Overview

Investing in real estate without the burden of purchasing property can be effectively accomplished through strategies such as:

- Real Estate Investment Trusts (REITs)

- Crowdfunding platforms

- Partnerships

These methods empower individuals to engage in the market while sidestepping the responsibilities associated with direct property ownership. The rising popularity of these avenues is underscored by compelling statistics: approximately 87% of investors are now utilizing REITs, alongside a remarkable 30% increase in participation in crowdfunding initiatives. This data illustrates a significant shift toward alternative investment strategies within the real estate sector, prompting investors to reconsider their approaches.

Introduction

In the dynamic realm of real estate investing, opportunities abound for those seeking to diversify their portfolios without the burdens associated with traditional property ownership. From Real Estate Investment Trusts (REITs) to innovative crowdfunding platforms, aspiring investors can explore a multitude of strategies that democratize access to the market.

As trends shift towards alternative investment methods, understanding these options becomes essential for minimizing risk while maximizing potential returns. With the right insights and a strategic approach, individuals can effectively engage in the real estate landscape, harnessing the power of collaboration and technology to achieve their financial goals.

Understanding Real Estate Investment Without Ownership

Investing in real estate without purchasing property presents a range of strategic opportunities that allow individuals to engage in the industry while sidestepping the responsibilities of property management. Key methods include:

- Real Estate Investment Trusts (REITs): These companies own, operate, or finance income-producing real estate across various property sectors. By acquiring shares in a REIT, investors can access property markets without the need to purchase physical assets. Notably, approximately 87% of investors are now leveraging REITs as a viable alternative strategy.

- Crowdfunding Platforms: Property crowdfunding enables multiple investors to pool their resources to finance property projects. This approach democratizes access to property financing, allowing individuals to contribute relatively modest sums of money. Recent trends indicate that crowdfunding has experienced a significant uptick, with a 30% increase in participation over the past year.

- Partnerships and Syndications: Establishing alliances with other investors allows individuals to share the financial burden and responsibilities associated with real estate ventures. This collaborative strategy not only mitigates risk but also enables greater funding for more lucrative properties.

Understanding these options is crucial for diversifying a financial portfolio while minimizing risk and management responsibilities. A recent monthly survey distributed to over 50,000 property professionals revealed that many are utilizing social media platforms such as Facebook and LinkedIn to engage with potential investors, highlighting the importance of networking in this sector. In fact, 77% of REALTORS® utilize these platforms for professional purposes, underscoring the significance of social media in contemporary real estate.

Moreover, the current landscape indicates that many investors are gravitating towards alternative approaches, with 55% exploring options beyond traditional property ownership. This shift is driven by a desire for flexibility and reduced management duties, particularly in light of recent economic stabilization and declining mortgage rates, which have rendered alternative opportunities more attractive.

Insights from the case study titled 'Future Outlook: Balancing Challenges and Opportunities' illustrate that the property sector faces a blend of challenges and opportunities, with potential improvements in affordability and appeal for funding arising from these conditions. Furthermore, the National Association of REALTORS® identifies areas expected to thrive each year based on key trends and metrics, providing valuable context for investors.

In summary, effective strategies for investing in real estate without acquiring property encompass leveraging REITs, participating in crowdfunding, and forming partnerships. These techniques not only provide insight into the property market but also empower investors to navigate the complexities of property funding with enhanced comfort and reduced risk. Additionally, demographic trends and economic conditions highlighted in 'The State of the Nation's Housing' report emphasize the importance of staying informed about the evolving landscape of property ventures.

