Overview

This article serves as a comprehensive step-by-step guide for mastering commercial real estate research, outlining essential strategies for understanding economic landscapes, analyzing development pipelines, and identifying properties with high conversion potential.

By emphasizing the importance of data utilization, engagement with local professionals, and staying abreast of market trends, readers are empowered to make informed investment decisions.

This approach not only enhances their ability to navigate the complexities of the commercial real estate sector but also positions them for success in a competitive market.

Introduction

In the ever-evolving landscape of commercial real estate, grasping the intricate interplay between economic indicators, local regulations, and emerging market trends is vital for investors aiming for success. By analyzing demographic shifts and infrastructure developments, while navigating the complexities of loan data and property valuations, each step in the investment process unveils unique opportunities and challenges.

As the market prepares for significant transformations in the coming years, remaining informed and adaptable becomes essential for capitalizing on high-conversion potential properties and cultivating valuable connections within the industry. This article explores key strategies and insights that can empower investors to make informed decisions and thrive in a dynamic real estate environment.

Understanding the Local Economic Landscape

To effectively navigate the local economic landscape and make informed decisions in commercial real estate, consider the following steps:

-

Research Economic Indicators: Begin by collecting data on essential economic indicators, including employment rates, GDP growth, and industry performance in the area. Resources such as the Bureau of Labor Statistics and local economic development agencies offer valuable insights that can inform your investment strategy. Furthermore, it is crucial to consider how cities are classified into cohorts based on population size: small (less than 150,000), midsize (150,000–349,999), and large (350,000 or more), as local economic conditions may vary significantly by city size.

-

Analyze Local Business Trends: Investigate the types of businesses that are thriving in the region. Are there emerging industries or sectors experiencing growth? Comprehending the local business ecosystem is vital for forecasting future demand for commercial real estate, as changes in industry can indicate new opportunities. For instance, the growing emphasis on eco-friendly residences with energy-efficient designs indicates shifting consumer preferences that may affect commercial real estate demand.

-

Evaluate Infrastructure Developments: Look into any planned infrastructure projects, such as new highways, public transport systems, or commercial developments. These initiatives can significantly enhance real estate values and attract businesses, making them critical factors in your investment analysis.

-

Consider Demographic Factors: Examine demographic data to gain insights into the population's age distribution, income levels, and growth trends. This information is vital for identifying the types of commercial properties that may be in demand, as different demographics often have varying needs and preferences.

-

Connect with Local Specialists: Networking with local property agents, economic development officials, and business proprietors can offer firsthand insights into the economic landscape and potential investment opportunities. These connections can assist you in staying updated on industry trends and discovering hidden treasures in the commercial property sector. As Joel Berner, a senior economist at Realtor.com, noted, "With existing home inventory also growing and nearly reaching pre-pandemic levels, buyers have many more options to choose from than they did a few years ago, and at better prices."

By following these steps, investors can better understand the interaction between economic indicators and commercial real estate, ultimately leading to more successful investment choices. Additionally, while experts do not anticipate a housing market crash in 2025, affordability remains a significant issue for first-time buyers, which can impact overall market conditions.

