Overview

Investing $100K in real estate requires a structured approach that begins with:

- Defining investment goals

- Assessing risk tolerance

- Selecting suitable investment strategies, including:

- Single-family rentals

- Fix-and-flip projects

- REITs

Understanding market trends, financing options, and effective property management practices is crucial for maximizing returns. These elements not only help navigate the complexities of the real estate market but also empower investors to make informed decisions. By leveraging this knowledge, investors can enhance their strategies and achieve their financial objectives.

Introduction

In the realm of real estate investing, the journey commences with a pivotal step: defining investment goals and comprehending risk tolerance. As prospective investors deliberate on committing substantial capital, such as $100K, they must navigate a landscape rife with diverse strategies and market dynamics.

From assessing various investment accounts to choosing between DIY management and professional assistance, each decision bears significant implications for future success. With current trends signaling a transformation in investor behavior and market conditions, it becomes imperative to explore viable options, including:

- rental properties

- fix-and-flips

- innovative platforms like crowdfunding

This comprehensive guide examines the multifaceted strategies for real estate investment, delivering actionable insights designed to empower investors in making informed decisions that align with their financial aspirations.

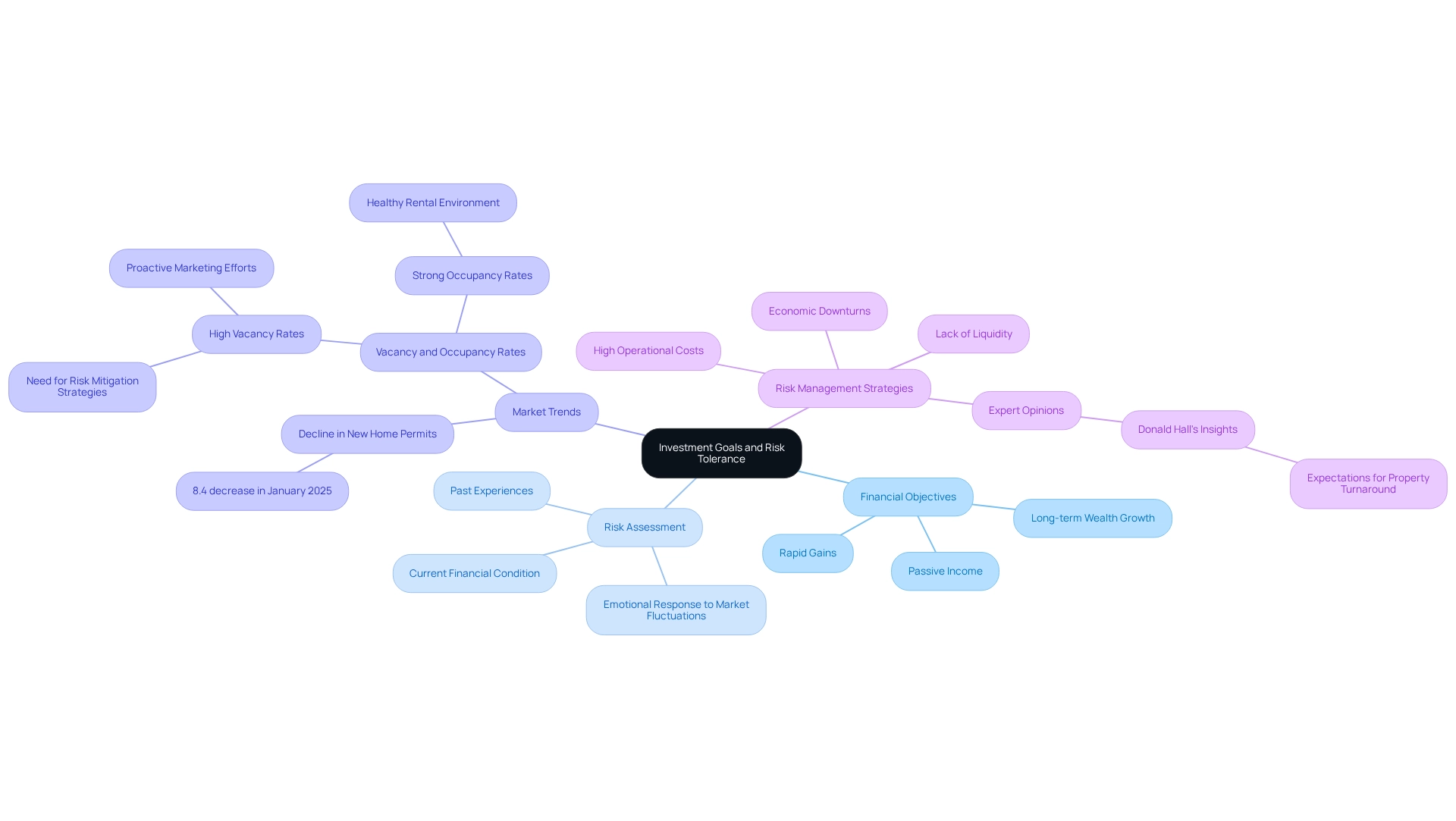

Establishing Your Investment Goals and Risk Tolerance

Before diving into the process of investing 100k in real estate, it is imperative to clearly define your financial objectives. Consider the following questions:

- What do I aim to achieve with this funding?

- Are you seeking long-term wealth growth, passive income, or rapid gains?

- Additionally, what degree of risk am I willing to take?

Recognizing your risk tolerance is a crucial step in the financial journey. Factors to assess include your current financial condition, past experiences with assets, and your emotional response to market fluctuations. For a systematic approach, consider utilizing a risk tolerance questionnaire or consulting a financial advisor to gain a clearer understanding of your comfort level concerning potential losses versus gains.

