Overview

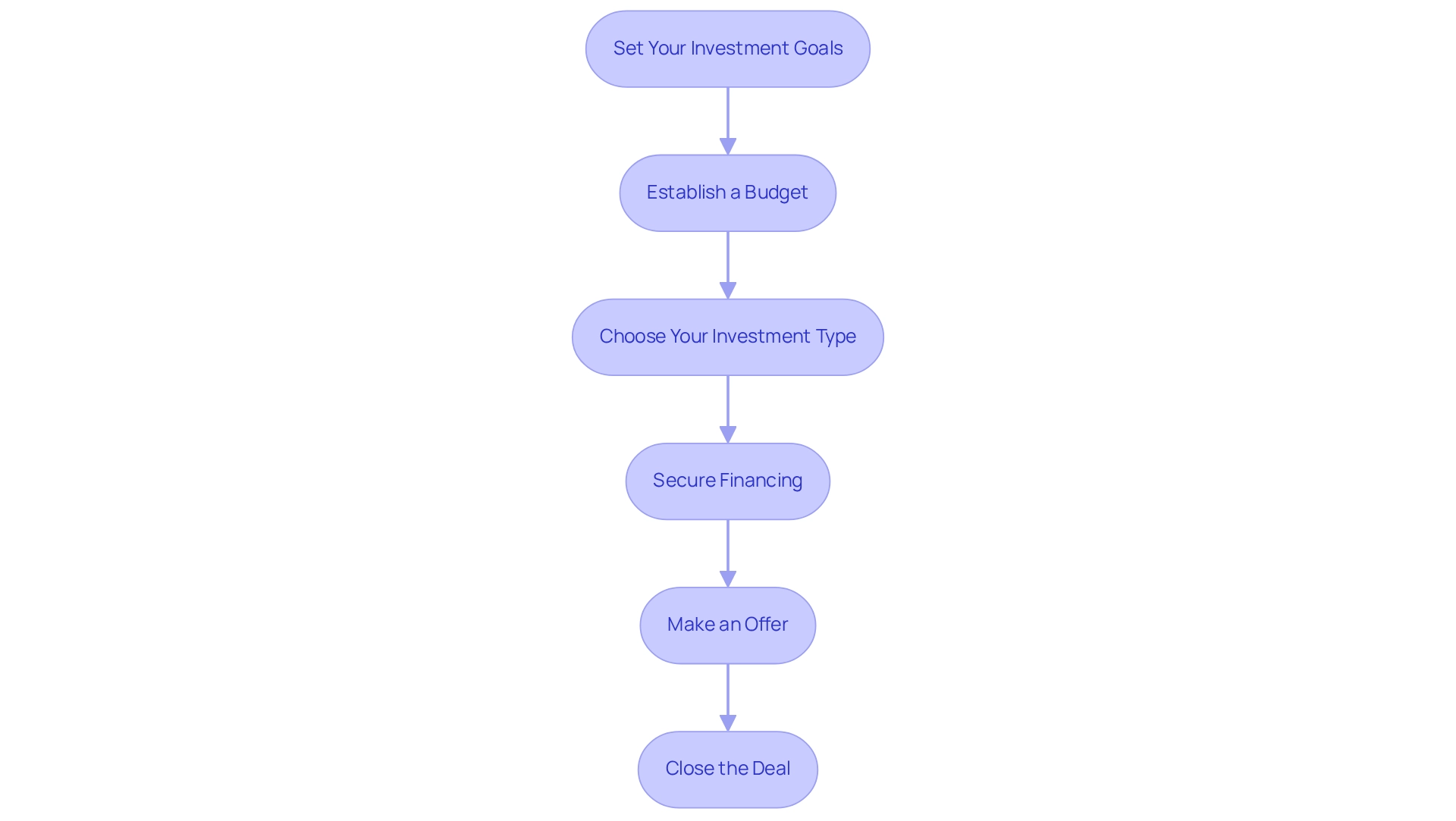

Investing in real estate necessitates a structured approach that encompasses:

- Setting clear investment goals

- Establishing a budget

- Selecting the appropriate property type

- Securing financing

- Making competitive offers

- Effectively closing deals

This article articulates each step in detail, underscoring the significance of:

- Market research

- Financial analysis

- Property management strategies

These elements are crucial for successfully navigating the complexities of real estate investing. By understanding these foundational steps, investors can enhance their decision-making processes and ultimately achieve their investment objectives.

