Overview

The article emphasizes the critical steps necessary for effectively selecting a real estate investment manager. It delineates a four-step process:

- Understanding investment management fundamentals

- Evaluating key selection criteria

- Assessing and comparing potential managers

- Establishing effective communication

Each of these steps is vital for ensuring that the manager's strategies align seamlessly with the investor's financial goals.

Introduction

In the complex realm of real estate investment management, the stakes are undeniably high, and the decisions made are pivotal. Investors are continually striving to maximize returns while deftly navigating the intricacies of market dynamics. Therefore, a thorough understanding of the fundamentals of this discipline is essential.

From conducting comprehensive market analyses to selecting the most suitable investment manager, each step plays a critical role in shaping investment success. This article explores the key components of real estate investment management, outlines the criteria for selecting a capable manager, and underscores the importance of effective communication to strategically position investments for growth.

By mastering these essential elements, investors can significantly enhance their decision-making processes and achieve their financial objectives in an ever-evolving landscape.

Understand Real Estate Investment Management

Property asset management stands as a vital field dedicated to supervising and enhancing property assets, aiming to maximize returns while minimizing risks. This multifaceted process encompasses essential activities such as market analysis, property acquisition, and portfolio management. Understanding the role of a portfolio manager is crucial, as these professionals are responsible for making strategic choices that significantly impact asset performance.

Market Analysis: Evaluating current market conditions is essential to identify both opportunities and risks. With 36.25% of individuals expressing concerns about potential negative impacts from political policies on market recovery in 2025, thorough market analysis becomes increasingly critical. Additionally, understanding the anticipated yearly expense of premium office space for 2024 offers valuable context for financial considerations.

Property Acquisition: Selecting properties that align with your financial objectives and strategies is paramount. Recent trends indicate that millennials are leading the home-buying market, driven by rising rental prices and shifting demographic preferences. This demographic shift underscores the importance of grasping market dynamics, as it can profoundly influence financial strategies. According to the Upmetrics Team, online platforms such as Realtor.com and Trulia play a crucial role in shaping consumer behavior, with millions of visits highlighting the growing reliance on digital channels for property decisions.

Portfolio Management: Continuous monitoring and adjustment of your asset portfolio are vital for optimizing performance. Successful asset management examples reveal that understanding consumer behavior—such as the 82% of homebuyers who prefer homes equipped with smart technology—can inform effective portfolio strategies. Insights from the case study titled "Consumer Behavior in Real Estate" demonstrate how aligning offerings with buyer expectations can enhance portfolio management effectiveness.

By mastering these fundamentals, you will gain a deeper appreciation for the importance of selecting the right real estate investment manager who aligns with your financial goals, ensuring that your property holdings are strategically positioned for success.