Current trends indicate that average risk tolerance levels among property investors in 2025 are evolving, with many becoming increasingly cautious due to economic uncertainties. This shift is reflected in the recent 8.4% decline in new home permits in January 2025, showcasing a more conservative strategy towards investment. As Donald Hall, Global Head of Research, emphasized in a recent webinar, understanding the expectations for a property turnaround is essential for investors navigating these changes.

Moreover, asset managers frequently employ rental yields and cap rates to identify profitable opportunities, which can significantly inform your financial strategy. Case studies on risk tolerance evaluation in property investing reveal that investors who actively engage in assessing their risk profiles tend to make more informed decisions. For instance, understanding the implications of vacancy and occupancy rates can profoundly influence financial strategies.

Current statistics suggest that high vacancy rates necessitate robust risk management strategies and proactive marketing efforts, whereas strong occupancy rates indicate a healthy rental environment, shaping future funding choices.

Furthermore, it is vital to consider other risks associated with property financing, such as economic downturns, lack of liquidity, and elevated operational costs. Expert opinions underscore the importance of establishing clear financial goals that align with your risk tolerance for those learning how to invest 100k in real estate. As you navigate the complexities of property investing, remember that a well-defined strategy not only enhances your potential for success but also aids in managing the inherent risks associated with the market.

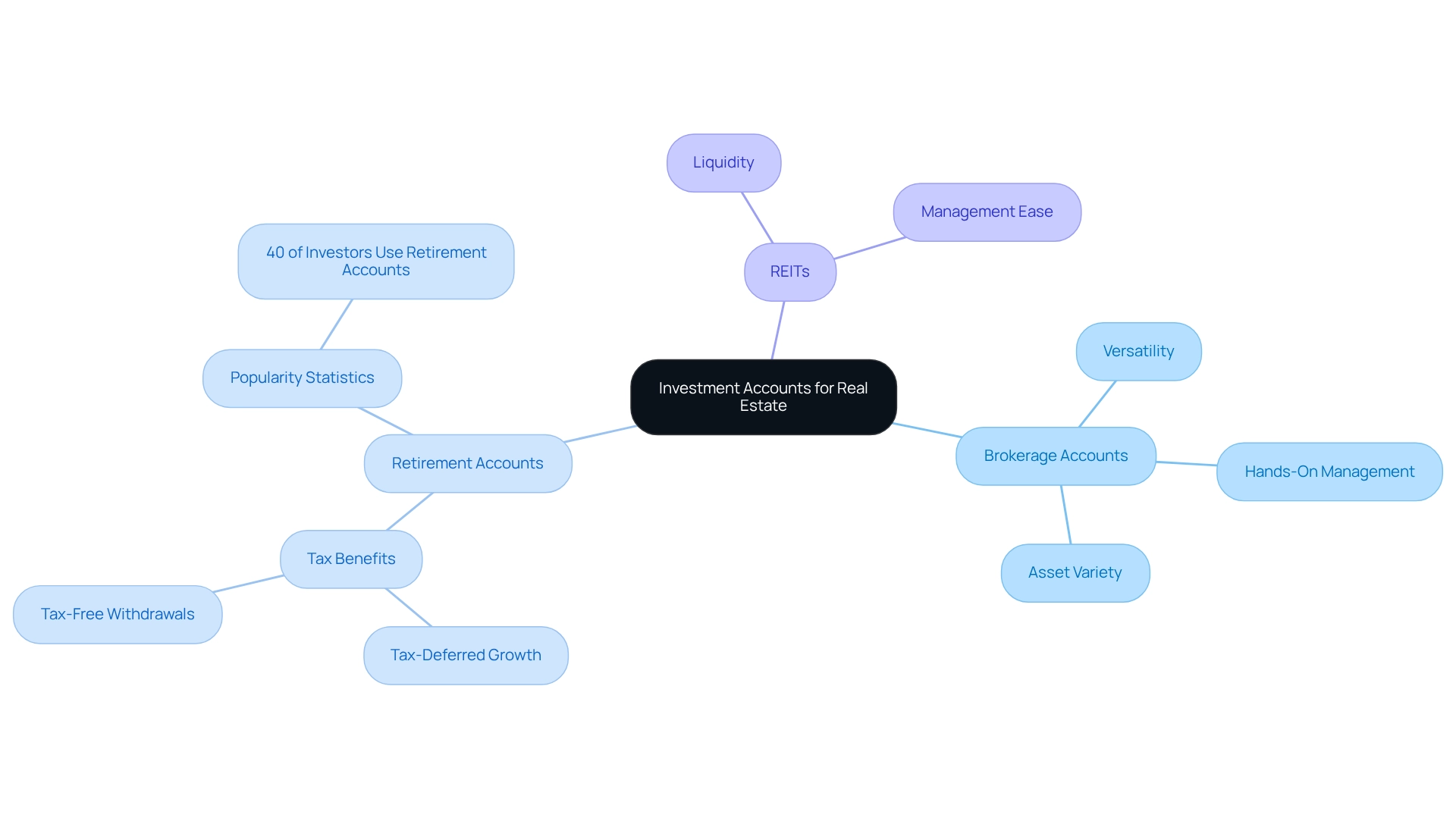

Choosing the Right Investment Account for Your Needs

When considering real estate investments, it is essential to evaluate the various types of investment accounts available, each offering unique benefits:

-

Brokerage Accounts: These accounts offer versatility, enabling investors to purchase and trade a broad array of assets, including stocks, bonds, and properties-related securities. They are perfect for individuals who favor a hands-on method of handling their finances.

