Overview

The article underscores the critical role of strategic asset allocation in real estate investment as a pathway to long-term financial success. It asserts that diversifying investments across various property types and geographic regions not only mitigates risks but also enhances returns. This assertion is bolstered by expert recommendations and statistical trends that reflect a growing acknowledgment of real estate's integral position within balanced investment portfolios. Such insights compel investors to consider the multifaceted nature of real estate as they formulate their investment strategies.

Introduction

Strategic asset allocation in real estate investment transcends mere financial trends; it stands as a crucial element that can profoundly impact long-term success. By diversifying capital across various property types, investors can adeptly manage risks and enhance returns, navigating the complexities of the market with increased confidence.

Yet, as the landscape continually evolves, how can investors guarantee that their asset allocation strategies remain robust and responsive to shifting conditions? This article explores the principles of asset allocation in real estate, providing insights and actionable strategies designed to optimize investment portfolios for sustained growth.

Define Asset Allocation in Real Estate Investment

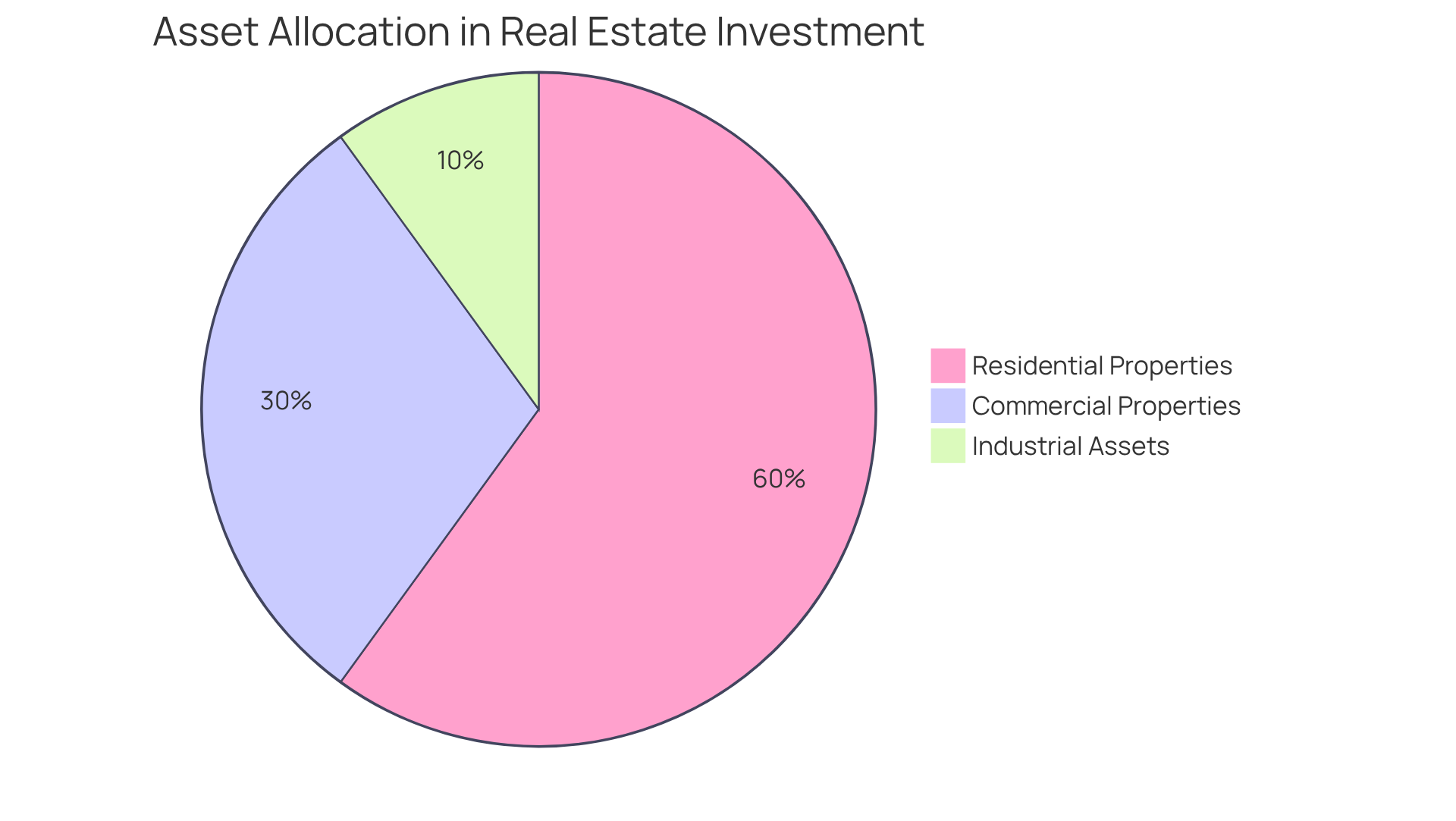

Asset allocation real estate in property management is a strategic approach that involves the distribution of an investor's capital across various property assets. This method aims to balance risk and return through asset allocation real estate by diversifying investments among various property types, including residential, commercial, and industrial properties. By wisely engaging in asset allocation real estate, investors can mitigate risks associated with market fluctuations and enhance their overall returns. For instance, an investor might use asset allocation real estate by allocating:

- 60% of their portfolio to residential properties

- 30% to commercial properties

- 10% to industrial assets

This effectively diversifies risk across various sectors of the property market.

Looking ahead to 2025, the typical target distribution to property among institutional investors is projected to be approximately 10.7%, reflecting a slight decline from 10.8% in 2024. This trend underscores the significance of asset allocation real estate as an essential component within a balanced financial portfolio, despite the decrease. Notably, Ji Zhang, a CFA, points out that target distributions to asset allocation real estate have increased by nearly 200 basis points since 2013, indicating a growing recognition of property’s importance in financial strategies.

Furthermore, financial expert David Swensen advocates for dedicating 20% of investable resources to property, emphasizing the critical role of asset allocation real estate in achieving long-term financial success. Investors are encouraged to consider these insights as they refine their investment strategies.

