Overview

The article delineates the essential steps for successful investments in fixer-upper real estate, underscoring the significance of:

- Thorough evaluations

- Strategic financing

- Effective renovation management

- Marketing strategies to maximize returns

It elaborates on the process, guiding readers from:

- Property inspection

- Budget planning

- Utilization of professional services

- Marketing techniques

This demonstrates how investors can adeptly transform undervalued properties into profitable assets, ultimately empowering them to make informed investment decisions.

Introduction

In the ever-evolving real estate landscape, fixer-upper properties stand out as a beacon of opportunity for savvy investors. These homes, defined by their need for repairs and renovations, often come with a lower price tag, enticing those eager to maximize their investment potential. The promise of significant appreciation post-renovation draws buyers increasingly towards the idea of transforming neglected spaces into desirable homes. As market conditions shift and demand for renovation-ready properties grows, understanding the nuances of evaluating, financing, and managing renovations becomes crucial for anyone looking to capitalize on this trend.

This article delves into essential steps for successfully navigating the fixer-upper journey, from identifying the right property to effectively marketing the finished result.

Define Fixer-Upper Properties and Their Appeal

A renovation project is defined as fixer upper real estate that necessitates repairs, enhancements, or modifications to improve its habitability or market appeal. Typically priced lower than move-in-ready homes, these fixer upper listings present a compelling opportunity for investors seeking value. The allure of fixer upper real estate lies in its potential for significant value increase post-improvements, enabling investors to build equity and enhance market worth.

In 2023, homes sold in master-planned communities underscored this trend, as buyers increasingly pursued fixer upper properties with renovation potential. Notably, 1 in 2,000 residences faced foreclosure in 2023, indicating a market condition that could influence the availability of renovation properties. Furthermore, the typical price gap between fixer upper real estate and ready-to-occupy homes in 2025 emphasizes the economic advantages of investing in these properties. Investors can customize their renovations to align with personal preferences or market demands, rendering fixer upper real estate a versatile investment option.

Intelligent living systems are becoming crucial for modern buyers, suggesting that investors should consider such enhancements during renovations. Additionally, 5% of properties are sold through estate sales, providing alternative avenues for acquiring renovation projects. Significantly, 78% of buyers indicate that the quality of school districts influences their purchasing decisions, further elevating the appeal of homes requiring renovation in desirable locations. As the market continues to evolve, the demand for fixer upper real estate is on the rise, reflecting a broader trend among investors who recognize the potential of transforming these neglected properties into coveted homes.

Evaluate Property Condition and Renovation Costs

Evaluating fixer-upper real estate commences with a meticulous property inspection. Identifying structural issues, plumbing and electrical problems, and any signs of water damage is essential. Engaging a professional inspector can yield a thorough assessment, ensuring no critical issues are overlooked. Following the inspection, create a comprehensive list of required repairs and improvements. Investigating regional expenses for materials and labor is vital for accurately assessing your improvement budget. In 2025, the average price of property inspections for renovation-ready buildings typically ranges from $300 to $500, depending on the property's size and location.

To safeguard against unexpected costs, it is prudent to incorporate a contingency of 10-20% into your budget. This buffer can aid in managing unforeseen expenses that frequently arise during remodeling. Notably, data indicates that 44% of property owners reported spending more on unexpected repairs in 2024 compared to the previous year, underscoring the necessity of comprehensive assessments and prudent financial planning for improvements.

When evaluating upgrade expenses, consider common structural challenges encountered in renovation projects, such as foundation issues, roof repairs, and outdated electrical systems. Professional guidance reveals that enhancement projects in fixer-upper real estate, which yield outstanding returns on investment, can lead to increases of 60% to more than 100% in real estate value, particularly for upgrades that enhance the residence's attractiveness and utility. For instance, collaborating with real estate agents can significantly improve your search for fixer-upper opportunities, as they possess the expertise to identify properties with strong potential for value appreciation. By leveraging their knowledge, purchasers can find properties that align with their budget and improvement objectives, streamlining the home-buying process. Furthermore, it is wise for homeowners to review their insurance policies to ensure adequate coverage for improvements, providing an additional layer of financial security throughout the enhancement process.