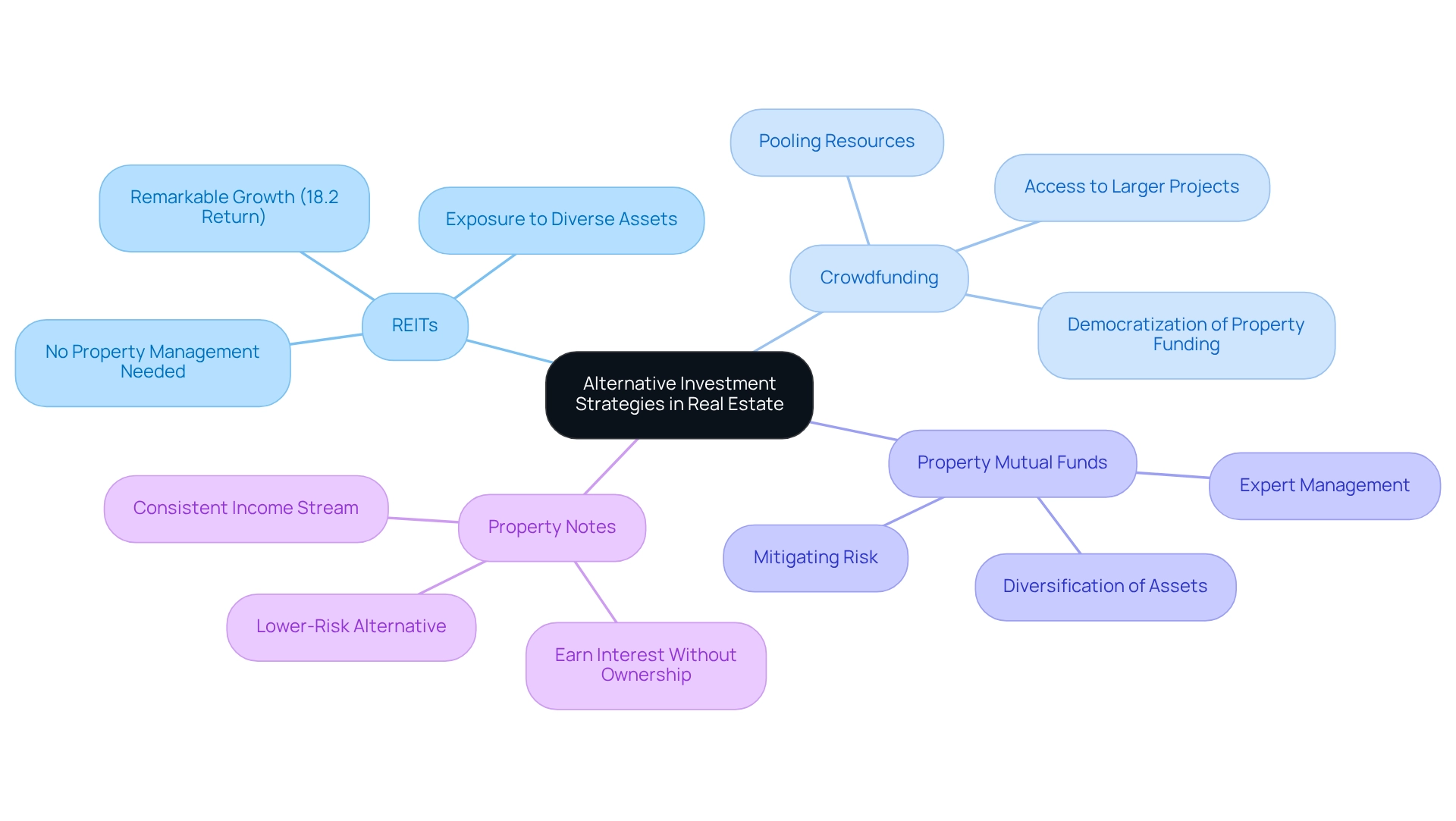

Exploring Alternative Investment Strategies

Investigating diverse investment approaches in property can unveil opportunities for investors eager to understand how to engage in real estate without the need to purchase property. Below are several key strategies:

- Real Estate Investment Trusts (REITs): REITs represent companies that own, operate, or finance income-generating real estate across various sectors. By acquiring shares in these companies, investors can gain exposure to a wide array of real estate assets, benefiting from rental income and property appreciation without the burdens of property management. Notably, in 2025, the growth of REITs has been remarkable, with the Developed Extended Index returning 18.2% since April 2024, underscoring their potential as a lucrative investment option. As John Barwick notes, "Asia is progressing more gradually towards specialization as diversified strategies account for 66% of regional capitalization in the Developed Index," indicating a trend towards diversification within the REIT sector.

- Crowdfunding: This innovative method allows multiple investors to pool their resources to finance property projects, making it an accessible option for those with limited capital. Crowdfunding platforms have gained significant traction, enabling investors to engage in larger projects that would typically necessitate substantial financial commitment. This democratization of property funding is revolutionizing the landscape, allowing more individuals to participate in the sector. The expansion of crowdfunding in property investments stands as a crucial aspect of alternative strategies that investors should consider.

- Property Mutual Funds: These funds invest in a diverse array of property assets, granting investors access to the property market without the requirement to manage assets directly. By investing in mutual funds, individuals can benefit from expert management and diversification, mitigating risk while still participating in property growth.

- Property Notes: Investors have the option to purchase notes backed by property, allowing them to earn interest without owning the asset itself. This strategy can provide a consistent income stream and is often regarded as a lower-risk alternative compared to direct property ownership.

Each of these strategies exemplifies ways to invest in real estate without acquiring property, presenting unique advantages and risks. It is essential for investors to conduct thorough research and reflect on their financial objectives before proceeding. Analysts remain divided on whether current valuations will support or hinder multiple expansions and relative valuations, a significant consideration for prospective investors. As the property sector continues to evolve, understanding these alternative investment paths will be vital for navigating the complexities of property investing in 2025.

For further insights and data-driven analysis, the Zero Flux newsletter serves as a reliable resource, curating essential property trends and insights from over 100 diverse sources.

