Overview

Investing in real estate online presents a streamlined approach for individuals to engage in property markets, characterized by lower barriers to entry, enhanced liquidity, and diversified investment opportunities. This article delineates essential steps for getting started, such as:

- Selecting a platform

- Setting up an account

- Grasping the challenges and strategies necessary for successful online real estate investing

By emphasizing the importance of informed decision-making, it underscores how these insights can empower investors to make strategic choices in a dynamic market.

Introduction

In an era where digital innovation reshapes traditional markets, online real estate investing emerges as a game-changer, democratizing access to property investments like never before. This modern approach not only opens doors for investors with varying financial backgrounds but also offers unique advantages, such as enhanced liquidity and diversification.

However, as the online landscape evolves, potential investors may find themselves grappling with questions about navigating this complex arena. What are the best strategies to maximize returns while minimizing risks? Exploring these facets can empower individuals to make informed decisions in the dynamic world of online real estate investing.

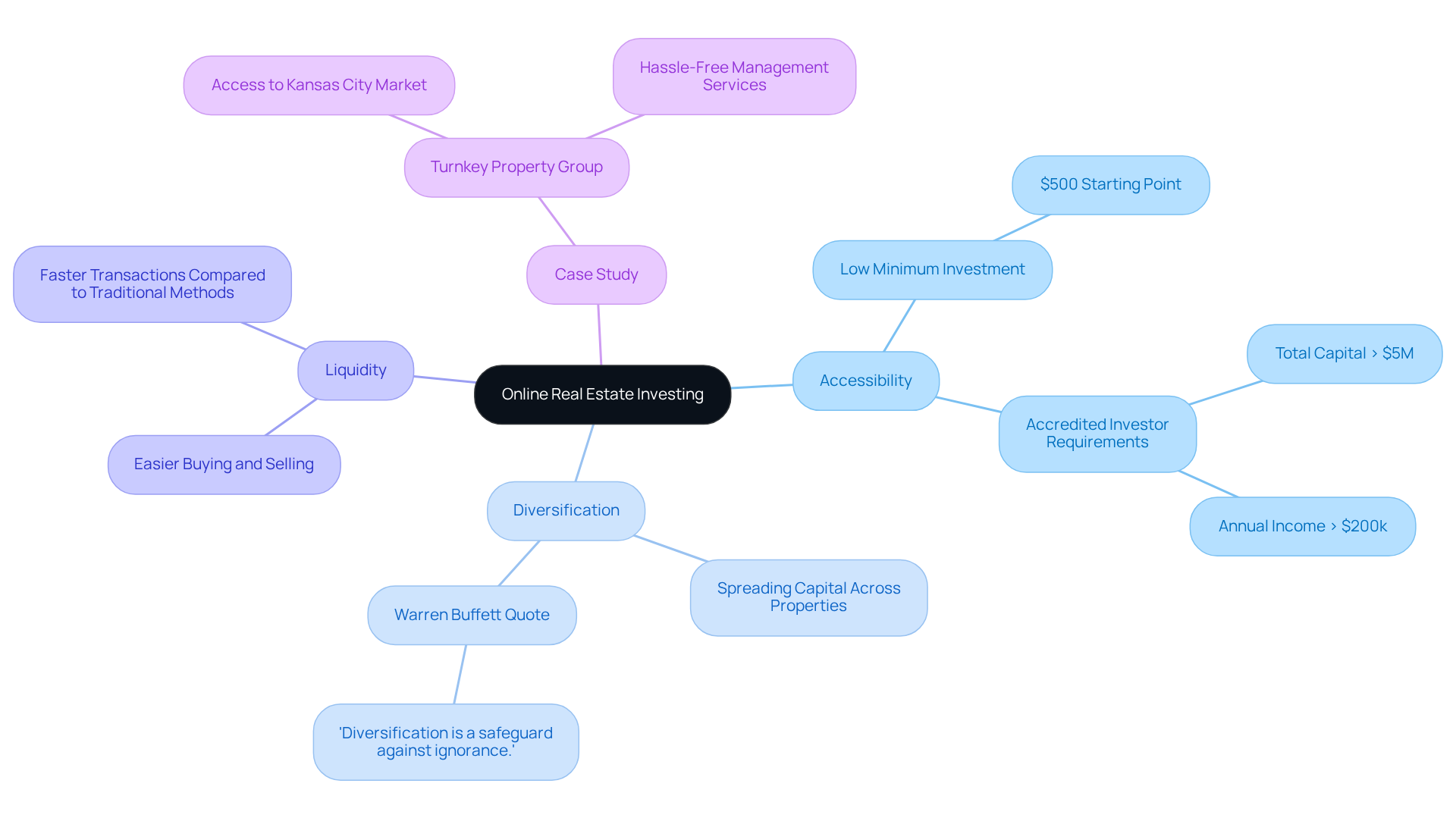

Understand Online Real Estate Investing

Investing real estate online empowers individuals to acquire shares in property projects or assets through digital channels, significantly lowering the barriers to entry compared to traditional methods. This innovative approach presents several compelling advantages:

-

Accessibility: Investors can explore a diverse array of real estate opportunities from virtually anywhere, often with minimal initial investment amounts. For instance, many services allow funding to start at just $500, opening the market to a broader audience. However, it is crucial to recognize that any entity must possess total capital exceeding $5 million to qualify as an accredited investor, underscoring the varying levels of accessibility for different types of investors.

-

Diversification: Investing real estate online facilitates the allocation of funds across multiple properties, thereby mitigating risk by spreading capital across various assets. This strategy aligns with the insights of renowned financiers like Warren Buffett, who stated, 'diversification is a safeguard against ignorance,' emphasizing the importance of resource distribution to protect against market fluctuations, particularly when investing in real estate online.

-

Liquidity: Many opportunities for investing real estate online provide greater liquidity than traditional property investments, simplifying the buying and selling of shares. This flexibility is particularly attractive in a market where property transactions can often take weeks or even months to complete.

-

Case Study: Partnering with Turnkey Property Group illustrates how investors can seamlessly enter the lucrative Kansas City market, enabling them to capitalize on the advantages that property ventures offer.

Understanding these essential concepts is crucial for effectively navigating the online property market and maximizing investment opportunities when investing real estate online.