Analyzing the Development Pipeline

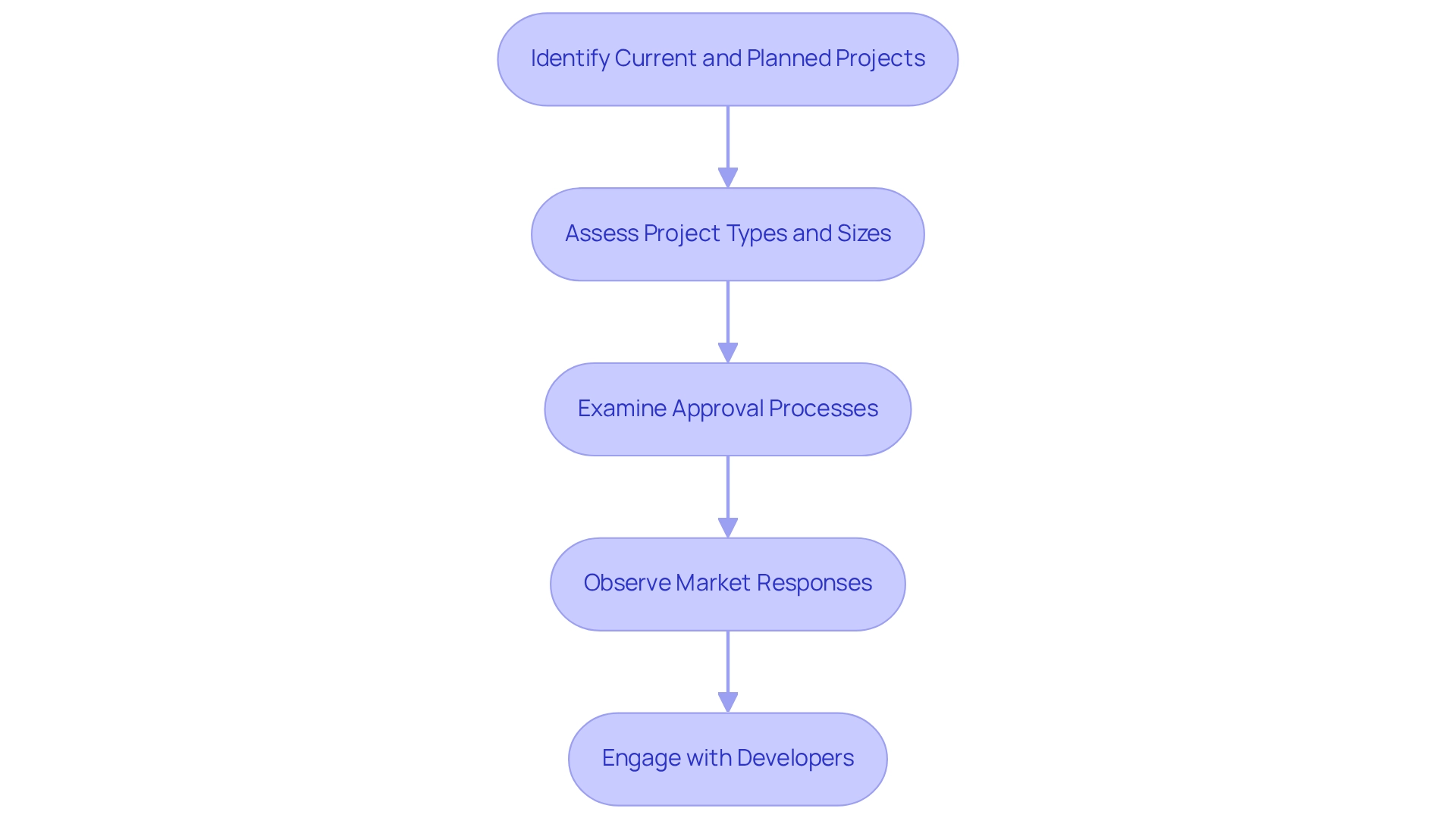

To effectively analyze the development pipeline in commercial real estate, follow these essential steps:

- Identify Current and Planned Projects: Leverage resources such as local government planning departments and commercial real estate databases to gather information on both ongoing and upcoming development projects. This foundational step is crucial for understanding the landscape of new opportunities in commercial real estate research.

- Assess Project Types and Sizes: Evaluate the nature of the projects being developed—whether they are office buildings, retail spaces, or mixed-use developments—and their respective sizes. This evaluation can uncover demand trends and emphasize potential competition, offering a clearer view of the dynamics.

- Examine Approval Processes: Familiarize yourself with the regulatory environment and the approval processes that govern new developments. Comprehending these processes is crucial, as any delays or obstacles can greatly affect project timelines and general economic conditions.

- Observe Market Responses: Keep a close eye on how the economy reacts to new developments. Are there noticeable shifts in rental rates or occupancy levels following the introduction of new projects? Such industry reactions can provide valuable insights into the success and viability of these developments.

- Engage with Developers: Building relationships with developers can provide deeper insights into their strategies and the challenges they encounter. This engagement can assist you in evaluating the viability of upcoming projects and comprehending the wider contextual landscape.

As the U.S. commercial real estate research shows a shift towards more balanced and stable conditions in the property sector, keeping updated about these developments is essential. Richard Barkham, Global Chief Economist & Global Head of Research, observes, "While we anticipate that economic growth in 2025 will spark a new property cycle, we recognize that potential risks are present." For instance, vacancy rates in multifamily properties are expected to decline in 2025 due to strong tenant demand, indicating a robust market environment.

Additionally, the ongoing workforce transition within the industry highlights the importance of aligning with the values of younger generations, focusing on climate action and technological advancements to attract new talent. A case study titled "Attracting and Retaining the Next Generation Workforce" emphasizes that property organizations must adapt to these values to build a robust talent pipeline. By adhering to these steps, you can maneuver through the intricacies of the commercial property landscape with assurance.

Exploring Emerging Trends and Forecasts

To effectively investigate emerging trends and predictions in the commercial property sector, consider the following steps:

-

Utilize Market Reports: Access comprehensive reports from reputable sources, including leading commercial property firms and economic research institutions. These reports provide valuable insights into industry trends and forecasts related to commercial real estate research, assisting you in staying updated on the latest developments.

-

Attend Industry Conferences: Engage in property conferences and seminars where industry leaders share their insights on upcoming trends and shifts in the sector. Engaging in these events can provide firsthand knowledge and networking opportunities that are crucial for understanding the evolving landscape.

-

Follow Economic Indicators: Monitor key economic indicators that can signal changes in the financial landscape. Elements like interest rates, inflation rates, and consumer spending habits significantly influence property dynamics and can offer early alerts of possible changes.

-

Utilize Technology: Employ advanced data analytics tools to monitor industry trends and forecasts. Platforms like CoStar and Real Capital Analytics are invaluable for accessing detailed data that can enhance your analysis and decision-making processes.

-

Connect with Sector Professionals: Establish connections with property analysts and economists to acquire knowledge about possible shifts in the industry and emerging trends. Their expertise can assist in enhancing your investment approach and spotting opportunities in a swiftly evolving landscape.

As of 2025, significant trends are being observed in the commercial real estate sector, particularly in areas such as digital economy assets, logistics, and storage facilities, which are anticipated to be leading investment prospects in the upcoming 12 to 18 months. Furthermore, the overall demand in the multifamily sector remains consistent with pre-pandemic levels, indicating stability in that area. A significant case study highlighting the evolving landscape is the surge in demand for data centers, driven by advancements in AI technologies.

For instance, Blackstone's recent USD 16 billion acquisition of AirTrunk exemplifies the growing interest in this area, as traditional property investors are increasingly entering the field. However, this shift also brings unique operational challenges and lower data transparency, which could pose risks for new entrants.

