Overview

Investing in real estate now presents a compelling opportunity.

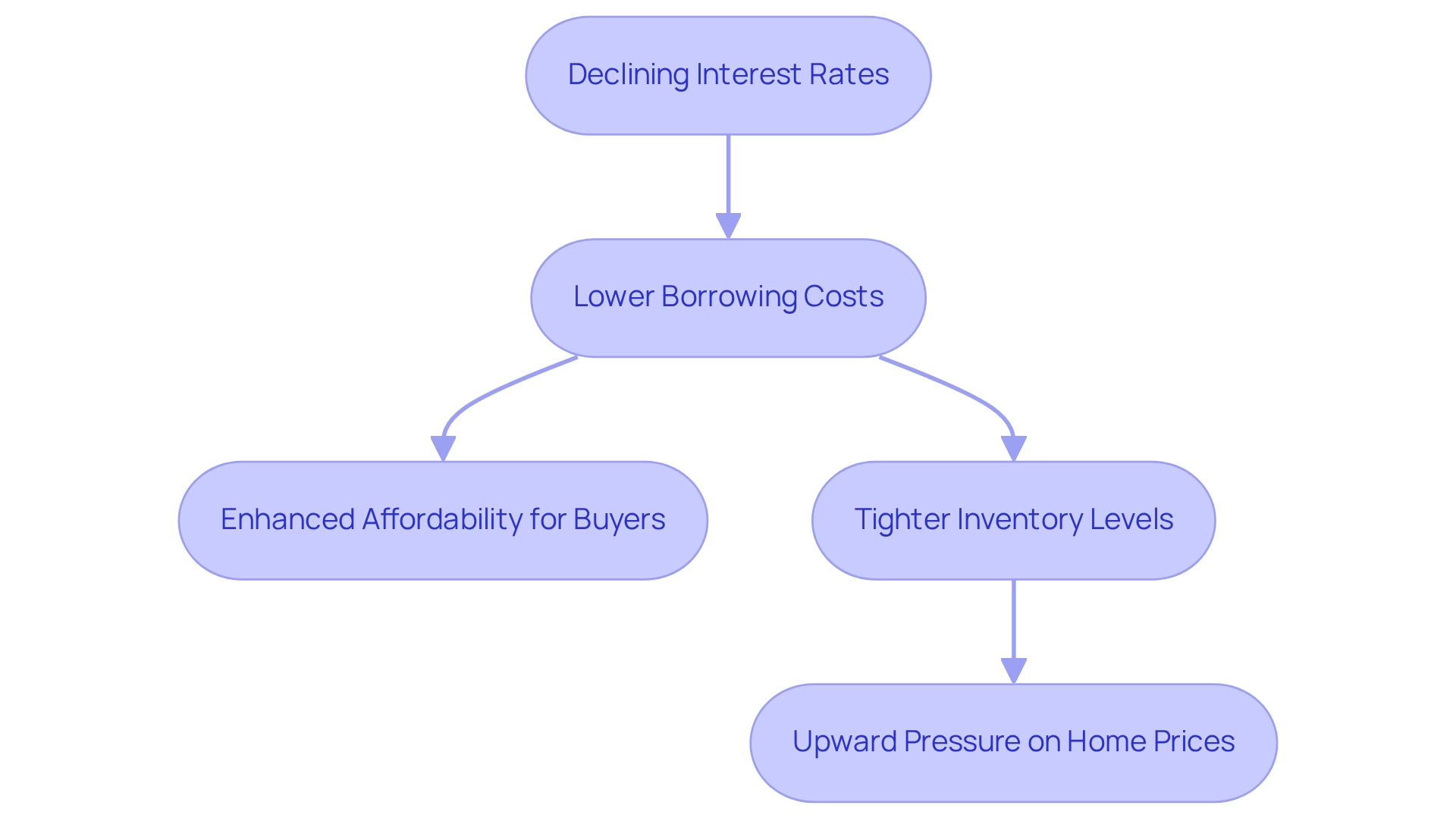

With declining interest rates projected to stabilize around 6.5%, borrowing becomes more affordable, potentially driving home prices upward as inventory tightens.

Historical data supports this trend, illustrating a strong correlation between decreasing interest rates and increased real estate activity.