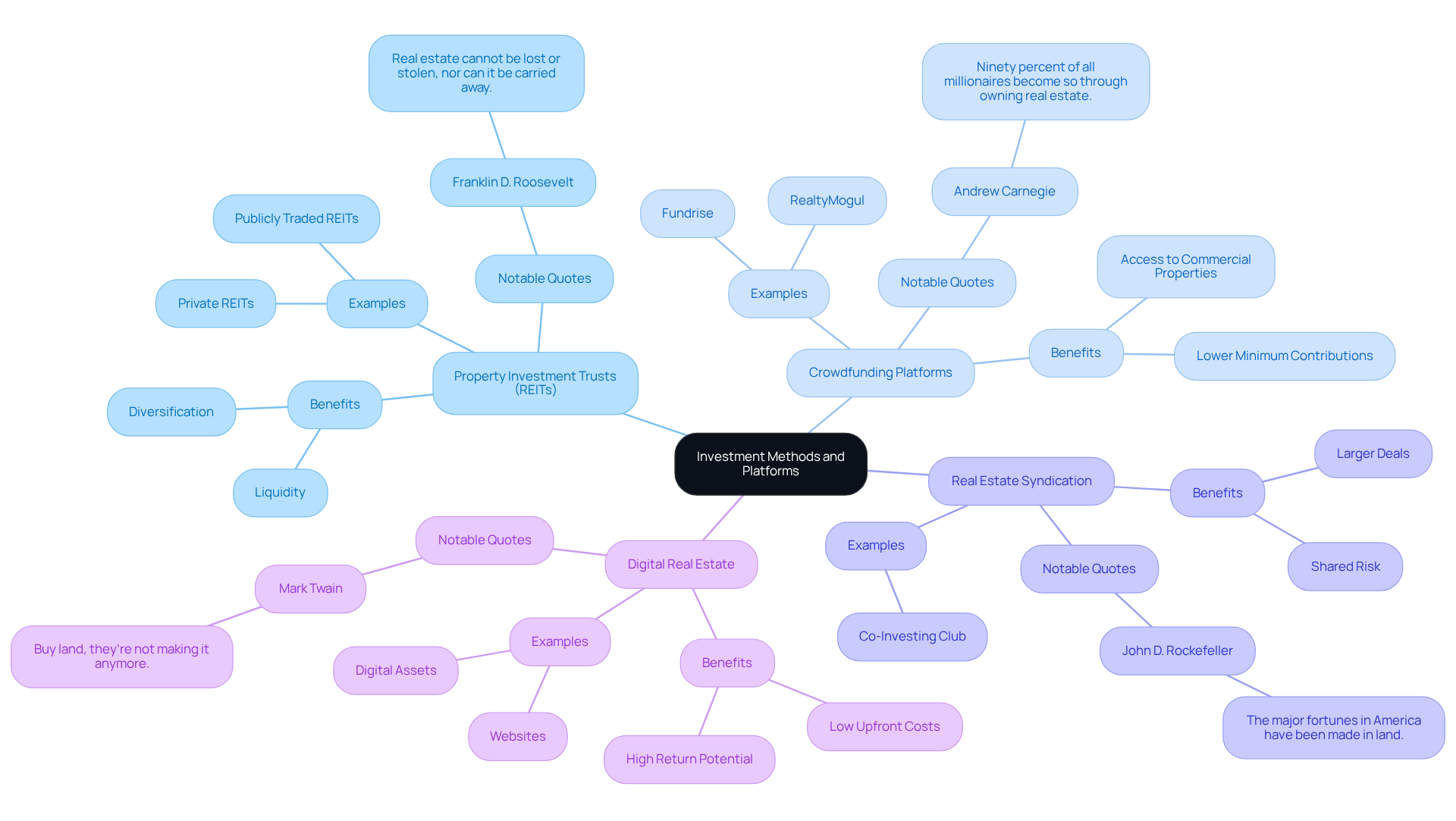

Explore Investment Methods and Platforms

- Property Investment Trusts (REITs): These firms possess, manage, or fund income-generating properties, enabling investors to purchase shares via stock markets. This offers a method of investing real estate online without the obligations of direct ownership, making it an appealing choice for individuals seeking liquidity and diversification. As Franklin D. Roosevelt aptly noted, "Real property cannot be lost or stolen, nor can it be carried away." When acquired with common sense, paid for entirely, and handled with reasonable care, it stands as one of the safest ventures in the world.

- Crowdfunding Platforms: Platforms such as Fundrise and RealtyMogul enable investors to pool their resources for property projects. This approach frequently necessitates reduced minimum contributions, thereby making it accessible to a broader audience. Notably, investing real estate online through crowdfunding can create opportunities to invest in commercial properties that might otherwise be out of reach for individual investors. Andrew Carnegie once stated, "Ninety percent of all millionaires become so through owning real estate," underscoring the potential of property ownership.

- Real Estate Syndication: In this model, a group of investors collaborates to acquire a property, sharing the profits in proportion to their financial contributions. This collaborative approach to investing real estate online allows investors to engage in larger deals while spreading the risk across multiple parties, thereby enhancing the potential for returns. A case study from the Co-Investing Club illustrates how collective funding can yield significant returns, showcasing the effectiveness of this strategy.

- Digital Real Estate: The rise of virtual properties, such as websites and digital assets, presents a new frontier for investors. This innovative approach can produce significant returns with relatively low upfront contributions, attracting those looking to broaden their portfolios beyond conventional real estate.

Investigating and contrasting these alternatives is essential for pinpointing the platform that best aligns with your financial objectives. As highlighted by industry leaders, understanding the nuances of each method can significantly influence your financial success. It is crucial to exercise thorough research and due diligence to mitigate risks.

