Overview

Real estate is currently regarded as a sound investment, driven by stabilizing interest rates, improving economic indicators, and robust demographic trends that are propelling housing demand. This article underscores these points by emphasizing anticipated improvements in affordability, a surge in buyer activity, and the potential long-term benefits of property investments. These benefits include rental income and tax advantages, which remain appealing despite some prevailing market challenges.

The combination of these factors creates a compelling case for investing in real estate. With interest rates stabilizing, buyers are likely to find more favorable conditions, leading to increased market activity. Furthermore, the improving economic landscape suggests a brighter future for property values, making now an opportune time for investment.

In summary, the insights presented here highlight the significance of real estate as a viable investment avenue. Investors should consider these trends and the potential for long-term gains when making decisions in the current market.

Introduction

As the real estate market evolves in 2025, a confluence of economic indicators, demographic shifts, and emerging challenges presents both opportunities and complexities for investors.

With interest rates stabilizing and inflation moderating, the stage is set for a potential resurgence in housing demand. This demand is driven by a diverse array of buyers, from aging Baby Boomers seeking accessible living to Millennials and Gen Z entering the market.

However, the landscape is not without its hurdles; high financing costs and regulatory changes loom large, prompting a need for strategic investment approaches.

This article delves into the current economic climate, demographic trends shaping demand, the risks and challenges investors face, and the long-term benefits of real estate investment. It provides a comprehensive overview for those looking to navigate this dynamic sector.