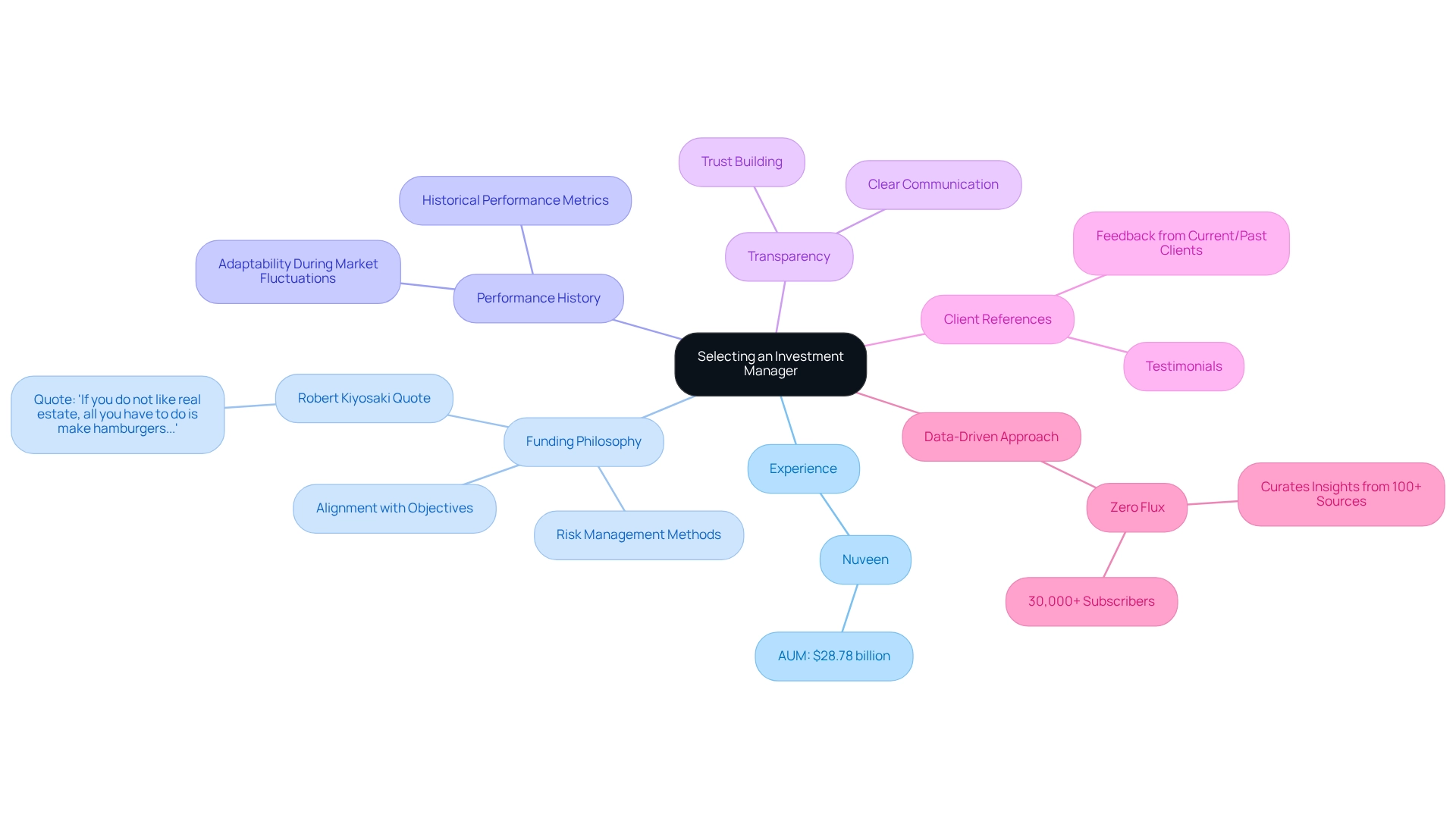

Evaluate Key Criteria for Selecting an Investment Manager

Choosing the appropriate property supervisor is essential for reaching your financial objectives. Consider the following key criteria:

- Experience: Prioritize managers with a solid track record in real estate investment management. Evaluate their years in the industry and specific areas of expertise, as experience plays a vital role in navigating market complexities. For instance, firms like Nuveen, which manages $28.78 billion in assets under management (AUM), exemplify the scale and credibility that can come with extensive experience.

- Funding Philosophy: Ensure that their strategy aligns with your objectives. This encompasses a comprehensive grasp of their risk management methods and asset allocation approaches, which should align with your own financial objectives. As Robert Kiyosaki famously stated, "If you do not like real estate, all you have to do is make hamburgers, build a business around that hamburger, and franchise it," emphasizing the significance of a solid financial philosophy in real estate.

- Performance History: Analyze their historical performance metrics, focusing on returns on investment and their ability to adapt during market fluctuations. A supervisor's previous performance can offer insights into their potential future success.

- Transparency: Look for leaders who prioritize clear communication regarding fees, strategies, and performance updates. Transparency fosters trust and helps you stay informed about your investments.

- Client References: Gather feedback from current or past clients to assess satisfaction and reliability. Testimonials can provide valuable insights into the supervisor's effectiveness and client service.

Furthermore, reflect on the example of Zero Flux, a data-driven property newsletter that has positioned itself as an essential resource for property professionals. Their commitment to curating insights from over 100 sources illustrates the importance of a data-driven approach in making informed decisions.