Investing Through Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) represent specialized firms that own, manage, or fund income-producing real estate across various sectors, making them an appealing choice for investors interested in real estate investment without the need to purchase property. Here are some key advantages of investing in REITs:

- Liquidity: Publicly traded REITs provide the flexibility to be bought and sold on stock exchanges, offering investors liquidity comparable to that of stocks. This feature is particularly advantageous in unstable markets, enabling swift adjustments to portfolios.

- Dividends: A standout aspect of REITs is their obligation to distribute at least 90% of their taxable income to shareholders. This policy results in a reliable stream of income, making REITs an attractive option for those seeking regular cash flow. In 2025, the average dividend yield for REITs has been reported at approximately 4.5%, which is competitive with other financial options.

- Diversification: Investing in a REIT allows individuals to broaden their portfolios without the complexities of managing multiple properties. This diversification can help mitigate risks associated with direct real estate investments, as REITs typically hold a variety of properties across different sectors.

To invest in a REIT, begin by opening a brokerage account. You can purchase shares directly through the stock exchange or consider investing in a REIT mutual fund or exchange-traded fund (ETF) for broader exposure.

Recent performance statistics show that while the FTSE Nareit All Equity REITs Index experienced a decline of 2.4% in March 2025, it has demonstrated resilience with a year-to-date gain of 2.9%. This performance has outpaced broader financial indices, which faced declines of 5.8% and 5.9% during the same period. Additionally, the FTSE NAREIT Mortgage REITs Index fell 4.4% in March 2025, underscoring the sector's volatility.

Such data highlights the stability that REITs can provide, particularly in uncertain economic climates.

Moreover, case studies illustrate successful REIT investments, showcasing their potential for long-term growth. For instance, despite recent market fluctuations, REITs have maintained a total return of 6.5% year-to-date, demonstrating their ability to deliver reliable returns even amid broader market challenges. As John Barwick observes, "Their comparatively low correlation with other assets also makes them an excellent portfolio diversifier that can help reduce overall portfolio risk and increase returns."

In summary, REITs present an attractive opportunity for investors interested in real estate investment without the complexities of property ownership, while enjoying the benefits of liquidity, consistent income, and diversification.

