Overview

This article delves into the critical question of whether a higher or lower cap rate is more advantageous for real estate investments.

- Higher cap rates generally signal greater potential returns; however, they also come with increased risks.

- Conversely, lower cap rates tend to indicate more stability and consistent income, albeit with lower returns.

This conclusion is substantiated through an analysis of various property types and market conditions, showcasing how cap rates embody the essential risk-reward balance that investors must navigate in their strategic decision-making.

Introduction

The cap rate stands as a pivotal metric in real estate, guiding investors through the intricate landscape of property investments. By grasping the intricacies of capitalization rates, individuals can unveil potential returns and the inherent risks associated with various assets. Yet, the ongoing debate regarding whether a higher or lower cap rate is more beneficial remains a crucial inquiry—one that could profoundly shape investment strategies.

What essential factors must investors weigh when assessing this vital metric, and how can they effectively leverage cap rates to refine their portfolios?

Define Cap Rate and Its Importance in Real Estate

The capitalization percentage, commonly referred to as the cap rate, is a vital metric in real estate for assessing the potential return on an investment asset. This figure is calculated by dividing the asset's net operating income (NOI) by its current market value. For instance, if an asset generates an NOI of $100,000 and is valued at $1,000,000, the capitalization percentage would be 10%. This percentage signifies the expected annual return on the investment, making it crucial for investors to compare different assets and evaluate their profitability. Understanding capitalization metrics is essential for making informed investment decisions, as they provide insights into the risk and return profiles of various real estate assets.

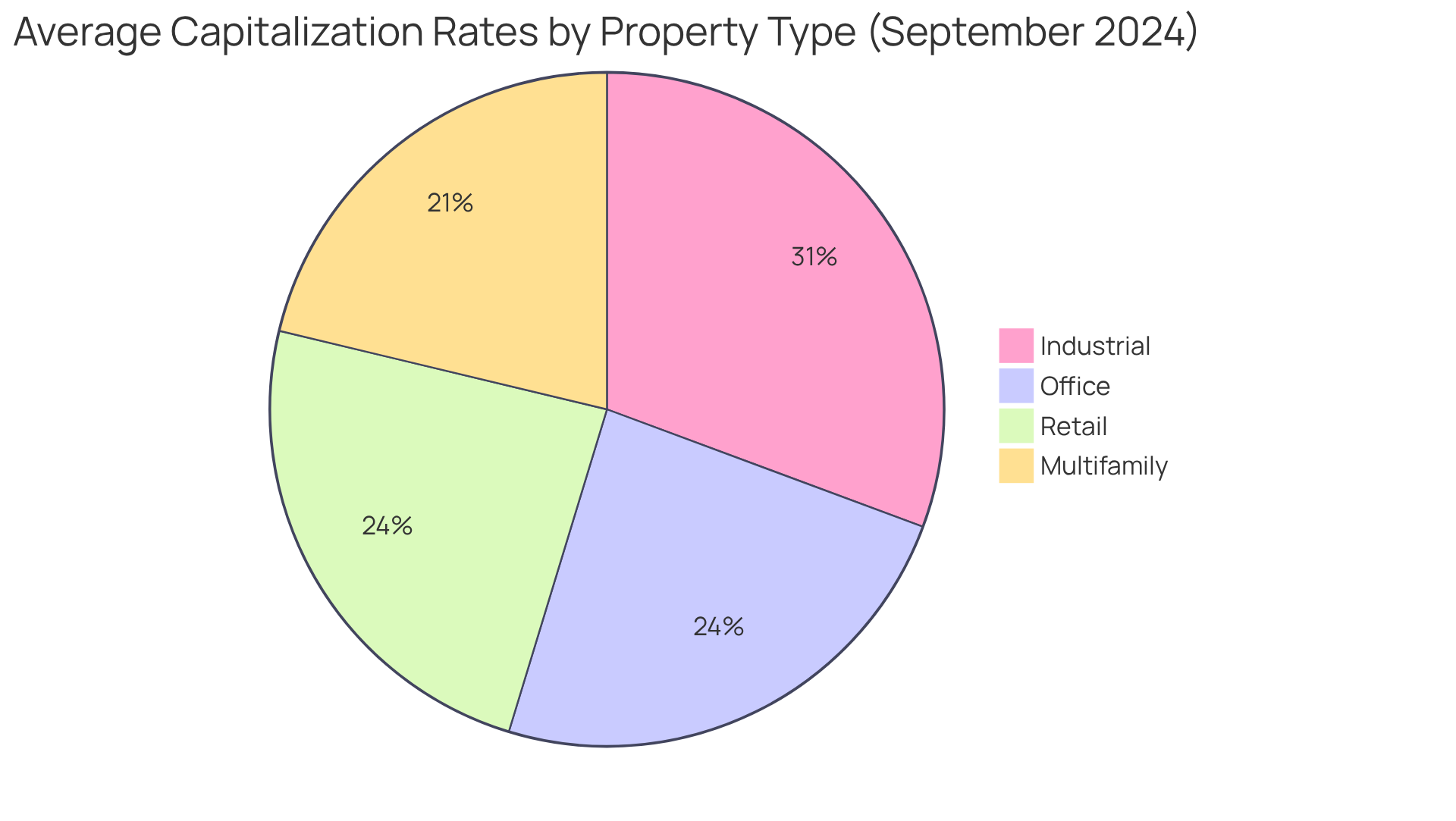

As of September 2024, average nationwide capitalization percentages were reported at:

- 6.1% for multifamily assets

- 6.9% for office spaces

- 8.8% for industrial properties

- 6.9% for retail establishments

These figures illustrate the varying risk levels associated with different property types, raising the question of whether a higher or lower cap rate is better, as higher capitalization ratios generally indicate greater perceived risk and potential returns. Experts suggest that when discussing whether a higher or lower cap rate is better, a cap percentage between 5% and 10% is typically considered favorable, reflecting a balance between risk and return.

Case studies further underscore the importance of capitalization ratios in investment strategies. For example, assets with differing capitalization values can yield similar returns under various income projections, emphasizing the need for investors to consider both capitalization values and potential appreciation when evaluating assets. Moreover, it is crucial to acknowledge that the question of whether a higher or lower cap rate is better should not be used in isolation but in conjunction with other metrics for enhanced investment decisions. Investors can also influence cap values through property renovations, which can boost net operating income and lower cap values.

In summary, capitalization ratios are not merely numbers; they are critical indicators that guide investors in navigating the complexities of real estate investments, enabling them to make strategic decisions based on comprehensive market insights. However, investors must remain aware of the potential risks associated with capitalization factors, such as the possibility of increased capitalization values at the time of sale compared to acquisition, and the importance of adjusting net operating income calculations for occupancy levels.

Analyze the Impact of High vs. Low Cap Rates on Investment Outcomes

High capitalization percentages typically raise the question of whether a higher or lower cap rate is better, as they indicate a greater potential return on investment while also carrying elevated risk. Properties with high capitalization ratios may be located in less desirable areas or may rely on less stable income sources.

For instance, an asset in a burgeoning sector might exhibit a cap percentage of 12%, suggesting a potentially lucrative investment; however, this also entails the risk of market fluctuations. Conversely, low capitalization values, generally ranging between 4% and 6%, are common in stable, high-demand markets. Such assets may offer more consistent income and reduced risk, but the trade-off often results in lower returns.

Investors must carefully weigh these factors when determining if a higher or lower cap rate is better for allocating their resources.