By thoroughly assessing these criteria, you can efficiently narrow your choices and select a real estate investment manager who aligns with your specific needs and financial philosophy.

Assess and Compare Investment Managers

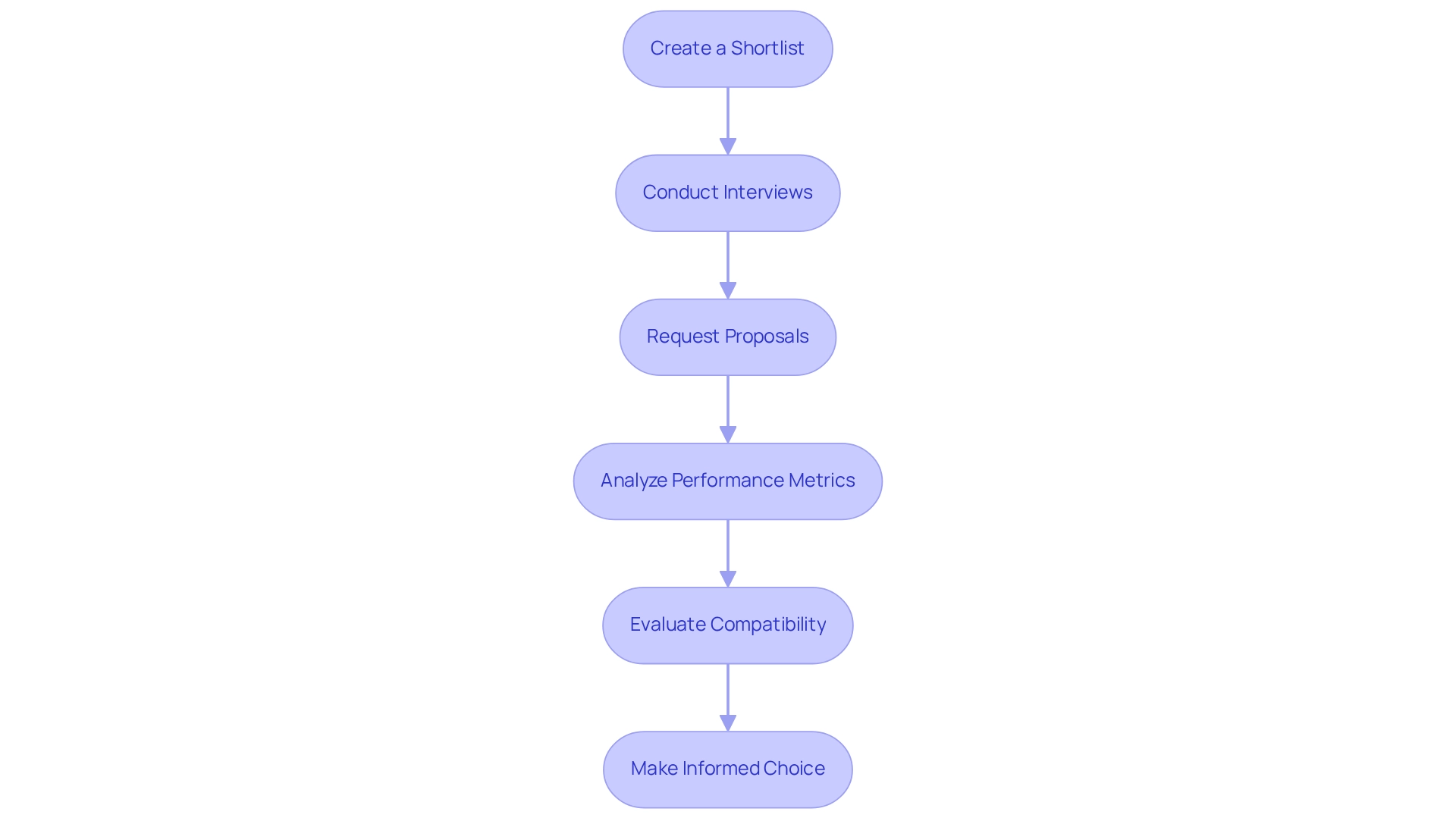

To effectively assess and compare potential investment managers, follow these structured steps:

- Create a Shortlist: Begin by compiling a list of candidates based on predefined criteria, such as experience, performance history, and financial philosophy.