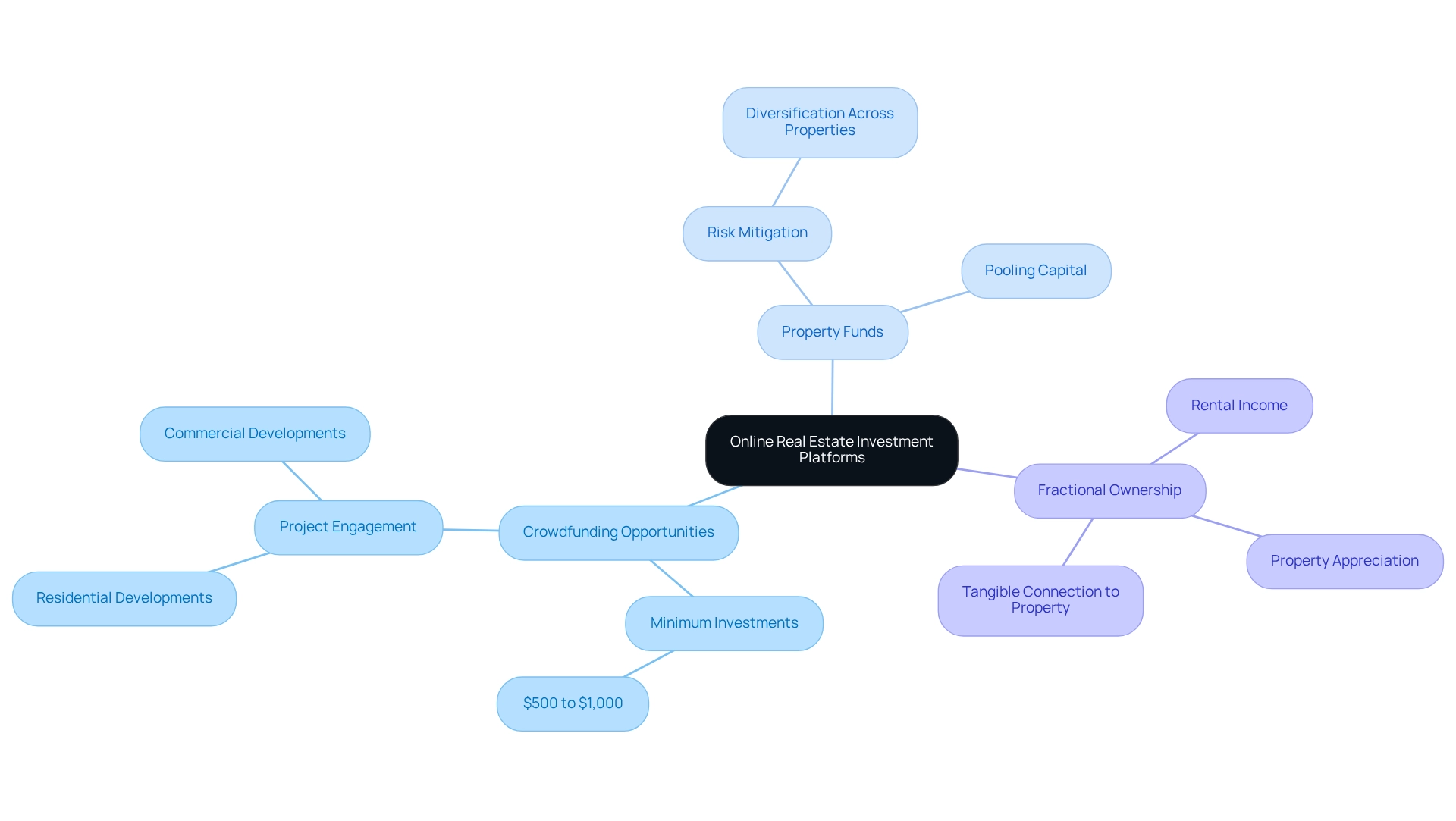

Utilizing Online Real Estate Investment Platforms

Online property funding platforms have revolutionized the way individuals invest in real estate without the need for direct ownership. These platforms present a diverse array of investment options, catering to various risk appetites and financial goals.

- Crowdfunding Opportunities: Investors can engage in specific projects, such as residential or commercial developments, often with lower minimum investments. This accessibility democratizes real estate investment, enabling individuals to contribute as little as $500 to $1,000, depending on the platform.

- Property Funds: Certain platforms guide investors on how to invest in real estate without purchasing property by allowing contributions to funds that pool capital for a diverse range of property assets. This strategy mitigates risk by distributing investments across multiple properties, making it particularly appealing in fluctuating markets.

Fractional ownership emerges as an innovative model, teaching investors how to invest in real estate without outright purchases. It enables individuals to own a share of a property, entitling them to a portion of the rental income and appreciation. This approach fosters a tangible connection to property holdings while alleviating the burdens associated with full ownership.

Among the most prominent platforms are Fundrise, RealtyMogul, and CrowdStreet, each offering unique funding opportunities tailored to different investor profiles. As of 2025, the growth of online property investment platforms has been remarkable, with a reported increase in participation driven by the convenience and accessibility they provide. Notably, 96% of purchasers initiate their home search online, underscoring the significance of digital platforms in the property market.

In conjunction with these platforms, successful crowdfunding property projects have surfaced, showcasing the potential for substantial returns. For instance, projects leveraging technology—such as virtual tours and AI tools for remote property viewing—are gaining traction. As Sharad Mehta observes, "The adoption of virtual tours, AI tools, and AR for remote property viewing is expected to grow, making these technologies essential for staying competitive."

This trend aligns with the innovative strategies that online platforms are implementing.

Furthermore, states like Texas, California, Florida, Ohio, and North Carolina exhibit the highest property activity, rendering these online platforms particularly significant in these regions. As the sector evolves, expert insights suggest that these digital platforms will continue to play a crucial role in shaping the future of property funding. Zero Flux, with its dedication to quality content and data-driven insights, serves as an invaluable resource for industry professionals and enthusiasts navigating these opportunities.