Introduction

In the dynamic world of real estate investing, understanding the fundamentals is crucial for success. Aspiring investors must master key concepts such as equity and cash flow while navigating the complexities of market trends. As millennials increasingly enter the buying landscape, a structured investment approach becomes paramount. This article delves into the foundational aspects of real estate investing, offering a step-by-step guide to help individuals:

- Set clear goals

- Conduct thorough market research

- Effectively manage properties

- Foster strong tenant relationships

With the right strategies, investors can unlock the potential of real estate and build lasting wealth in this ever-changing environment.

Understand the Basics of Real Estate Investing

Investing into real estate involves buying, owning, managing, renting, or selling real assets for profit. Understanding key terms is essential for success in this field:

- Equity: The difference between the value of an asset and the amount owed on it. Grasping equity is crucial, as it indicates your ownership interest in the asset.

- Cash Flow: The net income produced from an asset after all expenses are settled. Positive cash flow is vital for maintaining assets and supporting future opportunities.

- Appreciation: The rise in property value over time, influenced by market trends and economic conditions. Assets that increase in value can significantly enhance an investor's wealth.

- Return on Investment (ROI): A measure of the profitability of a financial venture, calculated as the net profit divided by the initial cost. A higher ROI signifies a more profitable investment.

Familiarizing yourself with these terms will provide a solid foundation for your investment journey. Recent trends reveal that 96% of home buyers begin their search online, underscoring the importance of digital resources in real estate. Furthermore, the U.S. housing sector recorded approximately 4.1 million transactions, reflecting a modest growth of 0.8% from the previous year, despite challenges such as high mortgage rates. This stability, coupled with rising median home prices, highlights the resilience of the market and the potential for savvy investors investing into real estate to capitalize on emerging opportunities. As industry specialists emphasize, data-driven insights are essential for navigating the complexities of property investments.

Follow a Step-by-Step Investment Process

To successfully invest into real estate, adhere to the following structured approach:

-

Set Your Investment Goals: Clearly define your objectives, whether they focus on generating cash flow, achieving property appreciation, or a blend of both. Recent statistics indicate that 44.33% of investors anticipate a decline in the affordable housing market in 2025, making goal clarity essential in navigating potential market shifts. Comprehending these dynamics is essential for establishing realistic and informed financial objectives.

-

Establish a Budget: Evaluate your financial standing to determine how much capital you can allocate to investments. Current best practices indicate that a comprehensive budget evaluation is essential for sustainable investing, particularly in a market where real estate prices are anticipated to stabilize this year, excluding office assets.

-

Choose Your Investment Type: Decide on the property sector that aligns with your goals—residential, commercial, or industrial. Each type presents unique opportunities and challenges.

-

Secure Financing: Investigate various mortgage options or alternative financing methods to fund your investment. Grasping the financing environment is essential, especially as the global real estate sector is anticipated to attain $5,388.87 billion in 2026 at a CAGR of 9.6%. This growth underscores the importance of securing favorable financing terms.

-

Make an Offer: Upon identifying a suitable asset, craft a competitive proposal grounded in comprehensive market analysis. Integrating technology can improve your financial strategy; for example, properties with drone photography sell 68% quicker than those lacking it, and the adoption of virtual tours has increased by over 300% since 2020, greatly boosting buyer involvement.

-

Close the Deal: Work together with a property agent and legal consultant to complete the purchase, ensuring all legalities are addressed while investing into real estate. By adhering to this methodical approach, you can successfully manage the intricacies of investing into real estate and strive towards accumulating wealth.

