Overview

This article delves into the mastery of the Debt-Service Coverage Ratio (DSCR) calculation within the realm of real estate. It underscores the significance of DSCR in evaluating an asset's financial health and its pivotal role in informing investment decisions.

A detailed, step-by-step guide for calculating DSCR is provided, ensuring clarity and precision. Furthermore, it highlights common pitfalls to avoid during this process. Notably, a DSCR exceeding 1.25 is generally viewed as favorable for securing financing, emphasizing its essential function in real estate investment strategies.

By understanding and leveraging DSCR, investors can make informed decisions that enhance their portfolio's performance.

Introduction

Understanding the intricacies of the Debt-Service Coverage Ratio (DSCR) is essential for anyone involved in real estate investing. This critical metric not only reveals an asset's ability to meet its financial obligations but also serves as a compass for informed investment decisions. As the lending landscape evolves and competition increases, the significance of mastering the DSCR calculation becomes even more pronounced.

Investors must ask themselves:

- How can they ensure they are accurately assessing this vital ratio?

- What common pitfalls should they avoid to safeguard their financial future?

By addressing these questions, investors can better navigate the complexities of real estate investment.

Understand the Debt-Service Coverage Ratio (DSCR)

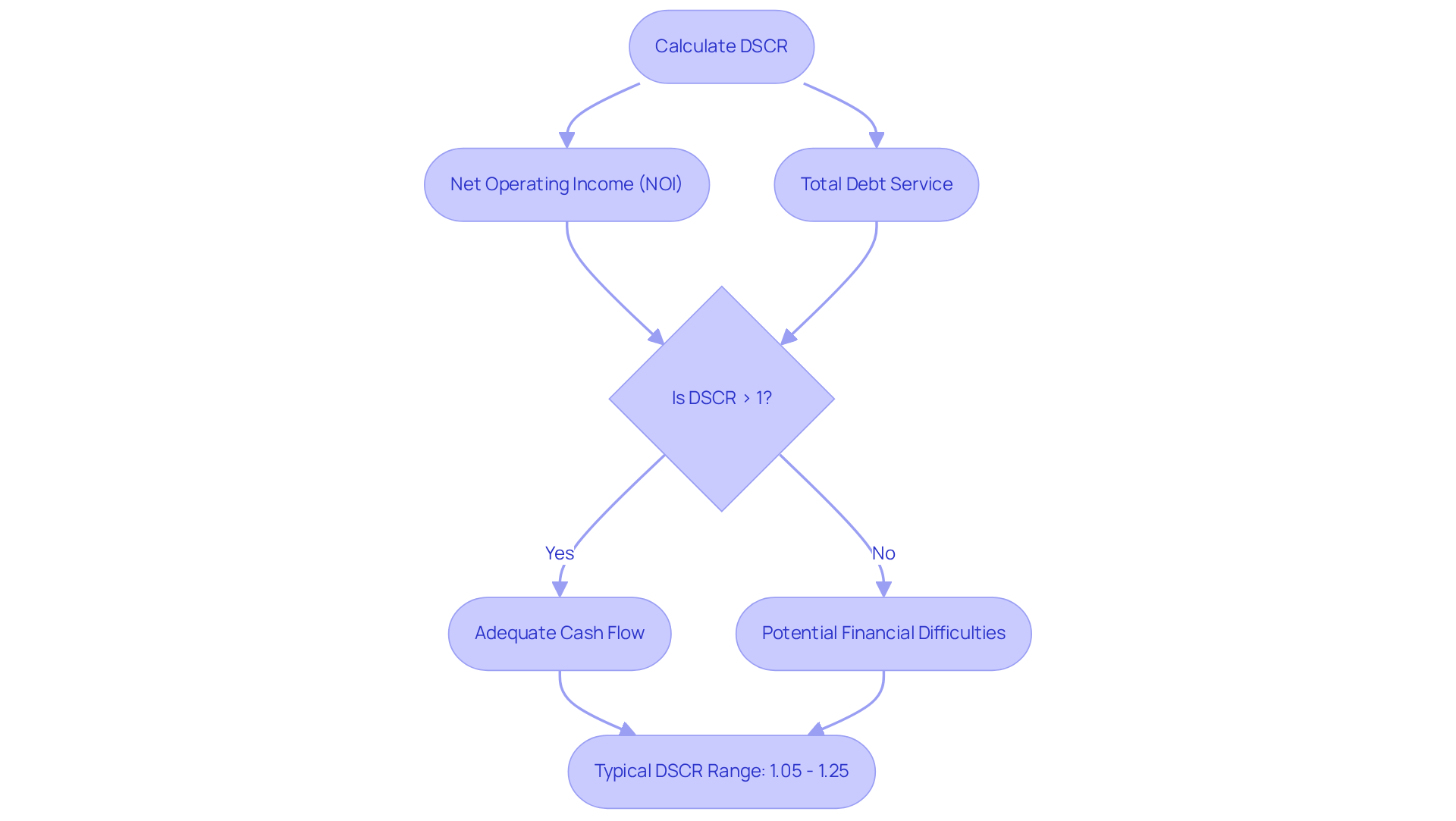

The Debt-Service Coverage Ratio (DSCR) calculation in real estate serves as a vital economic indicator, evaluating a real estate asset's capacity to generate sufficient revenue to meet its financial obligations. This ratio is calculated by dividing the net operating income (NOI) by the total debt service, which encompasses all payments due within