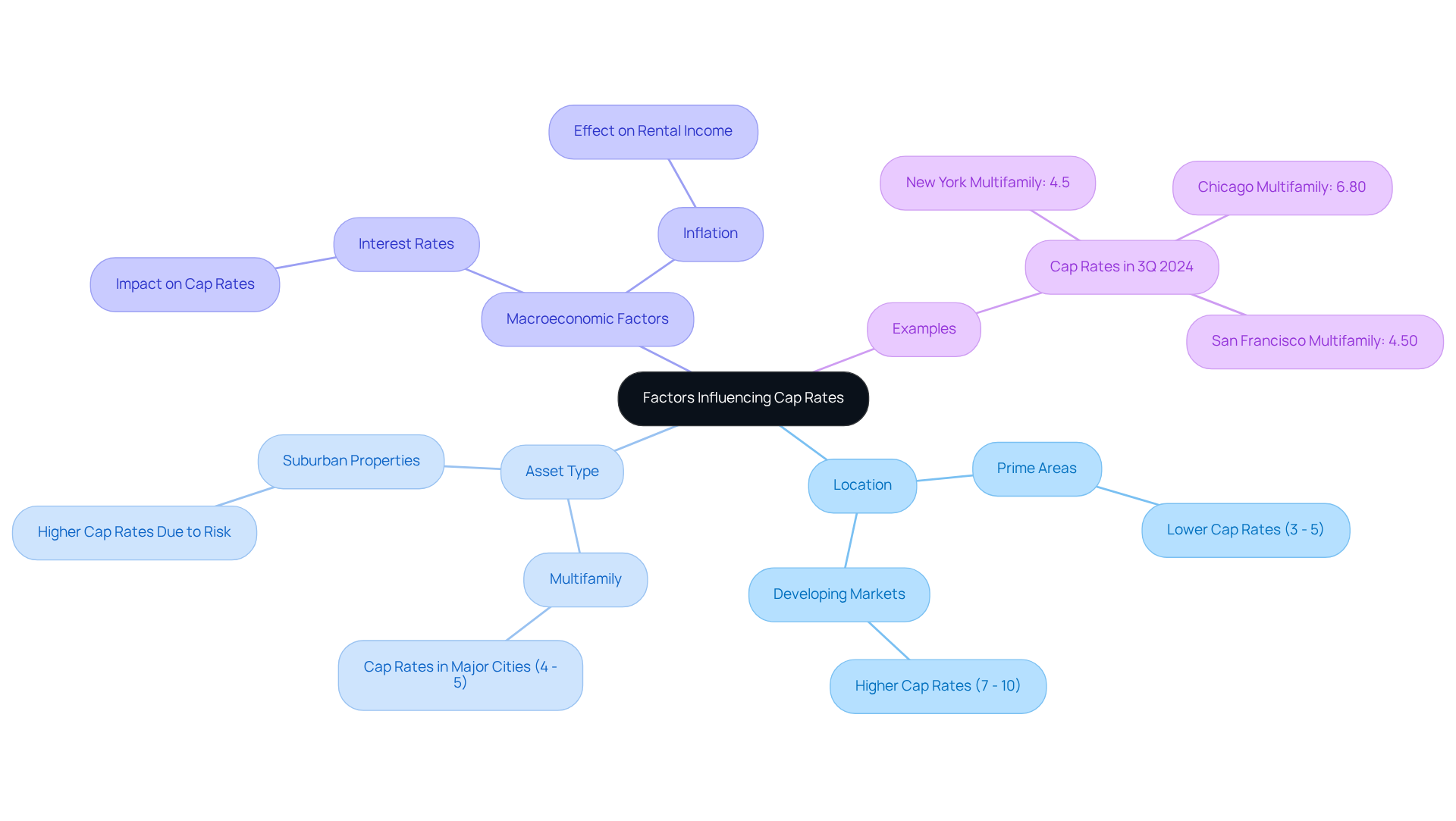

Examine Factors Influencing Cap Rates and Their Variability

Capitalization values are influenced by various elements, with location and asset type being paramount. Properties situated in prime areas, such as city centers, typically command lower capitalization percentages, often ranging from 3% to 5%. This is due to their high demand and perceived stability, making them appealing to core investors who seek consistent, long-term income. In contrast, assets in developing or less desirable markets may exhibit higher capitalization percentages, frequently between 7% and 10%, leading to the consideration of is higher or lower cap rate better, as investors pursue greater profits to offset the increased risks associated with these locations.

For instance, in the third quarter of 2024, multifamily assets in cities like New York and San Francisco reported capitalization figures around 4% to 5%, reflecting their robust demand. Conversely, Chicago's multifamily buildings showed cap values of approximately 6.80%, indicating a different risk-reward profile. Additionally, suburban multifamily properties often display higher capitalization values due to varying market dynamics and perceived risks.

Macroeconomic factors, including interest rates and inflation, also significantly impact capitalization ratios. Rising interest rates usually lead to increased capitalization ratios, prompting the discussion of is higher or lower cap rate better, as higher borrowing costs make real estate investments less appealing. For example, the national trend in 2024 revealed a rise in capitalization rates, influenced by elevated interest levels that escalated financing costs and curtailed transaction volumes. Understanding these dynamics is crucial for investors aiming to navigate the complexities of the real estate sector effectively, particularly when evaluating if a higher or lower cap rate is better, as they can profoundly affect investment strategies and potential returns.