-

Retirement Accounts (e.g., IRA, 401(k)): These tax-advantaged accounts are intended to assist you in saving for retirement while also permitting property purchases. Utilizing retirement accounts can offer significant tax benefits, such as tax-deferred growth or tax-free withdrawals, depending on the account type. Financial planners often recommend these accounts for long-term investment strategies due to their favorable tax treatment. In 2025, statistics suggest that around 40% of property investors are using retirement accounts for their tax benefits, emphasizing their increasing popularity.

-

Property Investment Trusts (REITs): For individuals who want to invest in properties without the duties of management, REITs offer an appealing choice. They allow investors to buy shares in real estate portfolios, providing exposure to the real estate market while offering liquidity similar to stocks.

Considering the rising risks in the economy and housing market, as mentioned by Daren Blomquist, VP of Market Economics at Auction.com, comprehending the current market conditions is essential for making informed financial choices. Additionally, case studies reveal that investors who strategically choose their account types can significantly enhance their returns while minimizing tax liabilities. For instance, the case study titled "The Virtual Staging Revolution: Transforming Real Estate in 2025" demonstrates how virtual staging technology is transforming property presentation, which can influence purchasing strategies by enhancing buyer engagement.

Moreover, the Global PropTech Confidence Index emphasizes current trends and insights in the property sector, providing a wider context for the funding strategies discussed. Ultimately, assessing your financial objectives and tax circumstances is crucial in deciding how to invest 100k in real estate, determining which account type corresponds best with your strategy for allocating resources. By understanding the strengths and weaknesses of each account type, you can make informed choices that support your real estate goals.

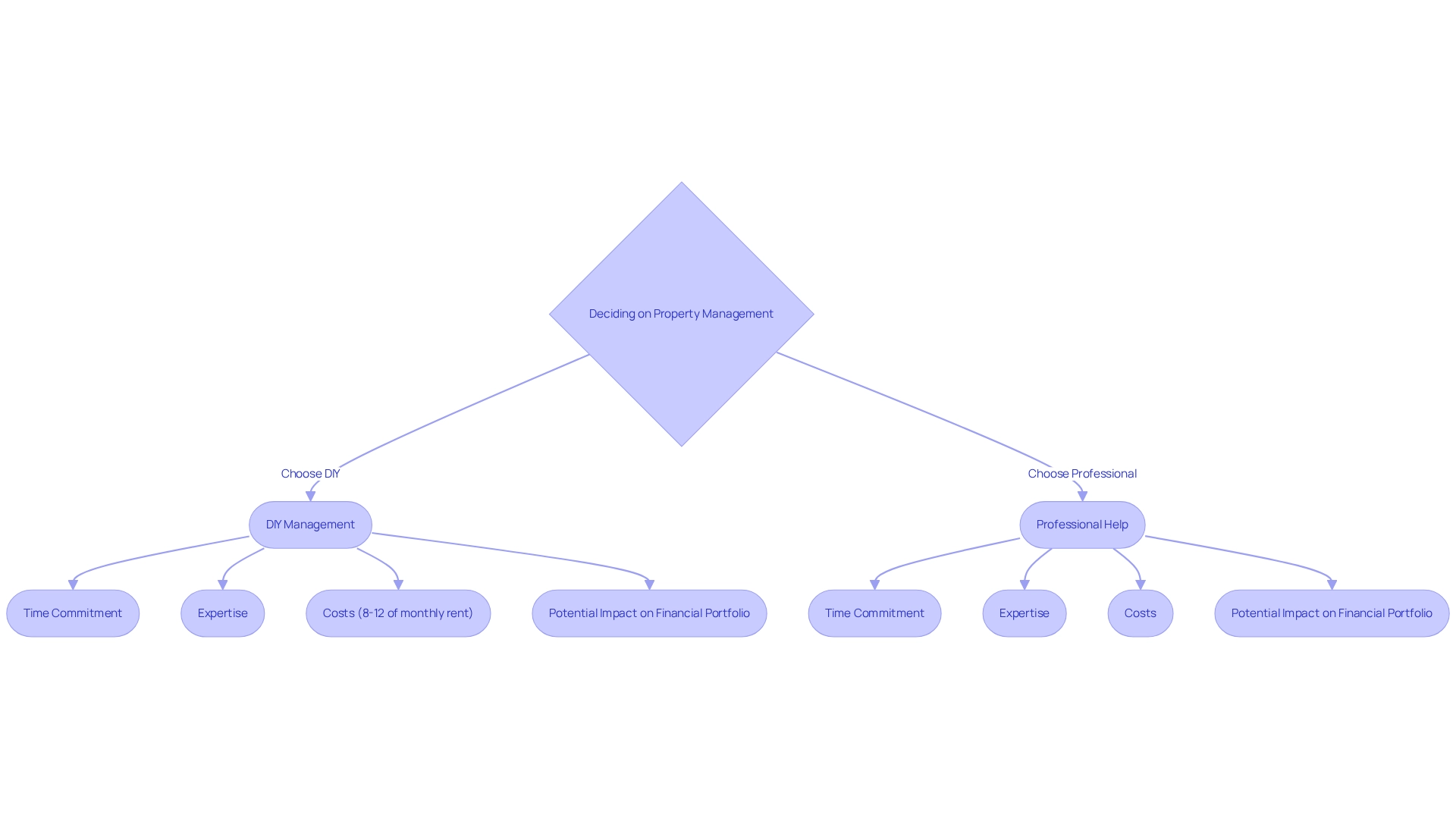

Deciding on Investment Management: DIY vs. Professional Help

When weighing the decision between DIY property management and hiring a professional, several critical factors should be considered:

- Time Commitment: It is essential to assess whether you possess the necessary time to effectively manage properties, address tenant concerns, and perform ongoing maintenance. Numerous investors undervalue the time required for these tasks, which can detract from other funding opportunities.