Explore Strategic Asset Allocation for Real Estate

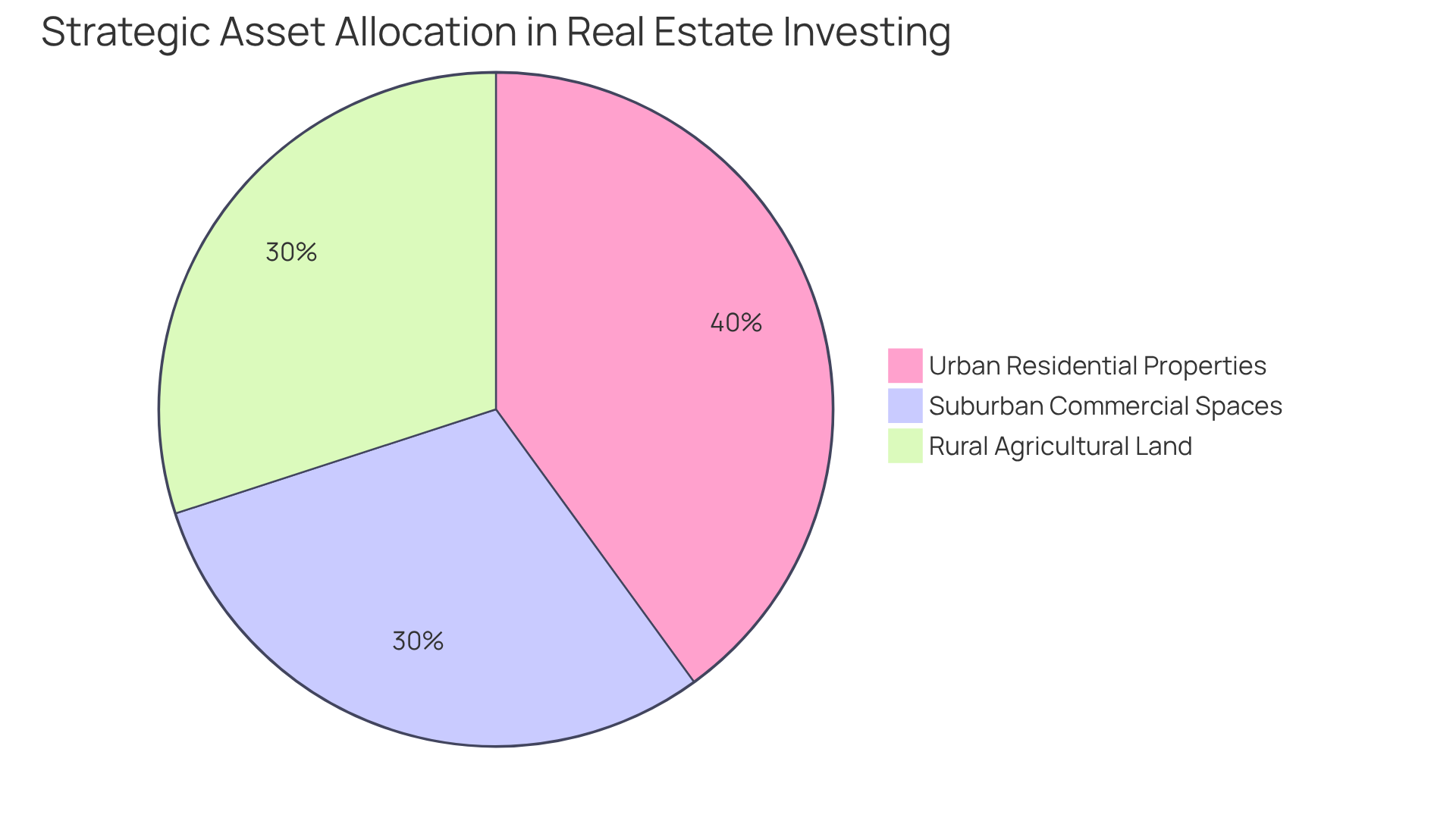

Strategic asset allocation real estate is a cornerstone of successful property investing, necessitating the establishment of target allocations across various asset categories tailored to an investor's objectives, risk tolerance, and investment horizon. In the property landscape, this entails evaluating the asset allocation real estate, focusing on the proportion of the portfolio dedicated to different property types and geographic regions. For example, an investor may choose to allocate:

- 40% to urban residential properties

- 30% to suburban commercial spaces

- 30% to rural agricultural land

This diversified strategy of asset allocation real estate not only mitigates risk but also positions investors to capitalize on emerging market opportunities.

Consistently assessing and adjusting asset allocation real estate distributions in response to evolving market conditions is crucial for maintaining an optimal portfolio balance. As of 2025, strategic asset distribution statistics indicate that a well-diversified real estate portfolio can substantially enhance overall financial performance. Experts recommend that novices allocate 10% to 15% of their earnings into low-cost, diversified options such as index funds or ETFs, which help in minimizing risk and providing a more stable financial experience.

Moreover, seeking guidance from financial professionals is vital for investors to tailor their distributions according to their unique circumstances. By implementing these strategies, investors can navigate the complexities of property investing with confidence and clarity.