Conduct Market Research and Financial Analysis

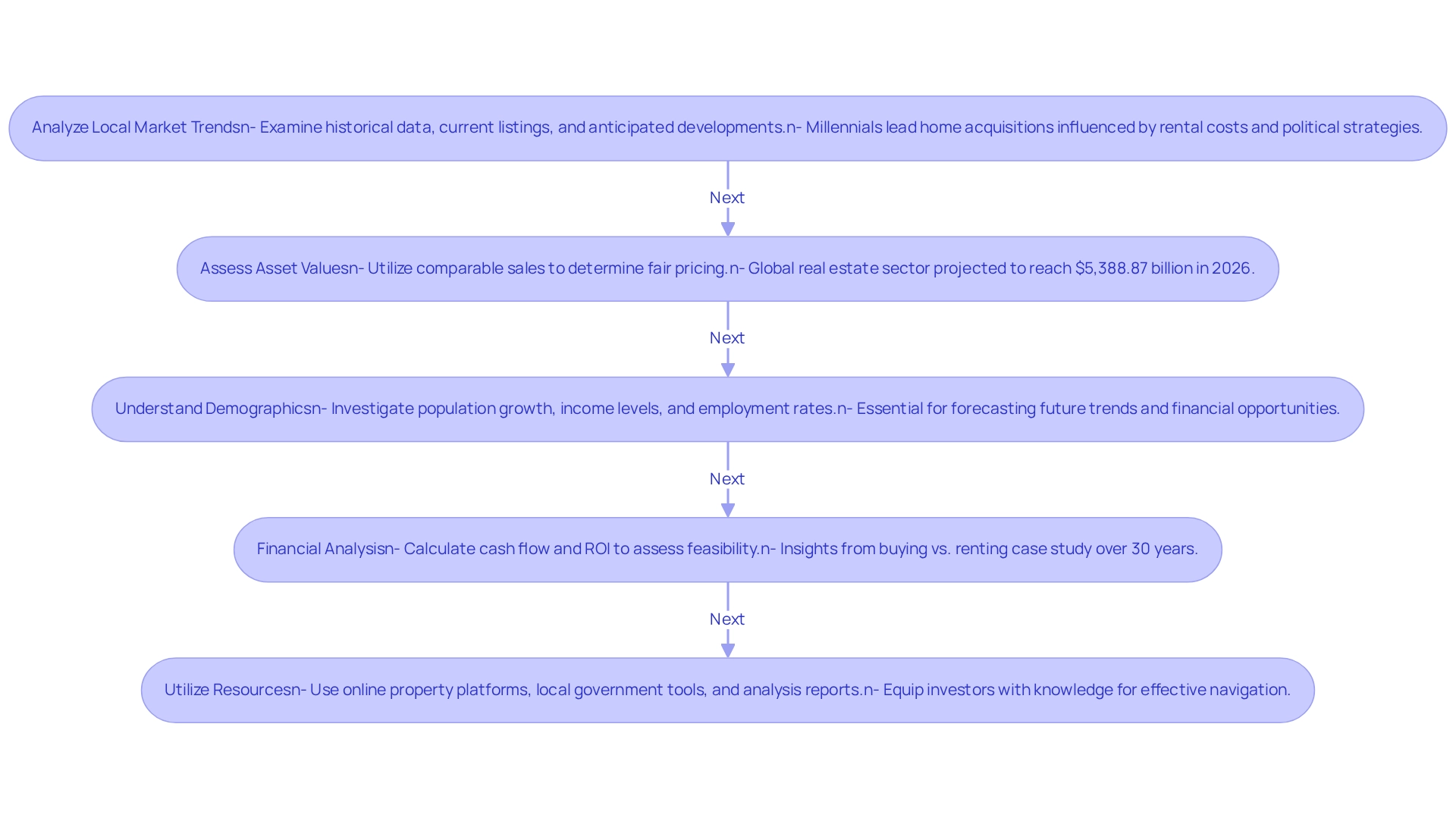

Carrying out comprehensive industry research is vital for successful investing into real estate. Key components include:

- Analyzing Local Market Trends: Examine historical data, current listings, and anticipated developments in the area to understand market dynamics. In 2025, millennials are spearheading home acquisitions, influenced by increasing rental costs and changing political strategies that impact economic stability. Notably, 36.25% of individuals believe that Trump's policies for inflation and tariffs will adversely affect economic recovery, potentially impacting local conditions.