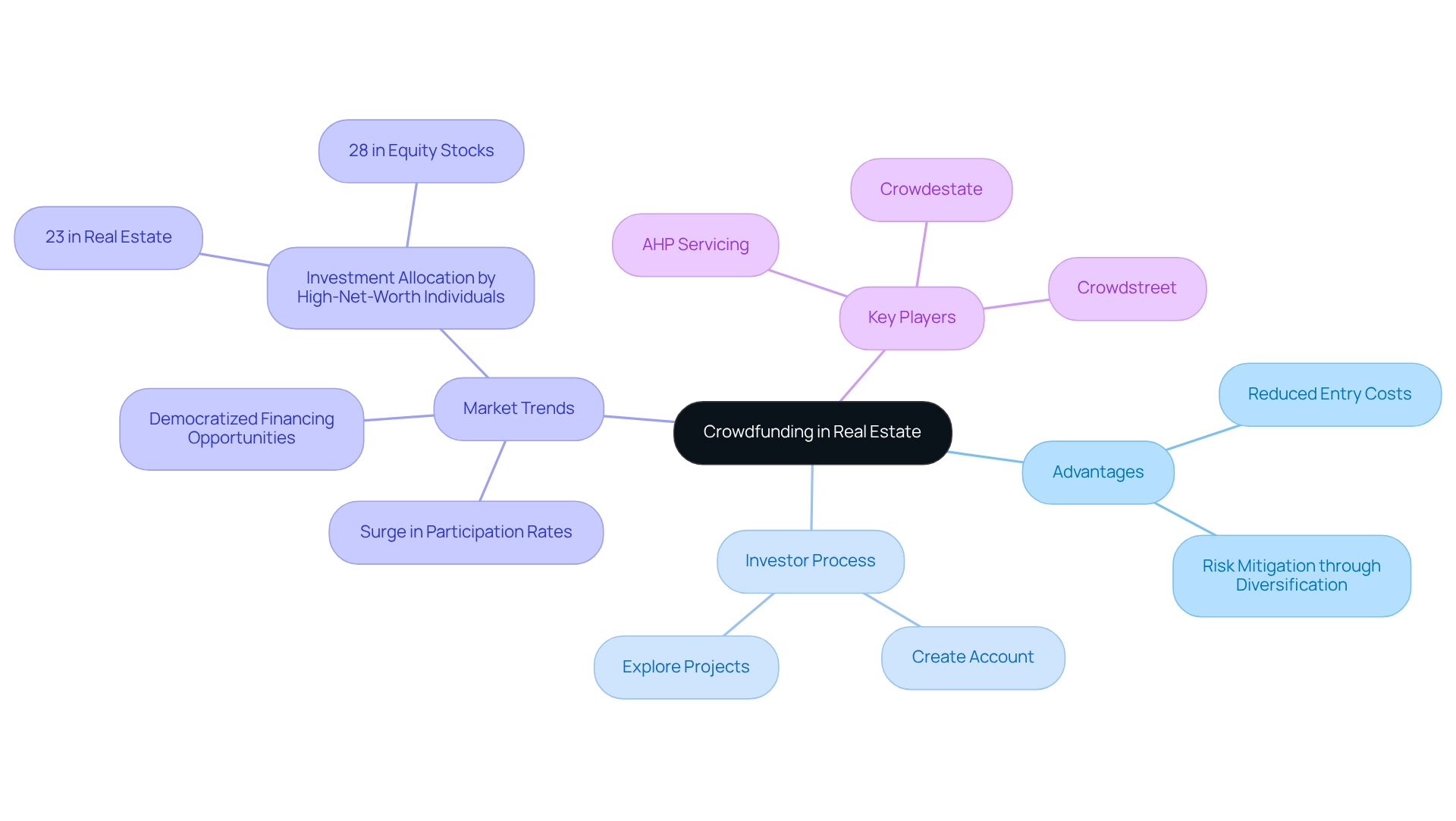

Crowdfunding: Pooling Resources for Real Estate Projects

Property crowdfunding presents an appealing opportunity for investors to explore real estate investment without the need to purchase property. By pooling resources, individuals can fund a variety of projects, including residential developments, commercial assets, and renovations. This innovative funding model offers several key advantages:

- Reduced Entry Costs: Unlike traditional property financing, which often requires substantial capital, crowdfunding allows investors to participate with smaller amounts, making it accessible to a broader audience. This approach enables individuals to engage in larger, potentially more lucrative projects that might otherwise be out of reach. Consequently, it opens doors to opportunities previously reserved for affluent investors.

Investors can effectively learn how to invest in real estate without buying property by mitigating risk through diversification. By allocating their funds across multiple crowdfunding projects, they can spread their investments among various properties and markets. Typically, those looking to understand this investment avenue begin by creating an account on a crowdfunding platform. From there, they can explore a range of available projects, assessing each opportunity in light of their financial goals and risk tolerance.

As we look towards 2025, the property crowdfunding market is poised for continued growth, showcasing significant participation from individual investors. This trend indicates a shift toward more democratized financing opportunities. Statistics reveal that participation rates in property crowdfunding have surged, with many investors recognizing the benefits of resource pooling for property ventures. Successful financiers often emphasize the importance of collaboration in achieving financial goals, as collective resources can enhance project success. For instance, JLL reports that high-net-worth individuals in India allocate approximately 23% of their total investable funds to property, slightly below the 28% allocated to equity stocks.

Furthermore, case studies of successful crowdfunding initiatives illustrate the potential for substantial returns and community impact, underscoring the importance of this investment strategy. Key players in the property crowdfunding sector, such as AHP Servicing, Crowdestate, and Crowdstreet, play a vital role in shaping the landscape and offer promising collaboration opportunities for investors. As the market evolves, resources like the CrowdCrux Podcast and Real Estate Crowdfunding 101 provide invaluable insights for those seeking to understand how to invest in real estate without buying property.

Investing Through Real Estate Limited Partnerships

Property limited partnerships (RELPs) represent a strategic funding option that illustrates how to invest in real estate without the need to purchase property. This model allows individuals to participate in property projects while avoiding the burdens of direct ownership. Within a RELP, general partners oversee the investment, whereas limited partners provide capital and enjoy several essential benefits:

- Passive Income: Limited partners can generate income without the demands of daily management, making it an appealing choice for those looking to earn revenue with minimal involvement.

- Risk Mitigation: A significant advantage of RELPs is the limited liability for investors. Limited partners are only responsible for their invested amount, safeguarding their personal assets against potential losses.

- Access to Expertise: Investing in a RELP grants individuals access to the knowledge and experience of seasoned real estate professionals. This expertise can enhance financial decisions and improve overall returns.