a specified timeframe. A ratio exceeding 1 indicates that the asset produces adequate income to cover its obligations, whereas a figure below 1 raises concerns about potential financial difficulties. For instance, an asset with an NOI of $120,000 and annual debt payments of $100,000 results in a DSCR of 1.20, exemplifying a robust cash flow situation.

Understanding the DSCR calculation in real estate is crucial for investors, as it directly impacts risk assessment and funding decisions. Typically, minimum DSCR calculation requirements range from 1.05 to 1.25, a critical consideration for investors evaluating real estate opportunities. Looking ahead to 2025, the lending landscape for DSCR is anticipated to become increasingly competitive, with a multitude of lenders offering appealing terms, including elevated loan-to-value ratios approaching 80% for stabilized assets. This evolution empowers investors to leverage their assets more effectively while mitigating risk. Furthermore, properties exhibiting high DSCRs are often perceived as more desirable investments, reflecting strong income generation relative to debt obligations.

As the private money lending market is projected to reach $2 trillion in 2025, the importance of the DSCR calculation in real estate investing cannot be overstated. Investors who understand the nuances of the DSCR calculation will be better equipped to navigate financing challenges and make informed investment choices, ultimately enhancing their portfolio's performance. As noted by Lendz Financial, understanding the DSCR calculation helps investors and brokers evaluate the financial strength of an income-generating property. Additionally, it is crucial to recognize that debt service coverage ratios falling below 1.1 in high-risk markets may lead to increased default rates, underscoring the necessity of maintaining a healthy coverage ratio.