- Conduct Interviews: Organize discussions with each manager to delve into their strategies, historical performance, and alignment with your financial objectives. Thoughtful interview questions can unveil insights into their decision-making processes and risk management approaches.

- Request Proposals: Solicit comprehensive proposals that detail their funding strategies, projected returns, and fee structures. This will aid in understanding their methodology and how it aligns with your financial goals.

- Analyze Performance Metrics: Evaluate historical performance data, concentrating on key metrics such as net operating income (NOI), capitalization rates, and internal rates of return (IRR). As Warren Buffett advises, it’s prudent to focus on four or five-year averages rather than yearly results to gain a clearer view of performance trends. This quantitative analysis is vital for assessing their track record.

- Evaluate Compatibility: Determine how well each manager's communication style and financial strategy align with your expectations. Surrounding yourself with individuals who share your vision can significantly enhance your financial journey. Remember, as Buffett famously stated, "You can't produce a baby in one month by getting nine women pregnant," underscoring the importance of thorough evaluation and understanding in the selection process.

By systematically comparing these aspects, you can make a more informed choice regarding which fund overseer is best suited for your needs. Additionally, consider the average number of applicants typically shortlisted for selection, which can range from three to five, to ensure a focused evaluation process. This approach not only reinforces the significance of grasping the fundamentals of your finances but also highlights the value of associating with superior individuals to foster personal growth.