Implement Asset Allocation Strategies in Real Estate

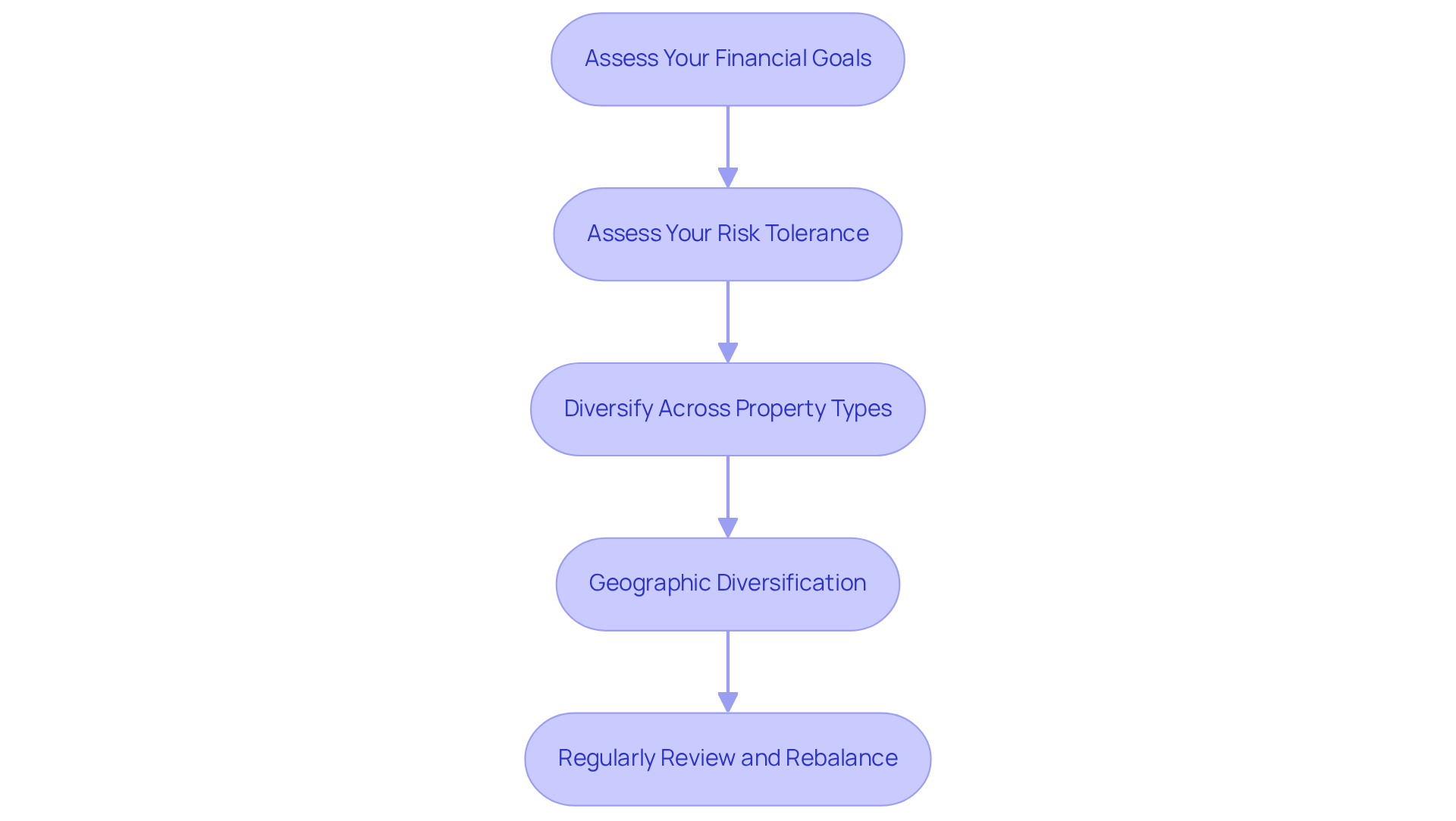

To implement effective asset allocation strategies in real estate, investors should follow these essential steps:

-

Assess Your Financial Goals: Clearly define your objectives for real estate ventures, whether you aim for capital appreciation, income generation, or a combination of both. Understanding your goals is crucial for guiding your investment decisions.

-

Assess Your Risk Tolerance: Acknowledge your comfort level with risk, as this will affect your asset distribution. For instance, those with a higher risk tolerance may allocate more towards commercial properties, while conservative investors might prefer residential options. Financial advisors suggest a cautious property allocation of 5% to 10%, moderate at 15%, and bold at 20% to 30%. Recent statistics indicate that in 2025, a significant portion of investors are leaning towards a balanced approach, reflecting these recommendations.

-

Diversify Across Property Types: Distribute your resources across different property categories to minimize risk. A well-rounded portfolio might include a mix of residential, commercial, and industrial properties, which can help stabilize returns and reduce exposure to market fluctuations.

-

Geographic Diversification: Invest in properties across different regions to lessen the impact of local market downturns. This strategy could involve targeting urban, suburban, and rural areas, allowing you to capitalize on diverse market dynamics and opportunities.

-

Regularly Review and Rebalance: Continuously monitor your portfolio's performance and make necessary adjustments to stay aligned with your strategic goals. This may involve selling underperforming assets or reallocating funds to more promising opportunities, ensuring your portfolio remains robust and responsive to market changes.