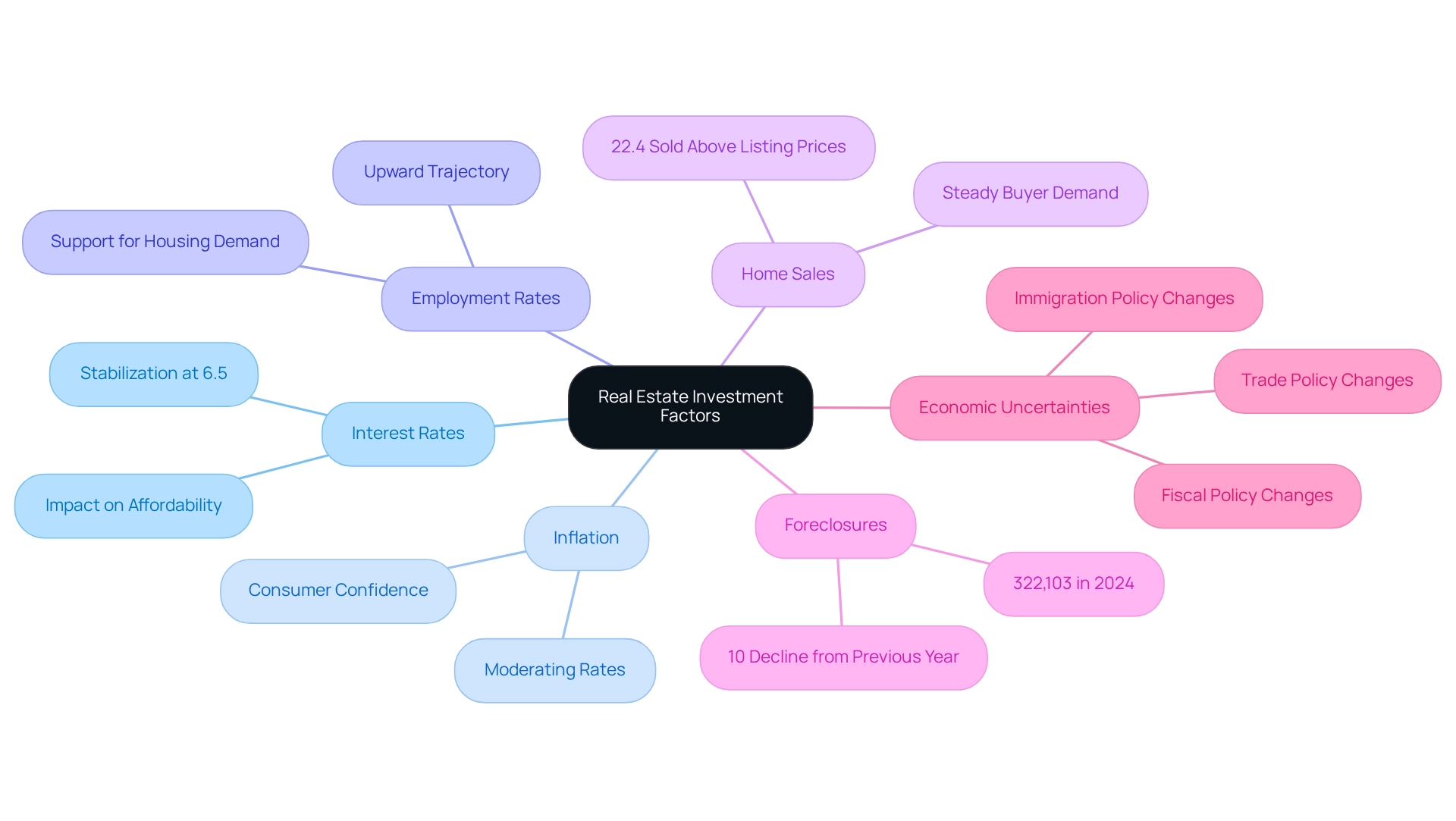

Evaluate Current Economic Indicators Favoring Real Estate Investment

In 2025, various economic indicators suggest that one might ask, is real estate a good investment right now? Interest rates, a primary concern for many investors, are anticipated to stabilize around 6.5%, a notable decrease from previous peaks. This stabilization is likely to enhance affordability for purchasers, thereby encouraging funding in both residential and commercial properties and raising the question of whether is real estate a good investment right now. Furthermore, inflation rates are beginning to moderate, which can enhance consumer confidence and increase spending power. Employment rates are also on an upward trajectory, contributing to a stronger economy that supports housing demand.

Recent data reveals that in January 2025, 22.4% of homes sold for more than their listing prices, indicating a steady buyer demand despite the challenges posed by high costs and interest rates. This resilience suggests that there may be increased demand if interest rates continue to decline. J.P. Morgan's analysis suggests that while growth in the housing sector may be moderated, the wider economic recovery is expected to enhance property values, leading to the consideration of whether is real estate a good investment right now for those looking to capitalize on these advantageous trends. As mentioned, "that encompasses real estate—regardless of what’s happening in the economy."

Moreover, the decrease in foreclosures—322,103 in 2024, down 10% from the prior year—further emphasizes a stabilizing environment. However, potential uncertainties related to changes in trade, fiscal, and immigration policy could impact this positive outlook. With the right guidance and resources, investors can navigate the complexities of the current landscape and make informed decisions that align with their financial goals.