Calculate the DSCR: Step-by-Step Process

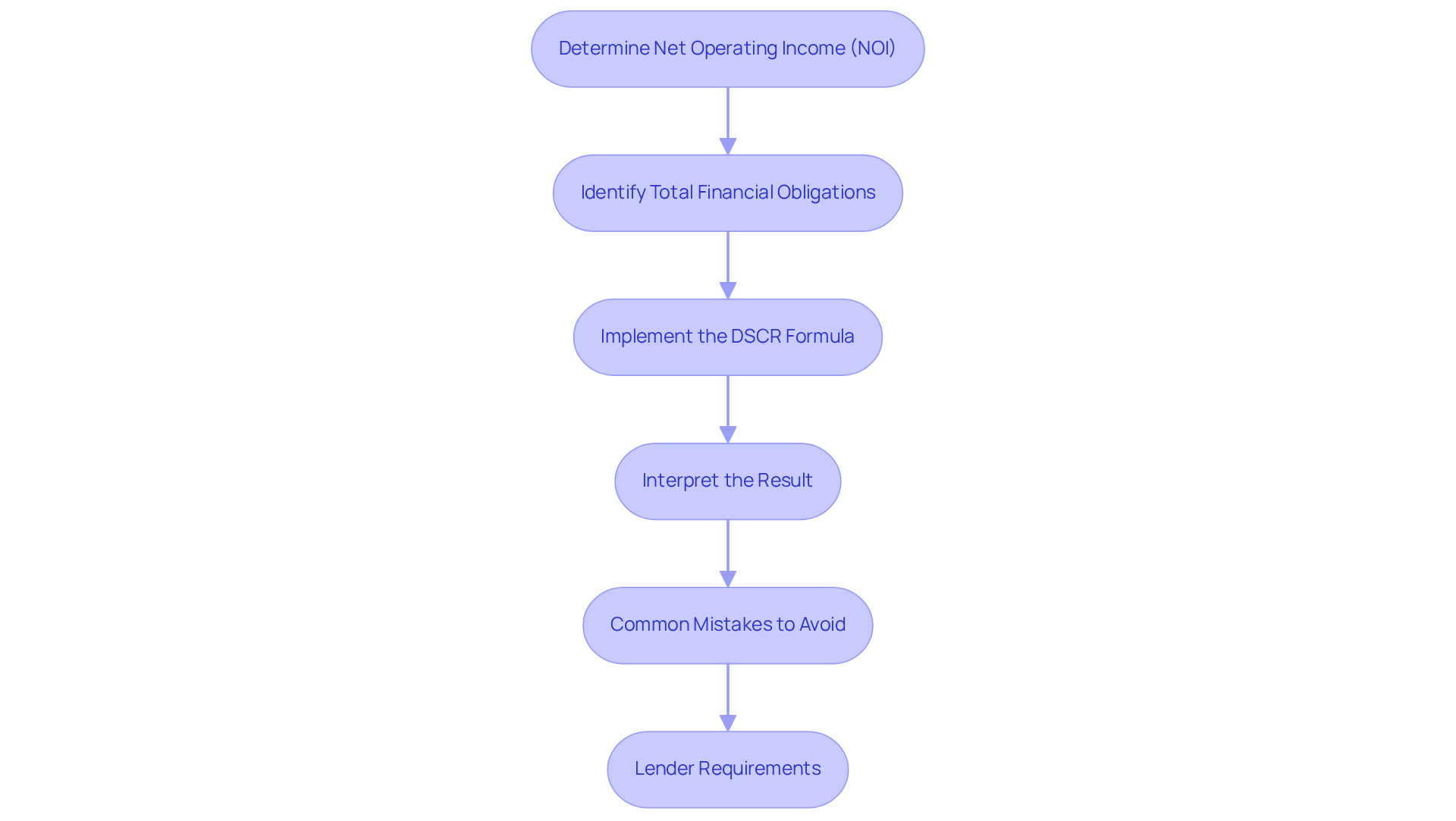

To calculate the Debt Service Coverage Ratio (DSCR), follow these essential steps:

-

Determine Net Operating Income (NOI): Begin by calculating the NOI, which is the total income generated from the asset minus operating expenses (excluding financial obligations). For example, if a property generates $100,000 in rental income and incurs $30,000 in operating expenses, the NOI would be $70,000.

-

Identify Total Financial Obligations: Next, ascertain the total financial obligations, encompassing all principal and interest payments due within a year. If your annual mortgage payment totals $50,000, that figure represents your total debt service.

-

Implement the Debt Service Coverage Ratio Formula: Utilize the formula Debt Service Coverage Ratio = NOI / Total Debt Service. In this case, the debt service coverage ratio equals $70,000 divided by $50,000, resulting in 1.4.

-

Interpret the Result: A debt service coverage ratio of 1.4 signifies that the asset generates 40% additional income than necessary to meet its commitments, demonstrating a robust economic position. Conversely, a ratio below 1 indicates potential monetary difficulties, as it implies that the asset's income is insufficient to cover its obligations.

-

Common Mistakes to Avoid: Be vigilant about frequent errors in financial ratio calculation, such as using gross income instead of net operating income or underestimating obligations. These mistakes can lead to flawed evaluations of an asset's economic condition.

-

Lender Requirements: Typically, lenders require a minimum debt service coverage ratio of 1.25, indicating the property must produce at least 125% of the yearly debt obligation. An elevated debt service coverage ratio not only signals economic stability but also enhances the likelihood of securing favorable loan conditions.