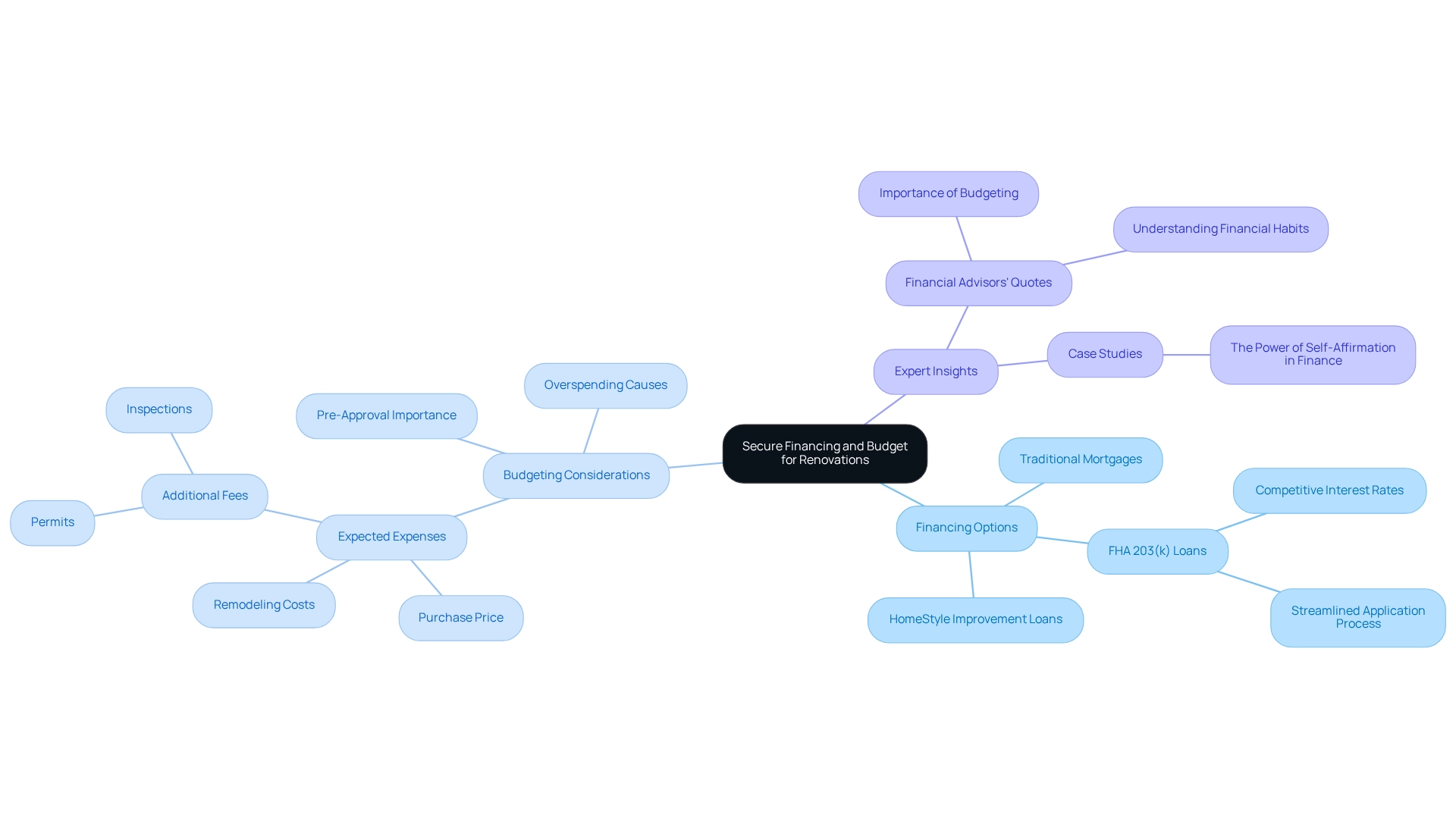

Secure Financing and Budget for Renovations

Funding a fixer-upper real estate project presents multiple viable options, including traditional mortgages, FHA 203(k) loans, and HomeStyle improvement loans. These financing methods enable investors to effectively cover both the purchase price and improvement expenses. To navigate this process successfully, establishing a detailed budget that encompasses all expected expenses—such as the purchase price, remodeling costs, and additional fees like permits and inspections—is essential. Furthermore, obtaining pre-approval for a loan serves as a strategic step, clarifying your borrowing capacity and expediting the purchasing process.

In 2025, the average interest rates for FHA 203(k) loans are competitive, currently hovering around 4.5%. This makes them an attractive option for many investors. Recent updates to the FHA 203(k) program have streamlined the application process, facilitating faster access to funds for improvements. Financial advisors underscore the importance of budgeting for enhancements, with one stating, "A well-structured financial plan can significantly enhance your investment's success."