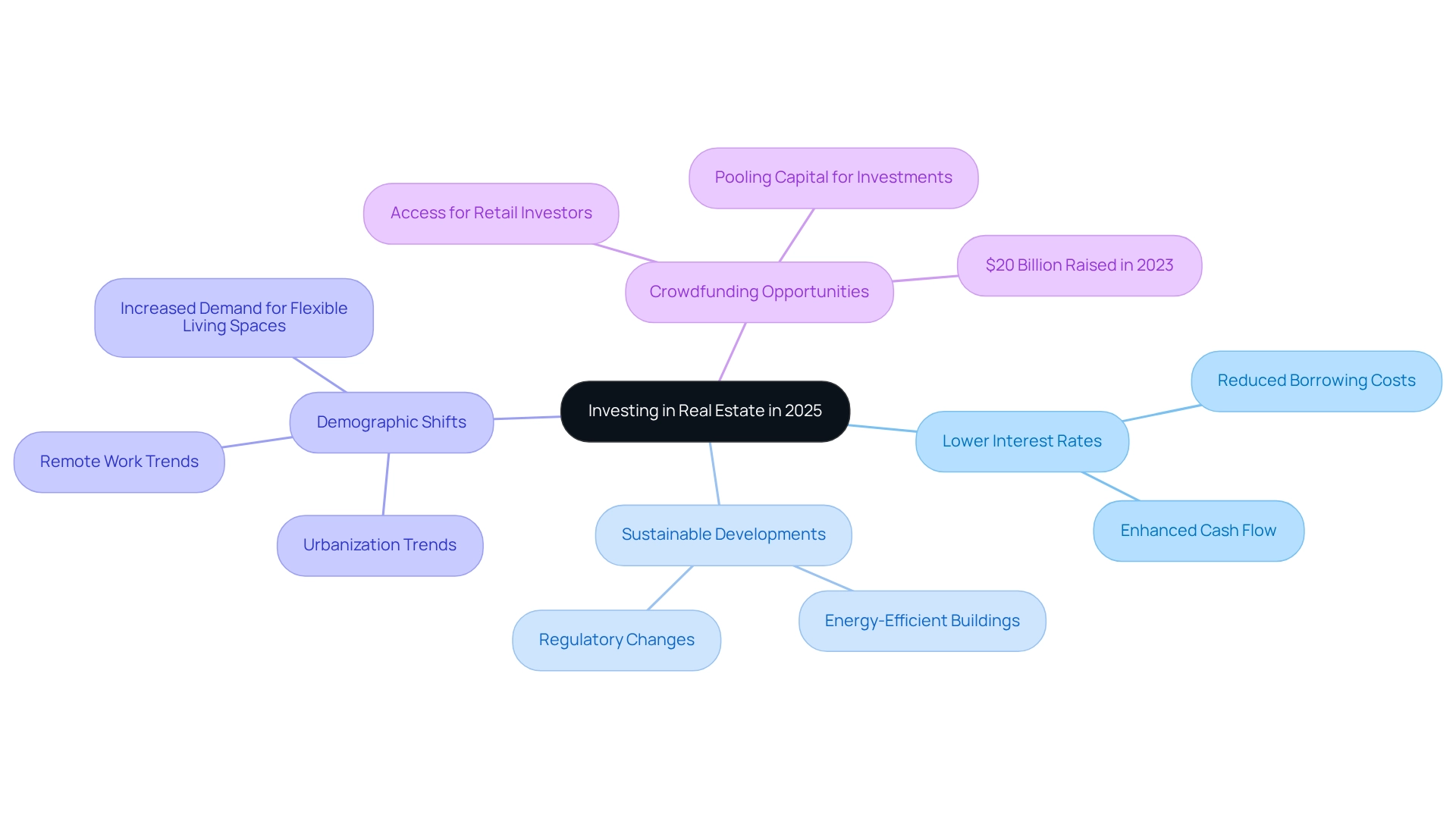

Furthermore, emerging trends such as demographic shifts and technological advancements are poised to enhance investment potential significantly in 2025.

As an informed investor, recognizing these dynamics can lead to strategic advantages in navigating the evolving market landscape.

Introduction

In 2025, the real estate landscape is witnessing a transformative shift as declining interest rates unveil new avenues for investment. With mortgage rates stabilizing around 6.5%, potential buyers are discovering it easier to enter the market, creating a wave of opportunities for both seasoned investors and newcomers alike.

As affordability improves, the dynamics of home buying and renting are evolving, leading to tighter inventory levels and upward pressure on prices. This article delves into the implications of these changes, exploring the benefits of investing in real estate now, the increasing demand driven by demographic shifts, and the innovative technologies reshaping the market.

Understanding these trends is essential for anyone looking to capitalize on the promising prospects of real estate investment in this new era.

Analyze the Impact of Declining Interest Rates on Real Estate Investment

In 2025, the real estate market is witnessing a significant decline in interest levels, poised to reshape investment opportunities. With mortgage rates anticipated to stabilize around 6.5%, a decrease from previous peaks, the cost of borrowing is diminishing, facilitating easier financing for potential buyers. This reduction in expenses is particularly beneficial for first-time homebuyers and investors, resulting in lower monthly payments and enhanced affordability.

As interest rates decline, existing homeowners may hesitate to sell, leading to tighter inventory levels. This scenario can create upward pressure on home prices, indicating that now may be an opportune moment to invest in real estate before prices escalate further. Historical patterns suggest that this is indeed a favorable time for investment, as periods of decreasing interest rates often correlate with heightened real estate activity, akin to the post-2008 recovery phase. Experts advise, 'Expect those budget figures to rise,' highlighting the anticipated economic shifts as demand increases.

