Overview

Investing in San Jose real estate, particularly in proximity to Google's expansion, presents substantial opportunities. The projected job creation and heightened housing demand resulting from the Downtown West project are pivotal factors.

Understanding the evolving market dynamics—such as demographic shifts and financial metrics—is essential for investors aiming to capitalize on the area's growth. This knowledge will also aid in effectively navigating potential risks.

As the market evolves, those who stay informed will be better positioned to make strategic investment decisions.

Introduction

In the heart of Silicon Valley, Google's ambitious expansion in San Jose is poised to reshape the local landscape, offering a wealth of opportunities for real estate investors. The Downtown West project promises to cultivate a vibrant urban environment, with profound implications for housing demand and economic growth.

As the tech giant's developments unfold, the San Jose real estate market is witnessing a surge in interest, fueled by an influx of professionals and families eager to be close to new job opportunities.

This article explores the multifaceted impact of Google's growth, examining key property types for investment, demographic shifts, and essential financial considerations. By grasping these dynamics, investors can strategically position themselves to capitalize on the evolving market landscape.

Understanding Google's Expansion in San Jose

The expansion of San Jose Google is underscored by substantial investments, particularly through the ambitious Downtown West project, which aims to establish a vibrant mixed-use urban environment. This initiative is projected to generate thousands of jobs and significantly stimulate local economic growth. As part of this development, a $200 million community benefits fund has been launched to address potential displacement issues, showcasing a commitment to community welfare alongside economic advancement.

Investors should closely monitor the evolving timeline of Google's developments, which includes the construction of office spaces, residential units, and retail areas across an 80-acre site. Although the timeline for the Downtown West campus has been adjusted, the company remains steadfast in its plans for a research hub consisting of eight buildings. Comprehending these elements will offer investors a clearer viewpoint on the opportunities that may arise in the real estate sector as the project develops.

Recent analyses indicate a mixed recovery in commercial real estate (CRE) prices, particularly in light of Federal Reserve rate cuts. This context is crucial for investors, as caution persists in the market, with reports suggesting that up to 10% of rental applicants may present fraudulent documents. Such dynamics highlight the importance of thorough due diligence when considering investments in areas impacted by San Jose Google’s expansion.

A case study titled "Mixed CRE Price Recovery Analysis" reveals this mixed recovery, emphasizing the need for investors to remain vigilant.

Expert opinions from real estate analysts emphasize the transformative potential of the Downtown West project, noting that it could redefine the local landscape and attract further investment. Jack Rogers stated, "We have entered into a multi-year lease with Jamestown to expand the Creekside program by transforming sections of Barack Obama Boulevard and South Montgomery Street into a vibrant area with retail experiences," illustrating the real-world implications of urban development in the area. As the project advances, remaining aware of updates and economic impact statistics will be crucial for investors seeking to leverage the opportunities created by Google's growth in San Francisco.

Furthermore, Zero Flux's commitment to quality content enhances subscriber engagement and positions it as a leading authority in real estate information, providing valuable insights for investors navigating this evolving landscape.

Impact of Google's Growth on San Jose Real Estate Market

The expansion of Google in San Francisco is significantly reshaping the local real estate landscape, with the median home price experiencing a notable increase. As of 2025, the median home price in San Jose has risen dramatically, driven by heightened demand for housing near San Jose Google’s new developments. This trend is underscored by the current price-to-rent ratio, which remains elevated, signaling a competitive market environment for investors.

Redfin reports that "San home values have already risen by 7.5% since last year, and this trend may persist," further emphasizing the upward trajectory of home prices. The influx of new residents and employees associated with San Jose Google’s growth is expected to further amplify demand for rental properties. Multi-family units, in particular, present a compelling investment opportunity as they cater to the increasing population seeking affordable living options.

In 2023, San Jose Google encountered difficulties in new construction, finishing only approximately 2,200 residential units, primarily upscale properties. This has exacerbated the scarcity of affordable alternatives, creating a gap that is likely to persist, driving prices up in traditionally lower-cost neighborhoods. The financial implications are substantial; at a 6.8% interest rate, a $1.5 million mortgage would necessitate a monthly payment of approximately $9,800, an increase of nearly $3,500. This could discourage some prospective buyers and further pressure the industry.