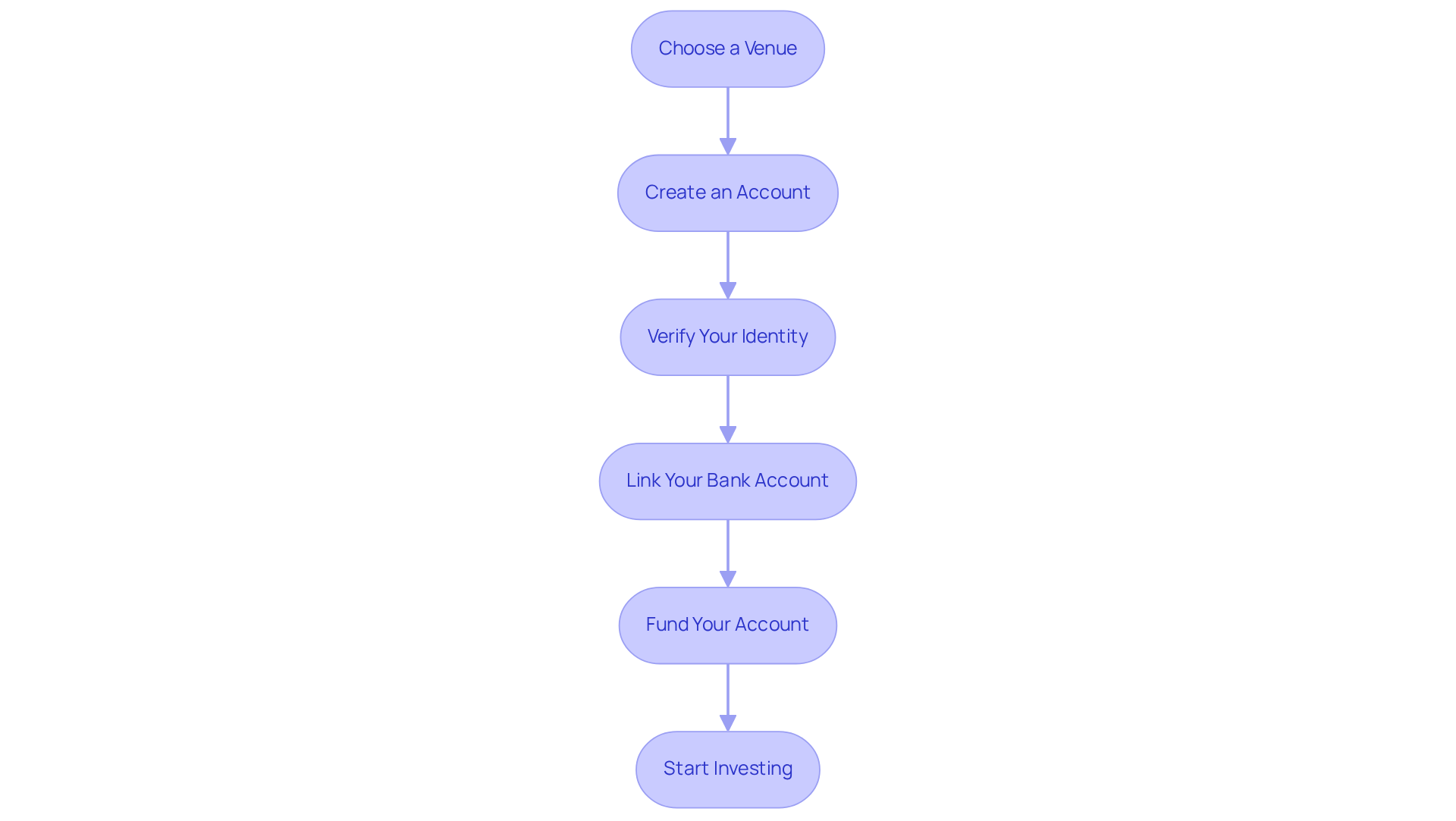

Set Up Your Investment Account and Start Investing

To embark on your online real estate investment journey, follow these essential steps:

- Choose a Venue: Conduct thorough research to select a reputable online real estate investment venue that aligns with your financial goals and investment strategy.