Furthermore, Building Performance Standards are gaining traction across various U.S. states and cities, with commitments to implement these standards by the end of 2024. This trend aligns with the UK's directive for minimum energy efficiency standards by 2030, reflecting a broader movement towards sustainability in commercial property.

As JLL recently unveiled their own internal large language model, JLL GPT, it highlights the significance of utilizing technology in managing these trends.

By adhering to these steps and remaining updated on the latest market predictions and trends through commercial real estate research, you can position yourself to make informed investment choices in the commercial property sector.

Analyzing Loan and Distress Information

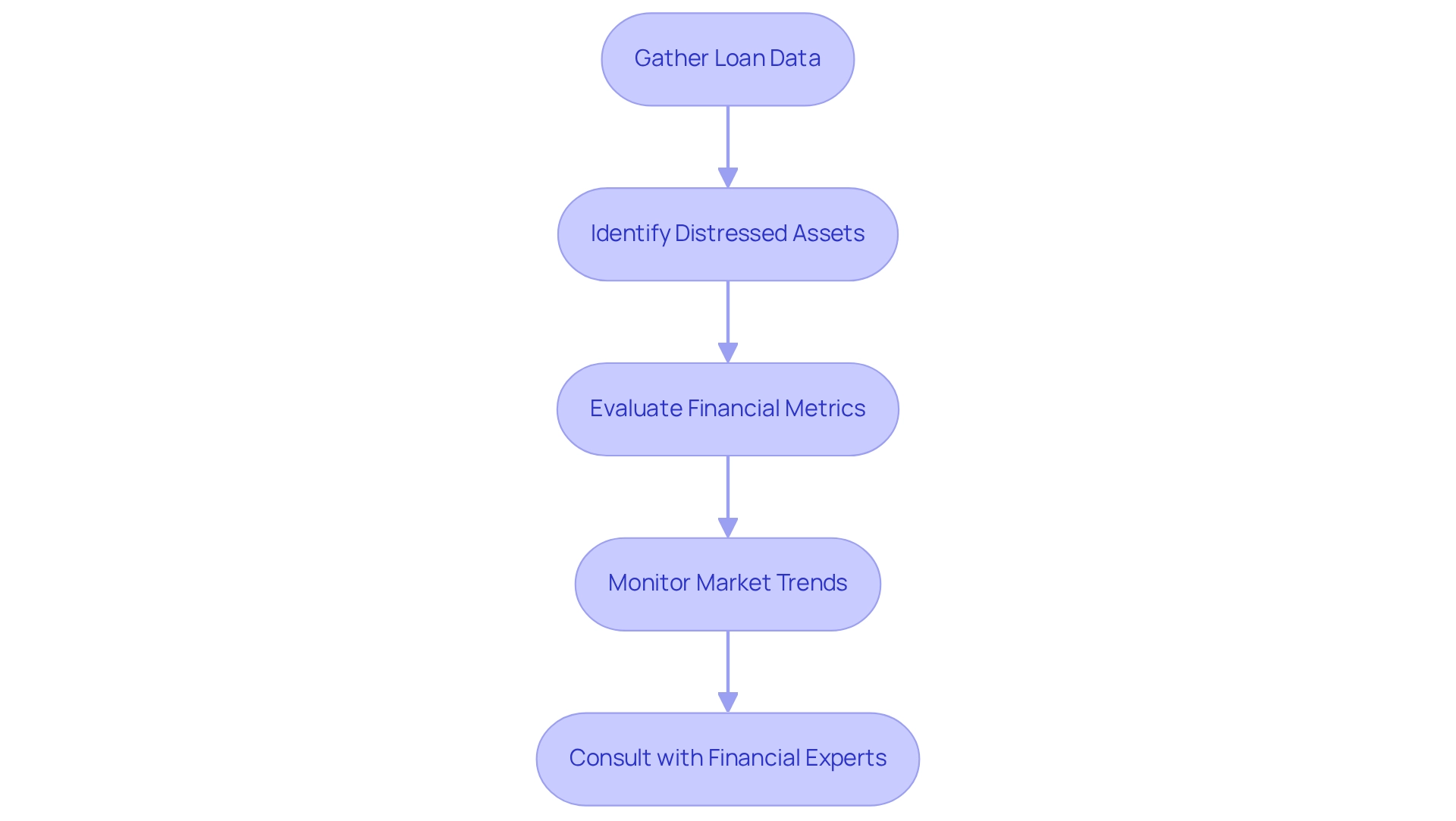

To effectively analyze loan and distress information in commercial property, follow these structured steps:

-

Gather Loan Data: Utilize comprehensive databases that provide detailed information on commercial real estate research, including terms, interest rates, and borrower profiles. This foundational data is crucial for understanding the landscape of available financing options.

-

Identify Distressed Assets: Focus on assets exhibiting high delinquency rates or those currently in foreclosure. These distressed assets can present lucrative opportunities for investors willing to navigate the associated risks. In 2025, statistics show a significant rise in troubled commercial real estate, making this a favorable time for strategic investments.

-

Evaluate Financial Metrics: Conduct a thorough analysis of essential financial metrics such as the Debt Service Coverage Ratio (DSCR) and Loan-to-Value (LTV) ratios. These indicators are crucial for evaluating the financial feasibility of assets and comprehending their potential for recovery or profitability.

-

Monitor Market Trends: Stay informed about prevailing market trends that could impact loan performance, including fluctuations in interest rates and broader economic conditions. For instance, recent reports suggest that manufacturing is projected to drive 25% of U.S. industrial demand by 2028, a significant increase from 4.3% in 2019. This trend signifies an increasing requirement for industrial space, mirroring changes in manufacturing strategies, which could impact the demand for industrial assets and their financing.