Understanding the DSCR calculation in real estate is crucial for investors. Mastering the debt service coverage ratio can significantly influence investment choices and financing opportunities.

Interpret DSCR Values: What Is Considered Good or Bad?

Interpreting the dscr calculation real estate values is essential for assessing the financial health of a property.

-

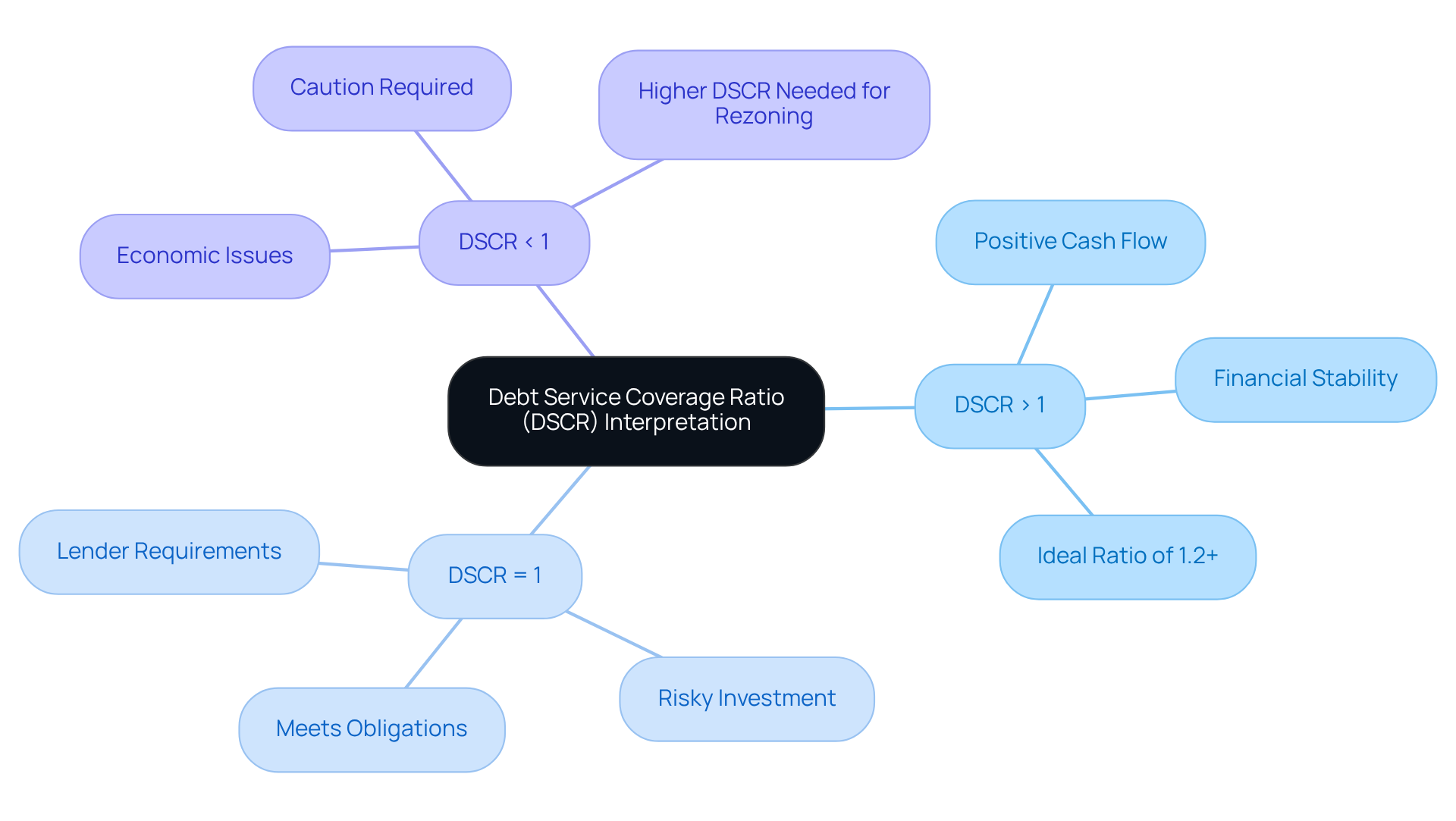

DSCR > 1: A ratio above 1 indicates that the property generates more income than necessary to cover its debt obligations. Typically, a debt service coverage ratio of 1.2 or greater is regarded as advantageous, offering a cushion for unforeseen costs and improving financial stability. According to Truss Financial Group, a debt service coverage ratio above 1.0 signifies a positive cash flow, which is essential for sustaining investment viability.