Investors should closely observe these dynamics, as the continuous need for residences driven by San Jose Google expansions will significantly affect market trends. With San being the most cost-burdened metro area in the nation—where housing costs are 2.4 times the national average—strategic investments in the real estate sector can yield significant returns. Comprehending these indicators will enable investors to make informed choices regarding resource allocation in this evolving landscape.

Identifying Key Property Types for Investment

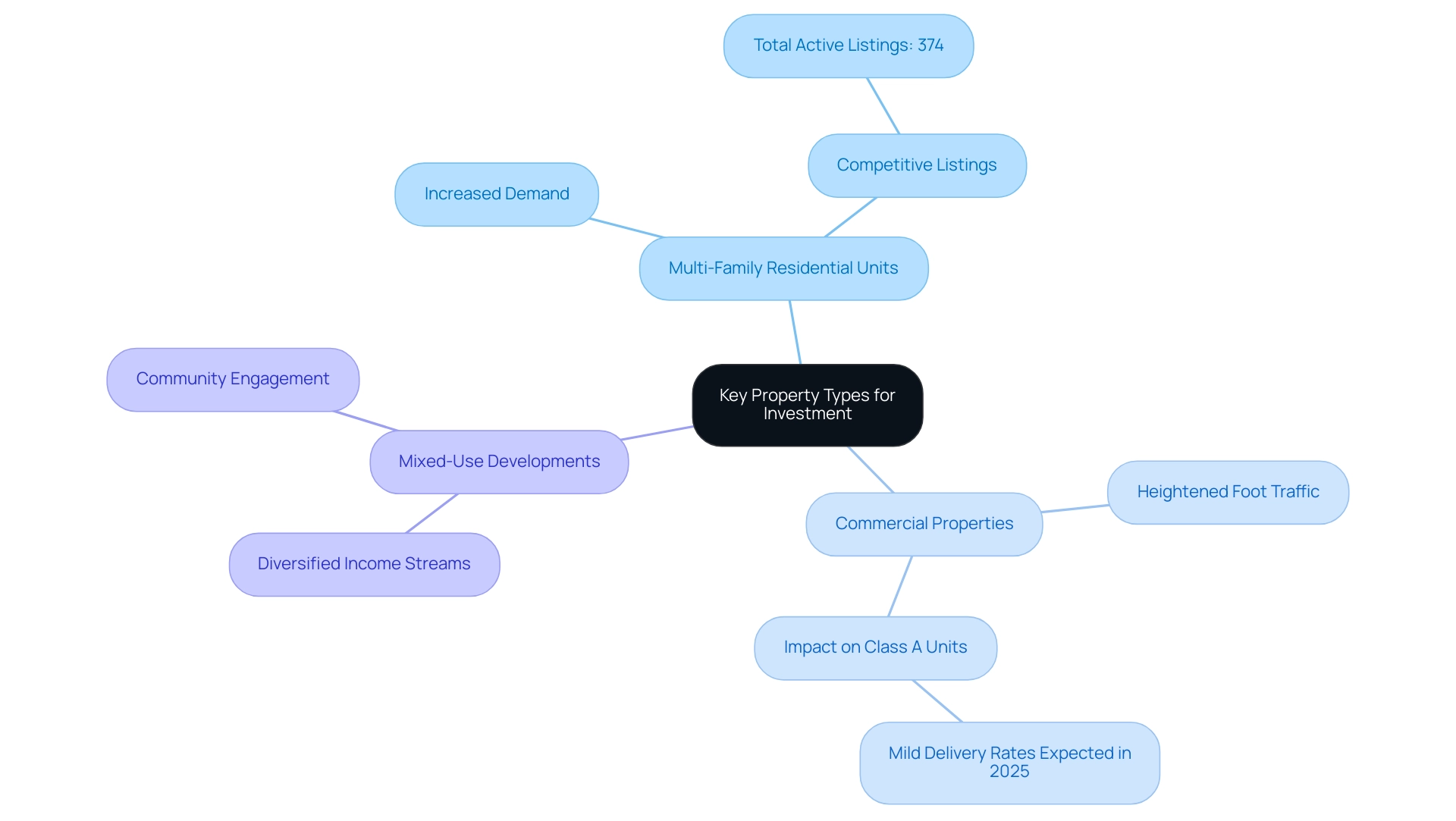

Investors should strategically concentrate on several key property types that are well-positioned to benefit from the expansion of San Jose Google in the area. These include:

- Multi-family residential units: With the creation of new jobs, the population is expected to increase, leading to a significant rise in demand for rental properties. In February 2025, the total active listings in San Jose were recorded at only 374, indicating a competitive environment for multi-family units. Clair Handy, a local realtor, observed, "The environment stayed quite active throughout winter, and increased rapidly into the new year and accelerated towards spring – it’s a strong seller’s situation in San Francisco!"