-

Consult with Financial Experts: Engage with financial analysts or real estate attorneys to gain deeper insights into the implications of loan distress. Their knowledge can assist you in navigating potential investment opportunities and comprehending the complexities of distressed asset investments. Financial analysts stress that grasping the subtleties of distressed assets is essential for making informed investment choices. Significantly, 90% of millionaires are affluent due to their investments in land, highlighting the significance of this sector.

By adhering to these steps, investors can proficiently assess commercial loan data and pinpoint troubled assets, positioning themselves to take advantage of new opportunities through commercial real estate research. Additionally, with competitors like No Cap boasting over 65,000 subscribers, Zero Flux's commitment to delivering factual information enhances its authority and subscriber engagement in the real estate insights space.

Establishing True Market Value Through Sales Comparables

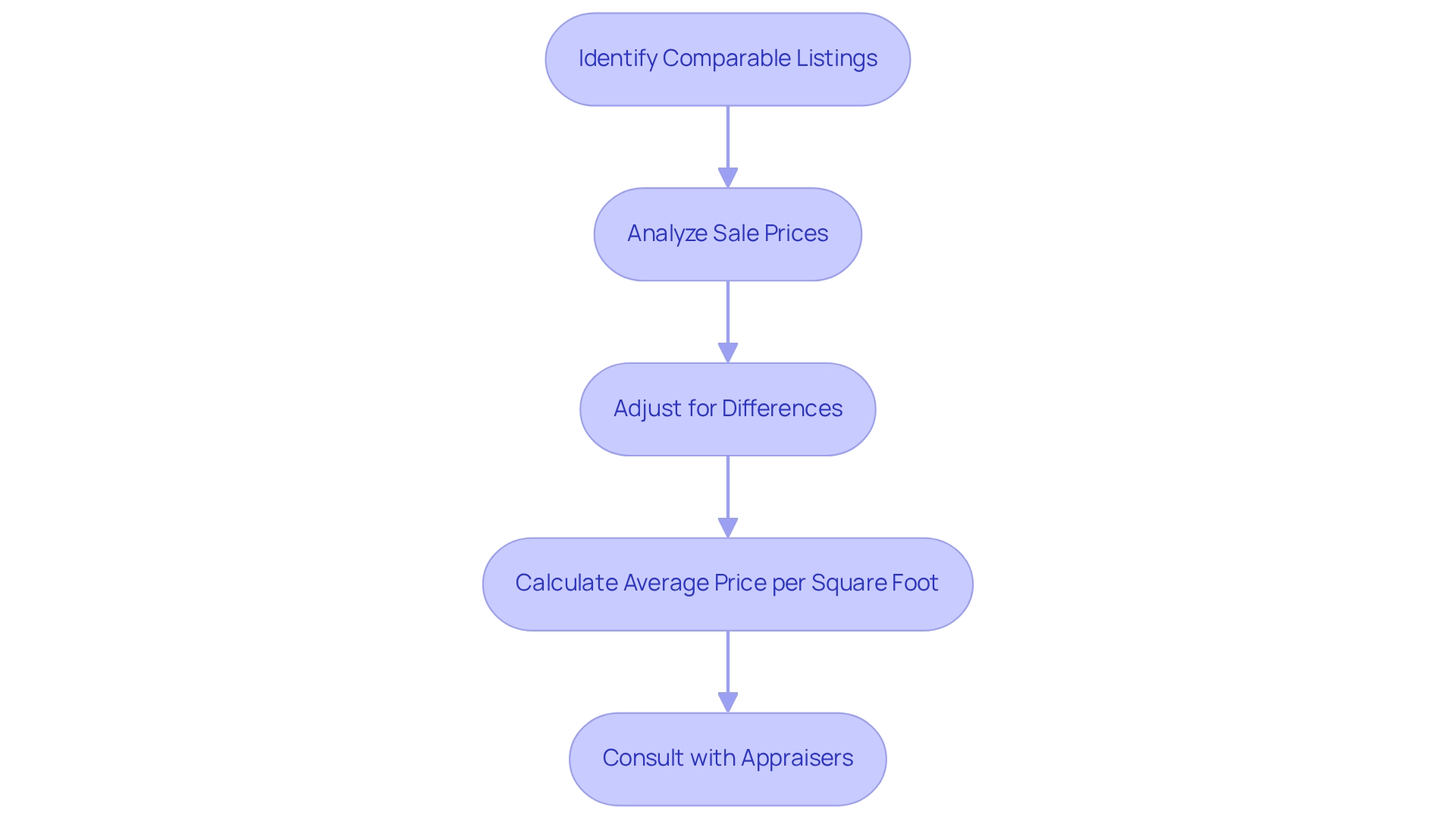

To accurately establish the market value of a commercial property using sales comparables, it is imperative to follow these essential steps:

-

Identify Comparable Listings: Begin by locating listings that closely match your target in terms of size, location, and type. Utilize resources such as MLS listings and commercial real estate research databases to find recent sales that fit these criteria.

-

Analyze Sale Prices: Examine the sale prices of these similar assets to determine a realistic price range for your target asset. Recent data indicates that the average sale price of industrial real estate in the Inland Empire increased by 5.3% over the past year. This statistic underscores the importance of current market trends in your analysis, as understanding these fluctuations can significantly impact your valuation.