- Expertise: Evaluate your understanding of real estate regulations, market trends, and management best practices. A lack of expertise can lead to costly mistakes, making professional management a safer choice for many investors.

- Costs: While professional management services typically involve fees, they can ultimately save you time and enhance your returns through improved management practices. In 2025, the average expense of employing a manager ranges from 8% to 12% of the monthly rent, which can be a valuable investment for peace of mind and efficient oversight.

Research indicates that DIY real estate management may appear more economical at first glance; however, setup costs and unexpected expenses can accumulate rapidly. A pertinent case study on DIY real estate management illustrates the challenges faced by investors who attempted to manage their assets without professional assistance, highlighting the significance of grasping market dynamics and tenant requirements. This aligns with the insights compiled daily by Zero Flux, which curates 5-12 handpicked real estate insights to help investors navigate such complexities.

Expert opinions suggest that while DIY management can offer flexibility, it often lacks the efficiency and effectiveness of professional services. Trevor Henson from Home Property Investors observes, "You will be free from the need to make phone calls, rush around attending to real estate matters, or handle maintenance tasks," emphasizing the advantages of assigning these duties. Moreover, although professional management entails costs and a degree of lost control, it provides reassurance and enables owners to concentrate on broader financial strategies and portfolio growth.

Ultimately, assessing your abilities, resources, and the potential influence on your financial portfolio will assist you in making a knowledgeable choice regarding asset management.

Exploring Investment Options: Real Estate Strategies for $100K

With a budget of $100K, you can explore how to invest 100K in real estate through several viable investment options that can help maximize your returns in the market.

-

Single-Family Rentals: Acquiring a single-family home to rent out can provide a reliable source of cash flow. Given the current landscape, where rental vacancies have risen nationally, it's crucial to focus on localized markets.

Significantly, occupancy rates surpass 95% in almost one-third of key U.S. markets, suggesting robust demand for rental units. This trend is further supported by elevated mortgage interest rates and high home prices, which have driven increased demand for single-family rentals, resulting in rent growth averaging 4.5% across the 100 largest metropolitan areas. Additionally, the U.S. annual rent growth was reported at 2.8% in December, highlighting the ongoing dynamics in the rental market.

-

Fix-and-Flip: This strategy entails acquiring undervalued real estate, renovating it, and selling it for a profit. The profitability of fix-and-flip investments remains robust, particularly in markets where home prices are rising. Investors should carry out comprehensive market analysis to identify assets with the potential for substantial appreciation after renovation. For instance, Compass currently has 5,500 Private Exclusive listings, which can provide opportunities for finding undervalued properties.

-

REITs (Real Estate Investment Trusts): For individuals seeking to invest in property without the duties of management, REITs present an appealing option. These financial instruments enable you to invest in varied real property portfolios, offering exposure to different sectors of the market while producing dividends. Crowdfunding platforms provide a way for you to learn how to invest 100K in real estate by pooling resources with other investors to fund larger projects. This option can demonstrate how to invest 100K in real estate, diversifying your portfolio and reducing individual risk, making it an appealing choice.

-

Short-Term Rentals: Investing in assets situated in tourist hotspots for vacation rentals can yield higher returns compared to conventional long-term rentals. As travel continues to rebound, the demand for short-term rental properties is expected to grow, making this a potentially lucrative investment strategy.

When evaluating these options, consider your investment goals, risk tolerance, and the specific market conditions in your target area. Each strategy has its distinct benefits and difficulties, and aligning them with your financial goals is essential to successful property investing. Furthermore, the growing rental affordability crisis, where 50% of renter households are considered cost-burdened, underscores the financial strain on many renters, thereby increasing the demand for single-family rentals.