To effectively engage with RELPs, individuals typically must meet specific financial criteria, which may include a minimum contribution threshold. Furthermore, investors should be prepared for a prolonged financial horizon, as projects often require time to realize their full potential.

Recent trends reveal an increasing interest in how to invest in real estate without buying property through RELPs, particularly as investors seek diversified portfolios. For instance, statistics show that returns from property limited partnerships can be competitive, with many partnerships achieving annual returns that exceed traditional financial avenues. Additionally, listed properties provide access to high-quality assets with substantial growth potential, further enhancing the appeal of RELPs as an investment strategy.

Darrin Friedrich, a Tax Partner in Aprio’s Real Estate and Construction Practice, emphasizes that investors should comprehend how to invest in real estate without purchasing property, particularly by considering the unique advantages of RELPs in the current market landscape, where diversification is crucial for managing risk.

A case study titled "Strong Foundations: The Case for Listed Properties" underscores the distinctive benefits of investing in listed properties, highlighting their access to high-quality assets with robust growth potential. This reinforces the value of RELPs as an efficient and liquid asset option, especially for those exploring ways to invest in real estate without direct ownership to diversify their portfolios.

As the property market evolves in 2025, expert insights suggest that RELPs will continue to be a viable choice for investors interested in how to invest in real estate without buying property while pursuing passive income and risk reduction. Financial advisors increasingly recommend these partnerships as a means to achieve stable returns while exploring avenues for investment without direct property acquisition, leveraging the expertise of industry professionals. By grasping the mechanics and benefits of RELPs, investors can make informed decisions that align with their financial objectives.

Moreover, with retail properties currently experiencing the lowest vacancy rate among commercial real estate sectors at 4.1%, the viability of real estate investments remains robust, further bolstering the case for RELPs.

Flipping Houses: A Quick Turnaround Investment Strategy

Flipping houses is a strategic approach that entails acquiring properties at a lower price, renovating them, and swiftly selling them for profit. To navigate this process successfully, several key considerations must be addressed:

- Market Research: A comprehensive understanding of local market trends is essential for identifying properties with strong appreciation potential. In 2025, the house flipping industry is influenced by various factors, including demographic shifts and economic conditions. Investors should analyze recent sales data and neighborhood developments to pinpoint lucrative opportunities. Notably, the increase in U.S. foreclosure activity reported in February 2025 may present additional opportunities for savvy investors.

- Budgeting: Accurate estimation of renovation costs and potential resale value is critical to ensuring profitability. Investors should prepare for unexpected expenses, as renovations can often exceed initial projections. A well-structured budget helps mitigate risks and enhances the likelihood of a successful flip.

- Timing: The speed at which a property is flipped can significantly impact profitability. In 2025, the typical duration required to renovate properties has been stated to be approximately 6 to 12 months, depending on the level of renovations and economic conditions. Efficient project management and a streamlined renovation process are vital for maximizing returns.

While flipping houses can be a lucrative venture, it is not without its risks. Unforeseen renovation expenses and price variations can negatively influence resale value. Based on recent findings, the typical stock exchange return of the S&P 500 is approximately 10% each year, which emphasizes the competitive characteristics of property investments.

Rob Barber, CEO of ATTOM, notes, "Home flippers just can’t seem to shake the doldrums. After more than a year when things were getting better, they turned notably worse again over the Summer." This highlights the significance of evaluating possible benefits against these risks, making informed choices based on thorough research and strategic planning.

Successful case studies demonstrate that with the right approach, flipping houses can yield significant profits. Zero Flux, a data-focused newsletter, acts as an essential tool for investors, assisting them in navigating the intricacies of the property sector through curated insights. However, it is essential to stay alert and flexible to evolving industry dynamics to succeed in this competitive environment.