-

Adjust for Differences: Modify the sale prices of the comparables to account for any differences between them and your asset. Consider factors such as the state of the asset, available amenities, and specific location benefits or drawbacks.

-

Calculate Average Price per Square Foot: Compute the average cost per square foot of the comparable real estate. This metric serves as a crucial baseline for assessing your property’s value, allowing for a more precise valuation.

-

Consult with Appraisers: Engage with professional appraisers when necessary to validate your findings. Their expertise can offer further insights and ensure that your value assessments are precise and trustworthy. For instance, the retail sector has shown resilience despite a 12% drop in foot traffic, achieving a 3.2% growth rate due to strict conditions and limited supply. This case illustrates how comprehending economic conditions can influence appraisals and valuations.

Additionally, as noted by Peter Kolaczynski, Director of CommercialEdge, "While we expect manufacturing to be a major driver of industrial development and activity going forward, the sector will also face some significant headwinds." This insight emphasizes the complexities investors must navigate in the current landscape.

In the present environment, grasping the subtleties of value assessment is essential. By adhering to these steps and utilizing recent sales comparables, investors can enhance their commercial real estate research to make informed choices that reflect the true dynamics of commercial properties in 2025. Moreover, leading markets for property investment, including Austin, Dallas, Nashville, Atlanta, and Phoenix, should be taken into account when planning your investment strategies.

Networking with Decision Makers

To effectively network with decision-makers in the commercial real estate sector, consider implementing the following strategies:

-

Attend Industry Events: Actively participate in conferences, trade shows, and networking events where industry leaders converge. These gatherings present invaluable opportunities to meet decision-makers face-to-face, fostering relationships that can lead to future collaborations.

-

Leverage Social Media: Utilize platforms like LinkedIn to connect with industry professionals. By sharing relevant content and engaging in discussions, you can enhance your online presence and establish credibility within your network. Engaging with posts and contributing to conversations can significantly increase your visibility among peers. Engaging in online communities, like LinkedIn and Facebook groups focused on property, enables you to exchange insights, remain informed about industry trends, and establish credibility among colleagues. Successful connections often stem from these informal interactions.

-

Join Professional Associations: Becoming a member of property associations grants access to exclusive events and networking opportunities. Organizations such as the Women’s Council of Realtors provide platforms for professionals to connect, exchange ideas, and advance their careers, particularly for women in the industry. This highlights the importance of networking in promoting diversity and inclusion within the sector.

-

Follow Up: After meeting someone, send a personalized follow-up message to reinforce the connection. Express your interest in future collaboration and reference specific topics discussed during your meeting to demonstrate genuine engagement.

-

Offer Value: When networking, prioritize how you can provide value to others. This could involve sharing insights from your experiences, offering assistance on projects, or connecting them with other professionals in your network. A mindset focused on mutual benefit fosters stronger relationships. Furthermore, as property professionals have a duty to advocate for sustainable practices and make knowledgeable decisions regarding development, reflect on how your networking efforts can aid these objectives.

-

Connect with Data-Driven Platforms: Engaging with credible information sources, such as Zero Flux, which has over 30,000 subscribers, can enhance your networking efforts. Connecting with data-driven platforms provides valuable insights that can inform your discussions and decisions within the industry.

By employing these strategies, real estate professionals can enhance their networking efforts in commercial real estate research, leading to fruitful relationships and opportunities within the industry. As Tristan Ahumada aptly noted, "A strong network fuels success by opening doors to new opportunities, providing market insights, and enhancing your credibility.

