Overview

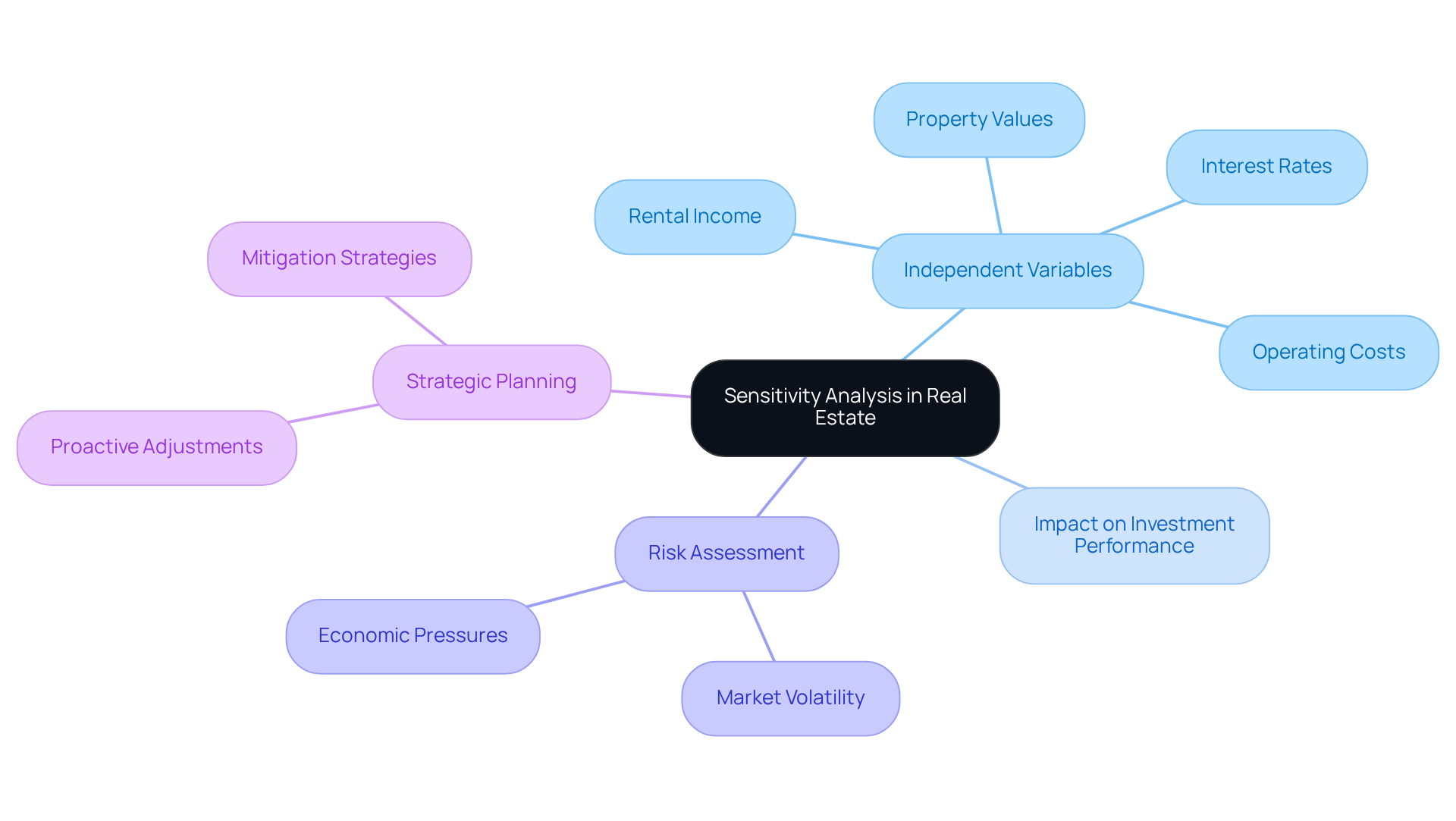

Sensitivity analysis in real estate is essential for making informed investment decisions. It empowers investors to evaluate how fluctuations in key variables—such as rental income, property values, interest rates, and operating costs—affect overall investment performance. By grasping these relationships, investors can better anticipate risks and adjust their strategies accordingly. This is particularly vital in a volatile market, where even minor changes can have a substantial impact on cash flow and returns. Understanding sensitivity analysis not only enhances decision-making but also fortifies an investor's position against market uncertainties.