By following these steps, investors can build a varied property portfolio that matches their financial goals and risk appetite, ultimately improving their success in asset allocation real estate. As David Swensen suggests, a 20% investment in real estate can be a strategic move for long-term growth. Additionally, case studies such as "Opportunities in Dislocated Markets and Distressed Assets" illustrate how strategic asset allocation can lead to successful investments.

Conclusion

Strategic asset allocation in real estate stands as a crucial pillar for investors seeking to optimize their portfolios and secure long-term financial success. By judiciously distributing capital across diverse property types and geographic regions, investors can mitigate risk while amplifying potential returns. This balanced methodology not only equips investors for market fluctuations but also positions them to capitalize on emerging opportunities within the real estate landscape.

The article illuminated essential strategies for effective asset allocation, emphasizing the significance of:

- Defining financial goals

- Comprehending risk tolerance

- Diversifying across property types

- Consistently reviewing and rebalancing portfolios

Insights from experts such as David Swensen, who champions a substantial allocation to real estate, underscore the necessity of these principles in formulating a robust investment strategy.

Navigating the intricacies of real estate investment mandates a deliberate and strategic approach to asset allocation. By adopting the best practices outlined, investors can construct a resilient portfolio that aligns seamlessly with their financial objectives and risk appetite. Embracing these strategies not only enhances individual investment outcomes but also fosters a more stable and prosperous financial future.