- Commercial properties: Retail spaces designed to meet the needs of San Jose Google employees and local residents are likely to experience heightened foot traffic and demand. This trend is particularly relevant as the tech workforce continues to grow in the area. However, it's important to note that Class A units may see less impact from these trends due to mild delivery rates expected in 2025.

- Mixed-use developments: Properties that integrate residential, commercial, and recreational spaces will attract investors seeking diversified income streams. These developments not only cater to the evolving lifestyle preferences of residents but also enhance community engagement.

By focusing on these property types, investors can effectively align their portfolios with the evolving demands of the San Francisco area, capitalizing on the opportunities presented by the ongoing expansion of San Jose Google. Furthermore, the insights provided by Zero Flux, a data-driven real estate newsletter, reinforce the credibility of these trends, helping investors navigate the complexities of the market.

Demographic Changes and Their Influence on Real Estate Demand

As Google continues to expand its footprint in San Francisco, significant demographic shifts are anticipated, particularly with an influx of young professionals and families seeking accommodation. This transformation is expected to drive demand for several key residential types:

- Affordable Living Solutions: With rising home prices, the necessity for affordable units will become critical to accommodate the growing population. By 2024, the demand for budget-friendly accommodations in San Francisco is projected to increase, mirroring broader trends in tech cities where property costs often outpace income growth. Notably, as of June 30, 2024, the County of Santa Clara employs 22,732 individuals, indicating a robust job market that will further stimulate demand for housing.

- Family-Friendly Neighborhoods: Areas that provide quality schools, parks, and community amenities are likely to experience heightened interest from families. The demographic shifts driven by the San Jose Google expansion will likely foster a preference for neighborhoods that promote a balanced lifestyle, rendering these areas increasingly attractive. With leading employers in San Jose, such as Cisco Systems and Adobe Systems, the economic landscape is poised to draw more families in search of stable environments. Transit-oriented developments near public transportation hubs will appeal to residents commuting to companies like San Jose Google and other tech firms. As the workforce grows, the convenience of transit access will play a pivotal role in accommodation choices. Population data projections indicate that by 2025 and 2030, the demand for housing will persist in its upward trajectory, underscoring the need for strategic investments in transit-oriented developments.

Investors should closely monitor these demographic trends to identify neighborhoods primed for growth and increased housing demand. By aligning investment strategies with the evolving landscape, they can seize the opportunities arising from the expansion of San Jose Google and the consequential shifts in the real estate market. As highlighted in the Zero Flux newsletter, which curates vital real estate market trends and insights, understanding these dynamics is essential for making informed investment decisions. Furthermore, as Simon Gilbert emphasized, the reliability of demographic data is crucial, and investors should seek expert analysis when assessing housing demand trends.