Introduction

Understanding the dynamics of real estate investment is crucial for navigating today's complex market landscape. Sensitivity analysis emerges as a powerful tool that enables investors to assess how fluctuations in key variables—such as rental income, property values, and interest rates—can significantly impact their overall returns. Yet, a pressing question persists: how can investors effectively leverage sensitivity analysis to not only anticipate risks but also capitalize on growth opportunities? This article delves into the intricacies of sensitivity analysis in real estate, offering insights that empower investors to make informed decisions and enhance their investment strategies.

Define Sensitivity Analysis and Its Importance in Real Estate

Sensitivity evaluation stands as a pivotal financial modeling method, meticulously analyzing how variations in independent variables influence a dependent variable within a defined set of assumptions. In the realm of property investment, sensitivity analysis real estate holds paramount significance, empowering investors to gauge the effects of fluctuations in rental income, property values, interest rates, and operating costs on overall investment performance. Consider this: a mere 1% increase in interest rates can lead to a substantial decline in cash flow, underscoring the critical role of sensitivity evaluation in facilitating informed decision-making.

By quantifying these relationships, investors can proactively anticipate potential risks and formulate strategies to mitigate them. This analytical approach is especially vital in today’s market, where rental prices have surged by 29.4% compared to pre-pandemic levels, driven by heightened demand and affordability challenges. Furthermore, with the U.S. property market projected to reach a staggering worth of $136.6 trillion by 2025, mastering the nuances of sensitivity evaluation becomes essential for navigating investment complexities.

Experts assert that sensitivity evaluation not only aids in risk assessment but also enhances strategic planning. Investors who harness this tool can pinpoint which variables exert the most significant influence on their returns, enabling them to make proactive adjustments to their investment strategies. Thus, sensitivity analysis real estate emerges as an indispensable resource for property investors aiming to bolster their portfolios and achieve sustainable growth.