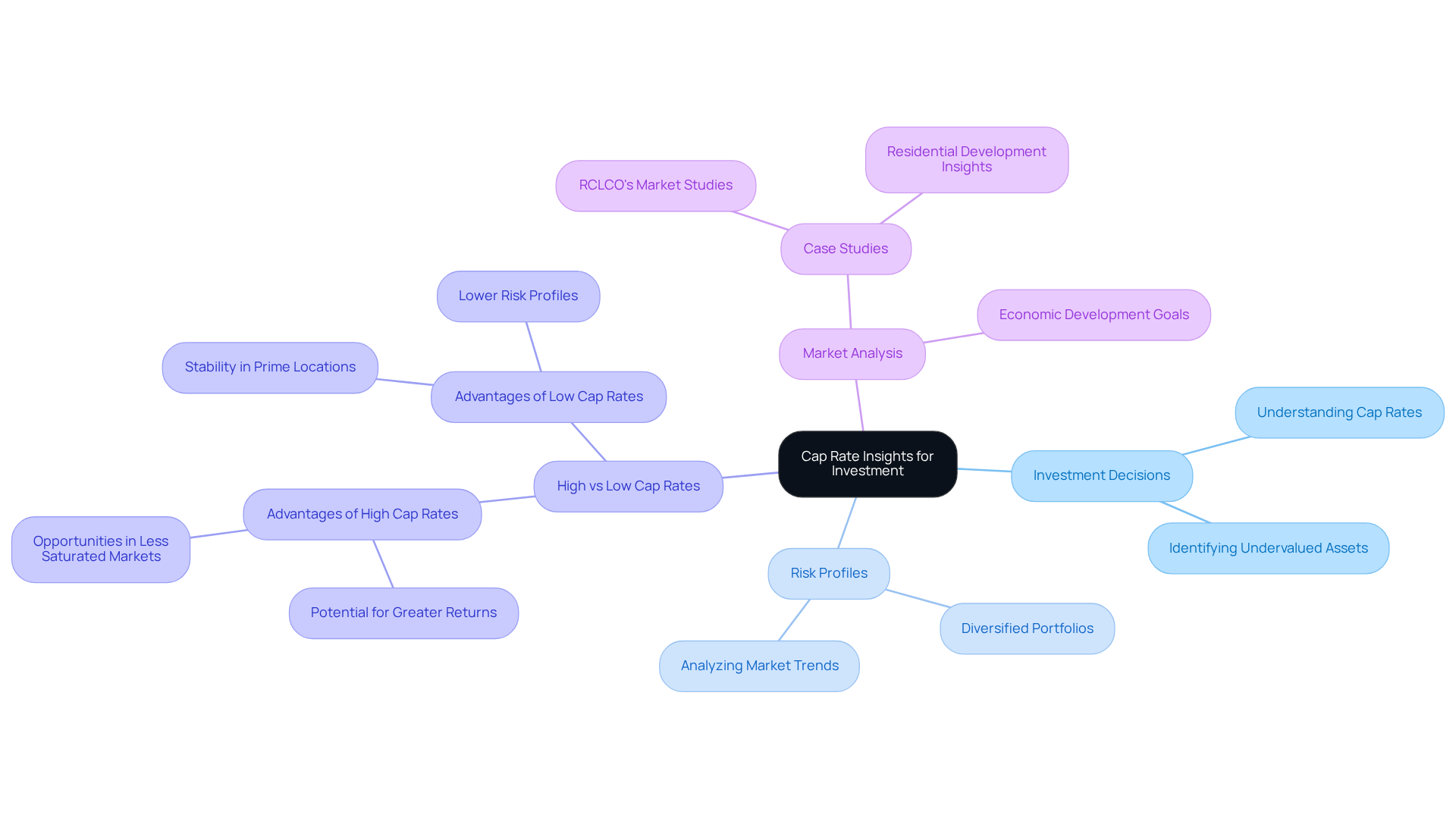

Utilize Cap Rate Insights for Strategic Investment Decisions

Cap yield insights are vital for investors looking to make informed decisions in real estate. By assessing assets within comparable sectors, investors can thoroughly analyze risk profiles. For example, a diversified portfolio may include both high and low cap assets, which raises the question of whether a higher or lower cap rate is better for facilitating a balanced approach to risk and return. Understanding the capitalization figures associated with various real estate categories aids in identifying undervalued assets and emerging areas poised for growth. Regularly evaluating capitalization ratios in conjunction with industry trends empowers investors to refine their strategies, enhance performance, and elevate overall portfolio value.

Statistics indicate that properties in prime locations, such as Lakewood Ranch—home to over 12,000 households and a robust job market—often exhibit lower capitalization ratios, which leads to the question of whether a higher or lower cap rate is better, reflecting their stability. Conversely, when considering whether is higher or lower cap rate better, higher cap rates may signal opportunities for greater returns in less saturated markets. By leveraging these insights, including case studies like RCLCO's analysis of market opportunities for residential uses, investors can navigate the complexities of the real estate landscape with increased confidence.

Conclusion

Understanding the implications of capitalization rates is essential for navigating the intricacies of real estate investments. The debate over whether a higher or lower cap rate is preferable hinges on the balance between risk and potential returns. While higher cap rates may suggest greater returns, they often come with increased risk and volatility. Conversely, lower cap rates typically indicate stability and consistent income but may yield lower returns. Investors must weigh these factors carefully to align their investment strategies with their risk tolerance and financial goals.

Throughout the article, key insights into the nature of cap rates have been explored. These insights include:

- How cap rates are influenced by location, market conditions, and economic factors.

- Properties in prime locations tend to have lower cap rates, reflecting their desirability and stability.

- Assets in less favorable areas may offer higher cap rates but also come with heightened risk.

- The importance of considering cap rates alongside other investment metrics and market trends has been emphasized, underscoring the need for a comprehensive approach to investment decision-making.

Ultimately, the significance of capitalization rates in shaping investment strategies cannot be overstated. Investors are encouraged to leverage cap rate insights to identify opportunities, assess risk profiles, and make informed decisions that enhance their portfolios. By understanding the nuances of cap rates and their implications for potential returns, investors can navigate the real estate landscape with greater confidence and strategic foresight.