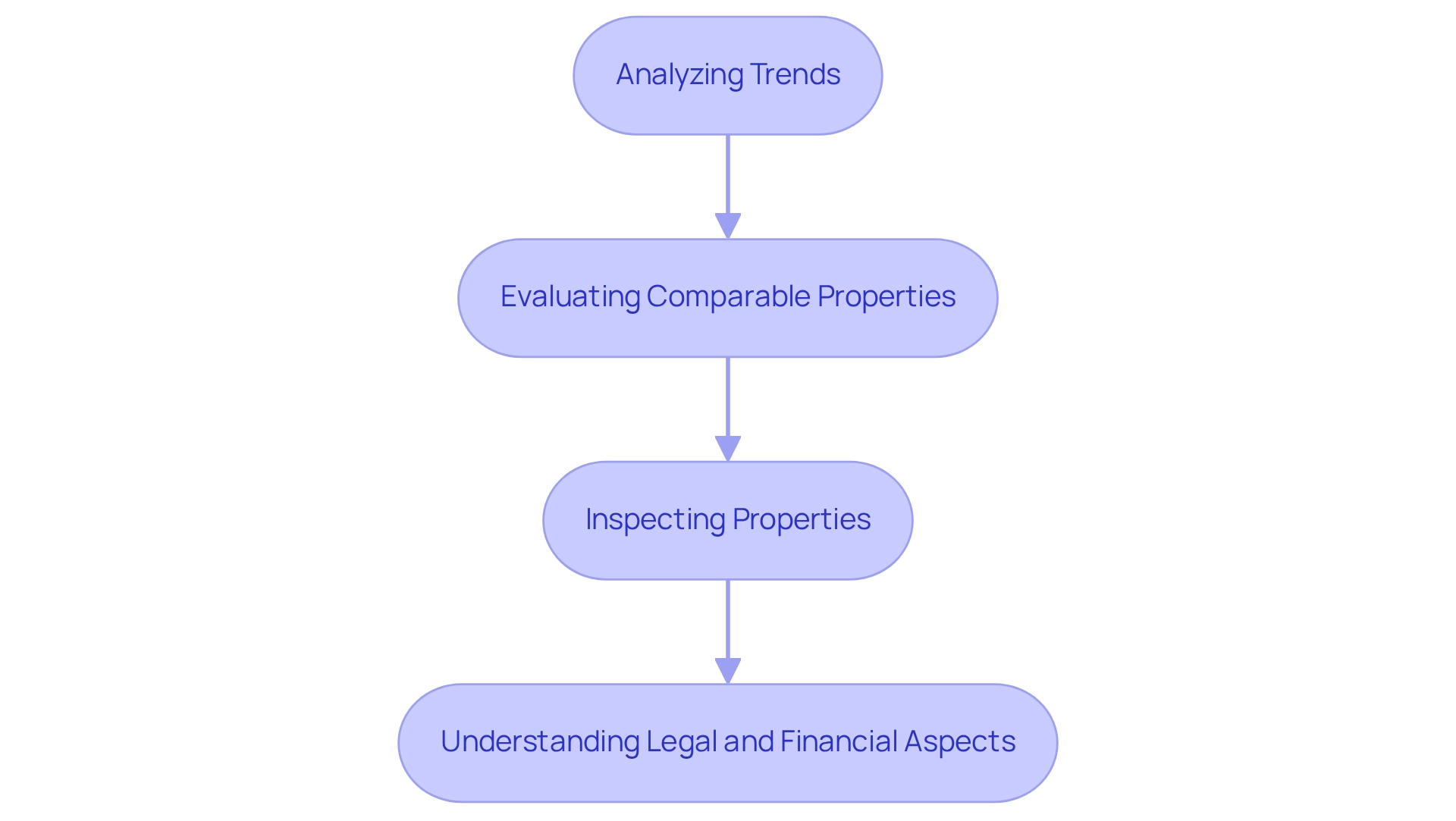

Conducting Market Research and Due Diligence

Performing comprehensive industry analysis and due diligence is essential for successful property investing. Here are essential steps to guide you:

- Analyzing Trends: Begin by examining historical data alongside current conditions and future forecasts. This comprehensive analysis aids in identifying potential financial opportunities and understanding the broader economic landscape affecting real estate.

- Evaluating Comparable Properties: Assess similar properties in the area to gauge pricing and demand. This comparative analysis not only guides your financial strategy but also emphasizes economic dynamics that could impact property values.

- Inspecting Properties: Conduct physical inspections to uncover any issues that may affect value or necessitate repairs. Recent trends indicate that thorough inspections are increasingly vital, as buyers are more discerning and informed than ever. In 2025, current trends in property inspections highlight the necessity for thorough evaluations to ensure financial viability.

- Understanding Legal and Financial Aspects: Familiarize yourself with zoning laws, property taxes, and financing options. A strong understanding of these components can avert unforeseen difficulties and improve your financial strategy.

In 2025, the significance of research in real estate funding cannot be emphasized enough. Statistics indicate that efficient commercial research greatly enhances the probability of successful financial ventures. For instance, a recent REALTORS® Confidence Index report revealed that understanding buyer demographics and motivations is crucial for tailoring investment approaches.

This report, released on March 20, 2025, offers valuable insights into consumer behavior, aiding REALTORS® in comprehending trends and buyer demographics.

Additionally, creative methods in research are arising, such as utilizing data analytics and digital tools to acquire insights into consumer behavior and trends. The median price per click in Google Ads is $2.69 for search and $0.63 for display ads, highlighting the costs associated with digital marketing strategies that can improve research efforts. Sai Suman Revankar observes that video content is highly effective, with 90% of marketers recognizing its worth in generating leads, making it a potent tool in property marketing.

As Nic DeAngelo from Saint Investment Group highlights, staying ahead of industry changes is crucial for making informed financial decisions. By adhering to these steps and employing contemporary research methods, you can improve your due diligence process, ultimately resulting in more informed and successful property acquisitions.