Identify Key Input Variables in Real Estate Financial Models

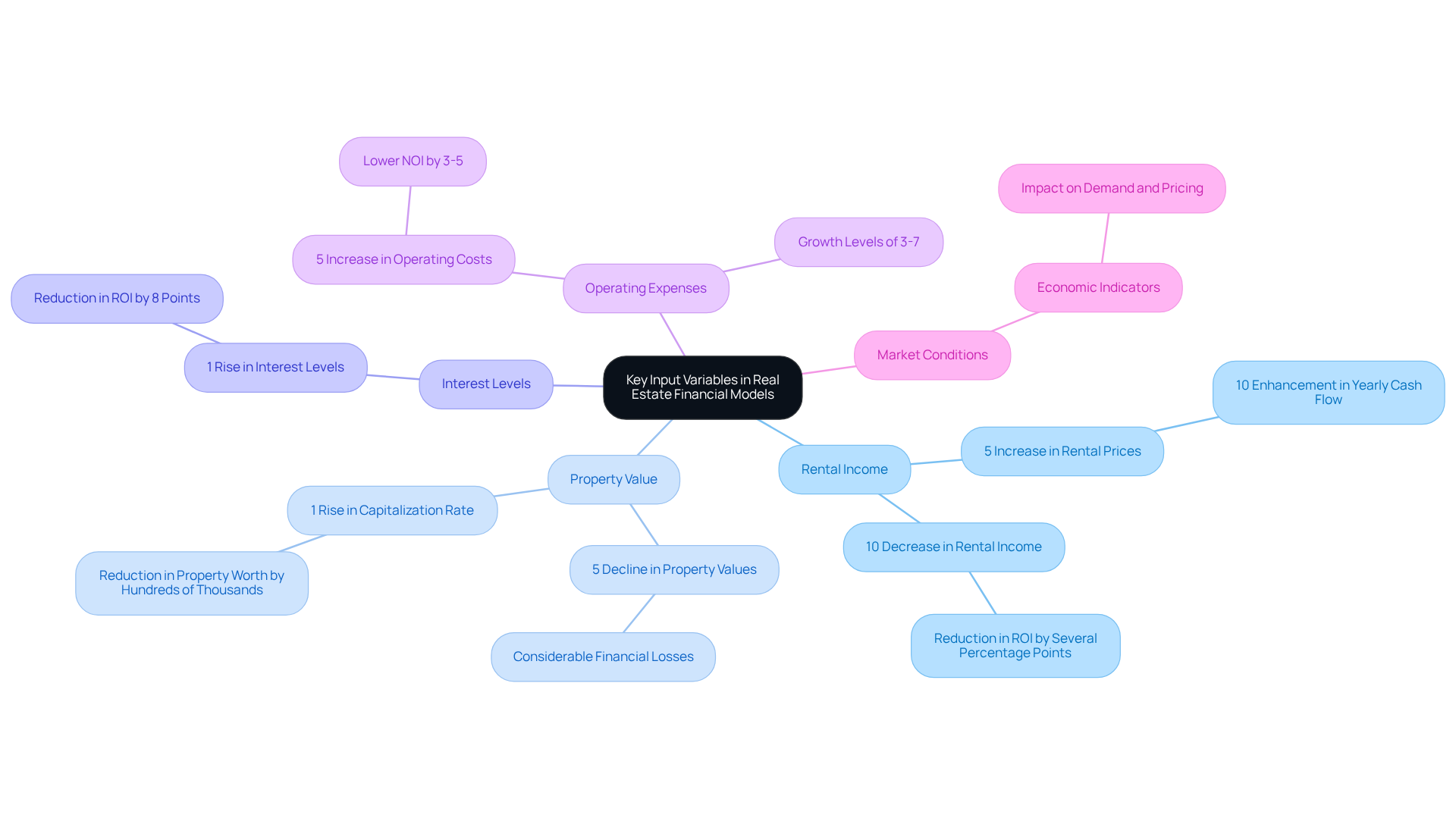

Key input variables in real estate financial models are essential for assessing investment performance and include the following:

-

Rental Income: Variations in rental rates or occupancy levels can profoundly affect cash flow. For instance, a 5% rise in rental prices can lead to a 10% enhancement in yearly cash flow, provided occupancy remains consistent. Conversely, a 10% decrease in rental income could diminish your ROI by several percentage points, underscoring the significance of maintaining competitive rental prices.

-

Property Value: Fluctuations in property values directly influence resale potential and overall investment returns. A 5% decline in property values can result in considerable financial losses, while a 1% rise in capitalization could reduce a property's worth by hundreds of thousands of dollars, emphasizing the necessity for careful market analysis.

-

Interest Levels: Variations in interest levels can greatly influence financing expenses, subsequently affecting cash flow. A 1% rise in interest levels can reduce ROI by 8 points, making it essential for investors to closely observe trend fluctuations.

-

Operating Expenses: Adjustments in maintenance, management, and utility costs can directly impact net operating income (NOI). For example, a 5% increase in operating costs can lower NOI by 3-5%. Operating expenses should be examined for growth levels of 3%-7%, highlighting the importance of meticulous budgeting and expense oversight.

-

Market Conditions: Economic indicators such as employment statistics and demographic changes play a crucial role in impacting demand and pricing within the property market. Understanding these dynamics allows investors to anticipate changes and adapt their strategies accordingly.

By concentrating on these variables, investors can utilize sensitivity analysis in real estate to gain valuable insights into their potential effects on investment performance, enabling more informed and strategic decision-making.