Identifying High-Conversion Potential Properties

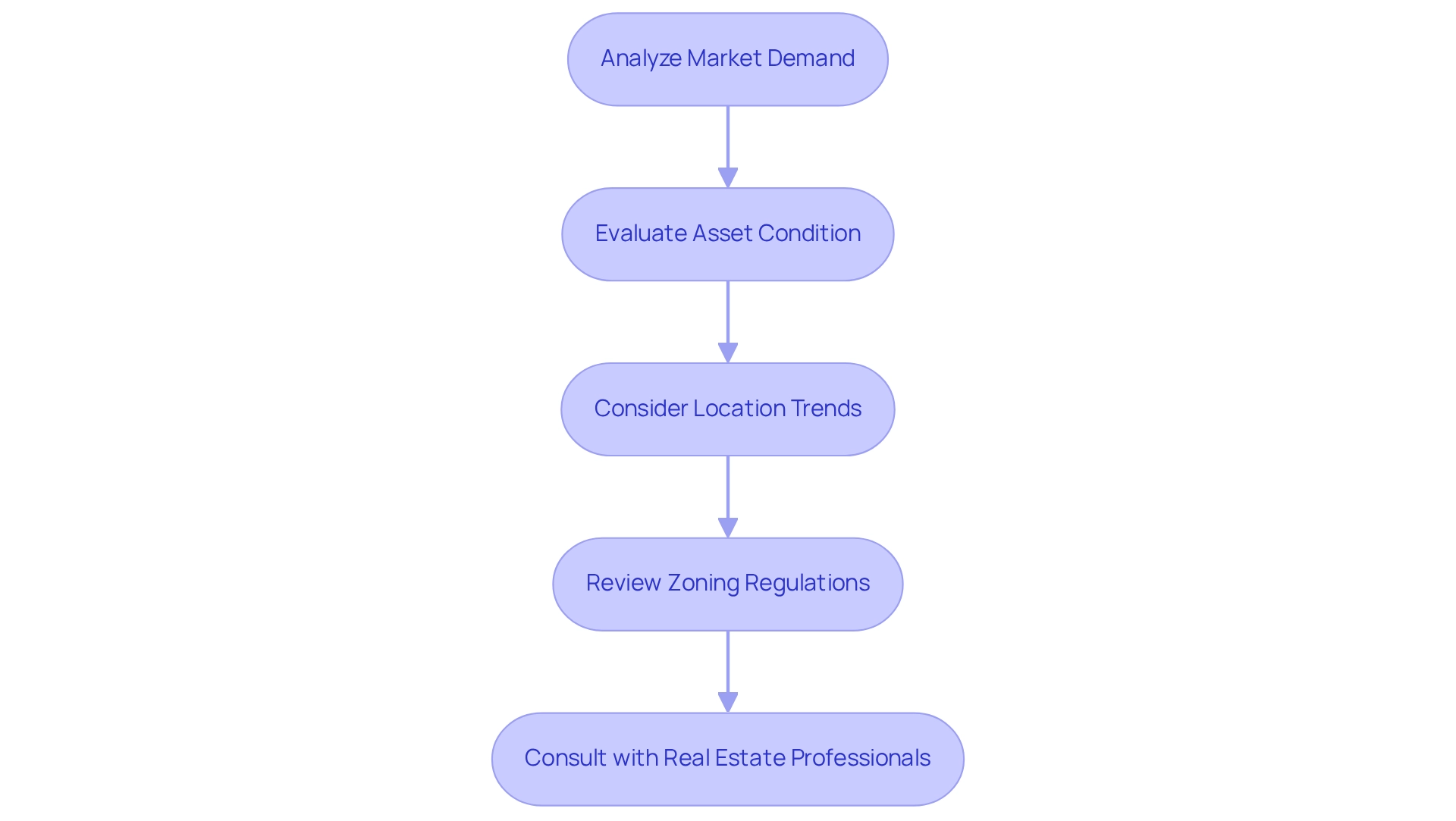

To effectively identify high-conversion potential properties, consider the following strategic steps:

-

Analyze Market Demand: Begin by investigating regions experiencing a surge in demand for specific types of real estate, such as multifamily housing or office-to-residential conversions. Recent insights indicate that digital economy assets, logistics, and warehousing facilities rank among the top asset classes expected to provide profitable opportunities for owners and investors over the next 12 to 18 months. This aligns with findings from the annual global real estate outlook survey, which underscores the increasing interest in these sectors.

-

Evaluate Asset Condition: Conduct a comprehensive assessment of the condition of potential assets. Properties requiring renovation can present significant upside potential if improved. Successful case studies reveal that strategic renovations can substantially enhance real estate value and appeal, especially in high-demand markets. For instance, MagicDoor's AI-driven platform streamlines real estate management, offering tools for rent collection and maintenance without subscription fees, making it accessible for both small landlords and larger portfolios.

-

Consider Location Trends: Focus on real estate situated in emerging neighborhoods or areas undergoing revitalization. These locations are likely to see increased demand, positioning them as prime candidates for investment. Understanding condition trends in commercial assets for 2025 can further inform your decisions in selecting locations with high conversion potential.

-

Review Zoning Regulations: Acquaint yourself with local zoning laws to identify sites that can be repurposed or redeveloped for higher-value uses. This knowledge is essential for maximizing the potential of your investments while ensuring compliance with local regulations.

-

Consult with Real Estate Professionals: Engage with local real estate experts who can provide valuable insights into industry trends and real estate potential. Their expertise can assist you in navigating the complexities of the market and effectively identifying high-conversion opportunities. As Peter Fisch noted, "Private credit seems to be booming, and many of the largest asset managers are raising huge sums into private credit," indicating a shift in investment strategies that could influence property demand.

By following these steps, investors can strategically position themselves to capitalize on the evolving commercial property landscape, leveraging data-driven insights and expert knowledge to make informed decisions.