- Create an Account: Navigate to the website and click on the 'Sign Up' or 'Create Account' button. You will need to provide personal information, including your name, email address, and phone number.

- Verify Your Identity: Most services require identity verification to adhere to regulatory requirements. This procedure typically involves submitting a government-issued ID and proof of address, ensuring the safety of your assets. As Marci McGregor emphasizes, "Time itself is one of your best assets," making it crucial to complete this step promptly.

- Link Your Bank Account: Connect your bank account to facilitate seamless fund transfers. Ensure that the system supports your bank for efficient transactions.

- Fund Your Account: Deposit funds into your trading account, keeping in mind any minimum deposit requirements that may apply.

- Start Investing: Explore the available funding opportunities on the platform. Carefully review the details, including projected returns and associated risks, before making your financial decisions. Research indicates that investors who remained committed during the 2010s achieved returns of 190%, emphasizing the significance of a long-term strategy.

By following these steps, you can efficiently establish your financial account and confidently start your journey into investing real estate online. Furthermore, be mindful that the typical duration to establish an investment account on property platforms can differ, so it's prudent to review the specific platform's guidelines. Always exercise caution and conduct thorough due diligence, as relying solely on platform-provided information can pose risks.

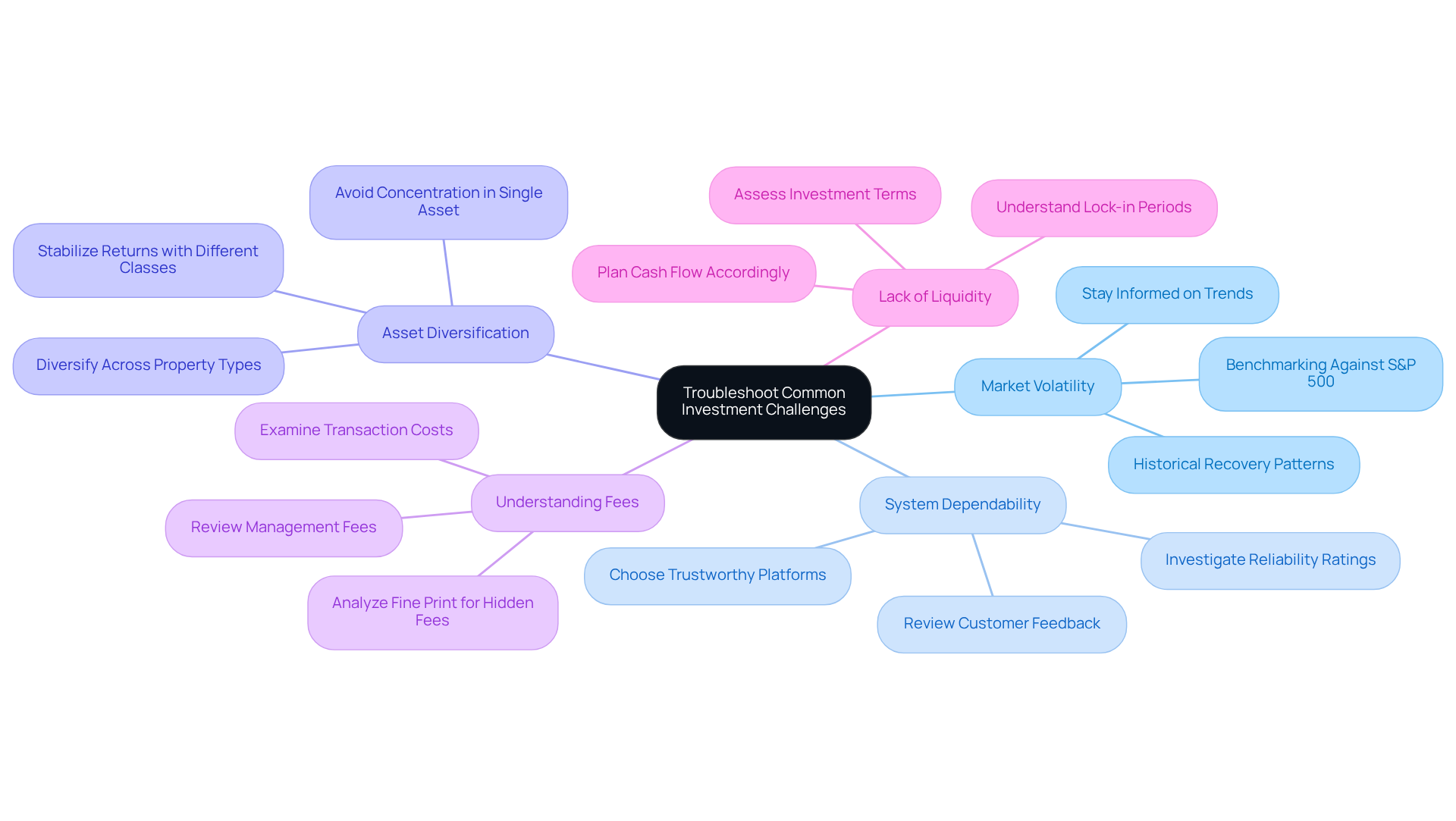

Troubleshoot Common Investment Challenges

Investing in real estate online presents several challenges that require careful consideration. Understanding these common issues and the strategies to address them is essential for success.

- Market Volatility: Real estate markets experience fluctuations influenced by economic conditions. Staying informed about market trends is crucial. Historical data indicates that significant recoveries often follow steep declines in volatile markets, suggesting that a proactive approach can yield positive outcomes. For instance, the historical average return of the S&P 500, adjusted for inflation, is approximately 7%, which can serve as a benchmark for assessing real estate opportunities.

- System Dependability: Selecting a reliable service is paramount for successful online ventures. Investigating reliability ratings and customer feedback can provide insights into a provider's history and service quality. A trustworthy platform not only enhances your financial experience but also mitigates risks associated with online transactions. Experts emphasize that ensuring the platform's good reputation can significantly influence your financial results.