Financial Considerations for Investing in Google-Adjacent Properties

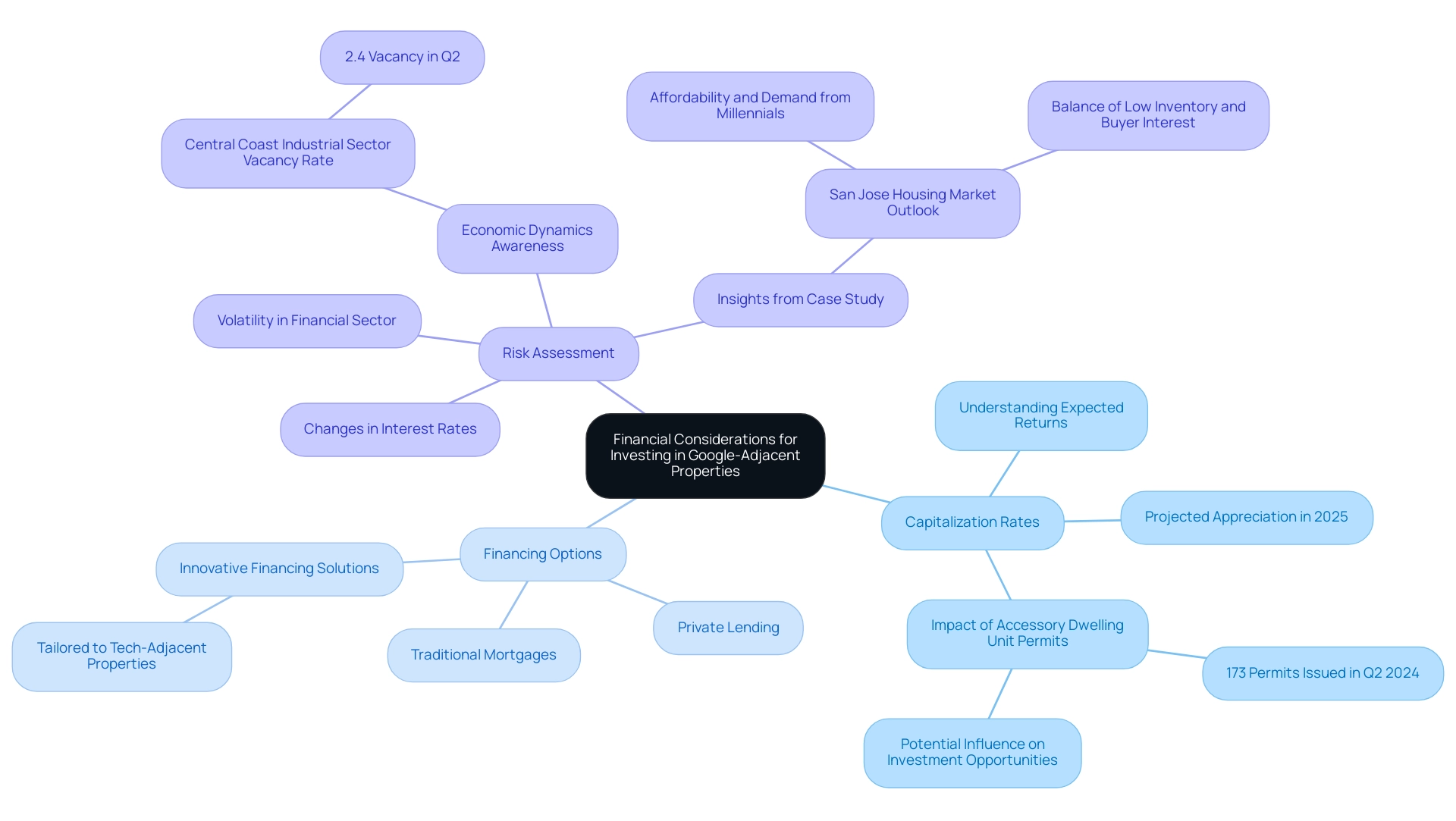

Investors must meticulously evaluate several financial factors when considering properties adjacent to Google's developments in San Jose.

Capitalization Rates: Understanding capitalization rates is crucial for assessing expected returns on investment. In 2025, the San Jose real estate sector is projected to experience continued appreciation, driven by strong demand from millennial homebuyers and favorable loan options. This trend suggests that capitalization rates may remain competitive, making it essential to examine current conditions and future growth potential. Notably, the recent issuance of 173 Accessory Dwelling Unit permits in Q2 2024 signifies a substantial increase in residential supply, which could further influence capitalization rates and investment opportunities.

Financing Options: A variety of financing methods are available to optimize cash flow for real estate investments. Investors should explore traditional mortgages, private lending, and even innovative financing solutions tailored to tech-adjacent properties. Given the rising interest in San Jose's housing sector, securing favorable financing terms through San Jose Google can significantly enhance investment viability.

Risk Assessment: Conducting a thorough risk assessment is vital for developing a robust investment strategy. Possible risks encompass volatility in the financial sector and changes in interest rates, which can impact property values and rental income. By staying informed about economic dynamics, such as the recent increase in available space in the Central Coast industrial sector, which concluded with a vacancy rate of 2.4% in the second quarter, investors can better anticipate challenges and adjust their strategies accordingly. Furthermore, insights from the case study titled 'San Jose Housing Overview' emphasize the area's affordability and the robust demand from millennial homebuyers, reinforcing the positive trend in the housing sector around San Jose Google. As indicated in the quote from "My Take On San Francisco's Housing Situation," potential sellers and investors should seriously assess current conditions, as they may not remain favorable indefinitely.

By comprehensively understanding these financial considerations, investors can align their decisions with their investment goals, ultimately positioning themselves for success in the evolving San Francisco real estate landscape.