Case studies illustrate the effectiveness of these financing options, showcasing successful FHA 203(k) loan applications that have transformed fixer-upper real estate into profitable investments. For instance, the case study titled 'The Power of Self-Affirmation in Finance' discusses how incorporating self-affirmations into financial planning can build confidence in budgeting abilities. By leveraging these resources and maintaining a disciplined approach to budgeting, investors can maximize their returns while minimizing financial risks. Additionally, identifying causes of overspending is crucial to prevent long-term debt, as noted by experts in financial management. James Lendall Basford remarked, "Those who struggle to pay debts often have an excess of something else," highlighting the importance of understanding one's financial habits. By addressing these aspects, investors can create a more robust financial strategy for their improvement projects.

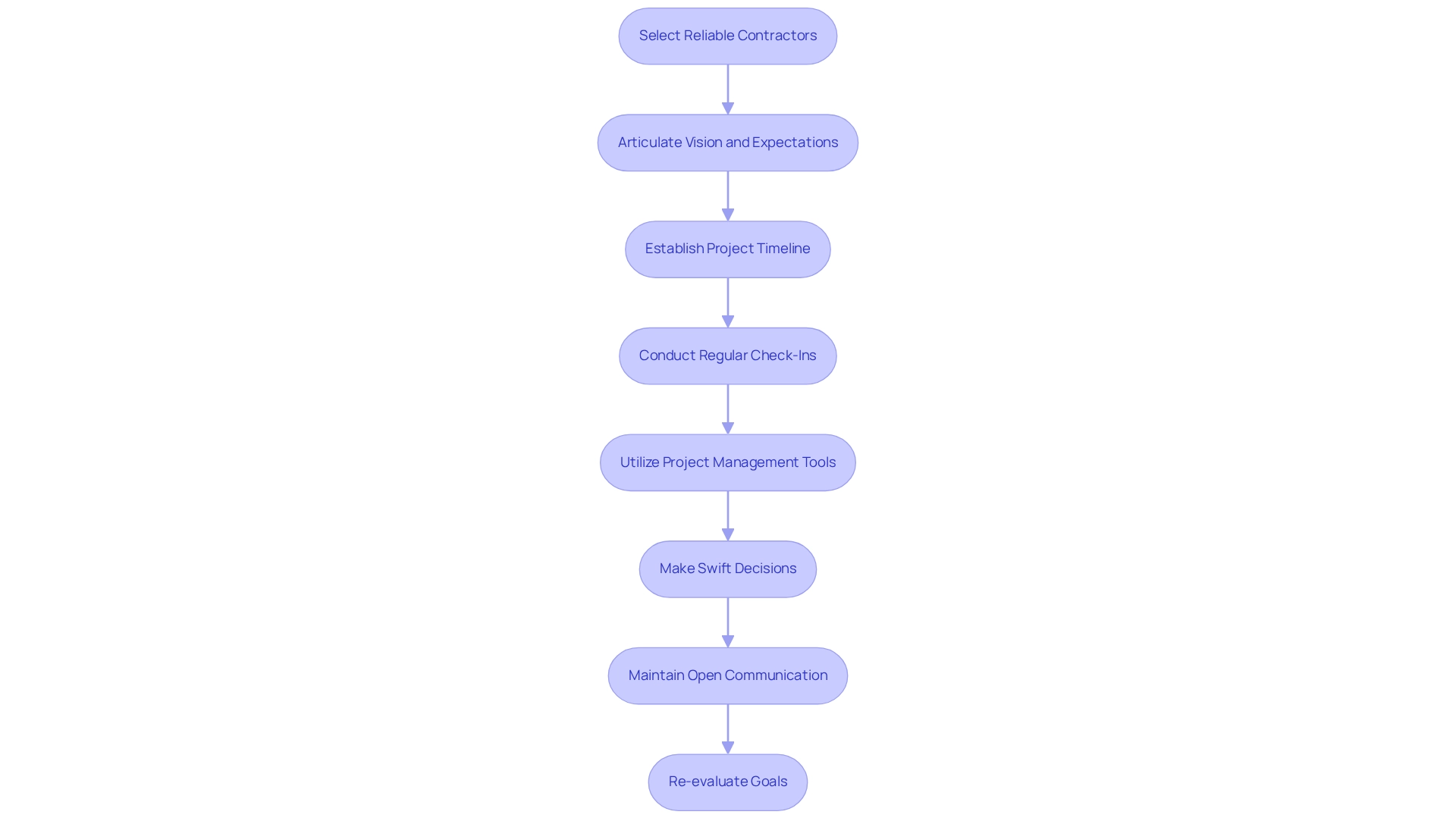

Manage Renovations and Oversee Project Execution

Effective remodeling management starts with the selection of reliable contractors who possess a proven track record of success. The National Electrical Contractors Association, with its 174 chapters, highlights the importance of choosing trustworthy contractors to ensure project completion and quality. Clearly articulating your vision and expectations is paramount for aligning all parties involved. Establishing a comprehensive project timeline and conducting regular check-ins with contractors allows for the assessment of progress and the timely addressing of any issues that may arise. Utilizing project management tools can streamline the monitoring of tasks, budgets, and timelines, ensuring that everything remains on track.

Be prepared to make swift decisions, as unforeseen challenges are common in remodeling projects. Maintaining open lines of communication with your team fosters a collaborative environment, facilitating the prompt resolution of obstacles. As Venus Williams advises, setting realistic goals and consistently re-evaluating them is crucial for success. This flexibility enables you to adapt to changing circumstances and keeps your project aligned with your objectives. Furthermore, remember that money serves merely as a means, as Ayn Rand observed; it can take you wherever you desire, but it cannot replace you as the operator.

By implementing these strategies and emphasizing the significance of cooperation and trust, as highlighted in case studies on team development, you can enhance the likelihood of a successful transformation that aligns with your investment goals.

Market and Sell or Rent the Renovated Property

Once renovations are complete, effectively marketing your property is crucial. Begin by preparing the property to highlight its finest attributes and establish a welcoming environment that appeals to prospective buyers or tenants. Professional photography is essential; listings with high-quality images attract significantly more interest. In 2025, staging remains a vital strategy, with studies indicating that 34% of buyers believe staging influences their perception of a property's value, especially when it aligns with their tastes. Investing in home staging typically leads to recouping costs through increased sale prices, making it a worthwhile investment.