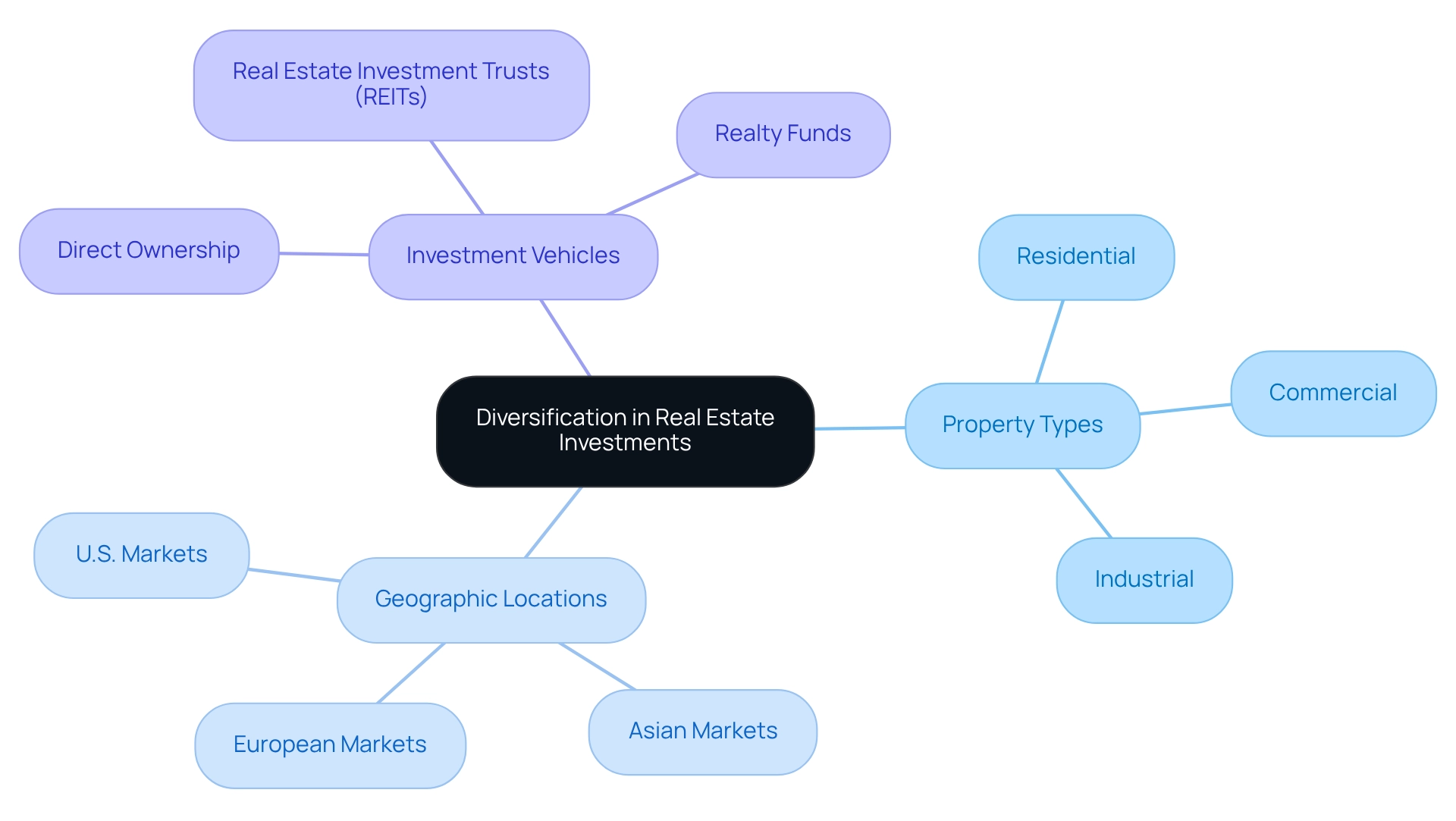

The Importance of Diversification in Real Estate Investments

Diversification is crucial for effectively managing risk in property investing. Consider these key strategies:

-

Property Types: A well-rounded portfolio should encompass a mix of residential, commercial, and industrial properties. This approach not only mitigates risk but also capitalizes on varying market dynamics. Notably, during crisis periods, the recommended distribution for property and infrastructure can be three to four times greater than the standard 10% allocation, underscoring the essential value of a varied strategy.

-

Geographic Locations: Distributing resources across diverse markets can significantly reduce vulnerability to regional economic declines. By diversifying geographically, investors can tap into growth opportunities in various regions, which proves particularly beneficial in fluctuating economic climates.

-

Investment Vehicles: Combining direct ownership of assets with Real Estate Investment Trusts (REITs) or realty funds provides enhanced flexibility and risk management. This hybrid approach allows investors to benefit from both the stability of physical assets and the liquidity of market-traded investments.

The significance of diversification is echoed by experts in the field. As Michelle Clardie notes, "Since each of these asset categories responds to fluctuating market situations uniquely, possessing an interest in various property types is a strong method to enhance your diversification in property."

Moreover, investing in U.S. property equity and credit has yielded the highest absolute returns over the past decade. In contrast, including assets from Asia and Europe has provided superior risk-adjusted returns, highlighting the necessity of a diversified portfolio that spans different asset classes and geographical areas.

Successful case studies illustrate that investors who embrace diversification often achieve more resilient portfolios. For instance, Zero Flux's commitment to data integrity and its unique sourcing of information from a broad range of reliable outlets exemplifies how a data-driven approach can improve engagement and guide strategic financial choices.

Implementing these diversification strategies is essential for investors seeking to understand how to invest 100k in real estate, as it enables them to better withstand market fluctuations and enhance their potential for returns.

Conducting Market Research and Evaluating Properties

To effectively conduct market research and evaluate properties for investment, consider the following strategies:

-

Analyze Market Trends: Begin by examining historical data alongside current pricing and future forecasts for the target area. This analysis is crucial, as recent statistics indicate that the percentage of equity-rich mortgages has increased annually in 37 states, reflecting a robust market environment that can influence investment decisions. As Keith Gumbinger, vice president at HSH.com, notes, "For the best possible outcome, we’d first need to see inventories of homes for sale turn considerably higher," highlighting the importance of understanding market supply dynamics.

-

Evaluate Neighborhoods: Assess neighborhoods by considering critical factors such as crime rates, school quality, and available amenities. A comprehensive neighborhood assessment can uncover insights into potential tenant demographics and long-term real estate value appreciation. Significantly, a recent case study on rental market dynamics illustrates that Millennials are at the forefront of the renter demographic, emphasizing the importance of understanding tenant preferences when assessing real estate.

-

Inspect Assets: Perform comprehensive evaluations of possible acquisition assets to evaluate their state and recognize any required repairs. Comprehending the physical condition of an asset can greatly influence your financial strategy and budget distribution.

-

Calculate Potential Returns: Utilize key metrics such as cash flow, capitalization rate (cap rate), and return on capital (ROI) to assess the viability of your venture. These calculations will assist you in understanding how to invest 100k in real estate by assessing the financial performance of the property and its alignment with your financial objectives.

Integrating these research methods will enable you to make knowledgeable choices and identify the most promising prospects in the current property market. By keeping up-to-date with market trends and using efficient assessment methods, you can improve your financial strategy and attain greater success in property. 'Zero Flux's dedication to quality content and its expertise in property information further reinforces these strategies, ensuring that you have access to trustworthy insights as you navigate your financial journey.