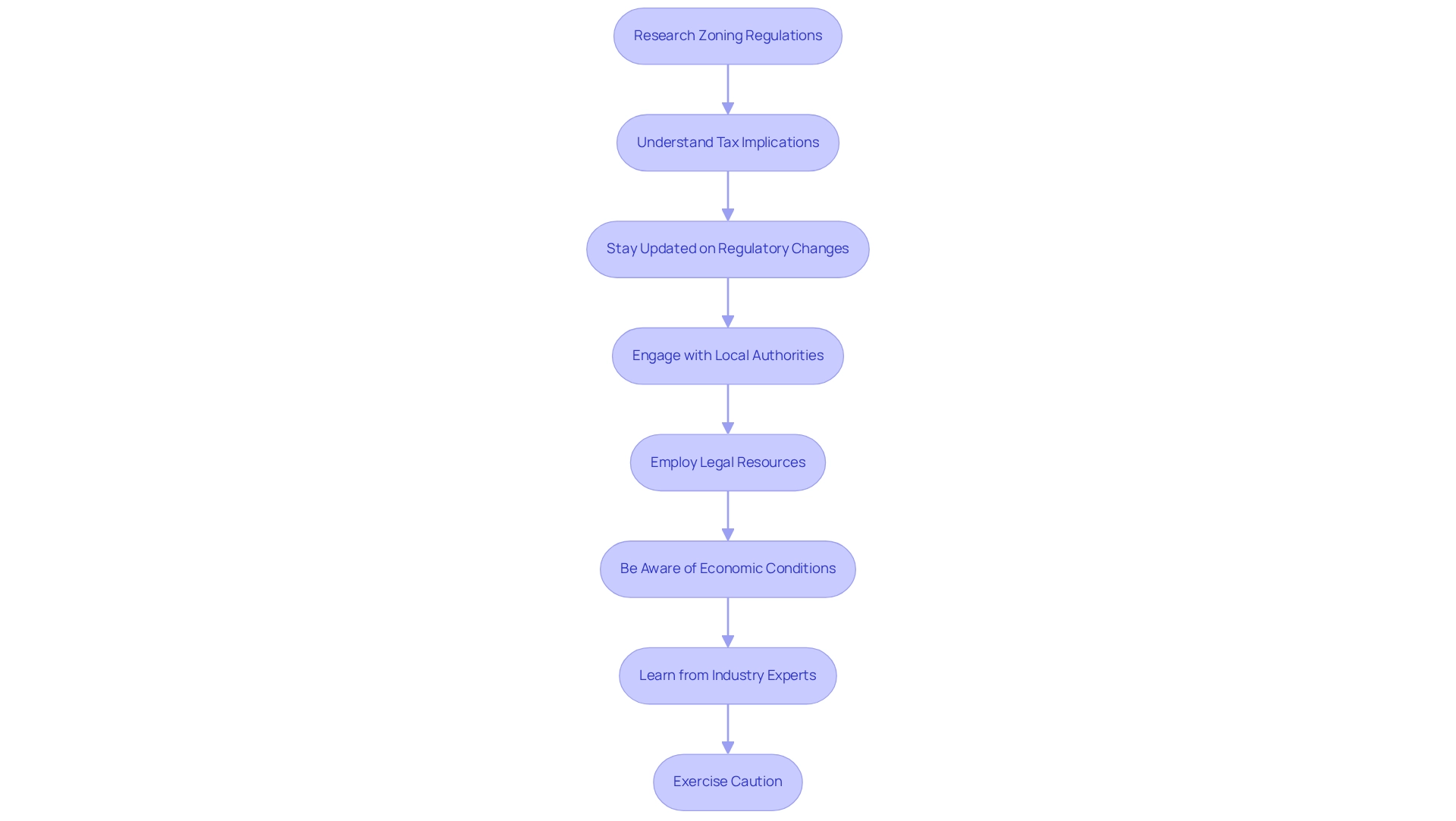

Navigating Local Regulations and Taxes

To navigate local regulations and taxes effectively in commercial real estate, consider these essential steps:

-

Research Zoning Regulations: Begin by familiarizing yourself with local zoning laws that dictate land use and development potential. Access local government websites or consult with planning departments for valuable insights on zoning classifications and restrictions.

-

Understand Tax Implications: Collaborate with tax professionals to gain a comprehensive understanding of the tax implications linked to your investments. This includes real estate taxes, capital gains taxes, and potential deductions that significantly impact your overall return on investment.

-

Stay Updated on Regulatory Changes: Consistently monitor changes in local regulations that may affect your properties or investment strategies. In light of current market uncertainties, as noted by industry experts, proactive engagement in this area is vital for long-term success. The Counselors of Real Property predicts that a robust recovery in commercial property transactions will not occur for several years, underscoring the need for caution.

-

Engage with Local Authorities: Cultivating relationships with local government officials and planning departments can yield insights into forthcoming regulations and development opportunities. Such engagement facilitates smoother navigation through the regulatory landscape.

-

Employ Legal Resources: Consider enlisting legal advisors specializing in property matters to assist in navigating complex regulatory environments. Legal experts ensure compliance with local laws and provide guidance on best practices for managing your investments.

-

Be Aware of Economic Conditions: Remain cognizant of the fact that expectations for the future economy fell to a 12-year low in March 2025. This context can influence local regulations and investment strategies.

-

Learn from Industry Experts: As emphasized by industry experts, new investors should prioritize education and long-term planning. Building a strong advisory group and exercising patience are essential for success in property investment.

-

Exercise Caution: As Anthony F. DellaPelle, Esq., global chair of the Counselors of Real Estate, articulates, "buyers and sellers will exercise caution heading into 2025." This mindset is crucial when navigating local regulations and taxes.

By adhering to these steps, investors can enhance their ability to maneuver through the complex terrain of local regulations and taxes, ultimately refining their investment strategies in the commercial real estate sector.