Analyze Practical Applications: Cash Flow Sensitivity and Market Impact

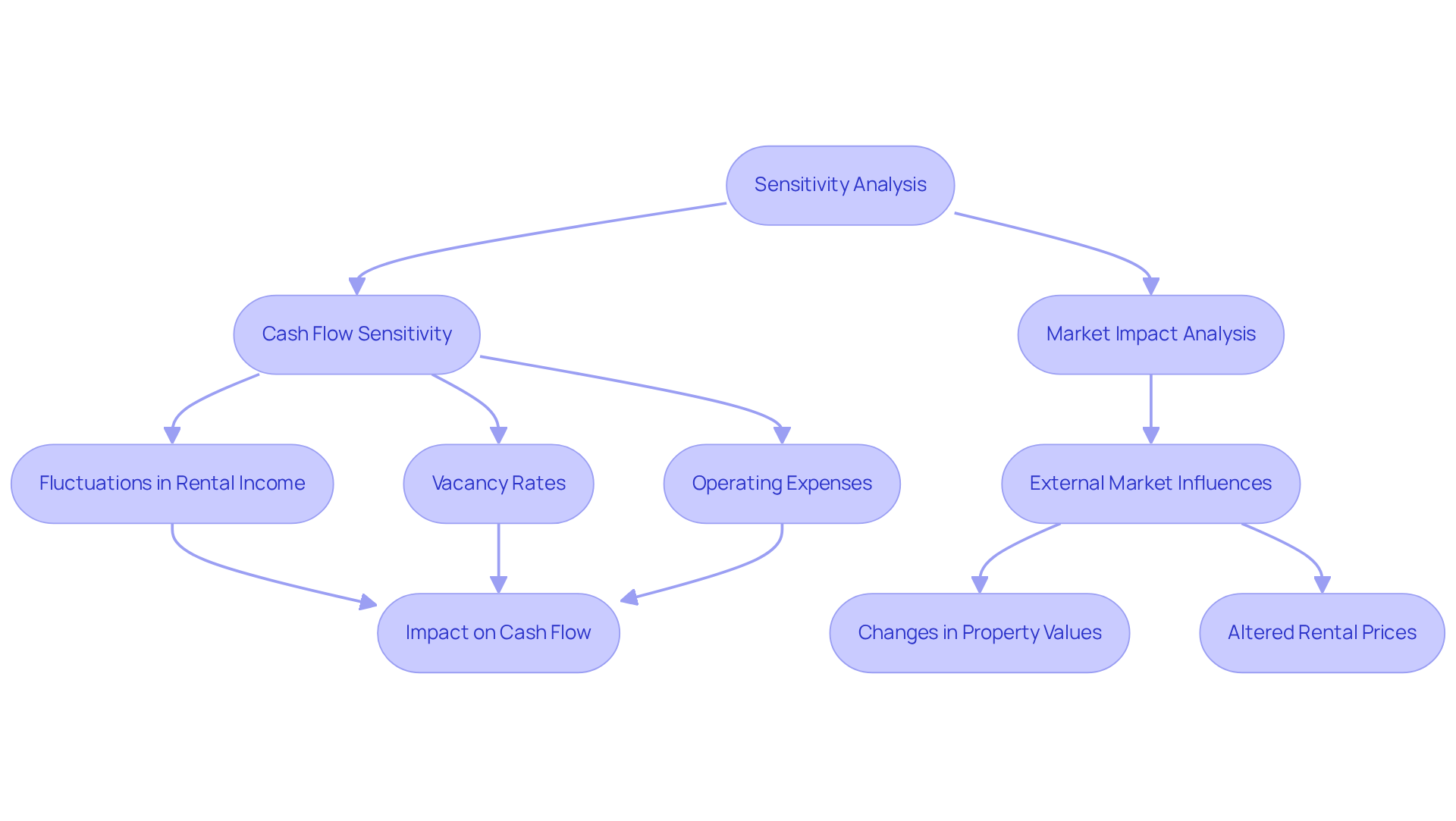

Practical applications of sensitivity analysis in real estate encompass several critical areas:

-

Cash Flow Sensitivity: Investors can model the effects of fluctuations in rental income, vacancy rates, and operating expenses on cash flow. A 10% decrease in rental income can significantly impact cash flow and overall profitability. Sensitivity analysis real estate allows investors to quantify these changes, providing insights into how such variations can affect their financial health and investment viability. Furthermore, even a slight rise in vacancy percentages can lead to significant revenue declines, particularly in apartment complexes or retail areas, underscoring the necessity of tracking occupancy levels.