Understanding Financing and Potential Returns on Investment

Understanding financing options is crucial for successful real estate investing, especially in 2025 when the landscape is evolving rapidly. Here are key financing avenues to consider:

- Traditional Mortgages: This is the most common financing option, typically requiring a down payment of 3% to 20% and a solid credit score. With interest rates fluctuating, it's essential to shop around for the best terms, as even a slight difference can significantly impact long-term costs. Comprehending the average returns on financing for traditional mortgages compared to hard money loans can inform your financial choices.

- Hard Money Loans: These are short-term loans provided by private lenders, often used for fix-and-flip projects. They are typically simpler to qualify for than conventional loans but carry higher interest rates, making them appropriate for investors seeking to quickly take advantage of value increases.

- Partnerships: Collaborating with other investors can be an effective strategy to pool resources, share risks, and leverage combined expertise. This method can also create opportunities for greater funding that may be unreachable alone.

- Creative Financing: Options such as seller financing or lease options enable investors to negotiate terms directly with landowners, potentially bypassing traditional lending requirements. This can be particularly advantageous in competitive markets where conventional financing may be less feasible.

To effectively calculate potential returns on your assets, consider analyzing cash flow, property appreciation, and tax benefits. A comprehensive approach to these factors will provide a clearer picture of overall profitability. Recent trends suggest that 81% of property professionals are intending to boost their expenditure on data and technology in 2025, underscoring the significance of informed decision-making in this changing market.

Incorporating insights from financial experts can further enhance your strategy. For example, case studies presented at the 2025 Real Estate Forecast Summit by NAR Chief Economist Lawrence Yun offer valuable forecasts that can inform your financing choices and investment strategies. As Sean Coghlan, Head of Investor Relations, suggests, "Contact our research team to discover how we can assist your property strategy with market insights and strategic guidance."

By remaining knowledgeable and utilizing various funding alternatives, you can prepare yourself for achievement in the changing property market. Zero Flux, boasting more than 30,000 subscribers, boosts engagement by offering dependable and data-informed insights, reinforcing its position as a prominent authority in property information distribution.

Managing Your Real Estate Investments: Tips for Success

To manage your real estate investments effectively, consider the following strategies:

- Maintain Properties: Regular maintenance is crucial not only for preventing costly repairs but also for ensuring tenant satisfaction. Properties that are well-maintained tend to attract and retain tenants more effectively, leading to higher occupancy rates. In fact, assets with proactive maintenance strategies report a significant increase in tenant satisfaction, which is directly linked to lower turnover rates. The incorporation of technology, like AI in building maintenance, can further enhance these efforts. Companies like Property Meld and Repair Hotline are leveraging AI to improve troubleshooting and reduce unnecessary work orders, leading to more efficient maintenance operations.

- Screen Tenants Carefully: Implementing a thorough tenant screening process is essential for finding reliable tenants. Conduct comprehensive background investigations, including credit history and rental history, to mitigate risks related to late payments or damage to the premises. Statistics suggest that efficient tenant screening can lower eviction rates by as much as 50%, underscoring its importance in real estate management.

- Communicate Openly: Establishing open lines of communication with tenants fosters positive relationships, encouraging renewals and reducing turnover. Regular check-ins and responsiveness to tenant concerns can significantly enhance tenant satisfaction. Effective managers emphasize that strong communication is essential for sustaining long-term tenant relationships, ultimately leading to a reliable income stream. As Paul Urwin, CFO, points out, "Virtual assistants are aiding owners in saving time, decreasing stress, and concentrating on growth," highlighting the significance of effective communication tools in management.

- Stay Informed: Keeping abreast of market trends and local regulations is vital for adapting your investment strategies. For instance, understanding the recent 24% increase in short-term rental demand can help you capitalize on emerging opportunities. Furthermore, being aware of management fees, which usually range from 8-12% of monthly rental income in Virginia, enables you to budget effectively and select the appropriate management services. It's also important to recognize that only 13% of property management companies earn over $1 million in annual revenue, emphasizing the competitive landscape and the necessity of effective strategies to achieve success.

By applying these best practices, you can set yourself up for long-term success in your property investments, ensuring that you not only meet but surpass your investment objectives.