-

Debt Service Coverage Ratio = 1: A ratio of 1 indicates the property merely meets its debt obligations, providing no margin for error. This situation is precarious; any decrease in income or rise in expenses could lead to economic distress, making it a risky investment. Investors should be aware that lenders generally require a debt service coverage ratio of at least 1.25 for loan approval, highlighting the significance of maintaining a healthy ratio.

-

DSCR < 1: A ratio under 1 indicates that the asset does not produce enough income to meet its obligations, signaling possible economic issues. Investors should approach assets in this category with caution, as they may require additional capital or restructuring to stay viable. Properties facing rezoning risks may require higher DSCRs of 1.35 or more, further complicating the investment landscape.

Grasping these ratios is essential for making informed investment choices, as the dscr calculation real estate directly indicates an asset's capacity to meet its financial commitments.

Avoid Common Calculation Errors in DSCR

To ensure accurate DSCR calculations, it is essential to be mindful of these common errors:

-

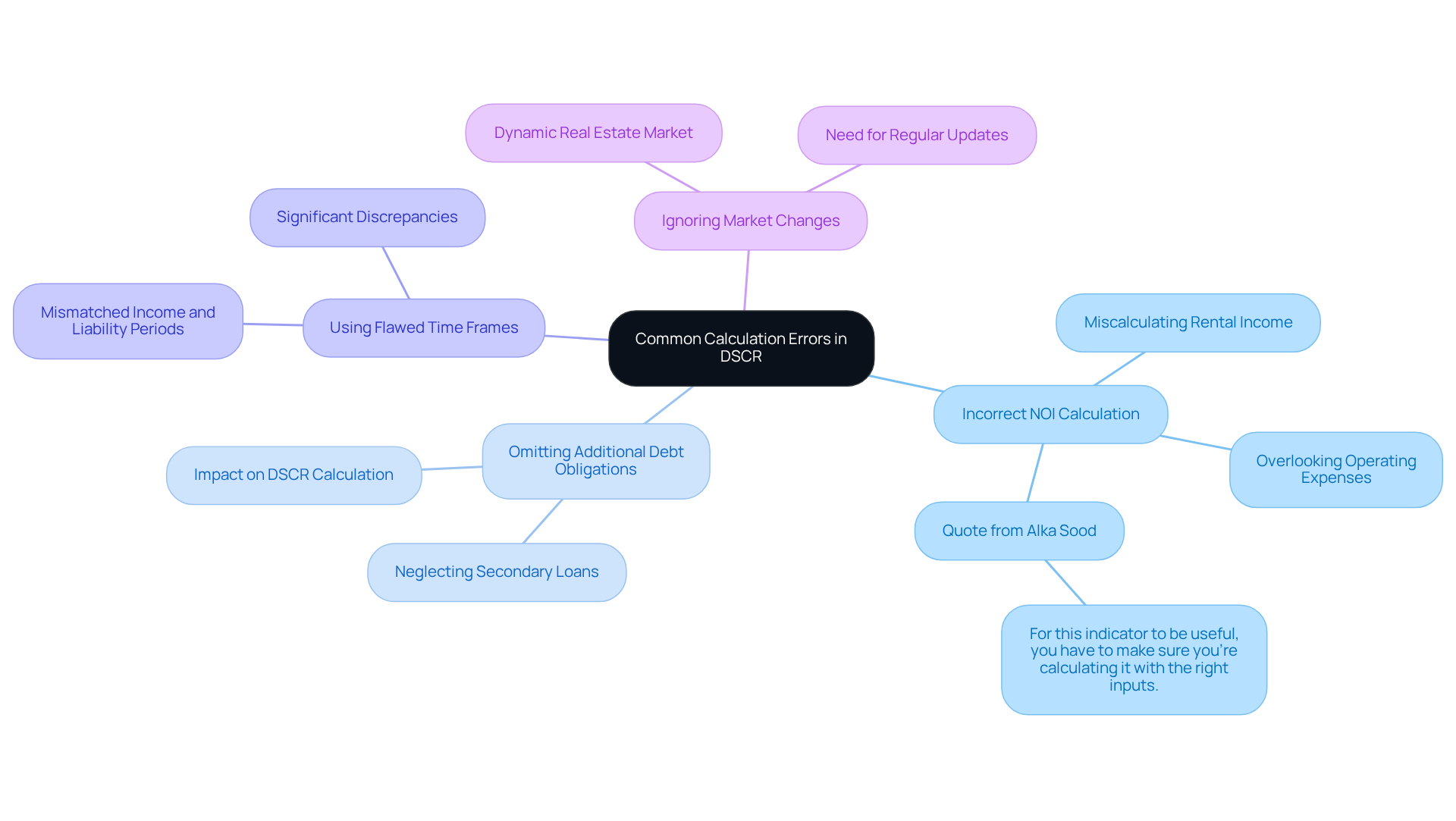

Incorrect NOI Calculation: Miscalculating rental income or failing to account for all operating expenses can inflate your Net Operating Income (NOI). Overlooking property management costs or maintenance fees can lead to an unrealistic assessment. Alka Sood from BDC Advisory Services emphasizes, "For this indicator to be useful, you have to make sure you’re calculating it with the right inputs." Always verify your figures and include all relevant costs to reflect true operational performance.

-

Omitting Additional Debt Obligations: Including all debt payments in your total debt service, such as secondary loans or lines of credit, is crucial. Neglecting these obligations can distort your DSCR calculation in real estate, which could potentially lead to unfavorable financing terms. A thorough comprehension of your monetary obligations is essential for precise calculations.

-

Using Flawed Time Frames: Ensure that your income and liability service figures correspond to the same time period, whether monthly or annually. Mixing these can result in significant discrepancies. For instance, if your income is assessed yearly while your debt obligations are monthly, it can misrepresent your economic health.