Understanding the implications of current interest trends is crucial for evaluating whether this is the right time to invest in real estate in 2025. According to the case study titled 'Long-Term Outlook for Mortgage Rates,' specialists indicate that it could take decades for mortgage rates to revert to the low levels experienced during the pandemic, underscoring the necessity of adapting strategies to navigate this changing landscape. As the industry evolves, remaining informed about these trends will be vital for seizing emerging opportunities.

Explore Key Benefits of Investing in Real Estate Now

Investing in property in 2025 presents a wealth of benefits that appeal to both seasoned investors and newcomers alike. With the current economic landscape marked by lower interest rates and a gradual recovery from past financial disruptions, now is an opportune moment to delve into real estate. Investors can take advantage of reduced borrowing costs, significantly enhancing cash flow and overall returns on investment.

Nevertheless, it is essential to note that 36.25% of individuals believe that Trump's policies regarding inflation and tariffs may negatively impact economic recovery in 2025, introducing a necessary caution to the otherwise optimistic outlook.

Moreover, the property sector is poised for a transformation towards sustainable and energy-efficient buildings, driven by rising consumer demand and regulatory changes. This evolution aligns with global sustainability initiatives and opens doors for investors to engage with emerging sectors. For example, San Francisco continues to hold its status as the most expensive city for renters worldwide, underscoring the potential for investment in high-demand areas.

Demographic shifts, including urbanization and the emergence of remote work, are reshaping housing preferences, leading to a heightened demand for flexible living spaces. Virtual home tours have surged by over 300% since 2020, illustrating a shift in buyer engagement that investors must adapt to. Those who can identify and respond to these evolving trends can strategically position themselves to benefit from increasing rental revenues and property values. Additionally, crowdfunding platforms have amassed nearly $20 billion in 2023, significantly lowering barriers to entry for property investments and facilitating access for retail investors. This shift has transformed the investment landscape, allowing individuals to pool smaller amounts of capital into substantial investments.

In summary, the combination of positive economic indicators, the anticipated expansion of the global property sector to $5,388.87 billion by 2026 at a CAGR of 9.6%, and the evolving dynamics suggest that 2025 is indeed a promising time for those looking to invest in real estate and build wealth.

Assess Market Activity and Demand Trends in Real Estate

As we progress through 2025, the real estate sector is exhibiting significant signs of heightened activity, prompting the question: Is now a good time to invest in real estate? Influenced by demographic shifts, economic recovery, and evolving consumer preferences, demand for housing remains robust, particularly in urban areas where job growth and lifestyle changes are driving a surge in home purchases. Notably, only 29.7% of Millennial renters can currently afford to purchase a home, underscoring the challenges many face in this market. The overall housing sector is expected to remain constrained due to ongoing supply limitations, complicating the situation for potential buyers.

The rental sector is also witnessing increased demand, as individuals increasingly opt for renting over purchasing due to affordability issues and the flexibility rental agreements offer. This trend is especially pronounced in metropolitan regions where housing supply is limited, resulting in competitive bidding and rising rental prices. A recent analysis of rental trends amid escalating home prices indicates that renting remains more affordable in certain states, while buying can become economical in others after a few years. This analysis reinforces the notion that many are turning to rentals as a viable choice in the current environment.

Moreover, the advent of new technologies and platforms for real estate transactions is enhancing the purchasing process, enabling investors to access data more efficiently and connect with potential buyers or tenants. This increased transparency and efficiency within the industry empowers investors to make informed decisions, further stimulating demand. As Gary Ashton, founder of The Ashton Real Estate Group of RE/MAX Advantage, advises, 'Make sure your home is in excellent condition,' highlighting the importance of property condition in a competitive landscape.

Overall, the current activity and demand trends present a dynamic perspective of the property sector, suggesting that now is an opportune time to invest in real estate for those seeking opportunities. Investors should remain vigilant and consider the tight market conditions, as well as the shifting preferences towards renting, to effectively navigate the complexities of the real estate sector.

Conclusion

The evolving real estate landscape in 2025 presents a wealth of opportunities, driven by declining interest rates and shifting consumer preferences. As mortgage rates stabilize around 6.5%, potential buyers and investors find themselves in a more favorable environment for property acquisition. This reduction in borrowing costs not only enhances affordability but also encourages increased market activity. It is an ideal time for investors to capitalize on the momentum before prices escalate further.

Investors must be keenly aware of the demographic trends shaping the market, such as urbanization and the growing demand for flexible living spaces. The rise of remote work, coupled with technological advancements in real estate transactions, is transforming how buyers and renters engage with the market. By staying informed and adapting to these changes, investors can strategically position themselves to benefit from rising rental incomes and property values in a competitive landscape.

Moreover, the shift towards sustainable and energy-efficient properties aligns with broader consumer demands and regulatory trends, offering additional avenues for investment. With crowdfunding platforms democratizing access to real estate investments, even retail investors can participate in this dynamic market. Overall, the combination of favorable economic indicators, demographic shifts, and technological innovations makes investing in real estate a prudent decision for building wealth in this promising era. Embracing these opportunities now can lead to significant long-term rewards as the market continues to evolve.