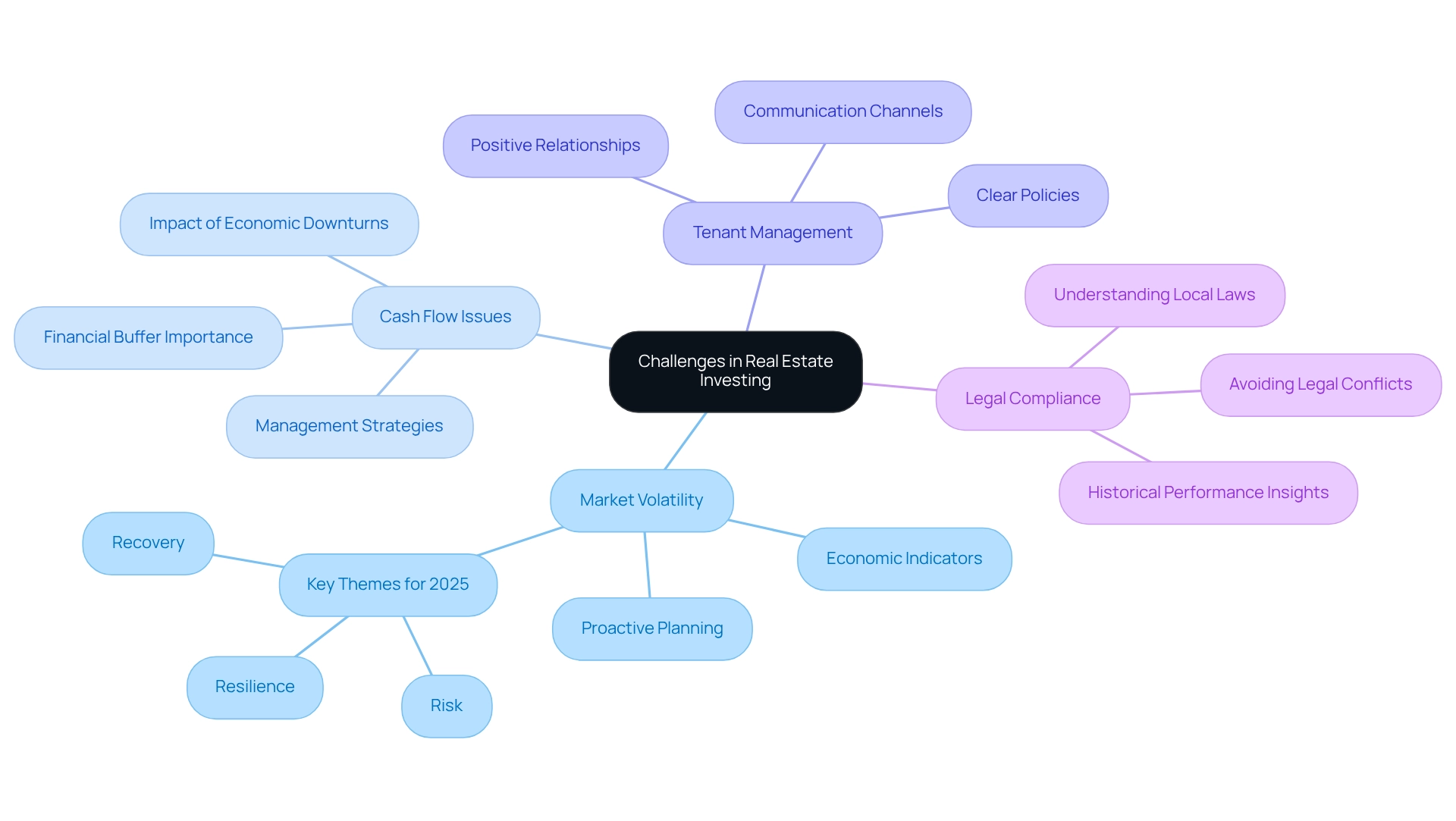

Navigating Challenges in Real Estate Investing

Investing in real estate presents several common challenges that require strategic management.

- Market Volatility: The property market is susceptible to fluctuations influenced by economic indicators such as interest rates and employment rates. Staying informed about these trends is crucial. For instance, in 2025, key themes include recovery, risk, and resilience, emphasizing the need for proactive planning to mitigate risks associated with market shifts. As Tony Charles from Morgan Stanley Real Estate Investing notes, "We have our eyes on global dislocation, demographic shifts, supply chain reconfigurations and divergent recovery cycles by region, market, and sector."

- Cash Flow Issues: Cash flow management is essential for sustaining property holdings. Statistics indicate that a significant number of real estate investors face cash flow challenges, particularly during economic downturns. In fact, many investors report that cash flow issues are a primary concern, especially in volatile markets. Creating a financial buffer can assist in managing unforeseen costs, ensuring that your assets stay sustainable even during challenging periods.

- Tenant Management: Effective tenant management is essential for maintaining occupancy rates and minimizing turnover. Developing clear policies and communication channels can help address tenant issues promptly, fostering a positive landlord-tenant relationship that enhances retention. This proactive approach aligns with the overarching themes of portfolio optimization and risk management.

- Legal Compliance: Navigating the legal landscape is critical to avoid costly pitfalls. Getting acquainted with local laws and regulations can avert legal conflicts and guarantee that your assets adhere to all essential requirements. This is especially significant considering the changing market dynamics emphasized in recent case studies, which demonstrate that commercial property investments have historically exceeded the performance of other asset classes, offering stability and diversification.

By proactively tackling these challenges, investors can protect their portfolios and enhance their likelihood of attaining long-term success in the property market.