-

Ignoring Market Changes: The real estate market is dynamic, and conditions can shift rapidly. Consistently refreshing your DSCR calculation in real estate to reflect current market trends is essential for ensuring a precise debt service coverage ratio. This practice not only helps in assessing your investment's viability but also prepares you for discussions with lenders. As emphasized in the case study on 'Calculating Debt Service Coverage Ratio,' the DSCR calculation in real estate is crucial for businesses, lenders, and investors to improve financial planning and reduce risks by applying the formula accurately.

By being vigilant about these common pitfalls, you can enhance the reliability of your DSCR calculations, ultimately supporting better investment decisions.

Conclusion

Mastering the Debt-Service Coverage Ratio (DSCR) is not just beneficial; it is essential for real estate investors aiming to make informed financial decisions. This critical metric assesses an asset's ability to meet its debt obligations and serves as a key indicator of investment viability. By understanding and accurately calculating the DSCR, investors empower themselves to navigate the complexities of financing, thereby enhancing their overall investment strategy.

In this guide, we have clearly outlined the steps to calculate DSCR, emphasizing the importance of:

- Determining net operating income

- Identifying total financial obligations

- Correctly interpreting the results

We have also highlighted common pitfalls in the calculation process, ensuring that investors can avoid mistakes that could lead to flawed evaluations. With a solid grasp of these concepts, investors can better assess potential opportunities and mitigate risks within their portfolios.

Ultimately, the significance of the DSCR in real estate investing cannot be overstated. As the market evolves, maintaining a healthy DSCR will bolster financial stability and improve the likelihood of securing favorable lending terms. Investors are encouraged to continually refine their understanding of this ratio, ensuring they remain competitive in an ever-changing landscape. By prioritizing accurate DSCR calculations, investors can enhance their decision-making processes and drive their success in real estate ventures.