- Assessing Asset Values: Utilize comparable sales (comps) to determine if real estate is fairly priced. This approach assists investors in making informed choices based on real trading activity. The global real estate sector is projected to reach $5,388.87 billion in 2026, indicating a robust environment for property valuation.

- Understanding Demographics: Investigate factors such as population growth, income levels, and employment rates to evaluate demand in the local area. These demographic insights are essential for forecasting future trends and financial opportunities, particularly as millennials increasingly engage in the housing sector.

- Financial Analysis: Calculate key financial metrics, including potential cash flow and return on investment (ROI), to assess the feasibility of a financial undertaking. A comprehensive analysis can reveal the long-term benefits of buying versus renting, as demonstrated in studies showing the financial implications over a 30-year period. The case study on the cost-effectiveness of buying versus renting provides valuable insights for potential homeowners, helping them understand these financial implications.

To collect pertinent information, utilize resources like online property platforms, local government tools, and comprehensive analysis reports. This multifaceted approach to market research and financial analysis equips investors with the knowledge needed to navigate the complexities of investing into real estate effectively.

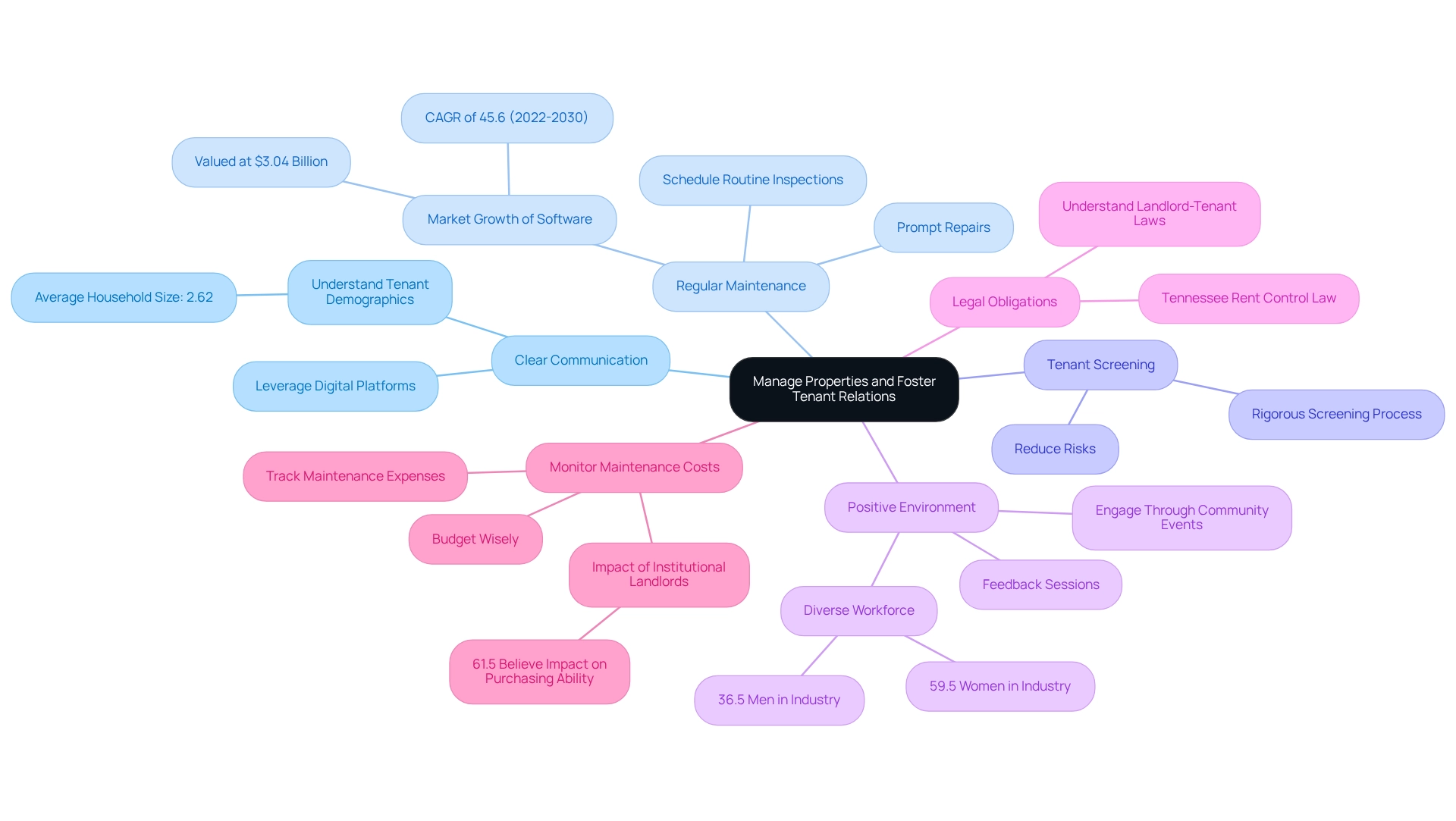

Manage Properties and Foster Tenant Relations

To manage your properties effectively, consider the following strategies:

-

Establish Clear Communication: Leverage digital platforms to facilitate seamless communication with tenants, catering to their preferences for quick and efficient interactions. With the average household size for homeowners being 2.62, understanding tenant demographics can significantly enhance communication strategies.

-

Conduct Regular Maintenance: Schedule routine inspections and address repairs promptly. This proactive strategy not only maintains asset value but also improves tenant satisfaction, as prompt upkeep is a crucial element in tenant retention. The real estate management software market, valued at $3.04 billion with a projected CAGR of 45.6% from 2022 to 2030, underscores the importance of embracing digital solutions for effective maintenance management.

-

Screen Tenants Thoroughly: Implement a rigorous tenant screening process to ensure reliable occupants. This essential step reduces risks associated with asset management.