- Asset Diversification: To minimize risk, it is advisable to avoid concentrating all your funds in a single asset. Diversifying your portfolio across various properties and asset types can help stabilize returns. This strategy aligns with the principle that different asset classes perform differently under varying economic conditions, thereby cushioning against market volatility.

- Understanding Fees: It is vital to be vigilant about the fees associated with your assets, including management fees and transaction costs. A thorough review of the fine print can prevent unexpected expenses that may erode your returns. For example, typical charges in online real estate ventures can include platform fees, which can vary significantly among providers.

- Lack of Liquidity: Certain assets may impose lock-in periods, restricting your access to funds. Understanding the terms of your investments and planning your cash flow accordingly is crucial to avoid liquidity issues.

By being proactive and informed, you can effectively navigate these challenges and enhance your experience in investing in real estate online.

Conclusion

Investing in real estate online signifies a transformative shift in how individuals engage with property markets, dismantling traditional barriers and creating opportunities for a diverse range of investors. This approach democratizes access to real estate investments, offering significant benefits such as increased liquidity, diversification, and a variety of investment methods tailored to different financial goals.

Key insights from the article underscore the necessity of understanding various investment methods, including:

- Real Estate Investment Trusts (REITs)

- Crowdfunding platforms

- Real estate syndication

Each method presents unique advantages, enabling investors to select options that align with their risk tolerance and investment objectives. Establishing an investment account requires careful research and a systematic approach, ensuring that investors are well-prepared to navigate the online landscape effectively.

In conclusion, as the online real estate investing landscape continues to evolve, staying informed about current trends and best practices is essential for success. By embracing the opportunities presented by this innovative approach and proactively addressing common challenges, individuals can position themselves to thrive in the dynamic world of real estate investing. Engaging with this field not only opens doors to potential financial growth but also empowers investors to take control of their financial futures.