Strategies for Successful Investment in San Jose Real Estate

To effectively invest in San Francisco's dynamic real estate sector, adopting a multifaceted approach is crucial. This approach encompasses the following strategies:

- Conduct Thorough Research: Understanding local trends, property values, and demographic shifts is essential for making informed, data-driven decisions. With an average annual price change of 7.2% over the past decade, staying updated on these metrics can significantly impact investment outcomes. This data underscores the importance of comprehensive research to navigate the intricacies of the San Francisco area.

- Network with Local Real Estate Professionals: Establishing connections with agents, property managers, and fellow investors can unlock valuable insights and opportunities. Interacting with specialists who navigate the San Francisco area daily provides a competitive advantage in recognizing promising investments.

- Diversify Your Portfolio: To reduce risk and improve potential returns, consider investing in various property types and locations. This strategy is particularly relevant in San Francisco, where housing costs are 2.4 times the national average, making diversification a prudent approach. The 'San Francisco Neighborhood Rankings' report emphasizes appealing areas based on criteria such as walkability and affordability, serving as a useful resource for prospective buyers and investors.

- Stay Adaptable: The real estate environment is continuously changing, especially in tech-focused regions like San Francisco. Be prepared to modify your investment strategy in response to fluctuations and new developments, ensuring that your portfolio remains aligned with current trends. As one expert noted, 'I have always known that San Francisco is expensive.' It is in the heart of Silicon Valley and is a very attractive place to live, but this data makes it very clear. By employing these strategies, investors can navigate the complexities of the San Francisco real estate landscape with increased confidence and success.