Effective Management of Real Estate Investments

Efficiently overseeing real estate investments necessitates a strategic method that incorporates several crucial practices:

- Regular Monitoring: Consistently observing economic conditions, property performance, and key financial metrics is vital. This vigilance empowers investors to make informed choices and adapt to evolving economic dynamics. In 2025, the property management industry is experiencing transformative changes, with increased adoption of AI and automation tools that enhance monitoring capabilities. These technologies facilitate real-time data analysis, enabling investors to respond swiftly to market fluctuations.

- Budgeting and Financial Planning: Establishing a comprehensive budget that accounts for all expenses, including maintenance, taxes, and potential renovations, is essential. Effective financial planning assists investors in forecasting expenses and allocating resources efficiently, ensuring sustainable growth. Engaging with digital tools can streamline this process, as highlighted by Claire Mulligan's insights on the reliance on social media for brand research and connection in 2023.

- Engaging Professionals: Leveraging the expertise of property managers or real estate advisors can save time and enhance financial performance. In a landscape where 61.5% of individuals believe institutional landlords will significantly influence purchasing abilities, expert advice becomes essential for managing complexities, ensuring that investors remain well-informed about trends and strategies.

- Diversification: Distributing resources across different property types and geographic areas mitigates risk and enhances overall portfolio performance. This strategy allows investors to capitalize on various market segments. As the industry evolves, staying informed about current trends in property management services utilization is crucial for making wise financial choices. Notably, the property management team consists of 59.5% women and 36.5% men, showcasing varied viewpoints that can influence financial strategies.

In 2025, efficient management practices are increasingly recognized as essential to successful real estate ventures. Statistics indicate that a well-managed portfolio can yield significantly higher returns, underscoring the importance of adopting best practices in investment management. The Zero Flux Newsletter exemplifies how a data-driven approach can assist investors in navigating complexities, reinforcing the significance of effective management practices.

By concentrating on these strategies, investors can equip themselves for success in a competitive environment.

Key Takeaways and Next Steps for Aspiring Investors

Learning how to invest in real estate without purchasing property opens up a range of opportunities for diversification and income generation. Here are some key takeaways for aspiring investors:

- Explore Diverse Investment Strategies: Consider options such as Real Estate Investment Trusts (REITs), crowdfunding platforms, and partnerships. These avenues allow investors to participate in property markets without the need for substantial capital.

- Conduct Thorough Market Research: Engaging in diligent market research is essential. Understanding current trends, such as the fact that 56% of tenants prioritize commute durations when selecting rental properties, can inform financial decisions and enhance potential returns. This statistic highlights the critical role of location in investment strategies.

- Leverage Real Estate Agents: Given that 88% of homebuyers rely on a real estate agent for information, aspiring investors should consider utilizing agent expertise. Agents are instrumental in facilitating transactions and can provide valuable insights into economic dynamics.

- Manage Investments Effectively: To maximize returns and minimize risks, implementing sound management practices is vital. This includes monitoring market conditions and adjusting strategies as necessary.

Next steps for aspiring investors involve:

- Identifying Financial Objectives: Clearly define your goals for your assets, whether it’s generating passive income or building long-term wealth.

- Researching Available Options: Explore various financial instruments and platforms that align with your objectives and risk tolerance.

- Starting Small: Begin with modest investments to gain experience and confidence in the field. This approach facilitates education without excessive financial risk.

As the real estate investment landscape evolves, data indicates a growing enthusiasm among aspiring investors, with many seeking creative pathways to enter the market in 2025. Financial advisors emphasize the importance of starting on a small scale, as this strategy not only mitigates risk but also fosters a deeper understanding of economic dynamics. Additionally, as noted by Sharad Mehta, 36.25% of individuals believe that certain policies may adversely affect market recovery in 2025, underscoring the necessity for investors to remain informed about external factors influencing the market.

Furthermore, transforming tax season into teachable moments can enhance clients' tax experiences, offering strategic planning opportunities for investors. By leveraging these insights and strategies, new investors can successfully navigate the complexities of investing in real estate without purchasing property.

Conclusion

Investing in real estate without the traditional burdens of ownership presents a myriad of strategies that cater to diverse financial goals and risk appetites. The exploration of Real Estate Investment Trusts (REITs), crowdfunding platforms, and partnerships reveals innovative pathways for aspiring investors. These options not only democratize access to real estate investments but also create opportunities for diversification and passive income generation.

Effective market research is pivotal in this landscape, equipping investors with the knowledge necessary to navigate evolving trends and make informed decisions. Engaging with real estate agents and leveraging online platforms can further enhance investment strategies, ensuring individuals capitalize on expert insights and technological advancements.

Ultimately, the key to successful real estate investing lies in a strategic approach that combines thorough research, effective management practices, and a willingness to adapt to market changes. As more individuals recognize the potential of alternative investment methods, the real estate market continues to evolve, presenting exciting opportunities for those ready to embrace innovation. By starting small and remaining informed, aspiring investors can confidently chart their course in this dynamic environment, paving the way for financial growth and stability.