-

Market Impact Analysis: Assessing external market influences, including economic declines or changes in demand, is crucial for comprehending their effects on property values and rental prices. For example, sensitivity examination may reveal that a 1% increase in interest rates could result in a 5% drop in property values. This insight prompts investors to reassess their acquisition strategies and prepare for potential market fluctuations. In the current environment, where interest rates have reached 6%, understanding these dynamics is essential for making informed investment decisions. Moreover, unleveraged core property assets are anticipated to yield returns of 4-6% in 2025, emphasizing the financial consequences of sensitivity evaluation in investment strategies.

These applications illustrate how sensitivity analysis real estate equips investors with a clearer understanding of potential risks and rewards, enabling them to make more informed investment decisions. By utilizing these insights, property professionals can navigate the intricacies of the market with enhanced confidence. As Peter Drucker noted, "Profit is secondary. 'Cash flow is essential,'" emphasizing the critical role of cash flow management in property investment.

Utilize Software Tools for Effective Sensitivity Analysis

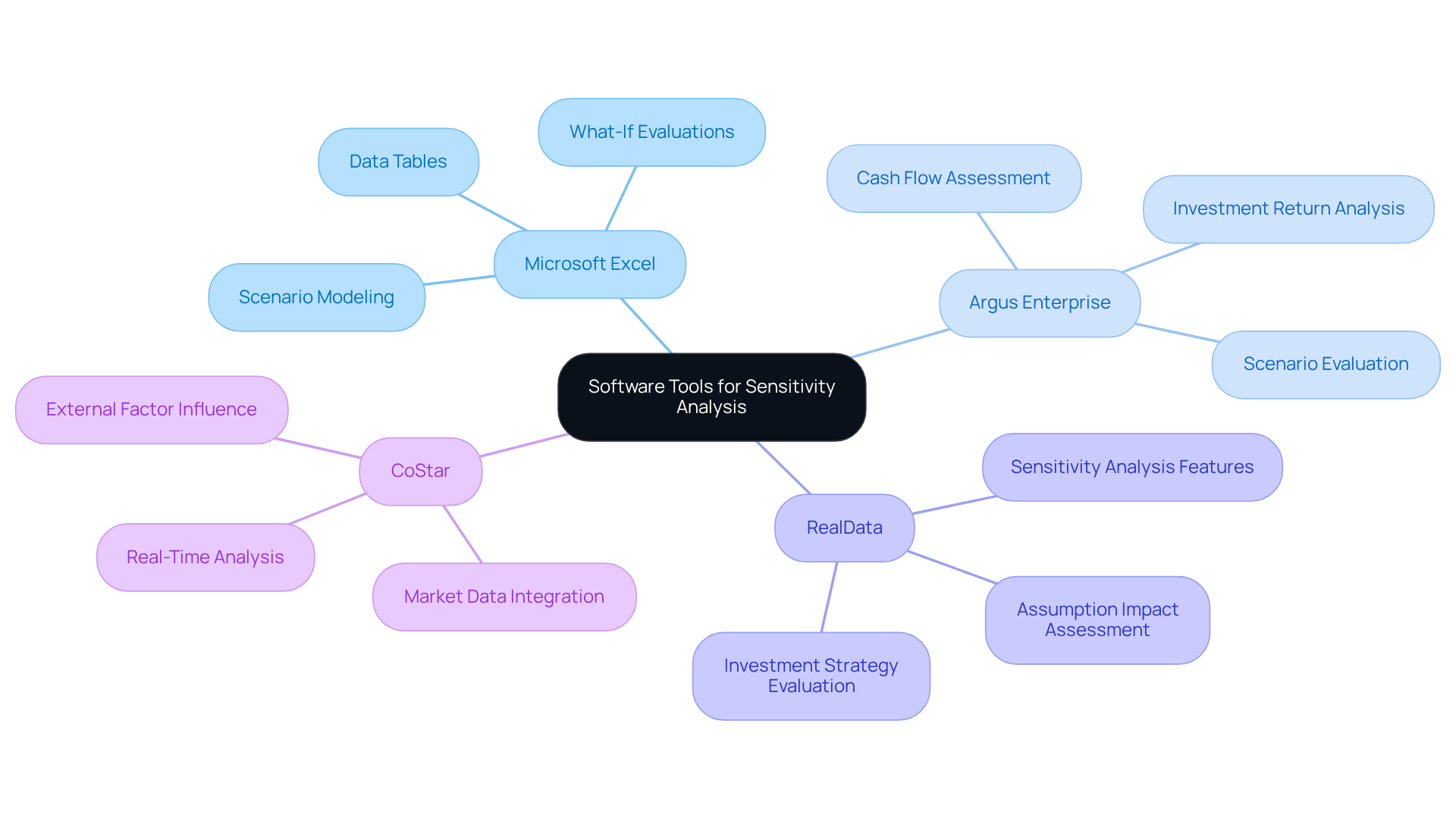

The utilization of specialized software tools significantly enhances the efficiency of sensitivity analysis in real estate. Among these, Microsoft Excel emerges as a versatile option, empowering users to create data tables and conduct extensive what-if evaluations. Its integrated functions facilitate the modeling of various scenarios by modifying input variables, making it an indispensable tool for property investors. A report from the University of Chicago reveals that 60% of financial models now incorporate behavioral economics principles, underscoring the necessity of robust tools like Excel for informed decision-making.

Argus Enterprise represents another formidable program specifically designed for commercial property evaluation. It provides advanced modeling capabilities that enable users to assess cash flows and investment returns across different scenarios, thereby offering a comprehensive understanding of potential outcomes. Realty Capital Analytics emphasizes that development models are essential for evaluating the financial feasibility of property projects, highlighting the critical need for advanced tools in this sector.

RealData also serves the real estate investment evaluation market, featuring tools that incorporate sensitivity analysis functionalities. This software aids investors in assessing the impact of changing assumptions on their investment strategies, ensuring well-informed decision-making. Regularly updating assumptions and collaborating with stakeholders, as highlighted by Vigasan, can help maintain the accuracy and relevance of the model.