Key Takeaways for Investors in San Jose's Google Real Estate Market

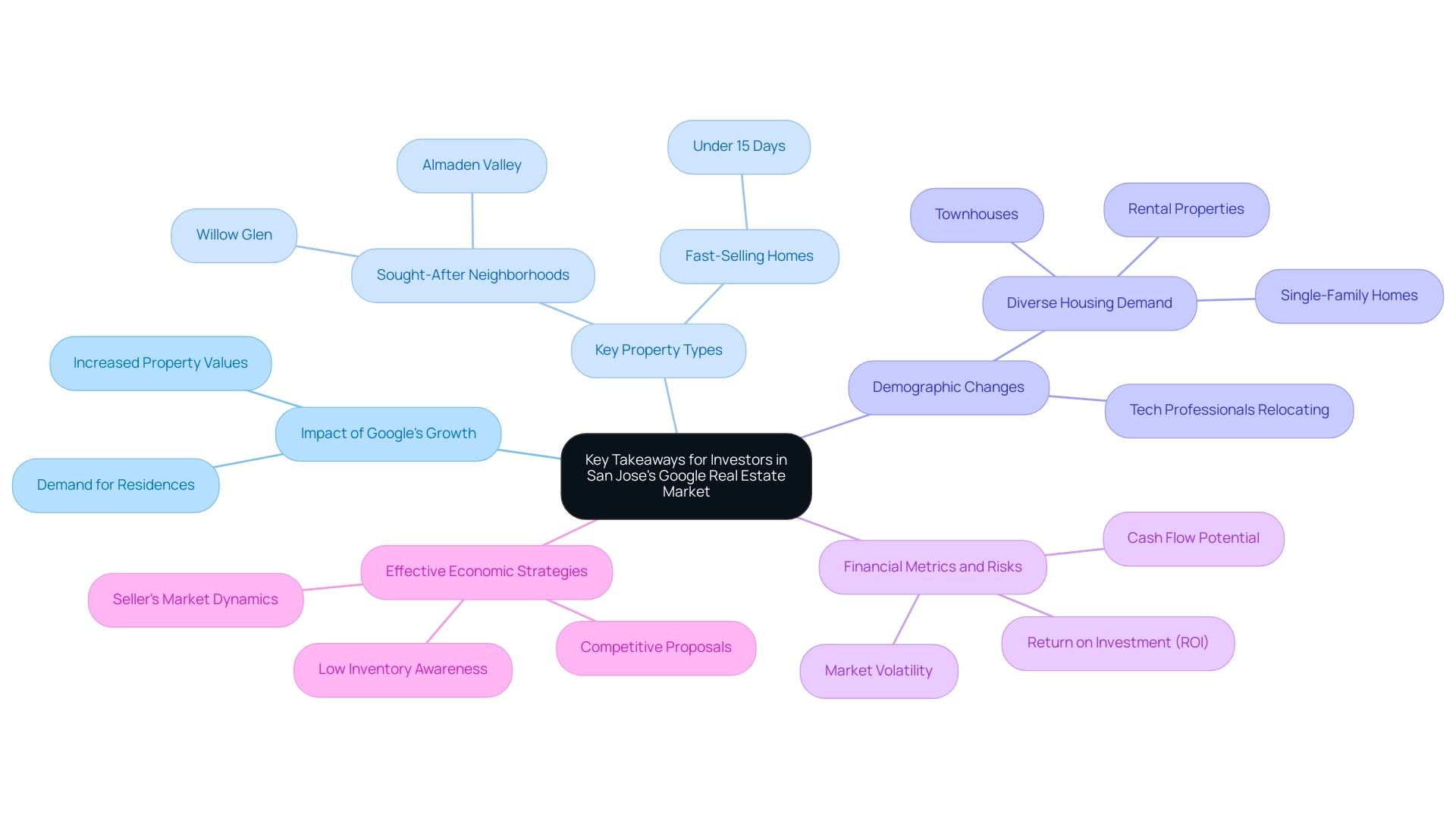

Investing in Sam's real estate market, particularly in proximity to Google’s expansion in San Jose, presents substantial opportunities for discerning investors. Consider the following key takeaways:

- Impact of Google's Growth: The ongoing expansion of Google in San Jose has a profound effect on local real estate dynamics. The tech giant's presence not only stimulates demand for residences but also attracts a workforce seeking nearby living options, consequently driving up property values in the area.

- Key Property Types: Target properties in sought-after neighborhoods such as Willow Glen and Almaden Valley, where homes frequently sell in under 15 days. These regions are poised for increased interest due to their closeness to tech hubs and amenities, making them prime investment opportunities.

- Demographic Changes: Examine the demographic shifts resulting from Google's growth. As more tech professionals relocate to the area, the demand for diverse housing options will rise, including single-family homes, townhouses, and rental properties that cater to various income levels.

- Financial Metrics and Risks: In making investment decisions, it is crucial to consider essential financial metrics such as return on investment (ROI), cash flow potential, and market volatility. Understanding these factors will help mitigate risks associated with fluctuating economic conditions.

- Effective Economic Strategies: Employ strategies that capitalize on current economic trends. For instance, being prepared for competitive proposals is vital, as the San Jose housing market is characterized by low inventory and high demand. Sellers currently hold a favorable position, which may not persist indefinitely, necessitating prompt action from buyers. As highlighted in the case study 'Personal Insights on San Francisco's Housing Situation,' the prevailing market conditions indicate a challenging period for buyers and a favorable atmosphere for sellers, with elevated prices expected to continue. Having witnessed markets rise and fall, I urge sellers to carefully evaluate current market conditions, as this may not be a lasting scenario.

By focusing on these areas, investors can strategically position themselves for success in the rapidly evolving San Jose Google landscape, seizing the opportunities brought forth by Google's expansion. With over 30,000 subscribers, Zero Flux offers valuable insights that assist investors in navigating these complexities, bolstered by positive feedback from its expanding community regarding its commitment to factual information.

Conclusion

The expansion of Google in San Jose represents not merely a noteworthy corporate development; it serves as a transformative force reshaping the local real estate market. As emphasized throughout this article, the ambitious Downtown West project is set to create thousands of jobs, thereby driving demand for housing and commercial spaces while simultaneously elevating property values. The anticipated increase in the median home price, coupled with the growing demand for multi-family and affordable housing options, highlights the urgency for investors to act strategically.

Understanding key property types, such as multi-family units and mixed-use developments, is crucial for capitalizing on the opportunities presented by Google's growth. The influx of young professionals and families seeking housing near tech jobs further underscores the necessity for diverse and affordable housing solutions. Investors must remain vigilant in monitoring demographic shifts and financial considerations, ensuring they are well-informed to navigate potential market volatility.

In conclusion, the San Jose real estate market is on the brink of significant transformation, driven by Google's expansion. By conducting thorough market research, networking with local professionals, and adopting a diversified investment strategy, investors can position themselves advantageously in this dynamic landscape. As the tech giant continues to grow, the opportunities for profitable investments will expand, making this the opportune moment for proactive engagement in San Jose's evolving real estate scene.