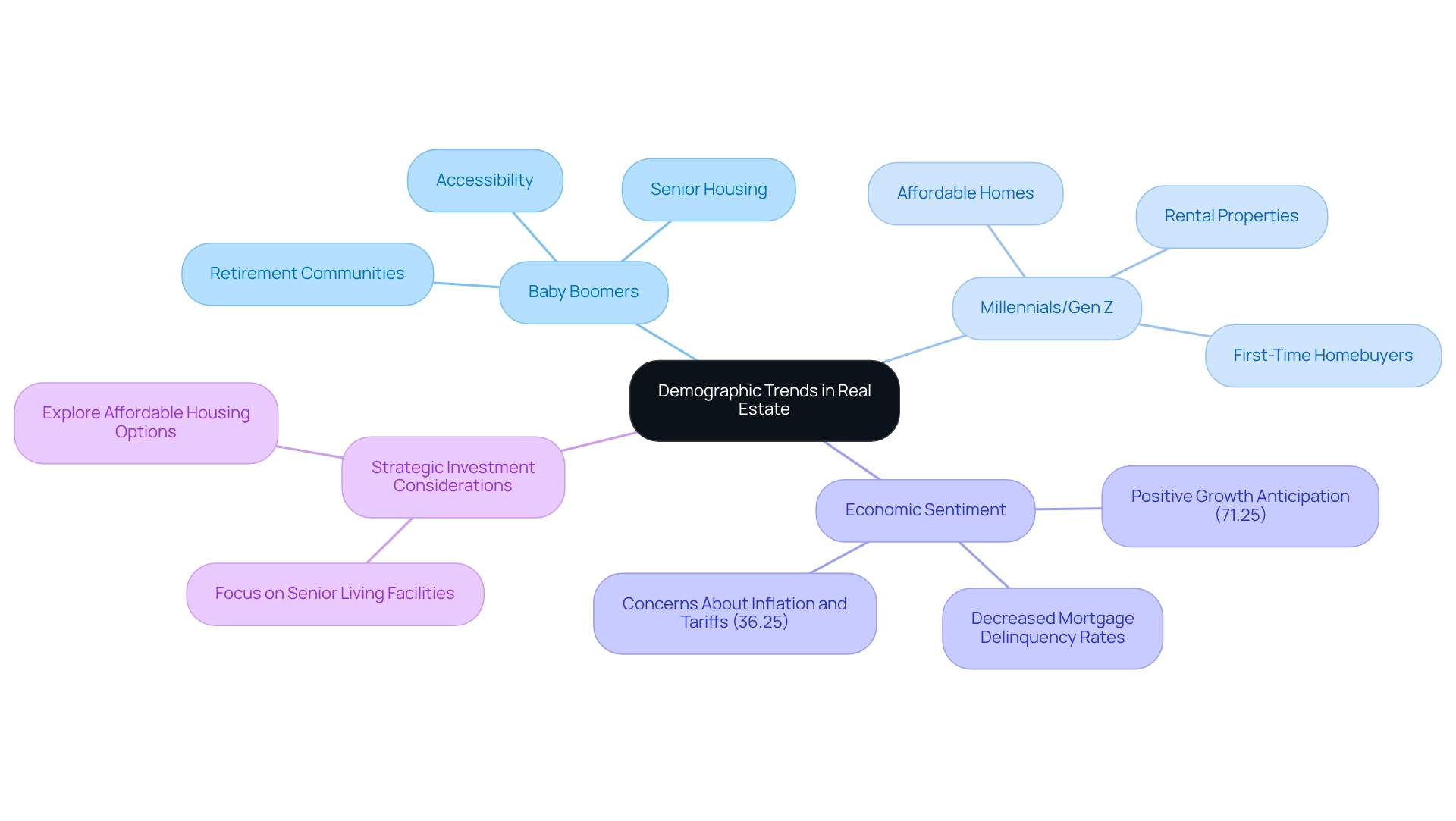

Analyze Demographic Trends Driving Demand for Real Estate

In 2025, demographic trends are profoundly influencing the real estate sector. The aging Baby Boomer generation increasingly drives demand for senior housing and accessible living options, as many are downsizing or relocating to retirement communities. Simultaneously, Millennials and Gen Z are entering the housing sector, actively seeking affordable homes and rental properties. Notably, Millennials now constitute a substantial portion of first-time homebuyers, indicating a shift in market dynamics.

This dual demand presents unique opportunities for stakeholders to cater to a diverse range of housing needs, from single-family homes to multi-family units and senior living facilities. Understanding these demographic changes is essential for evaluating whether real estate is a good investment right now and for aligning investment portfolios with evolving consumer preferences.

Furthermore, while 71.25% of individuals anticipate positive changes and growth in the economy, 36.25% express concerns about potential negative impacts from inflation and tariffs on recovery in 2025. Additionally, the overall U.S. mortgage delinquency rates have decreased, suggesting a more robust housing market, which raises the question: is real estate a good investment right now for those evaluating current conditions?

This nuanced landscape underscores the importance of strategic investment decisions, particularly in evaluating if real estate is a good investment right now in response to demographic trends. For instance, stakeholders might consider focusing on senior living facilities to address the needs of Baby Boomers while also exploring affordable housing options to attract Millennials and Gen Z.

'Zero Flux's dedication to data integrity ensures that these insights are reliable, providing stakeholders with a dependable tool to navigate these complex dynamics.