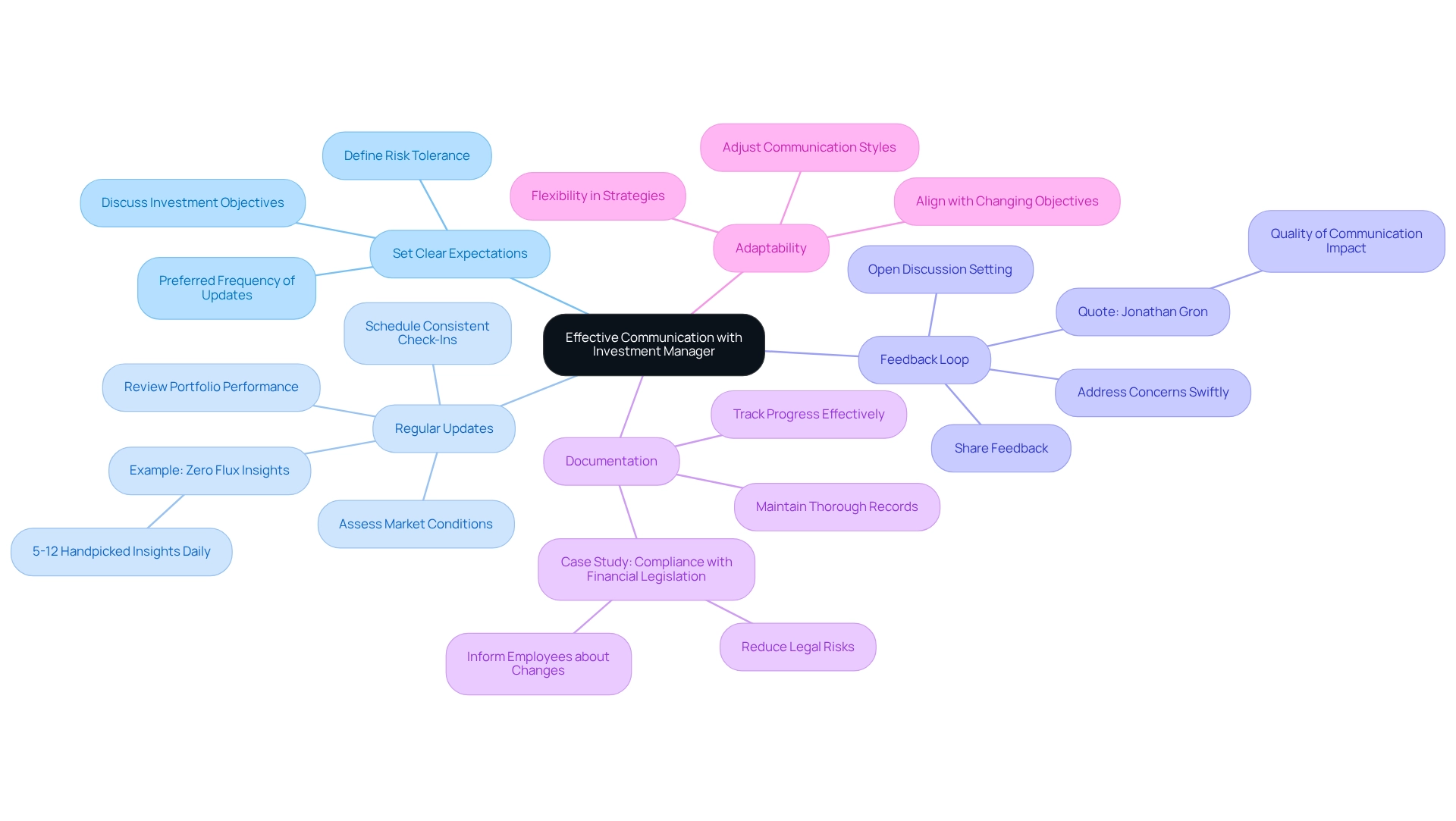

Establish Effective Communication with Your Investment Manager

Establishing effective communication with your real estate investment manager is crucial for achieving your financial objectives. To enhance this relationship, consider the following key practices:

- Set Clear Expectations: Initiate discussions about your investment objectives, risk tolerance, and preferred frequency of updates. This clarity lays the groundwork for a productive partnership.

- Regular Updates: Schedule consistent check-ins to review portfolio performance, assess market conditions, and make necessary adjustments to your strategy. For instance, Zero Flux compiles 5-12 handpicked real estate insights daily, illustrating the importance of staying informed through regular updates.

- Feedback Loop: Create a setting of open discussion where both you and your fund manager can share feedback and tackle concerns swiftly. As Jonathan Gron, Owner at OwlRatings, states, "The quality of your communication will make a profound difference in how you are perceived by others and how successful you are." This two-way communication is vital for maintaining alignment.

- Documentation: Maintain thorough records of all communications, decisions, and performance reports. This practice ensures transparency and accountability, allowing both parties to track progress effectively. A case study on maintaining compliance with financial legislation underscores the significance of notifying employees about changes to ensure adherence, which parallels the necessity for thorough documentation in asset management.

- Adaptability: Be willing to adjust your communication styles and strategies as needed. Flexibility can improve the working relationship and ensure that both parties stay aligned with changing financial objectives.

By prioritizing these effective communication strategies, you can cultivate a strong partnership with your real estate investment manager, ultimately supporting your investment objectives. Remember, wise communication is characterized by meaningful contributions rather than empty chatter.

Conclusion

Navigating the complex landscape of real estate investment management demands a firm grasp of essential principles and a strategic approach. Understanding core components—including market analysis, property acquisition, and portfolio management—empowers investors to make informed decisions that can significantly enhance their returns while mitigating risks. Selecting the right investment manager is equally crucial; evaluating their experience, investment philosophy, performance history, and transparency ensures alignment with personal investment goals.

Moreover, assessing and comparing potential managers through structured methods—such as creating a shortlist, conducting interviews, and analyzing performance metrics—refines the decision-making process. Effective communication with the chosen investment manager fosters a productive partnership, ensuring that both parties remain aligned on objectives and responsive to market changes.

Ultimately, mastering these elements positions investors for success and builds a foundation of trust and collaboration essential for navigating the ever-evolving real estate market. By prioritizing strategic insights and fostering clear communication, investors can optimize their investment strategies and achieve their financial aspirations with confidence.