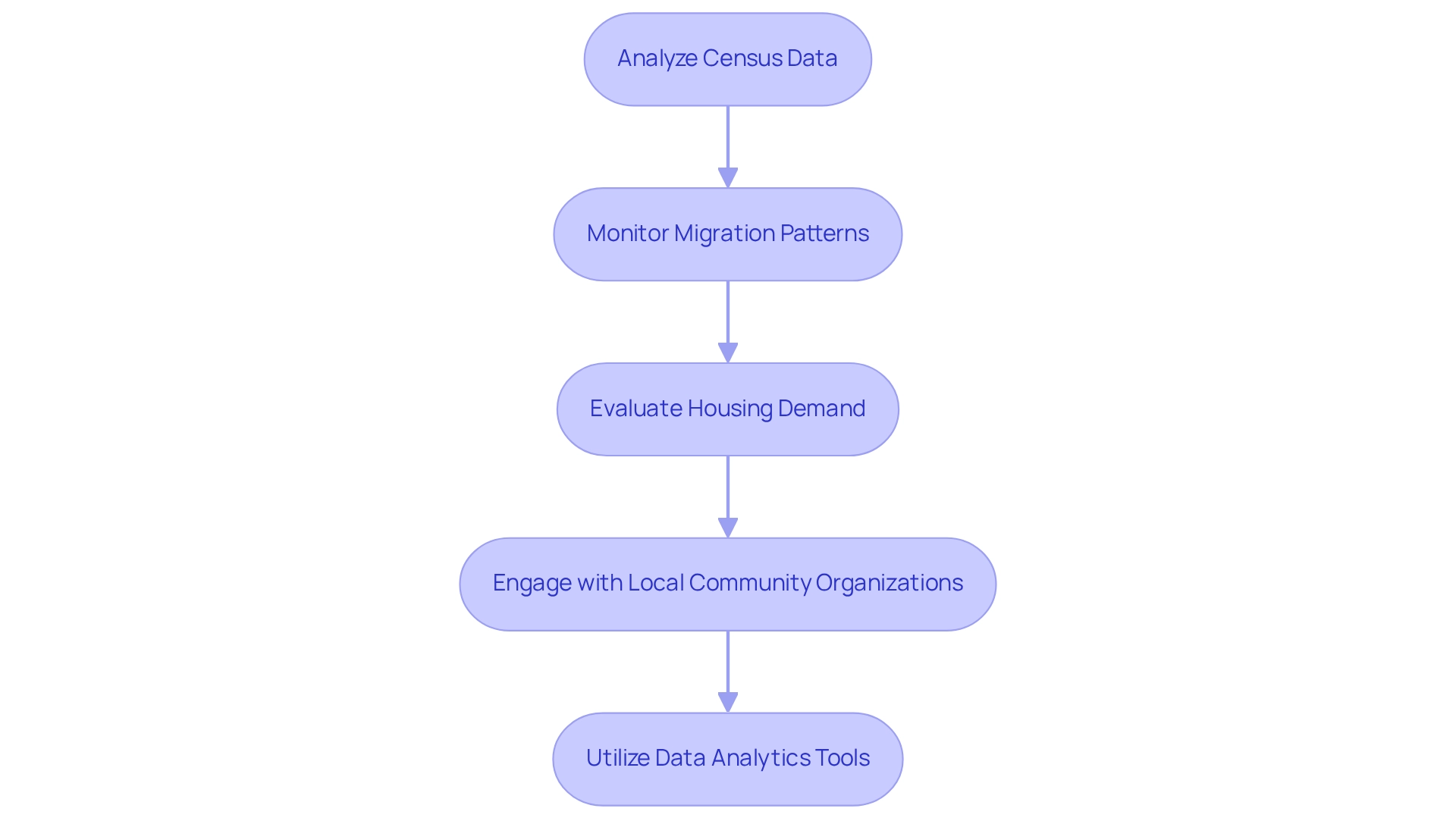

Gaining Insights on Demographics and Population Growth

To effectively gain insights into demographics and population growth for real estate investment, consider the following steps:

-

Analyze Census Data: Leverage the extensive resources available at data.census.gov, which hosts over 2.5 million tables of raw data. This information can assist you in comprehending essential population trends, age distribution, and income levels within your target audience, offering a solid basis for your investment strategy.

-

Monitor Migration Patterns: Investigate current migration trends, particularly the shift towards the Sun Belt, where population growth has accelerated. This region is becoming increasingly attractive for investment due to its favorable economic policies and demographic shifts. Understanding these patterns can help you pinpoint areas with high potential for growth in commercial real estate research.

-

Evaluate Housing Demand: Assess how demographic changes influence housing demand. The recent uptick in population growth in U.S. metro areas from 2023 to 2024 indicates a rising need for various property types, including multifamily units and commercial spaces. As Kristie Wilder, a demographer in the Census Bureau’s Population Division, notes, "Increasingly, population growth in metro areas is being shaped by international migration." Examining these trends through commercial real estate research will enable you to align your investments with industry demands.

-

Engage with Local Community Organizations: Establish connections with local organizations focused on community development and demographic research. These groups can provide valuable insights into emerging trends and future developments that may impact housing demand in your target areas.

-

Utilize Data Analytics Tools: Employ data analytics tools to visualize demographic trends effectively. These tools can assist you in analyzing intricate data collections and making knowledgeable, data-informed investment choices, improving your capacity to maneuver through the changing property market.

By following these steps, you can harness the power of demographic analysis and migration patterns to inform your real estate investment strategies, ensuring you remain ahead in a competitive market.

Conclusion

Investors in commercial real estate must remain vigilant to the dynamic interplay of economic indicators, local regulations, and emerging trends to thrive in an evolving market. By researching economic indicators, analyzing local business trends, and evaluating infrastructure developments, investors can make informed decisions that align with market demands and opportunities. Engaging with local experts and networking within the industry further enhances understanding and opens doors to potential partnerships.

Moreover, staying informed about the development pipeline, loan data, and distress information is crucial for identifying lucrative investment opportunities. Establishing true market value through sales comparables and understanding zoning regulations allows investors to position themselves strategically to capitalize on high-conversion potential properties. Recognizing demographic shifts and population growth patterns also plays a vital role in aligning investments with future housing demands.

In conclusion, the commercial real estate landscape is ripe with opportunities for those who remain proactive and adaptable. By leveraging data-driven insights, forging valuable connections, and continuously educating themselves on market trends, investors can navigate the complexities of the industry and maximize their potential for success. As the market evolves, the ability to anticipate changes and respond effectively will be the cornerstone of successful real estate investment strategies.