CoStar delivers a comprehensive platform that integrates market data and analytics, allowing users to conduct sensitivity analysis in real estate based on real-time market conditions. This capability is vital for understanding how external factors can influence investment performance. A study conducted by the Council of Supply Chain Management Professionals found that 75% of companies utilize financial modeling for supply chain planning, illustrating the widespread reliance on these tools across various industries.

By leveraging these tools, investors can simplify their evaluation processes, enhance accuracy, and gain deeper insights into their investment opportunities, ultimately leading to more informed and strategic decisions. However, it is imperative to avoid common pitfalls in sensitivity examination, such as relying on outdated data and testing an excessive number of variables, to obtain trustworthy insights in property assessments. The Zero Flux newsletter underscores the importance of data integrity and provides subscribers with a daily compilation of essential real estate insights, establishing itself as a vital resource for industry professionals.

Conclusion

Mastering sensitivity analysis in real estate is essential for making informed investment decisions. This analytical technique empowers investors to grasp how fluctuations in key variables—such as rental income, property values, interest rates, and operating expenses—impact overall investment performance. By quantifying these relationships, investors can foresee potential risks and devise strategies to mitigate them, thereby enhancing their decision-making processes.

The article emphasizes several critical aspects of sensitivity analysis, particularly the identification of key input variables that significantly affect cash flow and market performance. A comprehensive understanding of the dynamics surrounding rental income, property value fluctuations, interest rates, and operating expenses enables investors to navigate the complexities of the real estate market with greater efficacy. Furthermore, utilizing specialized software tools like Microsoft Excel, Argus Enterprise, and CoStar can streamline the analysis process, ensuring that investors make data-driven decisions based on accurate and current information.

In conclusion, the significance of sensitivity analysis in real estate investment cannot be overstated. As market conditions shift and external factors influence property values, leveraging this analytical approach becomes vital for successful investment strategies. By prioritizing sensitivity analysis, investors can deepen their understanding of potential risks and rewards, leading to more confident and strategic decisions in their real estate endeavors.