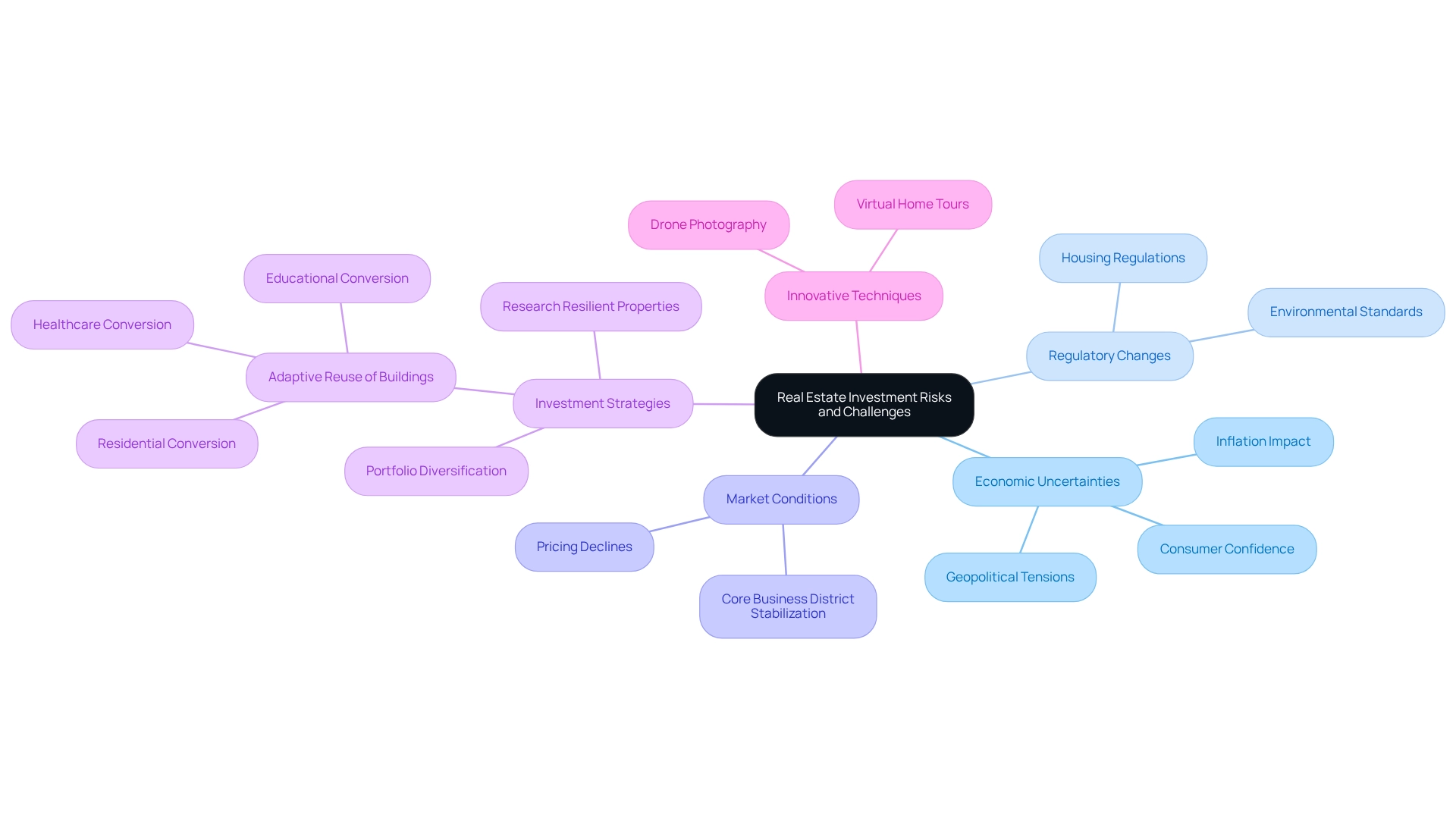

Consider Risks and Challenges in the Real Estate Market

In 2025, investors must consider whether real estate is a good investment right now, as the investment landscape is characterized by a blend of opportunities and challenges that require precise navigation. High financing expenses pose a significant hurdle; elevated mortgage rates can lead to questions about whether real estate is a good investment right now, resulting in a noticeable slowdown in market activity. This issue is exacerbated by economic uncertainties, such as the looming threat of recessions and geopolitical tensions, which can undermine consumer confidence and spending power. Furthermore, regulatory changes—particularly those related to environmental standards and housing regulations—introduce additional complexities for investors.

