tirtiroglu, "property price volatility has been largely overlooked even though the GFC has heightened the risk profile of property prices." This volatility can create both risks and opportunities for investors.

- Financing Risks: The environment of property financing is heavily influenced by interest rate changes. As of 2025, average interest rates have seen notable fluctuations, directly affecting mortgage payments and overall cash flow. Investors must stay informed about these changes to effectively manage their financing strategies.

- Management Issues: Overseeing real estate can be challenging, especially when dealing with troublesome tenants or unforeseen repairs. These issues can strain finances and require proactive management strategies to ensure profitability.

- Regulatory Changes: The real estate sector is subject to evolving laws and zoning regulations that can affect land use and profitability. Keeping up with these changes is crucial for making informed financial decisions.

- Natural Disasters: Properties are at risk from various natural disasters, including floods and earthquakes. Investors should consider the geographical risks associated with their properties and explore insurance options to mitigate potential losses.

By identifying these challenges, investors can develop strategies on how to invest 10k in real estate that not only safeguard their investments but also capitalize on emerging opportunities in the property market. This proactive strategy is essential for navigating the complexities of property investing in 2025. Furthermore, with over 30,000 subscribers, Zero Flux has established itself as a vital resource for industry professionals, assisting them in navigating these complexities through a succinct and informative format.

Continuing Your Education: Staying Informed in Real Estate

To remain competitive and informed in the ever-evolving real estate market, consider implementing the following strategies:

- Subscribe to Industry Newsletters: Engaging with reputable newsletters, such as Zero Flux, is essential for accessing the latest market trends and insights. With over 30,000 subscribers, Zero Flux curates data from more than 100 diverse sources, providing a comprehensive overview that helps investors make informed decisions. Its commitment to data integrity and factual information ensures that subscribers receive reliable insights, which is reflected in the positive feedback from its growing community.

- Attend Workshops and Seminars: Participating in educational events allows you to learn from industry experts and network with fellow investors. Significantly, average attendance rates for property workshops and seminars have demonstrated a consistent rise, indicating an increasing dedication to professional growth among investors.

- Join Real Estate Funding Groups: Becoming part of local or online funding communities enables you to share experiences and strategies. These groups often provide valuable insights and support, fostering a collaborative environment for learning.

- Utilize Online Courses: Online platforms provide an abundance of courses centered on property investment and market analysis. These resources enable you to learn at your own speed and acquire specialized knowledge, particularly on how to invest 10k in real estate, which can improve your financial strategies.

- Read Books and Articles: Continuously educating yourself through literature on property acquisition techniques and market dynamics is essential. Staying updated with the latest publications can provide fresh perspectives and innovative approaches to investing.

By committing to ongoing education, you not only enhance your financial knowledge but also position yourself to understand how to invest 10k in real estate effectively within the dynamic landscape. This proactive method is essential for attaining long-term success in your financial pursuits. As Warren Buffett skillfully likens investing to planting seeds, keep in mind that patience is essential for cultivating your assets and permitting them to develop, ultimately resulting in improved financial outcomes.

Additionally, as Scott Lockhart, CEO at Showcase IDX, notes, "Privacy has a competitive advantage... protecting your customers is going to be probably the biggest opportunity that’s out there in real estate." This highlights the importance of safeguarding customer information in your investment practices.

Conclusion

Understanding the intricacies of real estate investment is essential for anyone looking to build wealth in this dynamic market. The exploration of various property types, investment goals, and market dynamics provides a strong foundation for making informed decisions. Recognizing the significance of location, legal considerations, and design trends further enhances the ability to navigate this complex landscape effectively.

Implementing diverse investment strategies, from buy-and-hold to crowdfunding, allows investors to tailor their approach based on individual financial situations and objectives. By conducting thorough market research and analysis, prospective investors can identify lucrative opportunities and align their investments with evolving trends. Additionally, developing a comprehensive budget and exploring various financing options are crucial steps that can significantly impact investment success.

Effective property management practices, including tenant screening and maintenance, are vital for ensuring a steady income stream and maximizing property value. Moreover, being aware of potential challenges and risks, such as market volatility and regulatory changes, equips investors with the knowledge needed to safeguard their investments and seize opportunities as they arise.

Ultimately, continuous education and staying informed about market trends are essential components for thriving in the real estate sector. By embracing these strategies and insights, individuals can navigate the complexities of real estate investment, paving the way for long-term success and financial growth in a competitive environment.