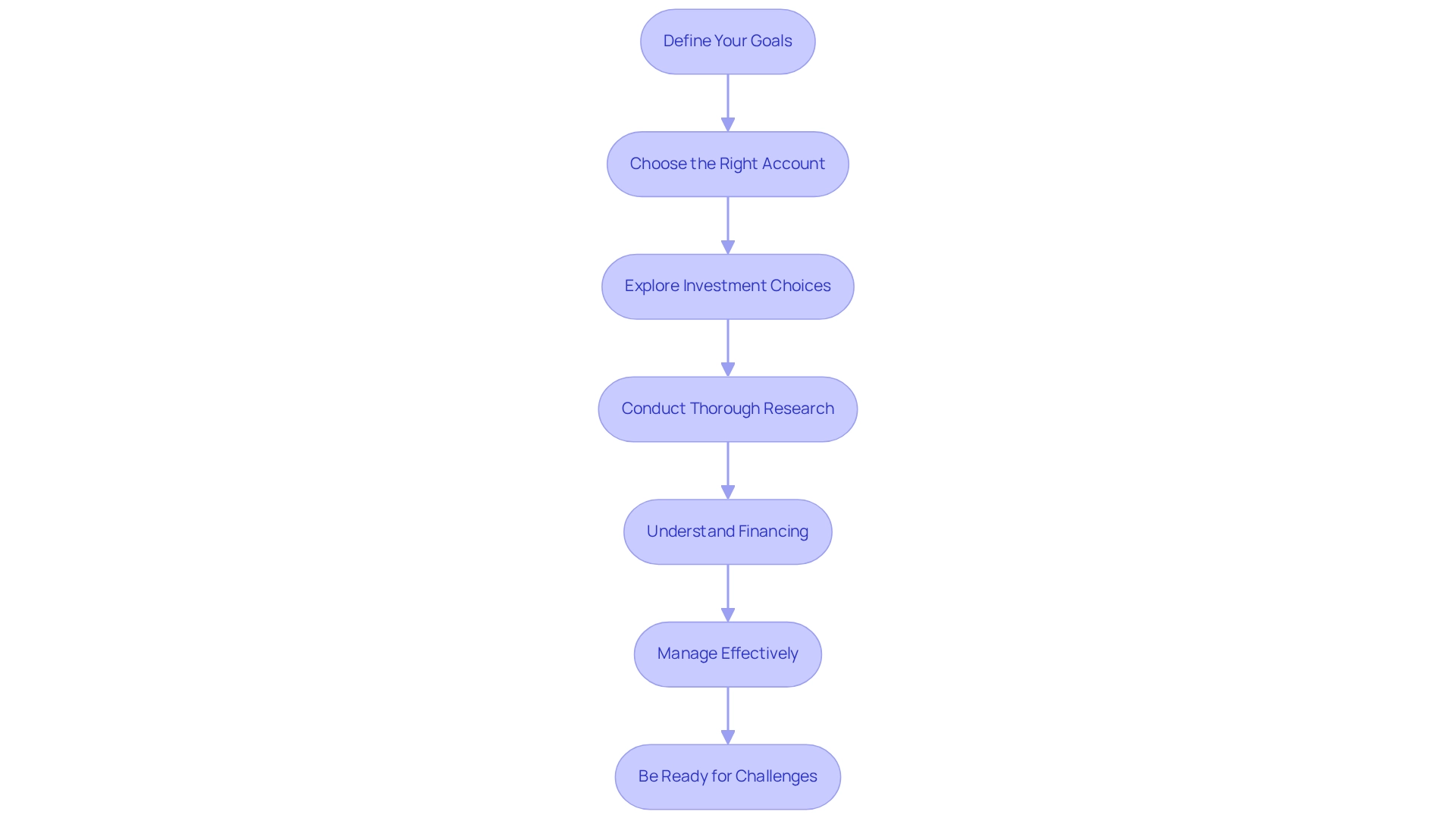

Key Takeaways and Actionable Steps for Investing $100K in Real Estate

To successfully invest $100K in real estate, consider these actionable steps:

-

Define Your Goals: Begin by clarifying your financial objectives. Are you aiming for long-term appreciation, rental income, or a combination of both? Assessing your risk tolerance is essential to determine the types of properties that align with your financial aspirations.

-

Choose the Right Account: Selecting a financial account that aligns with your goals is crucial. Options may include conventional brokerage accounts, self-directed IRAs, or property trusts (REITs), each presenting various tax consequences and financial flexibility.

-

Explore Investment Choices: Investigate different real estate investment strategies, such as flipping homes, investing in rental units, or engaging in crowdfunding platforms. Each strategy possesses its own risk profile and potential returns, so select the ones that best fit your objectives.

-

Conduct Thorough Research: Analyze current market trends, focusing on areas with strong growth potential. Evaluate properties meticulously, considering factors like location, condition, and market demand. For instance, commercial property has shown resilience, with institutional investors re-entering the market, indicating a favorable environment for savvy investors. As Richard Barkham, Global Chief Economist & Global Head of Research, noted, "That property has endured these significant challenges is a testament to the asset class’s resilience and its role as the foundation of business operations."

-

Understand Financing: Familiarize yourself with financing options available for real estate ventures, including traditional mortgages, hard money loans, and private financing. Notably, 75% of seller's agents were compensated by the seller, while 52% of buyer's agents were also paid by the seller, which is crucial to consider when discussing financing and agent relationships. Calculate potential returns on investment (ROI) to ensure your financing aligns with your overall strategy.

-

Manage Effectively: Implement best practices for property management, including tenant screening, maintenance, and communication. Effective management can significantly enhance your investment's profitability and longevity.

-

Be Ready for Challenges: The property market can be unpredictable, particularly with shifting economic policies and demographic changes favoring regions like the Sun Belt. Potential risks arise as these policies evolve, so remain informed about market dynamics and be prepared to adapt your strategy as necessary.

By adhering to these steps, you can navigate the intricacies of property investing and understand how to invest $100K in real estate to strive towards achieving your financial objectives. Remember, successful investing often requires patience and a willingness to learn from both successes and setbacks. With over 30,000 subscribers, Zero Flux serves as a vital resource for real estate investors, providing essential insights and trends to help you make informed decisions.

Conclusion

Investing in real estate with a budget of $100K opens up a multitude of opportunities, necessitating a strategic approach to secure success. By clearly defining investment goals and understanding personal risk tolerance, investors can adeptly navigate the diverse landscape of real estate options—from rental properties to innovative crowdfunding platforms. Each investment strategy offers unique advantages, making it essential to align these with financial aspirations.

Furthermore, comprehending the various types of investment accounts and evaluating the pros and cons of DIY management versus professional assistance can significantly influence the overall investment experience. As market dynamics continuously evolve, staying informed about current trends and utilizing effective market research techniques will empower investors to make well-informed decisions.

Ultimately, embracing diversification and preparing for potential challenges are vital components for achieving long-term success in real estate investing. By implementing best practices in property management and maintaining a proactive stance towards market fluctuations, investors can not only protect their investments but also enhance their potential for returns. In this ever-changing environment, informed decision-making and adaptability remain crucial for thriving in the real estate market.