When determining the price, analyze recent sales of comparable homes in the area to establish a competitive rate. This approach not only positions your asset favorably but also enhances its marketability. Utilize a mix of online platforms, social media, and local real estate agents to broaden your reach. For instance, assets that are well-promoted can experience a significant decrease in average duration on the market compared to non-renovated residences.

If choosing to lease the unit, ensure it is prominently featured on rental platforms. Consider offering incentives, such as a reduced rent for the first month, to attract tenants quickly. Additionally, incorporating life-cycle costing into your strategy can enhance the financial viability of build-to-rent projects, focusing on long-term rental income rather than immediate sale prices. This sustainable method not only enhances the longevity of your investment but also attracts a rising group looking for secure occupancy in rental accommodations. Notably, AI-driven real estate management platforms are estimated to have boosted rental income by up to 81%, further emphasizing the importance of utilizing technology in your rental strategy.

In summary, successful marketing of renovated homes in 2025 hinges on strategic staging, competitive pricing, and utilizing multiple channels to effectively reach potential buyers or tenants. By integrating these strategies, you can enhance the appeal and financial viability of your renovated property.

Conclusion

Fixer-upper properties present a unique opportunity for investors eager to enter the real estate market. By understanding the defining characteristics of these homes—such as their lower price points and potential for significant appreciation—investors can strategically position themselves to maximize returns. The increasing demand for renovation-ready properties underscores the necessity of evaluating property conditions, estimating renovation costs, and securing suitable financing to transform these neglected spaces into desirable homes.

A thorough evaluation of a fixer-upper, including a detailed inspection and budgeting for renovations, is essential for success. Engaging professionals and incorporating a contingency plan can protect against unexpected expenses, ensuring that projects remain financially viable. Understanding various financing options, such as FHA 203(k) loans, empowers investors to effectively cover both purchase and renovation costs.

Once renovations are underway, effective management and oversight become crucial. By hiring reliable contractors, maintaining open communication, and utilizing project management tools, investors can adeptly navigate the complexities of renovation projects. Finally, upon completion of the transformation, strategic marketing techniques—such as staging and competitive pricing—play a vital role in attracting buyers or renters.

In conclusion, investing in fixer-upper properties transcends merely acquiring a home in need of repair; it involves recognizing the potential within those walls. With careful evaluation, sound financial planning, and effective project management, investors can successfully convert these properties into lucrative investments. Embracing this approach not only enhances personal portfolios but also contributes to revitalizing communities, making the fixer-upper route a rewarding venture for all involved.