A recent report highlights that 36.25% of participants anticipate negative impacts from inflation and tariffs on recovery initiatives this year. Additionally, pricing declines, particularly in core business districts, are beginning to stabilize, offering a glimmer of hope for market recovery. To adeptly manage these risks, one must consider if real estate is a good investment right now. Investors are encouraged to diversify their portfolios and conduct thorough research to pinpoint resilient property types and locations, which raises the question of whether real estate is a good investment right now, as real-world case studies underscore the importance of adapting to economic conditions. For instance, properties utilizing innovative marketing techniques, such as drone photography, have been shown to sell 68% faster than those without such strategies. Millennials are increasingly leading the charge in home buying, with rising rental costs and political measures potentially influencing market stability and funding. The adaptive reuse of office buildings for residential, healthcare, and educational purposes is emerging as a vital strategy as investors respond to high financing costs and shifting demands. As the industry evolves, maintaining knowledge and flexibility will be crucial for successful property investment.

Explore Long-Term Benefits of Real Estate Investment

Considering the current market conditions, one might ask, is real estate a good investment right now, given that investing in property provides a multitude of long-term advantages that can significantly outweigh short-term economic fluctuations. Historically, many investors have asked, 'is real estate a good investment right now?' as it has proven to be a reliable asset class that consistently appreciates in value over time. For example, data reveals that median home values across 3,110 counties in the USA have shown remarkable resilience, reflecting a robust market even amidst economic shifts.

A primary advantage for investors lies in the potential for rental income, which ensures a steady cash flow. This income stream, coupled with tax benefits such as deductions for mortgage interest and property depreciation, enhances overall returns. As urbanization accelerates and populations continue to expand, the demand for housing remains robust, particularly in desirable locations. This trend is further supported by pending home sales data, indicating a significant build-up of potential home buyers and suggesting a healthy market outlook.

Moreover, advancements in property financing technology, including online platforms and crowdfunding, have made real estate investment more accessible and transparent for individuals. These innovations empower investors to explore diverse opportunities and make informed, data-driven decisions. According to MSCI, property assets have consistently outperformed other asset classes over the long term, raising the question: is real estate a good investment right now for those seeking to build wealth and achieve financial stability?

As Nadia Evangelou, Senior Economist and Director of Property Research, stated at the 2025 Property Forecast Summit, "The existing conditions offer unique chances for stakeholders to take advantage of the strength of property." This insight highlights the feasibility of property ventures in 2025.

In summary, the long-term benefits of real estate investment—encompassing historical appreciation rates, tax advantages, and expert insights—lead to the important question of is real estate a good investment right now for investors navigating the complexities of the current market landscape.

Conclusion

The evolving real estate market in 2025 presents a unique blend of opportunities and challenges for investors. With the stabilization of interest rates and moderation of inflation, a favorable environment for investment emerges, encouraging buyer confidence and enhancing affordability. As demographic trends shift—Baby Boomers seeking accessible living options and Millennials and Gen Z entering the market—a diverse array of housing needs arises, providing tailored opportunities for investors.

However, navigating this landscape is not without its risks. High financing costs, regulatory changes, and potential economic uncertainties necessitate a strategic approach to investment. By diversifying portfolios and staying informed, investors can mitigate these challenges and capitalize on market resilience.

Ultimately, the long-term benefits of real estate investment continue to outweigh short-term fluctuations. With consistent appreciation potential, rental income opportunities, and tax advantages, real estate remains a sound choice for those looking to build wealth and secure financial stability. As the market evolves, positioning investments thoughtfully will be crucial for success in this dynamic sector.