-

Foster a Positive Environment: Engage with tenants through community events or feedback sessions. Building rapport can lead to improved tenant relations and a sense of belonging, which is vital for long-term occupancy. As David Bitton, co-founder at DoorLoop, points out, the industry workforce comprises 59.5% women, highlighting the significance of diverse viewpoints in management strategies.

-

Stay Informed on Legal Obligations: Understanding landlord-tenant laws is crucial for compliance and protecting your investment. For example, Tennessee state law prohibits local governments from implementing rent control measures, which can significantly impact your rental strategy.

-

Monitor Property Maintenance Costs: Keeping track of maintenance expenses is critical. In 2025, maintenance expenses are expected to rise, making it essential to budget wisely and explore cost-saving strategies. Additionally, 61.5% of people believe that institutional landlords will affect purchasing ability, emphasizing the need to understand tenant needs and market dynamics. By adopting these best practices, property managers can enhance tenant relations and ensure a successful strategy for investing into real estate.

Conclusion

Understanding the fundamentals of real estate investing is essential for anyone looking to build wealth through property. By grasping key concepts such as equity, cash flow, appreciation, and return on investment, aspiring investors can lay a solid foundation for their investment journey. The structured approach outlined—from setting clear goals and establishing a budget to conducting thorough market research—equips investors with the necessary tools to navigate the complexities of the market.

Effective property management and fostering strong tenant relationships are equally vital components of a successful investment strategy. Prioritizing clear communication, regular maintenance, and thorough tenant screening allows investors to create a positive living environment that not only enhances tenant satisfaction but also protects their investment.

As millennials enter the housing market and trends continue to shift, staying informed and adaptable is crucial. The real estate landscape offers numerous opportunities for those willing to invest time and effort into understanding the market. With the right strategies in place, individuals can unlock the potential of real estate investing and achieve their financial goals, paving the way for lasting wealth in an ever-evolving environment.